author | 0xKpler

compile | GaryMa Wu said blockchain

Wu said the blockchain was reprinted and compiled with the permission of the original author

Original link:

https://medium.com/@0xKepler/a-road-forward-for-web3-gaming-e70d82dd19e3

Although the mainstream view in the industry has determined that P2E is unsustainable, and even thinks that Web3 games are dead, I still want to provide an optimistic and feasible outlook, and at the same time discuss how to combine cryptocurrency elements to build a sustainable game economy, and how to coordinate tokens to sustain How does the game itself benefit from the incentive relationship between people?

Idea 1: More targeted Tokenization

So far, many web3 games have tokenized most of their in-game assets.

Currency andNFTs earned by players can be sold directly for cash, which poses a great challenge to the game economy.

Challenge One: Economic Outflows

Since making money is the main motivation for players, they cash out their in-game currency to lock in profits. On a macro scale, the problem is that when almost everyone is a value extractor, the entire economy collapses. Value first has to be created, it doesn't just happen out of thin air. Since no one on the demand side for currencies and assets sees them as having value other than currency, prices will drop, which will translate into less income for players. The game becomes boring, existing players leave and it is impossible for new players to join. P2E games tend to rely too much on player growth rather than recurring token burn, which leads to a rapid downward spiral of the economy.

Challenge 2: Speculation crowds out other motives

When in-game assets are tradable, they change why people play games. This affects all players.

Assets that are easily tradable can deprive some players of their sense of accomplishment. Therefore, games with an in-game marketplace reach fewer players of this type (who are typically economic value-add players) and players who are more likely to be attracted by monetary rewards (usually value-extractor players). Over time, speculators drive up prices, making the assets needed for the game unaffordable for non-speculative players. In the end, only speculators remained. A functioning economy becomes impossible, as described in Challenge One.

Another problem arises when all game activity is denominated in the same asset. Web3 games typically award an in-game currency for actions across all game modes. This means that the team sets the value of each activity in advance, expressed in revenue per minute. Players only focus on economic gains, and use this to optimize gameplay. As a result, some modes or gameplay events may never appear, even though they make the game more varied and interesting. In a way, this leaves the player with no choice in what to play and how to play. Player choice is a key element of games and part of what makes them entertaining and satisfying. Daily activity or income caps help alleviate the problem, but are a tough solution for players. Another option is a daily reward pool, shared by all players for each event. If more players are involved in an action, the earning potential per minute decreases, creating a self-balancing effect.

When all game systems are tied together by an in-game currency, failure of one part (such as hyperinflation) will bring down all systems. For example, if making money is the main reason players play, a falling price can make all game modes uninteresting.

solve the challenge

"Make a fun game", this may be the answer for most people. But in my opinion, this misses the point. If you just want to make a fun game, then why do you need GameFi ? Therefore, I want to share my thoughts on how to design a game that incorporates cryptocurrency elements into a great Web3 game.

Limit the tokenization model and reduce the tradability of assets

To reduce speculation, games can limit the amount of assets that can be traded, especially with other players. While the behavior of NPC merchants can be controlled (eg, item costs are multiplied), peer-to-peer transactions between players depend on market dynamics and player psychology. Therefore, restricting the use of NFTs makes it easier for game economists to control the economy.

Although doing so will result in players having less earning potential at first, since they won't be able to sell all the items they receive. But are you going to create an unsustainable speculator's paradise or a sustainable game economy?

From non-tradable to a fully open trading market where everything is NFT/Token, this is a range that can be weighed and designed. But no matter what level of transaction a game allows, taxing transactions is crucial.

