Preface

As an emerging L2 public chain, Mantle faces competition from established L2 networks. The old "Four Kings" include Optimism and Arbitrum, which use fraud proof, and Zksync and Starknet, which use ZK proof. New players also have strong backgrounds and capabilities, such as Base built by Coinbase based on OP Stack, EVM compatible chain Linea launched by Consensys, ZK-EVM launched by Polygon, etc. How can Mantle stand out from the many L2 public chains?

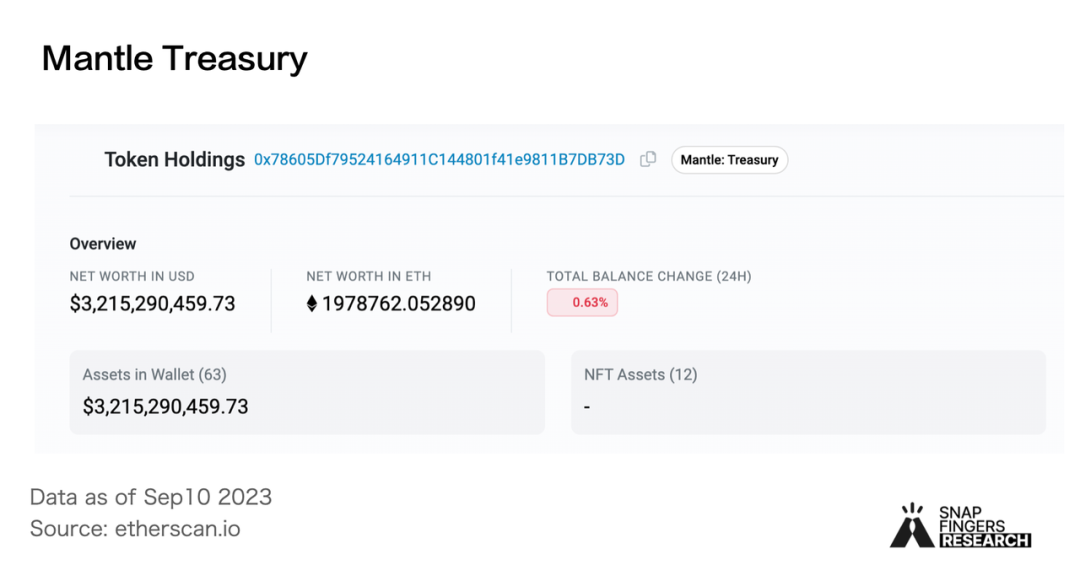

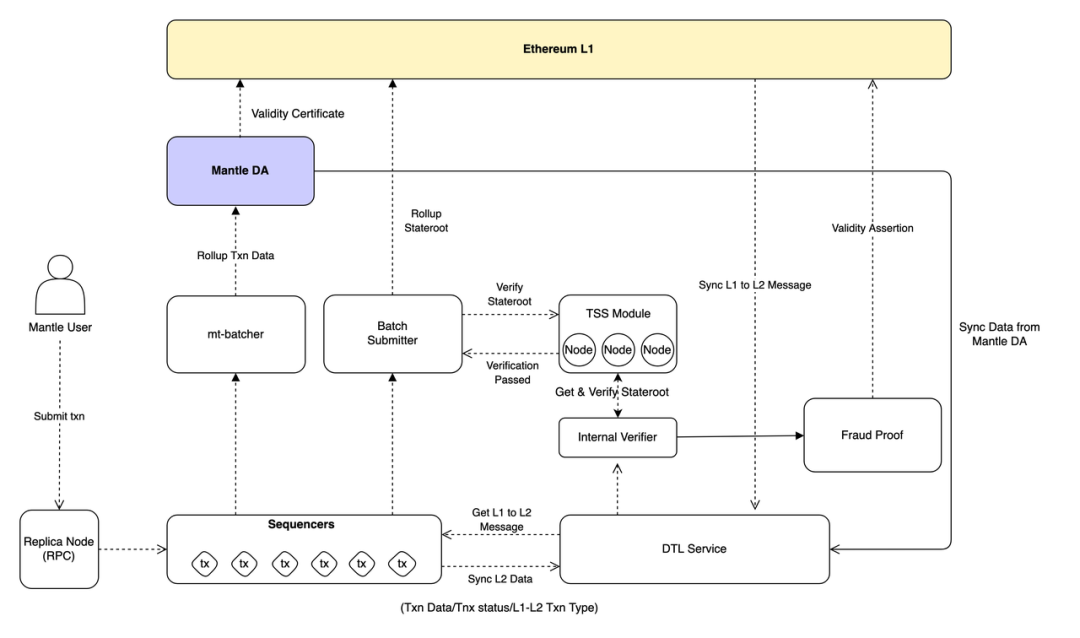

The core of Mantle is built using Optimistic rollup, combined with EigerLayer to use a modular DA layer, and introduces the TSS threshold signature scheme for network node management, thereby increasing TPS and reducing costs. In addition to technological innovation, Mantle has ample financial support, with more than US$3 billion in treasury funds providing a strong guarantee for the continued development of the Mantle project. These funds will be used to attract developers to build applications and expand the user base, thus forming a virtuous cycle. How will Mantle provide better performance through technological innovation while making better use of its financial advantages to build an ecosystem? This article will start from the historical background, technical characteristics, operating status and planning of Mantle.

