The European and American chapter of "Research on Global Blockchain Regulatory Policies" sorts out the regulatory policies on blockchain in three countries, namely the United States, the United Kingdom and Canada. From the perspective of financial attributes, the countries covered in the European and American chapters have the most developed and mature capital markets in the world, which is naturally consistent with the financial attributes of blockchain distributed ledgers.

Author: Will Awang

Proofreading: Yun Conglong

Choreography: Kuroba Koto

Produced by: Buildler DAO, LegalDAO

Cover: Photo by Donovan Reeves on Unsplash

Introduction

The European and American chapter of "Research on Global Blockchain Regulatory Policies" sorts out the regulatory policies on blockchain in three countries, namely the United States, the United Kingdom and Canada. From the perspective of financial attributes, the countries covered in the European and American chapters have the most developed and mature capital markets in the world, which is naturally consistent with the financial attributes of blockchain distributed ledgers. The United States is the global leader in the Web3 industry, and its tolerance and encouragement of technological innovation is undoubtedly an important reason for the creation of countless leading projects in the Web3 field. From the perspective of the legal system, the United States, the United Kingdom, and Canada belong to the common law system, and precedents are an important form of legal sources. Therefore, the response of regulatory agencies or judicial agencies caused by each hot-button event that attracts much attention will have an impact on subsequent similar events. The situation has been "legislated" and is likely to have a legally binding impact.

The European and American text of this report sorts out the regulatory framework of relevant countries in the field of blockchain supervision, and discusses it based on some projects or cases.

Leader of the Global Blockchain Regulatory Policy Research Project——Yun Conglong

Preface

The United States is undoubtedly the leader in the global Web3 industry. Its tolerance and encouragement of technological innovation have given rise to countless leading projects in the Web3 field. According to a16z’s report “Introducing the 2022 State of Crypto Report” [1]: “Although the market is currently entering a cold winter, we are still in the regular development cycle of the Web3 industry. Once the value of virtual assets is rediscovered, it will cause various With the attention and interest of market players, countless Web3 innovative and entrepreneurial projects will also rise." People from all walks of life in American Web3 are also rushing to each other, and now they have gradually formed a unified attitude towards Web3 virtual assets and technological innovation: accelerating supervision Innovate, never miss any revolutionary opportunity, and ensure that the Web3 revolution happens in the United States!

Since the Web3 project is based on the anonymity, decentralization and non-tampering characteristics of the blockchain, and the current application scenarios of the Web3 project are mainly concentrated in the financial field or have financial attributes, it is very easy to cause problems between project parties and investors. Information asymmetry between players can lead to fraud, market manipulation and other behaviors. What's more serious is that the transactions of some Web3 projects (cross-border transactions) can easily bypass customer verification (KYC) and anti-money laundering (AML) regulations, providing financing channels for criminals and terrorism. These issues have posed unprecedented challenges to the US government's supervision.

It is necessary for the U.S. government to regulate virtual assets from two basic positions: (i) protecting the interests of investors and consumers; (ii) regulating the long-term and healthy development of the Web3 industry. At present, the U.S. government departments are currently mainly regulating various types of digital assets (including but not limited to virtual currency Cryptocurrency, Non-Fungible Tokens (NFT), stable coins, etc.), and the derivatives of virtual assets Services and service providers have proposed compliance qualification requirements, such as exchanges, payments, custody, pledges and other businesses, as well as regulatory exploration of decentralized DeFi protocols, DAOs, etc.

1. Regulatory structure of the Web3 virtual asset industry in the United States

Up to now, the United States has not yet formed a unified regulatory framework for the Web3 virtual asset industry, presenting a "multi-headed regulation" situation, which is jointly regulated by the federal and state levels of the United States, and the regulatory agency represented by the SEC, through the "Regulation by Enforcement" to regulate the market (the United States is a country of case law, and case law is the main source of law in the United States).

The current SEC Chairman Gary Gensler said at the Aspen Securities Forum in 2021 that the current market situation is somewhat similar to the "Wild West" period[2], calling on Congress to give the SEC more regulatory authority to regulate the market. Generally speaking, the main reason for the current regulatory status is due to the complexity of the Web3 industry itself, which can be summarized as the following aspects:

1. There are many types of virtual assets, and their definitions are not uniform among various departments. Taking Bitcoin, Ethereum and other virtual currencies as examples, this involves regulatory entities in different fields such as commodities (CFTC), securities (SEC), currency (FinCEN), and property (IRS).

2. The life cycle of virtual assets involves many stages, such as mining, pledging, issuance, custody, trading, transfer, payment, lending, derivatives, arbitrage, etc., and the application scenarios of virtual assets are also different, such as consumer payment, investment Financial management, hacking, money laundering, terrorist financing, etc., cannot all be classified into a unified regulatory framework.

3. The Web3 industry is still in its early stages. With the continuous development of science and technology, there will be more and more new things born, and the fields involved will also continue to increase. This has caused innovation to always lead and supervision to lag behind.

At present, it can be said that we are at the end of the "Wild West" era. The US financial regulators have already passed the stage of throwing rats, and they can completely clear the mines of high-risk projects in the form of case by case. On February 7, 2023, the SEC's Division of Examinations announced its work goals for 2023[3], including Emerging Technologies and Crypto-Assets as one of the top regulatory tasks for 2023. Subsequently, the SEC non-stop carried out a new round of "Regulation by Enforcement" supervision on the virtual asset market, with Kraken, its ETH pledged products, and Binance-peged BUSD being the first to bear the brunt.

At the same time, a unified regulatory framework is also brewing in the US Congress, but it is still in the preliminary stage. In this context, before entering the era of Web3 virtual asset regulation, this article attempts to summarize the attitudes of the major virtual asset regulators in the United States towards the Web3 industry and their respective regulatory responsibilities for reference and study. The so-called "stones from other mountains can be used to attack jade", everyone is welcome to exchange and correct.

2. The main regulatory authorities of the Web3 virtual asset industry in the United States

SEC

The United States Securities and Exchange Commission (SEC) is an independent agency and quasi-judicial agency directly under the US federal government established in accordance with the US Securities Exchange Act of 1934. Securities supervision and management work aims to protect the interests of investors, promote the formation of capital, and maintain the fair and orderly operation of the securities market.

The current chairman of the China Securities Regulatory Commission, Gary Gensler, has repeatedly stated in public that, except for absolutely decentralized virtual currencies such as Bitcoin, the virtual currencies issued by most other projects should be regarded as "securities" and thus need to apply for approval from the SEC. Register or apply for an exemption. The purpose of such strict supervision is not to maintain the authority of the institution, but to protect investors, but to enable the industry to develop soundly in the long run. The SEC requires the issuer to disclose complete and non-majorly misleading project information to investors, so as to reduce the information gap between the issuer and investors and protect investors for their investment decisions. The information disclosure system is one of the cores of the Securities Law.

