From the prediction that Bitcoin will hit a new ATH in 2025 to Amazon agreeing to invest 4 billion USD in Anthropic, an artificial intelligence startup. Here are some outstanding news in the crypto market.

One analyst who continues to attract Watcher with his long-term Bitcoin predictions is forecasting the leading asset's direction post-halving.

Analyst Rekt Capital told his 353,800 Watcher on social media platform X that he is XEM at the 2017 and 2020 bull market cycles to XEM when Bitcoin might peak after the halving.

The halving is considered a bullish catalyst as it significantly reduces the newly issued supply of Bitcoin.

Using past data, Rekt Capital said Bitcoin could see an 18-month bull market after the April 2024 halving.

“Over the years, it took Bitcoin 518-546 days to peak after halving. If history repeats itself, Bitcoin could peak in mid-September or October 2025.”

Source: Rekt Capital

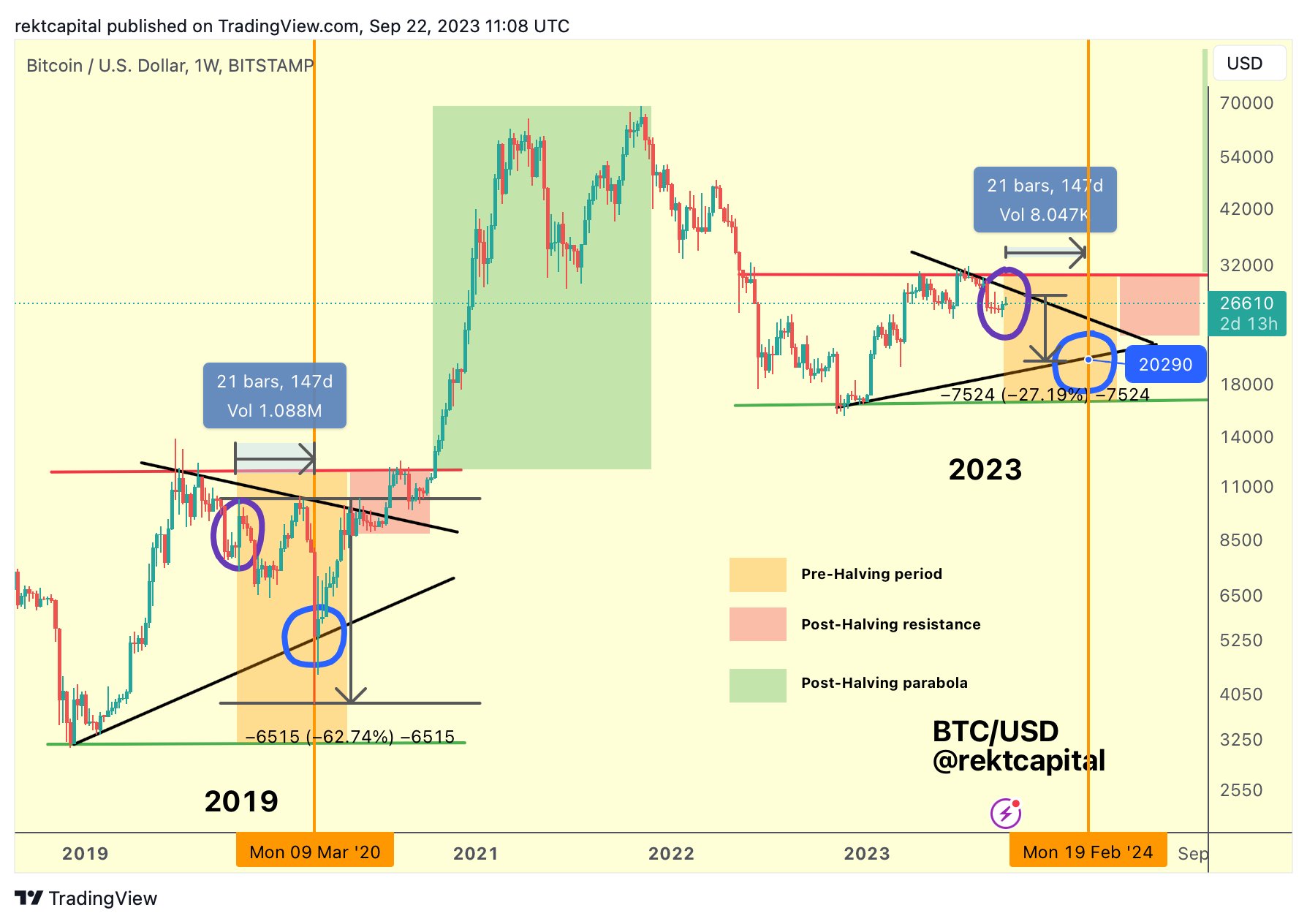

While Rekt Capital is bullish on Bitcoin prices in the long term, he warns that BTC could crash in the months leading up to the event.

