Original Source: Chasing Wind Lab

In a broad sense, blockchain is the underlying technology of Bitcoin. It has a total of six layers: data layer, network layer, consensus layer, incentive layer, contract layer and application layer. Among them, Layer 1 corresponds to the data layer, network layer, consensus layer, and incentive layer in the six-layer model; while Layer 2 corresponds to the application layer and contract layer.

In a narrow sense, Layer 2 refers to specific Ethereum extension solutions collectively, and is an independent blockchain that extends Ethereum and inherits the security guarantees of Ethereum. In fact, the term Layer 2 was also born in Ethereum, and its main purpose was to improve the scalability and transactions per second (system throughput) of Ethereum. In the blockchain world, the problem of the impossible triangle has been raised for many years. People believe that decentralization, security and high performance constitute the "impossible triangle" of the blockchain, and the three characteristics cannot be achieved at the same time in the design , only two of them can be met. As for Ethereum, its design philosophy has long prioritized security and decentralization over scalability.

As a result, Layer 2 on Ethereum emerged as a solution to complement the scalability of Layer 1, and inherited the security and decentralization of Layer 1. In Layer 2 of Ethereum, according to the difference in the underlying technology, it can There are three types of scalability solutions, State channels, plasma, and Rollups.

L2 to achieve expansion, there are five main routes: state channel, sub-chain plamsa, side chain, Rollup and Validium.

state channel. State channels allow users to make multiple off-chain transactions while only submitting transactions to the Ethereum network twice - once when the channel is opened and once when the channel is closed. In this way, TPS can be increased by 1000, but this mode only supports a fixed number of users, and does not support smart contracts.

child chain. Plasma is a low-profile copy of Ethereum, called a child chain (childchain), which can be extended to multiple layers, and there are grandchildren or great-grandchildren chains on the child chain. Unlike state channels, Plasma's can support a flexible number of users. However, the sub-chain does not have its own security mechanism, and both data and security depend on the Mainnet, and it also does not support smart contracts.

side chain. The side chain is a step further than the sub-chain, with its own consensus mechanism and security guarantee, which further optimizes the transaction speed, the most famous of which is Polygon. Sidechains are associated with Ethereum and can operate independently. However, there are still some obvious disadvantages in the side chain. First, the data is isolated from the main chain, and the degree of decentralization is worse than that of Ethereum.

Rollup. The core concept of Rollup is to decouple consensus from execution, execute transactions in L2, aggregate a large number of transactions to generate a large number of batches, publish transaction results in L1, and verify the validity of transaction results through a proof mechanism.

According to different proof mechanisms, it can be divided into: optimistic Rollup and zk Rollup. The specific differences will be introduced in detail later.

Validium. Validium also uses the zk Rollup proof method, but unlike Rollup , which stores data on the chain, Validium's data is managed by a group of data notaries stored off the chain, so its security is poor.

The following is a list of potential unissued currency projects on Layer 2. If you are interested, follow and collect.

1) Scroll

Scroll is an EVM equivalent of zkRollup for scaling Ethereum. Technically, Scroll is built on two main parts. The core part is zkEVM, which is used to prove the correctness of layer 2 EVM execution.

In April this year, Scroll announced the completion of a US$30 million Series A round of financing: Polychain Capital led the investment, and Bain Capital Crypto, Robot Ventures, Geometry DAO and others participated in the investment. It is worth mentioning that several members of the Ethereum Foundation and the Ethereum community also joined this round of financing as angel investors. From this point, it can also be seen that Scroll maintains a close relationship with the Ethereum community.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

2) Arbitrum

Arbitrum is an Ethereum scaling solution that enables high-throughput, low-cost smart contracts while maintaining trustless security. Arbitrum has three modes: AnyTrust Channels, AnyTrust Sidechains, and Arbitrum Rollup.

Official Twitter: Web link

Official website: web link

Cross-chain tutorial: web link

Arbitrum Nova

Arbitrum Nova was officially launched (August 10, 2022). It is a Mainnet based on Arbitrum's AnyTrust technology. It is a new technology optimized for ultra-low-cost transactions. It is similar to Arbitrum One, but Arbitrum One uses Arbitrum The chain built by Rollup technology.

Nova is a brand new chain with a different set of assumptions, designed for gaming, social applications, and more cost-sensitive use cases. The key technical difference from Arbitrum One is that Arbitrum One always puts all transaction data on Ethereum, while Nova utilizes a data availability committee to achieve significant cost savings.

