The BRC-20 protocol sparked a meme coin craze that clogged the Bitcoin network. Due to the blockage, daily minting fees hit an all-time high starting in May 2023.

Original author: [email protected]

Original source: web3 Chinese

The Bitcoin ecosystem has seen crazy growth this year. First Ordinals, then the BRC-20 token took the crypto industry by storm, with the market value of BRC-20 reaching $1 billion in just two months. BRC-20 allows for the minting and transfer of fungible tokens via the Ordinals protocol on Bitcoin. But Rodarmor believes that the problem with BRC-20 tokens is that they spam Bitcoin with “garbage” unspent transaction outputs (UTXOs).

In his September 26 article, he explained that the BRC-20 token had “undesirable consequences of UTXO proliferation” and suggested Runes as a UTXO-based alternative.

So what improvements does this new protocol improve over BRC-20? Why did Ordinals founder Casey Rodarmor propose this new agreement? Will the proposal of the new agreement have an impact on BRC-20? In this article, we will sort out the "Runes" protocol in detail.

Why was the Runes protocol designed?

Rodarmor claims that 99.9% of fungible tokens on the Bitcoin network are scams and memes. But Rodarmor said they won't disappear anytime soon, as these tokens create a good fungible token protocol for Bitcoin and may bring significant transaction fee revenue, developer attention and users to Bitcoin.

In fact, BRC-20 transactions have received backlash from some Bitcoin developers for spamming the network. The BRC-20 protocol sparked a meme coin craze that clogged the Bitcoin network. Due to the blockage, daily minting fees hit an all-time high starting in May 2023.

Rodarmor added: “If the protocol has a smaller on-chain footprint and encourages responsible UTXO management, it may be less harmful than existing protocols.” UTXO represents the amount of cryptocurrency remaining in the wallet after completing a transaction, The balance is used for subsequent transactions and stored in the UTXO database. Bitcoin’s UTXO model plays a role in making Bitcoin an auditable and transparent ledger by preventing the double-spending problem. Rodarmor said other fungible token protocols on Bitcoin, such as Really Good for Bitcoin, Counterparty and Omni Layer, have their own issues. Rodarmor believes that these protocols have problems such as complex protocol implementation, poor user experience, garbage unspent transaction output (UTXO), and the need for native tokens for operations.

Comparing Bitcoin’s existing fungible token protocols, Rodarmor concluded that he was not sure whether such a protocol should exist on the Bitcoin network. He is concerned about the deception of these Bitcoin fungible token protocols, calling it "an almost completely irreversible pit of deceit and greed." He said that Runes based on UTXO can solve the problems caused by other alternative token protocols of Bitcoin.

Comparing Bitcoin’s existing fungible token protocols, Rodarmor concluded that he was not sure whether such a protocol should exist on the Bitcoin network. He is concerned about the deception of these Bitcoin fungible token protocols, calling it "an almost completely irreversible pit of deceit and greed." He said that Runes based on UTXO can solve the problems caused by other alternative token protocols of Bitcoin.

Runes: a potential solution to the UTXO problem

According to Rodarmor, off-chain fungible token protocols require you to reconcile off-chain data with the blockchain, creating an awkward user experience. The address-based approach does not play well with Bitcoin's UTXO-based approach, causing similar troubles for end users. Rodarmor said Runes is a simple, UTXO-based alternative token protocol with a good Bitcoin user experience, aiming to replace BRC-20, Taproot Assets, RGB, Counterparty and Omni Layer. The Runes protocol can attract more users to use Bitcoin by not relying on off-chain data, running without native tokens, and being well synchronized with the native UTXO model. Transfer of Runes: Return using OP_RETURN

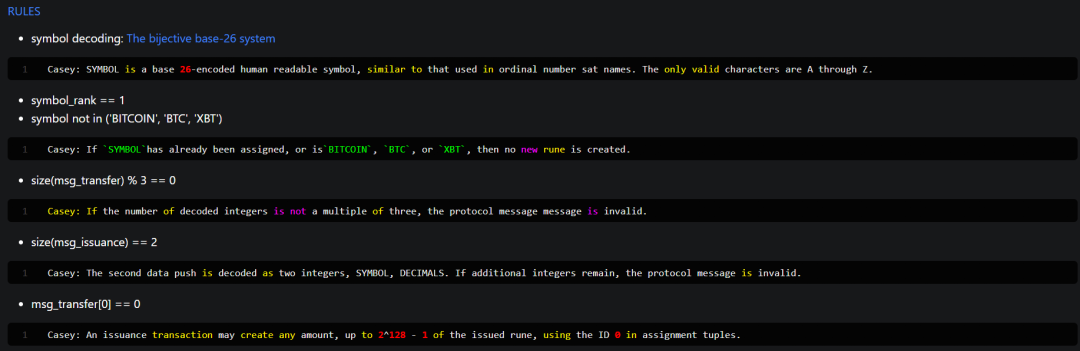

The first data output in the protocol message is decoded as a sequence of integers, which are interpreted as a sequence of (ID, OUTPUT, AMOUNT) tuples. If the decoded integer number is not a multiple of three, the protocol message is invalid. ID is the Token ID to be transferred, OUTPUT is the output index to be allocated (that is, which output is allocated to), and AMOUNT is the running amount to be allocated. After all tuple assignments have been processed, any unallocated Runes Tokens will be assigned to the first non-OP_RETURN output, and the remaining Runes Tokens can be burned by assigning the Runes protocol to the OP_RETURN output containing the protocol message.

