Arbitrum launched an AirDrop of ARB tokens in March, receiving enthusiastic feedback from users and supporters. The launch of the token transfers decentralized control of the protocol to ArbitrumDAO, which is governed by token holders.

Things have changed dramatically since the coin was launched. The first improvement proposal aimed at setting up the Arbitrum Foundation and distributing funds for it was rejected by token holders due to transparency and unclear communication issues. However, the proposal is only an approval that has already been acted on, so it cannot satisfy the objections of token holders. Concerned token holders and community members raised questions about token utility and why ARB tokens are worth owning when there is no cash flow, Gas tokens that aren’t Arbitrum, and possibly not even full governance control billion dollar valuation.

Why Token?

The rights and responsibilities of traditional financial asset holders (equity and debt) are largely standardized globally and across issuers. However, cryptocurrencies allow issuers to enact unique rights and responsibilities for each token, and even allow varying degrees of value capture between similar protocols. These rights and responsibilities form part of the token economic model and play a role in determining the success of the token and protocol.

ARB's Token Economic Model

ARB is the governance token of ArbitrumDAO, exercising significant control over Arbitrum One and the Nova network. According to the agreement document, the DAO controls the following:

- Chain Upgradability and Technological Future

- DAO treasury

- token inflation

- Sequencer profit - the net difference between fees charged for on-chain operations and L1 fees paid by Sequencer

- All Arbitrum social media platforms and accounts

While the protocol is still in its growth phase, the protocol and DAO are protected by a security committee of elected superusers who can act quickly through multisig to address any potential vulnerabilities or risks. The DAO has the power to change the composition of the security committee by electing and removing members.

The Arbitrum Foundation, a legal entity registered in the Cayman Islands, also supports the DAO. It takes on responsibilities such as entering into off-site agreements, allocating funds to the growth of agreements, and managing social media. The DAO has the power to change the directors who manage the Arbitrum Foundation.

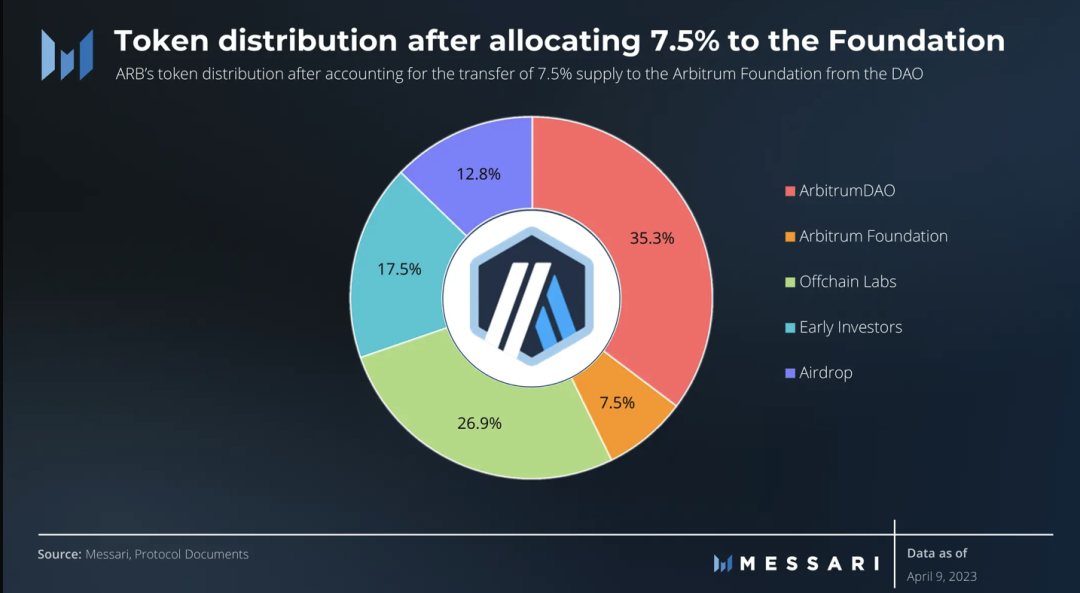

Tokens will be launched with a supply of 10 billion and a maximum inflation rate of 2% per annum. In the initial distribution, 7.5% of the total supply, or 750 million ARB tokens, was transferred from the DAO treasury to the Foundation's wallet. The transfer of this 750 million ARB was not disclosed in the initial token distribution. This became a pain point for token holders and the main reason why AIP-1 was rejected.

