The vision of xDAI or XUSD is still far away, but absorbing more real yield, improving capital efficiency as much as possible, and separating interest-bearing and circulation functions will be a must for stablecoins on the chain. On this road, The Ragnarok of USDC is also faintly visible.

Written by: Loki, Xinhuo Technology

Edit: Link, Geek web3

Lead: Loki believes that MakerDAO’s Spark Protocol adjusts the DAI deposit APY (DSR) to 8%, which is essentially to compensate users for the opportunity cost of holding traditional assets such as ETH and USDC, while emerging stablecoins such as eUSD and DAI will continue to rely on high interest rates. Occupying the market space of established stablecoins such as USDC. At the same time, the interest-bearing and circulation properties of DAI can be stripped to improve the capital utilization efficiency of MakerDAO DSR.

1. Starting from the growth of DAI

First of all, there is a question: why does MakerDAO provide DAI with a high rate of return of 8%? The answer is very clear - Maker hopes to transfer its own profits, actively provide arbitrage space for users/markets, and achieve DAI scale growth through subsidies.

According to MakerBurn data, the supply of DAI has increased from 4.4 billion to 5.2 billion in the past 4 days. Obviously, this is directly driven by DAI's high interest rate of 8%.

This part of the new demand is reflected in two ways:

1) Re-pledging of LSD. Since DSR provides DAI with a high APY of 8%, while the interest rate of using wstETH mint DAI is only 3.19%, this will create arbitrage space. If, on the basis of staking ETH, wstETH is used as collateral mint DAI and deposited into Spark DSR, calculated by pledging $200 worth of ETH to mint $100 DAI, the rate of return that can be obtained is:

3.7%+(8%-3.19%)/200%=6.18%

Obviously better than direct staking and other lock-free, single-currency, low-risk returns on the market, so some stETH holders will take this method for arbitrage, which will lead to an increase in DAI circulation.

2) Exchange other stablecoins for DAI. So how do players who don't have ETH or stETH participate? It's very simple, use USDT/USDC to convert to DAI, and then deposit it in DSR. After all, 8% is attractive enough both on-chain and off-chain, and this part of demand needs to be met by more DAI, thus indirectly Stimulate the growth of DAI circulation.

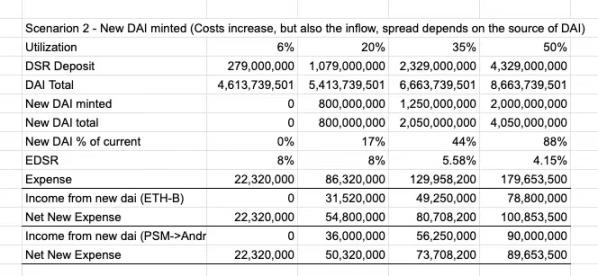

With the growth of DAI, it can be seen from the estimation of EDSR (Enhanced DAI Savings Rate) that the item of Income from new DAI has a net increase of 90M.

This means that while the circulation of DAI increases, the agreement will also have more USDC, which can be used to exchange more dollars, purchase more RWA assets, provide more real yield, and bring about a flywheel effect.

2. Where is the end point of arbitrage

The second question is where is the end point of DAI's growth? The answer is when the arbitrage space shrinks enough. The premise of answering this question is to understand that the EDSR (Enhanced DAI Savings Rate) mechanism is essentially to actively provide users with arbitrage opportunities.

So for users who pledge stETH/rETH, stETH/rETH is not very useful except as collateral for mint DAI. So as long as the interest rate of EDSR is higher than the rate of mint DAI, there are opportunities for profit.

The situation for USDT/USDC users is more complicated. Because USDC/USDT does not need to mortgage mint for DAI, it can be directly exchanged for DAI on DEX. From the user's point of view, USDC stored in AAVE can obtain about 2% rate of return, while switching to DAI and depositing it in DSR can obtain 8% rate of return , which shows that it is attractive, so users will continue to exchange.

There will be a problem here. If Maker continues to exchange the USDT/USDC deposited by users into RWA (while the DSR deposit rate remains stable), there should be a lower limit for DSR's income, and this lower limit is higher than that of USDC/USDT. risk return. This means that this type of arbitrage should continue for a long time, with DAI continuing to absorb USDT/USDC market share.

