Note: This article is from @JamesonMah Twitter, which mainly invests in games. The content of the original tweet is organized by MarsBit as follows:

Let's talk about shitcoins on Bitcoin.

BRC-20 Hyperthreading

This topic will cover:

1. What the hell is BRC-20?

2. Market conditions

3. How can I get it?

4. What will drive the next phase of BRC-20 adoption?

5. Why are Bitcoin bigwigs trembling with anger?

6. Some BRC-20 junk coins worth watching

Salut, let's jump in!

First off, if you haven't read my Ordinals super thread , stop what you're doing and read that article right now.

It's important to understand BRC-20s because, at their core, they are Ordinals.

read the post? let's continue.

Your first thought might be that this makes no sense.

The purpose of Ordinals is to introduce non-fungibility to Bitcoin, which is the first layer of native Bitcoin NFT.

Digital artifacts, right?

But garbage coins are fungible. Was the BRC-20 built on Ordinals?

let me explain.

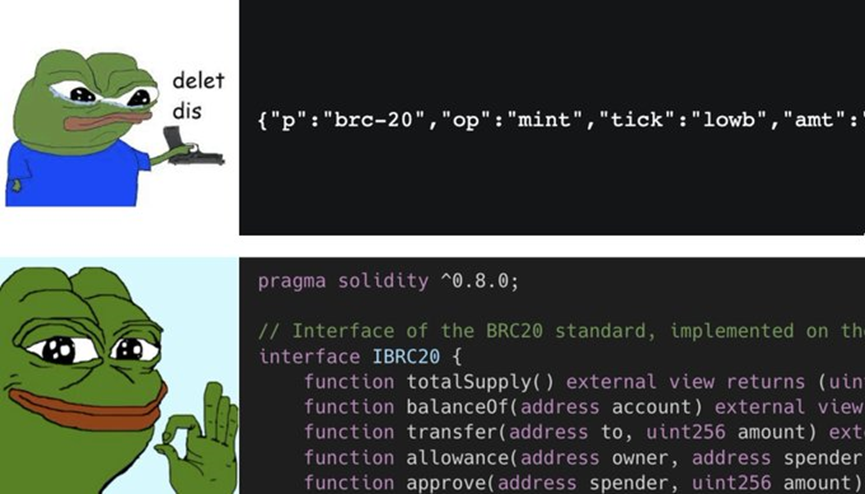

BRC-20 bears no resemblance to the ERC-20 token standard, so throw that comparison to the back of your head.

It's just a play on words, nothing more.

BRC-20 is more like a collection of NFTs with a supply of 10 million. Yes, they are "NFTs", but when the supply is so large, non-fungibility is questionable.

The analogy for the ETH NFT crowd is ERC-1155 semi-fungibles, where the NFT and the fungible are managed in the same smart contract.

BRC-20 is creating fungibility out of a protocol designed for non-fungibility (Ordinals theory).

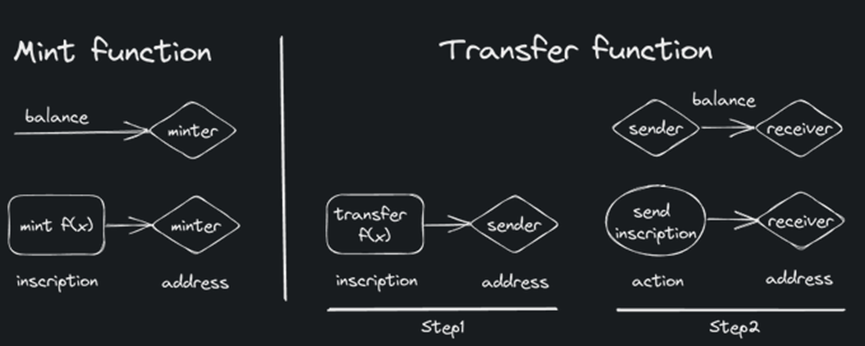

The architecture itself is relatively simple.

