What are the current opportunities for this narrative? Let's explore further.

Author: Hei Mi, Bai Ze Research Institute

DeFi is changing the landscape by tokenizing physical assets such as real estate and art.

Real World Asset (RWA) tokenization is the process of converting tangible assets into tokens or NFTs, enabling them to be traded on-chain.

This opens up new opportunities for investors, as RWA has the potential to provide sustainable returns independent of the crypto market, making it an attractive option for investors looking for diversification. On-chain capital is looking for such sustainable and safe income opportunities, so RWA tokenization can become the catalyst for the next DeFi bull market.

RWA tokenization also helps to release liquidity, allowing funds to flow freely from traditional markets into the encryption field, and enhancing the potential value of DeFi.

Today, various asset providers are starting to step into the RWA tokenization narrative, creating demand for tokenization in industries such as real estate, precious metals, luxury goods, climate, private/public fixed income, emerging markets, and trade finance.

For example, real estate tokenization - the tokenization of partial ownership of real estate enables investors to invest easily, and holders not only own a proportion of ownership, but also obtain real estate rental income. At the same time, homeowners also raised funds.

As DeFi infrastructure projects mature, RWA tokenization has been further developed and innovated.

Pioneering projects like MakerDAO, Aave, and Chainlink are taking the lead in exploring the potential of RWA in the DeFi space.

Although the regulation of RWA is still uncertain, the long-term potential of this narrative is still very large, capable of reshaping the DeFi landscape and bringing value to the crypto market and traditional markets. So keep an eye out for further developments in this narrative.

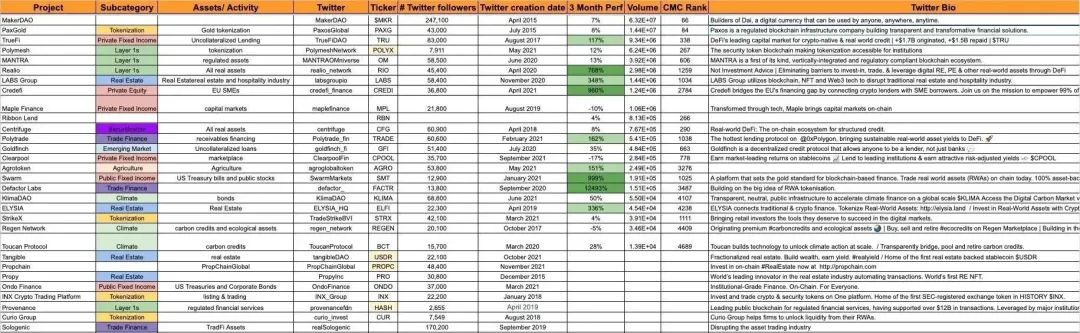

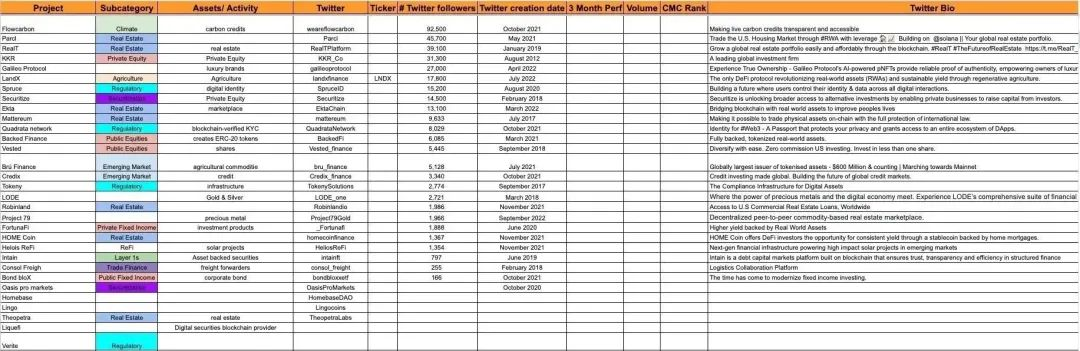

According to the collation and summary of encryption researcher Crypto Koryo, there are currently more than 50 RWA projects on the market, and the native tokens of some projects, such as $CREDI, $SMT and $FACTR have risen by more than 10 times in the past 3 months. However, most projects have yet to launch tokens. So what are the current opportunities for this narrative? Let's explore further.

1. Real estate tokenization

LABS Group ($LABS)

LABS Group is a real estate tokenization platform that allows homeowners to tokenize their homes to raise funds without intermediaries, and investors can also access other higher liquidity real estate tokens through the secondary market.

In addition, LABS Group has also launched a Web3 vacation platform Staynex, which enables resorts, hotels and villas to be tokenized into NFTs - Staynex passes. The Staynex Pass provides practicality to holders, not only giving them the flexibility to travel around the world, staying in hotels whenever they want, but also earning benefits from room rentals.

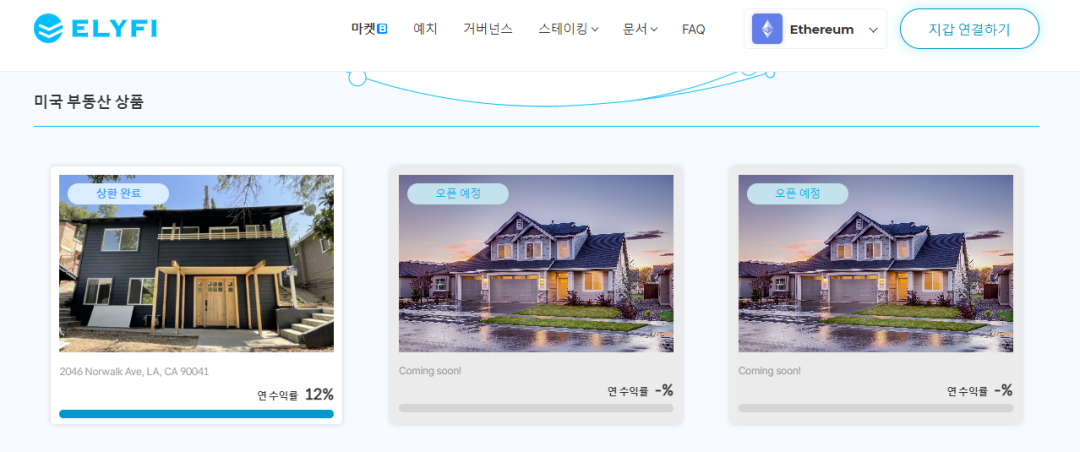

ELYSIA ($ELFI)

ELYSIA is a protocol for tokenizing RWA, making it easier to monetize RWA on the blockchain. Users can create their own RWA as tokens and then sell them on ELYSIA's DeFi platform ELYFI, or lend out other encrypted assets as collateral.

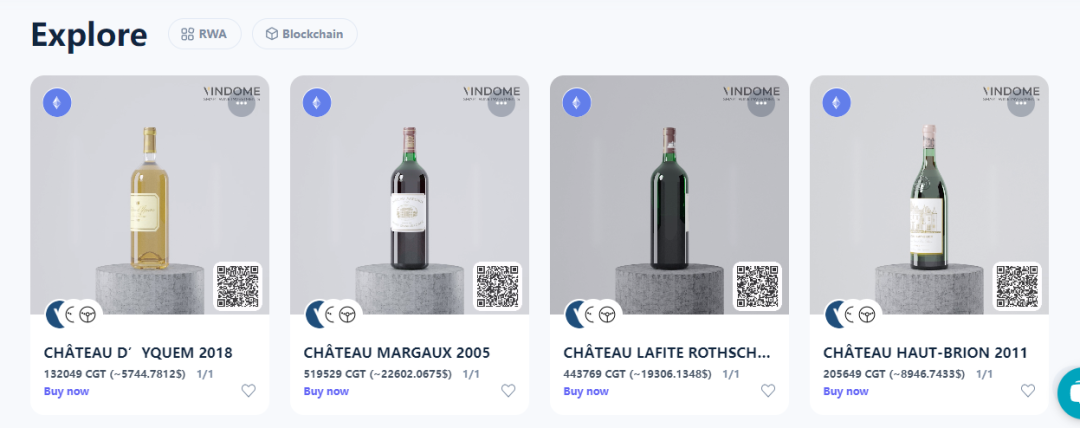

Tangible ($TNGBL)

Tangible is an RWA tokenized ecosystem. Providing users with access to RWA tokenization through the launch of Real USD, a native yield stablecoin backed by real estate.

