Original author: TechFlow TechFlow

Original source: TechFlow TechFlow

Recently, exchanges have frequently moved on the wallet track, and the meaning of bear market build has become stronger.

On August 10, the Web3 multi-chain wallet BitKeep completed the brand upgrade and changed its name to Bitget Wallet. Previously, Bitget Exchange invested an additional US$30 million in it and became the controlling shareholder;

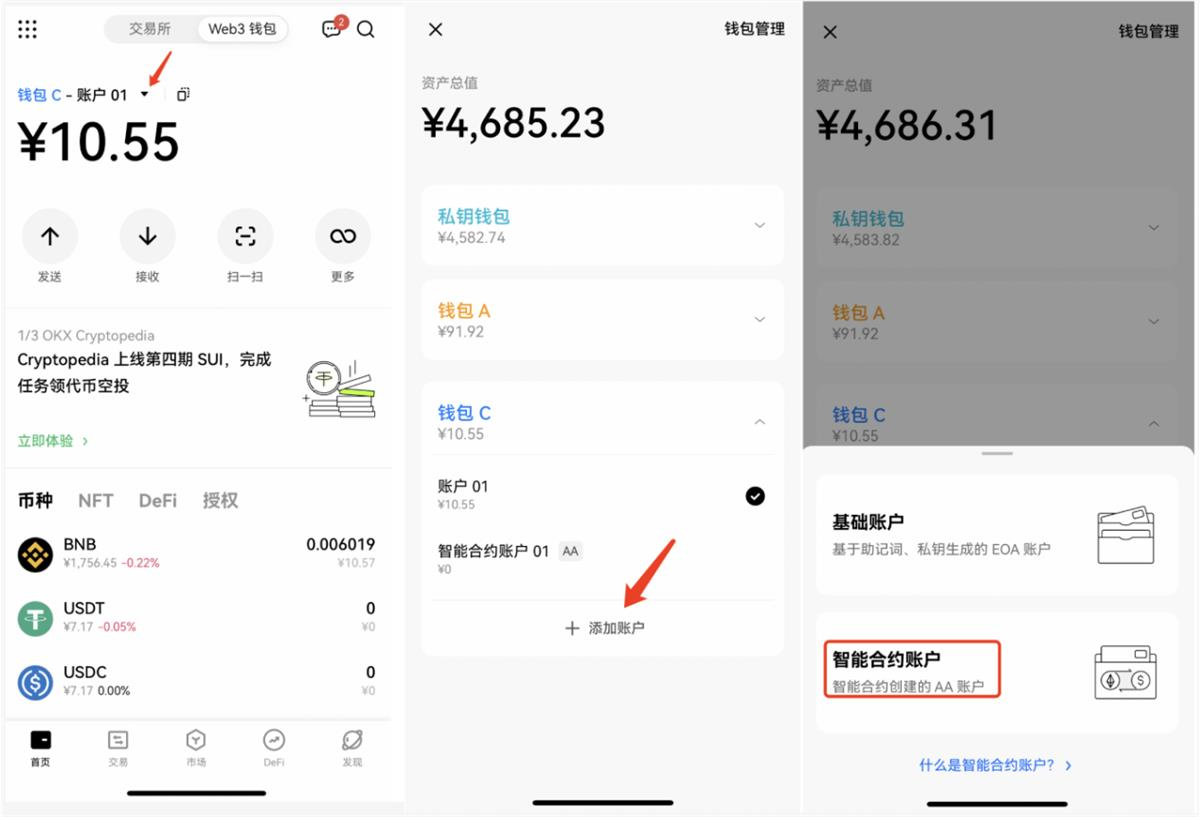

And a week ago, OKX announced the launch of the AA smart contract wallet, and also took the lead in implementing account abstraction among many CEXs.

Whether it is investment acquisition or independent research and development, the investment of CEXs in wallets is obvious. Note that this is not a custodian wallet on a traditional CEX, but a wallet that users can fully control independently, and it bears the CEX brand.

Many years ago, as an old leek, the author did not perceive the popularity of non-custodial wallets. Deposit money, buy coins, sell coins, withdraw money... It seems that CEX is the traffic entrance of the entire encrypted world, and the wallet is more like an exit for withdrawing assets.

Today, with more and more emphasis on decentralization and increasingly scattered hotspots on the chain, "interaction" re-endows the possibility of wallets as traffic portals; in addition, the emergence of account abstraction also makes people look forward to more friendly wallets tomorrow. attitude, the possibility of obtaining traffic outside the circle.