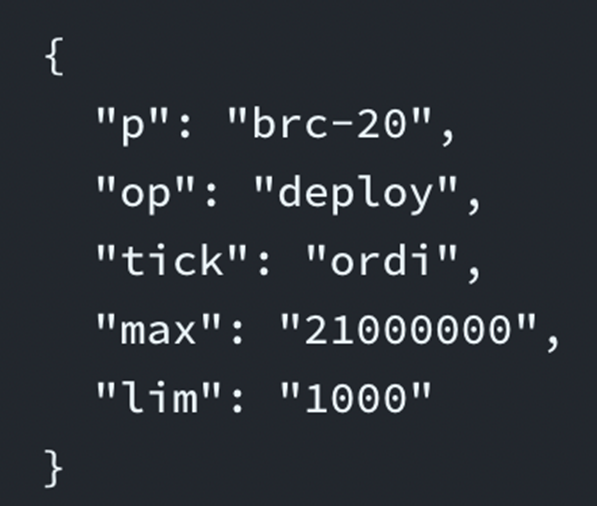

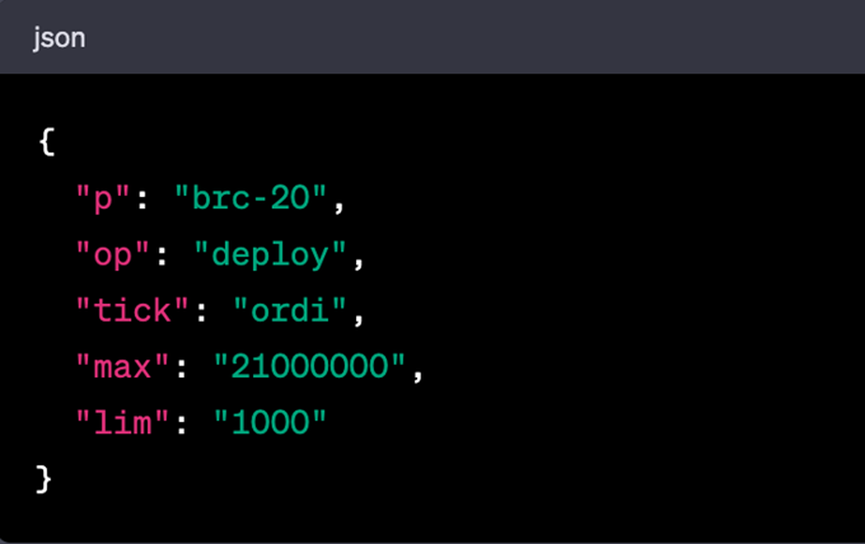

BRC-20 is JSON text embedded in Ordinals. There are some simple variables and functions in the text, for example:

1. Code (must be 4 characters)

2. Maximum Supply

3. Token Limit per Mint

4. Deploy, mint and transfer functions

https://twitter.com/domodata/status/1633658974686855168

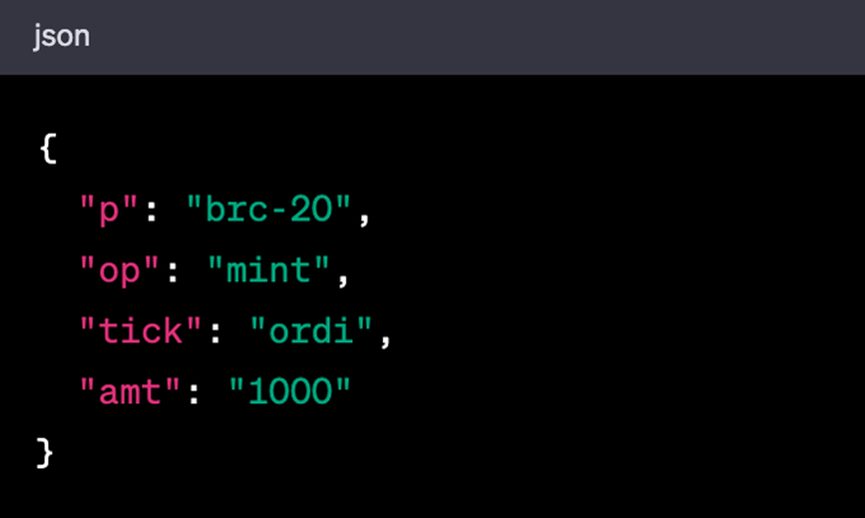

Below is an example from one of BRC-20 creator @domodata .

"p" = Protocol (BRC-20)

"OP" = operation (we are deploying)

"tick" = 4 character tick

"max" = maximum supply

"lim" = buyer's minting limit

This is a BRC-20 called $ORDI with a supply of 21 million and you can buy it in increments of 1000.

This JSON text is written in Ordinals and exists on Bitcoin L1.

The first person to deploy has claimed it. Ordinals ordering provides a generic record of who deployed first.

Once deployed, anyone can mint "tokens" (Ordinals) by writing mint functions.

Below is an example of "minting" 1K $ORDI tokens.

The described Ordinals will reside in the inscriber's Taproot address.

