Written by: AYLO

Compiled by: TechFlow TechFlow

I’m sure you’ve all heard of Friend.Tech, a platform that combines social media and cryptocurrency:

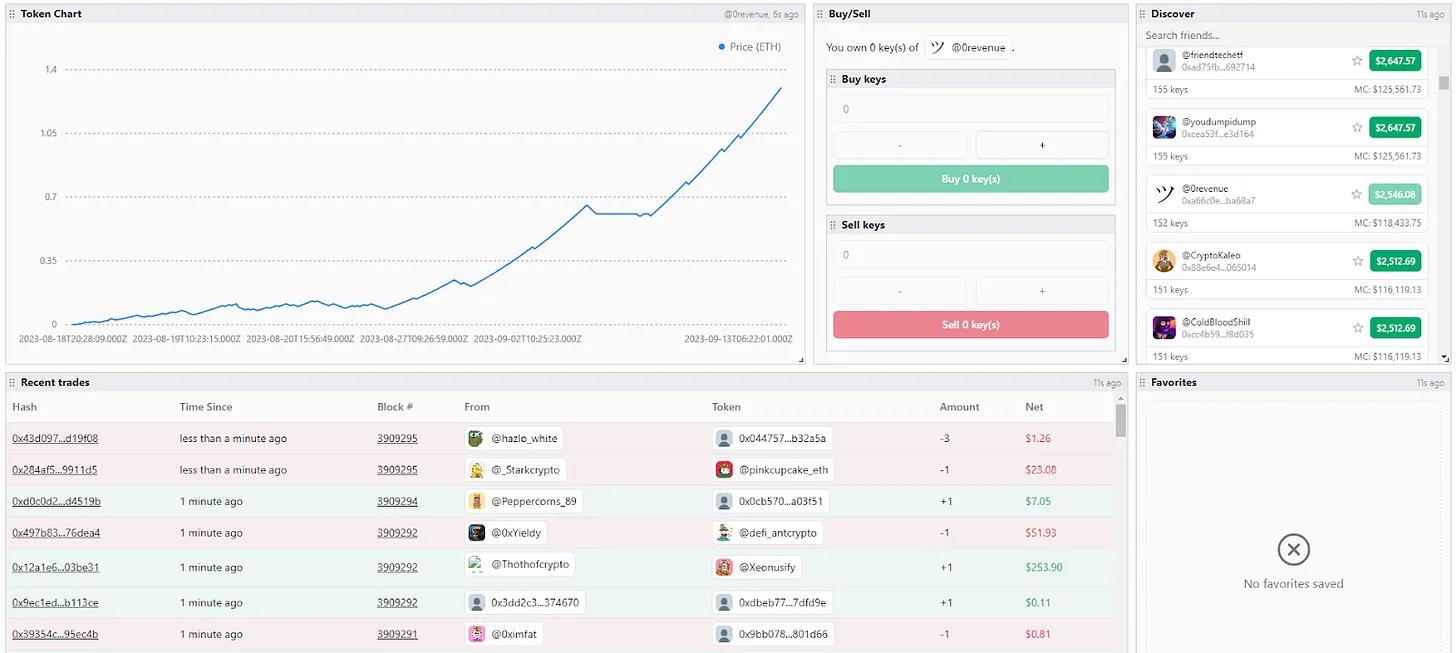

Users can buy, sell and trade "Keys", which are tied to a specific X (twitter) account, essentially buying shares of the platform's users.

The price of Key increases with the Bonding Curve. When the Key price is 1 ETH, there are usually about 100 people in a room.

Having the Key allows you to enter the user's private chat room within the application.

Creators can earn revenue from the sales tax on each Key transaction (5% goes to the platform, 5% goes to the creator).

The app works on mobile phones and uses unique "Progressive Web Apps" technology to bypass the app store.

Built on Coinbase's BASE chain.

At first glance, this looks like just another app catering to speculation (remember Bitclout?) but is that really the case? I've been thinking about this a lot over the past few weeks as I've been thoroughly testing the platform.

Today I want to discuss my findings and offer my unique perspective as an early adopter of the platform with a Twitter following. I developed my own strategy for FT, and I was one of the first to make a big push for a completely new approach, which I'll discuss at the end.

My overall point is: this could be a good investment (if you play your cards right), but you could also really get a lot of value out of it besides speculation on Keys and airdrops.

Data at a glance

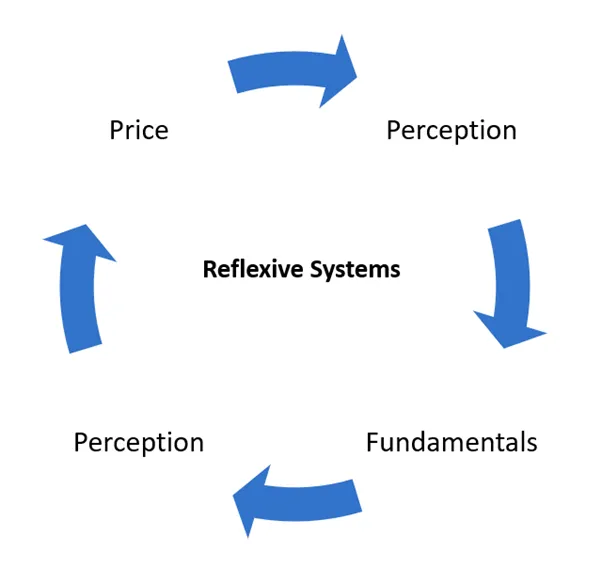

Looking at Friend.Tech’s on-chain metrics tells a seemingly very positive story.

