Sui is moving from behind the scenes to the front, showing the technical prowess he has accumulated over the years.

Author: Daniel Li

Layer1 blockchain Sui announced that its Mainnet will be launched in the second quarter of this year, and launched a series of educational activities and content called "Wave to Mainnet", aiming to let the community understand the potential of the Sui protocol before the mainnet goes live. Sui and Aptos, the leader of Layer 1, belong to the Meta public chain. They were founded almost at the same time when the project was established. Compared with Aptos, Sui pays more attention to the innovation of the underlying technology, and its goal is to become the first Internet-scale programmable area. Blockchain platform. Although Sui is far inferior to Aptos in terms of development momentum, projects driven by technological innovation often have the potential to accumulate steadily. Sui has accumulated rich technical advantages in the past few years. With the upcoming release of Sui's Mainnet, I believe Sui will soon There will be a wave of development.

Sui who works silently and Aptos who stands in the spotlight

Aptos has inherited nearly three years of open source technology and development experience from the Die project, and can quickly realize the construction of the underlying architecture and the layout of ecological projects. In contrast, Sui chose to build a Layer1 network from scratch, causing it to lag far behind Aptos in the development process. Therefore, in terms of attracting capital and investors' attention in the early days, the fast-growing Aptos can attract more investors' attention than Sui, which is still building the underlying structure. Secondly, as Layer1 public chains, both are committed to improving the security and scalability of the blockchain, creating a high-performance blockchain infrastructure network for billions of people. However, there are certain differences in the strategies or priorities of the two in terms of achieving their goals. Aptos focuses on marketing. Aptos is packaged as a unique product created by the best developers in the IT industry. It is its marketing method. Although it is exaggerated, it is more effective. In the past, with the name of Layer1 leader, Aptos attracted a large number of investor. In Q4 last year, the Mainnet was launched concurrently. Although the price has shrunk by more than 76%, it has performed very strongly since the beginning of the year and has recently corrected, but the total market value still reaches 2.08 billion US dollars. Secondly, in terms of ecological project cooperation, Aptos focuses on cooperation with well-known companies, such as launching an acceleration program with Google Cloud in terms of infrastructure; in terms of games, it has reached a cooperation with NPIXEL, a 3A-level game studio in South Korea; in terms of payment, it has cooperated with MoonPay, a Web3 financial technology company Collaborative Integration Ecosystem Project Petra et al. Cooperation with well-known companies has brought huge traffic and attention to Aptos, and also promoted the rapid development of its ecological projects.

Unlike Aptos, Sui places more emphasis on innovative applications of the underlying technology than on marketing. For example, Sui's improved version of the Move language can more clearly express the ownership, mutability, and composability of objects, making it naturally suitable for building metaverse facilities. In terms of ecological projects, since Sui's Mainnet has not yet been launched, most projects are still in the testing stage, so Sui is far behind Aptos in terms of attention. Therefore, in many cases, Aptos is like a star standing in the spotlight, while Sui is more like a silent cultivator in the background.

Both Sui and Aptos are Layer1 public chains, the founding teams are both from Diem, and both belong to the Move track, so there has been a competitive relationship between the two from the very beginning. However, since Sui built a Layer1 network from scratch, the development process was relatively lagging behind, and most of the early market attention was focused on Aptos, so the competitive relationship between the two was not obvious at the beginning. It was not until Sui's Wave 2 test was successfully concluded recently and the Mainnet was about to go live that it attracted the attention and vigilance of Aptos. Last month, Sui's CTO accused Aptos on Twitter of putting pressure on the Pontem team, the organizer of MOVECON (Move Eco's first large-scale forum), to cancel the speech of the Sui team, and even remove the Sui Foundation from the list of event organizers . This shows that Aptos has begun to regard the rising Sui as a competitor, and also affirms Sui's market position and potential from the side.

Compared with Aptos, Sui's underlying technology has obvious advantages

Although Sui still has many shortcomings compared with Aptos, for example, Sui is not as good as Aptos in terms of ecological projects and community scale, but Sui has been committed to the innovation and application of underlying technologies, and has accumulated rich technical advantages in the past year, from Sui- From the Move language to the Narwhal-Tusk consensus mechanism to the storage fund token economics, Sui has made major innovations at every level of the blockchain project. In this regard, even compared with other new Layer1 public chains such as Aptos, Sui is also unique.

Sui-Move

Both Aptos and Sui use the Move language, but there are differences between the two. The design of Aptos basically follows the classic design idea of Diem's Whitepaper, while Sui has been upgraded and adjusted to form a unique Sui-Move language. The biggest difference from Move is that Sui uses an object-centric model rather than an address-centric model. Therefore, on Sui, almost everything, such as tokens, smart contracts, NFTs, etc., can be represented as "objects". Each object has a series of attributes, including owner address, read and write attributes, transferable attributes, function attributes, etc. Sui-Move clearly states the characteristics of object ownership, sharing, mutable or immutable, while Aptos does not. Additionally, Sui's ownership API is more concise than Aptos' API because it more clearly demonstrates the blockchain design. In terms of functionality, compared to the Move language, Sui-Move has certain advantages in terms of security, smart contract support, programming model flexibility, and compatibility.

