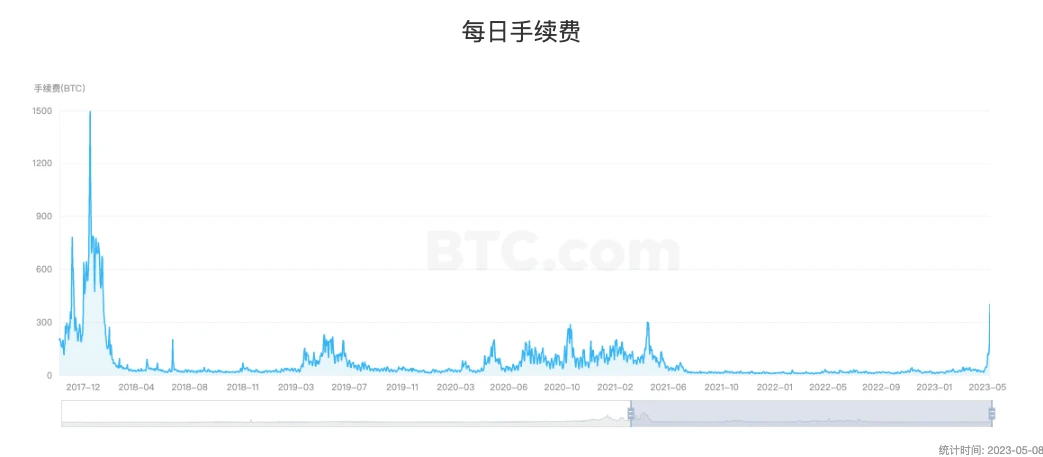

With the popularity of BRC-20 in the past two weeks, Bitcoin transaction fees have soared.

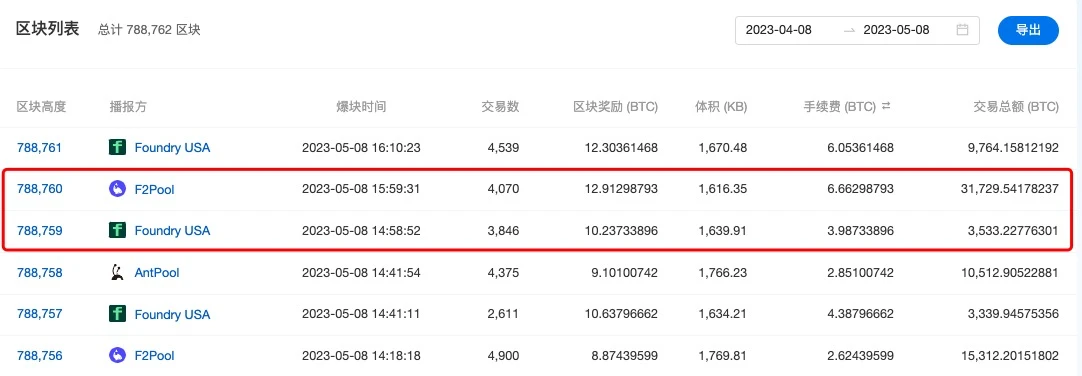

BTC data shows that the BTC daily transaction fee increased from 13.6 BTC two weeks ago (April 23) to 403.9 BTC(May 7), an increase of 2870% in two weeks, a record since January 20, 2018 highest record. Especially today, Bitcoin's handling fee on the six blocks of 788695, 788700, 788702, 788760 and 788762 exceeds the current block reward of 6.25 BTC.

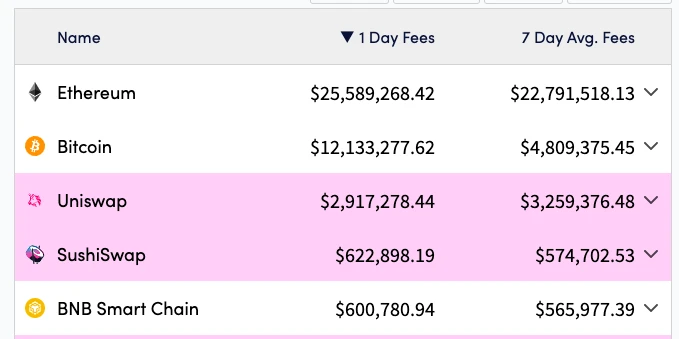

Thinking back to the DeFi wave in the past two years, Bitcoin miners are very jealous of other ecological miners earning transaction fees. Now that the situation has reversed, Bitcoin has grown into one of the most profitable ecology. According to Cryptofees.info data, in the past 24 hours, the transaction fee on the BTC chain reached 12.13 million US dollars, second only to Ethereum, and four times that of the third-ranked Uniswap ; the average transaction fee of Bitcoin in the past week was 4.8 million US dollars, still exceeding BSC, OP and other public chains and Layer 2 networks (Layer 2).

When the huge transaction demand meets the oldest blockchain with limited block space, problems also arise. More than 350,000 transactions are in an unconfirmed state, and the Bitcoin network is congested. This afternoon, it took an hour to package The case of a block. For users, in order to obtain faster packaging confirmation, they can only actively increase the gas fee multiple times.

With the intensification of network congestion, Binance is also repeatedly switching between shutting down withdrawals and opening withdrawals. It was announced at 11:00 last night that BTC withdrawals were shut down, and the service resumed early this morning; Resume withdrawal again. "Since the fees we set did not anticipate the recent surge in BTC network fees, there are still a large number of withdrawal transactions from Binance that have not yet been completed. The team is working hard to speed up the confirmation of all pending transactions. User funds are safe ." The official said out explanation.

Network congestion has also raised fears of an extreme downside move in the market. Although the vast majority of exchanges have opened U-standard futures contracts , currency-standard contracts still occupy a large share; once the network is congested and the market falls, some currency-standard users may be forced to liquidate before they have time to cover their positions, further driving up the price heading in an extreme downward direction. It is recommended that contract users make preparations in advance.

In addition, transaction fees exceeding block rewards have also raised concerns about Time-Bandit Attacks. A "time bandit attack" is an attack that only miners can perform by reorganizing blocks to extract MEV opportunities from previously mined blocks; when MEV is high enough compared to the block reward, miners can break consensus To extract MEV from old blocks, a miner with sufficient power may decide to regenerate the old block to capture arbitrage opportunities, thereby having a longer chain than the miner who originally generated the block. However, the "time bandit attack" is only theoretical, and has not yet occurred on blockchains with strong consensus like Ethereum (POW) and BTC .

For miners, under the expectation of Bitcoin production reduction next year, the emergence of the BRC-20 and Ordinals protocols will bring them new revenue growth paths. The data shows that the cost of engraving "inscriptions" through the Ordinals protocol has reached 746 BTC(21.03 million U.S. dollars), which can relieve financial pressure to a certain extent, and can better maintain the security of the Bitcoin network. Especially after the halving is completed next year, the block reward will be further reduced, and it will be particularly important to increase the transaction fee of the Bitcoin network-although it is not certain whether this upsurge can continue.