In the last week, most people in the world have learned that 95% of non-fungible Token (Non-Fungible Token) have no value. But did you know that people who still follow Non-Fungible Token knew this already?

With time, you will get a feel for the market and develop a sixth sense for understanding how the market works, the factors at play and the true value. After many years of experience, we have found that the Non-Fungible Token market is cyclical, with hot periods typically lasting just a few weeks, although these periods often last several months at the beginning of the year.

During this time, most Non Fungible Tokens become completely worthless and are slowly lost. When the next cycle comes, they will be replaced by a whole new batch of Non-Fungible Token . If I were a young man who likes to bet, I think maybe 95% of Non-Fungible Token become priceless between these cycles. This number will only increase as the supply of Non-Fungible Token increases.

However, the more important story to tell about the Non-Fungible Token ecosystem lies beyond the “95% worthless” appeal that has everyone paying attention. The story is that 94% of the market value is gone. Let's ask some questions to demonstrate the importance of this.

Would you measure the stock market by the number of stocks priced at a penny or less and would you use bankrupt and failing businesses to represent the overall value of the market? If I told you that the value of IBM, Microsoft, Apple and NVIDIA has dropped 95%, would that be more important?

That's the real story of Non-Fungible Token , and it's the same story the Forkast 500 Non-Fungible Token index has been telling us all year long. The top Non-Fungible Token collections on blockchains represent the majority of the value of the Non-Fungible Token market, so measure them as a proxy of the market, just like the S&P 500 is a proxy of the market stock, is the best way to gauge the health of the Non-Fungible Token economy. The index reflects that the Non-Fungible Token market has lost nearly 94% of its value since its peak in 2022.

Most of us don't see this as bad news, especially if you think Non-Fungible Token were overvalued before. But if we measure the value of Non-Fungible Token from their peak to today, let's also measure from when Non-Fungible Token were worth absolutely nothing. When we compare the 2020 data with the incomplete 2023 data, we find some very ponderous facts.

In 2023 alone, the number of unique buyers increased by 10,100%, sales increased by 31,837%, and the number of total transactions increased by 52,304%, even though transaction profits decreased by 64,999%. Perhaps most importantly, the majority of collectors and traders remain in the Non-Fungible Token economy, even though the profits from trading are not there. People trust the technology and believe in the future that Non-Fungible Token will create.

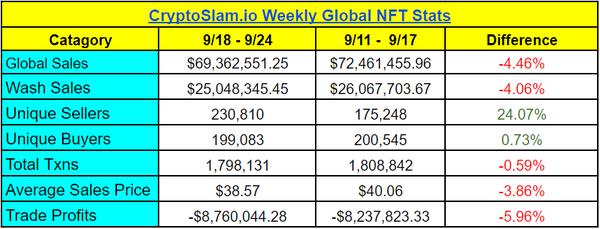

Last week was the fifth consecutive week of declining Non-Fungible Token trading sales, but similar to the previous week, there were still signs of stabilization overall. The numbers for the week remained largely similar to what we saw in May and June 2021, and the next milestone will be a drop to around $30 million to $55 million as we've seen in early 2021.

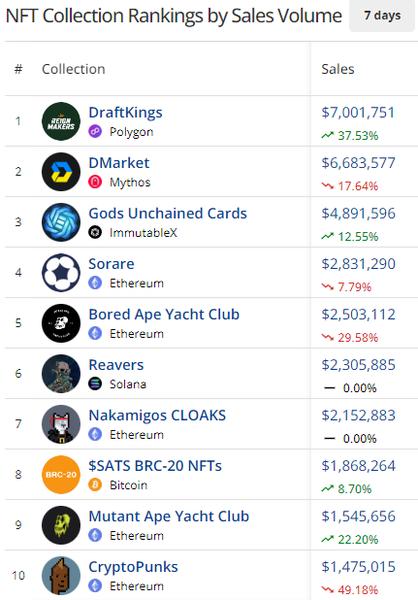

- DraftKings, DMarket, Gods Unchained , Sorare. “The Four” dominated the charts this week, representing approximately 30% of last week's total Non-Fungible Token volume .

- Reavers' new collection helped Solana for the first time since Tensorians entered the top list exactly a month ago.

- Nakamigos distributed Non-Fungible Token Cloaks to owners for free, and unregistered Non-Fungible Token were sold for 0.05 ETH. The submarket recorded excitement, with the Medium price of Non-Fungible Token sold reaching $276 on September 24.

- Bored Ape Yacht Club boasts the highest collectible Non-Fungible Token trade of the week with BAYC #3149 selling for $221,000.

- Ethereum is the true king of NFTs (sorry DraftKings), nearly selling out the other top collectibles combined for a total value of over $38 million.

- Polygon 's DraftKings has kept the blockchain platform front of mind, with 73% of Polygon 's revenue coming from the sale of sports merchandise.

- Solana has had a couple of new collections, Reavers and Clear Collectibles, that have attracted attention and transactions this past week.

- Mythos' DMarket still sees the majority of volume coming from in-game items. Check XEM S4mmy's series of articles. ETH about how CS:GO NFTs are revolutionizing the industry.

CSGO Skins are being traded on-chain.

$216 million in secondary sales Volume has been realized to date.

(1/8) pic.twitter.com/SzVJNCUCTp

— S4mmy. ETH (@S4mmyEth) September 22, 2023

Bitcoin Ordinals creator proposed changing the Ordinals numbering system along with replacing BRC20 with new values called Runes. This brings the very important activist community into the debate, as the impact could affect the value of existing collectibles.

General Bitcoin News