This article comes from the Stanford Blockchain Review. Deep Tide TechFlow is a partner of the Stanford Blockchain Review and is exclusively authorized to compile and reprint.

introduce

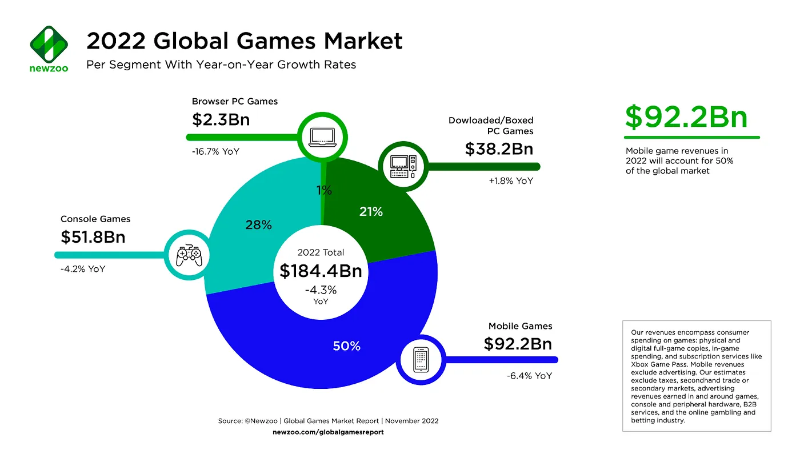

To me, gaming is a long-lasting adrenaline and dopamine injection, and since the invention of video games in 1958, the gaming industry has grown steadily and is now a staggering $185 billion a year in revenue.

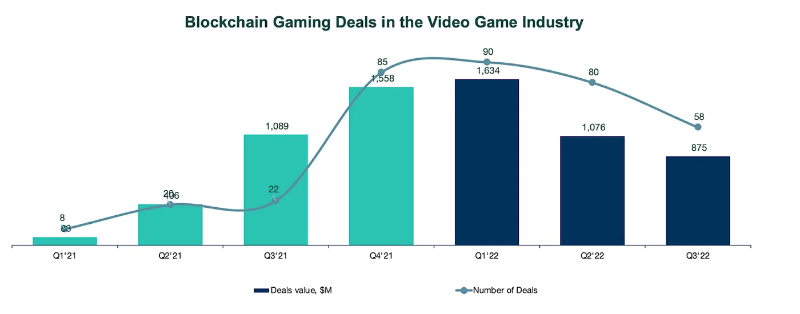

There are a wide range of game types, covering various game modes such as arcade machines, game consoles, browsers, mobile phones, cloud, and augmented reality, so players have also obtained more diverse game platform choices. In recent years, we have also seen the arrival of the blockchain gaming boom. Up to now, the scale of blockchain games is about 4.6 billion US dollars, and there are forecasts that its scale will grow to 65.7 billion US dollars in 2027. This is a rapidly growing category of games.

From Cryptokitties to Axie Infinity to the roller-coaster rise and fall of game guilds, capital flows in with the trend and withdraws with the trend.

However, despite the rise and fall, innovations are bound to emerge. I believe that gaming can serve as an entry point for the mass adoption of blockchain technology. Right now we still have many unexplored areas waiting to be explored. In this article, I analyze some of these challenges and explore potential opportunities for new economic models of blockchain game development, including content-driven/publishing-driven models, blockchain game XR, and the challenges of an open economy.

Target Audience

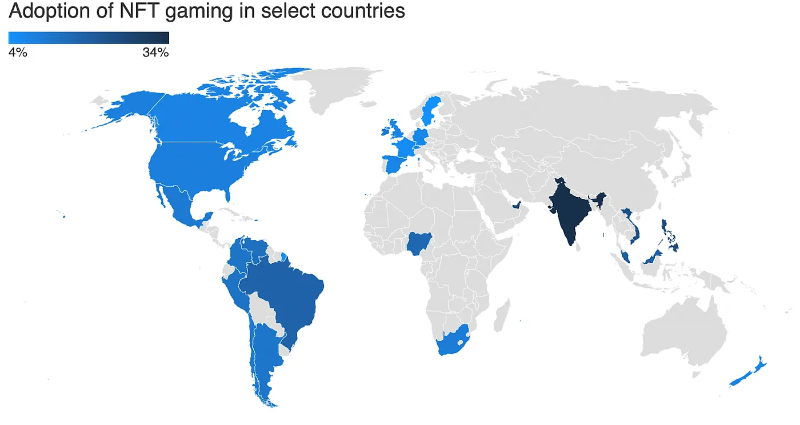

First, an important question is: who are "blockchain gamers"? While the industry is still nascent, the most active region is currently Southeast Asia, followed by Latin America and Africa.

