TL;DR

The emergence of the Ordinals protocol has brought a new narrative space to the BTC ecology. Recently, the re-creation of the BRC-20 token standard based on Ordinals has pushed the market FOMO sentiment to a climax. In this research report, Huobi Research discussed the origin of the Ordinals protocol, the opportunities and current data of the BRC-20 token, and the BTC ecology future development.

The Ordinals protocol endows BTC smallest unit Satoshi with higher transaction and collection value, opening a new door for the ecological development of Bitcoin. The Ordinals NFT market continues to increase in size, and its infrastructure will become an important track.

The attempt at the BRC-20 token standard sparked a new wealth effect, with over 18,279 BRC-20 projects already minted on-chain. The trading market expanded rapidly, and the dark horse of Unisat broke out, accounting for more than 50% of the trading volume.

BRC-20 token risks and opportunities coexist. BRC-20 still has many flaws, but it also creates some possibilities for the future ecological development of BTC . The BTC ecology is in a very early stage, requiring developers and the community to constantly tinker with the standard design and establish a sound infrastructure.

Table of contents

1. Ordinals Protocol: BTC ’s renaissance

2. BRC-20: Ordinals protocol evolution

2.1 The price miracle of the Ordi token

2.2 The rapid expansion of the Ordinals trading market

3. Carnival of multi-party support

4. Risks and opportunities

The encryption market is never short of hot spots. Recently, the popularity of BRC-20 has gradually increased, which has replaced Arbitrum’s currency issuance and AirDrop effects. BRC-20 is an experimental alternative token standard for Bitcoin proposed by domo@domodata based on the Ordinals protocol. Ordinals opens up a new narrative of BTC ecology and decentralization.

Since its inception, the core value of BTC has been decentralization and free trade, and it is also the only cryptocurrency with commodity attributes recognized by the US Securities and Exchange Commission (SEC). The BTC network is not Turing complete, but developers have always wanted to develop the BTC ecosystem and build an ecological empire similar to Ethereum. For example, the BTC two-tier network project and the Web5 network proposed by Jack Dorsey are all ecological projects that hope to develop a more powerful decentralized system based on BTC .

1. Ordinals Protocol: BTC ’s renaissance

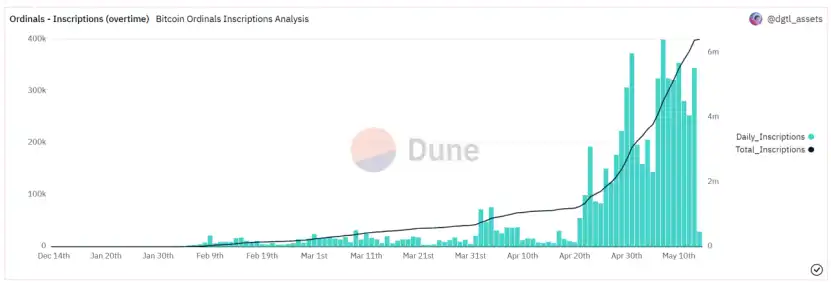

Since Casey Rodarmor created the Ordinals protocol on December 14, 2022, as of May 14, more than 6.41 million NFTs or Tokens have been minted, which has opened a new door for the development of the Bitcoin ecosystem. BTC NFT is defined based on the smallest unit of measurement of the BTC network, Sats (Satoshi). The Ordinals protocol assigns a unique identity to each satoshi, that is, number + comment, making each original homogeneous satoshi a unique "NFT". The Ordinals protocol endows Satoshi with higher transaction value and collection value.

The BTC NFT minted based on the Ordinals protocol is fundamentally different from the ETH NFT. Users can inscribe information on the chain, including text/pictures/audio/video, but the storage space of each block is only 4MB, which is the upper limit of Bitcoin inscriptions.

ETH 's NFT uses smart contracts to issue and trade based on the ERC-721 or ERC-1155 standard. The only information stored on the chain is the Token ID composed of integers. This string of numbers will be mapped to the URL to retrieve the Metadata (name, description, picture address) about the NFT. NFT Metadata is usually stored in IPFS or a centralized server.

The information in the BTC NFT is completely on the chain, and there is no need to store Metadata off the chain. An NFT includes a number, that is, the mining sequence starts from 0, which ensures the uniqueness of each Satoshi. It is precisely because the NFT is actually stored on the chain, the information contained in the NFT has a size limit and cannot be modified. This is also the reason for the pursuit of BTC enthusiasts.

More and more blue-chip NFT project parties have also joined the BTC NFT ecosystem and achieved success. Yuga Labs' "Twelvefold" won the bidding with the highest bid of 7.115 BTC . According to a research report by Galaxy, the market size of Ordinals NFT will reach 4.5 billion US dollars by 2025, and the market infrastructure of Ordinals NFT will tend to be perfected by the second quarter of 2023. Developers will also continue to explore new decentralized software or Bitcoin scaling technologies.

2. BRC-20: Ordinals protocol evolution

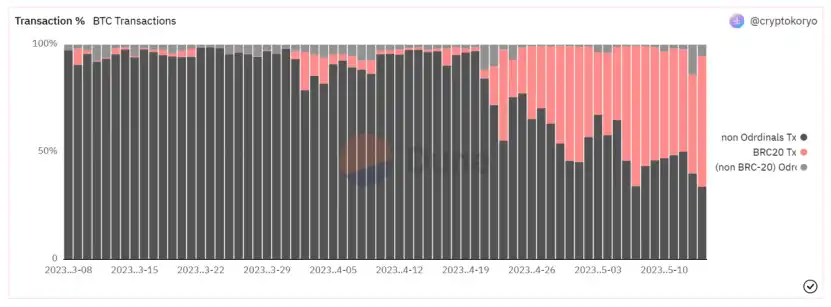

On March 9th, the founder domo informally proposed the BRC-20 protocol, which triggered the FOMO effect. According to ordspace.org, as of May 14th, there have been more than 18,279 BRC-20 token projects with a total market value of more than 500 million Dollar. At present, the transaction volume related to the BRC-20 protocol on the BTC network has exceeded the transaction volume of the non-Ordinals protocol. On May 7 and May 14, the transaction volume of the BRC-20 agreement once accounted for more than 65%, and the market sentiment seems to be continuing.

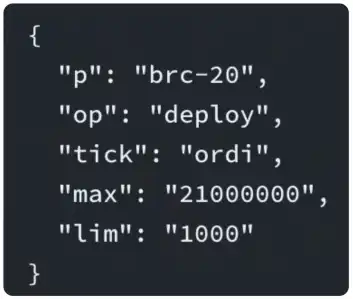

The BRC-20 protocol is a technology that uses the Ordinals protocol to create and trade homogeneous tokens (FT) on the Bitcoin blockchain. It uses JSON data token contract information, including token names, symbols, total Quantities, decimal places, etc. The name "BRC-20" is a deduction of Ethereum's ERC-20 token standard, but BRC-20 tokens cannot interact with smart contracts and cannot perform any automated operations.

2.1 The price miracle of the Ordi token

Ordi is the first token issued under the BRC-20 standard, with a minting limit of 1,000 tokens and a total of 21,000,000 tokens. Ordinal wallets such as Unisat quickly deployed tools for the BRC-20 standard and all 21,000,000 ordi tokens were minted in less than 18 hours. The price of Ordi also rose from $0.1 to $29.04 in just three weeks, achieving a 100-fold increase.

2.2 The rapid expansion of the Ordinals trading market

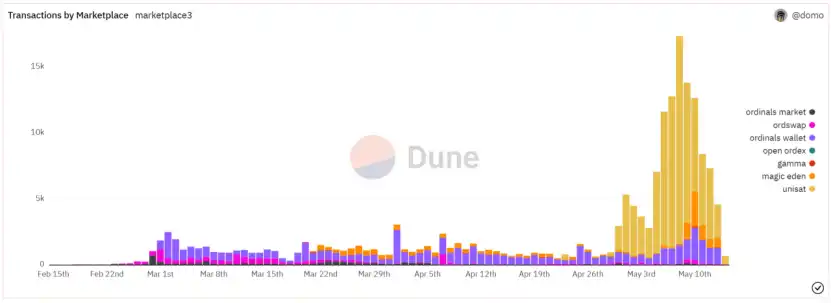

The BRC-20 token mechanism has some complexity and requires additional steps for storage and transactions. Specifically, when users mint Ordinals, they need to run a full node; in addition, there is no automatic market maker on the chain on Bitcoin, and a secure secondary market transaction is required. The demand of users and the potential huge fee income have dramatically accelerated the emergence of the Ordinals trading market, and even ushered in fierce competition. These infrastructure and auxiliary tools mainly serve Ordinals NFT, BRC-20 tokens and BTC domain names.

After Ordinals was born, it went through a two-month dormant period. During this period, Magic Eden recovered from the trauma of Solana, and moved to the BTC NFT trading market, winning the first trading volume. With the emergence of BRC-20, Unisat became a dark horse in the trading market. Currently, Unisat has become the number one transaction volume, with more than 50% market share. The creation of these tools and marketplaces facilitated the multiplication of more BRC-20 tokens, resulting in the minting of over 30,000 ordinal inscriptions in a single day.

3. Carnival of multi-party support

BRC-20 tokens have more room for hype than BTC NFT. From the perspective of retail investors, exchanges, developers, and miners, this is a carnival of your choice.

A Triumph for BTC Miners

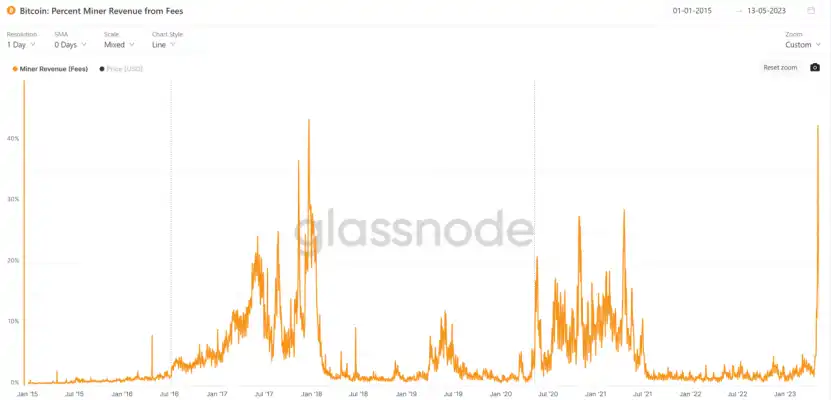

The minting and trading of BRC-20 has put unprecedented pressure on the BTC network. The minting and trading of a series of tokens such as BRC-20 has greatly increased the transaction fee of BTC . According to glassnode data, the number of transactions on the BTC chain reached 680,000 and 670,000 on May 1 and May 10, respectively. On May 7, the transaction fee for the entire Bitcoin network was 403.91 BTC, and just a month ago, the transaction fee for the entire Bitcoin network in a single day was only 21.89 BTC, an increase of nearly 18 times. As a result, the Bitcoin transaction fee rate has hit the highest record in the past 6 years. High fees and block rewards have created amazing benefits for miners.

The addition of head ecology and institutions

Blue-chip Ethereum NFT projects such as Yuga Labs, Crypto Punks, and BAYC have joined the Bitcoin ecosystem and issued NFTs. NFT markets such as Magic Eden and several leading exchanges are also supporting the Ordinals ecosystem. For exchanges, they can have more asset management opportunities and fee income. In order to enter the BTC ecosystem early and build relationships with communities and developers, many exchanges are more willing to be the first to eat crabs than investment institutions.

Boost from the BSV community

According to observations, at present, a large number of ecological applications of BRC-20 come from the original BSV community developers, including the BRC20 wallet Unisat. Behind it is the Chinese development team of the previous BSV ecology, which has developed Sensible Contract, a smart contract solution on BSV . BSV community members once again made fortunes on the BRC-20 track. The explosion of BRC-20 also provides development opportunities for developers who focus on the POW chain

4. Risks and opportunities

The current development of BRC-20 tokens is still in the early stage, with strong meme attributes and innovative concepts, and no actual use scenarios. Moreover, the BRC-20 standard is not as comprehensive and strict as the ERC token standard, which is not considered a standard for the substitutability of Bitcoin and ordinal numbers. As founder domo stated, this is just an experiment, and the bitcoin community is encouraged to tinker with standard designs and optimizations until there is general consensus on best practice performance. Afterwards, the ORC-20 and BRC-721 token standard protocols emerged one after another. These token standards have been improved in scalability, adaptability and security.

BRC-20 may be an interesting social experiment, but it has many flaws that cannot be ignored: (1) The ecological infrastructure of BRC-20 tokens is almost zero, and most of the tokens are meme attributes and have no use value; (2) ) The BTC ecology does not provide a Liquidity, and cannot guarantee the security of token transactions; (3) Since BRC-20 introduces a more complex mechanism for asset management, additional tools or platforms are required, which leads to security and The platform is linked and vulnerable to malicious attacks, which violates the decentralization of BTC ; (4) Regulatory risk, BTC is more like a commodity, but BRC-20 tokens may facilitate an unregistered securities market on the Bitcoin blockchain.

In addition, the FOMO sentiment triggered by BRC-20 tokens led to severe congestion on the Bitcoin network. On May 8, there was a rare phenomenon that no block was produced for an hour. At the same time, when Bitcoin service fee income continues to exceed block rewards, it may cause Time-Bandit Attacks. Miners will choose to process transactions with higher service fees and ignore transactions with lower service fees. At present, there are more than 300,000 unconfirmed transactions on the BTC network. Many BTC supporters are dissatisfied with the ecology of Ordinals or BRC-20, and believe that this is an attack and damage to the BTC network.

4.1 Future ecological development of BTC

Any new attempt will cause controversy and bring new thinking. We can see more possibilities of BTC narrative through BRC-20, and prepare for the next wave of wealth encryption. As more and more developers pay attention to the ecological track of BTC , solutions to solve the congestion problem on the chain continue to emerge. I believe that the BTC ecology will gradually prosper.

Better Token Standards and Smart Contract Marketplaces

Today, some exchanges and wallets have joined the discussion of BTC -based alternative token standards. Include data structures that replace JSON to reduce block space consumption. The Ordinals protocol, or more, needs better tools for indexing and managing these tokens. All these require industry developers and leaders to participate in the discussion.

Attract more investors

At present, the launch of BRC-20 and other tokens is more fueled by the secondary market, and the interest of investment institutions to participate is not high at present. The main reason is that there are still too many controversies about the emergence of token standards such as BRC-20. However, the innovation brought by the Ordinals protocol is also a new attempt at the future ecological development of BTC . The renaissance of BTC will reshape investors' stereotypes of BTC ecology.

The second layer of BTC may usher in the second spring

Under the prosperity of the second layer of Ethereum, BTC second-tier network has also poured in many developers. The early well-known one is Lightning Network. The use cases of Lightning Network include social platform reward payment, cross-border remittance, merchant payment, transfer transactions, etc., can Meet the needs of diverse payment scenarios. It is also one of the best ways to solve the current network congestion. In addition to Liquid, RSK, and Stacks projects, the BTC ecosystem is still in its early stages.