On Tangible, anyone can use Real USD to purchase valuable physical goods from the world's leading suppliers, including but not limited to art, fine wine, antiques, watches, luxury goods.

When a user purchases RWA listed on Tangible, TNFT ("Tangible non-fungible token") will be minted to represent the real thing. Tangible will deposit the physical item in a physical vault and send TNFT to the buyer's wallet. TNFT can be transferred and traded freely.

Propy ($PRO)

Propy provides buyers, sellers, and agents with a real estate transaction platform based on blockchain and smart contracts, which facilitates instant transactions and reduces fraud. Currently, the platform processes more than $4 billion in transactions with real estate partners located across the United States.

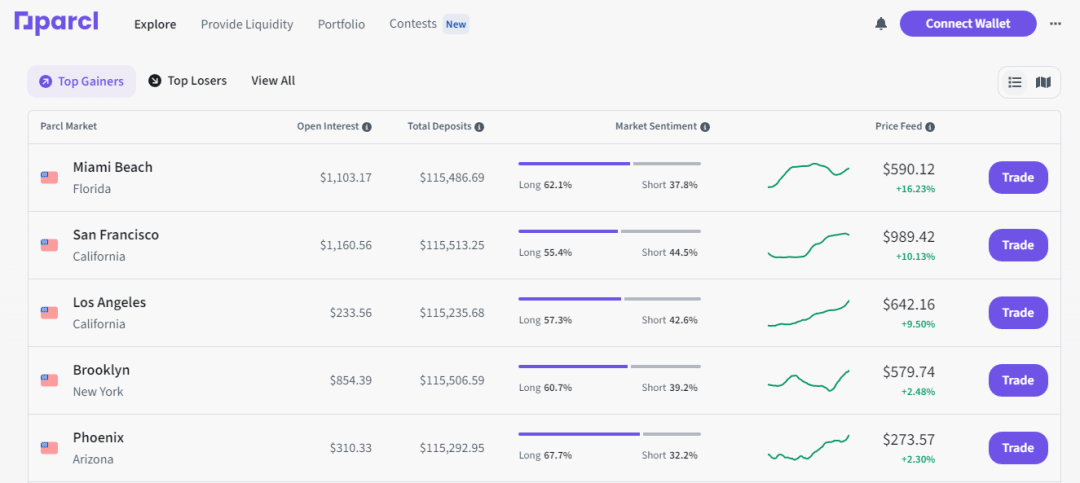

Parcl

Parcl is a synthetic asset trading platform focused on real estate. It provides price trends that can be invested in the global real estate market. Users can browse the global real estate market and go long or short according to the rise or fall of real estate value they think.

RealT

RealT was established in 2019. In the following 3 years, the platform has processed more than 52 million US dollars in real estate tokenization, and investors can simply purchase RWA tokens. More than 970 houses have been tokenized on the RealT platform, located in Detroit, Cleveland, Chicago, Toledo and Florida in the United States.

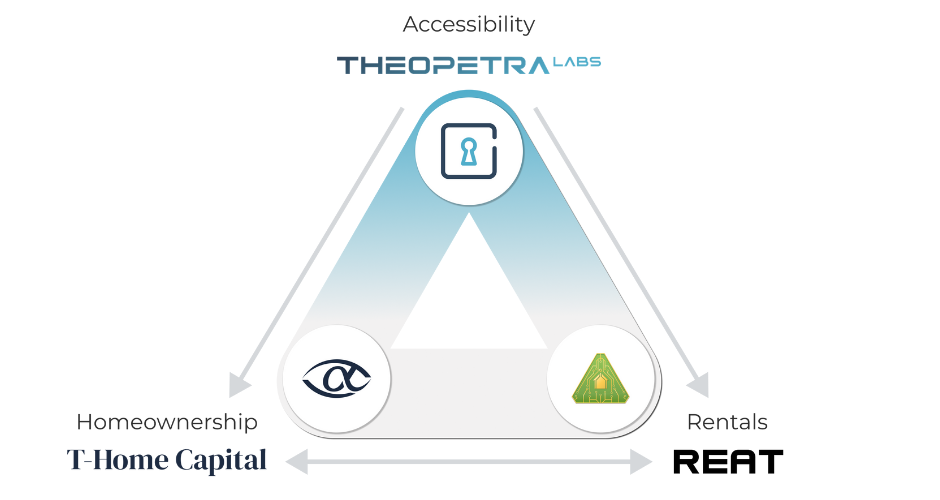

Theopetra

Theopetra and its partners T-Homes, REAT will build a real estate ecosystem around $THEO tokens, aiming to make housing affordable for the bottom class in the United States.

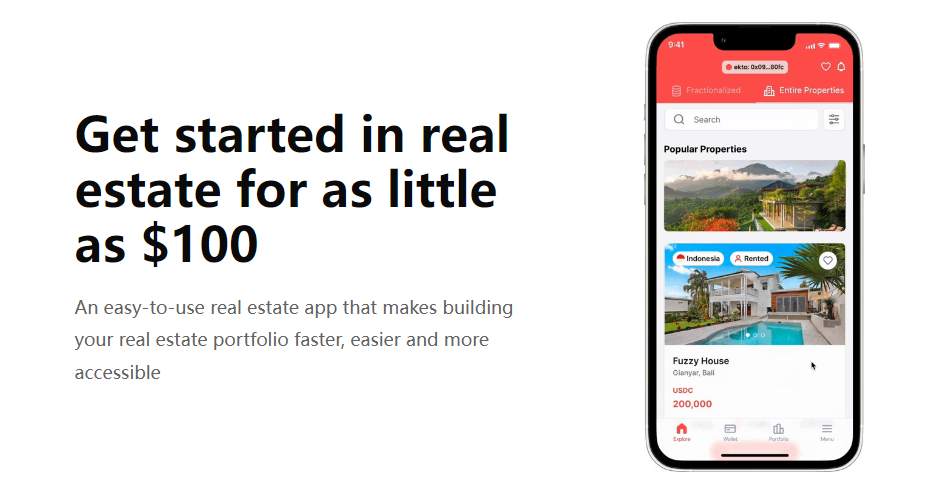

EktaChain

EktaChain is a blockchain-based decentralized real estate transaction platform designed to make real estate business faster and easier for everyone. The platform allows anyone to trade real estate for as little as $100.

Matterium

Mattereum is a platform that can tokenize RWA into NFT, including luxury goods, art, real estate. Behind every NFT transaction is an easy legal framework to handle any disputes that arise, and it applies to the laws of more than 160 countries.