Against this background, the SEC issued a guidance document titled “Framework for “Investment Contract” Analysis of Digital Assets” [4] on April 3, 2019, The purpose is to help issuers or other entities engaged in virtual asset business to analyze whether their virtual assets belong to "investment contracts" and should be included in the definition of "securities", so that they need to comply with the relevant regulations of the SEC and fulfill their compliance obligations.

The SEC has a very large jurisdiction. The virtual assets it defines are not limited to virtual currencies, but also include other forms of virtual assets such as NFTs and stable coins, as well as financial products derived from virtual assets. What’s more, the SEC’s jurisdiction is not limited to U.S. In the case of SEC v. Telegram Group Inc. [5], after the SEC identified the virtual currency Gram issued by Telegram as a "securities", it urgently applied to the court for an injunction before the issuance of Telegram. Although Telegram is an entity registered in the United Kingdom and operating in Dubai, because it issued virtual currency for some Americans and failed to disclose key information to the public, the SEC has adopted regulations on the issuance of Telegram on the grounds of protecting the interests of American investors law enforcement.

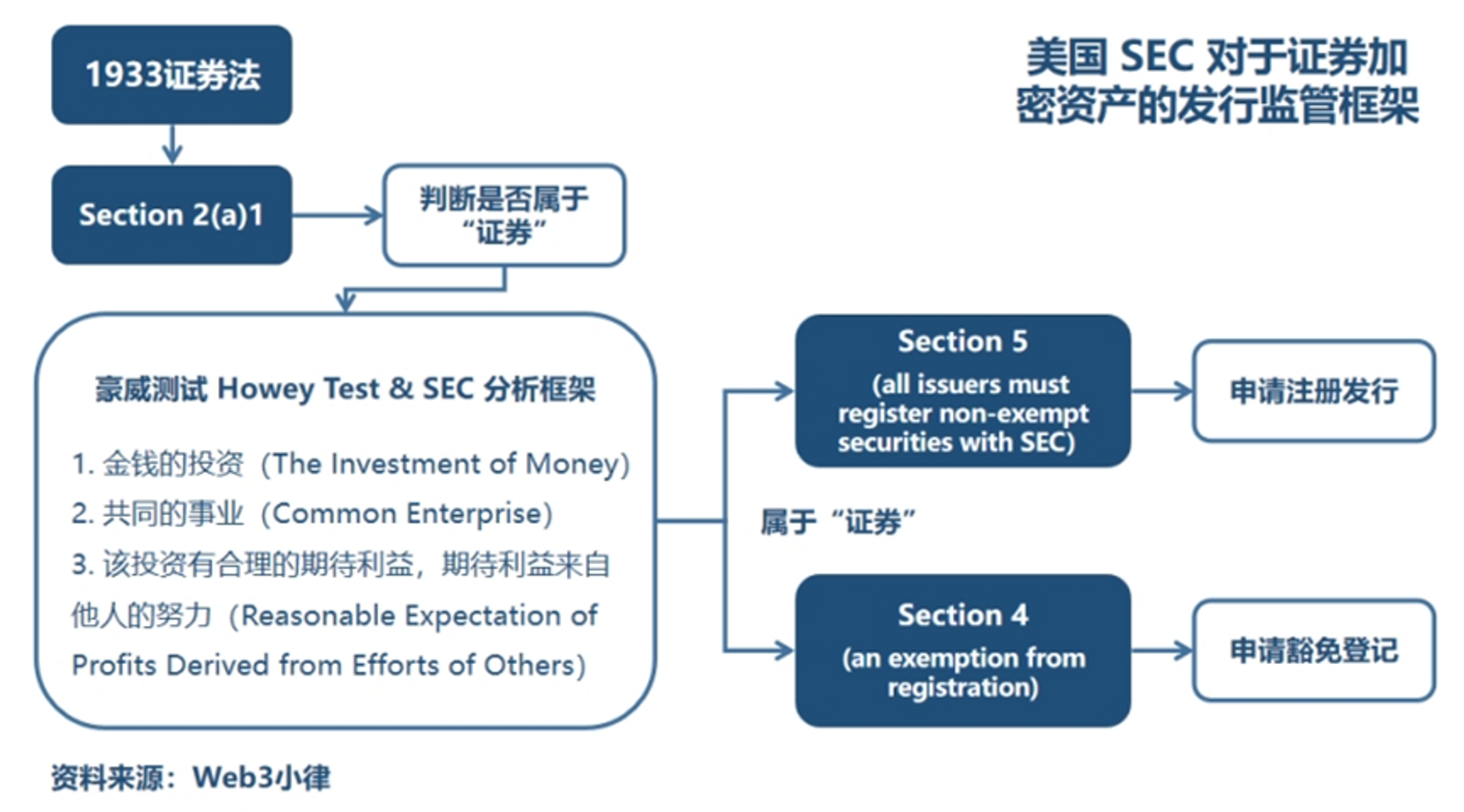

Determine whether it is a “securities”

As far as virtual assets are concerned, it is crucial to clarify whether the issuance and sale of virtual assets is an "Investment Contract" and thus falls under the definition of "Securities" and is included in the regulatory scope of the SEC. . When it comes to "securities", it is inevitable to avoid the "Howey Test". The Howey test is a standard used by the U.S. Supreme Court in the 1946 decision of SEC v. WJ Howey Co. [6] to determine whether a specific transaction constitutes an "investment agreement." Section 2 of the U.S. Securities Act of 1933 defines "securities". The definition is very broad and includes stocks, bonds and other forms of profit-sharing agreements. It also includes "investment agreements." Therefore, if a specific transaction meets the criteria of the Howey test, then the transaction will be regarded as a "securities" under the U.S. legal system and will need to comply with the relevant provisions of the U.S. Securities Act of 1933 and the Securities Exchange Act of 1934.

In the case of SEC v. WJ Howey Co., Howey Co. devised a business model in which it sold citrus grove land to buyers and then leased the sold land back from the buyers. Howey Co. was responsible for the citrus grove land. Buyers do not need to take care of the land themselves, and passively share the profits through the operation of Howe. The SEC subsequently sued OmniVision, arguing that the transaction constituted an investment agreement that fell within the category of "securities" as defined by the U.S. Securities Act. The court used the landmark "Howey test" to determine whether the transaction constituted a security.

In short, securities are a form of investment in which investors passively participate in other people's businesses and expect to gain benefits through other people's efforts. If there is no other people's efforts or other people's efforts fail, then investors will face The risk of loss of the amount invested (there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others). To determine whether the issuance or sale of virtual currencies meets the standards of the "Howey Test", the SEC also provides the same three conditions in its "Analysis Framework":

- The Investment of Money. In addition to the conventional definition of "money (usually currency)" that we can understand, other definitions of "money" specifically specified by the SEC include but are not limited to: (i) Investors complete specific tasks (Bounty Program) Virtual currency rewards obtained through airdrops, because the issuer aims to promote its economic interests and cultivate its virtual currency trading market in this way; (ii) Investors receive virtual currency rewards through air drops, Because the issuer aims to facilitate the circulation of its virtual currency in this way. It can be seen here that the SEC has expanded and interpreted the definition of "Money" to meet different scenarios of virtual currency issuance and circulation.