01 The background of the birth of Mantle

1.1 Mantle development history

Mantle was originally an L2 network project incubated and managed by the original BitDAO. In May of this year, Mantle officially became an independent brand and completed the brand merger with the original incubator. The Mantle treasury manages assets worth approximately US$3.2 billion, mainly composed of BIT, MNT, ETH, USDC, and USDT. Its initial supporters include cryptocurrency exchange Bybit, venture capitalists Peter Thiel, Dragonfly, Pantera Capital, and Polygon. It can be seen from the historical background that Mantle has the blessing of a large-scale DAO treasury and carries the vision of supporting DeFi and decentralized tokenized economy. It is very powerful in terms of motivation and resources.

1.2 Large platforms have entered the L2 track one after another

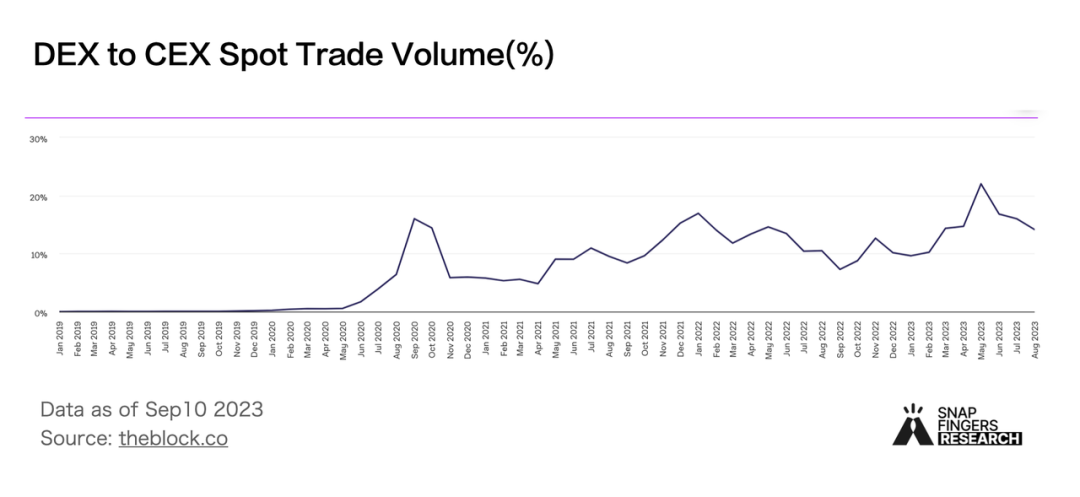

With the continuous rise of DEX, there is an obvious trend of cryptocurrency trading volume migrating from CEX to DEX. Coinbase's second-quarter financial report can also confirm this. Its non-trading revenue exceeded trading revenue for the first time, and trading revenue began to decline both year-on-year and month-on-month.