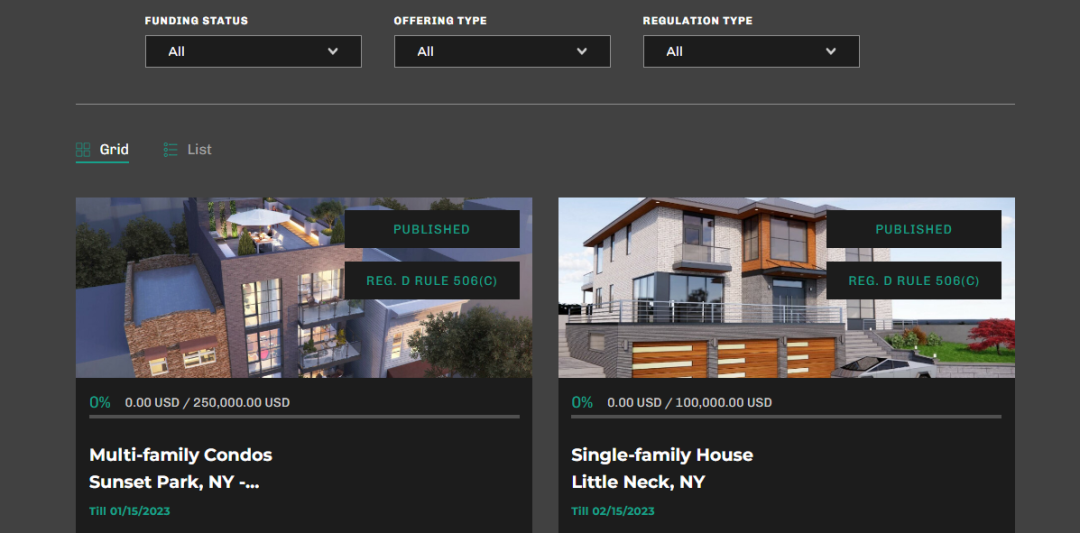

Robinland

Robinland's mission is to build a bridge between TradFi and DeFi for the real estate industry. Tokenizing high-quality, rent-generating commercial real estate assets allows them to access liquidity from individual investors or institutional lenders like MakerDAO.

HOME Coin Finance

HOME Coin Finance offers investors the opportunity to earn stable income in a stablecoin $HOME backed by home mortgage loans.

2. Multi-asset tokenization

Paxos ($PAXG)

Paxos is a blockchain financial infrastructure platform that provides corporate customers with services such as asset tokenization, custody, trading, and settlement, enabling any asset to be transferred credibly and instantly at any time.

While U.S. regulators forced Paxos to stop minting the dollar stablecoin $BUSD in February, the platform is still promoting its gold-pegged coin $PAXG (PAX Gold). Paxos issued $PAXG back in 2019, and in the three-plus years since then it has quietly grown to a ~$500 million market cap. Different from the ETF representing gold, $PAXG represents that the holder holds physical gold, and can redeem 1:1 physical gold at any time.

It is worth mentioning that Paxos is one of the most funded blockchain companies, with a total financing amount of more than US$500 million. Major investors include OakHC/FT, Declaration Partners, Mithril Capital, and PayPal Ventures.

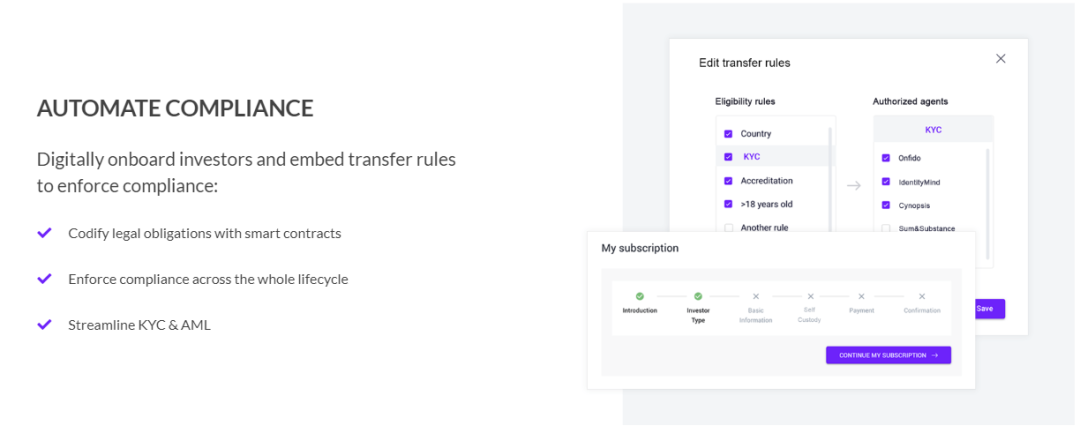

Tokeny Solutions

Tokeny provides an enterprise-level tokenization infrastructure that allows companies to issue, transfer and manage assets on the blockchain in a compliant manner, enabling them to increase asset liquidity.

StrikeX ($STRX)

StrikeX is an RWA tokenized ecosystem with products including:

• TradeStrike (RWA Token Centralized Exchange, CEX)

• Stock Token Bridge (RWA token creation platform)

• StrikeX Wallet

• TradeX (RWA Token Decentralized Exchange, DEX)

• Xchain (a private blockchain serving the StrikeX ecosystem)

• $STRX (StrikeX ecosystem native token)

INX ($INX)

INX provides a US SEC regulated trading platform for RWA tokens and cryptocurrencies.

Curio ($CUR)

Curio is an RWA tokenized ecosystem with products including:

• Rollapp (RWA token creation platform)

• CurioInvest (tokenize limited edition cars, users can invest together and share profits)

• $CSC (Swiss Franc Stablecoin)

• CapitalDEX (RWA Token Decentralized Exchange, DEX)

• Wrapped Fractional Physical-NFTs (ownership, intellectual property tokenization)

3. TradFi

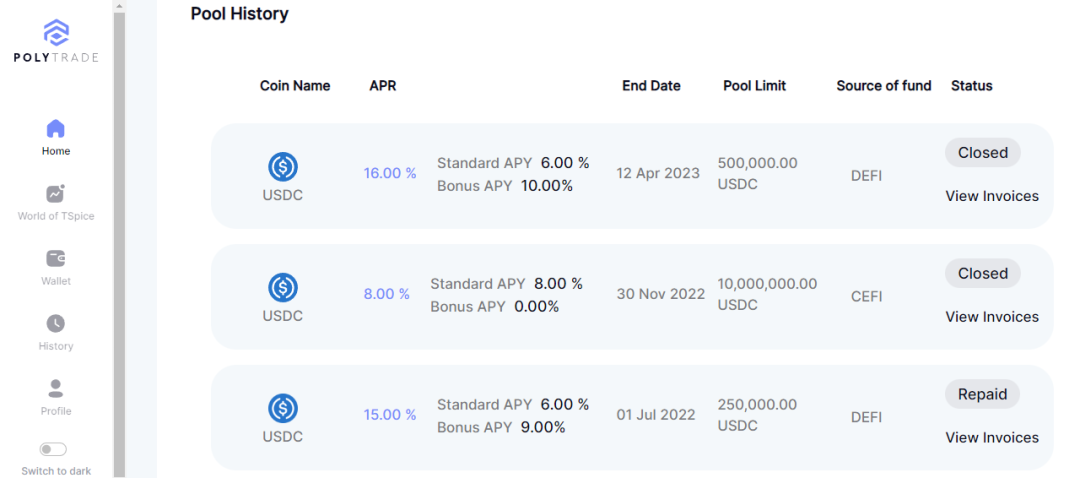

Polytrade ($TRADE)

Polytrade built a decentralized trade finance platform designed to provide seamless lending to businesses across multiple industries.

Defactor ($FACTR)

Defactor aims to provide businesses with financing opportunities and liquidity by bridging traditional financing with DeFi.