Compared to developed countries, blockchain games are more popular in developing countries, and the ARPU (average revenue per user) of blockchain games is much higher than traditional Web 2 games (eg Axie Infinity has >$100 ARPU).

According to Newzoo's report, which sampled US, UK and Indonesia, Indonesian players value profit more than players from other countries, I think this is the difference between developed and developing countries, because the income level of developed countries tends to Higher than developing countries, so in developed countries, the marginal effect of playing blockchain games should be lower. This may also be one of the main reasons why blockchain gaming activity decreases dramatically during bear markets (as token prices fall, game earnings are no longer as attractive as they were in bull markets).

In short, blockchain games are currently more attractive to those aiming to monetize the games, who are value extractors by definition, which puts pressure on the game economy. To sustain the economy, we need more value creators than extractors. Southeast Asia, Latin America and Africa are not the most active game-consuming regions, the US, China, Japan, South Korea and the UK are.

It's worth considering that games need to be tailored to attract players from these five regions, as they may help sustain the game's economy. In this sense, the focus of blockchain games needs to shift to fun, and while there are similarities between the US and UK markets, China, Japan, and South Korea are three completely different game markets with different player behaviors and cultures, so Regionalization can be an important strategy, and I'm excited about teams aiming to target these regions with tailored marketing strategies.

For example, if the target market is Japan, one can develop an anime-themed action role-playing game and focus on Twitter and Line, or if the target region is India, one can focus on a mobile-based first-person shooter game and marketing strategy Mainly focused on Youtube influencer collaborations.

Types of blockchain games

Looking at the top 10 games with the most MAUs (monthly active users), we can find a lot of collectible card games (CCGs) and strategy games. This trend may be mainly caused by the following 4 reasons:

- These types are more compatible with NFT transactions and DeFi, which attracts speculators, as these are by far the main adopters of blockchain games.

- The development cycle is relatively short, and the mindset of some early developers is to develop light/simple games and use experience to launch new works.

- These types of games are suitable for web browser-based games, usually appeal to a less time-sensitive audience, and fit well with collectible card games and strategy games.

- Current infrastructure limits the types of games that can be played (low throughput/high gas fees mean games with strong micromanagement features tend to only offer on-chain tradable assets).

This trend may change as the infrastructure matures and industry talent continues to flow in. The range of playable games may expand, and more portable device development kits may bring blockchain games to mobile phones and consoles.

More choice of devices for players to play blockchain games will lead to higher mass adoption, which for most Web2 players could mean action role-playing games (ARPGs), open worlds, hyper-casual games, etc. And so will be on stage.

Action RPGs tend to have longer development cycles, requiring more human resources to maintain patches and plan interesting plot lines, so if the game's setting appeals to this group, an ARPG can appeal to a core group of players with a high The time spent and the ability to spend money. In short, action RPGs are really fun (like World of Warcraft), and the inherent nature of having tradable gear is great for moving assets on-chain. And, since many ARPGs have implemented the gatcha system at this point, we can remove the opacity of "low gear drop rates" by moving these probability-based events on-chain, making them more transparent to the player.

Open world games tend to have longer development cycles. Also, open world games add additional layers to the game content by introducing non-linear character growth and more areas to explore. This type of game is more suitable for specific regions (for example, this type is more popular in Asia than other parts of the world, especially in Korea and Japan). Open world games that require more opacity to be removed are better candidates for on-chain deployment than ARPGs due to more probabilistic events such as areas to explore and random enemy generation.

It is my personal prediction that hyper-casual games will become a popular blockchain game genre, which has traditionally struggled to retain users due to the lack of depth of content. However, if hyper-casual games are fully deployed on-chain, the combined nature of the blockchain will allow for potentially unlimited UGC (user-generated content) in the game. Since the barriers to development of hyper-casual games tend to be low, UGC in this Types are more popular than others. On top of that, many stories can be created not only by a game's own community, but also by other players entering/leaving the game from other communities.

However, it is worth noting that there are certain commercial barriers for blockchain games to expand to different devices (such as game royalty split disputes with hardware providers, programmable smart contracts to bypass 30% app store fees, etc.), These are often overlooked.

I'm excited by the teams that are building open world, ARPG, and hyper-casual games that tend to focus on the community and leverage a crypto culture with potentially programmable royalties to avoid reliance on centralized marketplace trading venues.

Content Driven Studio Vs Publisher Model

Historically, the game companies with the highest market capitalization have been publishers (e.g. Steam, Tencent) and for good reason: content-driven games tend to be cyclical (e.g. Ubisoft) and thus lead to erratic revenues because Content is based on ideas. In the game industry, talent stickiness is also very low (about 15.5% turnover rate), and as an idea-driven industry, this means that core designers leaving content-driven studios can cause fatal damage.