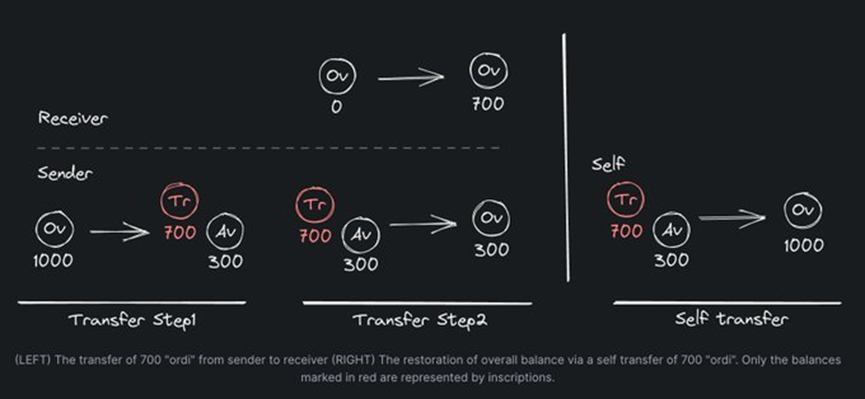

In order to transfer/sell, additional Ordinals are created, much like a "credit/debit card" system in your wallet.

If you want to sell 300 of your 1K $ORDI tokens, you can add a "transfer" function on the balance.

If you own the Ordinal below + the one in the last tweet, any blockchain indexer can add the two up and see that you have 700 tokens.

voila.

Stop here for a moment.

This might sound like a cutting-edge experiment, right?

That's because it is what it is.

BRC-20 founder @domodata made it clear that "these will be worthless" and "it's just a fun experiment."