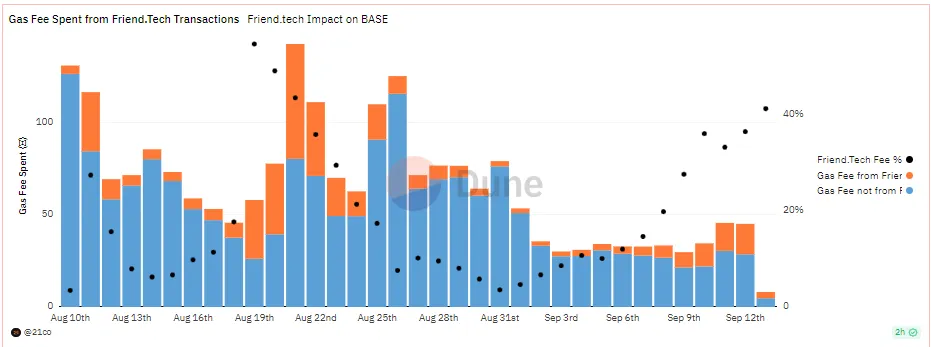

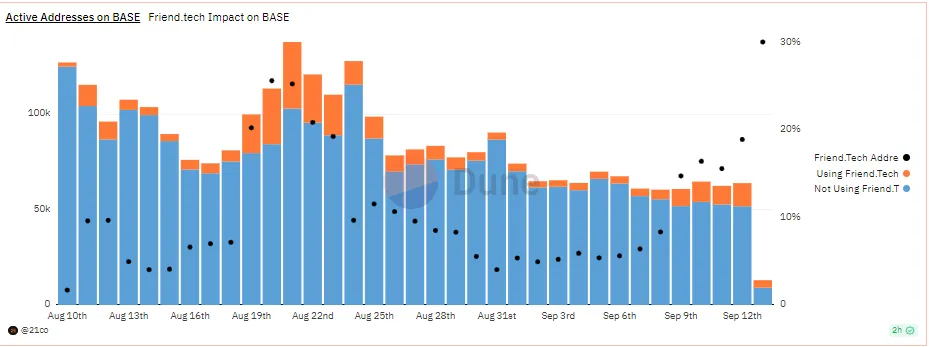

First of all, FT is undoubtedly the number one application on BASE. This can be seen in the percentage of fees FT incurs on the BASE chain, which averages about 20%. An application generating 20% of total expenses is staggering. Even more shockingly, BASE is now the leading Optimistic rollup, ranking second among all Layer 2s, which further highlights the fact that FT accounts for so much activity on the chain.

FT's importance to the BASE chain can also be seen from its active user share, which currently averages around 10%.

This activity resulted in the platform distributing more than $8 million to users in a little over a month. That's a pretty impressive performance for a beta app.

Coinbase launching its own chain is a major move that should not be underestimated. As interest in cryptocurrencies ramps up again, Coinbase will guide the masses into their new decentralized home. You can imagine that as BASE grows in popularity, so will its primary applications.

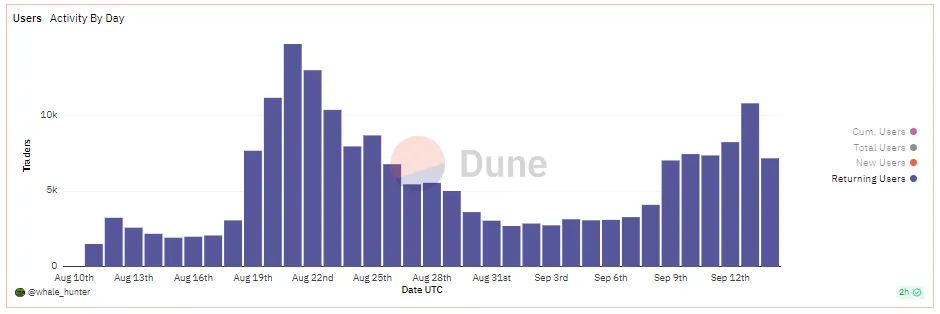

If we look at daily active users, we can see a steady increase over the past two weeks. It should also be taken into account that this activity only tracks users who make transactions and does not include users who hold keys and participate in group chats, so the actual number is likely to be much higher.

The user stickiness graph is also very bullish, showing repeat use of the platform.

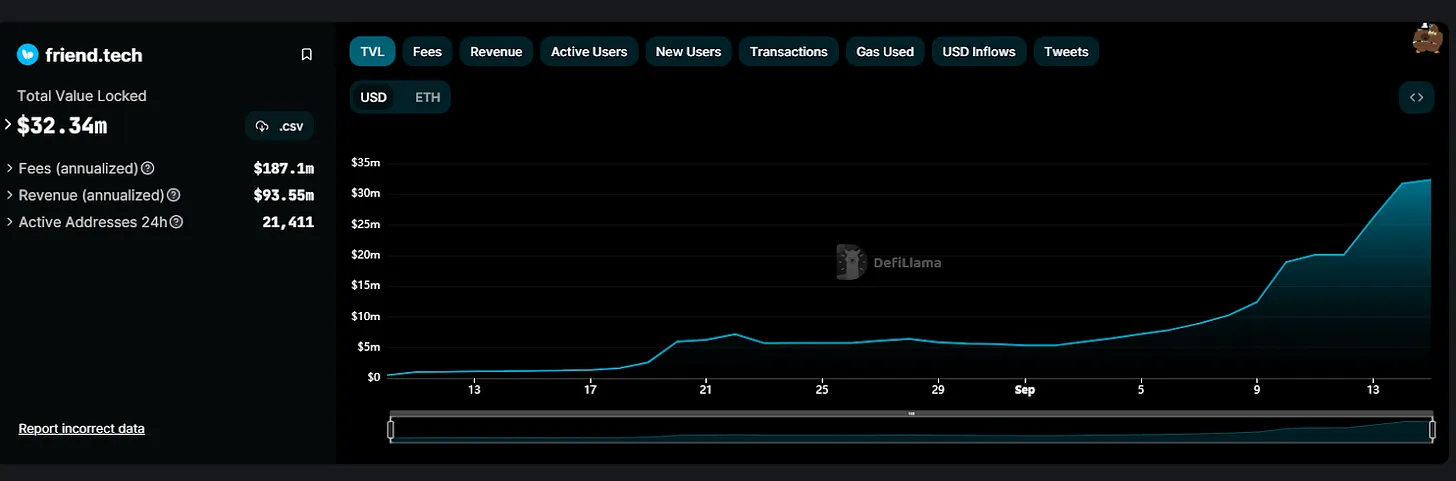

Now let’s look at TVL, which has been showing a growth trend.