When CEXs start to roll their wallets, under the calm waters of bear market currency prices, dark tides are surging:

Competing for traffic is the eternal theme across cycles.

In Web3, the infrastructure is the traffic entrance

In the Internet we live in, a basic consensus is that applications control the entrance of traffic .

For example, an article on the WeChat official account can become a popular 10W+ reading. In this process, you only need to worry about whether the content itself is attractive, and you don’t have to worry about not having an audience. Potential audiences are all WeChat users, and the app itself holds a huge traffic pool.

And if we push the time forward 10-20 years, it wasn't always like that.

In the 2G or 3G era, it is the infrastructure provider, that is, the telecom operator, who masters the traffic password . The operator has worked hard to lay out the network cable for communication, and also launched VAS (Value Added Service) by the way: color ring tones, multimedia messages, mini games and mobile newspapers... All services go from my operator and are paid by phone bills Serve.

These businesses are a bit unfamiliar to the new generation of young people, but at the time everything seemed logical:

The infrastructure provider invests heavily in infrastructure construction at one time, and then slowly recovers the cost through the marginal cost of almost 0 phone charges + value-added services. Considering the huge number of users, it is basically a stable and profitable business.

Is it a bit like CEX?

A large investment in building the trading system of the exchange, supplemented by continuous operation and maintenance and iteration, and then recovering the cost by earning transaction fees (spot/contract). After you have the basic disk, you can expand more services and fields.

10 years ago, CEX was the proper main entrance for traffic in the encrypted world, not even one of them.

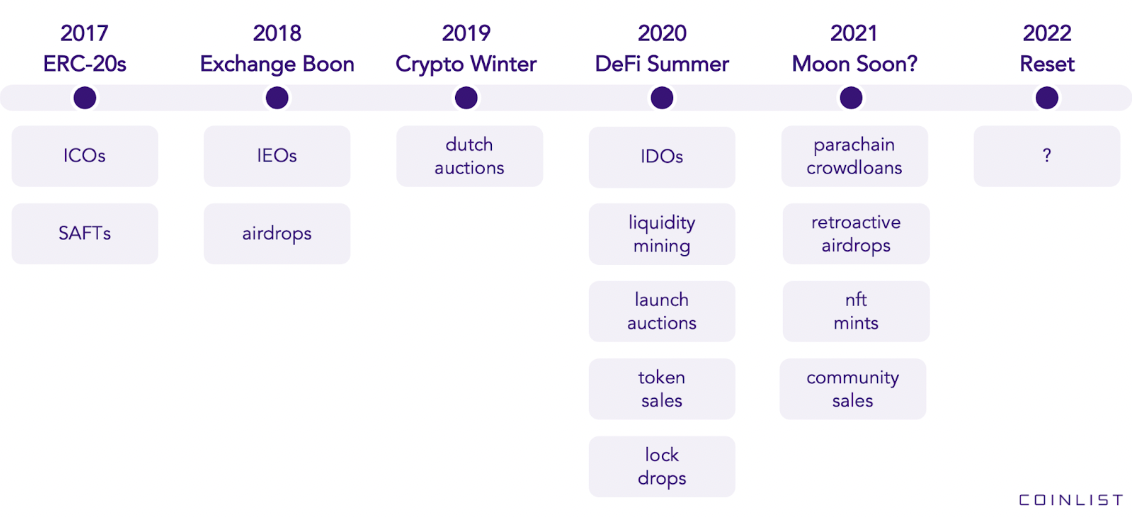

Six years ago, the ICO model emerged, and users could use wallet assets to directly access a smart contract to obtain tokens;

Five years ago, CryptoKitties appeared; in almost the same year, Opensea was established, and then the wave of NFT hype came, and users can access the platform through their wallets to trade NFT;

Three years ago, Compound launched liquidity mining for the first time, detonating the summer of DeFi. Users can directly interact with DApps to obtain token income...

Don't forget, because Web3 traffic has its own transaction attributes, wherever there are profitable transactions, there will be traffic.

As the first infrastructure of any transaction, the wallet has gradually improved its status as a traffic portal in the changing narrative and paradigm shift. At the same time, it also contributed to the success of metamask, which was established in 2019.

In this process, CEXs are a little behind the scenes. The traffic overlord in the early days of the encryption world, in the development process of frequent hotspots on the chain and the rise of NFT, the traffic began to be divided, just like the telecom operators in the past were divided by WeChat and Alipay.