Governance

AIP-1 is an approval that has already taken action, raising concerns about whether the ARB token will have any governance capabilities. However, token holders rejected the proposal, leading to improved transparency and clarity in protocol design, which is where the token’s governance capabilities lie. The Foundation has taken several steps to address token holders' concerns, including:

- Publishing a Transparency Report detailing the foundation's setup and costs in more detail;

- Propose a replacement for AIP-1.1, adding a budget and phased unlock plan for funds transferred to the foundation;

- Propose a replacement for AIP-1.2, updating the document to more clearly articulate the Foundation's role and the DAO's control over it.

Additionally, community member Alex D. proposed AIP-1.05, demanding that the foundation return all funds transferred to it. However, based on the current vote count, this proposal is likely to fail.

Concerns about a token's lack of governance appear to be unfounded due to the immediate improvements that come with active governance.

cash flow

Layer 2 (L2) protocols generate cash flow through two main revenue streams:

- Sequencer profit is the difference between fee income generated from L2 users and fee expenditure paid to the base layer. Arbitrum's Sequencer profits will be transferred to the DAO treasury.

- Sequencer can generate maximum extractable value (MEV) by reordering user transaction requests. Currently, the Arbitrum sequencer does not capture MEV, but the DAO can earn profits from MEV by auctioning off block production rights once decentralized sequencing is implemented. As the main development team of Arbitrum, Offchain Labs has reservations about MEV auctions and is exploring ways to reduce MEV.

Although the agreement will not currently distribute cash flows, these will accumulate to the treasury and be used for further growth. In modern finance, generating free cash flow and reinvesting it is generally considered a good approach, as long as the business is in a period of high growth. Layer-2 is a high-growth industry, and the cryptocurrency industry is also high-growth. If future growth saturates, the DAO can vote to distribute its free cash flow.

Non-Gas Assets

ARB may never become a gas token on Arbitrum, but that doesn't need to be a prerequisite for it to be valuable. ARB will likely add other utilities in the future as it moves to a decentralized set of sorters. DAOs may mandate ARB staking on Sequencers to economically align incentives and allow for slashing in case of any misbehavior, similar to validators in a proof-of-stake network. This will increase the value of the token as users demand greater security from the protocol.

Competition with Optimism

It is clear that the ARB token has value through its cash flow, governance, and security. We can estimate its value by comparing key metrics with its closest competitor, Optimism.

