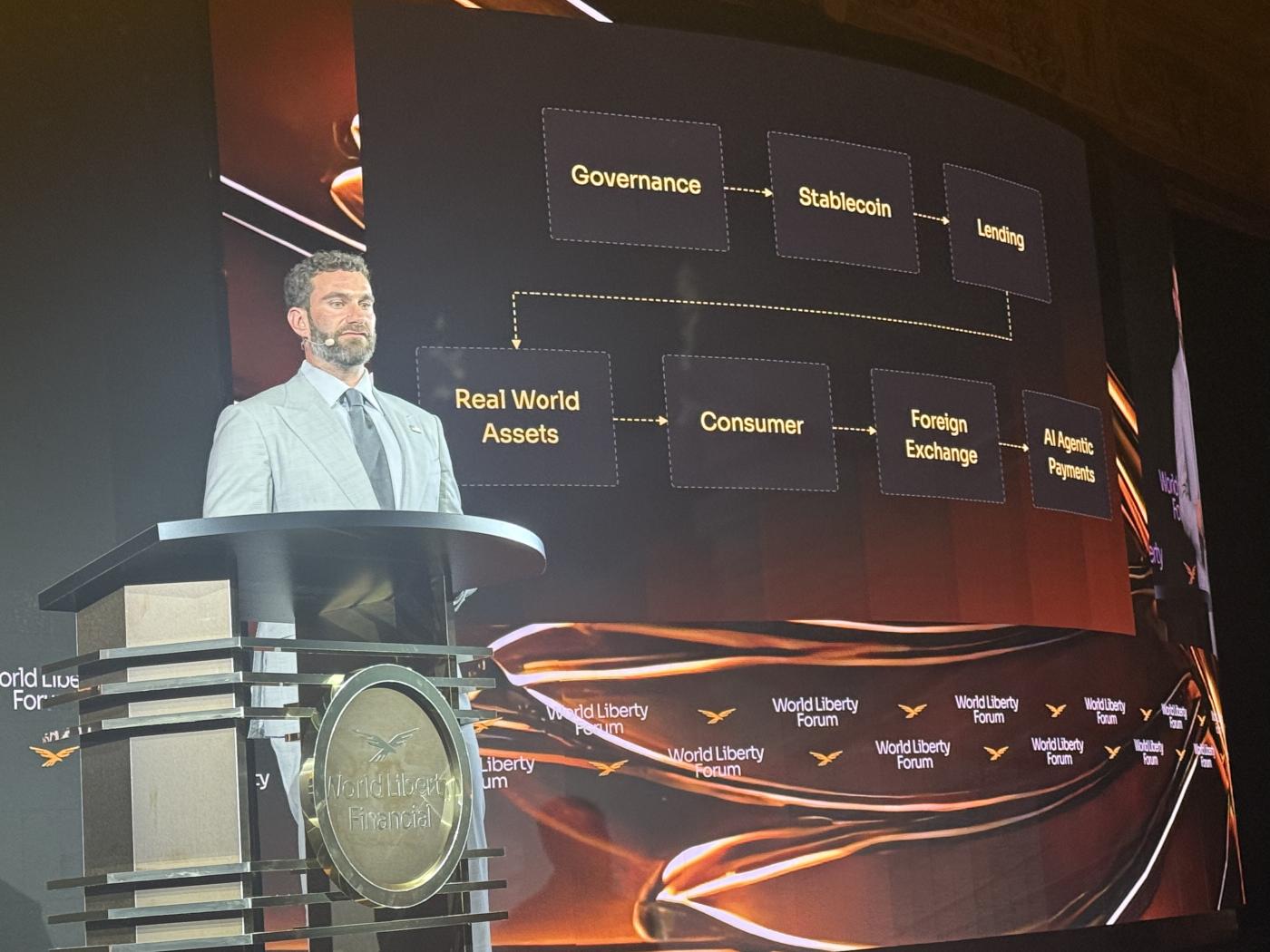

At the event, Zak Folkman, co-founder and COO of World Liberty Financial, gave a systematic introduction to WLFI's complete ecosystem blueprint and several products that will be launched soon.