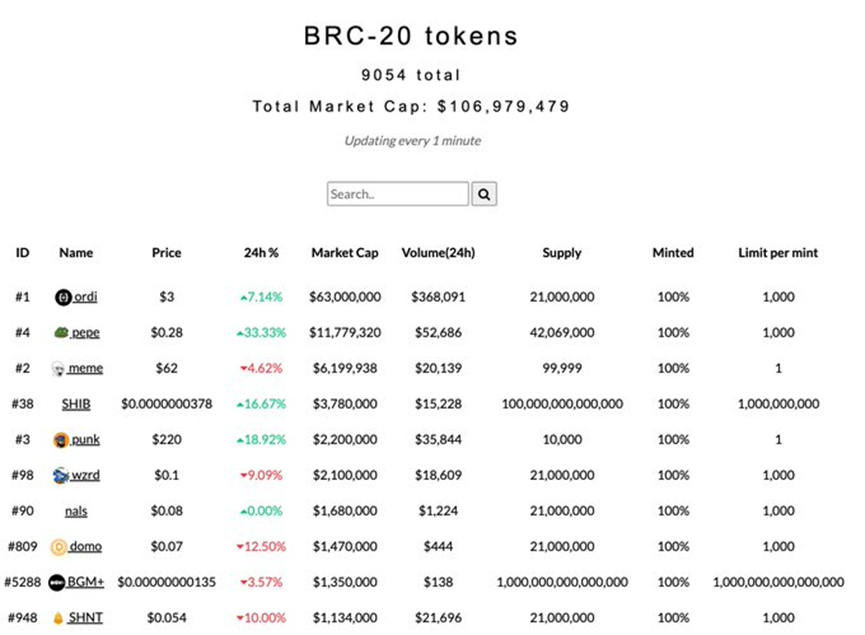

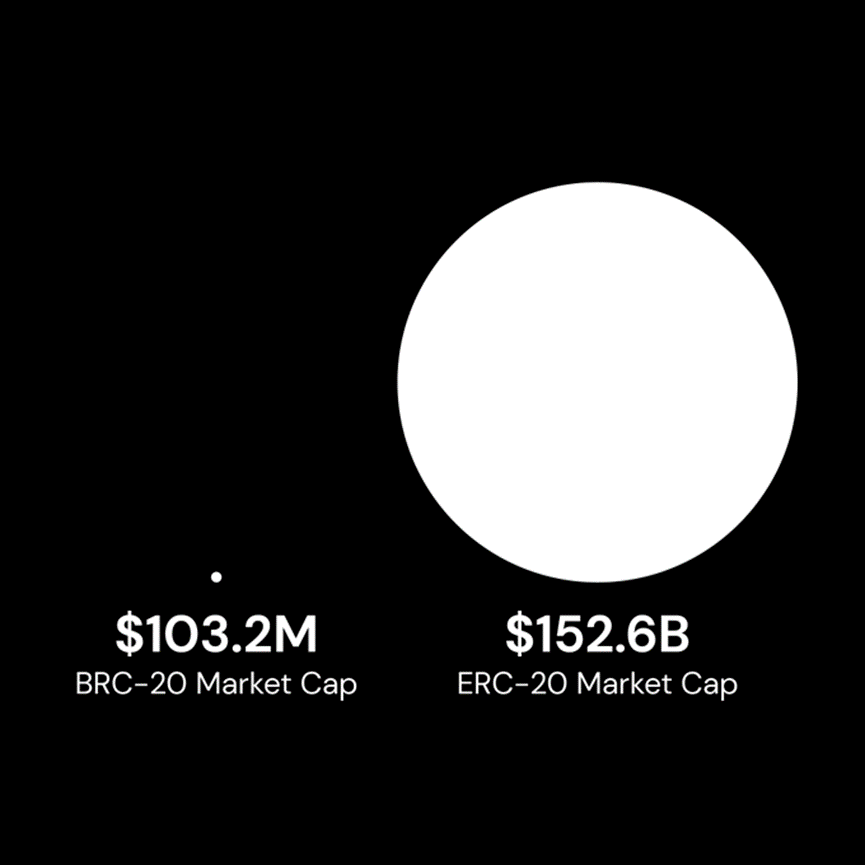

However, the market cap of BRC-20 has exceeded $100 million.

The simplicity of the BRC-20 makes sense.

Similar to Ordinals, my opinion is that the basic nature of BRC-20 actually makes them more attractive, especially in terms of memorability.

Most importantly, each BRC-20 will live forever on L1 of BTC.

If you've paid in Ethereum or the smart contract world, you've probably been caught by developers changing contracts, reducing Liquidity, raising sales taxes, etc.

What is the charm of BRC-20? Those are impossible.

Its rigidity is a feature, not a bug.

Critics of BRC-20 cite the fact that the supply and per-mint cap are immutable after deployment.

But as with JPEG Ordinals, that's actually its unique quality.

As I said before about Ordinals: what you buy is always yours.

Next is the market, how active is the market so far?

BRC-20 was posted by @domodata nearly two months ago on March 8th.

nothing happened...

…until shitcoin season hits everyone.

ERC-20 $PEPE really marks the rise of BRC-20.

Since then, we see:

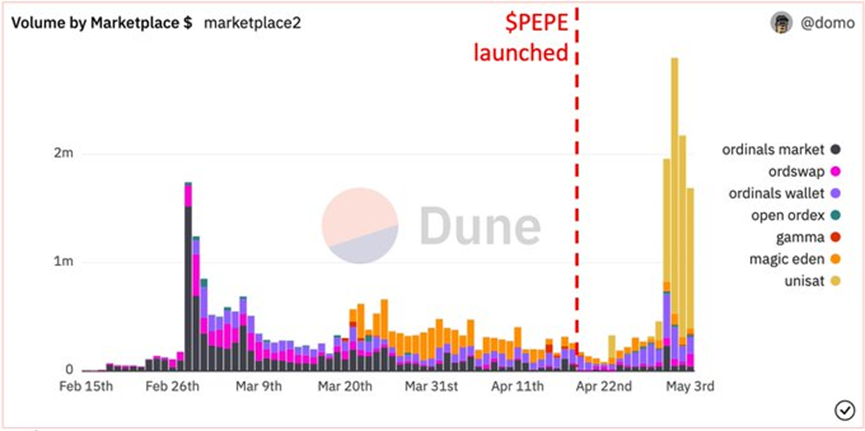

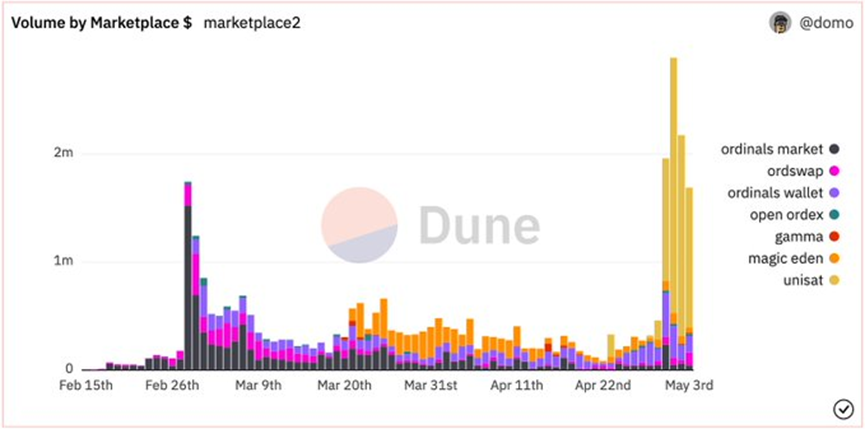

- BRC-20 token secondary trading volume exceeded $10 million, most of which was completed in the last week