daily trading volume

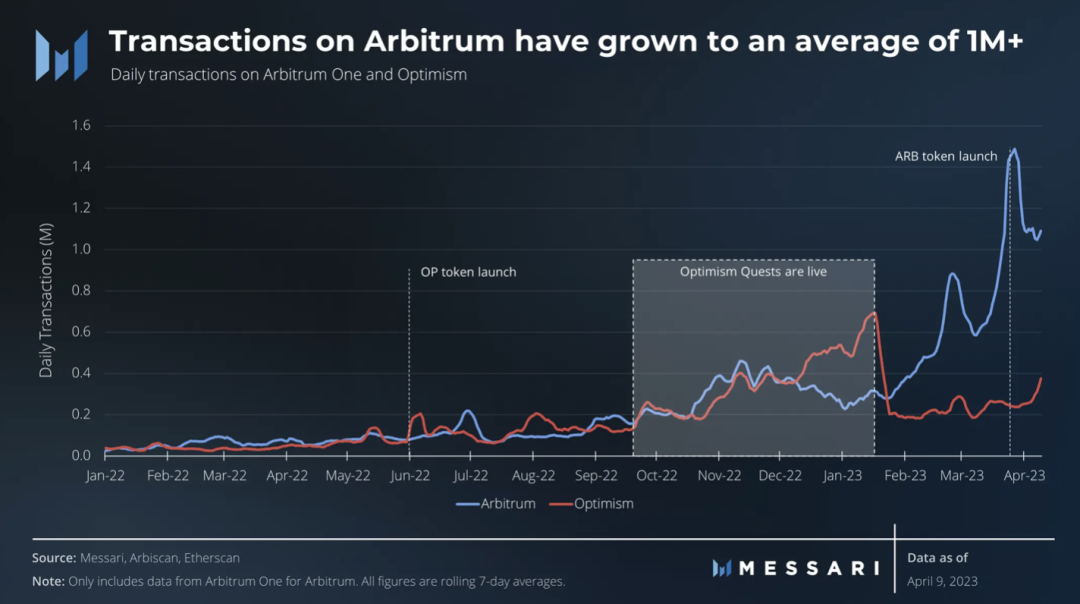

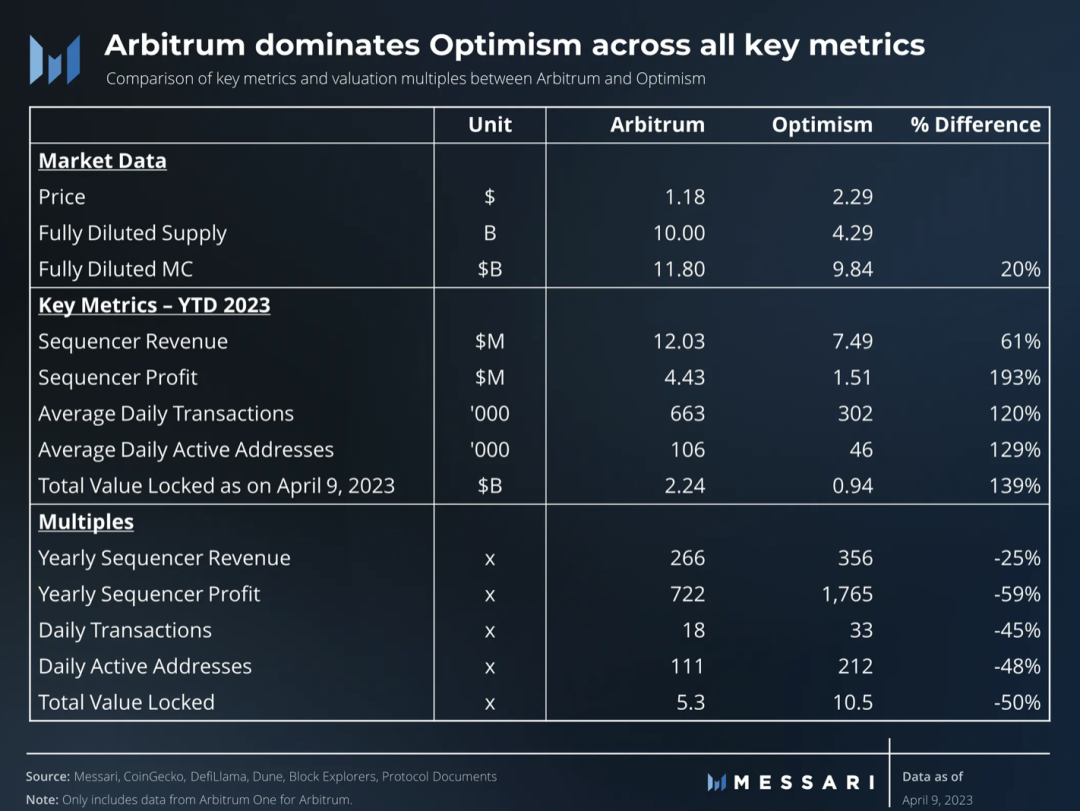

In 2022, Arbitrum and Optimism will have similar average daily volumes of 153,000 and 155,000, respectively. However, Optimism's activity appears to have experienced a sharp decline when it ends in January 2023, largely due to the support of its incentive program. Arbitrum, on the other hand, experienced a sharp increase in 2023 due to the anticipation of the AirDrop, with 2.7 million activities on the day of the AirDrop. As of now, Arbitrum's average daily volume of 663,000 is more than double that of Optimism, which has an average daily volume of 302,000.