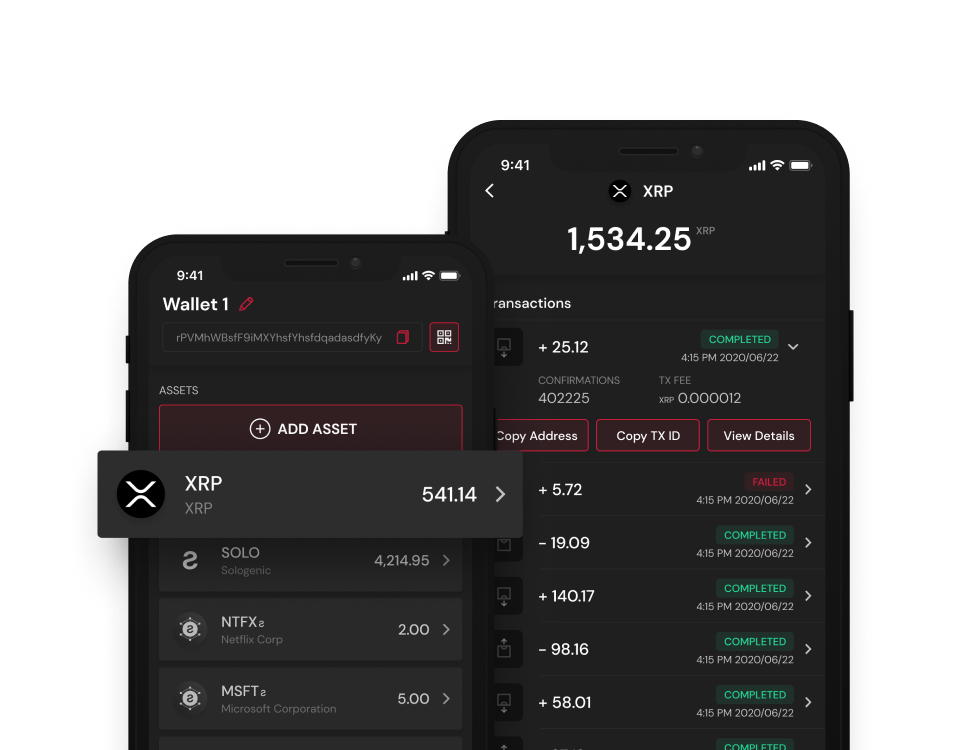

Sologenic

Sologenic is an RWA tokenized ecosystem with products including:

• Sologenic Asset Tokenization (RWA token centralized exchange platform, CEX, will tokenize more than 40,000 stocks, ETFs and commodities)

• Sologenic DEX (RWA token decentralized exchange platform, DEX, can also trade the above tokenized assets)

• Sologenic NFT marketplace

• Sologenic wallet

Consol Freight

ConsolFreight is a blockchain platform focused on the digital transformation of the shipping industry, providing trade financing and cargo insurance services.

Four, Layer-1

Polymesh Network ($POLYX)

Polymesh is an institutional-grade permissioned blockchain purpose-built for the RWA token. Highlights:

• Incorporate governance, identity, compliance, confidentiality into the core of the blockchain.

• All participants—whether token issuers, investors, node operators, must first pass the decentralized KYC verification.

• Node operators must be financial entities.

• The native token $POLYX is classified as a utility token by Swiss law. (according to the guidance of FINMA, the Swiss financial regulator)

MANTRAO ($OM)

MANTRA Chain is an L1 blockchain built on the Cosmos SDK, aiming to become a collaborative network between enterprises, attracting enterprises and developers to build any application from NFT, games, Metaverse to compliant DEX.

The first dApp on MANTRA Chain is MANTRA Finance, which aims to become a globally regulated DeFi platform, bringing the speed and transparency of DeFi to the opaque TradFi world, allowing users to issue and trade RWA tokens.

Realio Network ($RIO)

Realio Network is an interoperable L1 blockchain focused on the issuance and management of RWA tokens.

Provenance ($HASH)

Provenance is an L1 blockchain created in 2018 based on the Cosmos SDK, designed to enable financial institutions and financial technology companies to seamlessly and securely issue and trade financial asset tokens.

Since then, the chain has enabled more than 60 financial institutions, fintech companies, DeFi, and banks and credit unions to issue, manage, and trade financial asset tokens at scale. As of 2023, Provenance has processed over $12 billion in financial asset transactions.

Intain

Intain is an L1 blockchain focused on financing and credit.

5. Climate/ReFi

KlimaDAO ($KLIMA)

KlimaDAO offers individuals and organizations the opportunity to directly participate in the carbon credit market through its infrastructure and $KLIMA tokens backed by real carbon assets.

KlimaDAO aims to solve key problems in the carbon credit market:

• Illiquidity: There are many different types of carbon credits; different intermediaries, splitting the total liquidity of the carbon market.

• opaque

• low efficiency

Regen Network ($REGEN)

Regen aims to be a catalyst for a global renewable ecosystem using blockchain, DeFi, and other Web3 tools. Users fund renewable projects by purchasing and trading carbon credit tokens and eco-credits.

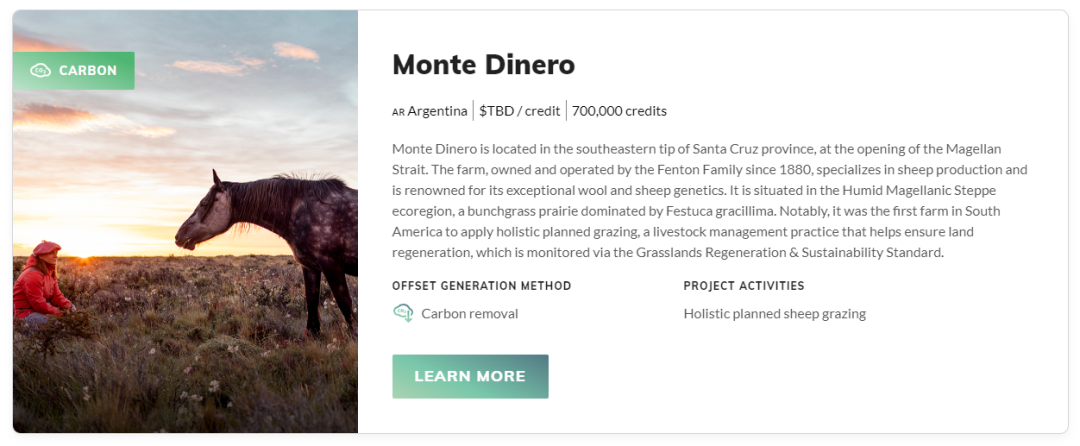

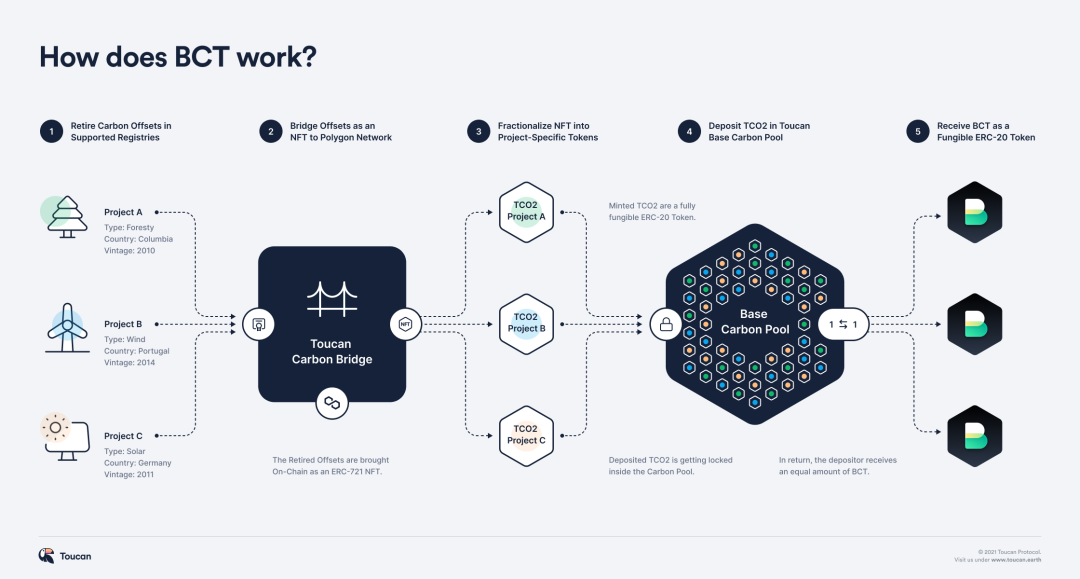

Toucan Protocol ($BCT)

Individuals and businesses can expand their protection of the planet by using Toucan's infrastructure to convert carbon credits into tokens.

