Author: Micah Casella & Jennifer Obem / Source: https://messari.io/report/state-of-the-sandbox-q2-2023

Translation: Huohuo/Blockchain in Vernacular

Key Takeaways:

1) The notional activity of Sandbox’s total NFT minting (59%), primary sales (52%), and active buyers (22%) increased month-on-month.

2) A 30% increase in non-land primary sales volume and an 18% increase in real estate sales volume led to a decline in total revenue of only 15% QoQ, while the other five revenue indicators fell by more than 25%.

3) The US Securities and Exchange Commission filed a lawsuit against Coinbase and Binance, in which they argued that many cryptocurrencies and tokens, including SAND, are securities. Additionally, the outcome of the SEC v. Ripple Labs could affect ongoing and future cryptocurrency regulation in the United States.

4) The Sandbox works with brands like Paris Hilton, Cipriani, Warner Music, Marathon City, Metafight and Playground. Several other brands and companies are also focused on building virtual experiences in the Web3 industry.

5) According to The Sandbox roadmap, it plans to release new features by the end of the third quarter, such as the ability to self-publish experiences on the map. It will also enable users to create estates and rent/lease land and estates in Q4 2023.

1. Getting Started with Sandbox

Sandbox is a metaverse game where players and creators can make 3D assets and experiences (such as games) that can be monetized through NFTs. The tokenization and gaming features utilized by The Sandbox are listed below:

1) SAND — an ERC-20 token and digital game currency for purchases, monetization and asset creation

2) LAND — Digital Ownable Land in The Sandbox Virtual World

3) ESTATE — a combination of land to create larger parcels

4) Assets — Assets created using the VoxEdit app will be converted to ERC-1155 tokens when uploaded to the Sandbox marketplace

5) GEM - burn tokens to attribute assets

6) CATALYST — burn tokens to define asset layers/scarcity

7) Game Maker — a toolbox that enables users to create 3D games and experiences in The Sandbox virtual world

Due to the tradable nature of SAND tokens and other assets within the Sandbox virtual world, The Sandbox offers Mindcraft-style games with digital ownership and a stronger in-game economy.

Sandbox offers a variety of in-game NFTs as well as user-generated NFTs. VoxEdit NFT Builder is used to create 3D objects (assets) such as characters, equipment, wearables and artwork.

The Sandbox was originally a 2D mobile game launched in 2012 by software development company Pixowl. Pixowl was founded in 2011 by Arthur Maddrid and Sebastien Borget. As of April 2018, the Sandbox mobile game iteration has accumulated more than 40 million downloads. In May 2018, The Sandbox changed its name to 3D Virtual Universe Game and started blockchain-centric development. In August 2018, Pixowl and The Sandbox were acquired by gaming-focused software development company Animoca Brands and a venture capital fund.