With Nova running, Arbitrum now has two independent chains running that can support nearly all blockchain use cases. Compared to Arbitrum One, Nova will be the solution of choice for games and social applications, while Arbitrum One will continue to be the home of DeFi and NFT projects.

Arbitrum Nova Tutorial: Web Links

Arbitrum ecological focus project with tutorial: web link

Arbitrum eco- focused projects

3) zksync

zkSync is Ethereum's scaling and privacy engine. Its current scope of features includes low-gas transfers of ETH and ERC 20 tokens in the Ethereum network, atomic swaps and limit orders, and native L2 NFT support. This document is a high-level description of the zkSync development ecosystem.

zkSync is built on the ZK Rollup architecture. ZK Rollup is an L2 scaling solution where all funds are held by smart contracts on the main chain, while computation and storage are performed off-chain. For each Rollup block, a state transition Zero-knowledge Proof(SNARK) is generated and verified by the main chain contract. This SNARK includes a proof of validity for each transaction in the Rollup block. In addition, the public data update of each block is released with cheap calldata through the main chain network.

Official Twitter: Web link

Official website: web link

Cross-chain tutorial: web link

zkSync ecological focus project with tutorial: web link

zkSync ecological focus project with tutorial

4) StarkNet

Financing: More than 2 billion knives, the investment lineup is luxurious, and V God is rumored to be an angel investor.

Data: The top brand of the ZK series, the data on the chain crushes other ZK series projects.

Technical route: StarkEx & StarkNet, technically took over a lot of the existing work of Ethereum, the core solves the problem of ability and reports the trust problem.

Ecological projects: dydx, sorare, immutable, deversifi, celer, argent, etc.

Layout logic: Interact with starkware and starkware Dapp, and AirDrop in the future.

Official Twitter: Web link

Official website: web link

Cross-chain tutorial: web link

Starknet ecological focus project with tutorial: web link

Eight testable interactive projects in the StarkNet ecosystem

5) Optimism

Optimism is a low-cost and lightning-fast Ethereum L2 blockchain. Coins have been issued, but according to the official introduction, the AirDrop here has not been completed, and more AirDrop will be distributed to ecological projects in the future.

Official Twitter: Web link

Official website: web link

Ecological must-do items with tutorials: web link

6) Aztec network

What it is: AZTEC is Ethereum's privacy engine that enables confidential transactions on the public mainnet. The protocol utilizes Zero-knowledge Proof to encrypt and hide the value of AZTEC-enabled transactions.

The round was led by Paradigm, with participation from IOSGVentures, Variant Fund, Nascent, imToken, Scalar Capital, Defi Alliance, ZK Validator, and angel investors Anthony Sassano, Stani KulecFhov, Bankless, Defi Dad, Mariano Conti, and Vitalik Buterin. The last round of investors was a_capital , Ethereal Ventures, and Libertus Capital continued to inject capital.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

7) Argent

Argent is a mobile social recovery wallet supporting Ethereum and zkSync Layer 2. On the zkSync network, Argent provides Layer 2 DeFi investment opportunities based on AAVE, Lido and Yearn protocols. Argent may provide you with the opportunity to obtain zkSync Token through a series of integrations.

The $40 million Series B round was led by Fabric Ventures and Metaplanet, with participation from Paradigm, Index Ventures, Creandum, and strategic investors including StarkWare, Jump, and Animoca Brands.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

8) Zecrey Protocol

Zecrey is a decentralized asset aggregator at Layer 1 and Layer 2, compatible with Ethereum and other smart contract platforms, and is also the first feasible solution to protect transaction privacy based on the account model.

Zecrey's privacy Cross-chain solution has two core functions: privacy-centric Cross-chain bridge and asset exchange. In order to support these functions, in terms of product functions, Zecrey currently behaves as an all-in-one plug-in wallet that supports Multichain networks, and can manage Multichain assets in one account.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

