Like traditional securities, virtual asset exchanges developed based on blockchain technology experienced rapid development and lack of effective supervision in the early stages of the industry. In addition to the various blockchain project developers blessed by the aura of technology and the myth of wealth creation, there are also shocking cases of exchanges being attacked by hackers, internal theft, and even abnormal business entities causing investors to lose their money. The previous FTX incident and the recent JPEG incident have also proved that the lack of effective supervision will seriously hinder the healthy development of the industry and will also breed various illegal behaviors. Compliance supervision is urgent, and the certainty of supervision will also greatly boost industry confidence.

However, similar to other emerging industries, business development always precedes supervision. In other words, the lack of supervision is not due to the lack of willingness of the authorities in various countries to manage it, but to the unification of industry perceptions, the improvement of supporting facilities, and the maturity of the regulatory framework. Time to settle. Happily, we are seeing these conditions gradually mature. On December 7, 2022, the "Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Bill 2022" was passed by the Hong Kong Legislative Council to implement the virtual asset service provider licensing system that will be implemented on June 1, 2023 . Licensed institutions becoming an important part of virtual asset exchanges means incorporating virtual assets into one of the forms of wealth recognized by mainstream society, thus bringing more incremental funds and liquidity to the industry. As an institution that wants to seize the spotlight in the compliance market, establishing a compliant exchange with a VASP license in Hong Kong will become an important opportunity that cannot be ignored.

Web3 compliance is a systematic project that involves many aspects such as the operational level and the technical level. First of all, only qualified large-scale virtual assets and only non-security currencies can be open to retail investors, and currently the exchange cannot engage in derivatives such as contracts after being licensed. In order to comply with the license requirements, exchanges must formulate and implement reasonable currency listing review rules and conduct due diligence on the project team, liquidity, technical security, regulatory status, etc. of the proposed currency listing. At the same time, Hong Kong regulatory authorities require exchanges to comply with compliance policies such as KYC/AML/CTF that comply with anti-money laundering legal requirements. In line with international anti-money laundering rules, exchanges also need to review cross-platform transfer transactions of virtual assets in accordance with the "Travel Rule" to further prevent criminals from using virtual assets to engage in illegal and criminal activities. In addition, the Hong Kong SFC will also review and supervise the exchange's organizational structure, suitable candidates, financial funds, etc.

These contents and requirements are not easy for an exchange that specializes in transaction management. Not to mention the manpower and material resources spent on repeatedly exploring various needs in the design stage, and the lengthy cycle of development, implementation and verification of usability. It is very likely to lead to missing the golden opportunity to enter the market, and compliance efficiency is very critical. After solving the complicated public chain characteristics, managing the massive addresses and private keys of hot and cold wallets, and building a trading system that meets the requirements, how to conduct KYT/AML will also be a key issue that needs to be solved.

Based on more than 10 years of service in financial risk control and compliance system construction, the ChanAegis team provides KYT/AML products and solutions for Web3 compliance customers, which can help customers quickly implement the construction and implementation of KYT/AML systems, reduce compliance costs, and improve Compliance efficiency. Through simple system connection and configuration, customers can meet the relevant requirements for virtual assets KYT/AML in the Hong Kong government's "Guidelines on Combating Money Laundering and Terrorist Financing".