2. Key data indicators

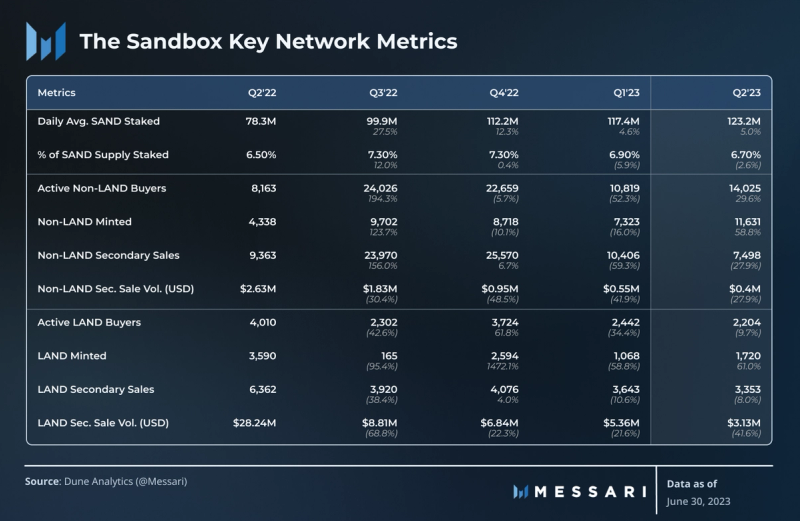

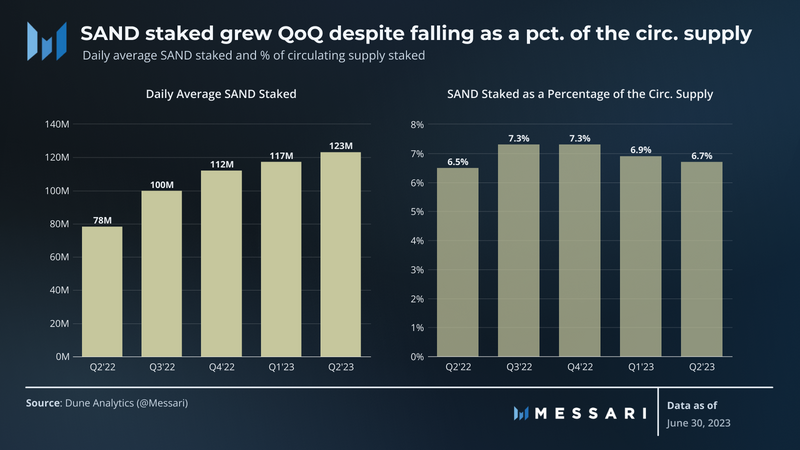

Active non-LAND buyers, non-LAND minting buyers, and LAND minting in Q2 2023 recover after a general decline in the sandbox's key network metrics (except for sand staking) in Q1. While the average daily SAND stake continued to increase month-on-month, it decreased as a percentage of the SAND supply as more SAND was unlocked and entered the circulating supply.

