Author: Nancy, PANews

On September 4, the encrypted gambling platform Stake.com suffered a hacker attack, resulting in losses of up to $41.3 million. Stake.com did not disclose the exact amount stolen, but only stated that user funds were safe and all services had been restored.

While the large-scale hacking attack shocked the crypto community, outsiders were curious about the strength of Stake.com’s asset reserves. How can Stake.com completely cover the loss of this theft in a short period of time? What is the real revenue of this on-chain gambling leader?

A total of more than 41 million US dollars was stolen, and all services were restored after only five hours

Last night (September 4), blockchain security agency PeckShield issued a document stating that the encrypted gambling platform Stake.com was suspected of being attacked. According to ZachXBT, the loss was approximately US$15.7 million (including 6,000 ETH, 3.9 million USDT, 1.1 million USDC and 900,000 DAI). Subsequently, on-chain detective ZachXBT reported that another $25.6 million was transferred from Stake.com on the BSC and Polygon chains, bringing the total amount stolen to $41.3 million.

According to SlowMist founder Yu Xian, the theft of Stake.com is related to a problem with the private key. It may not necessarily be that the private key is stolen, but it may also be that the interface/service related to the private key is maliciously used.

However, Stake.com’s official response to the theft seemed to be extremely calm. They only issued a statement confirming that an unauthorized transaction had occurred in the ETH/BSC hot wallet, without providing a detailed explanation of the theft. But the platform says user funds are safe and BTC, LTC, XRP, EOS, TRX and all other wallets remain fully operational.

At the same time, Stake.com co-founder Ed Craven also tweeted, "For these reasons (theft), at any time, Stake will reserve a portion of the cryptocurrency in the hot wallet for emergencies. All affected The wallet should be back up and running soon." At the same time, Stake.com co-creator Bijan Tehrani also said, "When we can, we will share more information as much as possible."

Only about five hours later, Stake.com announced that all services had been restored and deposits and withdrawals of all currencies had been reopened.

Annual revenue exceeds US$2.6 billion, once accounting for 5.9% of all Bitcoin transaction volume