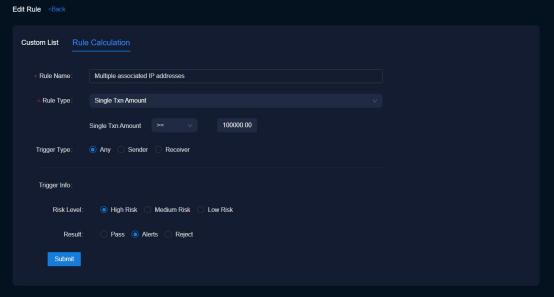

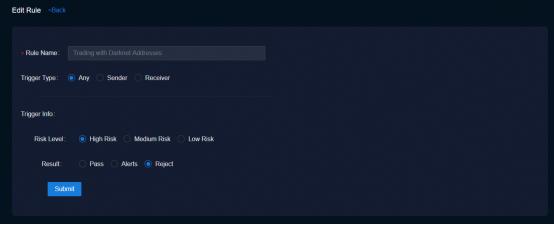

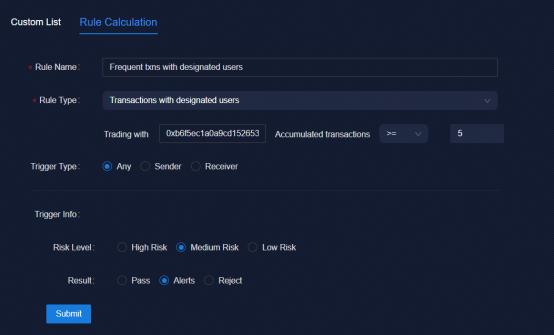

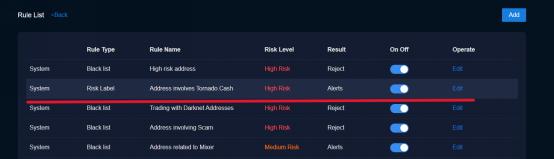

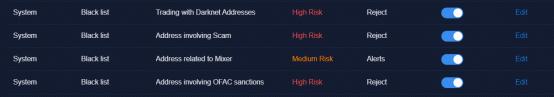

1. Rule Configuration

Rule Configuration supports multiple rule type templates and custom rule configurations. It also has built-in rich risk tags and blacklist data sources to monitor transactions within the platform in real time to ensure compliance with compliance requirements.

Rule Example 1: The customer frequently changes the IP address or device used to access the financial institution's platform and/or conduct transactions within a short period of time (such as within a few hours);

Rule Example 2: Customers enter the financial institution’s platform and/or issue transaction instructions from IP addresses that may have higher risks (such as IP addresses that meet the following description);

Rule Example 3: The purchase and sale of virtual assets has no obvious purpose, or the nature, scale or frequency of transactions appears unusual;

Rule Example 4: Virtual asset transfers that have always been associated with chain jumping;

Rule Example 5: Virtual asset transfers to and from wallet addresses with higher risks (e.g. wallet addresses directly and/or indirectly associated with illegal or suspicious activities/sources or designated persons);

2.Risk Warning

Risk warning can timely grasp the current transaction risk dynamics within the platform, conduct comprehensive quantitative risk statistical analysis of transactions and addresses, locate clear transaction risk characteristics based on statistical data, assist users in decision-making and optimize regulatory rules.

3.KYT Report

Through real-time monitoring of transactions within the platform, penetrating analysis of the addresses of both parties in each transaction, and an advanced rules engine, we provide users with professional and comprehensive address risk portrait reports. It not only outputs the transaction data overview and risk profile of the address, but also outputs the risk transaction behavior characteristics and graph visual analysis results of each address, comprehensively grasping the address transaction risk situation and supporting review.

The core of finance is risk control. I believe that the certainty of regulatory compliance will lay a solid foundation for the healthy and sustainable development of the Web3 industry. Only by doing a good job in compliance, risk control, and being responsible for the safety of users' assets can we achieve stable business. Zhiyuan.

About UsSharkTeam's vision is to secure the Web3 world. The team consists of experienced security professionals and senior researchers from around the world, who are proficient in the underlying theory of blockchain and smart contracts. It provides services including on-chain big data analysis, on-chain risk warning, smart contract audit, crypto asset recovery and other services, and has built an on-chain big data analysis and risk warning platform ChainAegis. The platform supports unlimited levels of in-depth graph analysis and can effectively fight against Advanced Persistent Theft (APT) risks in the Web3 world. It has established long-term cooperative relationships with key players in various fields of the Web3 ecosystem, such as Polkadot, Moonbeam, polygon, OKX, Huobi Global, imToken, ChainIDE, etc.

Official website: https://www.sharkteam.org

Twitter: https://twitter.com/sharkteamorg

Telegram: https://t.me/sharkteamorg

Discord: https://discord.gg/jGH9xXCjDZ