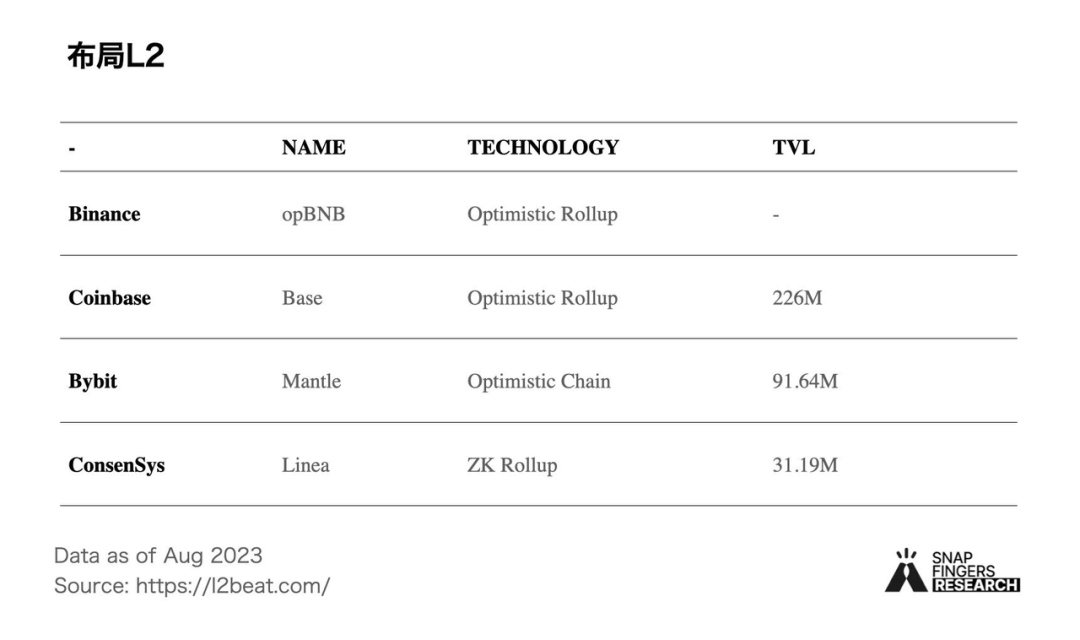

Platforms with a large number of users have all deployed in L2 this year: Binance’s opBNB, Coinbase’s Base, Bybit-backed Mantle, and Metamask’s Linea. Base, as the L2 launched by Coinbase, is a reflection of the further expansion of its user life cycle value. The layout of Binance L2 is more of a strategic intention. If the L2 network wants to remain active, it needs enough users to use and contribute liquidity. Binance has the largest user exchange platform in the world. Secondly, BNBchain users are highly active and can Leverage its own large user base to force or encourage them to use their own Layer 2, thereby helping the network grow rapidly.

Mantle's development plan and process are in line with current L2 trends. L2 is developing and iterating rapidly, and the Ethereum Cancun upgrade planned for November will significantly reduce the storage cost of L2. Lower transaction fees and faster user experience will surely lead to richer application scenarios. On the other hand, compliance is also an important issue in the current encryption world. The SEC has repeatedly debated whether cryptocurrencies are securities, which may be why the Base and Linea teams have stated that they have no plans to issue coins. In fact, even if no coins are issued, L2 can still obtain gas and MEV income through the sequencer. Currently, the sequencers of the two largest L2 solutions (Arbiturm and OP) adopt the official centralized operation method. In addition, with the support of modular OP Stack and other infrastructure, L2 can be quickly deployed under compliance conditions. It can be said that L2 is an almost certain future.

Mantle's L2 concept was proposed in June 2022. In November, the Mantle network was opened for internal testing. In March this year, the Mantle test network was online. In July, its mainnet Alpha phase was online. The Mantle DA data layer and the threshold with node Slashing mechanism have been implemented. Signature Scheme (TSS), according to the roadmap, Mantle will launch the mainnet Beta version in September, providing more stable and reliable network services and supporting more DApps and protocols. The ecological development of Mantle is also progressing simultaneously. There are 83 projects running on its network during the test network stage. After the main network is launched, the national treasury allocates US$200 million to establish the ecological fund Mantle EcoFund to support the construction of the Mantle ecosystem and promote the development of Mantle Network. Adoption among developers and DApps, motivating strategic venture partners to support and invest in the Mantle ecosystem, etc.

02 The dilemma of L2 and Mantle technical architecture

Rollup's two major technical solutions, OP fraud proof and ZK zero-knowledge proof, have their own advantages and problems to face. The storage cost of OP's CallData is higher, and the calculation cost of ZK is higher. In addition, the current mainstream solutions all use centralized sequencers, which have a certain risk of single point of failure. Mantle is a protocol based on Optimistic Rollup. The difference from other Rollups is that Mantle's modular architecture can improve performance in calculation, execution and other aspects. The Mantle network uses independent modules for transaction execution, data availability and transaction confirmation, which can effectively improve data availability without affecting network security and optimize the Mantle network schedule. At the same time, developers can also deploy in a relatively low-cost and more efficient ecological environment. contract.

2.1 Mantle introduces a modular data availability layer to significantly reduce transaction costs

In the current blockchain architecture, Optimistic Rollup requires submitting a large amount of transaction data to Ethereum's data availability layer with high Calldata fees. As transaction volume increases, this fee reaches 80-95% of the total fee, severely restricting Rollup's cost efficiency.

As an emerging L2 solution, Mantle successfully reduces operating costs by introducing modular EigenLayer as an independent data availability layer. EigenLayer is a low-cost, efficient off-chain data availability network that allows Mantle to submit only necessary state roots to the Ethereum mainnet, and a large amount of transaction data is stored in EigenLayer.