- Common Enterprise. Generally speaking, the issuer will publish a white paper to explain the purpose of its fundraising, such as building a Layer One public chain. This is a common cause between investors and issuers. But for Bitcoin, a project without a specific and clear purpose (common cause), the SEC does not classify it as a "securities."

- The investment has reasonable expected benefits, and the expected benefits come from the efforts of others (Reasonable Expectation of Profits Derived from Efforts of Others). This has been the most controversial point, and the SEC gave the following explanation in its "Analytical Framework" to help the analysis:

(i) Reliance on the Efforts of Others. The "others" here refer to project parties, promoters or core contributors who have provided important management and business functions for the success of the project? (Active Participant), and this effort will directly affect the success or failure of the joint venture, while investors only need to invest money and do not actually participate in the operation and management of the project. Fortunately, the SEC's interpretation of Active Participant is closer to the centralized project party than to the core contributors in the decentralized organization. Otherwise, it would be terrible!

(ii) Reasonable Expectation of Profits. The SEC pointed out in the analysis framework that if the following behavior exists, it is likely to meet the definition of "reasonable expected benefits": capital appreciation of virtual currency, or holding virtual currency can enjoy benefits similar to dividends or profit distribution, or holding virtual currency greatly Beyond the scope of reasonable use by investors, or the project party/AP can make a profit by holding virtual currency (please refer to the subsequent SEC V. LBRY case), or the project party/AP can use the virtual currency through direct or indirect marketing value-added behavior.

(iii) Other Relevant Considerations. Federal courts usually consider the economic reality of the virtual currency or the business model of the project. If the virtual currency has strong consumption attributes, it may not constitute an "investment contract." To give an inappropriate example, investors expect to use their virtual currency to purchase a Tesla on a mature e-commerce platform (the consumption attribute of virtual currency), which is different from the investor's expectation to use the project party/AP. Actively build so that early public chain projects can be continuously improved and put into use, thereby increasing the value of the virtual currency you hold (the investment attribute of virtual currency).

The SEC and federal courts have emphasized that the Howey test is flexible and can adapt to a variety of business models designed to exploit the funds of others based on the promise of profit. In other words, the SEC and courts are likely to interpret the facts broadly to ensure that a transaction is likely to meet the requirements of the Howey test and every aspect of the analytical framework. As the court said in the case of SEC v. WJ Howey Co.: "For the factual basis, the form can be ignored, and the focus is on the economic model and business model of the project."

Registration or Exemption of “Securities”

According to the U.S. Securities Act, there are only two compliance methods for the issuance or sale of all securities: (i) registering securities with the SEC; or (ii) applying to the SEC for an exemption from registration of securities. For virtual currency projects that pass the Howey test, SEC securities registration is not suitable because this form will bring huge costs and strict disclosure requirements. Therefore, the SEC's registration exemption has become an ideal compliance path for virtual currency projects. Currently, project parties can register for exemptions in accordance with Regulation D, Regulation A+, Regulation S and other relevant regulations [7].

Reg D: Private placement to accredited US investors. The most common application for projects is the exemption under Reg D. Rule 504, 506(b), and 506(c) each have their own advantages. The most important thing is that these three regulations do not need to apply to the SEC in advance, and only need the project party to submit a sales notice, namely Form D, within 15 days after the ICO. It can be seen that Reg D is more suitable for Crypto projects in the early private placement stage. Since investors and financing amounts are relatively controllable, SEC supervision is relatively loose.

Reg S : For issuance outside the United States, one is to issue and trade outside the United States; the other is that the audience must not be a U.S. citizen.

Reg A+ : Targeted at the American public. This is equivalent to a small IPO, with more stringent information disclosure requirements and regulatory compliance requirements, with the core appeal of protecting the interests of small and medium-sized investors in the United States.

In general, the SEC has actually provided virtual currency project parties with a compliant financing path similar to Web2 companies, such as Regulation D (similar to angel rounds, A rounds and B rounds) that is suitable for private equity qualified investors in the early stages. round stage), as well as Regulation S for investors outside the United States (similar to strategic investment by overseas investors), and Regulation A+ (similar to IPO) for the public at a later stage. However, considering the complexity of the registration process and the cost of compliance from the perspective of economic benefits, this compliance path is not cost-effective.

Then the compliance advice that can be given to the SEC is: Web3 project parties who want to conduct ICOs should assume that the SEC will treat them as "securities" and adopt corresponding overall compliance strategies. The consequence of such compliance advice is that compliance pressure forces many start-up Web3 projects to withdraw from the United States (territory), and some projects even exclude American investors (persons).

CFTC

The Commodity Futures Trading Commission (CFTC) is an independent agency established by the US government in 1974. The U.S. Congress authorized the CFTC to manage and enforce the U.S. Commodity Exchange Act of 1936 (CEA) and the regulations promulgated by it. It is mainly responsible for supervising the U.S. commodity futures, options and financial futures and options markets, aiming to promote the public interests and the integrity of financial markets to protect market participants and the public from fraud, market manipulation and other acts that disrupt market order.

As early as 2015, in an enforcement action against Coinflip, Inc.[8], the CFTC defined Bitcoin as a “commodity” under the CEA (CEA Section 1 a (9) of the Act defines “commodity” to include, among other things, “all services, rights, and interests in which contracts for future delivery are presently or in the future dealt in.” The definition of a “commodity” is broad […] Bitcoin and other virtual currencies are encompassed in the definition and properly defined as commodities."). Coinflip, Inc. operates a Bitcoin financial trading platform called Derivabit to match Bitcoin options contracts for investors. During the operation, it failed to comply with CEA and CFTC regulatory requirements to fulfill its compliance obligations. As a result, it is subject to regulatory enforcement penalties from the CFTC.

In addition, current CFTC Chairman Rostin Behnam also stated that the CFTC’s regulatory framework already has the ability to regulate most virtual currencies in the virtual asset market, including Bitcoin and Ethereum. In the column of Digital Assets on the CFTC official website, information about virtual assets (mainly involving virtual currencies) is also released, clearly informing the public that virtual assets, including all virtual currencies, are “commodities” [9], which will enable the CFTC to Regulates fraud and market manipulation in the virtual asset market. However, the CFTC is not qualified to regulate virtual asset transactions in the spot market that do not involve margin, leverage, or financing. However, as many legislative proposals currently under consideration in Congress will give the CFTC greater powers, I believe that the current embarrassing situation of the CFTC will soon be improved.

