Crypto Degens making 10x take on immense risk.

But you now you don't have to.

Introducing @Rodeo_Finance, the sustainable leveraged farm that lets you be a degen and earn real yield. 🐎🤠

1/ @Rodeo_Finance has set itself a goal of building a sustainable leverage ecosystem.

By allowing users to lend and borrow, while also enabling them to earn passive income through a variety of real yield bearing strategies.

Rode is read to change the name of the game.

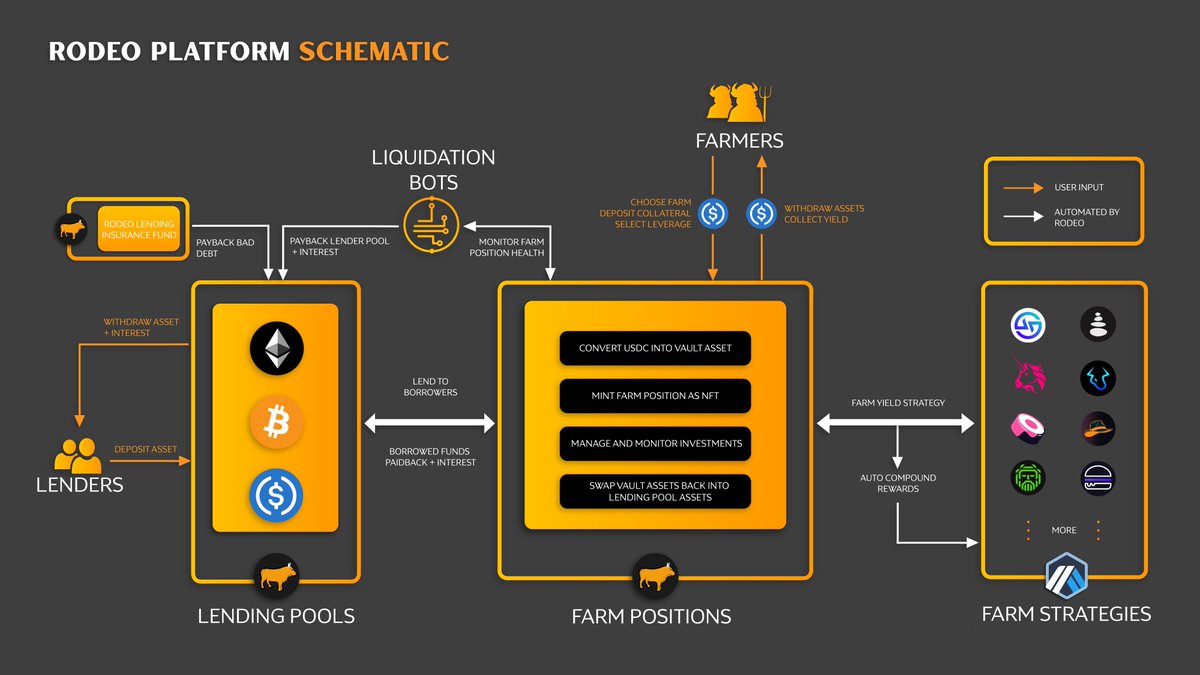

2/ First thing to understand is @Rodeo_Finance has two sides which aim to create a virtuous cycle.