- 2.5 million BRC-20 transactions

- 120 BTC ($3.5 million) engraving fee

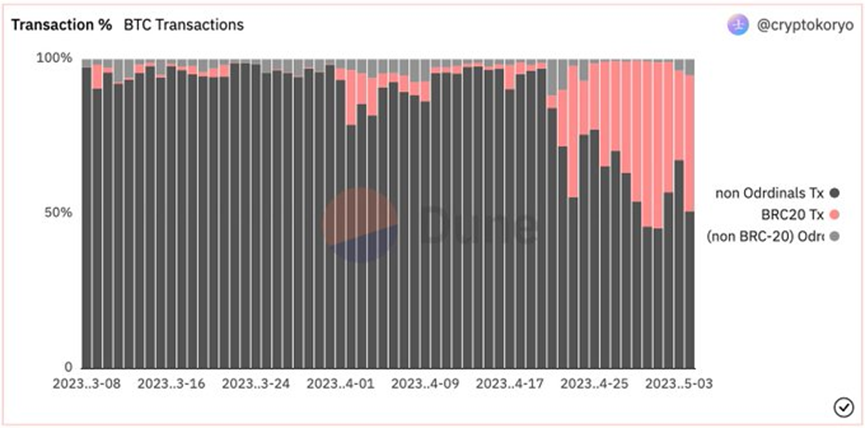

- BRC-20 transactions account for 50% of all Bitcoin network activity (!!)

The current market cap of all BRC-20s is approximately $106 million per brc-20.io .

While Liquidity is relatively thin ($10 million in volume per $106 million market cap), price action has been quite impressive in a short period of time, suggesting that market participants see room for upside.

The supply and demand imbalance in the market so far is also fascinating.

Because BRC-20 is cheap to mint (just gas), there will be excess demand for each mint as long as there is speculative interest in the shitcoins on Bitcoin.

It's (almost) like a free option.

The downside is that the demand for new tokens is only in the form of gas. There is no initial issue price associated with the BRC-20.

@ercwl put it aptly: "If you waste blockchain capacity/burn fees, you end up with a shitcoin."

More on that later.

https://twitter.com/ercwl/status/1653508862631084036

Let's get down to business.

How to buy and sell BRC-20?

Thankfully, we're out of the stone age of Ordinals, with countless impressive builders paving the way for an easy-to-use UI/UX in BRC-20 deployment, minting, buying and selling, and custody.

One builder in particular is largely responsible for the influx of money into BRC-20.

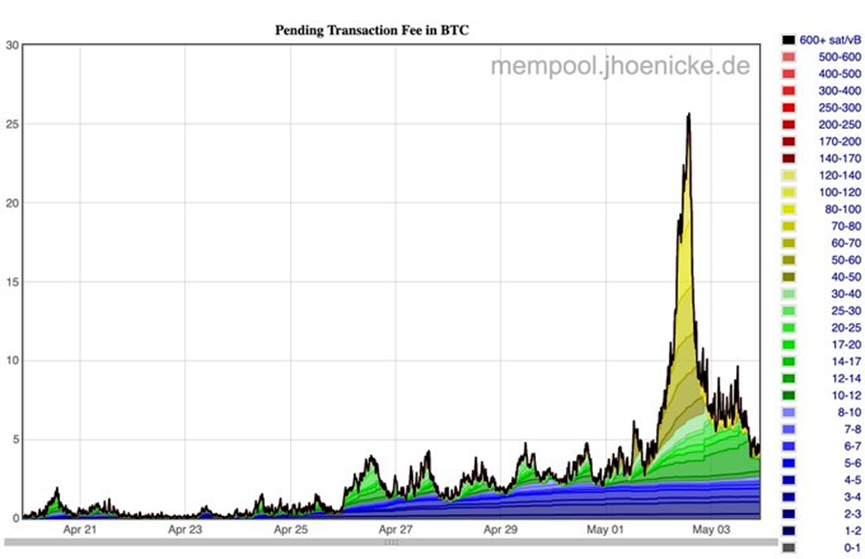

I'm posting the same graph again because it's absolutely ridiculous.