“Bitcoin is 210 days away from halving. At this point in the 2019 cycle, the price has formed a lower high (purple). It then took Bitcoin 147 days to fall 62% from its higher Dip low. If this were to repeat itself in the current cycle, if Bitcoin were to form a lower high (purple), it would take 147 days for BTC to drop 27% to a Dip higher low (blue circle). That means Bitcoin could retest its higher Dip in mid-February 2024 around $20,300.”

Source: Rekt Capital

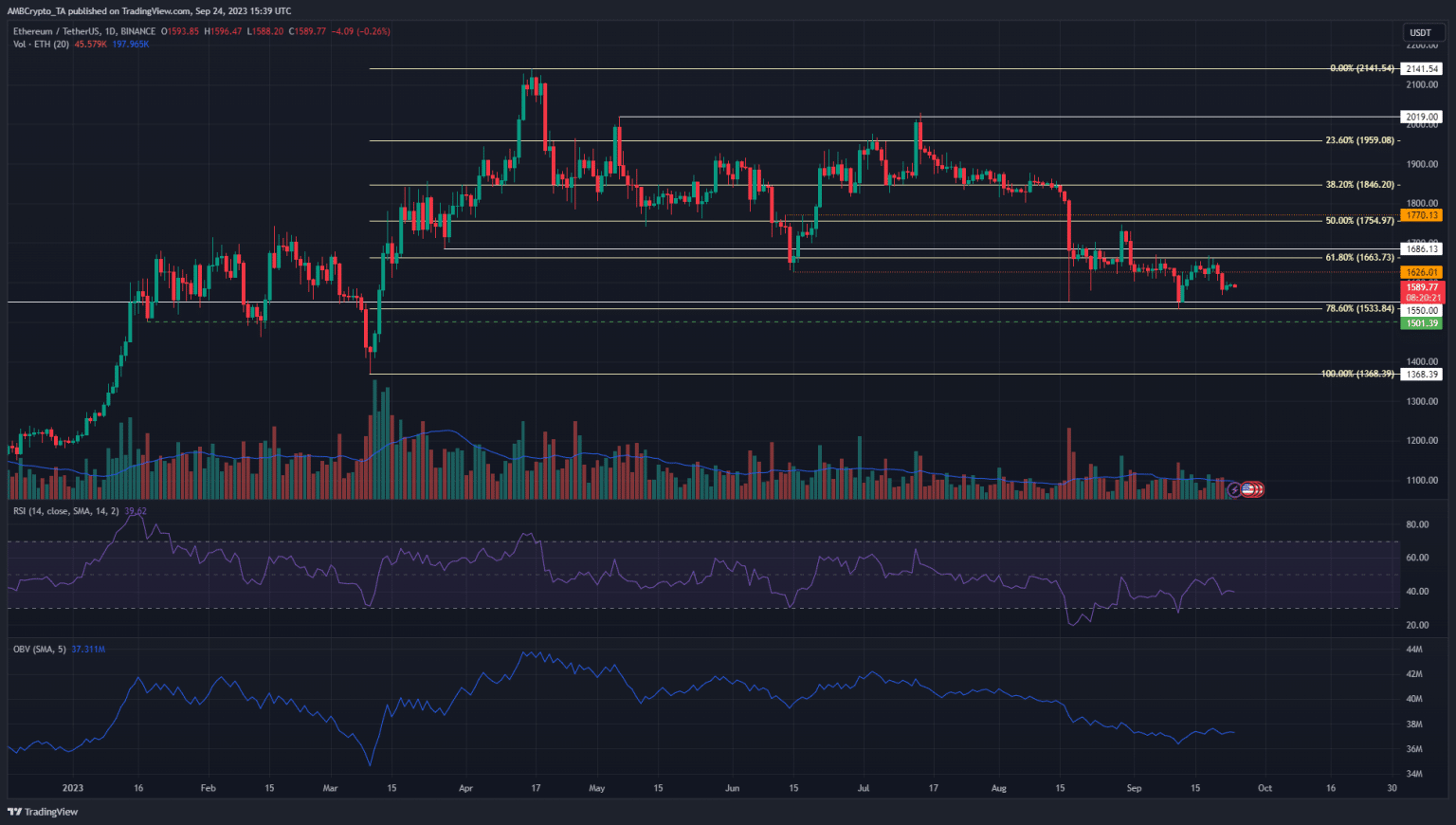

Ethereum (ETH) has been in a downtrend since early August when the price slipped below the $1850 level.