As the first data availability module, EigenLayer's organic combination with Ethereum enables Mantle to both ensure security and achieve ultra-low transaction fees. This breaks through the technical problem of "high security and low scalability" in the current L2 solution. EigenLayer also exports the security of Ethereum's mortgage assets to external protocols through the "repeated pledge of ETH" mechanism, which can provide tens of billions of dollars in security for Mantle. This significantly reduces the threshold and cost for L2 networks such as Mantle to launch their own security models. Overall, EigenLayer's modular data availability layer can strip the high costs of L2 network storage and data submission from the Ethereum main network. Under the premise of ensuring security, Mantle transaction fees are expected to be reduced by several orders of magnitude and throughput increased by more than hundreds of times.

In addition, EigenLayer supports dual staking. This allows $MNT to run as a staked token together with $ETH. Through double collateralization, $MNT can be used by validators as collateral to provide security and data availability to the network, and can also be used as Gas.

2. 2 Mantle improves the security of fraud proof and shortens the challenge period through TSS nodes

Fraud proof Optimistically believes that all Rollup transactions submitted by the sequencer are valid. In order to ensure security, the challenge period is longer. It takes 7 days to withdraw money from L2 to the mainnet. If the security of node verification can be improved, it can Effectively shorten the challenge period.

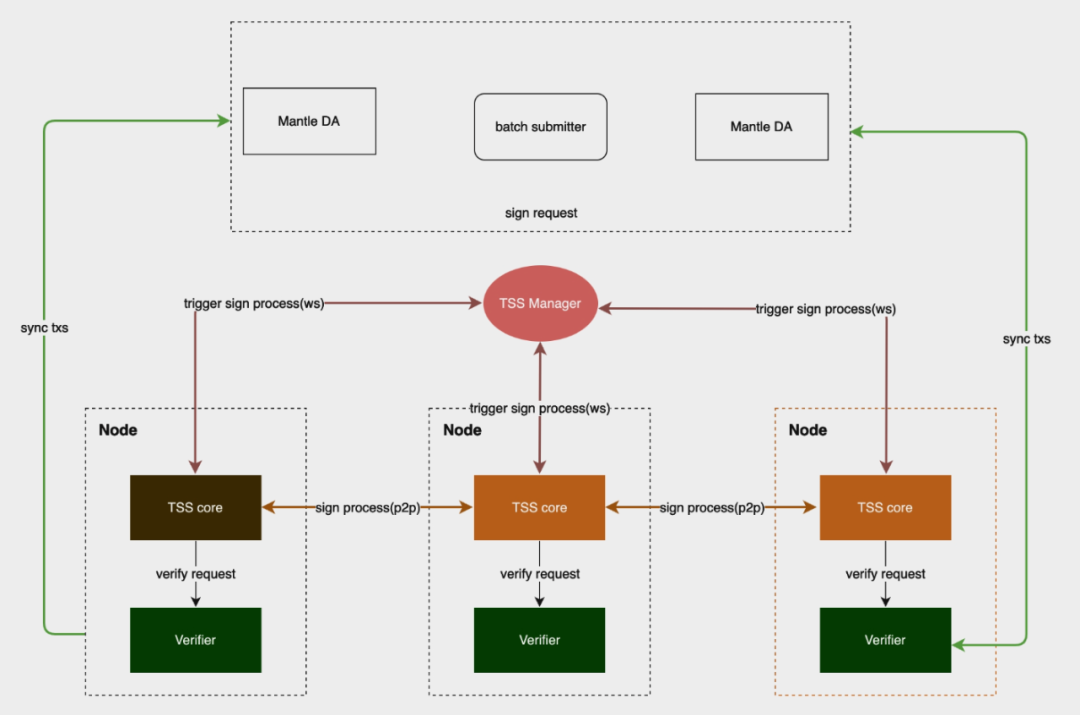

Mantle verification nodes adopt the Threshold Signature Scheme (TSS), which can minimize the trust risk of execution results. TSS can generate public keys through distributed key generation. Each node holds a part of the private key to generate a valid signature. Multiple TSS nodes verify and sign the block data sent by the Sequencer to ensure its correctness.

Mantle TSS node operators need to pledge a fixed amount of MNT on Ethereum. If malicious behavior or failure is detected, the pledge will be slashed to ensure network security. The Slashing module has clear settings for two types of node evil behaviors:

The absence of node verification, malicious signatures and other behaviors will be recorded to the TSS administrator. When the absence of node verification increases, the TSS administrator will submit a proposal to reduce the pledge part of the node with the consent of the majority of other nodes (according to the pledge ratio). .