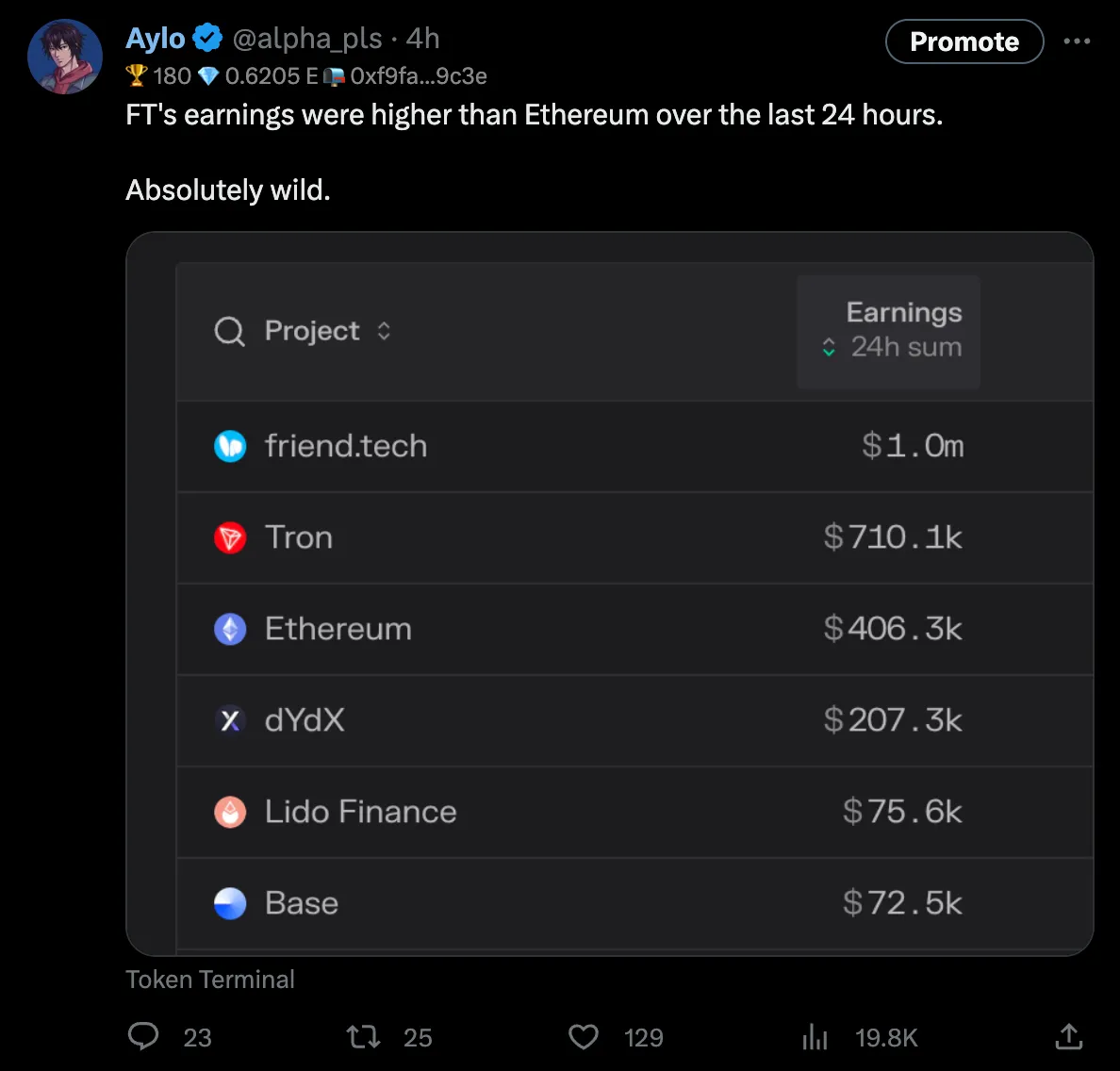

At the time of posting, it has also surpassed Ethereum in revenue over the past 24 hours.

At the time of posting, it has also surpassed Ethereum in revenue over the past 24 hours.

So what do these statistics tell us?

People are returning to the app steadily, staying longer and keeping ETH on the platform. These are very good user retention rates for a new social app and indicate strong future growth.