Regulatory Compliance for “Commodity” Futures Trading

According to the provisions of Article 1 a(9) of the CEA, goods under the CEA are a very broad definition, which includes not only physical goods, but also intangible goods, as well as rights and interests similar to carbon emission rights, etc. (…all other goods and articles…and all services, rights, and interests…in which contracts for future delivery are presently or in the future dealt in). In addition, multiple judicial precedents in the United States have also determined that virtual currencies are "commodities" under the definition of CEA and must comply with CEA and relevant legal provisions and accept supervision by the CFTC.

On this basis, if the transaction of virtual assets meets: (i) the transaction object must be a "non-eligible contract participant" as defined by the CEA; (ii) the transaction is conducted on margin or leverage (on a leveraged or margined basis); and (iii) the commodity is not “actually delivered” within 28 days, then the transaction will be defined as “futures” under CEA Item 2(c)2D Transaction (a contract of sale of a commodity for future delivery)", then the result is that the platform that provides the transaction and the institutions engaged in the transaction must comply with the CEA and relevant legal provisions and accept the supervision of the CFTC.

In a recent enforcement case of CFTC v. Ooki DAO [10], the CFTC not only conducts supervision within its inherent jurisdiction, but also intends to extend the liability to members of the DAO. Ooki DAO is a decentralized autonomous organization. Members of the DAO organization operate and manage a decentralized DeFi protocol called bZx through proposals, voting and other means. The CFTC believes that the virtual assets (virtual currencies) traded by the bZx protocol are "commodities" under the CEA. In addition, the transactions engaged in by the bZx protocol are "futures transactions" defined by the CEA, so the actual controllers and operators of the bZx protocol must Comply with CEA and related laws and regulations and accept the regulation of CFTC. Since Ooki DAO has never been registered with the CFTC, the CFTC accused Ooki DAO of violating the relevant laws and regulations of the CEA and the CFTC by providing illegal leverage and margin transactions to U.S. residents.

Exploring the supervision of DAO

The CFTC's allegation of violating futures trading qualifications in this case is not new. It is worth noting that the CFTC also requires members participating in Ooki DAO voting governance to take personal responsibility. The regulatory logic of the CFTC is as follows: First, according to federal law, Ooki DAO meets the definition of an unincorporated association, which consists of the following four aspects: (1) a voluntary group of persons; (2) ) without a charter; (3) formed by mutual consent; (4) for the purpose of promoting a common objective.

Secondly, based on relevant federal law and a series of state precedents related to partnership law, the CFTC determined that members of an unincorporated organization for profit need to bear personal liability for the actions of the organization. This is different from the ability of legal entities such as LLCs or Corps to separate entity liability from personal liability, which is fatal for DAOs. The CFTC compared the centralized entity to the Ooki DAO organization, that is, the LLC and the DAO also control the bZx protocol. The LLC governs the bZx protocol through member voting, while Ooki DAO also governs the bZx protocol through member voting. Therefore, the CFTC stated that once an OOKI virtual currency holder affects the outcome of the Ooki DAO governance proposal through governance currency voting, the Ooki virtual currency holder can be deemed to have voluntarily participated in Ooki DAO governance and needs to be responsible for the actions of the DAO. Personal Responsibility.

More details of the case will need to wait until the hearing is completed before they can be confirmed. However, there is no doubt that the CFTC's regulatory action has caused considerable shock in the Web3 industry. The main reason is that members who participate in governance through DAO voting may need to bear direct legal responsibility. Although U.S. regulators have been expanding their influence on virtual assets, to the surprise of many, the CFTC, not the SEC, was the first to take action against the DAO. It may be that the CFTC found the nature of this case to be relatively egregious, as the founders publicly admitted that they created a DAO to evade US regulation.

FinCEN

The U.S. Financial Crimes Enforcement Network (FinCEN) was established in 1990. After the September 11, 2001, incident, it was incorporated into the U.S. Department of the Treasury and became a subordinate agency of the U.S. Department of the Treasury due to the requirements of the U.S. Patriot Act. FinCEN’s rights come from the U.S. Bank Secrecy Act (BSA), which clearly stipulates that if the virtual currency business involves the generation (acquisition), transfer, and transaction of virtual currency, it shall be subject to the Bank Secrecy Act. regulations. FinCEN is mainly responsible for the supervision and management of BSA, and is engaged in preventing money laundering (AML), combating the financing of terrorism (Combating the Financing of Terrorism (CFT)) and customer due diligence (Know-Your-Customer, KYC). Specific work, on the one hand, is responsible for preventing and punishing domestic and foreign money laundering activities, combating terrorist financing and other financial crimes; on the other hand, it is responsible for collecting and analyzing financial transaction information, and tracking suspicious persons and activities by studying the mandatory disclosure information of financial institutions .

FinCEN considers virtual currencies to be “value that substitute for currency and are therefore “monetary instruments” under the BSA” [11]. According to the "Application of FinCEN's Regulations to Certain Business Models Involving Convertible Virtual Currencies" [12] issued by FinCEN on May 9, 2019, it is clarified that virtual currency "managers" (such as virtual currency issuers, etc.) that provide services to Americans ICO related project parties) and "exchange parties" (such as CEX, DEX and other virtual currency exchanges), if they meet the definition of "Money Transmitter", they belong to the Money Service Business (MSB) under the BSA ). Therefore, all entities engaged in virtual currency trading business need to comply with the provisions of the BSA and related financial supervision and fulfill compliance obligations. FinCEN's compliance obligations include a series of requirements such as registering and reporting to FinCEN in accordance with the BSA, accepting FinCEN's supervision, establishing a corresponding anti-money laundering compliance system, collecting customer information and reporting suspicious financial activities.

As early as 2015, the CFTC imposed a regulatory penalty of US$700,000 on Ripple Labs Inc.[13] because Ripple Labs Inc. and its subsidiary XRP II, LLC deliberately violated the provisions of the BSA and failed to apply for an MSB from FinCEN. Engaged in the sales and exchange of its virtual currency XRP without a license, and failed to establish a corresponding anti-money laundering compliance system, failed to collect customer information and report suspicious financial activities.

That is to say, any subject who wants to carry out compliant virtual currency trading business in the United States (currently mainly involved in the field of exchanges) needs to apply to FinCEN for MSB registration and implement a comprehensive anti-money laundering risk assessment and reporting mechanism, especially Involving cross-border transfer of funds, exchange of virtual currency, legal currency, stable currency, etc. The Huobi exchange recently acquired by Sun Cut announced in 2018 that it had obtained the US MSB license. In addition, according to the New York Times, Twitter recently submitted the registration documents to FinCEN to become an MBS, paving the way for its entry into Web3 payment.

Different from centralized entities, special attention should be paid to the DeFi field. DeFi protocols like Tornado Cash are usually decentralized smart contracts hosted on the Ethereum blockchain, allowing anyone with Internet access to conduct transactions. So how to comply with smart contracts requires clear supervision. I believe that DeFi projects will soon face regulatory pressure from FinCEN.

OFAC

In contrast, OFAC, which is also part of the U.S. Department of the Treasury, has broader regulatory authority derived from the International Emergency Economic Powers Act (IEEPA) passed in 1977. OFAC supervises all financial transactions in the United States and can sanction any A person, entity or country that poses a threat to national security.

The Office of Foreign Assets Control of the US Department of the Treasury (OFAC), established in 1950, is an agency under the US Department of the Treasury. Its mission is to manage and implement all US national security and foreign policy-based Economic and trade sanctions, including financial sanctions against all terrorism, transnational drug and narcotics trade, and proliferation of weapons of mass destruction. Although OFAC has a relatively small reputation, it has great power. It usually issues sanctions lists against countries, entities or individuals, and imposes penalties for violations of OFAC regulations and transactions with countries, entities or individuals on the sanctions list. At the same time, it is authorized by special legislation All foreign assets in the United States can be controlled and frozen. In June of this year, OFAC announced sanctions against Blender.io, a virtual currency mixing application platform[14], claiming that it supported the hacker organization Lazarus Group to launder more than 20.5 million US dollars. The hacker organization was organized by the Democratic People’s Republic of Korea (DPRK ) supports and was sanctioned by the United States in 2019. The reason for OFAC sanctions is that it provides Materially assistance, sponsorship, or financial and technical support for illegal cyber activities inside and outside the United States, which may have a significant impact on the national security, foreign policy, economic health, and financial stability of the United States. threaten. OFAC has frozen all of Blender.io’s U.S. assets and prohibited U.S. entities or individuals from conducting any transactions with Blender.io .

Let’s look at the Tornado Cash case again [15]. In August this year, OFAC’s official website showed that Tornado Cash provided materially (Materially) assistance, sponsorship, or financial and technical support for illegal online activities in the United States and abroad. Since its establishment in 2019 Since then, it has been used to launder more than $7 billion worth of virtual currency, including providing support to entities and individuals on the OFAC sanctions list. These actions may pose a major threat to the national security, foreign policy, economic health, and financial stability of the United States. Therefore, Sanctioned by OFAC.

This is the same logic as OFAC’s sanction of Blender.io . The difference is that this is the first time OFAC has directly sanctioned a decentralized smart contract on the chain. Tornado Cash is a smart contract. The founders have handed over all the management methods before, making it a completely decentralized and autonomously operated on-chain protocol. This has caused concerns in the Web3 industry about OFAC's regulatory authority. Has OFAC's regulatory authority been expanded and interpreted? In addition, some Web3 organizations such as Coinbase and Coin center even filed a lawsuit against OFAC, claiming that OFAC has no right to limit sanctions on software programs because software code is a form of expression of speech and may violate the First Amendment of the US Constitution. case" (citing the famous 1996 case Bernstein v. the US Department of State).

IRS

The Internal Revenue Service is part of the U.S. Department of the Treasury. In March 2014, the IRS defined virtual assets as "Property" [16] for tax purposes, which is different from CFTC's definition of virtual assets as "commodities", and the SEC's definition of some virtual assets as "securities". FinCEN defines virtual currency in virtual assets as “convertible virtual currency”. On this basis, the IRS has set taxation guidance for transactions related to virtual assets, and the general taxation principles that apply to property transactions also apply to transactions using virtual assets.

After the IRS Notice 2014-21, a general document on virtual assets issued by the IRS in 2014, the IRS released the Revenue Ruling 2019-24 document [17] in 2019, which further detailed the tax issues related to virtual assets transactions. .

3. Coinbase’s virtual asset regulatory compliance

On April 14, 2021, Coinbase Global, Inc. ( COIN.US ) successfully listed on NASDAQ through direct listing (DPO), becoming the first comprehensive virtual asset service provider listed in the United States. Coinbase is well-known for its compliance. It has a BitLicense license and a trust license from New York State in the United States, an MTL license in various states in the United States, and an e-money service license from the British FCA and the Central Bank of Ireland. It can provide legal currency deposits and currency transactions. Asset Services. The company itself has not issued any platform tokens due to the need for compliance listing, nor has it carried out higher-risk derivatives business. Compared with other CEX exchanges such as Binance, Huobi, and OKEx, Coinbase can be called " keep".

Although on January 4, 2023, Coinbase was fined $50 million by the New York State Department of Financial Services (NYDFS) for violating the New York Banking Act and the New York State Department’s compliance program[18], its global compliance The regulatory path and regulatory exploration of virtual assets are worth learning from.

Coinbase’s main business model

A virtual asset exchange is a platform for investors to trade virtual assets with another asset (another virtual currency or legal currency), as an intermediary for buyers and sellers to match transactions, mainly by charging transaction commissions to earn profit, while also providing a series of financial value-added services. Virtual asset exchanges are mainly divided into: (i) centralized exchanges (Centralized Exchange, CEX) integrated platforms that integrate traditional exchanges, brokerages, banks and other functions, such as Coinbase, Binance, etc.; (ii) decentralized exchanges Decentralized Exchange (DEX) realizes peer-to-peer, intermediary-free trading platforms based on blockchain smart contract technology, such as Uniswap, Curve, Compound, etc.; (iii) traditional financial trading platforms, such as Paypal's layout of the virtual asset market, etc.

As one of the representatives of CEX, Coinbase is difficult to compete with giants like Binance in terms of transaction volume, but unlike other CEXs, Coinbase continues to apply for and obtain qualification licenses from government regulatory agencies, and its main compliance strategy has been approved by the government. The recognition from regulatory agencies and traditional financial fields has laid the foundation for its long-term stable operation. Coinbase products are mainly divided into two categories: transaction and subscription services, of which transaction revenue accounts for more than 80% of the company's revenue. However, due to the instability of transaction revenue, since the end of 2018, the company has launched a series of subscription products and financial services, such as The goal of custodial, storage, pledge, loan, payment and other businesses is to obtain diversified income and diversify sources of income. [19][20]

Coinbase’s Global Regulatory Compliance

Coinbase conducts innovative virtual asset business in the current global complex and changing regulatory environment, which is not only subject to the laws and regulations of the US federal and state levels, but also the laws and regulations of foreign governments and international regulatory agencies. In the absence of clear virtual asset legislation in major jurisdictions, Coinbase not only needs to comply with laws and regulations under the existing traditional financial regulatory framework, including banking and financial services, trusts, securities, derivatives markets and transactions, brokerage dealers, commodities , credit, virtual asset custody, remittance, domestic and foreign currency and virtual asset transfers, retail and commercial lending, foreign exchange, privacy and data protection, cybersecurity, anti-fraud, payment services (including payment processing and settlement services), consumer protection , antitrust and competition, bankruptcy, taxation, anti-bribery, economic and trade sanctions, anti-money laundering, anti-terrorist financing, and compliance with the latest laws and regulations issued by some jurisdictions for virtual assets.

Globally, laws and regulations related to virtual assets are changing all the time, and different jurisdictions have different interpretations and applications of virtual assets, which has brought regulatory uncertainty to Coinbase in the process of developing virtual asset innovation business and global regulatory compliance challenges. At least for now, in the United States, Coinbase is not regulated by the U.S. Office of the Comptroller of the Currency (OCC) similar to federal banks, nor is it regulated by the U.S. Commodity Futures Trading Commission (CFTC) similar to derivatives and clearing agencies. Coinbase’s virtual asset trading platform It is also not regulated by the U.S. Securities and Exchange Commission (SEC), similar to national securities exchanges or alternative trading systems.

According to Coinbase’s main business model and combined with its prospectus[21], 10-K, and 10-Q public documents, the legal compliance matters of its main business are as follows:

4. Supervision and compliance of various virtual asset businesses

The following will be based on Coinbase's various virtual asset businesses to analyze the legal compliance issues that need to be paid attention to when conducting various businesses. The various business qualifications obtained by Coinbase can be viewed on its official website Licenses & Disclosures [22]:

Payment business (Money Transmission, Stored Value, and Virtual Currency Business Activity)

For virtual asset payment (transmission, exchange, trading, etc.) business, FinCEN mainly regulates it from the perspective of anti-money laundering. According to FinCEN's "Application of FinCEN's Regulations to Certain Business Models Involving Convertible Virtual Currencies" issued on May 9, 2019 and "Application of FinCEN's Regulations to Persons Administering, Exchanging, or Using Vi real currencies ", clarifies the virtual asset "manager" and "exchanger" that provide services to Americans, such as meeting the definition of "Money Transmitter" (such as virtual asset exchange, trading, issuance, custody, etc.), It is a Money Service Business (MSB) under the BSA and needs to submit a registration application to FinCEN within 180 days of the entity's establishment. Therefore, basically all entities engaged in virtual asset trading business need to comply with the relevant regulations of the BSA and FinCEN and perform compliance obligations. FinCEN's compliance obligations include a series of requirements such as registering and reporting to FinCEN in accordance with the BSA, accepting FinCEN's supervision, establishing a corresponding anti-money laundering compliance system, collecting customer information and reporting suspicious financial activities.

In addition to applying for an MSB license from FinCEN, entities engaged in virtual asset payment business also need to apply for state-level payment licenses from each state. The virtual asset regulatory regulations of each state are different, such as New York State's Bitlicense. The MSB license is suitable for international remittances, foreign exchange exchanges, currency transactions/transfers, ICO issuance, provision of prepaid items, issuance of traveler's checks and other businesses. The MTL license is suitable for virtual currency transactions, currency transactions, legal currency transactions and other businesses.

In Coinbase’s Licenses & Disclosures, it has obtained MTL licenses from most states in the United States. In addition, the American Web3 payment company Stripe has basically obtained MTL licenses from most states in the United States [23].

Coinbase obtained the Bitcoin License (BitLicense) from the New York State Department of Financial Services (NYDFS) in 2017, becoming the first Bitcoin exchange with a formal license in the United States. It can provide users with the ability to buy, sell, receive and store Bitcoins in New York State. currency services [24]. BitLicense is a virtual asset license created by NYDFS in accordance with the New York State Financial Services Law [25]. It is used to regulate virtual asset institutions and related trust companies in New York State (a New York State limited purpose trust company). Licensed entities must meet the BitLicense Compliance regulatory framework, including consumer protection, anti-money laundering compliance and cybersecurity guidance. Accordingly, Coinbase is required to comply not only with the restrictions and requirements of the BSA, the investment of customer funds, the use and security of customer funds and virtual assets, but also with other applicable liability, net worth, disclosure, reporting and recordkeeping requirements of the Company, and Comply with the obligations of the company’s actual controller and senior executives to be subject to approval, supervision, and inspection by regulatory agencies. Previous entities that have obtained Bitlicense include XRP II, Circle Internet Financial, Gemini Trust Company, and itBit Trust Company.

Outside the United States, Coinbase has obtained a license from the German Federal Financial Supervisory Authority to provide virtual asset custody and trading, and has registered as a Crypto Asset Exchange Service Provider in Japan to provide virtual asset trading to Japanese customers. and payment services. Based on these licenses and qualifications, Coinbase is required to comply with numerous laws and regulations, including anti-money laundering, fiduciary obligations for customer assets and funds, regulatory capital requirements, management competence requirements, operational controls, corporate governance, customer disclosures, reporting and record keeping, etc. .

Issuance and trading—Securities

For businesses such as the issuance and trading of virtual assets, it is necessary to always pay attention to the SEC's regulatory standards in the form of "Regulation by Enforcement" to delineate whether virtual assets are "securities". In addition to the jurisdiction granted to the SEC at the legislative level by Congress, the SEC can also continuously expand its jurisdiction over all aspects of virtual assets through administrative enforcement (since the United States is a case law country, case law is the most important source of law in the United States). There are two ways: (i) SEC files civil lawsuits against virtual asset companies, founders, and executives on the grounds of violation of U.S. securities laws, and determines jurisdiction through court judgments, such as the yet-to-be-closed SEC v. Ripple case; (2 ) The SEC also imposes administrative penalties on virtual asset companies, founders, and executives on the grounds of violating U.S. securities laws, and determines jurisdiction through courts. For example, since 2022, the SEC has imposed administrative penalties on Binance’s BNB token, Coinbase and other platforms. Investigate whether virtual assets are unregistered "securities", and after Ethereum moved from POW to POS, the SEC determined that they were "securities", and after the FTX thunderstorm, the SEC determined that FTT tokens were "securities", thus deeply involved in FTX Bankruptcy and reorganization cases. At the same time, in recent years, both the SEC and state securities regulators have indicated that certain virtual assets may be classified as “securities” under U.S. federal and state securities laws, and some foreign jurisdictions have issued similar warnings, Under the law, virtual assets may be considered "securities." However, although regulators have launched a series of enforcement actions and regulatory measures against virtual assets, virtual asset trading platforms, and their developers, they have not actually given clear official guidance.

The legal test to determine whether a virtual asset is a "security" (Howey Test) is a highly complex, fact-driven analytical exercise that is highly subjective and evolves over time with unpredictable results. Although the SEC issued a guidance document titled “Framework for “Investment Contract” Analysis of Digital Assets” on April 3, 2019, it aims to help those engaged in virtual asset business Subjects should analyze whether their virtual assets belong to "investment contracts" and should be included in the definition of "securities", so they need to comply with the relevant regulations of the SEC and fulfill compliance obligations, but this analysis framework cannot be used as an official guidance document of the SEC.

If virtual assets are defined as "securities", then the issuance, sale, trading and liquidation of securities virtual assets will be strictly regulated by the SEC and require corresponding qualifications or licenses. For example, the issuance or sale of securities virtual assets can usually only submit securities registration or exemption registration applications to the SEC; all intermediary service providers related to securities virtual assets will face strict supervision by the SEC, and individuals who trade securities virtual assets in the United States Or entities may need to apply to the SEC for registration as a "broker" or "dealer" (Broker-Dealer); securities virtual asset platforms that match transactions usually need to be registered as a national stock exchange, or as an alternative trading system (Alternative Trading System) , ATS, generally refers to various securities trading platforms other than existing exchanges); entities that provide clearing and settlement for securities virtual assets may need to register with the SEC as a securities clearing agency, but in fact the SEC has not approved blockchain-based Any securities clearing and settlement system.

Cases of identification of “securities”

Let’s look at the case of SEC v. LBRY Inc. [26]. The court made a ruling in favor of the SEC, further expanding the SEC’s authority. LBRY is a decentralized digital content sharing platform. LBRY did not issue its virtual currency through ICO, but retained 40% by itself, and the remaining 60% was used for users of the LBRY ecosystem. Users can purchase and trade on the exchange . The SEC believes that LBRY's handling of its virtual currencies meets the definition of "securities." The court also recognized the SEC's point of view and believed that: (i) LBRY's statement in public made potential investors aware of the objective fact that investing in virtual currency has potential value; (ii) LBRY hoped that through LBRY's centralized team management and Entrepreneurial efforts to achieve the growth of the value of virtual currency; (iii) the law does not stipulate that virtual currency with both consumption attributes and investment attributes cannot constitute an "investment agreement"; (iv) the SEC has never stated that the issuer only needs to comply with the "Investment Agreement" when conducting ICO registration requirements under the Securities Act.

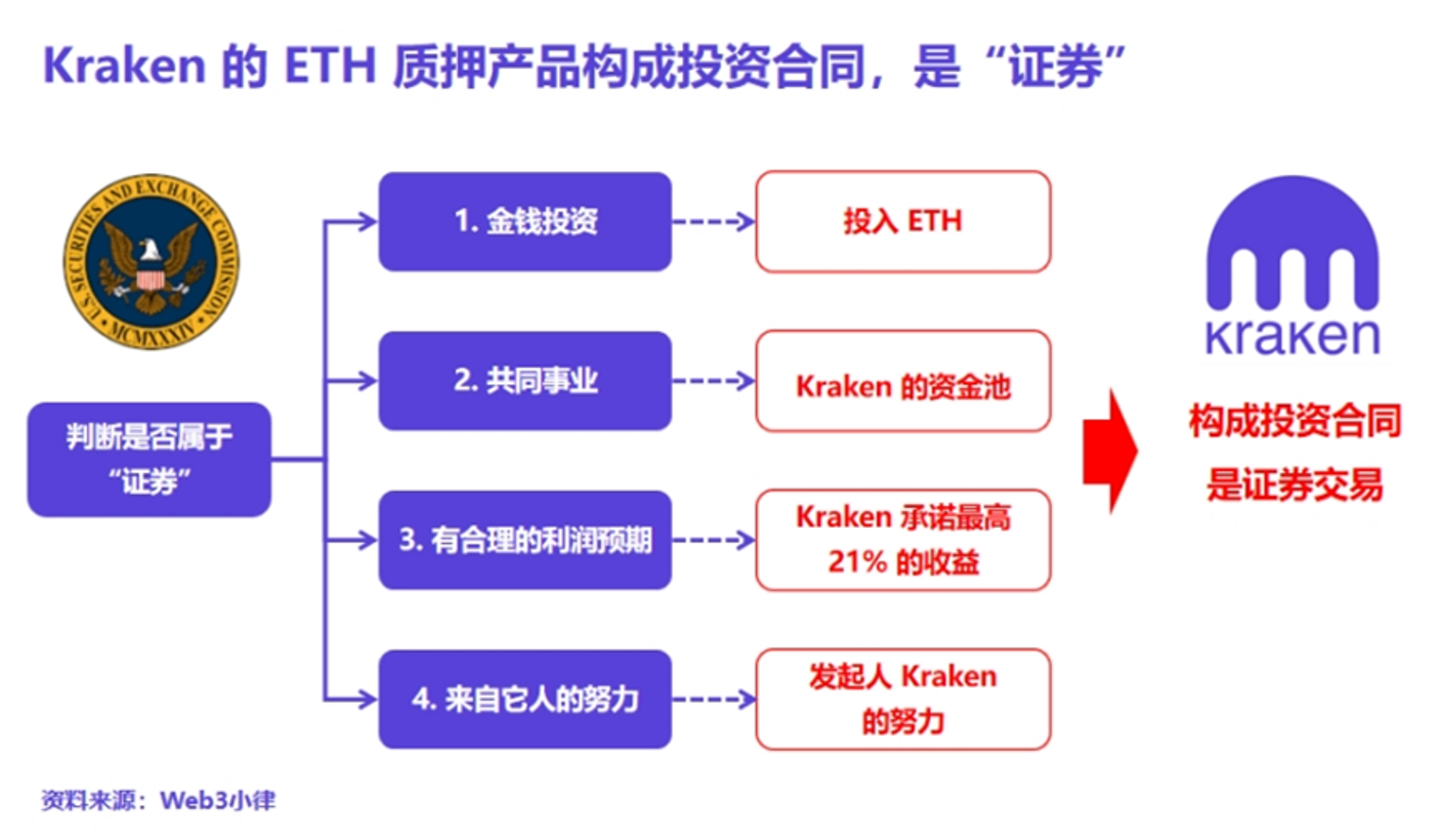

In addition to the SEC directly identifying virtual assets as "securities", the SEC can also supervise financial products designed with virtual assets. For example, the SEC penalized virtual currency exchange Kraken on February 9, 2023, arguing that the Staking as a Service (STaaS) products it provided to investors were unregistered securities, and in its press release[27] , said that “when investors provide assets to such STaaS product services, they lose control over these assets and bear the risks associated with these platforms, with little protection.” After getting the user’s assets, Kraken will Control the user's assets, use them for any purpose (lack of disclosure information, investors don't know, maybe they are used to invest in FTX?), and finally promise users to get rewards.

There is a huge difference between the STaaS product provided by Kraken and Ethereum or ETH pledge (Solo Staking). Firstly, Kraken received investors’ funds (full control); secondly, the funds were mixed with the fund pool and used by Kraken for common causes (it is unknown what exactly); again, Kraken did promise a maximum return of 21% (Ethereum The return of ETH Staking on the foundation's official website is around 3%-5%); in the end, investors only participate in the investment and realize the return through Kraken's efforts. This satisfies all the conditions of the Howey test, constitutes an "investment contract" and is a securities transaction.

Gary Gensler personally appeared on the scene and explained in a video why STaaS products such as Kraken need to comply with the US Securities Law: "When a company or platform provides you with these types of products and promises returns, no matter what they call their services Whether it is Lending, Earn Rewards, APY or Staking, this kind of behavior of providing investment contracts in exchange for investor funds should be protected by the federal securities laws... This enforcement action should clearly indicate to the market that STaaS service providers must register and Provide full, fair and truthful information disclosure and investor protection.” Ultimately, Kraken will “immediately” end its staking service to U.S. users and will pay a $30 million fine to the SEC to resolve charges it offered unregistered securities .

Interestingly, a16z pointed out in his article "Principles & Models of Web3 Decentralization" [28] that the Web3 project can achieve legal decentralization (Legally Decentralized) by satisfying the following two points: (i) Information on all operations and management of the project are transparent and available for everyone to check at any time (through a transparent blockchain distributed ledger); (ii) without additional management efforts from a centralized team to drive project success or failure (through smart contracts, decentralized economic model and DAO to implement). On this basis, if the project conducts ICO or similar behaviors, it may be considered as not in line with the "common cause" and "the investment has reasonable expected benefits, and the expected benefits come from the efforts of others" proposed in the "analysis framework". conditions. Paradigm also explained why Ethereum and ETH pledge (Solo Staking) Not "securities". According to the four conditions of the Howey test, regardless of whether the verifier's deposit of ETH into the smart contract is in line with "money investment", the behavior of Ethereum or pledged ETH is regarded as an "investment contract", because it cannot meet the second point of the Howey test. point (common cause) and point 4 (efforts of others) cannot be established.

Therefore, it can be seen from the above cases that project parties who want to conduct ICO or other means of issuing virtual currency should assume that the SEC will regard it as a "securities" issuance, and thus adopt corresponding compliance strategies.

Broker-Dealer

For the brokerage business of virtual assets, if the virtual assets on the trading platform are identified as "securities", then the trading platform needs to apply for a Broker-Dealer License from the SEC. Coinbase's broker-dealer business is jointly operated by two subsidiaries, Coinbase Capital Markets and Coinbase Securities, both of which are registered with the SEC as broker-dealers under the US Securities Exchange Act of 1934. The Securities Exchange Act of 1934 defines a "Broker" as a person who deals in securities on behalf of another person and a "Dealer" as any person who deals in securities for his own account, whether through a broker or otherwise. Brokers and Dealers must be registered with the SEC and the states in which they do business. Once registered, they will be required to become members of the Financial Industry Regulation Authority (FINRA) and be bound by its rules. All broker-proprietary businesses are subject to regulation, inspection, investigation and discipline by the SEC, FINRA and state securities regulators, as well as other government agencies and self-regulatory organizations.

Issuance, trading - commodities and derivatives (Commodities and Derivatives)

For the issuance and trading of virtual assets, it is also necessary to pay attention to the supervision of CFTC. The CFTC has clarified that most virtual assets (including Bitcoin) are "commodities" under the Commodity Exchange Act of 1936 (CEA) in the United States, which will enable the CFTC to have the ability to supervise fraud and market manipulation in the spot virtual asset market , but otherwise, the CFTC has no ability to regulate transactions in the spot virtual asset market that do not involve margin, leverage, or financing. Therefore, any improper transactions (Improper Trading) on the Coinbase platform will be subject to CFTC supervision.

In addition, CFTC has the right to supervise futures contracts, options contracts, swaps and other derivatives transactions in the virtual asset market, as well as leveraged transactions of spot commodities, as well as platforms that provide these virtual asset derivatives transactions. Coinbase Financial Markets, a subsidiary of Coinbase, has submitted to the National Futures Association (National Futures Association, NFA, a self-regulatory organization for the US futures and derivatives market, whose responsibilities are to maintain the integrity of the derivatives market, protect investors, and ensure that members fulfill their obligations. Regulatory obligations) to apply for registration as a futures commission merchant (Futures Commission Merchant, FCM), but also need to obtain a license from the CFTC to list virtual asset derivatives. In addition, FairXchange, Inc., which was recently acquired by Coinbase, has a designated contract market (DCM) license, and Coinbase intends to enter the virtual asset derivatives market through this move.

CFTC regulatory compliance licenses include DCM (Contract Market Development), DCO (Swap Execution Facility), and SEF (Derivatives Clearing Organization). These licenses allow licensed entities to provide derivatives for general investors and institutional investors in the United States transactions, and can also act as a non-intermediary clearinghouse.

Custody

The virtual asset custody business here refers to the safe custody and protection of customers' virtual assets and the professional services of managing customers' private keys to meet the needs of customers' asset security, compliance audit, and asset appreciation. U.S. federal law requires investment managers and broker-dealers who trade large amounts of cash or securities to deposit these assets with entities that meet certain custodial requirements [30]. This escrow rule (which originated during the Great Depression) initially helped create a financial market marked by high levels of investor trust and liquidity. Therefore, for custody business, in practice, we have seen that entities with custody business have at least obtained relevant trust licenses at the state level and are subject to the supervision of state financial regulatory agencies.

Coinbase subsidiary Coinbase Custody Trust Company, LLC is a New York State chartered limited purpose trust company (New York State Trust Company), which was approved by NYDFS in 2018 and is subject to its supervision, inspection and supervision. NYDFS specifies various compliance requirements for virtual assets, including custody of virtual assets, capital requirements, BSA and anti-money laundering program requirements, restrictions on related party transactions, and notification and reporting requirements. Coinbase's custody business is mainly aimed at B-end institutional customers, such as Wall Street funds, banks, and private equity firms, providing safe and efficient virtual asset custody services. Coinbase has been recognized by Grayscale, the world's largest virtual asset management institution. In 2021, Coinbase also helped Chinese technology company Meitu purchase and host its first bitcoin and ethereum assets of approximately $90 million.

For other compliant virtual asset custodians, we have seen that both Bitgo and Anchorage Digital have chosen South Dakota as their compliant custody supervisor. South Dakota Division of Banking has always been known for its well-developed trust laws and intends to develop custody business The main body generally needs to obtain the local trust license (Trust Charter) to carry out the custody and settlement business of virtual assets and fiat currency assets for institutional customers. Anchorage Digital has further obtained approval from the Office of the Comptroller of the Currency (OCC), which is in charge of U.S. banking institutions, at the federal level, becoming a truly federally chartered virtual asset bank[31].

Considering the nature of custody business, both virtual asset exchanges and wallet service providers should belong to custody business in form. For virtual asset exchanges, on February 15, 2023, the SEC issued a proposal for qualified custodians of investment advisors[32], which may prohibit investment advisors from hosting assets on virtual asset exchanges. It can be seen that after the collapse of FTX, the SEC put forward higher requirements for the custody business of virtual asset exchanges. For wallet service providers, due to the self-custody (Self-Custody) characteristics of virtual assets, there is currently no information about Metamask and Cobo Wallet applying for a trust license at the state level.

Pledge business (Staking)

According to information on the Ethereum Foundation website, ETH staking refers to the act