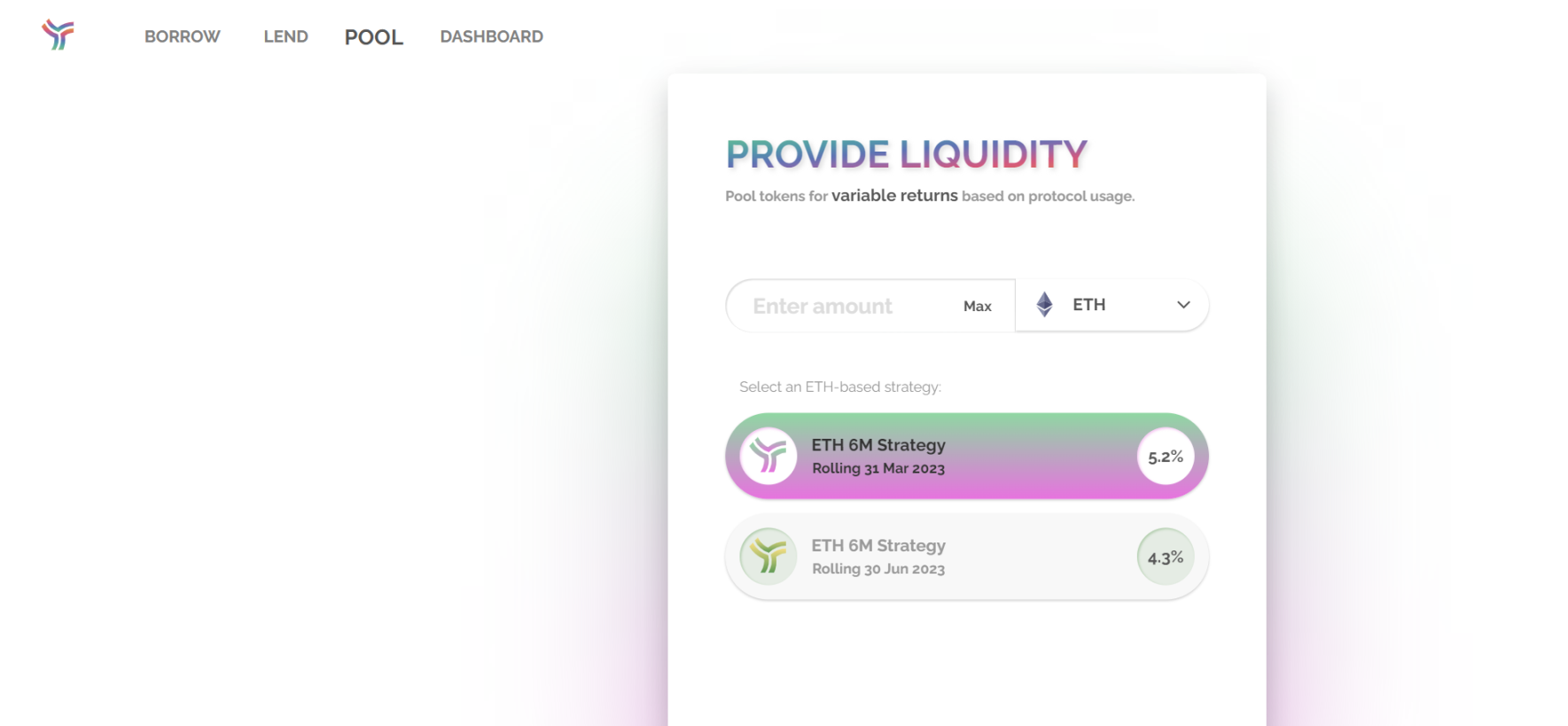

9) Yield Protocol

Collateral-based fixed-rate lending on Ethereum, Arbitrum.

The project's FAQ stated: "In the long run, we hope that the Yield agreement will be owned by the community", so it seems that the certainty of issuing Token is relatively high. Whether the token will be implemented on Arbitrum or Ethereum remains to be seen, but regardless, Yield Protocol is a project worth watching.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

10) DeFi Saver

DeFi Saver is a one-stop asset management solution for a range of decentralized financial protocols, and applications on Ethereum. It supports multiple DeFi protocols, including Maker, Fulcrum, Compound, and dYdX.

The TVL of this project has always been very high. If the issuance of coins is worth looking forward to, it was very expensive to open an account in the past, but now it can be done in a few U when the gas is low.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

11) Cozy Finance

Cozy is an open-source protocol that enables investors to participate in automated and trust-minimized protection markets .

Securing the market mitigates the risks typically associated with investing in decentralized finance (DeFi) markets and applications. Since DeFi application protocols appear to be more vulnerable to hacking and exploitation than some investors' traditional financial instruments, Cozy provides a platform to programmatically protect assets from loss. Investors who have confidence in the security of their DeFi applications can use the Cozy platform to earn interest by supplying assets to the protection market.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

12) Zapper

Zapper is a DeFi portfolio management dashboard that allows you to deploy and manage DeFi positions quickly and easily, keeping your portfolio, Liquidity pools and Yield Farming positions on top of a single interface at all times. Zapper is a Liquidity pool aggregator that currently provides access to over 200 different pools. Additionally, it recently implemented AMM swap functionality using Uniswap and Balancer exchanges.