Narwhal & Tusk

Sui’s consensus mechanisms all minimize the communication required between validators to process transactions to achieve lower latency. Sui's consensus mechanism is divided into two parts: Narwhal and Tusk. Narwhal is a mempool protocol that stores unconfirmed blockchain transactions and broadcasts them before the consensus protocol validates them. The protocol's task is to achieve consensus while maintaining data availability and is independent of the consensus protocol, tolerant to asynchronous or intermittent failures. Tusk is an asynchronous consensus protocol that takes care of transaction ordering. The protocol uses shared randomness to eliminate extra communication between nodes and allow each node to determine the total order of transactions. When combined with the Narwhal protocol, it ensures high performance in the event of a failure.

In theory, there is no known upper limit to the throughput scalability of Sui's design. And in terms of security, compared to synchronous blockchains (i.e., most proof-of-work-based blockchains), Sui's security properties can resist adverse network conditions, network partitions, or DoS attacks on validators because it No synchronization assumptions are imposed on the network.

developer experience

A core feature of Aptos is seamless upgrades, allowing developers to focus on building without disrupting users. In contrast, the Sui Development Kit (SDK) provides more convenience for developers. The SDK provides open-source, versatile and user-friendly tools and allows developers to save a lot of time on debugging smart contracts, waiting for audits and building basic technology stack elements. In addition, the SDK also tries to connect other ecosystems and non-crypto use cases, such as: game APIs are directly connected to the general Layer1 instead of side chains or game-focused L2; Portability to bootstrap the community; "Handshake" is a front-end tool that serves as a conduit for users to distribute, claim/redeem Sui digital assets (e.g. payments, merchant coupons) to crypto and non-crypto users.

Sui Token Economics

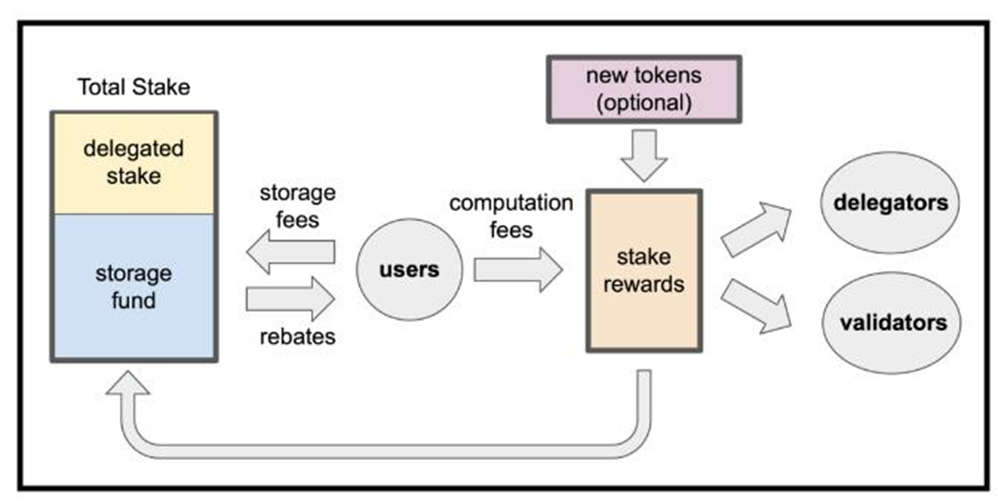

In addition to a series of technical innovations designed to optimize the composability and scalability of the system, Sui has implemented a unique token economics model. Different from the token economics model of traditional Proof-of-stake chains, Sui's token economics model adds a "storage fund" function. Since the blockchain is a data structure that only increases but does not decrease, more and more data needs to be maintained on the chain as time goes by, and the cost will increase accordingly. Higher fees for users, the "storage fund" is basically born to solve this problem, make early adopters pay more, so that all users can use the network based on similar fee levels.

In addition, Sui's storage fund also pays out validators in the system, or people who actually store blockchain data and complete data maintenance work. As maintenance increases, payouts to validators also increase, which incentivizes more people to become validators in the system, and as more people become validators, the total amount of storage space available increases. will increase, which further leads to a reduction in gas costs for writing to the blockchain. Sui's token economics model is typical of a highly scalable chain economics model, using game theory to ensure that gas fees remain relatively constant over the lifetime of the blockchain.

Sui Ecological Project Inventory

Hybrid Liquidity trading application MovEX

MovEX is the first AMM+ Order-book hybrid Liquidity DEX on Sui, which combines the advantages of AMM and Order-book to provide everyone with a Liquidity trading experience by creating a hybrid Liquidity pool. Internally, MovEX has a settlement engine that distributes orders between AMM and Order-book, which ensures both minimal slippage for traders and fairness for Liquidity Provider. Liquidity Provider can also customize the price range to provide one-sided Liquidity, which can effectively manage Impermanent Loss.