The node maliciously signs. When a TSS node submits fraudulent data to the network, it will be recorded by other nodes and fed back to the TSS administrator. Then the TSS administrator will submit a penalty proposal, and with the consent of the majority of other nodes (according to the pledge ratio), the node's The pledge part is reduced.

Note: Mantle’s initial solution for verification nodes is multi-party computation (MPC) technology, which has been transformed into a TSS solution during the Mainnet Alpha stage.

03 Mantle’s ecological potential

3.1 Mantle’s ecological incentives

Mantle has strong ecological assets, including more than 3.2 billion US dollars in funds including the treasury, and a large user base, which has laid a solid foundation for the development of the Mantle ecosystem.

In order to better stimulate ecological development, Mantle has launched a series of ecological incentive plans. Support for ecological projects is mainly reflected at two levels:

The first is financial support. Mantle has established a US$200 million ecological fund. The four major goals of the fund are to attract developers into the Mantle ecosystem, promote venture capital, support the prosperity and development of the ecosystem, and achieve investment returns. Sufficient ecological funds can attract a large number of high-quality projects to choose Mantle. Deploy and enrich its L2 ecosystem.

Secondly, it cooperates with the exchange Bybit. High-quality projects in the Mantle ecosystem have the opportunity to be recommended to Bybit for listing, thereby gaining a broader user base and liquidity, which provides a strong driver for the long-term development of the project.

3.2 Mantle LSD plan may significantly increase user scale and asset scale

Mantle has a reserve of more than 270,000 ETH in its treasury, which provides it with strong financial strength in the LSD field. Based on such strong financial backing, Mantle will carry out strategic cooperation with a number of top LSD protocols to form a strong ecological synergy, jointly promote the research and development and application of LSD solutions based on the Mantle network, and massively increase the user scale and asset scale of the Mantle network. . This ecological synergy can not only produce synergistic network effects, but also optimize capital usage efficiency. This will significantly increase the adoption and influence of the Mantle Network.

First, Mantle plans to release a liquid ETH deposit protocol called Mantle LSD, which will be a liquid staking protocol based on the Ethereum mainnet. Users can obtain mntETH tokens of equal value and income by depositing ETH in the protocol. The token still retains the price and liquidity of ETH while earning staking income. Mantle LSD leverages the unique advantages of the Mantle ecosystem. First, the Mantle treasury currently holds approximately 270,000 ETH, which provides Mantle LSD with a huge initial deposit size and liquidity advantage. The total market value of mntETH is expected to reach billions of dollars after its issuance, which is expected to make it quickly become the top three protocols in the decentralized LSD field. This will not only bring scale effects to Mantle LSD itself, but will also provide positive incentives for the use and circulation of mntETH on the second-level network Mantle.

Secondly, mntETH can be used directly on the Mantle network or even as another version of ETH on that network. This will greatly enhance the usage scenarios of mntETH and enhance its stickiness in the Mantle ecosystem. Compared with other LSD projects, this is a unique advantage that can enhance users' stickiness to the Mantle network. Furthermore, Mantle LSD can maximize the reuse of Mantle’s established community, governance structure, brand influence and other resource investments, thus significantly reducing operating costs and risks, which also optimizes capital usage efficiency. At the same time, Mantle LSD will operate under Mantle's overall governance framework to ensure its long-term competitiveness and sustainability. Finally, from a technical point of view, Mantle LSD adopts a simple system architecture, which reduces complexity risks and makes it easy to be accessed and compatible with other applications and ecosystems. This lays the foundation for cross-chain interoperability and ecological expansion.

In addition to issuing mntETH, Mantle will also carry out strategic cooperation with top DeFi protocols. For example, it has cooperated with Lido Finance to establish the stETH ecosystem on Mantle Layer 2. Mantle is also considering cooperation with protocols such as Pendle and StakeWise. In addition, Mantle is also exploring income options such as direct mortgage, and proposes to establish an economic committee as a sub-DAO to improve asset management efficiency.

Mantle has formulated a systematic LSD strategic plan by issuing mntETH, developing strategic cooperation with high-quality ecological resources, and leveraging its own capital and governance advantages. This will not only enrich its DeFi ecosystem, but also bring more unique user stickiness to the Mantle network. Compared with other L2 solutions, Mantle has significant advantages in this regard, which will effectively promote the rapid growth and cross-chain interconnection of the Mantle network.

At present, Mantle has reached a TVL of US$40 million. With the launch of ecological incentives and LSD strategic cooperation, Mantle's ecological projects and TVL are expected to grow rapidly.