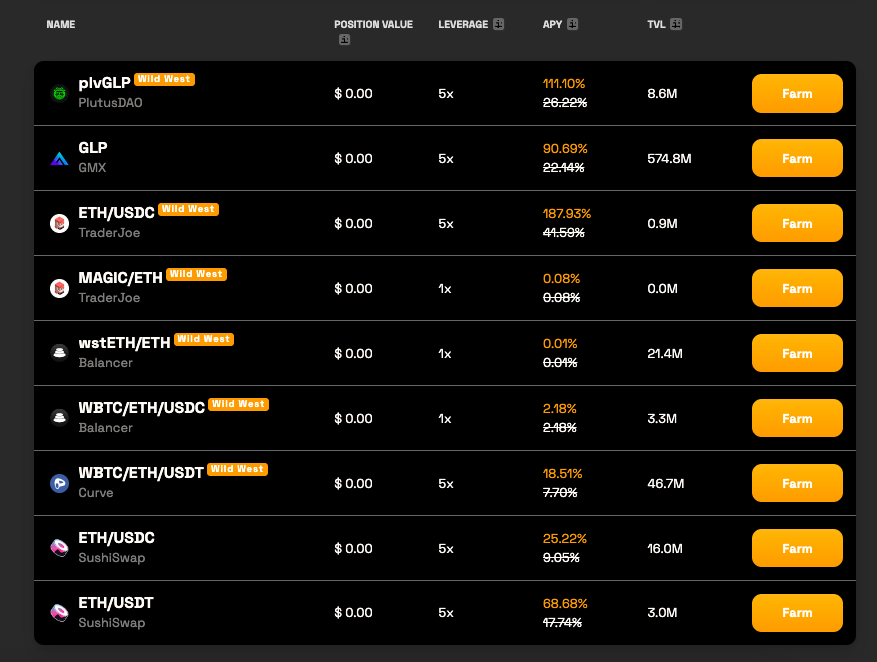

- Passive Liquidity Farmers ( Lenders)

-Leveraged Farmers

Let's breakdown this down further.

3/ In Rodeo, lenders can deposit their tokens to generate passive income.

- Acting as the counter-party for leveraged yield farmers (more on this).

Lenders, in return, receive a "rib" token - that represents the collateral deposited, which accrue interest as they auto compound.

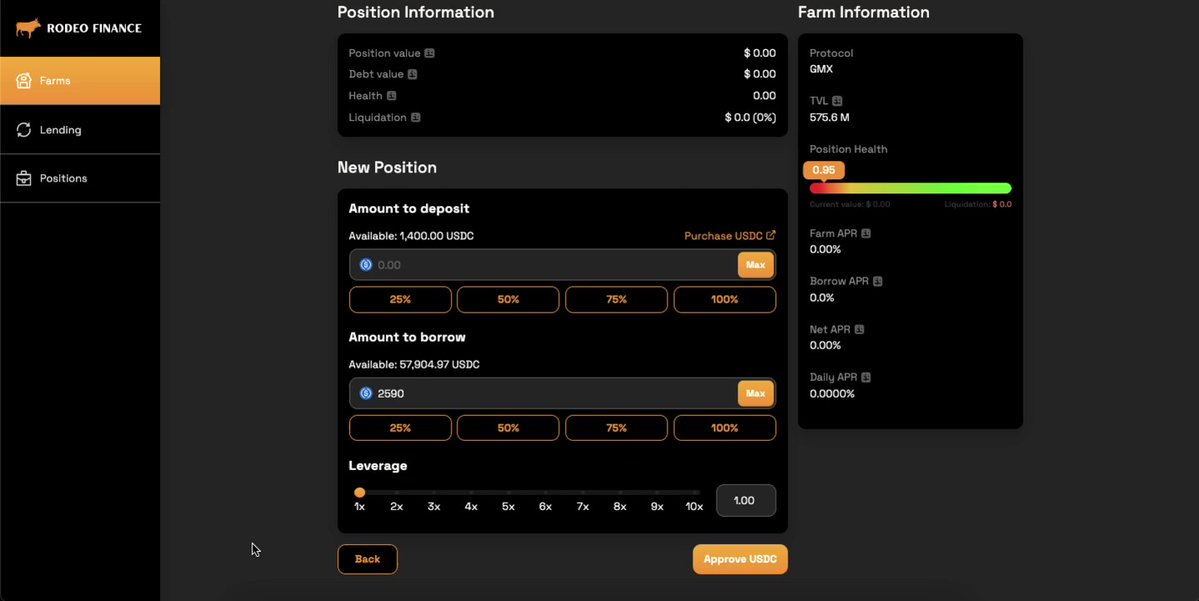

4/ On the other hand, farmers in @Rodeo_Finance aim to borrow from assets deposited.

In a very intuitive way, users can simply select the farm they like, deposit $USDC, select the leverage they want to utilize - up to 10x - increasing the yield they wish to earn.