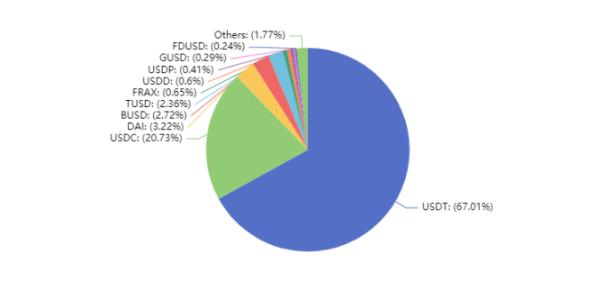

3. The commonality between RWA income and Staking stablecoins on the chain: cannibalizing traditional stablecoins

Of course, the road to DAI's encroachment on Tether/Circle's share may not be so smooth, because DAI itself also has some shortcomings (such as RWA's security issues) and its scale is still at a disadvantage. But don’t forget that DAI is not the only player trying to occupy USDT/USDC. In addition to DAI, crvUSD, GHO, eUSD, Frax, and even Huobi and Bybit have launched their own RWA assets.

There will be a stablecoin faction divergence here: Where does the underlying income come from?

One is the approach of Huobi/Bybit. The underlying income comes entirely from the income of RWA. All that needs to be done is to return the part of the income that Tether/Circle embezzled to the user. The other faction is purely pledged stablecoins such as crvUSD and eUSD. The underlying income comes from the staking income of the collateral in other agreements (it may be expanded to more scenarios in the future, such as debt notes as collateral.) And the DAI model In fact, two sources of income are mixed.

But these types all point to the same end-reducing the opportunity cost, or compensating the user's opportunity cost (for example, holding USDC is actually the user's transfer of opportunity cost to Circle to invest in traditional targets such as US debt).

If you choose to mint DAI with wstETH, you can still get the benefits of Staking without sacrificing any of your own APY; if you choose to mint eUSD with ETH, Lybra will charge a small fee, but most of the Staking APY still belongs to you . But when you use USD to buy USDT/USDC, the 4%-5% RWA rate of return is taken away by Tether/Circle.

Tether's net profit in Q1 alone in 2023 will reach US$1.48 billion. If DAI can completely replace Tether/Circle, it will bring real revenue of US$5-10 billion per year to the cryptocurrency market. We often criticize the lack of real yield scenarios for cryptocurrencies, but ignore the biggest scenario, which is also the simplest - just return the income/opportunity cost that belongs to currency holders to them. (For example, Spark can provide up to 8% DAI deposit interest rate, returning the opportunity cost of USD holders due to inflation to users)

In my opinion, whether to embrace RWA or decouple from RWA, insist on decentralization or cater to regulation, these different choices may coexist, but the route to encroach on the market share of centralized stablecoins is clear. As long as the APY advantage of Spark or Lybra still exists, the market share of USDC/USDT will continue to be eroded. For this point, the calculation stability of the RWA collateral model is consistent with the calculation stability of the original collateral on the chain.

4. A more efficient future: separation of interest and circulation

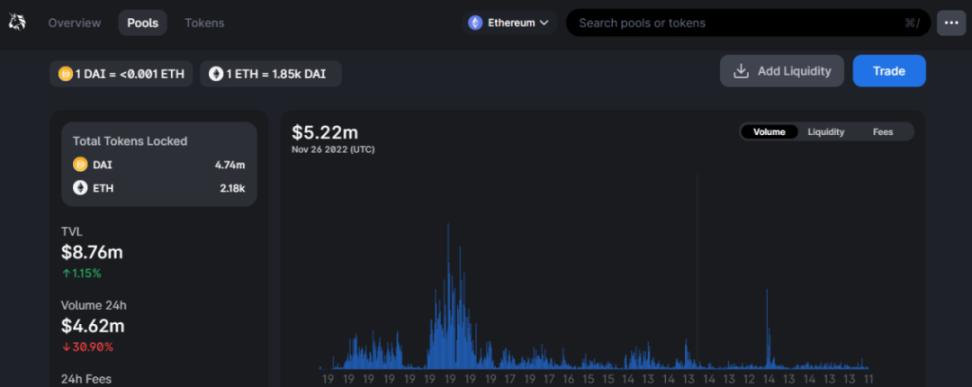

Maker DAO's Spark DSR also has a problem: entering DSR means withdrawing from circulation, so the increase in circulation does not really affect the actual business, but a game of idle funds. So what needs to be considered is whether there is a better solution? My answer is to separate interest and circulation.