Recently, Mantle has also launched community incentives. Users who participate in activities through the mainnet or test network can share the 20M MNT reward in the first season. The Citizen of Mantle NFT whitelist also has some rewards for early Mint SBT users, and the first 5,000 participants can receive 500k MNT rewards.

For details, please refer to the following link:

Mantle Journey: Create Your Profile to Access the Season Alpha 20M $MNT Reward Pool

04 Mantle’s Token Economics

4.1 Token Overview

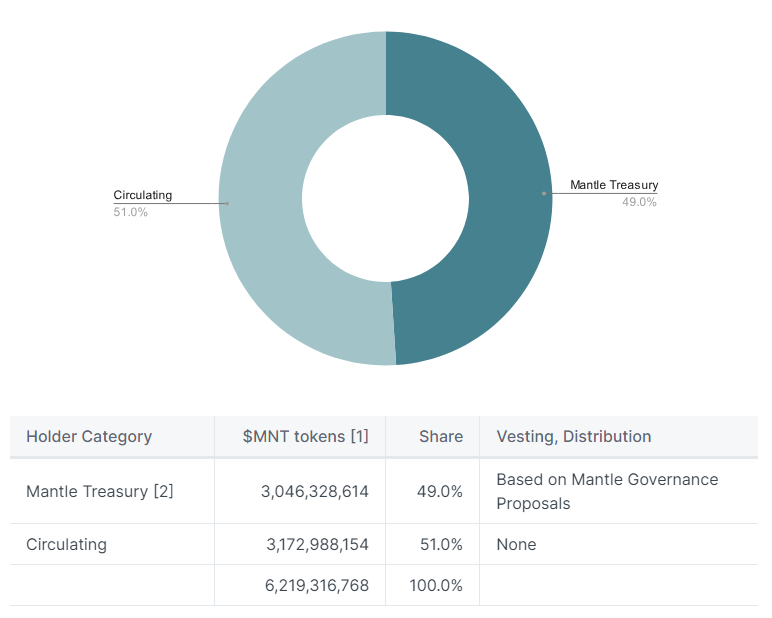

The $MNT token has a dual role in the Mantle ecosystem: it is both a governance token and a utility token. Holders of $MNT can participate in ecological governance by holding tokens, or use tokens to complete various interactions in the ecosystem. Based on the approval of the two proposals BIP-21 (brand unification as Mantle) and MIP-22 (Mantle token design), $MNT became the new governance token. The subsequent MIP-23 passed further clarified that the total circulating supply of Mantle tokens is 7 billion. Quoting the official $MNT initial allocation snapshot provided by the official on 2023-07-07, the $MNT distribution is as follows:

As can be seen from the distribution chart, the Mantle Treasury holds nearly half of the $MNT tokens. The official also elaborated on this in the project documents: $MNT held in the Mantle treasury can be regarded as "uncirculated". The distribution of Mantle Treasury's $MNT tokens is subject to the Mantle governance process, and the budgeting, fund raising, and distribution processes follow strict procedures.

After the initial allocation, sources for $MNT in the Mantle treasury include:

Bybit’s irregular donations

Mantle’s mainnet gas fee income

At the same time, according to the official document content, $MNT in the Mantle treasury is expected to be mainly used for the following purposes:

1. User incentives

Drive user adoption of Mantle products through various strategies such as multi-season achievements, missions and other incentive programs. Target metrics for user adoption include daily active users, total transaction and protocol fees, total value locked (TVL), and other relevant product adoption metrics. These incentives are designed to attract and engage users within the Mantle ecosystem.

2. Technology partner incentives

Focus on incentivizing dApps, infrastructure service providers and core protocol technology partners that contribute to the growth and development of the Mantle ecosystem. By providing incentives to these partners, Mantle aims to foster collaboration and partnerships that enhance the entire ecosystem and expand its capabilities.

3. Core contributor team and consultants

Follow the same budget proposal process to ensure transparency and accountability in the allocation of resources to teams and consultants that actively contribute to project success.

4. Others

When situations such as: acquisitions, token swaps, inventory sales and other transactions occur. All will be evaluated on a case-by-case basis, taking into account their potential benefits to the Mantle ecosystem and alignment with project goals.

4.2 Token function

Currently, $MNT is expected to carry two functions:

Governance token. As a governance token, each $MNT token is given equal voting weight. Users only need to hold tokens to participate in the project's governance decision-making process, and achieve this through the holding of tokens. The degree of influence of personal opinions on proposed decisions. The community hopes that in this way, currency holders can actively participate in community governance, thereby ensuring the decentralization of the community and promoting a community-driven approach to shape the future of the Mantle ecosystem.

