Original Author: quantumzebra 123

"Although GMX is in the current bear market, it may collapse in the bull market." A friend recently started spreading FUD about GMX again. “GMX is designed to create an imbalance between long/short positions in a bull market, reducing GLP returns and triggering a death spiral.”

My first reaction was to take this as a joke.

GMX is one of the best performing DeFi protocols in 2022. A bull market will only increase its heat and push the $ GMX price even higher.

But after thinking it over, I realized it wasn't all nonsense. So I tried to use data to verify whether the above situation is really possible.

My findings are as follows:

In a bull market, almost no traders will open short positions on GMX .

GMX dominated by bulls will reduce GLP returns to a certain extent, but this does not mean that liquidity providers will withdraw.

GMX 's mechanism flaws have been covered up in the bear market, but the so-called GMX bull market death spiral theory is untenable.

I will share my analysis in detail below, and everyone is welcome to make a decision. I don't care if I'm right or wrong. All I care about is whether I should continue to hold my $ GMX when the next bull run comes.

What is GMX

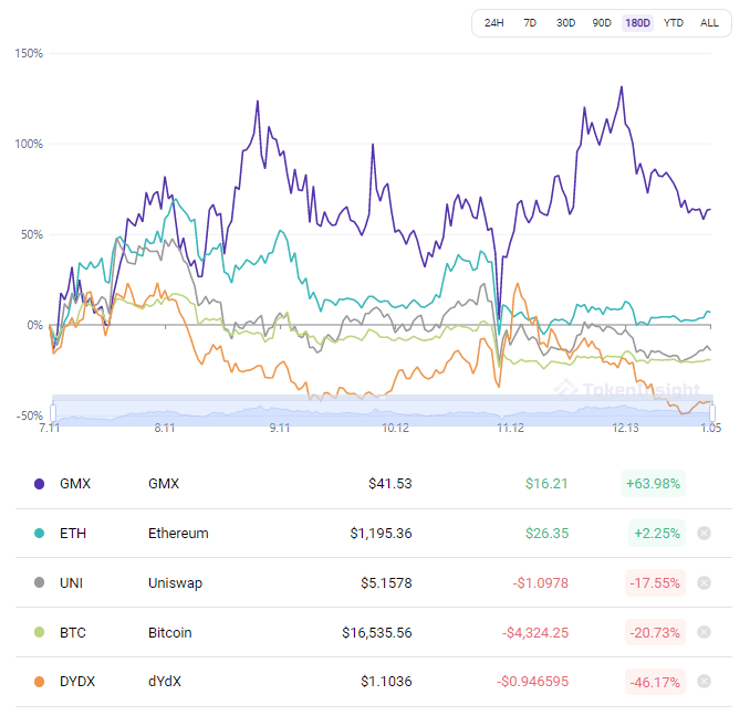

In the past six months, GMX has significantly outperformed the market, while the prices of DeFi blue-chip projects like DYDX have plummeted.

GMX offers spot and margin (leverage) trading with zero slippage. GMX lets users trade with GLP pools, unlike traditional Perp exchanges. In traditional Perp exchanges, users are counterparties to each other. To be picky, GMX cannot be considered a Perp exchange, but its user experience for margin trading is very similar to Perp.

GLP is the capital pool of GMX , about 50% of which are stablecoins, and the other half are cryptocurrencies, such as $ BTC(15%) and $ ETH (35%). The GLP pool is the counterparty to every transaction on GMX . LP provides liquidity for GMX by depositing assets into the GLP pool. In return, GLP holders receive 70% of the fees generated by the GMX platform. If a trader loses money, GLP holders also earn additional gains, and vice versa.