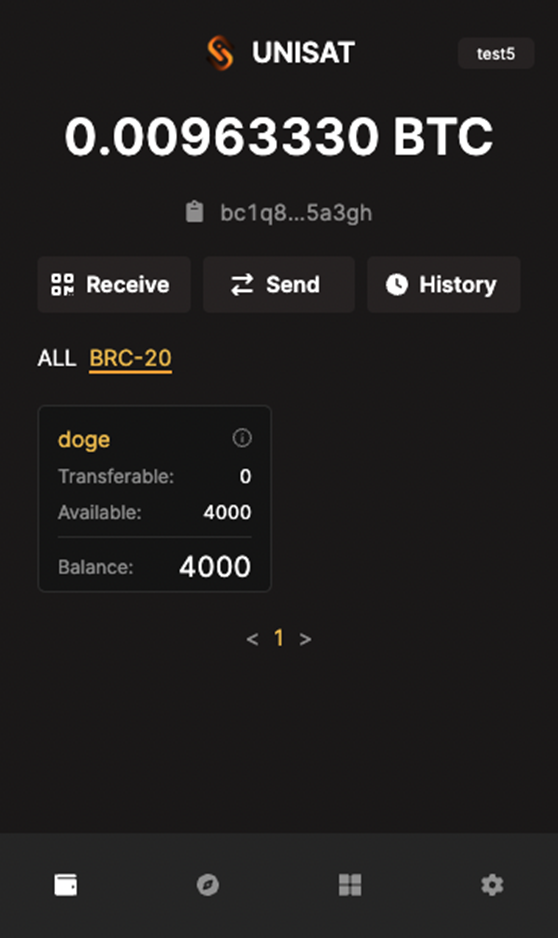

Unisat has two main products: @unisat_wallet plugin wallet + their website.

Both interfaces are very natural to Web3 users.

What is innovative about Unisat is that they index all BRC-20 data, providing users with a seamless legacy experience.

For starters, I highly recommend setting up a @unisat_wallet and checking out their {}brc-20 page ( https://unisat.io/brc20 ).

It allows you to filter by minting progress percentage, holder distribution, etc.

Minting is as easy as using their UX to add minting functionality.

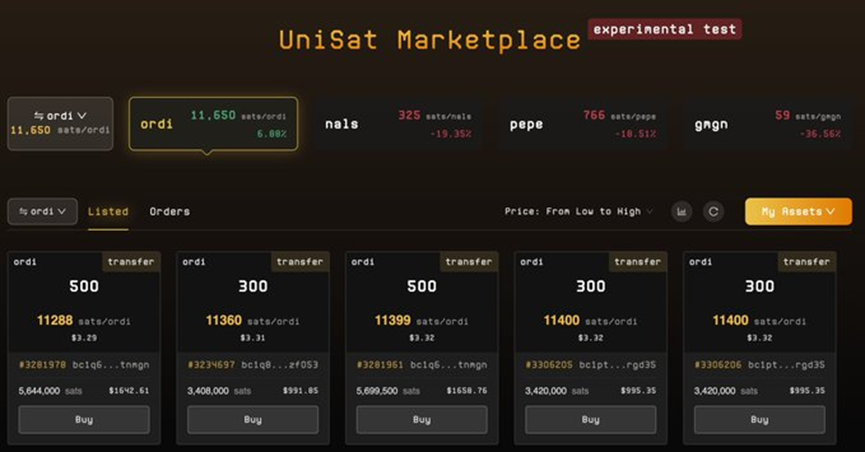

In terms of transactions, Unisat has a BRC-20 market.

It looks and feels like an NFT marketplace, not a DEX (again, back to how BRC-20 scaled NFTs to a logical extreme).

You buy/sell by the tick size listed, i.e. buy 200 tokens as a single Ordinal.

There are other developers working on indexing BRC-20 and providing a clean transaction experience, for example @ordinalswallet recently launched their marketplace, similar to @unisat_wallet 's design.

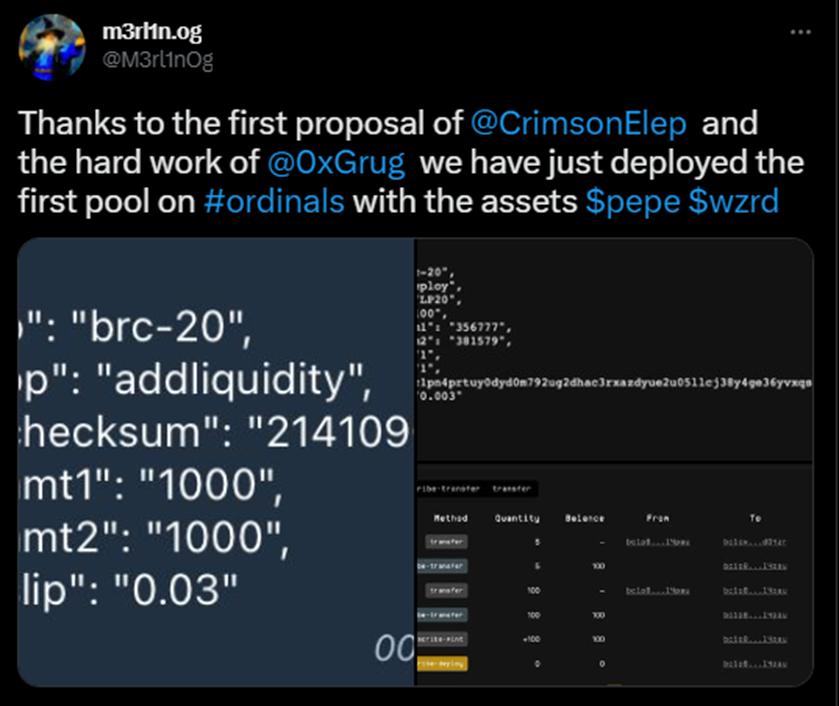

What about BRC-20 DEX?