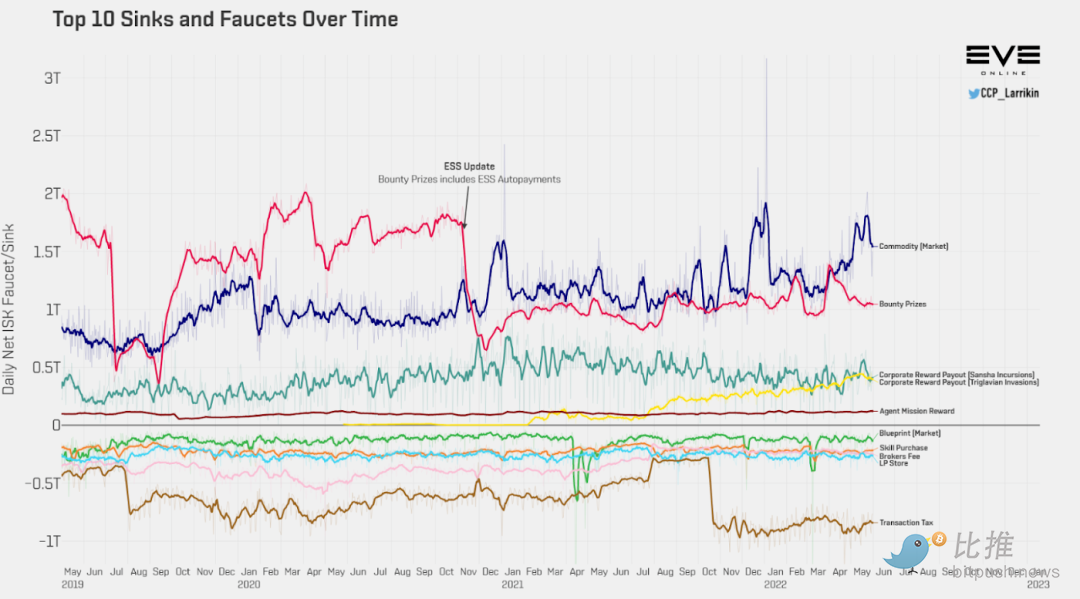

The main token burn in Eve Online (probably the most complex and longest-running virtual economy) is the transaction tax.

To incentivize transactions, we can reward different NFT/Tokens for various activities and make player progress dependent on multiple resources. This results in higher transaction volume and therefore, more tax/token burn. Another benefit of such a system is that activities are no longer rewarded with the same token/asset. Transaction prices (markets) between assets now set the value of each action. Easy tasks see lots of people participating, leading to increased supply and lower prices. Therefore, players are motivated to find different activities. The market will value the resources needed to progress, so the act of generating assets will be a worthwhile endeavor in which at least some players will participate. If a campaign feels underrepresented in the market, game designers can, for example, increase the asset's relevance to progress or reduce taxes on it.

Finally, by making multiple activities worthwhile tasks, the player has to choose/specialize. For example, one player can increase their fishing skills while other players upgrade their axes to chop wood.

Another question is whether to tokenize the input or the output. Games can increase transaction volume by tokenizing inputs as each player trades them. Players then convert the inputs into rarer assets. These outputs may still require work (e.g. non-tradable assets need to be farmed to upgrade). Rare assets still indicate real skill and time investment. At the same time, players have the opportunity to get a head start by buying items instead of farming, which is a money-making opportunity for other players. To ensure that players can cash in when they are no longer enjoying the game, which is one of the main selling points of Web3 games, the deconstruction mechanism can come in handy. Here, players convert their output assets into input assets (heavily taxed).

Another approach is to grant non-tradable assets that can be upgraded to NFTs, for example by fusing with a resource that requires skill and commitment. Such a tokenization system minimizes asset inflation/inflation. It's easier to control the player's experience, since players will only have limited transactions with others. On the other hand, overall trading volumes will remain low.

In my personal opinion, both systems work well enough. Every game designer must decide between an open market and a planned economy.

isolation system

Likewise, there may be value in somewhat restricting transactions between assets from different activities. The goal is to isolate systems from each other so that there is less interdependence, which means more control. Additionally, this helps reduce the danger of a failure in one system having a negative impact on other areas of the game.

Game developers need to control the levers of the economy, just like central banks. It is important to note that players do not have to participate in the economy. Therefore, it is necessary to have an interesting economy. The economy should fluctuate along an equilibrium, not stagnate. Otherwise, it's boring and not much deals happen. In contrast, a perfectly balanced game is not the goal of game design. For example, having powerful weapons and tweaking metadata over time is usually good. This maintains the player's sense of immersion. A second caveat is that mapping real-world examples to virtual economies is challenging because virtual economies are often simplified versions of reality. Making the in-game economy more complex is not a solution, as most players are not interested in highly complex economic simulations. Therefore, central bank policies will play out differently in the game.

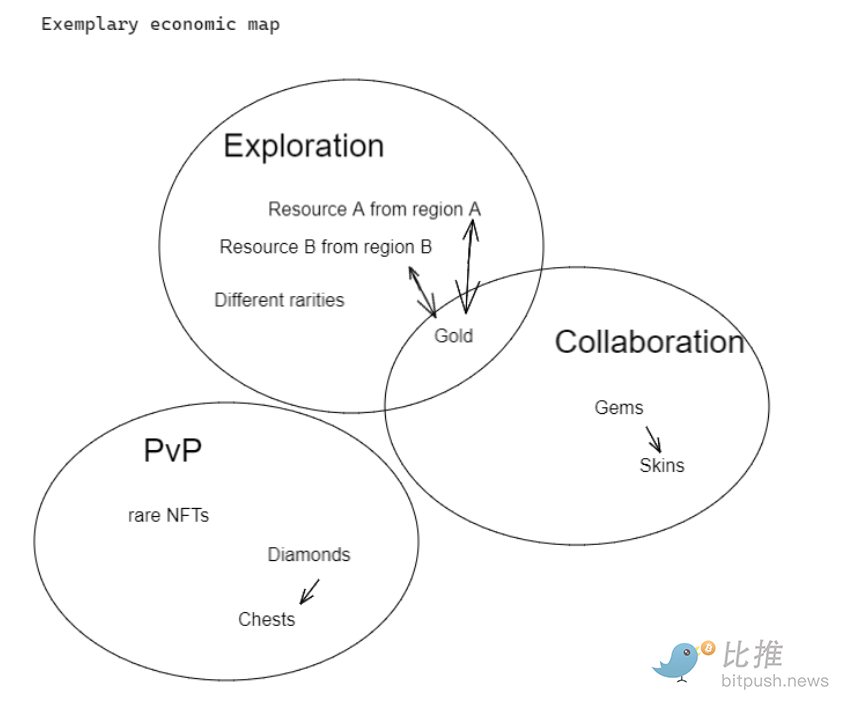

To find out which assets are tradable and which are segregated, game designers can map economic pillars (currencies, resources) into game pillars/playstyles and use different currencies/resources in different systems. Make them somewhat intertwined, but don't make them all interchangeable. To isolate the system, the game requires multiple resources and currencies. Isolated systems are easy to control. However, they are also pretty boring. Therefore, an economy requires interaction between systems. Additionally, interchangeability increases player agency, giving them more choice in game activities.

NFTs > Fungible Tokens (FTs)

By rewarding players with NFTs instead of FTs, games can shift the player's focus from monetary rewards to in-game utility.

There are several factors at play here:

NFTs carry in-game utility. In contrast, the in-game value proposition of FTs is more abstract. Players can buy assets with tokens, but this requires an extra step. By making in-game assets the default option, rather than "earn tokens > decide to buy assets with it", the economy will see less outflows on average.

Also, FTs are easier to sell due to their higher Liquidity. Players are just less likely to sell their NFTs for cash due to Liquidity, which makes a big difference when looking at the economy as a whole. A little conversion rate optimization here and there can add up quickly. For example, an efficient marketplace focuses players' attention on financial optimization, while a barter trade system (NFT<->NFT) incentivizes social interaction.

NFTs are more personal than FTs. Using visuals and storytelling (lore) creates emotional value. Players who have feelings for characters or items will not sell their NFTs.

From a game design perspective, it also makes sense to put NFTs at the center. NFTs are like resources, and FTs are like currencies. Resources themselves have value, and currency is the bridge between resources. Therefore, there are often more resources than currency in games. Keep the economic map in mind when designing currencies and resources.

About Land NFTs

Web3 game companies have used land sales to raise pre-development funding. While this is a great way to start a project, it also presents financial challenges. Investors are likely to most expect a financial return if the direct utility of the land is not clearly communicated. As a result, prices skyrocketed, crowding out the real players who could add value to the game's economy. Instead, extractive speculators took their place.

Although landowners can lease out their land, this is still a palliative, not a permanent solution.

A Land Value Tax (LVT) seems like an idea worth exploring. Their goal is to reduce speculation while incentivizing in-game usage. Land is taxed, but everything built on it (like houses) is not, because these activities add value to the economy. This distinguishes land value taxes from property taxes. Occupying land has become expensive, with uncertain returns. So the land ends up in the hands of productive players who use it in the game and can generate a surplus (revenue > cost). It became cheap to buy land (less speculative premium), but expensive to hold.

There are several ways to incorporate LVT, which I will not discuss here. One approach is to look at transaction data in the market to estimate land values, using regression or ML models for land with no recent transactions. Another approach is the Harberger Tax, which relies on self-assessment + auto-listing at self-assessed prices. In game theory, players have an incentive to quote the true value they get from land. Otherwise, they risk selling for less than they're worth (underpricing) or paying too much tax (overpricing).

LVT may be good for the economy, but it also poses the risk of maximizing productivity. Only the most productive people own the land because they can pay the highest taxes. But making land ownership so competitive isn't fun for less competitive player types (most players). Some systems, such as Harberger taxes, also add complexity, requiring a certain level of sophistication from the target group of land titles within the player base.

But as always, game economists can design along the continuum between purely productive and purely speculative land systems, in terms of tax rates. Game developers can then use the tax money to build a sustainable game. For example, funding public goods or UGC in games, burning tokens to balance the economy, doing marketplaces on AMM , or even some form of UBI.

Besides LVT, other methods can also minimize the problem of speculation, such as only giving landowners non-tradable in-game assets (with no real-world ROI), or making land scarce, limiting the accumulation of value in specific locations.

Idea 2: Incorporate cryptocurrency elements more judiciously

As mentioned above, it is impossible to create a viable and interesting game economy if the use case for the cryptocurrency element in Web3 games is simply gold trading to make money. Here are some more sustainable trends that I hope to see more of in the future.

Crypto as a Metagame

Crypto adds layers to the core game peripherals, the core game remains unchanged, and the cryptocurrency elements are aimed at other player types to build a new economic ecology based on the game.

The core game can be completely isolated from the metagame, or you can try to build some connections, which have the potential benefit of creating a flywheel utility.

F2P mixed with Crypto

Keeping the base game free increases TAM. New incoming players can be transformed into consumer groups in the future, and NFT is a new form of micro-transaction. If players value true ownership and are willing to pay more for being able to resell it later, NFTs could command a higher price than standard game assets.

Due to recent ad regulation, it is difficult to achieve ROI in mobile games, making it difficult to locate whales. Historically, a small group of players, the whales, have been responsible for most of the revenue. With no way to target them, the game is reaching a general, wider audience. Instead of selecting the player with the highest LTV before the app is installed, the filtering now only really starts after the app is installed. Therefore, games should focus on more detailed segmentation based on in-app activity and monetization strategies for specific segments. As a "new thing" that some players want to try, NFT has an opportunity here.

Another advantage of the F2P+Crypto mode is that it is easier to use. Players don't need to understand how wallets, NFTs and AMMs work before playing the first game. The job of game publishers is to convert installs into active player bases, not convert non-crypto players into advanced crypto users. By acclimating players to these new products, games will see higher conversion rates. Of course, players shouldn't need to pay high entry fees by purchasing NFTs, or understand how the scholarship system works.

Shifting from NFT-threshold gaming experience to F2P means that game developers can no longer rely on upfront investment. Overall, this should have a positive impact on the game economy as it forces the team to develop more sustainable token burn.

Classic F2P games and their web3-enabled parts can be strictly separated, or partially overlapped. The latter can increase conversion rates without splitting the player base like before. Games, on the other hand, must ensure that web3 elements do not exhibit adverse spillover effects (eg, increased speculation) on non-encrypted parts of the experience.

Let's see an example of this pattern. Rather than making cryptocurrency a meta-game layer, games can also use tokenization as a voluntary layer on top of core gameplay to enhance the experience (as opposed to crowding out core motivation by focusing on monetary incentives). By introducing wagering matches and tournaments alongside traditional matchmaking, skill-based games like battle royale games can bring the tension of esports to all player levels. A way to distinguish between two groups of players (interested in tokens and not interested) could be something like this:

A player earns tokens based on their rank in the game

Based on the number of hits, the player's armor decays.

Players no longer receive rewards after hitting the hit threshold threshold during a match.

To continue earning rewards, players need to repair their armor by burning tokens.

This system gets players used to rewards and gives them some tokens to play in staking matches, hopefully converting them. At the same time, we prevent unnecessary inflation, since players who are not interested in tokens will not receive any tokens for a short period of time, while adding a recurring drain in the form of a repair mechanism. If enough people can become participating players in this way, and these people tend to be more willing to spend money, then this system can even increase the balance of the economy in addition to being the driving force of UA.

However, this way of enhancing gameplay through cryptocurrency is not universal. It might work for esports competitions, which bring their own requirements (skill-based, fun to watch, ...). For example, adding wagering matches or other forms of betting to hyper-casual games doesn't seem like a good idea. But I'm sure game designers will find a different way.

Coordinating Incentives with Crypto

In general, cryptoeconomics is good at incentivizing value addition, bootstrapping the community, and enabling rapid growth by providing an open framework for participation.

Games are no longer just games. They bring people together to socialize, attend events, watch esports, and more. With the games-as-a-platform trend (some might call it the metaverse now), it's critical to provide a steady stream of new content. Some game platforms like Roblox rely on UGC, but:

They get a huge cut from creators.

They still hold full control of the platform, resulting in disparities in power and preventing third parties from investing significant resources without guarantees due to commercial risks.

UGC is limited to in-game content and does not extend to broader areas where it can add value, such as streaming, esports, or merchandise.

Cryptocurrency networks act as a neutral settlement layer, enabling permissionless participation (eg, anyone can build on top of NFTs), giving creators the assurance they need. Additionally, game studios can now incorporate in-game value-added activities such as streaming into their UGC strategy while benefiting from blockchain’s trustless nature. Making gaming platforms an open economy that incentivizes builders around the world to build trust is not possible in web2 with traditional legal structures because regulations do not have an international scale.

UGC can help create local preferences for different target markets (such as culture-specific events or skins), which has proven to be a great way to expand into new markets.

It only matters to some players, but to them, it means everything.

Turning games into platforms further helps to introduce additional consumption mechanisms, increase the depth of consumption, and generally make the economy healthier and increase income potential.

Idea 3: Game Type

Some genres and games seem to be a better fit for web3 mechanics than others. For example, MMORPGs involve a lot of transactions, can be taxed, and have many social components, where cryptocurrency elements can help coordinate incentives. The card game focuses on NFTs rather than FTs, and players need to collect multiple card decks to compete against enemy decks, acting as a significant drain of resources and diverting attention away from monetary rewards.

Hyper-casual games are an ongoing trend in mobile gaming, accounting for more than 25% of all game downloads. In specific cases, I can see how elements of cryptocurrency could add value here.

Blockchain also enables a new subset of games: fully on-chain games. On-chain games will span multiple genres, similar to browser games. Existing genres will be ported over, such as strategy games or poker (doing it on-chain is not a bad idea, as centralized services are highly regulated these days). New experiences will be developed, for example, there may be games designed to be played by bots, where the meta-game of creating bots becomes the primary gameplay.

On-chain games provide permissionless interoperability, meaning others can build game modes, marketplaces, new games, clients, plugins, etc. without asking. The core team does not need to be involved in commercial development and technical support like a licensed system, which makes such a structure more scalable. Improving incentive coordination through cryptocurrency elements, third-party creation is the strong point of on-chain games. Plus, players and builders are assured that no one can block their access.

On-chain games are still in their infancy and face many bottlenecks. Scalability, zkSNARKS (or other privacy-preserving techniques), and developer experience all need improvement. Permission-free creation will lead to a lot of content, potential scams, and a more complicated user experience. Sanitize and abstraction will become critical, similar to how Steam Workshop makes modding easier. I don't expect on-chain gaming to go mainstream, but I do expect it to have an efficient, niche economy like the modding scene.

Idea 4: AAA games are overrated

Frankly, the vast majority of web3 games right now, even if they say they are, are not AAA. I don't think that's necessarily a bad thing. Because maybe we don't need AAA titles.

AAA is not a well-defined term. It refers to games with large budgets and long development cycles. But AAA is not a sign of game quality. It has to do with better graphics, big marketing budgets, well-known IPs, and tons of content (Games as a Service).

As web3 games slowly enter the mainstream, they demand that cryptocurrencies as a whole become easier to use. This is an infrastructure challenge, not something the game should change. We're still in the initial experimental stage where graphics and marketing to the masses are less important. Players will come to try new experiences. Only then will it push them to overcome the hurdle known as onboarding crypto.

In the experimental phase, fast iteration cycles are required to quickly accumulate knowledge. Smaller studios and non-AAA titles are more flexible here. Big studios are unlikely to be the first adopters. Building a triple-A game is resource-intensive and therefore comes with high risks. AAA games are generally safe and mostly stay away from adding web3 components, also because of the antipathy of their playerbase.

Beyond that, big studios also tend to avoid small experiments because, even if they succeed, they don't add much to their bottom line. So small studios may have an advantage. They can use NFTs to raise funds, and then scale through aligned contributors (for example through additional content via UGC). Further development of infrastructure (such as advanced creator tools such as the high-end game engine Core), which lowers the barriers to entry for game developers, supports this trend.

Idea 5: Application distribution of Web3 games

With web2 companies like Steam taking a negative stance on cryptocurrencies, plus walled gardens like Google and Apple's app stores trying to control payment channels and slash expenses, having a web3 native distribution platform should be a priority. They are in keeping with the openness and cutout ethos of cryptocurrencies. Without it, players would still be at the mercy of the monopoly. From the web2 platform to the web3 distribution channel is like the transition from CEX to DeFi .

Building a web experience based on open Internet standards is the most resilient solution (second only to on-chain gaming). On the other hand, they often lack functionality. The bull case is that with increased attention, coupled with the incentives of cryptocurrencies, we may drive tool development in this space.

The challenge is that value is gained by using open standards to minimize lock-in, coupled with the fact that app stores are an important part of the user search journey. While some players are willing to overcome small hurdles to play the game, changing the habits of the masses is a massive undertaking. I hope our actions are enough to start a new trend.

Summarize

Developing games is challenging. Creating games with web3 elements is even more complex. Looking at the current trends, I think we are on a better path than we were a year ago. I'm picky but optimistic.

Given the above arguments, investing in gaming tokens is risky. Even if a game gets a playerbase, remaining relevant over a long time frame is something not many teams can do. To me, platform and studio tokens are currently a more attractive investment thesis.