The specific implementation is as follows:

(1) Stripping of DAI’s interest-bearing attributes

After the current DAI is deposited into Spark, it will become sDAI, and the income generated by DSR will be accumulated on sDAI. For example, you deposited 100DAI at the beginning and converted it into 100 sDAI. With the accumulation of DSR income, you can exchange your 100sDAI into 101 DAI when withdrawing, and the extra DAI is yours income.

The disadvantage of this mechanism is obvious: interest generation and circulation are a two-choice issue for DAI. After DAI enters DSR, it loses its circulation ability, which becomes a game of idling funds .

Then if we change the method, the user does not directly deposit assets into Spark, but first through another protocol (let’s call it Xpark), the user deposits DAI into Xpark, and Xpark puts all DAI into Spark to accumulate income. At the same time, Xpark issues a xDAI to the user. Xpark always guarantees a 1:1 exchange between xDAI and DAI; however, the income of DSR is only distributed according to the deposit amount of DAI, and xDAI holders cannot obtain any income.

The advantage of this is that xDAI can enter circulation, serve as a means of transaction, as a margin, and be used for payment. It can be used as LP in DEX. Since xDAI can achieve rigid redemption with DAI, there will be no problem in treating it as the equivalent of 1USD . (Of course, it would be a better choice for Spark itself or MakerDAO to issue xDAI.)

There is a potential problem here: if the occupancy rate of xDAI is too low, will it not be enough to support it as a trusted circulating asset? There is also a corresponding solution to this problem. For example, the DEX scenario can be realized by using a virtual liquidity pool (or superfluid pledge):

1) The protocol first absorbs $1m ETH and $1m DAI pools, of which 80% of DAI is stored in DSR, and 20% of DAI and ETH are pooled

2) When users Swap, they use the remaining 20% for acceptance, and if the ratio of DAI rises or falls to a threshold (for example, 15%/25%), the LP pool will redeem or deposit from DSR.

3) Assuming that under normal circumstances the LP mining APY brought by the transaction fee is 10%, and the DSR APY is 5%, then the virtual liquidity pool can be used to obtain LP under the same circumstances:

10%+50%*80%*5%=12% APY, achieving 20% capital efficiency improvement.

(2) More thorough stripping

Imagine another situation where the collateral of a certain stablecoin includes treasury bonds RWA, ETH, WBTC, USDC, USDT, then the way to get the highest APY is to let RWA earn USD income, ETH earn Staking income, and WBTC earn Take the current income of AAVE, put USDT-USDC into Curve as LP, all in all, try to make all the collateral enter the interest-bearing state as much as possible.

On this basis, the stable currency is issued, let’s call it XUSD for the time being, XUSD cannot generate interest, and all the proceeds of the pledge are distributed to the minters of XUSD according to the minting amount and the type of collateral. The difference between this approach and the Xpark idea mentioned above is that the interest-bearing and circulation functions of XUSD have been separated from the very beginning. From the very beginning, the capital has achieved the maximum utilization efficiency.

Of course, the vision of XUSD seems to be far away, and even xDAI has not yet appeared, but the emergence of a negotiable DAI DSR certificate will be a certainty. If MakerDAO/Spark does not do it, I think there will be a first one soon. The three parties started to do this, and at the same time, Lybra v2 also planned to realize this complete divestiture, with peUSD as the currency in circulation, and the exchanged eUSD as an interest-earning asset.

In general, the vision of xDAI or XUSD is still far away, but absorbing more real yield, improving capital efficiency as much as possible, and separating interest-bearing and circulation functions will be the only way for stablecoins on the chain. On this road, the dusk of the gods of USDC is also faintly visible.