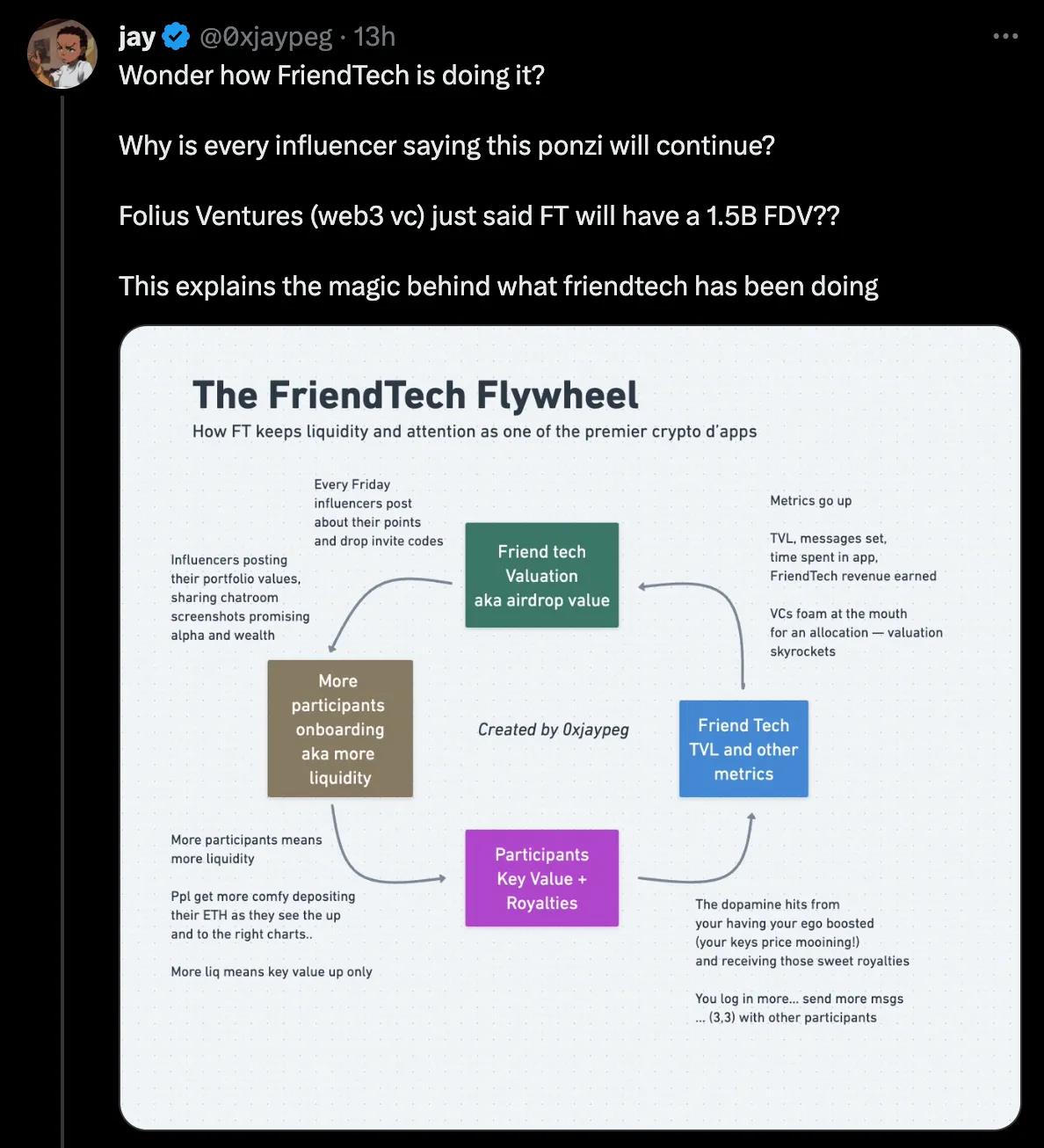

An important factor driving this retention is a powerful flywheel.

We have seen this before in DeFi applications, where mining players come in, take profits and then leave. But the large number of returning users to FT suggests something different is going on.

If a platform has no real utility, then you tend to see its TVL drop and a death spiral begin. FT exhibits stickiness. FT suggests it might actually have enough utility to stick around for a while.

FT analysis and opinion

What I like about this app is that it doesn’t compete with mass social apps like X, IG, TikTok, etc. It has its own niche, which is small, private, and exclusive chat rooms. Anyone can create a small community that really values being a member of the chat room.

This is the Bonding Curve that people miss. This means that the total number of people in the room is effectively limited to a small group. This is a feature, not a bug.

For me personally, it’s really rewarding to be able to share some thoughts, deals, and information that I wouldn’t otherwise share publicly with the public. I really enjoy the chat room atmosphere with myself and many others and really make money by getting information that can't be found anywhere else.

FT is composable and you're starting to see a lot of people building on it. We will see many new products in the ecosystem - complete DeFi suites (perpetual contracts, lending, buying and selling interfaces, etc.), analysis platforms, tools to better utilize FT, etc. Many projects are already here and are getting better and better.

I don't know what the outcome will be, but it does increase the network effect of FT. It would not be difficult for the FT to launch a funding scheme to further stimulate construction around it.

FT's potential TAM (potential market size) is quite large. So far, the product seems to be marketed as a marketplace for tokenized paid groups, all of which you can see in the app. Paid groups themselves have been around as a category for a long time. They have captured this market and made it easy for anyone to set up their own group.

The potential of this application goes far beyond crypto users, traders, and enthusiasts. The music industry is rumored to be another important market entry strategy for FT. Imagine having intimate access to the world's top artists, and you can bet there are hundreds of people willing to pay for such an exclusive panel.

From a technical perspective, FT is the worst right now, but still attracts a lot of attention. As they add more features, more people will be able to find creative ways to use the platform. Being able to add video to a chat room will appeal to a completely different group of people.

Bootstrapping using Ponzi economics is the best strategy for getting a large number of people to do something quickly, but it's clearly not sustainable.

I do think FT will need to add different revenue streams for creators on the platform. Currently, you earn through Keys' sales tax. Creators receive 5% of transaction fees. However, if the Key holder wishes to hold on to it for the long term, the creator will not see any additional income. For now, they're earning airdrops and platform shares, which is great, but in the long run anyone maintaining a valuable chatroom will need clearer incentives.

Some ideas could be charging people who don't hold a Key a one-time fee to post in a room, providing limited time passes to rooms, and tipping posts. There are many options for extensions.

Since I've been relatively positive about FT so far, let me balance my opinion and discuss the things I'm not sure about:

I think 3,3 (people buying and holding each other's keys) is a ponzi scheme and eventually people will lose ETH because they bought someone else's keys at a ridiculous price, vs. that person being able to post it in their chat room The value provided is completely disproportionate.

If you get involved early you'll have good luck, but if you get involved late the consequences will be dire when people start dumping each other's keys. This will happen sooner or later.

People are buying each other's keys at outrageous valuations, and at some point in the future, those keys won't be able to prove their value. The only goal of this strategy is to accumulate the most points and hope that the airdrop will make the ETH investment worth it. Maybe it will work, but the risks are extremely high. But I can't deny that this kind of action is very beneficial to the early growth of the platform.

Indexing mirror chat is a big problem that the application needs to solve, and I don't have a good answer.

Many Alpha messages in FT chat are copied to the Internet for free.

This hurts the value proposition of the app. But that's not entirely the case, because people still value being able to interact directly with people and have keys, but it certainly also hurts the value of keys by diluting exclusivity.