Utility tokens. As a utility token, $MNT will become the Gas token on the Mantle network, that is, the gas fees generated by all interactions performed by users on the Mantle network need to be paid through $MNT.

In addition, $MNT tokens can be used as collateral assets for Mantle network nodes, further incentivizing participation and contributing to the security and stability of the network. In the long run, when the Mantle ecosystem develops the LSD track or even the Restaking business, $MNT can also be used alone or paired with LP as collateral.

4.3 Valuation analysis

Since the Mantle mainnet is still in the Alpha stage, and the infrastructure and application ecology are still developing, the data is insufficient for valuation analysis. The following is a qualitative valuation analysis based on token circulation.

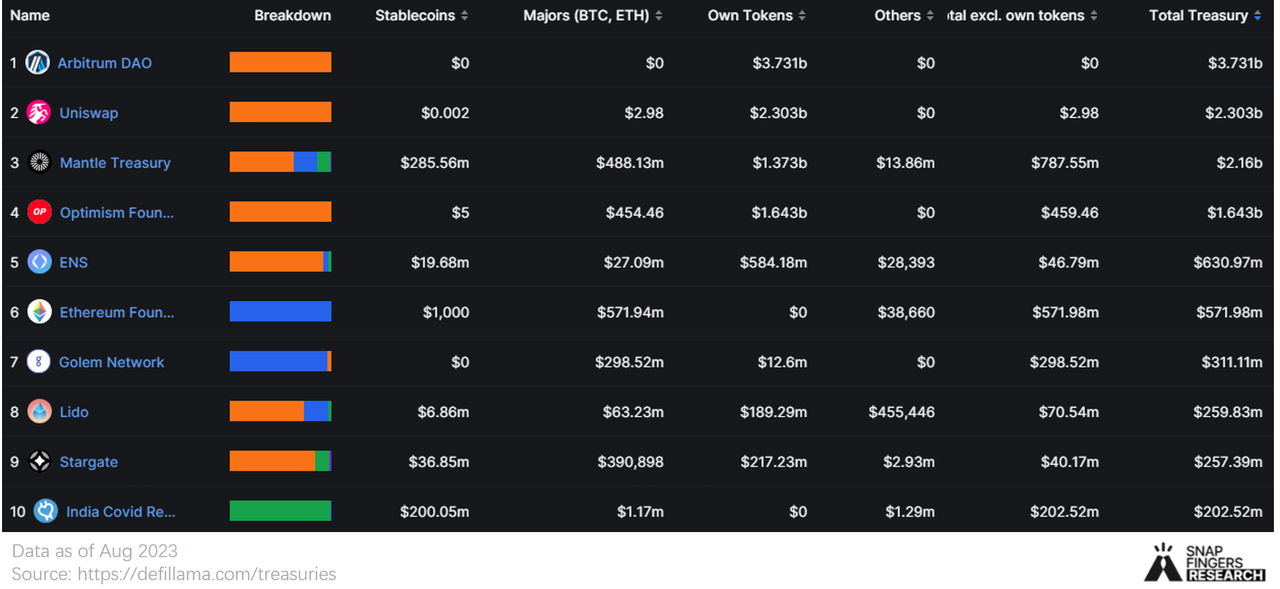

1. Mantle DAO’s mainstream high-quality assets in the treasury can provide strong market-making support

As can be seen from the figure below (the fund holdings of the top ten richest DAO organizations), although the treasury’s funds rank third among all DAOs, compared with the top two DAOs (Arbitrum DAO, Uniswap ), Mantle has a clear advantage. Arbitrum and Optimism's treasury is almost 100% owned by their own governance tokens, while ETH, USDC, and USDT account for 22.1% of Mantle's treasury. This determines that Mantle DAO will have stronger market-making capabilities than other DAOs and will also have more high-quality assets to support ecological development. These factors provide a more solid basis for MNT token valuation.

2. Mantle network operations involve multiple token staking scenarios, which will effectively reduce token circulation.

Unlike other L2s that use ETH as a gas token, MNT tokens are regarded as the gas tokens of the Mantle chain. As long as the ecosystem develops stably and interactions on the chain are active, MNT will be consumed steadily without the need for other artificial controls.

There are various scenarios in Mantle network operations that can reduce MNT circulation:

Become a Mantle DA node by staking MNT tokens

Become a sorter node by staking MNT tokens

Become a TSS node validator by staking MNT tokens

Of course, the LSD platform that is already under planning will also use MNT as the main LP pledge token.