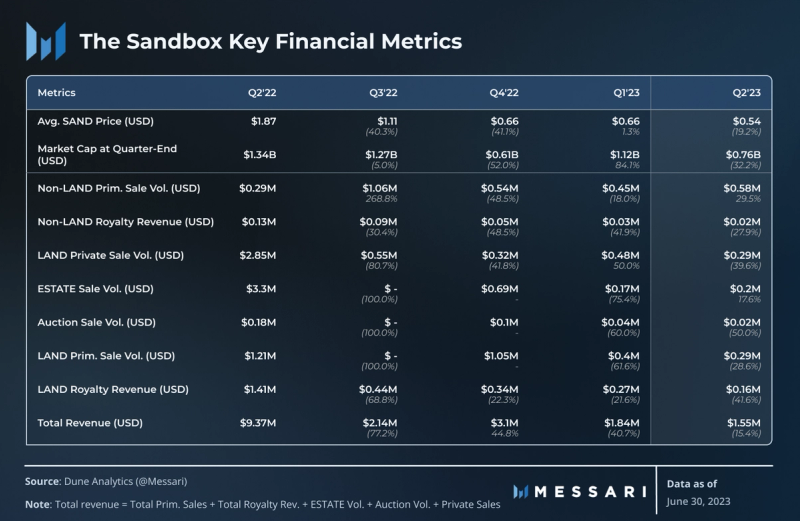

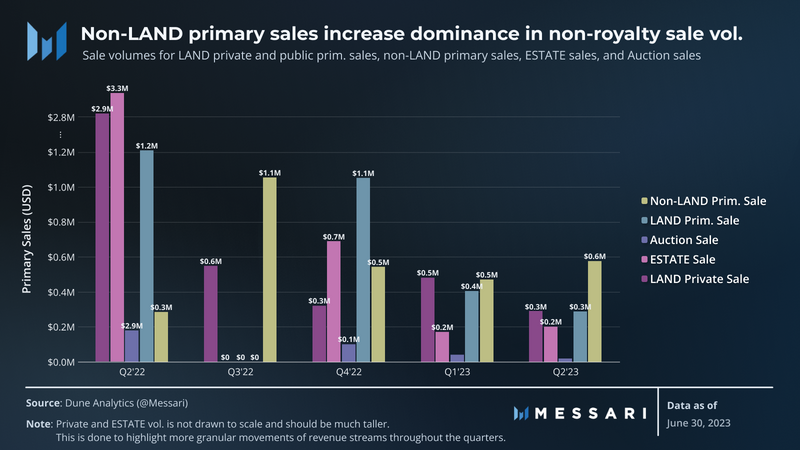

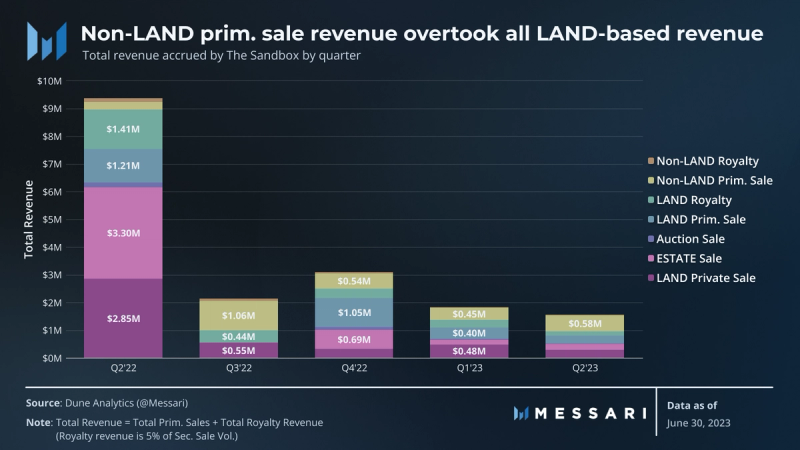

On the financial front, revenues were anchored by a 30% increase in non-Rand primary sales volumes and an 18% increase in real estate sales -- so total revenues were down just 15% sequentially, while the other five revenue metrics were down more than 25%. As non-LAND primary sales increased, it surpassed private LAND sales, accounting for 37% of total revenue (up from 24% in the previous quarter).

3. Performance analysis

1) Unique Active Buyers

Unique active buyers measure the number of different wallets buying land and non-land assets.

Activities on SandBox are conducted through digital real estate called LAND NFTs. Therefore, LAND is valued for its fundamental role. Non-land NFTs are less valuable, although they are still necessary for various types of activities in the SandBox metaverse(e.g., catalysts for creating assets and GEMs for attribute-giving assets).

Due to the difference in general currency value, LAND is harder to come by (OpenSea's ETH base price is 0.28 ETH as of this writing), reducing the buyer base. Non-LAND assets have lower prices (OpenSea has an ETH floor of 0.0001 as of this writing), allowing for a larger buyer base. These discrepancies were exacerbated by poor market conditions, which could lead to a continued decline in the number of active land buyers (-10% QoQ) and an increase in the number of active non-land buyers (+30% QoQ).

2) Total Primary Sales

Primary sales totals measure the amount sold for SandBox assets. The sandBox Company retains revenue from primary sales.

Although land sales totaled more than non-land primary sales, non-land primary sales grew 30%, higher than any single Land sale type. Throughout 2Q23, users can mint different non-LAND assets from various notable series such as Hell's Kitchen and Paris Hilton, which also host events throughout the quarter.

3) Secondary sales volume and royalty income

Secondary sales volume measures the dollar amount for which SandBox assets are sold on secondary exchanges such as OpenSea and LooksRare. The SandBox Corporation retains a 5% royalty on secondary sales.