As I was editing this article, I heard that the FT team had taken steps to shut it down. It will be interesting to see how this develops.

I think some of the larger accounts would have to stop sharing certain content in their chat rooms if their chats were spread out onto the internet. For many, the USP of FT is sharing content you wouldn’t normally share with a wider audience.

I think ultimately utility will be one of the most important aspects of keys, as you can't prevent a chat from being leaked, nor can you rely solely on its value.

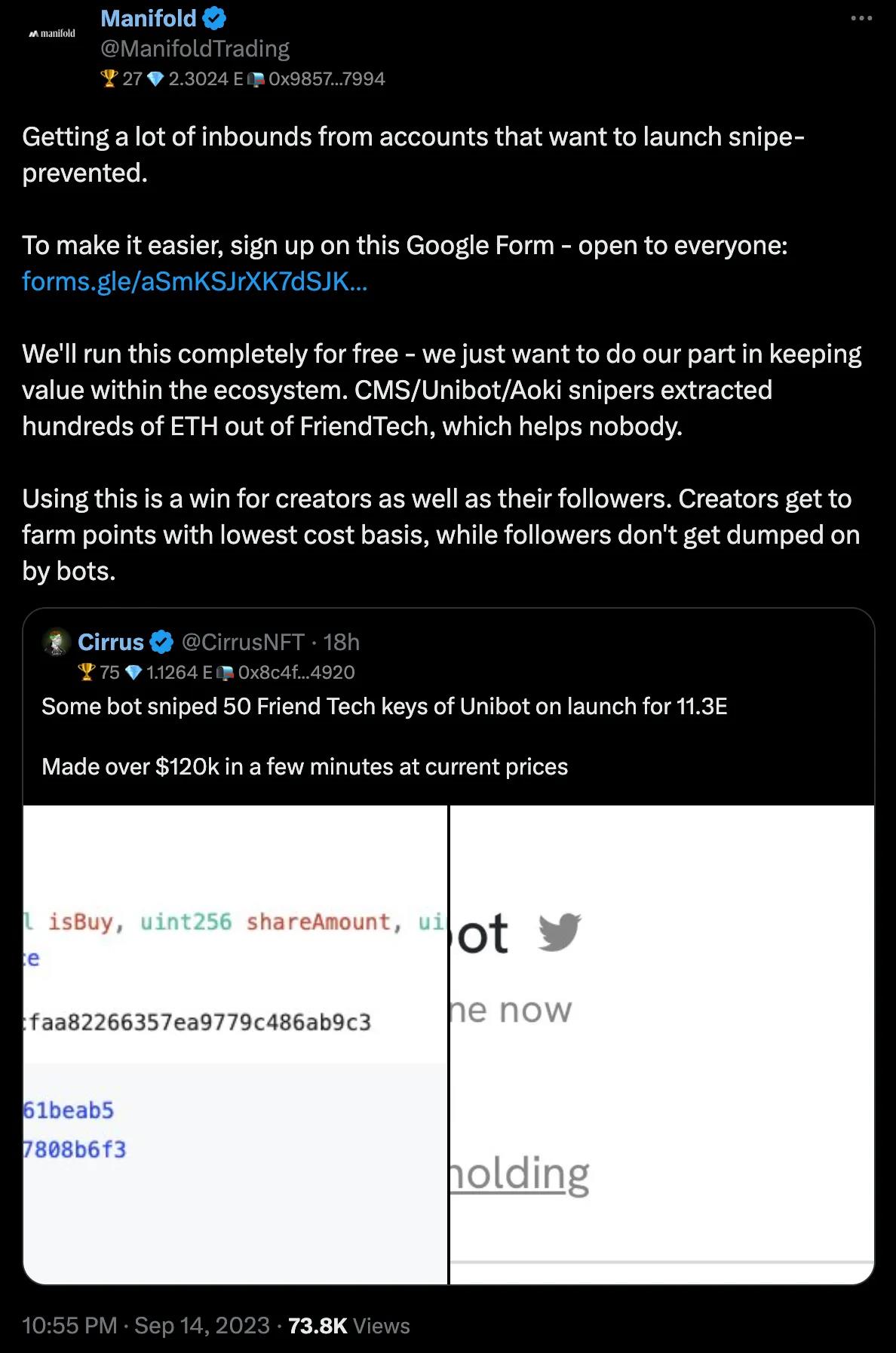

Another problem is sniping. Bots are snapping up keys, and no one has a fair chance to buy them. Although there are some solutions like:

Manifold is offering anti-crash buying services for large accounts. I still think the FT themselves need to do something about this.

I thoroughly enjoyed my time on FT, but I would say I wasn't blind to the problems I saw.

Clearly, the FT will also have to contend with potential regulation. But we can’t forget that the project is still in beta, which is exactly why a beta version is released – to find and fix issues before rolling it out to a wider audience.

Earn airdrops

Friend.Tech recently unveiled its points distribution system. People have found some ways to accumulate points:

through referral links;

The value of your own Key increases;

holdings;

Trading volume (to a lesser extent).

The platform seems to focus more on total Keys holdings and in-app daily activity. You can't just hold Keys and earn points. You must be active to earn points. It's designed to drive user behavior, create habits and increase retention.

Your point total will be announced every Friday.

