After briefly retesting the $25,000 support on June 15, Bitcoin rallied 6.5% as the bulls successfully defended the $26,300 level. Even so, overall sentiment remains a bit pessimistic as the top cryptocurrency by Capital has dropped 12.7% in two months.

U.S. District Court Judge Amy Berman Jackson's rejection of the temporary ban on Binance.US has somewhat eased investor sentiment. On June 16, the exchange reached an agreement with the US Securities and Exchange Commission (SEC), avoiding an asset freeze.

In the longer time frame, the global regulatory environment is extremely harmful for crypto prices. In addition to the SEC trying to unilaterally attribute exactly which altcoins it considers securities and litigation with two leading global exchanges, the European Union has signed Crypto Market regulations. (MiCA) into law on May 31. This means that crypto businesses have set a timeline for implementing and complying with MiCA requirements.

Curiously, while Bitcoin's performance was lackluster, on June 16, the S&P 500 Index hit a 14-month high. Even with this rally, JPMorgan strategists predict stocks will come under pressure in the second half of 2023 "if growth stalls absolutely."

Investors will focus on the US central bank, as US Federal Reserve Chairman Jay Powell will testify before the United States House Committee on Financial Services on June 21 and The US Senate Banking Committee on the morning of June 22 in a semi-annual questioning session before lawmakers.

Let's review Bitcoin Derivative metrics to gain insight into how professional traders are positioned amid a weaker macroeconomic backdrop.

Margin markets provide insight into how professional traders are positioned as they allow investors to borrow crypto to capitalize on their positions.

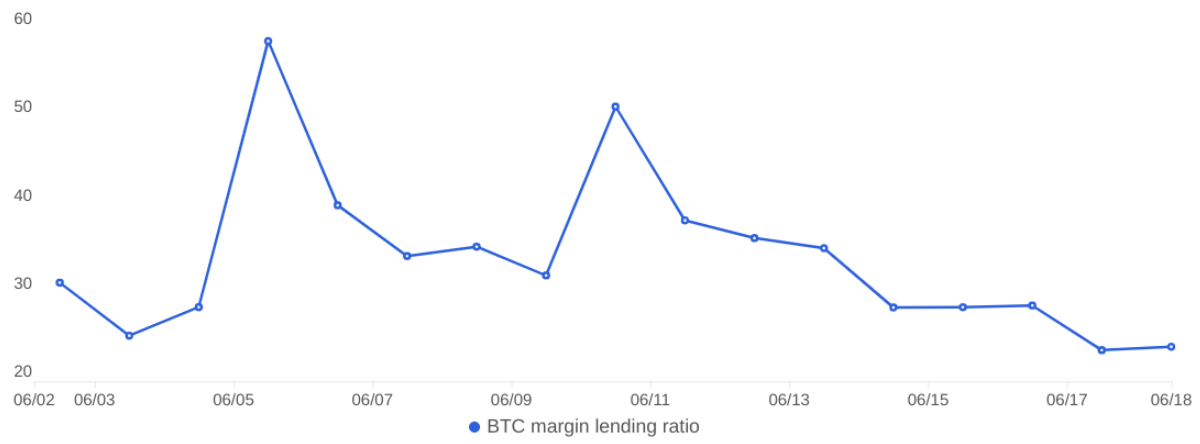

For example, OKX offers a margin lending indicator based on the stablecoin/BTC ratio. Traders can increase their exposure by borrowing stablecoins to buy Bitcoin. Bitcoin borrowers, on the other hand, can only bet on the cryptocurrency's downward momentum.

Stablecoin/BTC margin lending rate on OKX | Source: OKX

The chart above shows that OKX traders' margin lending ratio has decreased since June 10, showing that the overwhelming dominance of Longing orders has ended. The current 23:1 ratio in favor of stablecoin lending still favors the bulls but is near a five-week low.

Investors should also analyze the Bitcoin futures Longing-to- Short metric, as it excludes external factors that affect only the margin market.

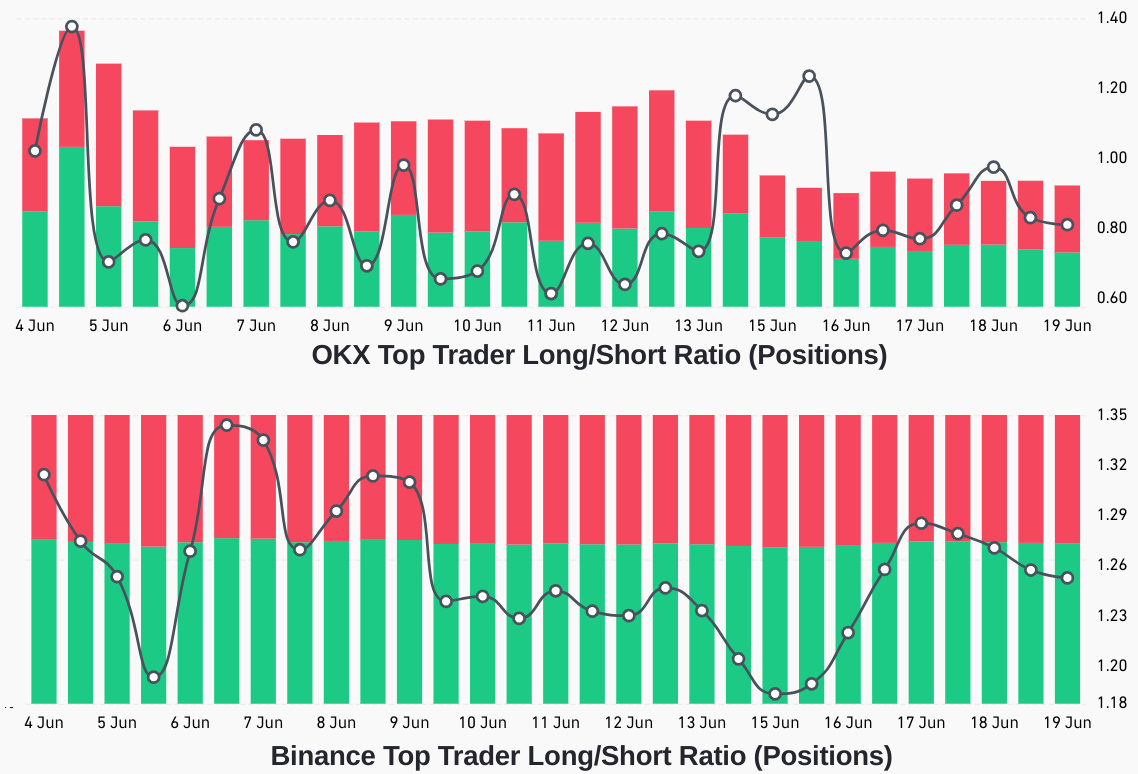

Bitcoin Longing-to- Short Ratio of top traders on the exchange | Source: CoinGlass

There are sometimes methodological differences between exchanges, so it is advisable to track changes rather than absolute metrics.

Top traders at OKX significantly reduced their Short positions on June 15 as Bitcoin price slid to a 3-month low of $24,800. However, those traders did not feel comfortable holding a larger ratio of Longing positions and since then the ratio has returned to 0.8, in line with the two-week average.

However, Binance showed the opposite trend, as top traders reduced their Longing-to- Short ratio to 1.18 on June 15 but later added Longing positions, pushing the indicator to 1.25. . Despite the improvement, the Longing-to- Short ratio of top traders on Binance is now equal to the two-week average.

In general, Bitcoin bulls lack confidence to leverage Longing positions using margin and futures markets. BTC lacks momentum as investors' attention has turned to equities since the Fed's decision to pause rate hikes to improve the company's earnings outlook.

According to Bitcoin Derivative metrics, despite extremely negative regulatory pressure, professional traders have not turned bearish. However, the bears have the upper hand as the 20-day resistance at $27,500 consolidates, limiting the short-term rally to just 3.8%.

Join Telegram of Bitcoin Magazine: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Minh Anh

According to Cointelegraph