MovEX supports market trading and limit order trading, two common functions on centralized trading platforms. Ordinary users can provide Liquidity for the liquidity pool at a custom price range; professional traders and Liquidity Provider can become Liquidity Provider through the Order-book , similar to market makers in centralized exchanges. At present, the MovEX product is still in the testing stage, and users can link the application through the Sui Wallet wallet to experience the product.

WalletSui Wallet

Sui Wallet is a browser extension that acts as a portal to the Web3 world, allowing users to connect to DApps and sign human-readable transactions from trusted DApps. It is the official wallet of the Sui Blockchain, allowing users to create, import and persistently store Seed Phrase and derived private keys, transfer coins and NFTs, and view owned fungible tokens and NFTs. The Sui wallet was originally developed for the testing use of Sui developers, and it is currently the most recognized wallet on the testnet.

Decentralized trading application Suiswap

Suiswap is the DEX of the automatic market maker mechanism (AMM ) on the Sui chain, which supports the exchange and trading of native assets in the Sui ecosystem. At present, Suiswap supports users to receive test tokens, conduct transactions or form LPs to provide Liquidity for the Liquidity pool. The final form of the product will not be seen until the Sui mainnet is launched.

Overcollateralized Lending App Leizd Protocol

Leizd Protocol is a decentralized lending application within the Sui ecosystem, which operates the lending function in the form of over-collateralization. The application uses the decentralized US dollar Stablecoin USDZ as an intermediate asset. Like MakerDAO on the Ethereum chain, the risk of lending products is controllable by minting Stablecoin. In LeizdProtocol, borrowers can deposit encrypted assets as collateral to mint USDZ, then lend the required USDZ, convert it into Stablecoin such as USDT or USDC, and return the borrowed USDZ and interest at maturity to withdraw the Collateral asset. Depositors can also pledge encrypted assets to mint USDZ in exchange for deposit interest, or exchange USDZ for other encrypted assets and deposit them in the deposit pool to earn interest.

It is reported that Leizd Protocol plans to deploy Multichain on the two networks of Sui and Aptos, allowing users to use assets on the two chains to achieve loans. However, the test product of Leizd Protocol has not yet been launched, and the product still exists in the concept introduction stage.

NFT trading platform BlueMove

BlueMove is a platform that supports NFT creation and trading, and has been successfully deployed on two networks, Sui and Aptos. The smart contract of the platform adopts a modular system and clearly defines the scope of execution through standardized signatures, so that new functions can be introduced over time without compromising security, such as collective quotations, feature quotations, and multiple cancellations.

In addition, BlueMove also issued a total of 300 million platform tokens MOVE, of which 5% are used for AirDrop, 40% are used to reward traders and collectors who actively participate in the platform, and 15% are used to reward users for staking MOVE Tokens and the rest for funding and team development. The primary utility of the MOVE token is on-chain governance and membership benefits.

Currently, users can buy or sell NFTs on BlueMove and get MOVE rewards. In addition, users can also obtain the platform's transaction fee share and additional MOVE rewards by staking MOVE tokens.

Web3 Chain Game: Abyss Worlds (Abyss Kingdom)

Abyss World is a Sui Layer 1 blockchain-based action role-playing game developed by Metagame Industries, with powerful Web3 technology and gaming experience. It aggregates Web2 and Web3 game players, allowing players to experience immersive gaming fun in the virtual world. Various characters, maps and plots in the game will be supported by Sui blockchain technology, allowing players to create a real game world. According to the roadmap, Abyss World will officially open the public beta in the third quarter of this year.

In the Web3 gameplay, NFT is a key option to attract users to participate in the project early. Abyss World started the sale of the first batch of Genesis NFT Gazer series on March 23. These NFTs are not just small pictures, but are bound to the rights and functions in the game: players holding NFTs can share potential income in the game, get more rare props and skins, and get the game's first Internal test qualification. In addition, due to the in-depth cooperation with Mysten Labs, in addition to binding Abyss World's native token AWT, NFT also has the right to bind Sui token AirDrop, which can be described as the current head project of Sui ecology.

Summarize

Sui is the first permissionless Layer1 blockchain designed from the ground up to provide a more user-friendly experience for Web3 users. However, technology is only valuable if it solves real problems, and it can only be truly successful if people are willing to pay for it. Sui has always focused on the innovation and application of underlying technologies, which brings him rich technical advantages. With Sui's Mainnet about to go live, now is the time to turn these technological advantages into market competitiveness. Through the "Wave to Mainnet" series of events, Sui is moving from behind the scenes to the front, showing people the technical prowess he has accumulated over the years. In the future, how the underlying technology will drive the overall DX/UX, who will be able to attract more users and Liquidity, these questions will gradually be answered over time.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the authors and guests, and have nothing to do with Web3Caff's position. The content of this article is for information sharing only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of your country or region.