As a company grows and becomes institutionalized, employees and equity holders typically prefer more predictable revenue, so publishers are often better able to scale. However, while the publisher model looks great on paper, it usually requires more start-up capital and the expertise to handle distribution channels, marketing and, to a lesser extent, community management. These skills are usually built from years of experience in the industry, especially the distribution pipeline, the flywheel effect and the size of the traffic moat publishers are able to build, so there is less competition for the top spot as a Web2 game publisher. (People go to Steam not only because their favorite games are released there, but also to buy games/find games to play on Steam)

In Web3, the clear winner going to the publisher's platform has not yet been determined, most studios are self-publishing, so publishers are still in a competitive but unsaturated market. When it comes to listing a game on a publishing platform, there is a trade-off between launch efficiency and the quality of listing content to determine if listing a game without a license should be allowed.

On the other hand, game development studios have less capital requirements and may choose to rely on distribution channels such as Steam and Origin. However, if funding is raised before a prototype game is produced, the team background and track record becomes very important. This has turned a lot of new and less fundable talent into the indie developer market, who tend to be slower/lower quality in making games.

This is one of the areas where AIGC can greatly improve, as it can save developers the time and cost of designing a lot of game content (from graphics to NPC design to audio, etc.), thus opening up investment possibilities for these developers. This is especially relevant for Web3 game studios, as the vast majority of them are single-digit development studios.

In my opinion, visionary studios should aim to make blockbusters and transition into publishers.

- In Web2, Valve produced popular games such as Half-life, and then moved to Steam;

- In Web 3, the same goes for Sky Mavis (the Ronin chain designed to attract other games, not just Axie).

This requires studios to understand the game, be able to design the game, and overcome the aforementioned challenges, such as open economy challenges, blockchain choices, etc., which is arguably the tougher path.

However, with the rise of the AIGC, I expect the cost of content creation to drop significantly over time, which may unleash the creativity of more independent studios/small teams and infuse more content into the space. 0-to-1 innovations have been rare in recent years, as initially VCs tended to back fewer content studios, but this trend may reverse as easier methods of creating content emerge.

I'm excited about teams with strong marketing and business development backgrounds building a publishing platform with onboarding features like an easy-to-use wallet. The field's lead tends to fade as a clear winner emerges. I'm also excited about content studios working on fully blockchain-based game development, a space where leadership is less likely to fade.

Successful content development can create intellectual property (IP) and tie it to merchandise and cosmetics, which could potentially be combined with XR as we discuss below.

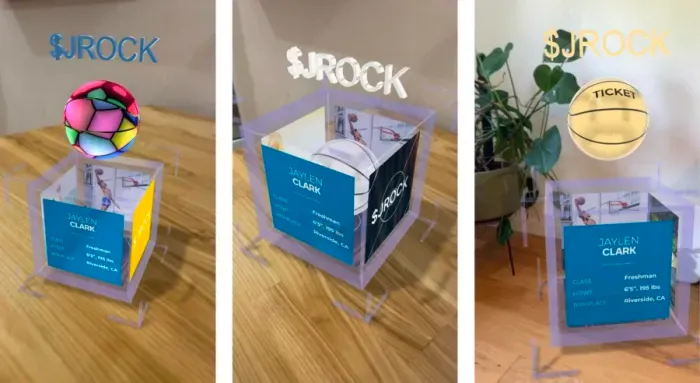

XR (extended reality) and blockchain game decoration

It's a hybrid experience of virtual and reality, imagine your custom NFT item from the Metaverse is now projected in 3D through your smartphone/smart glasses into real life, you love it so much, after some consideration, you decide to make it 3D print it out.

Your 3D item metadata is encrypted (e.g. using asymmetric encryption to encrypt angles, rotations, dimensions, etc.), they are masked in the metaverse to prevent grabbing, and only the printer verifies your ownership (e.g. via wallet address ), your item will be printed. Every item you print is unique, it belongs only to you, and while other people may be able to view your NFT in the metaverse, they will never be able to own the same physical object as you.

You can even prove that the manufacturing/printing process was done correctly by using zero-knowledge (ZK) based attestation of ownership (to prove you are the owner without revealing your identity) and then running a client with a network of validators to prove that the manufacturing/printing process was done correctly Owner/artist identities remain anonymous.

If printing takes place elsewhere than the NFT owner's physical location, a decentralized tracking system (such as the one in Vechain) can be used to track the location of the item to ensure proper shipping. You can even set up a network of validators to ensure the condition of printed items is maintained during shipping.

The challenge of an open economy

The game economy determines the lifespan of the game . A sustainable economy is inherently difficult to achieve because it requires a balance of value extractors and creators to keep the economy healthy. Guilds such as Yield Guild Games ("YGG") are not a new thing, back in 2004, many RPG games, such as MIR3, had large guilds for equipment collection - which put pressure on the in-game economy.