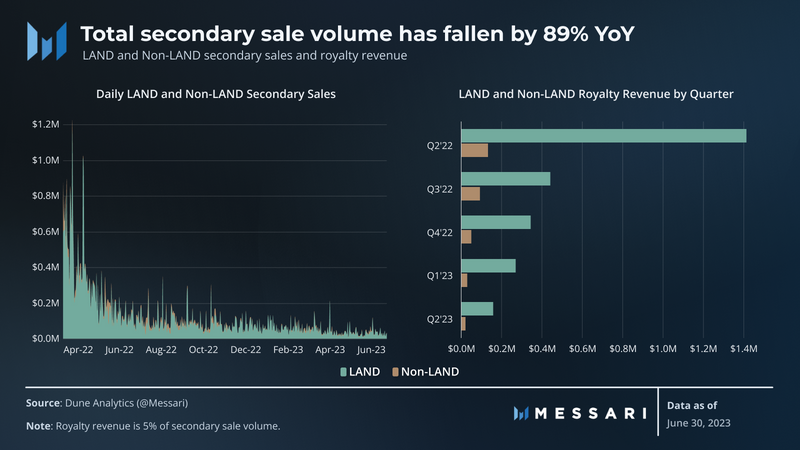

Even as the LAND floor price fell, LAND continued to dominate secondary sales volume, falling from above 0.5 ETH in early April to below 0.4 ETH in late June. Regardless, land and non-land assets have suffered a decline in secondary transactions in every quarter over the past year. While the decline in reserve prices may have led to lower trading volumes, continued poor market conditions may also have dampened secondary market activity.

4) Total income

Gross revenue is the sum of gross primary sales and gross royalty revenue. Royalty income accounts for 5% of total secondary sales.

Historically, Sandbox's revenue has come primarily from land sales. This quarter added another exception, though, as non-LAND primary sales accounted for 37% of The Sandbox's total revenue. The rise in non-LAND primary sales dominance was in non-LAND royalties (-28%) and land royalties (-42%), private (-40%), auctions (-50%) and primary The quarter-on-quarter decline in sales (-29%) came amidst. Growth in non-land primary sales (30%) and real estate sales (18%) led to a decline in total revenue of just 15% QoQ.

5) Daily average number of SAND pledges

Include SAND staked as a percentage of circulating supply to observe that the percentage of SAND staked makes SAND illiquid and temporarily insulated from selling pressure.

The daily SAND pledge volume continued to grow, increasing by 5% month-on-month. Despite the increase in SAND pledges, the ratio of SAND pledges to circulating supply decreased by 2% quarter-on-quarter as circulating supply was 3% quarter-on-quarter. While the amount of SAND staked notional has increased each quarter over the past year, the amount of newly unlocked SAND has released more liquid SAND into the economy. The increased liquidity of SAND could put more selling pressure on the SAND token.

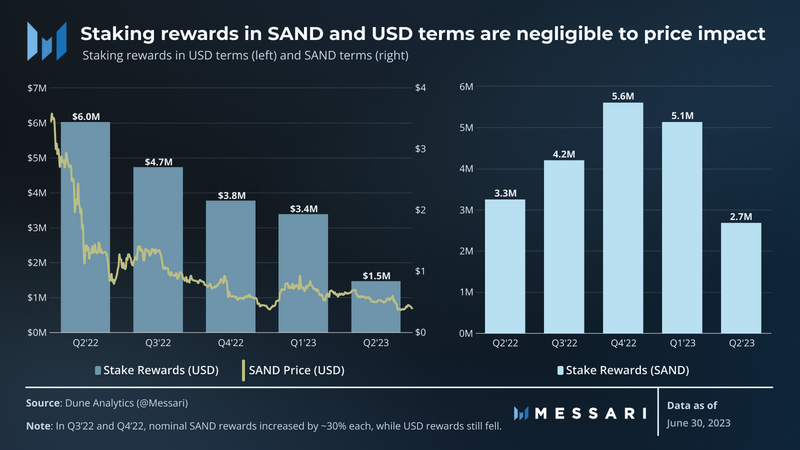

6) SAND staking rewards

SAND staking takes place on the Polygon network and involves two staking pools: one for LAND owners and one for everyone else. LAND owners can stake up to 2,000 SAND per LAND asset in the pool. In another pool, any SAND holder can stake their SAND, although LAND owners get a multiplier based on the amount of LAND they own. A total of 150,000 SAND is distributed weekly between the two mining pools.