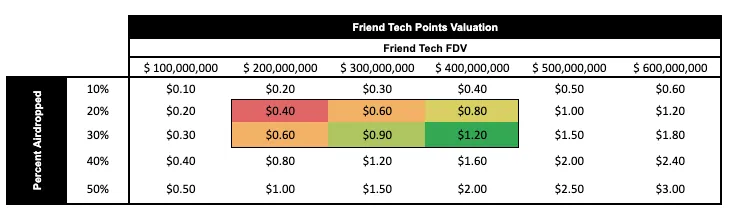

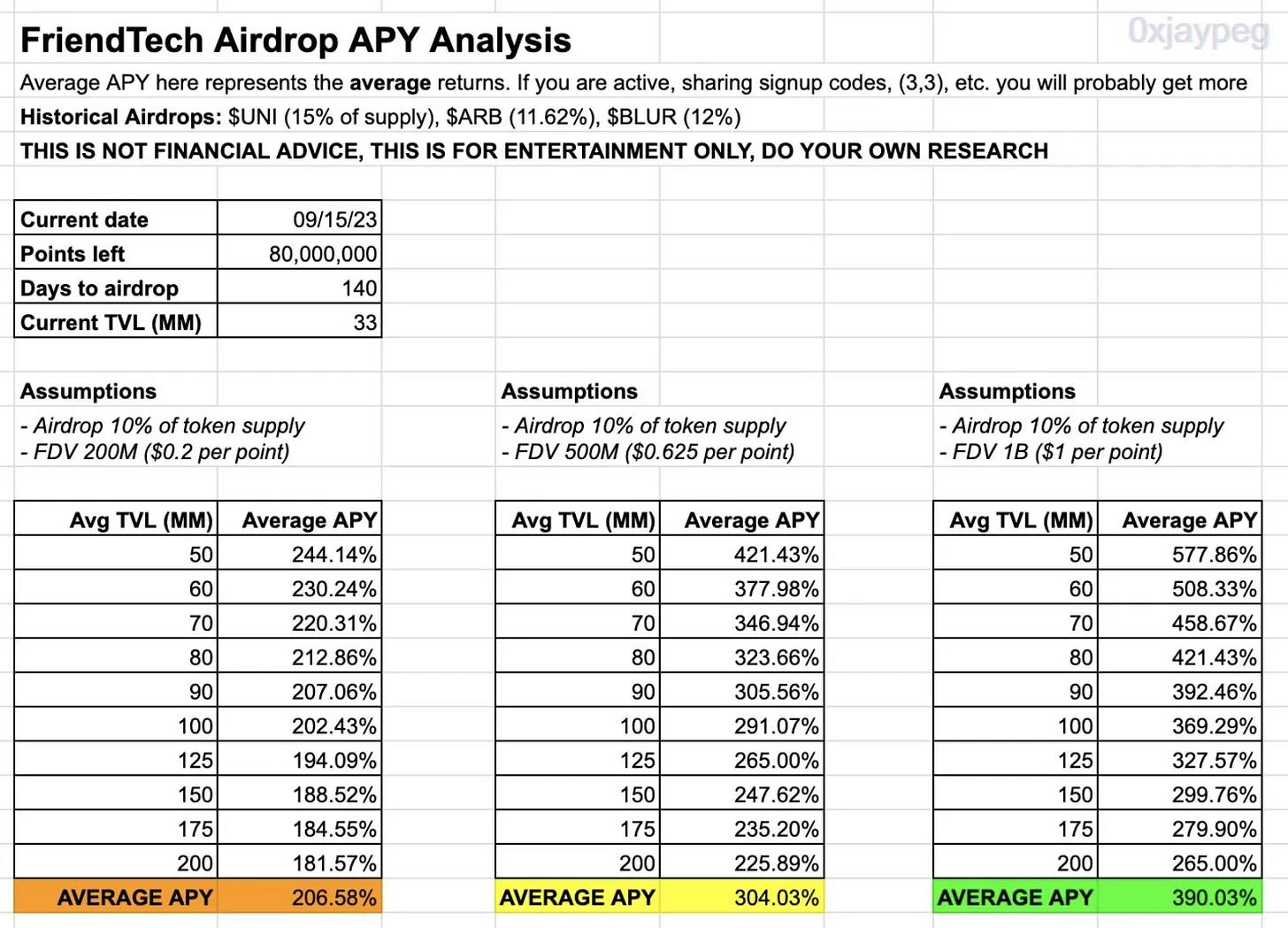

How much will these points be worth? For now we only have speculation. We don’t know the rate at which points are exchanged for tokens, the proportion of the total supply allocated in the airdrop, or the market conditions at the time the tokens were released, so it’s difficult to put an exact monetary value on points.

Some people gave ballpark figures and some guesses about the value of the airdrop based on a few different scenarios:

As you can see, conservative estimates place the value of each coin at approximately $0.5 . Not bad if you invest in people whose group chats you enjoy and get utility from.

ecosystem

Another great benefit of FT is the ecosystem of tools built to serve the community. I’ve curated a few of them to help you get started.

DeFi

PerpsTech

Perpetual contract Dex specially designed for FT. Use perpetual contracts to long or short KOL.

HyperLiquid

Hyperliquid provides a way to speculate on the FT ecosystem as a whole by trading TVL-based perpetual contracts. This is a great way to gain exposure before FT releases a token.

ERC20 wrapper for DerpDEX

DerpDEX creates a wrapper that converts FT Keys into freely tradable ERC20 tokens, allowing you to use Keys outside the FT ecosystem in any way you want.

tool

FriendTech Gems

A simple Chrome extension that overlays key FriendTech information directly in your X feed. It helps you tremendously to track the market without spending any extra time searching, very convenient.