5/ "With greater leverage comes greater responsibility."

As with any borrowing and lending protocol, minimizing bad debt is crucial. Therefore, @Rodeo_Finance approaches liquidations in two ways:

- Gentle liquidations (Half position liquidated)😅

- Full liquidations 💀

6/ This is an interesting approach to have when it comes to debt liquidations.

- Allowing farmers to have gentle liquidations is a win-win.

@Rodeo_Finance maintains security of lending assets, and the user to be able to keep some of their funds.

7/ Rodeo is building an ecosystem that is Decentralized, offering real yield, offering the ability to "ape" in, while allowing you to maintain passive strategies.

It's no surprise, they chose to deploy within @arbitrum, enabling users some of the best liquid strategies to date.

8/ Since Rodeo V1 rolled out, there has been significant excitement about what's to come.

- More Strategies

- More Incentives

- $RDO Token Launch

- Airdrop 🪂

9/ 1️⃣ The initial launch of Rodeo's Corral - Leveraged Yield Farming - has peeked the interest of many in the @arbitrum community.

- Reaching over 1000 users and $800k in TVL to date.

The implementation of more incentivized strategies will kick this to the next level.

10/ 2️⃣ Rodeo Stampede

This will be done in accordance with the launch of their new token $RDO.

Primarily to be used for passive liquidity farmers to maintain a sustainable and competitive ecosystem.

11/ 3️⃣ Rodeo Rocket Vaults

Essentially Automated risk managed vaults. 🤖

This will give users the ability to hedge some risk in liquidity pools by introducing short and long positions to minimize volatility.

12/ 4️⃣ Rodeo Lasso

Lasso is @Rodeo_Finance first iteration DAO governance model.

The DAO will be in charge of deciding some key initiatives such as Farm integrations, New assets and overall direction of the Protocol.

13/ As we approach Rodeo V2, sustainability will be key. This means high unsustainable APRs will not be the goal here.

But rather creating a flywheel effect that benefits users and investors over the the long term.

Rodeo Wagon Wheel (Dynamic Liquid Leverage) is that flywheel.

14/ Rodeo Silos

Silos will allow users to earn $RDO rewards via liquidity pools.

- In essence issuing xRDO tokens which can be initially utilized to purchase additional leverage.

The model pays homage to @CamelotDEX model of utilization of "x"tokens.

15/ Essentially, @Rodeo_Finance will deploy a ve(3,3)-like model, rewarding participants for longer-term liquidity commitments to the protocol.

This will be aimed at reducing friction points, while maintaining capital efficiencies of sticky liquidity.

16/ Rodeo Saloon

The Rodeo Saloon will accommodate "main" pools that host the majority of trades taking place.

Utilizing Balancer's linear boosted pool technology, Saloon will provide composability for Rodeo's ribAssets, ultimately resulting in higher APRs.

17/ Last but not least, they have announced an $RDO token airdrop will be coming.

As many of the features do require a native token to incentivize liquidity, place bribes and reward the community.

18/ @Rodeo_Finance appears to be positioning itself as an automated yield machine.

Focusing on creating an ecosystem that is symbiotic and mutually beneficial for users and the protocol.

19/ This thread was done in collaboration with the Rodeo Team.

As always DYOR, I encourage you to read their documentation, blogs, and follow their page for the latest updates.

- docs.rodeofinance.xyz

- medium.com@Rodeo_Finance

-

20/ Tagging Fellow DeFi Chads:

@Deebs_DeFi

@jake_pahor

@crypto_linn

@DeFiMinty

@defi_mochi

@TheDeFinvestor

@0xTindorr

@0xsurferboy

@Louround_

@wacy_time1

@Hercules_Defi

@IamZeroIka

@0xSalazar

@thelearningpill

@FarmerTuHao

@rektdiomedes

@DefiIgnas

@CryptoStreamHub

21/ Thank you for reading!

I hope you've found this thread helpful.

Follow me @Flowslikeosmo for more.

Show your support by Liking and Retweeting the first tweet below 👇

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content