SAND Staking Rewards shows the total amount of USD earned by users staking SAND tokens. It is compared to price to show the often weighted relationship. USD-denominated SAND staking rewards are also affected by the amount of SAND rewards.

In Q2’23, staking rewards fell 48% in sand terms and 57% in USD terms. While rewards in USD terms have been declining over the past year, SAND rewards in 3Q22 and 4Q22 are up ~30% sequentially. Users seeking rewards by staking SAND appear to be more affected by the SAND USD price than the nominal SAND rewards. The distribution of sand from staking accounts for less than 0.2% of new sand entering the market, making sell pressure on sand staking rewards negligible. The price appears to be largely a result of market trends in the gaming industry.

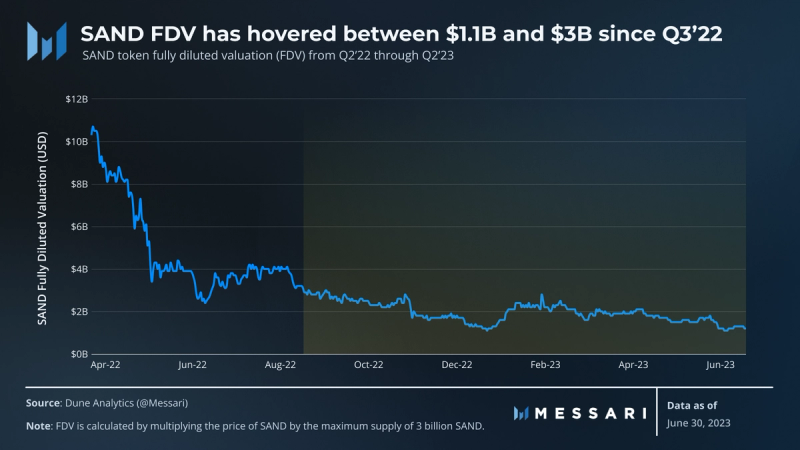

7) SAND FDV

Changes in the Fully Diluted Valuation (FDV) reflect the price of an asset. Additionally, tracking FDV complements price volatility with a sense of scale of asset importance.

SAND's fully diluted valuation has yet to fall below $1.1 billion. In 2Q23, it hovered between $2.1 billion and $1.1 billion. Either way, SAND's FDV ends up at $1.22 billion, just 1% higher than in early 2023. From the beginning of the second quarter of 2023 to the end of the year, the price of SAND fell by 35%. The drop in the price of SAND is in line with the general trend of the cryptocurrency gaming market. The price of the second largest gaming token experienced a similar drop, with MANA down 36% for the quarter, AXS down 30%, and GALA down 41%.

8) Qualitative analysis

In Q2 2023, Sandbox hosted an event announcing new partnerships and integrations and updating its roadmap for the future. Despite mixed regulatory signals, The Sandbox remains focused on building and improving its gaming ecosystem.

Notable events, partnerships and integrations:

The Sandbox ecosystem continues to grow with new partnerships and integrations announced in Q2 2023. A number of projects have partnered with The Sandbox to provide its users with a customized Metaverse experience, a few notable ones are listed below:

-Fitness Brands — Gym Aesthetics, Salsation, Go24, Cycliq, Stages, Playinnovation, Trib3, and Myzone.

DanceFight — a well-known dance battle app, released on The Sandbox an exclusive collection of avatars based on 10 of the world's top hip-hop dancers.