soon

https://twitter.com/TO/status/1653570686751834112

The seamless transaction primitive (DEX) is the core pillar of the next stage of adoption and development of BRC-20.

@uniswap has catalyzed ERC-20 velocity and capital growth in a way that centralized order books couldn't.

For the BRC-20, such a development would be a game-changer.

https://twitter.com/LeonidasNFT/status/1653852613610205189

Another core unlock for BRC-20 growth is scalability.

I mentioned earlier that since each mint requires only gas, the entire bitcoin network sets the market price for primary bitcoins.

Unfortunately, this means that the cost of non-BRC-20 transactions has skyrocketed.

The image below basically sums it up. Pending mempool tx fees increase exponentially due to BRC-20.

That sucks for all the other non-speculative users of the network.

How will this play out?

Currently, approximately $3.5 million has been paid to inscribe BRC-20 tokens.

The market cap of all BRC-20s is about $106 million.

Therefore, the demand for shitcoins far outweighs the supply and the marginal cost of participating.

Realistically, I think this will continue as long as the junk coins remain intact.

The fee to inscribe BRC-20 will continue to rise, but as long as it's +EV minted, people will mint.

Eventually, the supply will saturate, new coins will have nowhere to go, and the meta will change.

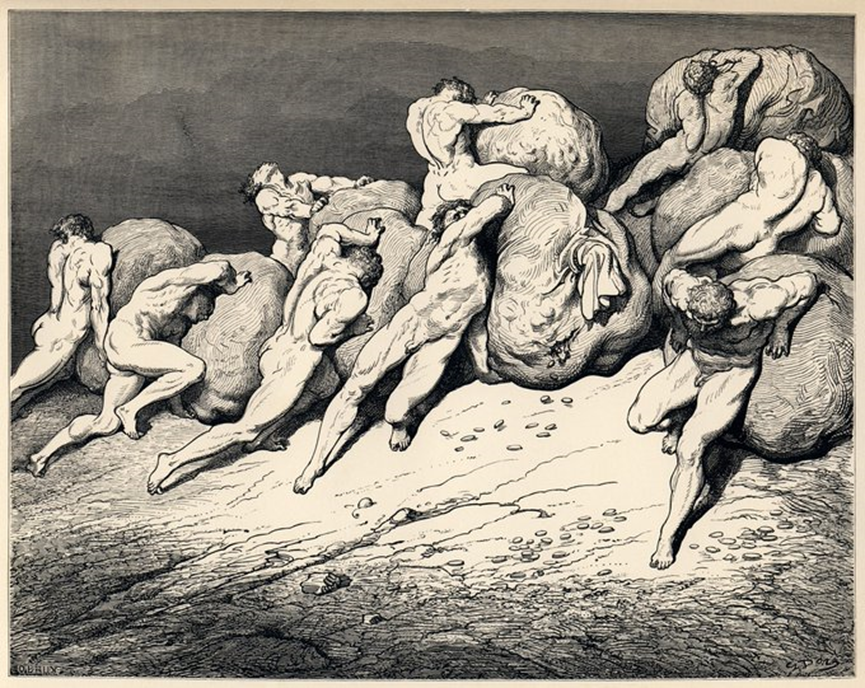

Still, for now...if you think JPEG Ordinals are a Bitcoin Maxis nightmare...

BRC-20 is like Dante's fourth hell.

The longer this goes on, the stronger the reaction I expect from the purest parties in the Bitcoin community will be.

https://twitter.com/culturaltutor/status/1640562334857871361

Potential solutions are nothing new.