Official Twitter: Web link

Official website: web link

13) Zerion

Build and manage DeFi portfolios.

Completed $12.3 million in Series B financing, led by Wintermute Ventures, with participation from Mosaic, Coinbase Ventures, Alchemy, and Placeholder.

Official Twitter: Web link

Official website: web link

14) Slingshot

Slingshot is a decentralized transaction aggregation platform based on Polygon, Arbitrum and Optimism.

$15M Series A raised led by Ribbit Capital, K 5 Global, Shrug Capital, The Chainsmokers, Jason Derulo (US Singer), Guillaume Pousaz (Founder of Checkout.com) and Austin Rief (CEO of Morning Brew ), existing investors Framework Ventures and Electric Capital participated.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

15) Fuel Labs

Fuel v1 started as a Layer 2 (L2) scalability technology for Ethereum as a whole. This is the first optimistic Rollup deployed on the Ethereum mainnet at the end of 2020. Fuel is the fastest execution layer of the modular blockchain stack. It focuses more on the execution layer to conduct transactions in parallel (parallel execution), so that fuel can use more CPU cores and threads.

Completed $80 million in financing, led by Blockchain Capital and Stratos Technologies, with participation from Alameda Research, CoinFund, Bain Capital Crypto, TRGC, Maven 11 Capital, Blockwall, Spartan, Dialectic and ZMT.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