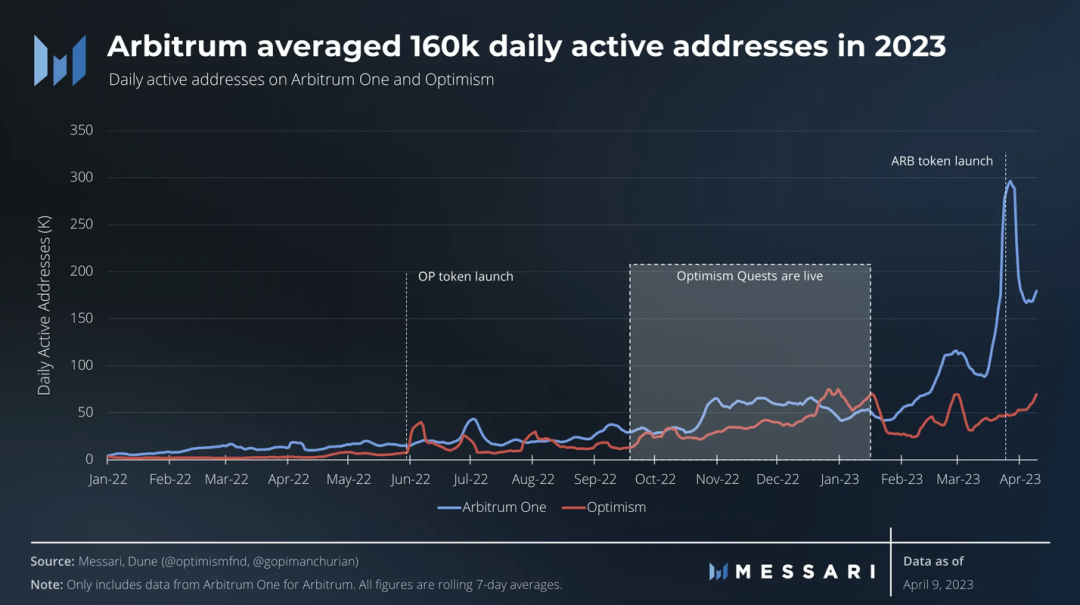

daily active users

Active addresses trended similarly to transactions, with Arbitrum having higher daily active addresses than Optimism. In 2022, Arbitrum will have an average daily active address of 27,000, while Optimism will have 17,000. As of now, Arbitrum has an average daily active address of 164,000, with an AirDrop daily peak of 612,000. Optimism will have an average daily active address of 48,000 in 2023.

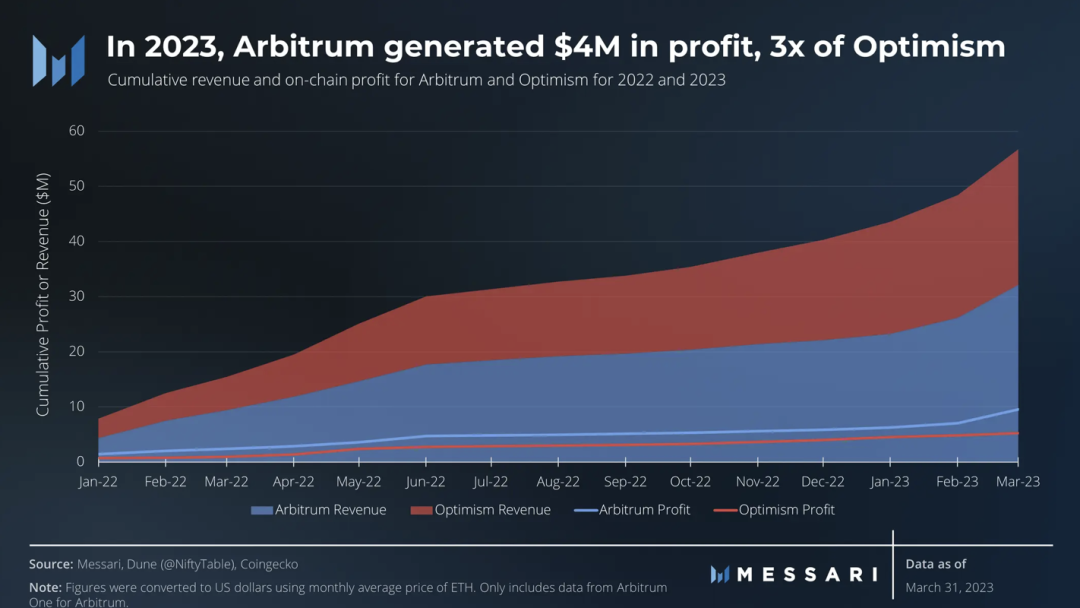

Sequencer revenue and profit

Due to its higher activity volume, Arbitrum generates higher Sequencer revenue and profits than Optimism. In 2022, Arbitrum generates $22 million in Sequencer revenue and $6 million in profit, while Optimism generates $18 million in Sequencer revenue and $4 million in profit. In Q1 2023, Arbitrum generated $10 million in revenue and $4 million in profit, further outpacing Optimism with $6 million in revenue and $1 million in profit.