In Web2, game designers typically act as the governments and central banks of the world to regulate the economy and ensure game items fluctuate within healthy price ranges to increase player retention. Studios are able to control the economy because Web2 games are closed loop and each game can be treated as an isolated country with little trade with each other .

However, Web3 is open by nature, which means that studios can only act as central banks and governments for their games, and cannot control the entire world. There are many game economies interacting (such as money flowing from decentraland to sandbox), so , we may need to additionally consider the "foreign exchange" system - how game items are exchanged between different economies. Just like gold in the Bretton Woods system, ETH/ Stablecoin has become the medium for most game asset transactions. Will we see a direct game-to-game asset exchange one day? I think this is unlikely as Liquidity fragmentation could become a bigger problem as more and more game assets are on-chain.

Now game studios need to take into account additional factors such as lending (outflow) and borrowing (inflow) and leverage (e.g. leveraged to buy game items), which can destroy the game economy. There is no doubt that designers need to think more about how to adjust the in-game economy to accommodate the external traffic that occurs in Web3.

Dual token models (governance + utility token models) are popular in blockchain games right now , but it's worth thinking carefully about where the reservoirs and outlets are in the economy, especially for utility tokens. Reservoirs have a similar effect on value creation as outlets have on value extraction. In general, the more reservoirs a game has, the more likely its economy will remain strong.

Teams should also consider taking on a more powerful central bank role in the early stages of the game (when the number of players is less than N), promulgating policies that directly or indirectly affect token production, and then as the number of players increases, power should be transferred to the DAO . Algorithm-based policies should also be considered under community proposals (e.g. increasing incentives for players to participate when economic outflows are too high).

Pre-release NFTs are another single point of failure in the blockchain game economy, with many studios using them as a source of funding, but it creates an issue for early holders that can affect game development. You have a mixed audience who might extremely extract value when the game releases/posts positively, and the players who really want to try and support the game are a different kind of player. This makes the task of satisfying stakeholders extremely challenging, thus reducing overall player retention (as does launching a platform).

I'm excited about the teams that are building scalable stress analysis software capable of ingesting and analyzing common on-chain and off-chain data. While each game's economy is different, many core metrics should remain constant across the board (e.g. active player in/out, money in/out in fiat currencies). In other cases, studios may require professional financial advisors/designers/asset managers. Also, it might be wise to have as few tradable assets as possible in the early stages, since the more assets there are, the more layers the game economy has, making it harder to control the game economy.

F2O game economy?

The term originated from the company Limit Break, as the Digi Daigaku Genesis AirDrop garnered huge attention on various platforms. Digi Daigaku chose to release in secret and offered free minting on August 9th without disclosing any information, which is completely different from traditional NFT releases. Limit Break is the company behind Digi Daigaku. On August 29, Limit Break announced that it had raised $200 million in funding. With the help of this financing news, Digi Daigaku’s reserve price exceeded 15 ETH.

Genesis will give holders access to subsequent AirDrop, which allows the gatcha system to be implemented here, and if subsequent AirDrop are used to unlock content and unique powers/items, etc., this can help increase user retention. Users also don't have to worry about RUG scams, are more likely to get hooked on the game than spend time calculating the rewards, and have an easier time reaching an audience, and are more likely to continue developing the game (as royalties are likely still the major studio's method of income).

However, if the value of subsequent AirDrop is 0, Genesis will also be worth 0 in theory, and high royalties may also become a bottleneck hindering the circulation of NFT. Those small studios that have not raised huge funds like Limit Break due to marketing With a limited budget, you may not be able to get enough exposure for your project, and thus not be able to enjoy the benefits of the F2O model, and if the number of F2O games increases in the market, the user acquisition cost may be minimized.

So far, F2O sounds similar to the F2P market, but I don't think the two markets will converge, because the number of holders of Genesis NFT collectibles is limited, and if only specific NFT holders are allowed to test the game, then F2O may Potentially easier to control the rate at which the player base expands. How the game designer chooses the draw process for free minting is also an important decision (based on community activity, skill level in similar games, etc.).

Overall, F2O seems to be a better fit for well-funded studios planning to implement a gatcha system and have clear monetization plans for traditional players, but the idea is developing rapidly and more suitable use cases may emerge soon. So far, I'm cautiously neutral and haven't seen how it could be the ultimate solution for designing blockchain game economies.

Summarize

The economics of Web3 games are complex, but there is huge potential. Before creating a stakeholder question, developers should carefully consider their target audience and monetization methods, and should be bold in experimenting with new incentive models because the risk/reward ratio is not symmetric.