So CEXs also started to do IEO, make wallets, build NFT platforms, support BRC-20, and provide more convenient entrances for liquidity staking or mining... everything became logical.

Keep the basics of the business, and at the same time, keep up with the rhythm to compete for traffic entrances in the change of hot spots on the chain, and use the advantages of the accumulated trading users to divert traffic to your own non-custodial wallets and other businesses.

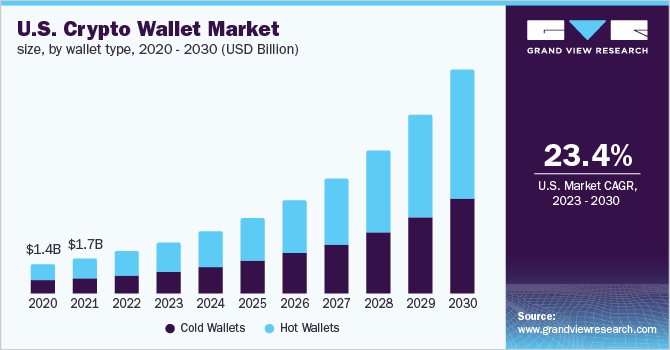

According to data from grandviewresearch, as of August 2022, the number of global encrypted wallet users has reached 84.02 million from 76.32 million users in August 2021; Growing at a Compound Annual Growth Rate (CAGR) of 24.8%.

Faced with this volume, even if the overlap between wallet users and CEX account opening users in the data is not accurately calculated, it is a very reasonable choice for CEXs to enter the wallet construction one after another only by looking at the market size and growth rate.

Why not do it if you can get more traffic?

Standing in the day after tomorrow to see tomorrow

Twenty years ago, telecom operators were the main entrance for communications and value-added services. But we have all witnessed the later things. After the rise of the mobile Internet after 3G, a hundred flowers bloomed in the upper layer applications, and the traffic was divided by various vertical applications. , but no more tolls from traffic will be received.

History will not simply repeat itself, but it always rhymes with the same rhyme.

One day in the crypto, one year in the world. In the external environment of the rise of DEX, global regulatory pressure, and rapidly changing narratives, will CEX also worry about traffic and falling behind?

The answer is of course yes. At present, CEX is a wallet, connecting with the self-built public chain, empowering its own platform currency, and providing similar experience and services to the app on the chain. At best, it can "not fall behind".

But to become a team leader, you need to look at tomorrow from the day after tomorrow.

If there is a future in the encryption market, seeking large-scale adoption by users is definitely an unavoidable topic; and how to better plan for large-scale adoption, technically speaking, trends such as account abstraction, ERC-4337, and smart contract wallets have gradually emerged. .

And some L2, such as Starknet, have gradually begun to only support AA accounts, not EOA.

Although from today’s point of view, in most scenarios, there is no situation where non-smart contract wallets are not available, let alone the question of who will pay for the gas fee after using AA. Its programmable, batch operation and various advantages of non-main chain gas are more like a future-oriented foreshadowing:

That is, the wallet and interactive experience after mass adoption should look like this.

Therefore, the author believes that the exchanges are laying out wallets in advance from the perspective of the day after tomorrow, which is the trend of competition and the top sense of the upper reaches of the industry food chain .

For example, OKX released a smart contract wallet at the current time, which is not good from the perspective of the overall market environment. At the same time, if you experience it carefully, you will also find that the smart contract wallet entrance of OKX is actually hidden relatively deep, and it is not directly exposed.

However, if we think about the future and launch it first when the market is in a low and stable state, and then quickly iterate and small-scale trial and error, when the market situation reverses, the product experience may be almost polished. In the face of the influx of good market When there is more traffic, the natural confidence will be stronger.

The exchanges have suffered the loss of "people have me but I have nothing" before, and they will inevitably "people have me better" at this stage . Whether it is an acquisition or self-research, the traffic portal of the wallet cannot be lost, and it has the potential to play well in combination with its own business.

In addition, think about it another way, if there is mass adoption, you can use this wallet as well as that wallet. For ordinary new users outside the circle, the considerations of brand endorsement, incentive activities, and user experience are much higher than the competition between CEX and DEX, and they will not fall into the fundamentalism of "CEX is not centralized, so I don't use it". Therefore, CEX Under the conditions of capital and scale advantages, it may be possible to strike later when the next wave comes.

After all, why is his first wallet Metamask.

In the eternal battle for traffic, user experience will always win.