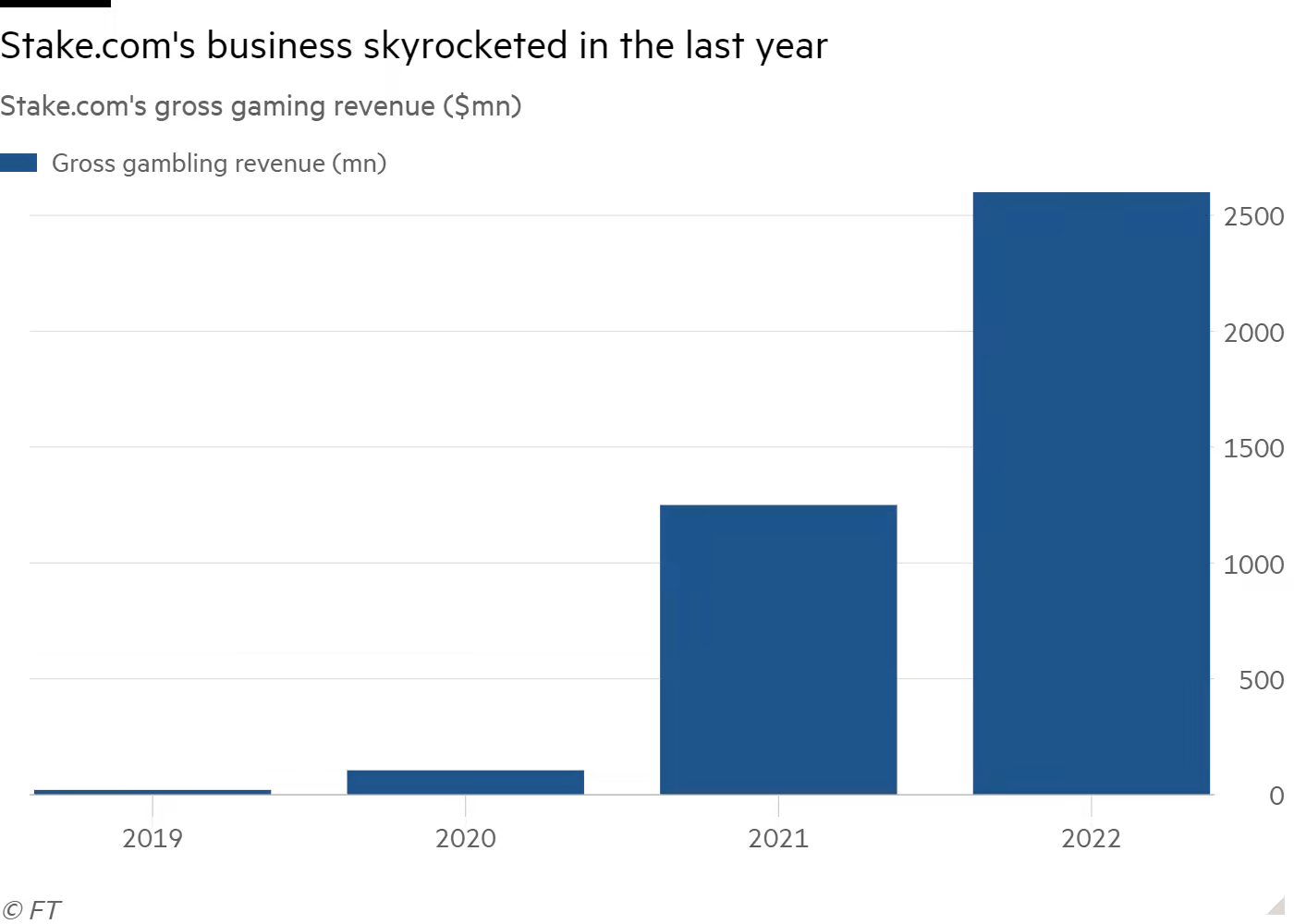

Stake.com is the world's seventh largest gambling website located in Melbourne, Australia, with 600,000 ordinary users and 6 million registered accounts, most of which come from the "grey" areas of Brazil, Japan and other Southeast Asian countries. According to data from the consulting firm Regulus Partners, its annual revenue in 2022 alone will be close to US$2.6 billion, approximately twice the total revenue in 2021 and nearly 26 times in 2020, surpassing well-known gambling platforms such as DraftKings and 888.

