This article comes from | CoinGecko

Original author | Nicholas Boey

Compilation | Odaily Odaily 0xAyA

Editor’s Note: Just last night, Delaware Court Judge John Dorsey approved a plan to allow FTX to sell its billions of dollars worth of cryptocurrency. FTX previously submitted a plan in August to sell its cryptocurrency holdings under the guidance of a financial advisor. Under the plan, there is a weekly sales limit of $100 million for most types of cryptocurrency held, which can be permanently increased to $200 million. Previous court filings revealed that FTX held $3.4 billion worth of cryptocurrency.

CoinGecko has compiled FTX’s cryptocurrency asset data, compiled by Odaily Odaily.

FTX, once a well-known cryptocurrency exchange, had a diverse portfolio of digital assets before its decline. It is seeking regulatory approval to liquidate crypto assets worth a total of $3.4 billion. Here are the top ten crypto assets held by FTX in its bankruptcy estate.

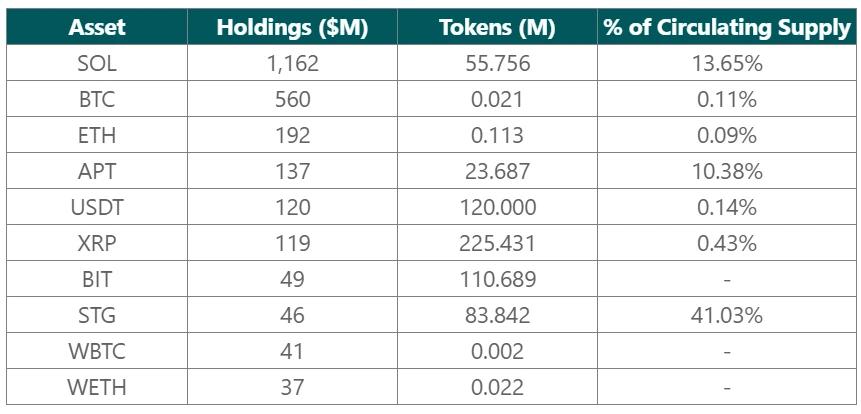

As of August 2023, the top ten positions of FTX are as follows:

What other coins does FTX hold?

FTX’s largest holding is Solana (SOL), with approximately 55.8 million SOL worth $1.162 billion. FTX is one of the largest holders of SOL, holding more than 10% of the total supply of SOL. Bitcoin (BTC) follows closely behind, with FTX holding approximately 20,500 BTC, equivalent to $560 million. However, this only accounts for a very small portion of Bitcoin’s circulating supply, just 0.1%. Ethereum (ETH) ranks third among FTX’s holdings, with approximately 112,600 ETH worth $192 million, accounting for 0.09% of ETH’s circulating supply.

SOL, BTC, and ETH together make up 56.3% ($1.9 billion) of FTX’s massive $34 billion cryptocurrency portfolio.

FTX’s holdings also include Aptos (APT), Tether (USDT), Ripple ( XRP ), BIT (BITDAO), Stargate Finance (STG), Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH), accounting for 10% of its holdings 21.8%.

The remaining holdings of FTX, 21.9%, include over 400 other coins.

FTX’s SOL Unlocking Plan

Most of FTX’s SOL holdings are subject to a structured unlocking program. Although they hold a large number of tokens on SOL, it is important to note that the majority of these tokens (42.2 million) cannot be immediately sold on the market.

FTX’s SOL unlocking plan is as follows:

According to the unlocking plan, 6.184 million SOLs are unlocked every month. This monthly release represents approximately 1.1% of FTX’s total SOL holdings. However, it is worth noting that 7.5 million SOL are expected to be unlocked on March 1, 2025, accounting for 13.5% of FTX’s total SOL holdings.

According to the unlocking plan, 6.184 million SOLs are unlocked every month. This monthly release represents approximately 1.1% of FTX’s total SOL holdings. However, it is worth noting that 7.5 million SOL are expected to be unlocked on March 1, 2025, accounting for 13.5% of FTX’s total SOL holdings.

BTC and ETH account for 22.1% of FTX holdings

Bitcoin (BTC) and Ethereum (ETH) account for a considerable proportion, accounting for 22.1% of FTX’s total holdings. However, BTC and ETH only account for approximately 0.10% of the circulating supply of their respective cryptocurrencies. On liquidation, the market should be able to absorb these positions without significant impact.

Altcoin and Stablecoins: FTX holds 23.7 million APTs

FTX holds $137 million worth of APT, accounting for 4.0% of its total holdings. These 23.7 million tokens represent approximately 10.4% of the current APT circulating supply. However, it is important to emphasize that due to the unlocking arrangement, the exact distribution between the liquid and illiquid nature of APT tokens is not yet clear.

Additionally, FTX holds $119 million worth of XRP, accounting for 3.5% of its portfolio. These 22.54 million tokens represent approximately 0.43% of the current circulating supply of XRP, indicating that its potential impact on the market may be lower than that of SOL and APT.

FTX’s holdings also include $46 million worth of STG, representing 1.35% of its portfolio. Despite their smaller monetary value, these 83.8 million STG tokens represent 41.03% of the current circulating supply.

In terms of stablecoins, FTX held $120 million worth of USDT as of August 31, 2023, accounting for 3.5% of its total holdings.

source

This analysis examines the top ten digital asset holdings of FTX.com, FTX.US, and Alameda Digital Assets, including major currencies that meet liquidity thresholds. Data for this analysis comes from official court documents and uses each digital asset’s closing price on August 31 on CoinGecko, and Solana’s token economics data comes from Solana Compass .