real rate of return

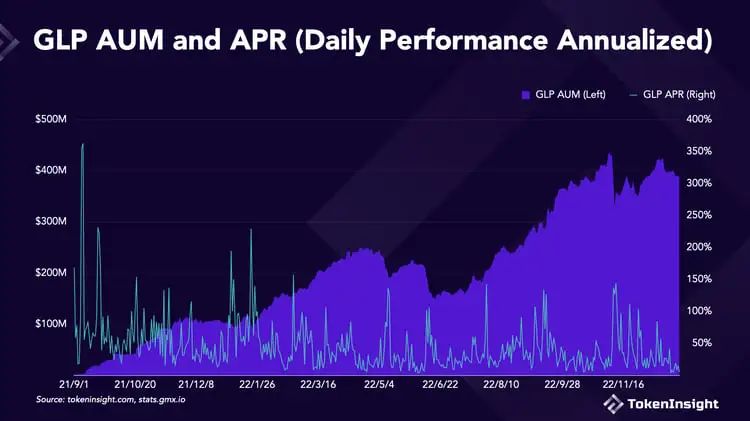

GMX is on the rise in 2022 as discussions about Real Yield sweep Crypto Twitter. Degens moved from highly inflationary tokens to tokens like GLP that provide $ ETH yields. GMX 's GLP has consistently delivered 20%+ APR for most of 2022, dwarfing even Terra's Anchor in its glory days. Although the macro environment has led to an overall downturn in the encryption market, GLP has achieved growth against the trend while maintaining a very competitive APR.

Here APR = Daily Rate / GLP AUM * 365.

GLP challenges

GLP's biggest challenge is staying competitive in a bull market, as its design flaws are less apparent in a bear market.

Every design is a trade-off. While GMX allows traders to execute zero-slippage trades in a fully decentralized manner, GMX requires traders to pay borrowing fees to GLP, whether they are long or short. This is not the same as trading on a real Perp exchange.

In a traditional Perp transaction, there is always one trader who pays the counterparty with the opposite position a funding fee based on the difference between the Perp price and the spot price. For example, when the market is bullish and the funding rate is positive (Perp price > Spot price), traders with long positions pay funding fees to traders with short positions. In a trade, there is always one party that receives a funding fee to maintain its position.

As mentioned before, GMX is not Perp, it just provides a trading experience similar to Perp. Delphi Digital briefly touches on this in their analysis, but doesn't delve into it.

In a bear market, traders are more evenly divided between longs and shorts, with little difference between the real Perp Exchange and GMX .

But in a bull market, traders are bullish. True Perp exchanges balance this bias by forcing longs to pay shorts a funding fee. However, not only do short sellers on GMX not receive funding fees, they must also pay borrowing fees. So, during a bull market, people shorting GMX are out of their minds.

In a bull market, GMX will be all bulls, which has two effects.

First, this makes GLP pools less capital efficient, as half of the pool consisting of stablecoins would be useless. Traders will only lend $ BTC and $ ETH from the GLP pool for long bets. It's like flying a plane with only one side of the engine working, you don't immediately fall out of the sky, but you become less safe.

Second, GLP will keep losing money to traders as they rent out both $ BTC and $ ETH upside potential to traders. GLP can only rely on platform fee dividends to make up for losses. A drop in GLP returns could cause liquidity providers to look elsewhere for higher returns. A bull market means they can easily find Ponzi coins that can achieve 1,000,000% APR before the party is over. (does anyone remember $TIME)

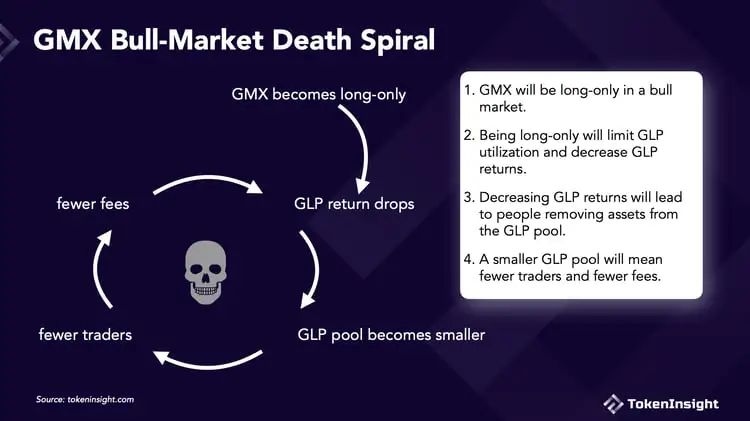

The drop in total GLP results in fewer assets that traders can borrow. Without sufficient liquidity, traders will have to turn to other platforms. Fewer traders lead to fewer fees generated by the platform, which further cuts into GLP returns and triggers a death spiral.