Stake.com Revenue Change Between 2019 and 2022

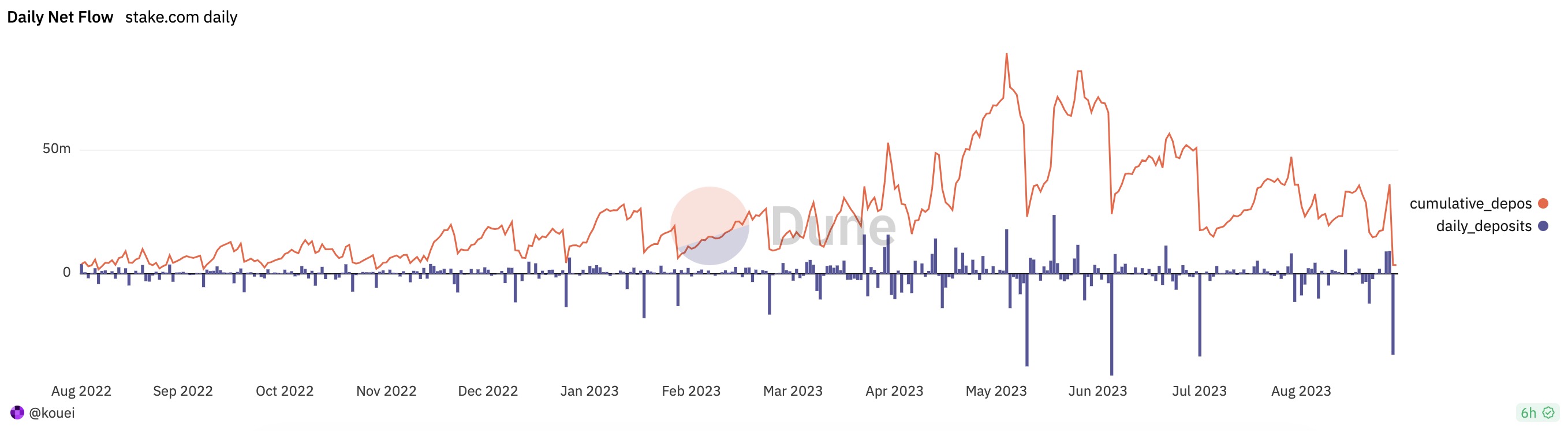

According to Dune data, since August 2022, Stake.com has accumulated more than 2.16 billion US dollars in customer deposits and more than 429,000 total users.

It is worth mentioning that, according to Ed Craven’s tweet, as of December 2022, Stake.com accounted for 5.9% of the total Bitcoin transaction volume, 12.3% of the total Dogecoin transaction volume, and Litecoin transaction volume. 15.1%.

Stake.com's revenue of US$2.6 billion far exceeds that of many crypto platforms. For example, Circle's full-year revenue in 2022 is US$150 million, BitDeer's net revenue in 2022 exceeds US$333 million, MakerDAO's total revenue in fiscal year 2022 is US$65 million, etc. Even compared to the recently popular gambling platform Rollbit, which has a revenue of US$350 million in 2022, it is far ahead. Judging from these published data, Stake.com is enough to cover these stolen funds.

The huge profits of Stake.com are inseparable from the leadership of Ed Craven and Bijan Tehrani. Among them, Ed Crave is also one of the youngest self-made billionaires in the world. He once ranked fifth on the 2022 Australian Financial Review Young Rich List with a net worth of US$1.1 billion. He had previously spent more than A$120 million to buy two houses. Toorak mansion hits headlines.

According to the Financial Times, Ed Craven and Bijan Tehrani met through the game RuneScape and co-founded Primedice, the first online gambling site similar to the Bitcoin gambling site Satoshi Dice, in 2013, allowing players to place bets using cryptocurrency. According to the two men, the price of Bitcoin was below $20 at the time, and the unexpected returns from their early crypto investments also provided ample funds for their business.

Then in 2017, Ed Craven and Bijan Tehrani established Stake.com, which mainly provides online casino games and sports betting services, supporting players to place bets through cryptocurrencies such as Bitcoin, Ethereum, Dogecoin, Litecoin and Bitcoin Cash. Note.

“Significant marketing spend is crucial for a platform that mixes cryptocurrencies and gambling operations and will contribute to user trust, especially in the face of some very strong competitors.” To this end, Stake.com invests in advertising A large amount of money. For example, in addition to being a sponsor of British football clubs Everton FC, Watford Football Club, Everton Football Club, etc., Stake.com also signed a US$100 million annual endorsement agreement with Canadian rapper Drake. Reached cooperation with mixed martial arts organization UFC, etc.

Canadian rapper Drake and Stake.com

Regarding the success of Stake.com, Nigel Eccles, founder of gaming company FanDuel, believes that Stake.com’s success is due to its aggressive marketing and becoming “the first truly global gambling website to accept cryptocurrency.”

According to Ingo Fiedler, co-founder of Blockchain Research Lab, the platform may be largely attributed to the fact that cryptocurrency and gambling are "natural allies", and they both attract customers who are willing to take risks. “Day traders who speculate in cryptocurrencies are a group very similar to typical gamblers, and the downturn in cryptocurrency markets following last year’s crash may also prompt more traders to turn to betting platforms.”