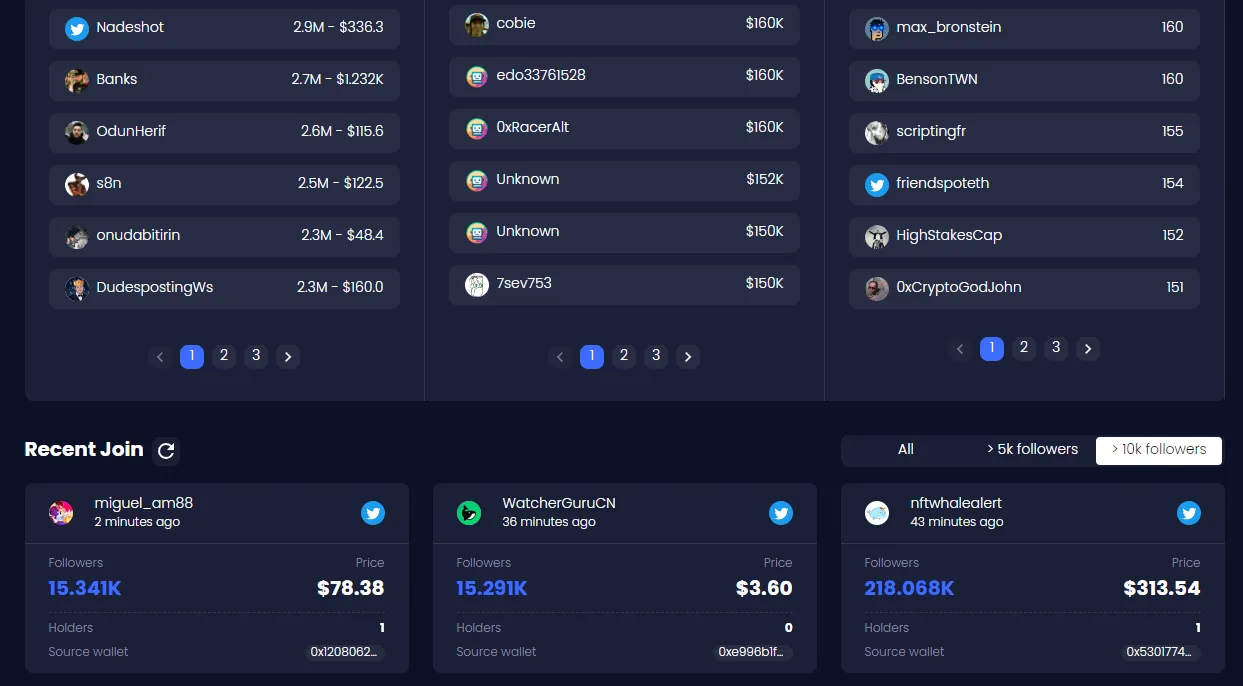

FriendTech.info

A great place to view top accounts. My favorite feature is the "Recently Joined" section where you can try to spot people before they blow up.

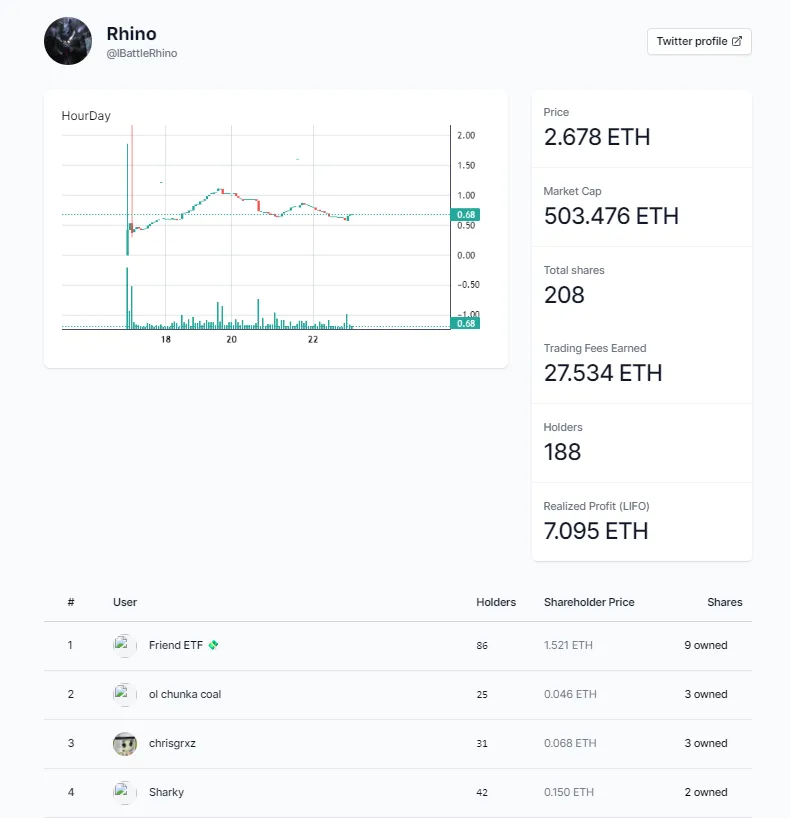

You can also get valuable information about each user and see who holds their keys.

FriendMex

This is your go-to front-end for all power users.

Friendex by Spotonchain

A clean and minimalist KOL aggregator that groups accounts by number of followers. The best feature is the ability to sort the Recently Joined section by number of followers.