Flow Carbon

Flow Carbon is a platform for tokenizing carbon credits, helping to increase transparency and liquidity, helping to expand the carbon credit market.

6. Agriculture

Agro Global Token ($AGRO)

Agro Global Token is a cryptocurrency designed to provide solutions to agricultural problems and make substantial investments.

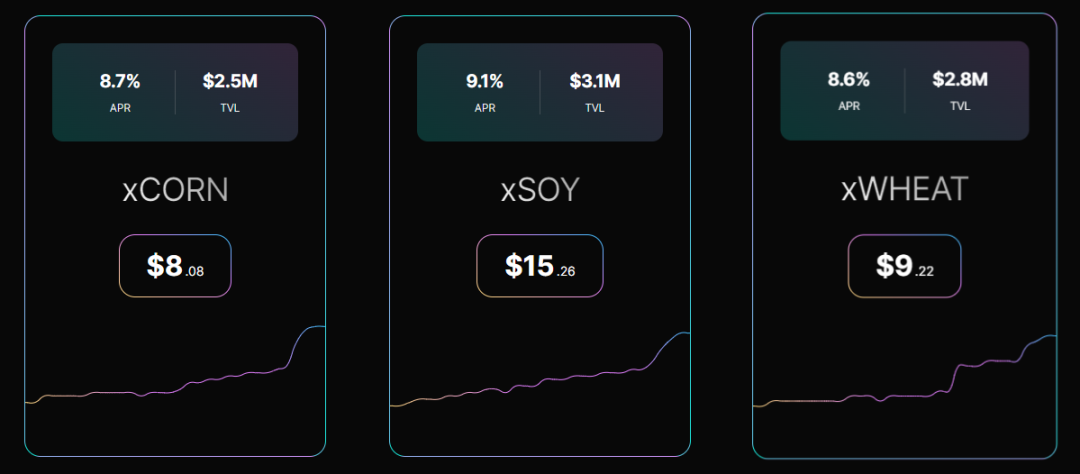

LandX Finance ($LNDX)

LandX is a decentralized protocol designed to bridge the gap between farmers and investors.

The LandX protocol is an agreement between the borrower (the farmer) and the investor, the investor provides the farmer with capital in exchange for a portion of the future benefits of the land, and the farmer solves the financing puzzle for the purchase of new land, new equipment.

7. Identity

SpruceID

SpruceID is a company focused on decentralized identity and Web3 authentication. Its identity toolkit SSX enables users to manage and control their digital identities without relying on third parties.

Quadrata

Quadrata is a decentralized identity system, businesses and consumers can generate a digital passport (SBT, non-transferable) through an ID card/passport, and seamlessly access the entire Web3 dApp network on the basis of privacy protection.

8. Private Equity

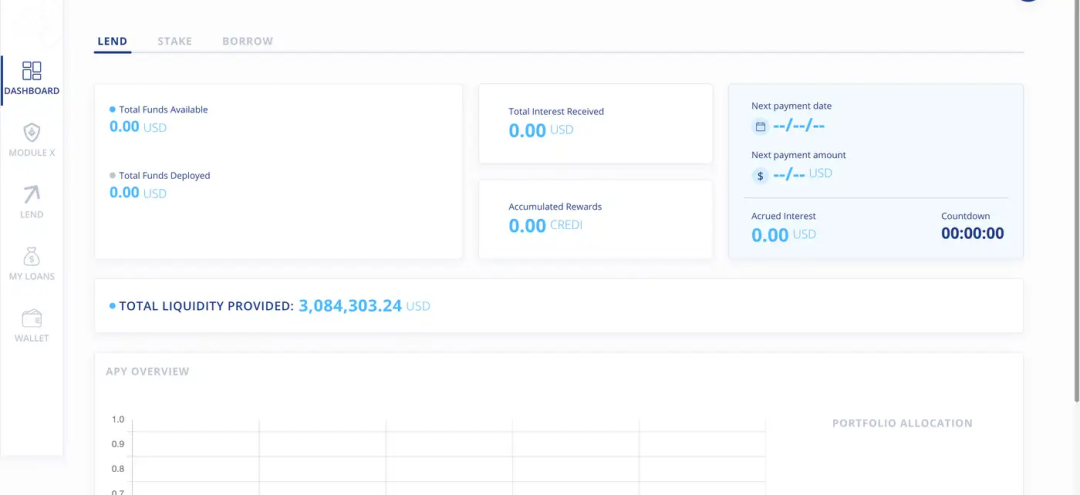

Credefi Finance ($CREDI)

Credefi connects cryptocurrency investors with SME borrowers and aims to provide decentralized and secure loans to real-world businesses, while providing lenders with fixed income independent of crypto market volatility.

KKR

Investment giant KKR, which manages approximately $471 billion in assets, has tokenized healthcare feeder funds on the Avalanche blockchain to increase accessibility for individual investors. The threshold for large institutional investors and ultra-high-net-worth individuals to participate in KKR funds is usually several million dollars, while the minimum investment threshold for individual investors has been reduced to $100,000 through this "tokenized" feeder fund.