TVL

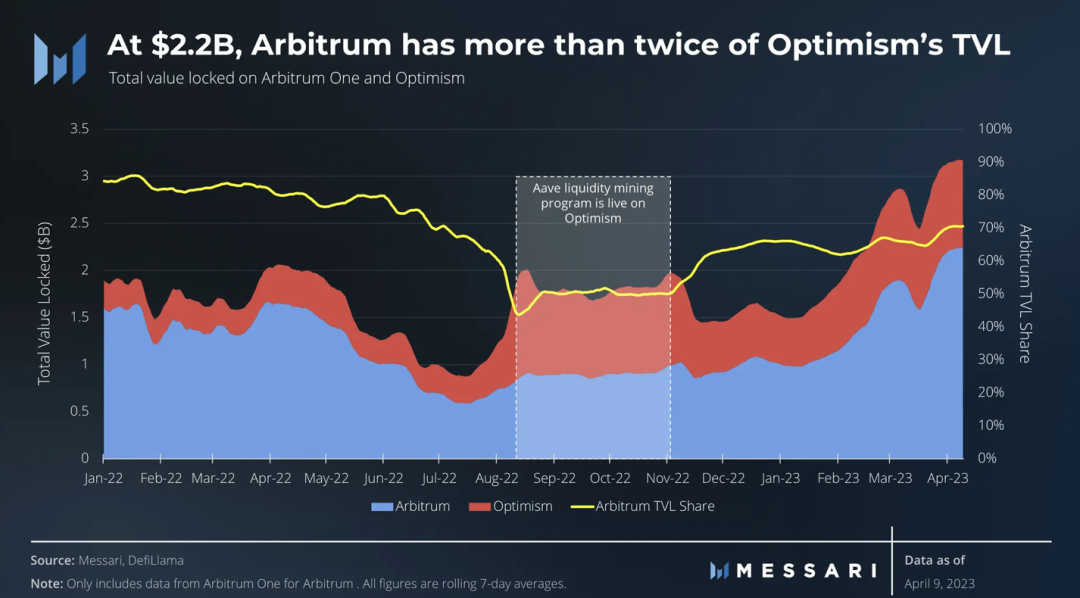

Arbitrum has a higher TVL than Optimism for most of 2022 and 2023. Arbitrum’s dominance has been further strengthened after its token launch, as ARB has become an important collateral asset in its DeFi protocol. Currently, Arbitrum has a TVL of $2.2 billion, compared to Optimism's $900 million.

relative valuation

Although Arbitrum's fully diluted market capitalization is 20% higher, it is significantly undervalued on all key valuation metrics. While Optimism has an incentive plan, Arbitrum can outperform most of 2022. Now with the ARB token, Arbitrum can run its own incentive program, further extending its lead.

other factors

Although Arbitrum and Optimism are close competitors, the comparison is not entirely accurate. Here are some additional details that should be considered.

AirDrop

Arbitrum experienced a massive increase in activity on the day of the AirDrop, including higher transaction volume, active users, sorter revenue, and profits. Since the period analyzed is 2023, this somewhat overstates Arbitrum's adoption metrics.

Super Chain Ecosystem

Optimism has an early lead in creating a hyperchain ecosystem, with Coinbase announcing that it is building on the OP Stack. Arbitrum also announced its own Rollup ecosystem, Arbitrum Orbit, but has yet to announce any significant builders.

Differences in Governance Structure

ARB tokens have greater governance control over Arbitrum than OP holders have over Optimism. OP holders share governance rights with their Citizens' House, which controls the revenue generated from the Sorter. Therefore, ARB should generate more value than OP from the same revenue.

in conclusion

Arbitrum, the largest Layer-2 solution for Ethereum, already outperforms its only major competitor, Optimism, across all metrics. The DAO and the Foundation should ignore this minor annoyance and act together to ensure Arbitrum builds on its early lead. With the end of the Ethereum Shanghai upgrade, the L2 battle is far from over. Optimism is also planning an upgrade of its own, and more Rollup releases are coming.