Article author and source: ME News

On February 18th, World Liberty Financial (WLFI), the Trump family's crypto project, held its inaugural World Liberty Forum at Mar-a-Lago in Florida, focusing on the future development of finance, technology, and policy. Zak Folkman, co-founder and COO of World Liberty Financial, systematically introduced WLFI's complete ecosystem blueprint and several upcoming products at the event.

Governance token $WLFI: From $550 million in funding to nearly one million holders

Folkman emphasized at the outset that $WLFI is not just a token, but also a tool for community leadership—holders have substantial voting rights over protocol upgrades, treasury allocations, new market listings, and strategic direction. The project was compliantly issued in the US through Regulation D and Regulation S, raising over $550 million in a single round, considered one of the largest in DeFi history.

“This is a belief, not just capital,” he pointed out, noting that WLFI currently has nearly 1 million independent holders across DeFi protocols and centralized exchanges. At the event, he previewed an upcoming staking proposal to further entice long-term incentives, which is expected to generate considerable discussion within the community.

USD1 stablecoin: Rising to third place globally in 9 months, with a market capitalization of $5.25 billion.

As a pillar of the ecosystem's "digital dollar," USD1 is hailed by Folkman as a "killer app." This stablecoin, pegged 1:1 to the US dollar, is 100% backed by assets such as US Treasury bonds and custodied by PICO.

Transparency is the biggest selling point: monthly third-party certification reports + the world's first Chainlink real-time on-chain reserve proof, allowing anyone to verify the authenticity of reserves at any time.

The data is impressive—in just nine months since its launch, its market capitalization has reached $5.25 billion, making it the world's third-largest dollar-backed stablecoin (Tether took five years to reach $2 billion). Daily real transaction volume exceeds $1.5 billion, highlighting actual settlement and commercial use rather than speculation.

On-chain lending and RWA tokenization: From cumbersome TradeFi to instant DeFi

Folkman contrasts traditional lending with paperwork and high fees, highlighting the instant, transparent, and 24/7 availability of WLFI on-chain lending—collateral is verified by code, not a committee.

Major launch: The first institutional-grade RWA project – tokenization of luxury overwater villas at the Trump International Hotels & Resorts in the Maldives. Partners include DarGlobal (technology development), the Trump Organization (brand support), and Securitize (compliance infrastructure), with WLFI providing USD1 as the native settlement layer.

“In the past, these types of assets were only available to millionaires. Now anyone can hold them in parts, trade them 24/7, and even use them as collateral to obtain liquidity without selling the assets.” The on-site demonstration generated a warm response.

World Swap: Challenging the 7 Trillion Yuan Cross-Border Foreign Exchange Market

To address the high spreads and hidden fees levied by banks, Folkman launched World Swap—a cross-border exchange and remittance platform centered around USD1. Prototype demonstrations show: multi-currency holding, instant and transparent conversion, and withdrawals to local bank accounts in under one minute (direct connection to banks, no wallet required).

The first step is the launch of the US-Mexico corridor (the world's largest remittance channel), with plans to expand to 40+ currencies. "This is not a tool, but a way to liberate ordinary people from an expensive, slow system."

AI-powered payment agents: seizing a trillion-dollar emerging market

Looking ahead, Folkman is most excited about the AI agent economy. USD1's programmable, instantaneous, and permissionless nature makes it an ideal settlement currency for autonomous transactions by AI agents.

The developer platform is now live: one-click project creation, wallet generation, spending strategy settings, and more, all accessible through a complete dashboard. WLFI is collaborating with global AI companies to promote USD1 as the default payment method.

"In the future, trillions of AI micro-transactions will occur every day—this is a market that is not yet fully developed but has unlimited potential, and we have already made preparations in advance."

At the end of the product launch, Folkman summarized: WLFI is not a single DeFi project, but the next generation of global financial infrastructure—a full-stack closed loop from governance, stable settlement, on-chain credit, asset on-chain, cross-border flow, to AI-native payments.