9. Public Equity

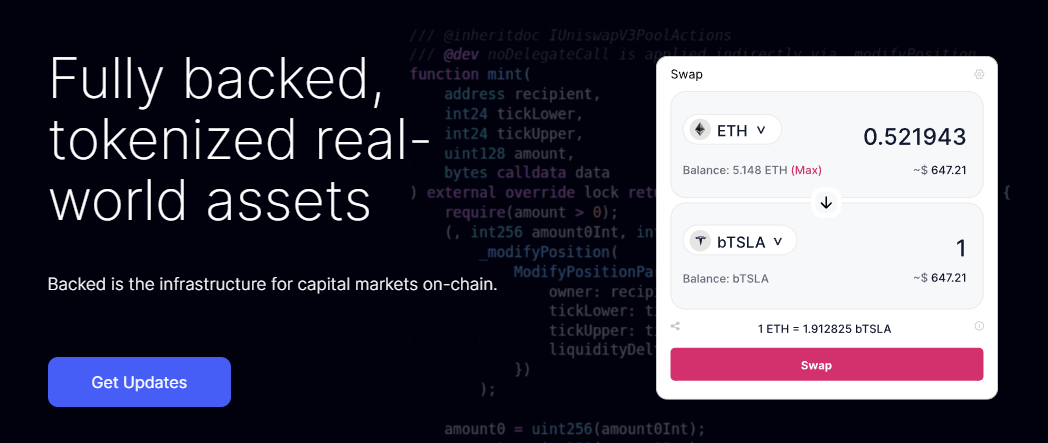

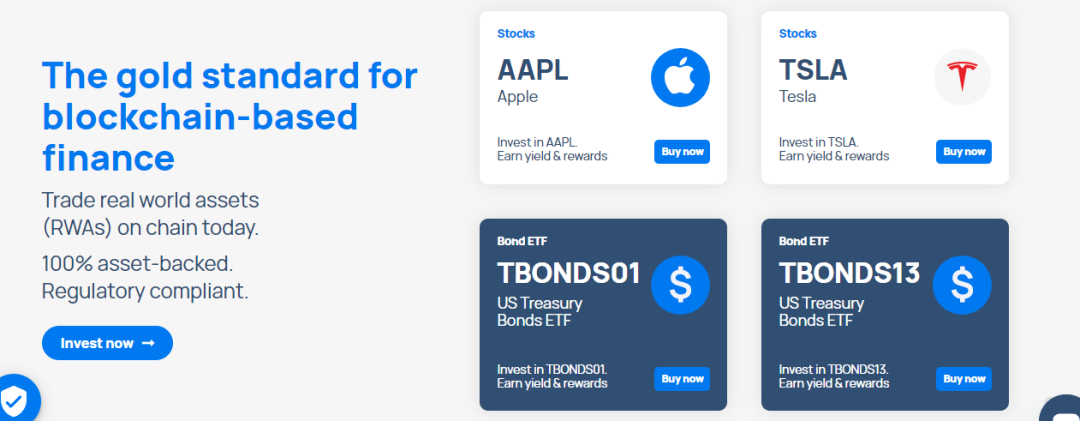

Backed Finance

Backed Finance is an RWA token trading platform where RWA such as stocks and ETFs are tokenized into ERC-20 tokens that track market prices. Tokens are freely transferable between wallets and are 100% backed by RWA reserves.

10. Private Fixed Income

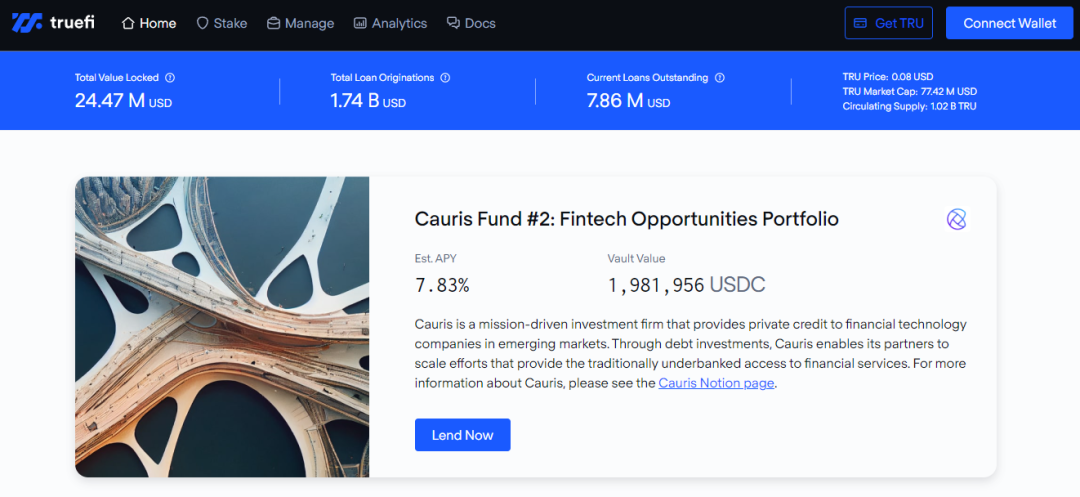

TrueFi ($TRU)

TrueFi is a decentralized credit protocol that enables institutions to obtain credit at a fixed rate to reinvest their business in a capital efficient manner. Investors can choose the corresponding loan fund pool for USDC/USDT/TUSD/BUSD to add liquidity to them, so as to earn income by lending and earning interest. TrueFi currently focuses on providing stablecoin unsecured lending services to crypto-native trading investment institutions, and will gradually explore unsecured loans to companies and individuals in the future.

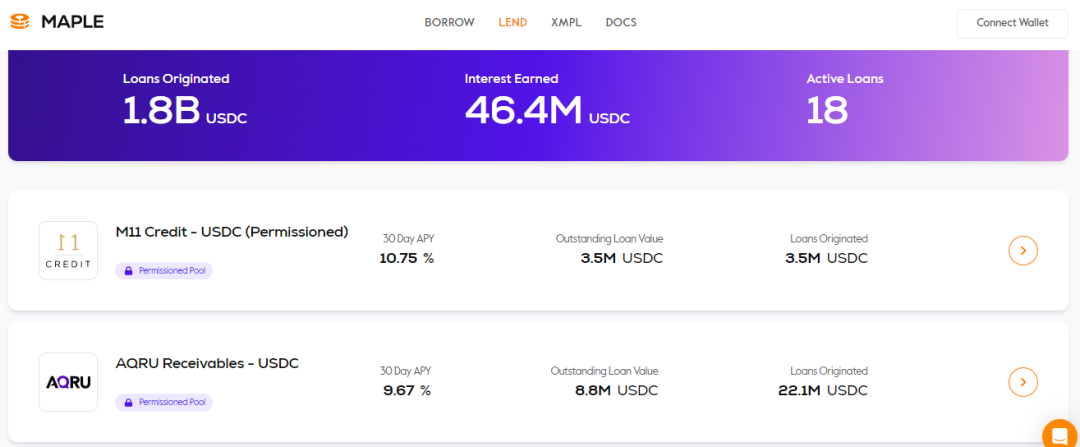

Maple Finance ($MPL)

Maple is a decentralized credit protocol that provides institutions with unsecured loans. Investors can deposit funds ($USDC and $MPL) into the loan pool as a liquidity provider to fund loans and earn income.

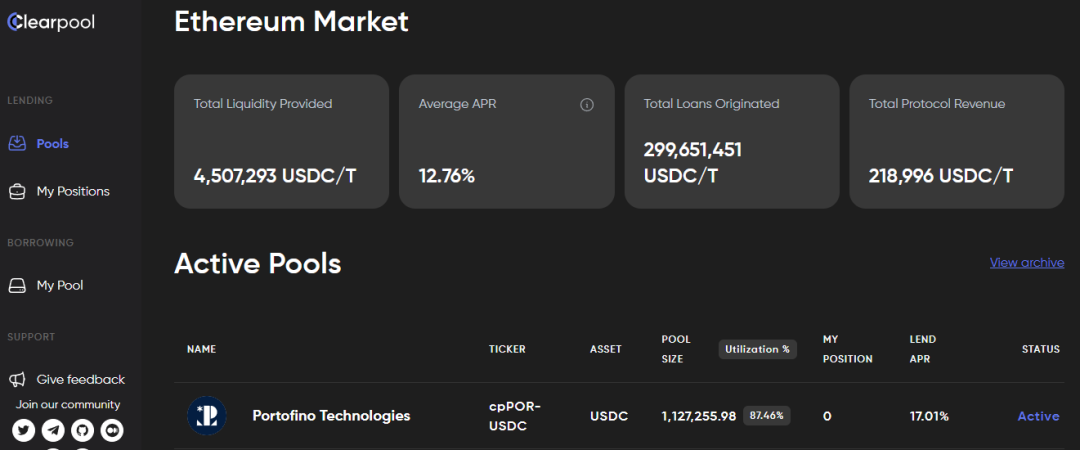

Clearpool ($CPOOL)

Clearpool is a decentralized credit protocol that provides institutions with unsecured loans. (Lenders can only provide liquidity to institutional pools they are invited to join)

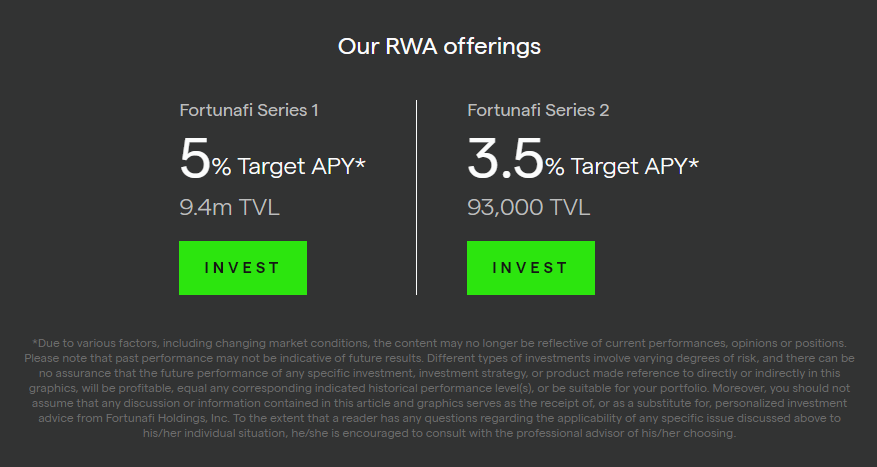

FortunaFi

Fortunafi is a decentralized credit agreement that provides unsecured loans for businesses, and businesses will use a certain percentage of monthly business income as repayment interest.