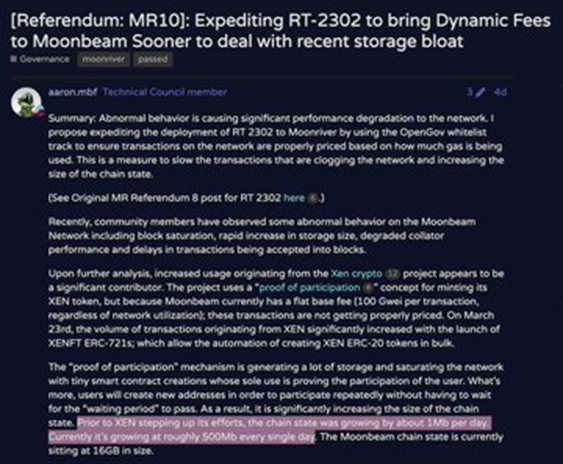

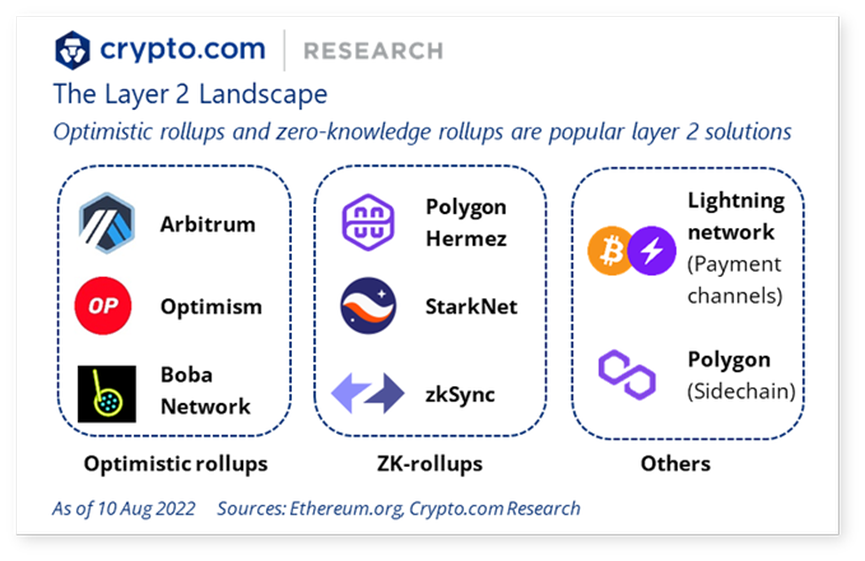

The panacea for network bloat has been found on other chains: Layer 2

BRC-20 is great for L2 because inflation doesn't limit important L1 activity...and Bitcoin L2 already exists.

Will another token standard surpass BRC-20?

It's possible, but the chances are dwindling.

BRC-20 is approaching escape velocity.

Remember Stamps? It is a competitor to the Ordinals theory, storing inscription data in the base part of the node, rather than the Witness part.

There are 18600 inscriptions on Stamps.

Ordinals are 3.4 million.

escape velocity.

The BRC-20's appeal hasn't stopped competitors from trying, including Stamps' own SRC-20.

ORC-20 is another protocol that attempts to migrate BRC-20 to a more mutable version.

And finally http://trustless.computer who implements BRC-20 into smart contracts.

https://twitter.com/punk3700/status/1652357882208464897

To round out this theme, which BRC-20s are worth watching?

Liquidity flowing into these tokens will herald broader benefits for the entire ecosystem and potentially attract more participants.

(NFA - I don't own these coins at the time of writing.)

Big Three: (MC = Marginal Cost)

1. $PEPE. One of the first BRC-20 (4th deployment), even before ERC-20 PEPE. $12 million MC

2. $ORDI. Original BRC-20. $63 million MC

3. $MEME (not to be confused with @Memeland ). $6 million MC

If (and when) the first BRC-20 hits a nine-figure market cap, expect a splash.

Take a look back at this lengthy thread:

1. BRC-20 </> ERC-20

2. BRC-20 are text-based ordinals in large supply

3. The market is very hot, the transaction volume exceeds 10 million US dollars, and the market value reaches 106 million US dollars

4. UI/UX is evolving at an incredible pace thanks to @unisat_wallet @ordinalswallet and others.

5. DEX capabilities will double the speed and capital expansion of BRC-20

6. The pricing of minting is determined by the Bitcoin rate, which means that BRC-20 is currently the marginal rate maker on the network

7. This caused fees to skyrocket - L2 is a possible solution.

8. The BRC-20 has competitors, but the window for scaling up is closing

9. Observe the overall price trend of the top MC tokens

If you finished my big thread, congratulations!

I invite you to mint my own custom Metaveralist badge: Mint for free on Polygon .

@HelloMetaversal and I will be offering badge holders perks in the future.

Link: https://mint.highlight.xyz/63fd0406d21c0bafe66b3f5f

If you liked this in-depth look at Bitcoin's BRC-20 shitcoin, follow me @JamesonMah for more research on the intersection of NFTs, culture, and finance.

If you can, I hope you will like or retweet the first tweet: