Transaction mining is like a star-absorbing method, it’s super cool when you suck it, and it’s so cool to the last crematorium! From Fcoin to various Defi mining to Looksrare and X2Y2, the predecessors have piled up experimental data for us one after another. In the end, the light ones are sluggish, and the heavy ones are lost~

The reason why Linghu Chong didn't get any results after practicing "Star Absorbing Dafa" was because of the ultimate martial art - "Yi Jin Jing"!

When will Blur's transaction mining be cool? Can it find its own "Yi Jin Jing"?

This is a question that many players have been thinking about. Blur has fully absorbed the previous transaction mining experience of Looksrare and X2Y2. Batch interval AirDrop are adopted to offset the bubble with market expectations! But it's just a matter of dying early or dying too late!

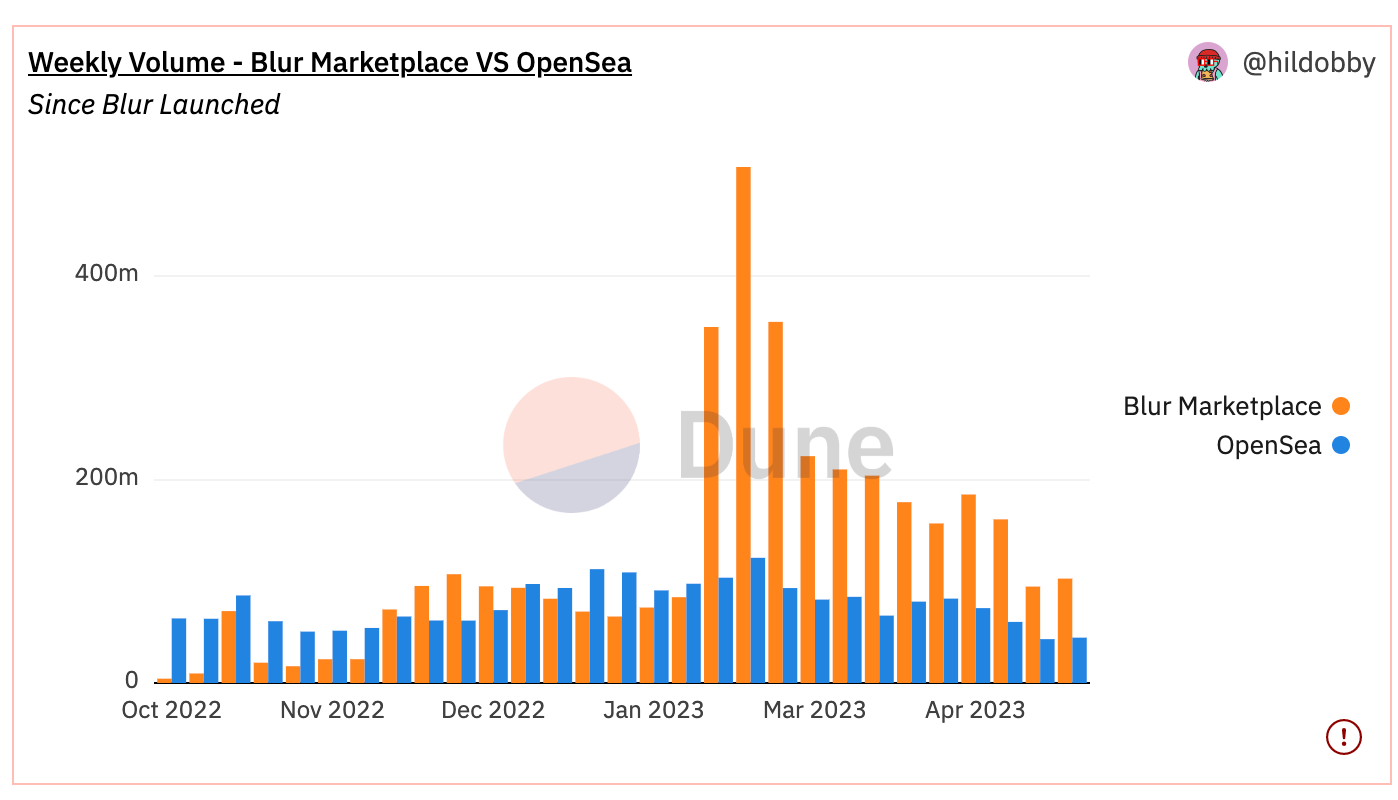

The first batch of mining companies are making a lot of money. From December 22, Blur’s trading volume has been comparable to that of Opensea. After the AirDrop in February 2023, the momentum has not fallen but has risen. Blur’s trading volume has been stabilizing Opensea for several times. , as the price of blur currency has been falling, this momentum is constantly weakening. (see picture 1)

Blur is about to usher in the second AirDrop in June. It is said that there will be 300 million tokens. Will the currency price be able to resist by then? From a mathematical point of view, I can't bear it! Will Blur's transaction volume be able to overwhelm Opensea by then? Mathematically, it's unstoppable!

So Blur seems to be unable to escape the fate of Looksrare and X2Y2~

Is the trajectory of fate really going to be like this? Blend has to go online and let me see the variables of Blur's fate!

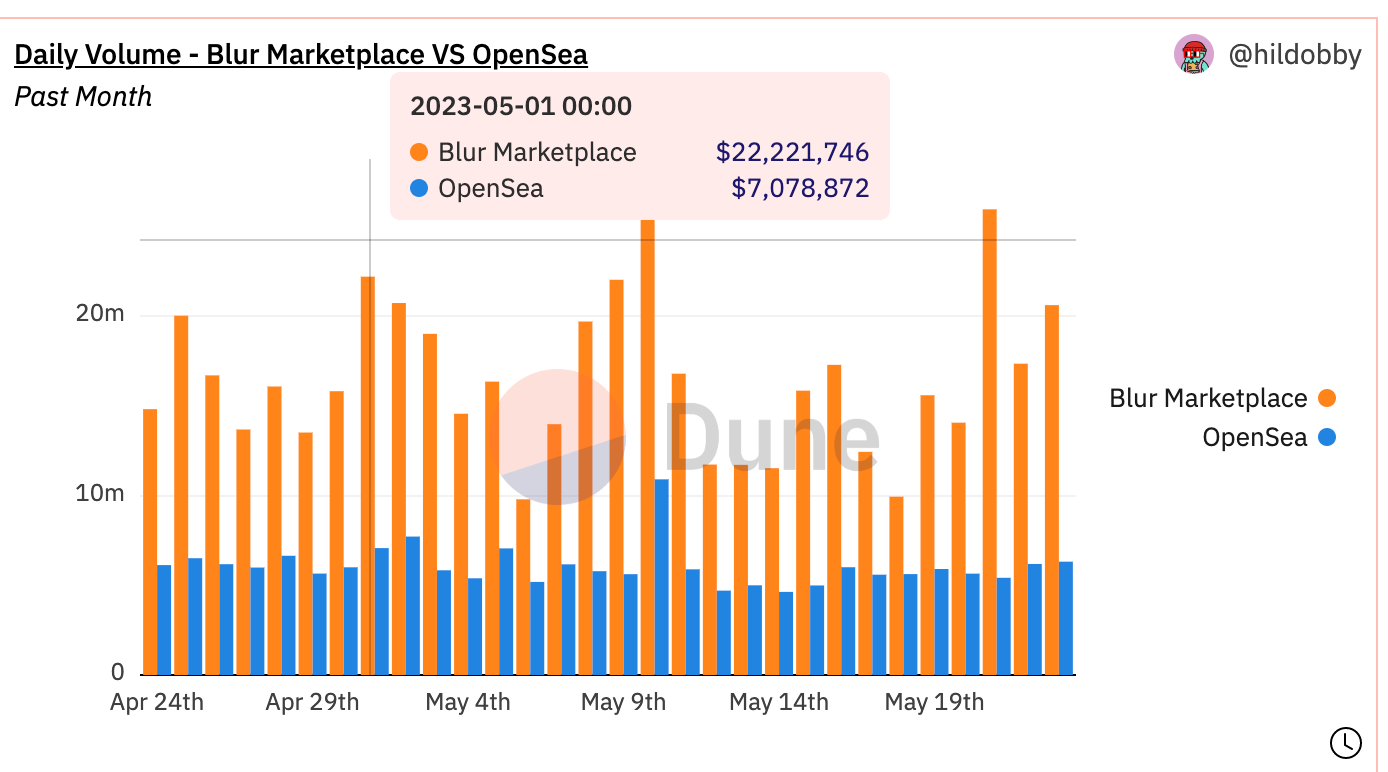

Figure 2 Figure 3,

Blend's data is very eye-catching, (Figure 2)

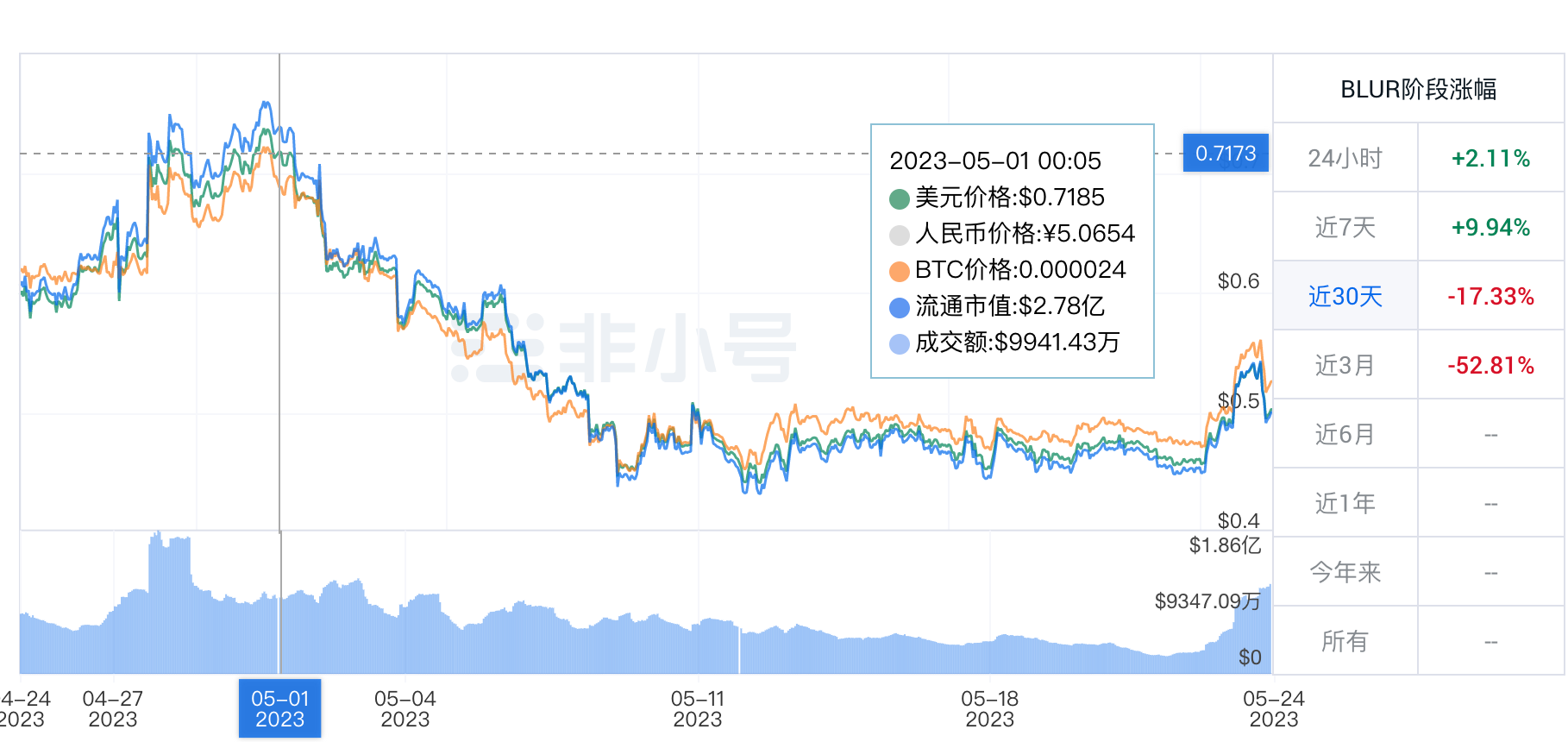

Looking at the K-line of Blur's currency price again, I am very disappointed! (image 3)

Because Blur's currency price did not slow down at all because of the launch of Blend!

After writing this, the judges must be wondering if Dunyi's brain is broken, is that all? It's just an AirDrop incentive bubble~

At first I thought that was the case too. X2Y2 also engaged in peer-to-peer lending, but the decline was irreversible. But after I carefully studied Blend's mechanism.

Still can't help but say: something!

Although the essence of Blend is an optimized and sustainable peer-to-peer lending, the strategic purpose of Blur’s launch of Blend, in my opinion, should not be to carve up the share of the lending market for self-empowerment!

But in order to revitalize effective transactions and promote user transactions, Blend does not want users to mortgage NFT. Trading platforms dream of users' NFTs constantly changing hands, and the fundamental value of their tokens will always be the trading volume of the platform!

How does Blend facilitate transactions?

An innovative function of Blend is called Buy Now, Pay Later (BNPL), which is generally understood as "new home loan", which encourages users to borrow money to buy and sell NFT. The users of Benddao are mainly users who already own NFT to mortgage loans-"Old House Mortgage". Therefore, although the two belong to the same type of lending, the target groups are completely different. This explains why the data of Blend is bright but the data of Benddao and others have not dropped sharply!

However, since May 1st (Blend was launched on May 10th), the transaction volume of the Blur platform has not increased significantly. why?

Because NFT as a whole is too cool, the blue chips are collectively falling. Blend's buy now pay later (BNPL) can only show advantages when asset prices are rising. This is like FT's spot leveraged trading, borrowing money to do more, greatly improving the utilization rate of funds during the rising period, and using a small amount to make a big fortune. Assets are flat when they fall.

The current data of Blend is pretty good, mostly due to AirDrop incentives and user curiosity. However, during this time period (before the second AirDrop in June), it is indeed a good move to do a good job in user education and build defense depth!

This function of Blend is a very sophisticated innovation! Fully consider its own advantages and market demand, make up for the lack of the market. Unlike X2Y2's peer-to-peer lending, Blend's UI entry is deeply embedded in Blur's original trading interface. It can also be seen from the UI design that Blend's strategic intention is to encourage users to trade, not to mortgage!

Adopting a perpetual model rather than a regular basis is also reducing friction costs as much as possible. Although Benddao also has the function of buy now and pay later, the final effect is very different!

And this kind of peer-to-peer lending must also be based on sufficient traffic. This mechanism is relatively dependent on the lender. Only with sufficient loan depth can we have a good experience. Therefore, the lender is given as much initiative as possible (you can freely set the amount and interest rate, and you can initiate repayment at any time) and Token Incentives! I have to say the design is really ingenious! It can be seen that there is deep thinking.

After careful inspection, it turns out that the Blend mechanism is directly operated by Paradigm, and the co-authors in the published articles, Dan Robinson, etc., are senior contributors to leading DeFi protocols such as Comound and Uniswap. I have to admire, the boss is indeed a boss!

Let me just say something gossip: it is really interesting to have more product innovations like this in Web3! It's so boring to look at some vain concepts and follow-up products every day!

To summarize : Blend’s main focus is on Buy Now Pay Later (BNPL) “new home loans” to facilitate user transactions. It may become an indispensable part of the future NFT market. Mortgage loans from Benddao and others are different user groups, and there is no fierce competition. But the underlying foundation of Blend is a peer-to-peer lending model, which requires sufficient depth to have a good user experience!

The innovation adopts the sustainable model, does not rely on the liquidation of the oracle machine, and gives the lender enough initiative, but it is also accompanied by risks. How to make money and effectively prevent and control risks requires players to slowly get used to it~

In the end, the above is just a deduction. As for the details, we need to wait until the NFT market ushers in a relatively large and long-term rebound to fully verify how much Blend’s mechanism can hold for Blur! Especially when Blur's follow-up AirDrop incentives are weak! So whether Blend can become Blur's continuation of "Yi Jin Jing" remains to be seen~

This article does not dismantle the Blend mechanism in detail. If you are interested, you can read the Blend Whitepaper and experience the product (PS, the Whitepaper is quite general, and you have to experience the product yourself to understand it more deeply)

Portal - https://www.paradigm.xyz/2023/05/blend

Make a prediction : Opensea will launch similar functions sooner or later, it depends on when Opensea can't hold back, lol~

This article only disassembles and deduces the mechanism of Blend, and does not make any investment suggestions for Blur's investment. DYOR~

Personal Twitter: https://twitter.com/DONE65820614

To know what's happening;

To be a builder;

To win!

Escape One, 2023-5-24