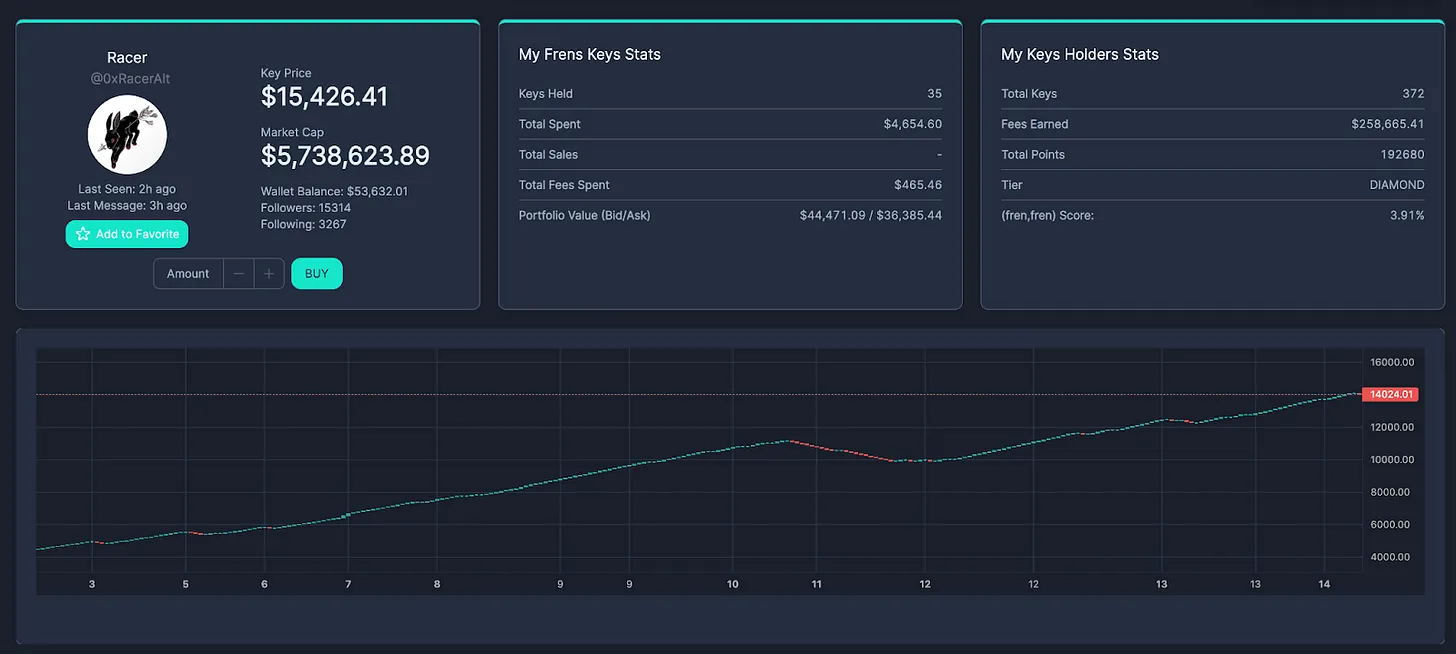

frentech.octav

Another great analytics platform that displays all statistics related to any FT account. The FT founder's market capitalization is now $5.7 million, and it would cost $15,000 to buy his Key.

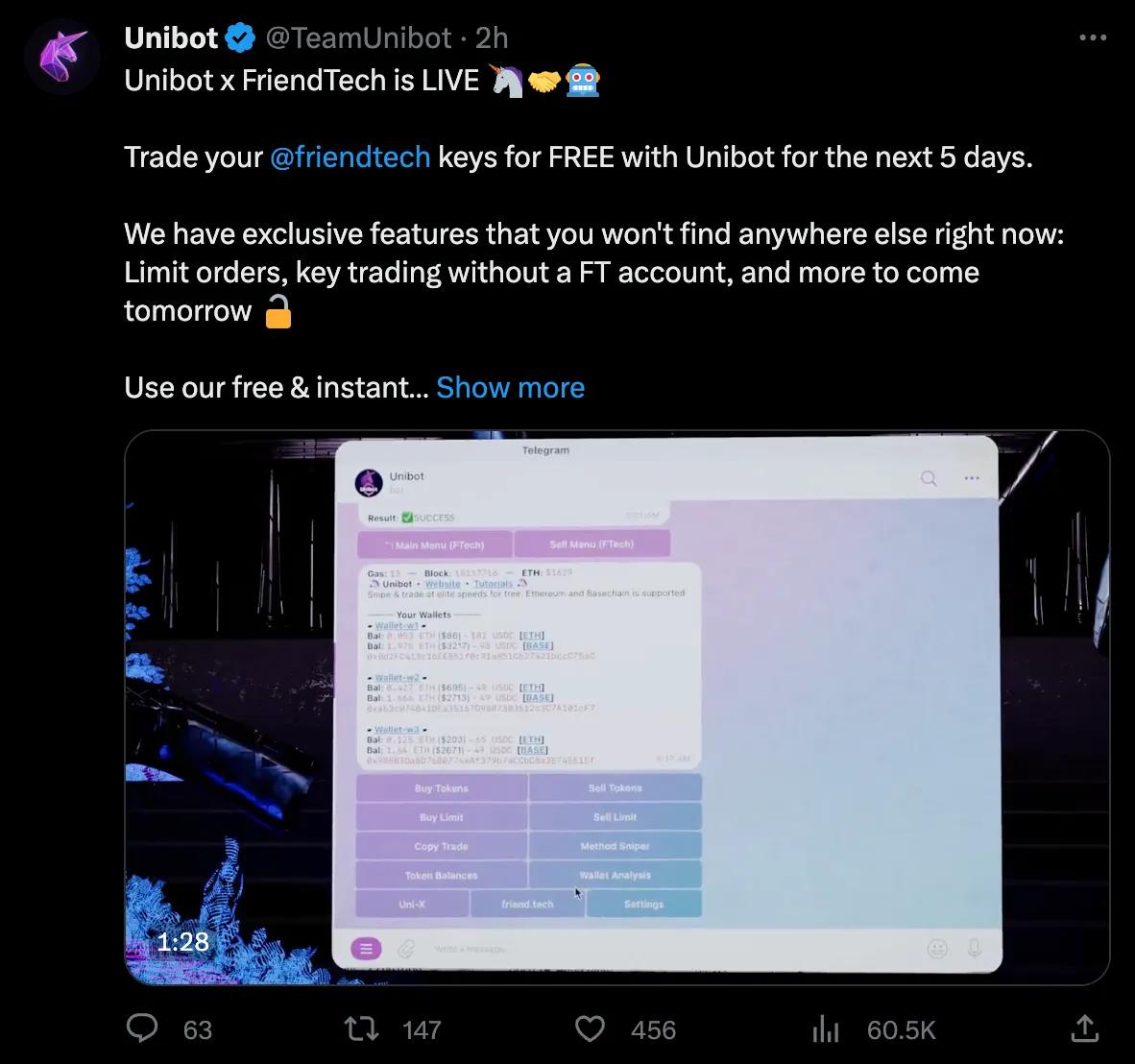

Unibot

Now that sniper bots have entered the arena, you should consider trying one out to stay competitive.

Meowl

If Telegram isn't your thing, Meowl recently added an FT option to its Discord bot.

I understand the current skepticism about Friend.Tech, but you just have to use your imagination and imagine what it could become. Most applications in this space have no future, and FT is probably no exception, but it could very well be a vehicle to attract users who don't care about cryptocurrencies.