GMX ’s Bull Death Spiral

GMX ’s bullish death spiral consists of four steps:

Traders on GMX only go long in a bull market.

Going long only will limit GLP utilization and reduce GLP returns.

A drop in GLP returns will cause people to remove assets from the GLP pool.

Smaller GLP pools will mean fewer traders and fewer fees.

I will use data to verify each of these steps.

Traders on GMX only go long in a bull market

This is 95% correct.

Since short positions can receive funding fees on other exchanges but must pay borrowing fees on GMX , no rational trader would short GMX during a bull market.

The data support this conclusion.

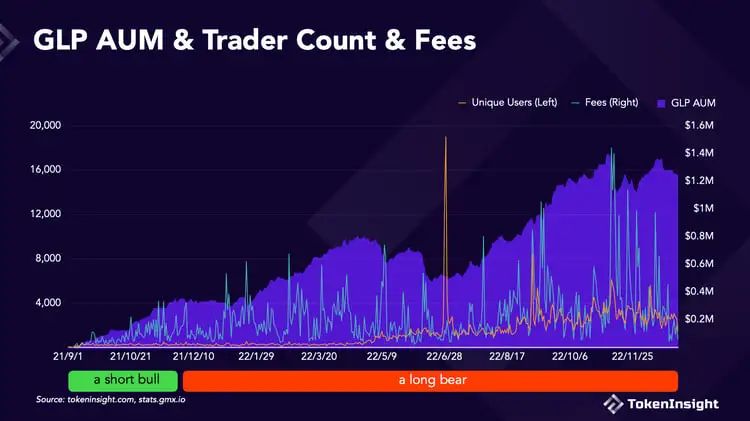

The 15-month history of GMX can be divided into two parts. The first stage is from September 1, 2021 to November 10, 2021. It is a short-lived bull market, and ETH has reached a ATH-All Time High. The second phase, starting on November 10, 2021, is a long and painful bear market, with ETH falling by more than 70%.

While traders were almost evenly split between longs and shorts during the second phase, 95% of GMX 's open interest was long during the first phase. History will likely repeat itself when the next bull market arrives.

Going long only will limit GLP utilization and reduce GLP returns

The data doesn't confirm or disprove this claim, but it's probably wrong.

Just looking at GLP utilization and APR, GLP even performed better in the first stage, and only going long improved utilization and APR. But that's an unfair comparison.

However, whether traders make money is closely related to the price action of ETH .

Degen will lose money to open casinos.

This has been true for most of GMX 's 15-month history, but not all. Last fall, as $ ETH rallied to an all-time high, traders turned a loss of about $2 million (September 21, 2021) into a profit of about $3 million (November 10, 2021), netting $5 million. However, as $ ETH then plummeted from $4,878 to $1,200, GMX traders squandered all their profits and racked up a net loss of over $40 million.

While the sample size is small, we have to admit that GLP consistently loses money to traders during bull markets. In that case, would GLP's share of the fee be enough to cover the loss?

I calculate GLP's actual return by adding the trader's profit (or loss) to the platform fees.

Adjusted GLP APR decreases during bull market phases and increases during bear market phases because GLP returns decrease during bull markets due to traders' profits and increase during bear markets due to traders' losses. In a bear market, traders not only have to pay handling fees, but also keep losing money to GLP.

Adjusted GLP APR is averaging around 50%, which is pretty good. But this is also where the data gets confusing, because the first brief bull market phase coincided with the early days of GMX ’s launch, when everything was experimental and the amount of data was limited, so the conclusions may not be accurate.

Declining GLP returns will cause people to remove assets from the GLP pool

So, will LPs flee when GLP returns fall? not quite.