Source: TradingView

The 1-day price chart above shows that Ethereum is forming a series of lower highs and lower Dip since the beginning of August. This characterizes a downtrend. Fibonacci retracement levels from mid-March show $1,533 as a 78.6% retracement.

It tested as support on September 11 and subsequently, ETH bounced to the $1,663 resistance level. The bulls failed at this level and the price turned down in the past few days. As a result, the market structure tends to be bearish on lower time frame charts such as the 4-hour.

The RSI has been below the neutral level of 50 on the daily chart since mid-July, signaling an ongoing downtrend. OBV also has no intention of breaking the downtrend from June, which means buying pressure remains weak.

Therefore, although the $1,533 level is technically significant and close to the $1,500 psychological support level, buying ETH in this area still carries risks.

Ripple's David Schwartz recently clarified allegations surrounding false information made by a user on platform X (formerly Twitter).

Users imply that the protocol behind XRP is centrally designed to disproportionately empower and enrich the top 1% of investors.

Rejecting claims of centralized wealth creation, Schwartz emphasized that XRP is structured to empower anyone who wishes to use the ledger to track ownership and exchange of assets.

The Ripple CEO firmly rejected the notion that the protocol was created with a design that only benefits large investors, emphasizing the universality and accessibility of XRP applications .

Ripple increases staff recruitment

According to recent announcements , blockchain company Ripple is increasing its workforce, with a primary focus on Canada. The company is also hiring in London, Singapore, Australia and elsewhere.

Accordingly, Ripple is looking for multiple employees for its Toronto office, focusing on Vai such as Principal Engineer in different fields; Senior Software Engineer specializing in Machine Learning and Data Platforms, as well as many other management positions.

They are also looking to hire individuals in more specialized Vai , including those involved with the RippleNet payments network and technical program management. In addition, the company has posted recruitment information for interns and is looking for human resources with expertise in cloud network architecture and IT system engineering.

Binance Coin (BNB) price saw a rejection from the $220 region on September 18. This helped the bears take control of the price action for the week. Meanwhile, the dispute between the SEC and Binance is still ongoing.

Source: TradingView

The 4-hour chart shows that BNB 's market structure is bearish. It has been trading in a range of $204 to $221, with the midpoint at $212.7. This level has been retested as resistance in recent days.

The Dip in the range also coincided with bullish order blocks. Therefore, the $204 area is expected to provide solid support and demand will likely force BNB to rally on a retest.

The RSI indicator does not support this conclusion as it continues to show that the downward momentum is still maintained. Meanwhile, OBV has been trending down since September 19 and is a sign of weak buying pressure over the past few days.

In the case brought by the US Securities and Exchange Commission (SEC) against the TRON Foundation, Justin Sun and Rainberry enterprise, the judge agreed to extend the defense period.

Sun now has until December 8, 2023, to give its attorneys the opportunity to “find a workable resolution of the SEC's claims against defendants before making a motion.” .

In March 2023, a legal storm hit Justin Sun, the TRON Foundation, the BitTorrent Foundation, and an organization called Rainberry.

The SEC blacklisted Sun, accusing him of masterminding the manipulation of TRX's market value. According to a court order on September 14, 2023, both Sun and Rainberry's legal representatives asked the court to allow more time to defend.

BONE has seen on-chain growth of up to 1,300% as it nears the critical phase of contract abandonment.

According to data from on-chain analytics firm IntoTheBlock, BONE is seeing large holder Capital increase 1,300%, reaching 30.17 million BONE on September 24, a significant jump from 509,520 BONE on the day yesterday.

Shibarium has reached a total of 3,131,328 transactions; 1,250,604 wallet addresses and 812,508 total blocks.

There are currently 12 validators on Shibarium, with 28,047,502 BONE authorized.

Amazon has reportedly agreed to invest $4 billion in artificial intelligence startup Anthropic, as the e-commerce giant steps up competition with Microsoft, Meta, Google and Nvidia in the burgeoning AI sector. develop.

Initially, Amazon will inject $1.25 billion to buy a minority stake in Anthropic. Like Google's Bard and Microsoft-backed OpenAI's ChatGPT, Anthropic has developed its own AI-powered chatbot called Claude 2.

Anthropic was founded in 2021 by former OpenAI researchers after raising $124 million in initial Capital and aims to develop artificial general intelligence (AGI) with strict safety measures.

Join Bitcoin Magazine's Telegram: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine