Original Author: Sleeping in the Rain

Original source: [email protected]

I have seen many people, including @0xJamesXXX , discuss the empowerment of $UNI before. I recently saw a post in the @Uniswap governance section, which is very interesting. It created a very practical long-tail liquidity scenario for $UNI . I will summarize it in two sections according to his ideas:

The real magic of the XYK model is that it easily creates markets for long-tail assets, and the new $UNI token model should lean towards Uniswap's facilitation of long-tail liquidity pools. Currently, most long-tail assets are paired with $ETH . This has long been the logical standard for various reasons. The problem with this is that the opportunity cost of $ETH is getting higher and higher.

The real magic of the XYK model is that it easily creates markets for long-tail assets, and the new $UNI token model should lean towards Uniswap's facilitation of long-tail liquidity pools. Currently, most long-tail assets are paired with $ETH . This has long been the logical standard for various reasons. The problem with this is that the opportunity cost of $ETH is getting higher and higher.

At this point, $ETH is too precious to be the go-to asset pair for shit coin. My understanding is that $ETH itself has a pledge rate of return, and pairing LP is a bit wasteful. $UNI (a token with essentially zero opportunity cost) has a chance to replace ETH as the asset pair of choice. $UNI can serve as a liquidity connector and hub, connecting a wide range of long-tail asset portfolios.

Similar to the Bancor V1 token model, but $UNI has advantages that $BNT never had. First, Uniswap is a preeminent DEX in a more mature ETH ecosystem. Second, $UNI has a scale and market cap that $BNT never had. Third, projects will use $UNI as a pairing asset because it benefits them, not because it is imposed by the protocol.

$UNI also brings the advantage of being more correlated to $ETH , meaning that the $UNI pair is less susceptible to Impermanent Loss. In summary, $UNI outperforms $ETH in both opportunity cost (staking yield) and capital risk (Impermanent Loss exposure) . How to run?

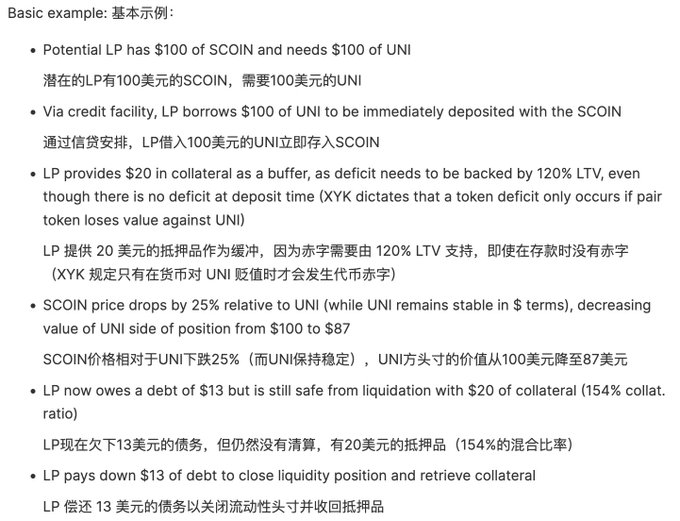

For $UNI to function as a base pair, borrowing at scale needs to be very cheap. The UNI Credit Facility (UCF) is a Hook that allows LPs to borrow $UNI for liquidity positions. It is more capital efficient than Aave in all cases, ranging from 1x to infinitely more. It requires no upfront capital, as borrowers only need to collateralize the deficit of their position if the currency pair $UNI trades against it.

Lots of incentives (liquidity incentives) With UCF, Uniswap should run small incentives/co-incentives for hundreds or thousands of projects. Through the treasury's 2 billion US dollars, let $UNI become a long-tail asset index.

V4 (and UCF) will be deployed on multiple chains, so these incentives will have broad reach. Whoever ends up distributing these incentives—whether it’s the DAO committee, the foundation, or the core team—needs to be accountable to the community while maintaining some latitude to get a tough job done.