11. Public Fixed Income

Swarm Markets ($SMT)

Swarm Markets provides a compliant DeFi infrastructure for RWA token issuance, liquidity and trading, and is supervised by German regulators.

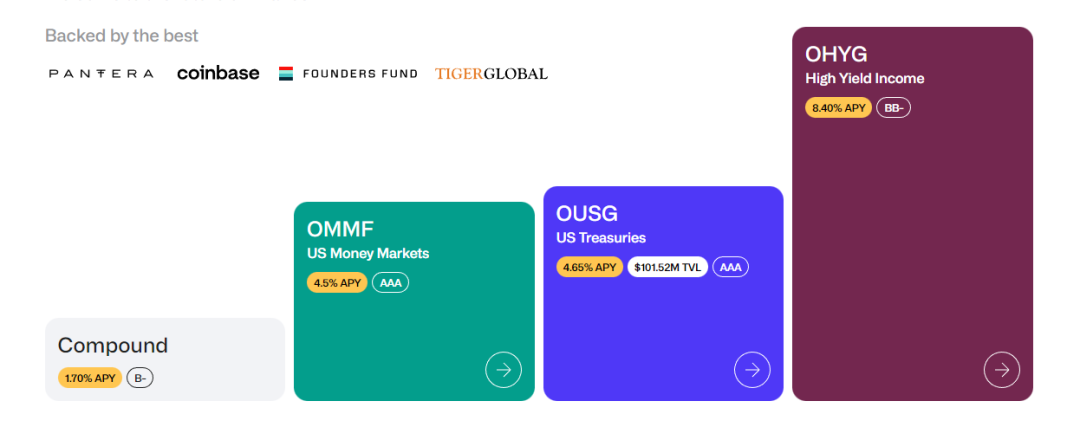

Ondo Finance ($ONDO)

DeFi protocol Ondo Finance has launched a tokenized fund based on U.S. Treasury and corporate bonds.

12. Emerging markets

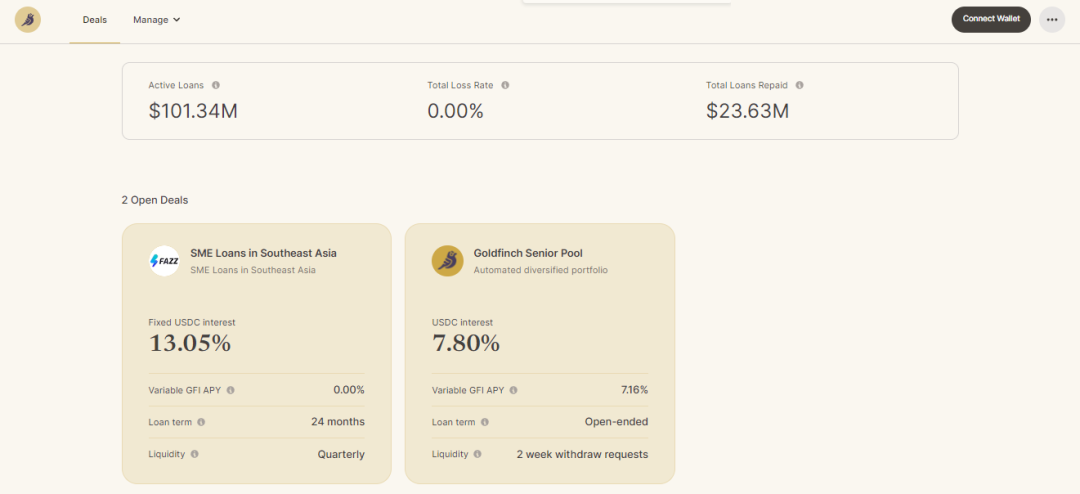

Goldfinch ($GFI)

Goldfinch is a decentralized credit protocol for real-world debt funds and fintech companies with over $100 million in total loans to date. Investors can provide funds to the loan company's pool of funds to earn interest.

Brú Finance

Brú Finance is a decentralized credit protocol focused on agricultural products. Farmers can tokenize their agricultural commodities and mortgage them on the chain to obtain loans, while agricultural commodities are stored in physical warehouses. Borrowers and lenders are well protected as agricultural commodity price volatility remains low.

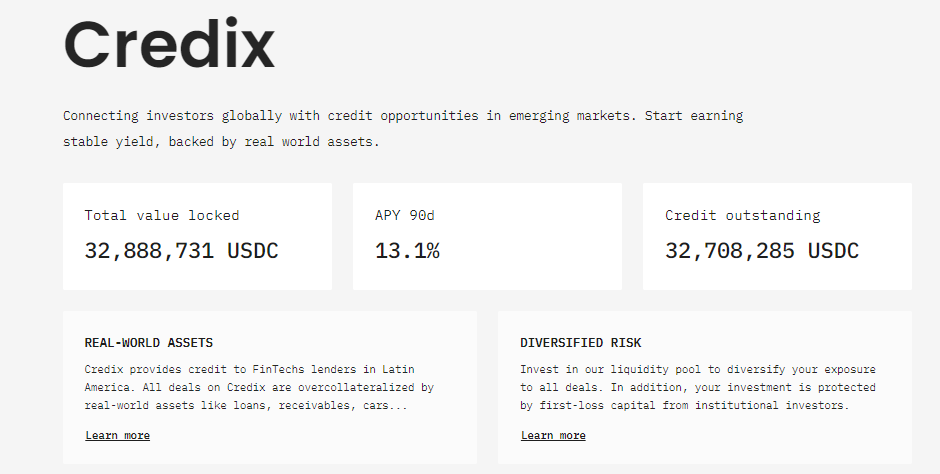

Credix Finance

Credix Finance is a decentralized credit protocol focused on unsecured lending for emerging markets.

13. Security Tokens

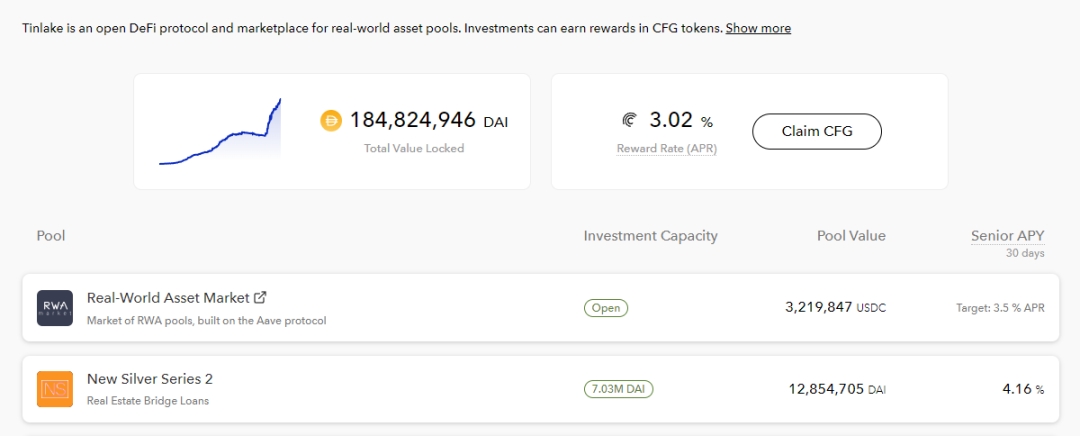

Centrifuge

Centrifuge is an on-chain credit ecosystem designed to provide SME owners with a way to collateralize their assets on-chain and gain access to liquidity.