In the first stage of GMX development, that is, in the bull market, the Adjusted APR of GLP is often negative, but the AUM continues to grow.

If anything, it appears that a reduction in GLP AUM leads to an increase in APR. When there are fewer GLP holders at the table, everyone who remains gets a bigger slice of the pie. This dynamic balance prevents bank runs and helps stabilize the supply of GLP.

Smaller GLP pools will mean fewer traders and fewer fees

It is also not clear from the data whether a smaller GLP pool means fewer traders and fewer fees. There are so many factors at play that cause and effect are not obvious.

The large reductions in GLP pools were all triggered by major events rather than APR fluctuations, such as Terra in May, 3AC in June, and FTX in November. These events all lead to high market volatility and the most active traders. Therefore, a decrease in GLP AUM is often accompanied by an increase in fees.

The dynamic balance mentioned in the previous section is thus amplified, the remaining GLP holders already get a larger share, and the pie gets bigger: significant crypto FUD → more GLP redemptions and more Traders and higher fees → high GLP APR → more GLP minted.

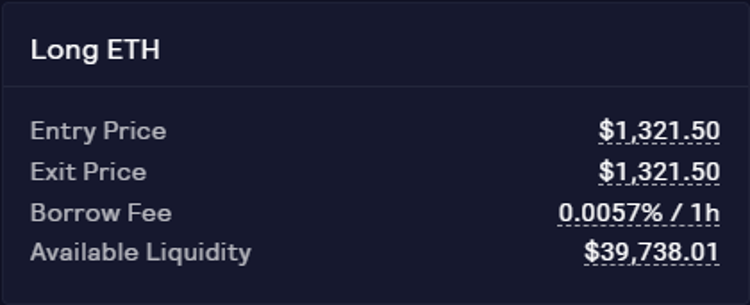

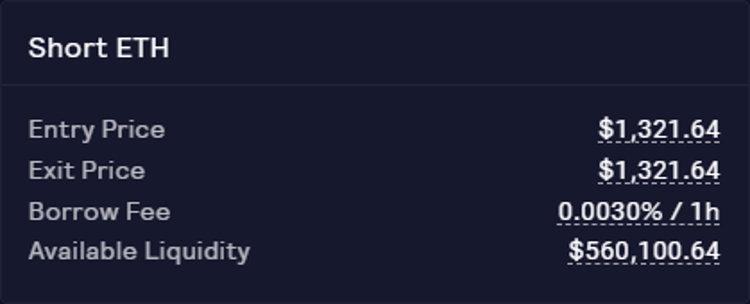

However, there is always the risk of liquidity drying up. As I write this, the available liquidity for $ ETH on GMX is down to less than $40k, because there was a small bull market and every trader was eager to profit from it. There will be many more moments like this, especially during a secular bull market. While it's hard to predict what will happen then, based on past performance, it's unlikely that GMX will crash right away.

Source: GMX

Source: GMX

write at the end

The so-called GMX bull death spiral is untenable. Even if all traders are long in a bull market, GMX/GLP is still a pretty attractive money printing machine. The fees distributed by GMX to GLP holders are sufficient to cover losses incurred by traders.

However, long-short imbalances are a real problem. GMX may consider taking steps to mitigate this impact. For example, GMX could increase the borrowing fee for long positions and include a funding fee for short positions to incentivize traders to open short positions. GMX can also reduce swap fees to incentivize users to exchange BTC/ ETH for stablecoins in the GLP pool.

During a bull market, the decline in GLP returns can also have a broad impact on projects that rely on their GLP yields, such as Umami, Jones DAO, Rage Trade, GMD, etc.

Narratives on Twitter can affect market sentiment and prices. GMX benefits from the true yield narrative and may be hurt by others. Winning or losing does not matter. The following scenario is not impossible: GMX long liquidity tightens in a bull market, traders cannot open new positions, GLP holders cannot redeem, FUD ferments on Twitter, and the market starts to believe opinion instead of fact. Black swans didn't exist until adventurers discovered them in Western Australia.