3. Mantle DAO has long-term plans for the stability and appreciation mechanism of MNT tokens

In April this year, BitDAO passed the BIP-20 proposal and modified Bybit's donation method, from donating a floating amount of BIT based on the exchange ratio to donating a fixed amount of BIT every month. This program lasts for 48 months, with a total donation amount of 2.7 B. The donated BIT is kept in the DAO treasury and will be destroyed through proposals when necessary. In May, the BIP-21 proposal was passed, and the total amount of donations mentioned in the BIP-20 proposal (2.7B) was completed ahead of schedule. This proposal is undoubtedly good for holders. On the one hand, it makes the circulation of BIT more predictable. On the other hand, it further reduces the concentration of BIT holdings and reduces the market's tendency to understand BIT as a Bybit exchange token.

In addition, it can be seen from the BIP-22 proposal that Mantle DAO has always considered the stability and appreciation mechanism of the MNT token. Some control measures include:

It will be possible to control possible inflation by destroying treasury MNT tokens.

Referring to the ARB token model, the newly minted MNT tokens every year will not exceed 2% of the total supply.

05 Risk warning

5.1 Centralization risk

Judging from the distribution of token holdings, there is currently a high degree of concentration, which is also a common concern in the market. It can be seen from the proposal that Mantle DAO is actively facing market doubts. The donation plan in the BIP-20 proposal can also see the project side's actions and attempts to gradually reduce the centralized currency holding ratio. Judging from the number of currency holders, the number of MNT token holding addresses has reached 70,000 (including L1 and L2). From a liquidity perspective, MNT is listed on multiple DEXs such as Uniswap, and has tens of millions of dollars in liquidity. There are ample liquidity options for MNT holders.

5.2 Community governance risks

Currently, the Mantle treasury holds approximately 49% of the total amount of $MNT tokens. The official document states: "These tokens can be regarded as non-circulating" and "These tokens will be used to promote ecological development and support the ecosystem." Application Construction”. In the newly passed MIP-24 and 25 proposals, DAO established a special economic committee and LSD strategy proposal, which shows the DAO's efforts in community governance optimization.

At the same time, the Ringing Finger Research Institute learned from the official that the Mantle treasury is managed by Mantle Governance. At the current stage, it serves as the asset management part of the DAO, and its use decisions are established and proposed by the DAO. Currently the Mantle Treasury does not participate in Mantle governance voting.

5.3 Technical security risks

Mantle is an L2 protocol based on Optimistic Verification. The current Mainnet Alpha version of Optimistic Verification is still under development.

The data availability layer Mantle DA is the core technology part of Mantle Network. Mantle DA is rewritten from Fork EigenDA. Currently, Mantle DA is the version of Mantle before the EigenDA mainnet is integrated. After the EigenDA mainnet is online, the team will re-evaluate whether to migrate to EigenDA based on the actual situation.

References

https://snapshot.org/#/bitdao.eth

https://www.bitdao.io/zh

https://snapshot.org/#/bitdao.eth/proposal/0x6ebdd692948cb84ef2f1855718ffd4aa6421c092a656825870f70b2c27485040

https://treasurymonitor.bitdao.io/mantle-treasury

https://www.bitdao.io/analytics

https://treasurymonitor.bitdao.io/

https://www.gate.io/zh/learn/articles/what-is-mantle/454

BIT Network: An Iterative Modular Chain Approach, https://discourse.bitdao.io/t/archived-bit-network-an-iterative-modular-chain-approach/2988

https://www.panewslab.com/zh/articledetails/8903p3w6.html

https://cryptowesearch.com/blog/all/mantle-network-mainnet-launch-modular-layer2-blockchain

https://www.theblockbeats.info/news/43897

https://www.theblockbeats.info/news/42349

https://www.mantle.xyz/blog/announcements/mantle-a-new-approach-to-scaling-ethereum

https://www.theblockbeats.info/news/36518

https://twitter.com/0xMantle/status/1613236965562015745

https://web3caff.com/zh/archives/63434

https://w3hitchhiker.mirror.xyz/GDSJApI2AyhfQSQVkdcAzlEeMqGxTiiypu1rVJX1JZw

https://twitter.com/Moomsxxx/status/1671904364393295873

https:// Followin.io/zh-Hans/feed/5645145

https://discourse.bitdao.io/t/discussion-mantle-ecofund/4692

https://twitter.com/Moomsxxx/status/1671569578743169039

https://forum.mantle.xyz/t/discussion-mantle-lsd/7085

About Snapfingers Research

Snapfingers Research is a research platform under Snapfingers, focusing on DeFi and TradeFi research on various public chains.

Related Links

Twitter @SnapFingersLabs

Mirror.xyz/snapfingersresearch.eth

Public account: Ring Finger Research Institute