Centrifuge launched in 2017 and has raised a total of $317 million in assets across its marketplace.

Securitize

Securitize has pioneered a fully digital, all-in-one platform for issuing, managing and trading digital asset securities that comply with the existing US regulatory framework.

14. Others

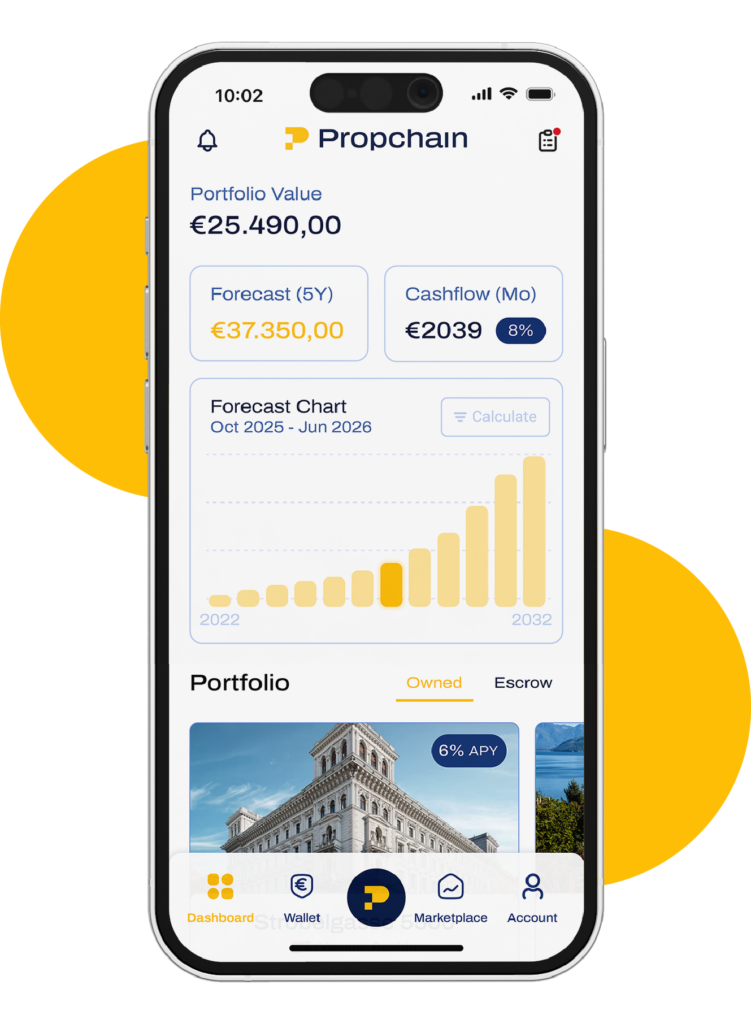

PropChain ($PROPC)

Propchain is a blockchain-based real estate token investment market, providing users with access to invest in the global real estate market, as well as tools of various nature, scale, and valuation. Propchain solves many of the problems that real estate investors have encountered in the traditional market. The platform is constantly procuring new properties, listing tokens after due diligence to ensure that there is never a shortage of investment options on the platform, and also guarantees the safety and security of properties. sustainability.

Propchain allows investors to invest as low as €1,000. All properties are managed by Propchain's property management team, and investors only need to collect rent from the properties.

Galileo Protocol

Galileo Protocol is a platform for tokenizing RWA into NFT, and NFT supports multi-chain transfer. At present, the platform mainly provides tokenization services for luxury goods.

LODE

LODE is a tokenization market focused on gold and silver. It has created tokens representing silver $AGX and tokens $AUX representing gold, so that investors can quickly invest, trade and transfer. 100% of the physical gold and silver is held in LODE's physical vaults.

Project 79

Project 79 is a tokenized marketplace focused on gold, mining, precious metal warehouses, precious metal refineries, and land ownership.

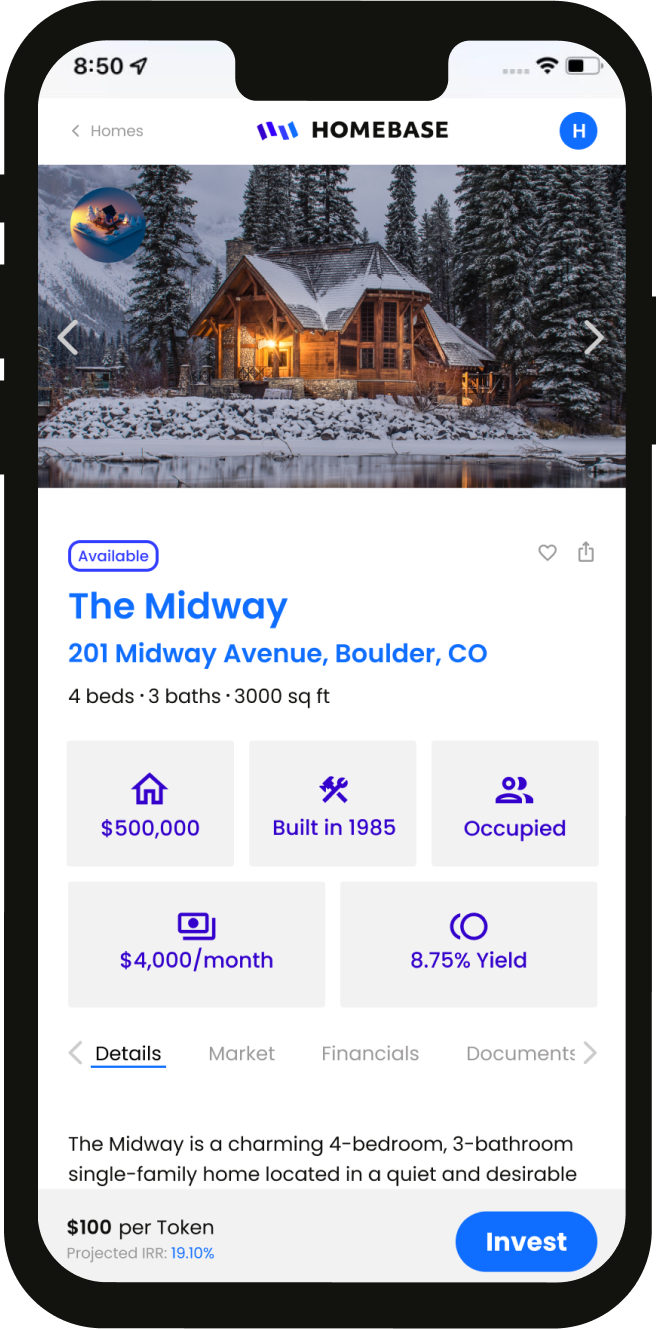

Homebase

Homebase is a real estate tokenization platform. Through Homebase, users can invest in rental-generating residential real estate for as little as $100.

Lingo

Lingo is a hotel real estate tokenization platform. Token holders can not only earn income, but also get free room opportunities in hotels around the world based on the holding time.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the authors and guests, and have nothing to do with Web3Caff's position. The content of this article is for information sharing only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of your country or region.