Marathon City - Introducing "Nipsey Hussle's Universe," a Metaverse experience honoring the late rapper's legacy.

Cipriani — Announced a partnership with Cipriani to deliver experiences featuring iconic venues such as Harry's Bar.

Playground — Introducing a unique digital environment for fans of NBA star LaMelo Ball on The Sandbox.

Paris Hilton - Introducing Paris Hilton's first headshot collection (5,555 sold).

Open Campus — Acquired LAND in Sandbox to provide a Web3 education themed metaverse experience.

SBS Content Hub — SBS Content Hub, a subsidiary of South Korean broadcaster, partners with The Sandbox to bring popular media content to its Metaverse

Nuclear Blast — Indie Record Label Partners with The Sandbox to Create 'Blast Valley' Heavy Metal-Themed Virtual Universe Experience

Gamer Arena — Turkey's leading gaming platform is launching the Sandbox interactive gaming experience for its users.

Affyn — Singapore-based Web3 company Affyn is partnering with Sandbox to deliver an interoperable Metaverse experience with a focus on a global community of creators and collaborators.

MMA Management Game - MetaFight is launching an exclusive, limited-time MMA themed experience that is separate and complementary to the MetaFight game, featuring unique in-game events and rewards.

Infinite Pulse — a music-themed community featuring major artists and labels such as Warner Music Group, Jamiroquai, Elvis, and more — kicked off with the first sale of its 1015 land.

4. Roadmap and updates

Future upgrades planned for LAND owners are as follows:

Ability to self-publish experiences on maps scheduled for release in late Q3 2023. The feature will roll out to creators first. By the end of the fourth quarter of 2023, achieve the minting and selling of in-game assets with NFT functions on the blockchain.

SAND staking program with weekly rewards of 100,000 SAND, SAND only for SAND and LAND owner pools. The program ends on July 4, 2023.

From April 2023, LAND owners who hold LAND for more than three months are eligible to receive an exclusive NFT. Upcoming LAND sales for Movie Verse, Sports LAND, and more local community LAND sales from brands like Warner Music Group, Adidas, Lionsgate, and more in Q3/Q4 2023.

Ability to create estates and lease land and estates, scheduled for release Q4 2023. Experiences hosted on Premium LAND will gain additional visibility on the map in Q4 2023.

Megacity Land Sale The Sandbox has launched a LAND sweepstakes for Mega City 3, a virtual city that incorporates aspects of Greater China. The virtual city welcomed 17 brands and IPs, and the sweepstakes offered 222 regular LANDs and 12 premium LANDs, as well as a series of exclusive NFTs. In addition, OpenSea auctioned 6 estates and 12 1x1 lots.

5. Coinbase and Binance in action

The U.S. Securities and Exchange Commission filed a lawsuit against Coinbase and Binance, accusing them of operating unregistered securities trading platforms in violation of U.S. law. The lawsuits take the position that many cryptocurrencies and tokens are securities, including SAND.

Shortly after the lawsuit was filed, the district court overseeing a separate SEC lawsuit against Ripple ruled that XRP is not, per se, a security. Nonetheless, it also ruled that certain transactions involving the initial sale of XRP were “investment contracts” and securities under U.S. law. The ruling could affect current and future cryptocurrency-related enforcement actions and regulations in the United States, including lawsuits against Coinbase and Binance.

6. Summary

Despite facing a tough quarter of declining revenue (–15%), staking rewards(–48% in SAND terms) and falling SAND prices (–19%), The Sandbox persevered by fostering new partnerships, launching new collections of assets Follow through (Paris Hilton, The Wild Ones, etc.) and add experiences for current users. The sandbox ecosystem continues to face an uphill battle due to regulatory uncertainty from mixed signals from SEC classifications and court rulings. However, with new partnerships and month-over-month increases in total NFT minting (72%), total primary sales (52%) and total active buyers (22%), expect The Sandbox to expand its network at the next inflection point market.