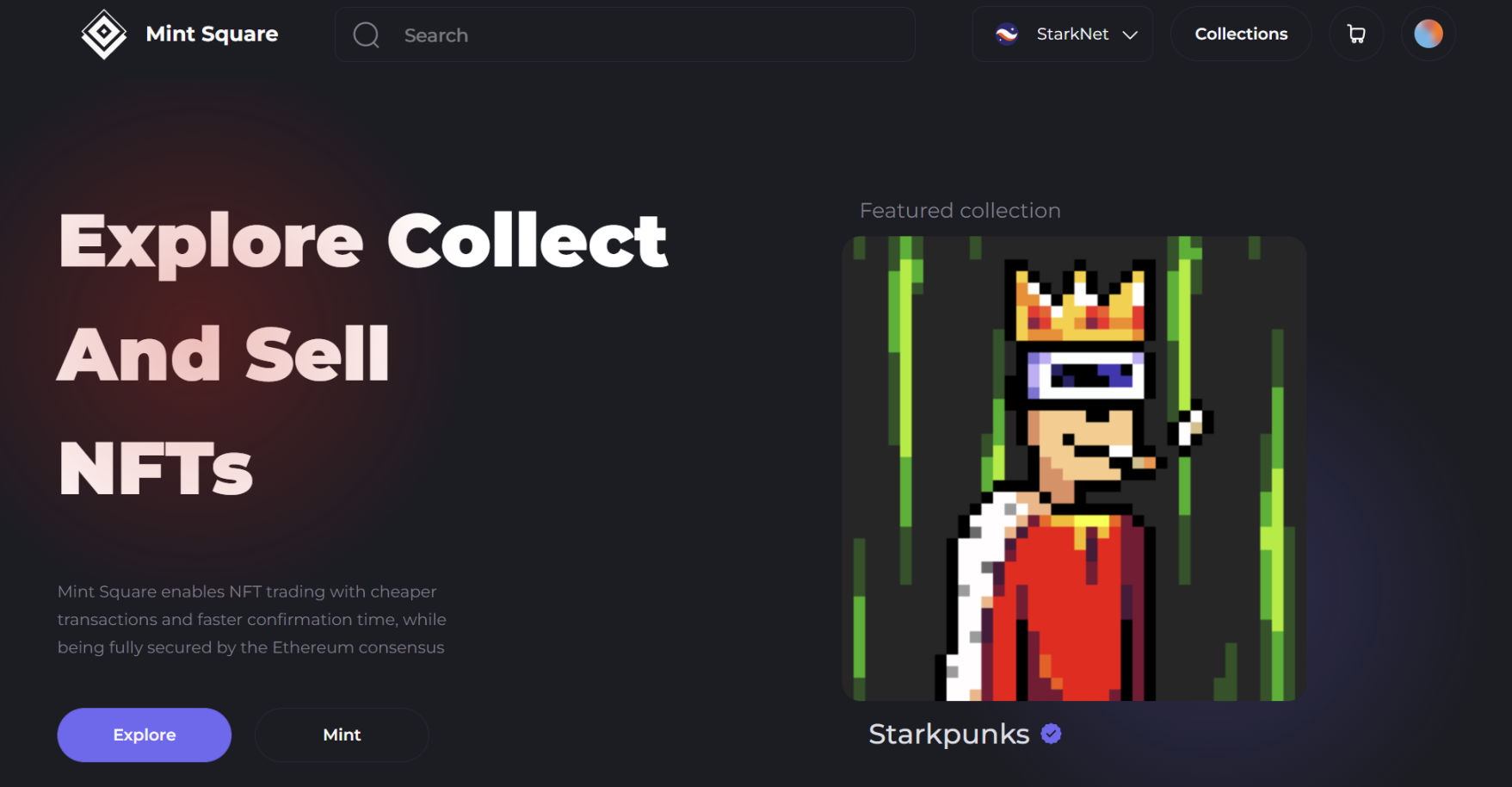

16) Mint Square

Mint Square is an NFT platform based on Ethereum's layer 2 ZK Rollups.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

17) Starkswap

Starkswap will leverage StarkNet's best-in-class speed and security to provide a top-notch DEX experience in DeFi as a native layer 2 Dapp . Build the next generation of DeFi powered by public ZK- Rollup technology.

The Starkswap team is comprised of crypto-native developers and entrepreneurs with FAANG and top startup backgrounds.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

18) zkLend

zkLend is a money market protocol that combines zk- Rollup scalability, superior transaction speed and cost savings with the security of Ethereum. zkLend is an L2 money market protocol built on StarkNet that combines the scalability of zk- Rollup with the security of Ethereum, enabling participants to efficiently earn interest on deposits and seamlessly borrow assets.

The zend token issued by Zklend will have three major functions (i) preferential borrowing rate, (ii) improving borrowing capacity, and (iii) governance participation.

$5M Seed Round Led by Delphi Digital, Other Lead Investors Include StarkWare, Three Arrows Capital, Genesis Block Ventures, Alameda Research, CMS, MetaCartel DAO, DCVC, Amber Group, TPS Capital, Ascensive, D 3 Web Capital , 4 RC and SkyVision Capital, and other angel investors.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

19) A board

Aboard is a Multichain, multi-platform, Order-book style decentralized Derivatives exchange. The exchange will be a comprehensive, efficient and all-in-one platform that will bring the TradFi trading experience into the DeFi world.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

20) volmex finance

Volmex's mission is to build the best possible cryptocurrency volatility index and experience for cryptocurrency volatility traders. Volmex pioneered the first crypto volatility index and tradable crypto volatility products, Volatility Token v1. Volmex Implied Volatility Indices such as EVIV Index and BVIV Index track the 30-day implied volatility of Bitcoin and Ethereum respectively. Volmex is building a perpetual futures exchange, which will be the first place to trade VIX perpetual futures.

Volmex Labs is a leader in crypto volatility products and indices. The Volmex Labs team consists of world-class talent from various crypto and TradFi companies, including Staked, IMC Trading, ConsenSys, and more. Volmex is backed by leading cryptocurrency investors and traders including Robot Ventures, CMS Holdings, Orthogonal Trading, Huobi, DWF Labs and more.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

21) AltLayer

AltLayer is a temporary expansion layer based on OptimisticRollups, which is connected with Layer 1 and Layer 2 of Ethereum, Solana, Polkadot, Cosmos, and even Arbitrum, Optimism, etc.

AltLayer is a highly scalable application-specific execution layer system that derives security from the underlying L1/L2. It is designed as a modular and pluggable framework for the Multichain and multi-VM world. At the heart of AltLayer is a system of multiple optimistic rollup execution layers called flash layers, with novel innovations that make them one-shot and therefore highly resource-optimized.

Completed a $7.2 million seed round of financing, led by Polychain Capital, Jump Crypto and Breyer Capital, Polkadot founder Gavin Wood, former Coinbase CTO and former a16z partner Balaji Srinivasan, Circle co-founder Sean Neville, and Synthetix and Bodhi Ventures Co-founders Kain Warwick and Jordan Momtazi participated in the round.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

22) ZKEX

ZKEX is a decentralized Multichain Order-book exchange (DEX) built on top of three ZK- Rollup : zkLink, Starkware and zkSync. ZKEX is decentralized, trust-minimized and Non-custodial, and transactions are guaranteed by Zero-knowledge Proof.

Official Twitter: Web link

Official website: web link

Operation Tutorial: Web Link

The above are the Layer 2 potential projects sorted out. This article is only my opinion, not investment advice.