Ordinals protocol can make transactions tricky because of the use of witnesses. For example, if you have a transaction with two inputs, each input has a signature, and each input can add additional data to the witness. So if a transaction is signed, another person signing the same transaction can add their own witness data. This means it can be signed using a set of transfer instructions, and so can other users. Runes use OP_RETURN instead of the witness part of the transaction so this doesn't happen.

This also means that the Runes and Ordinals protocols are separate. In some ways, this is beneficial: the separation between Ordinals and Runes makes development simpler without dependencies on each other. The disadvantage is that Runess cannot leverage the existing user base and the decentralization of Ordinals, making launching a node base more challenging.

Issuance of Runes: UTXO-based homogeneous token tracking

If the protocol message has a second data push, it is an issue transaction. The second data push is decoded into two integers, SYMBOL, DECIMALS. If there are any other remaining integers, the protocol message is invalid. SYMBOL is a basic 26-bit human-readable symbol similar to the one used in Ordinals names. The only characters currently valid are A through Z. DECIMALS is the number of digits after the decimal point that should be used when displaying Runes. If SYMBOL has not been assigned, the Runes Token will be assigned an ID value (starting from 1). If SYMBOL has already been allocated, or is BITCOIN, BTC or XBT, no new rune will be created.

This is what's special about the Runes protocol. Instead of linking the balance record to the wallet address, it places the record in the UTXO itself. A new Runes Token starts with an issuance transaction, specifying the supply, symbol, and scale, and allocating that supply to a specific UTXO. Any number of rune tokens can be contained in a UTXO, regardless of size. UTXO is only used to track balances. The transfer function then uses that UTXO, splits it into multiple new UTXOs of arbitrary size, containing varying numbers of runes, to send the record to others.

For example, if someone uses a UTXO of ten thousand satoshis (any number), it can contain one million satoshis (any number). If he wanted to send 100k Runes to each of two friends, he could put a tuple specifying where those runes go into the OP_RETURN of the Bitcoin transaction. Put 1 UTXO and get 3 UTXOs. Two of them will be given to friends with 100k Runes each, and the other one will be left with 800k Runes for yourself.

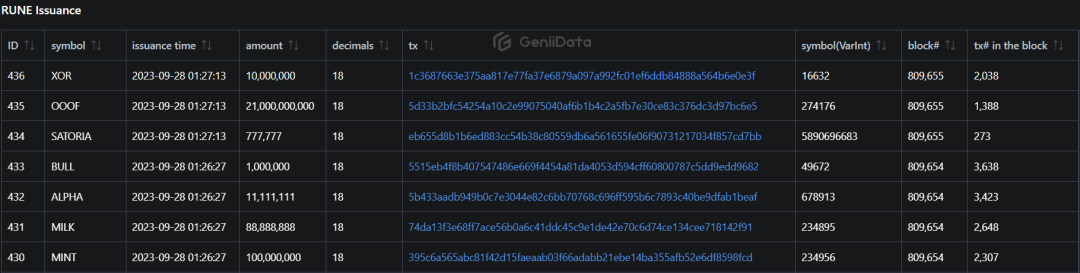

Source: geniidata

Source: geniidata

Runes VS BRC-20

The BRC-20 token mixed Bitcoin with unnecessary UTXO, causing efficiency problems, while the Runes protocol solved the UTXO diffusion problem caused by it based on UTXO. Compared with BRC-20, Runes reduces a layer of server consensus and becomes simpler. At the same time, it does not rely on off-chain data and has no native tokens. It is very suitable for Bitcoin's native UTXO model.

The core idea behind Runes is to minimize its on-chain footprint while encouraging users and developers to adopt practices that optimize UTXO usage, aiming to integrate more seamlessly with the underlying architecture of Bitcoin itself. The main advantage of Runes is its potential to promote responsible UTXO management and curb the generation of bad UTXOs that currently clog the Bitcoin network. In this way, Runes contribute to the overall health and efficiency of the Bitcoin blockchain.

Here we focus on an obvious advantage of the Runes protocol: compatibility with the Lightning Network, which is an obvious advantage over BRC-20. In short, users can add Runes to various multi-signature wallets and settle their balances to different providers. while introducing new use cases, developers, and users to the Lightning Network.

So is Runes the best solution for issuing coins on the Bitcoin chain, and can it completely replace BRC-20 and other existing alternative token protocols? I think there is still a question mark at the moment. Although Runes is implemented with the more powerful technology of the fungible token protocol on Bitcoin, BRC-20 has formed a strong network effect with holders and developers, and is constantly adjusting in real time.

The future of Runes and the vision of Rodarmor

The protocol is currently only three days away, but 436 Runes Protocol tokens have already been deployed.

Source: geniidata

Source: geniidata

Runes has huge potential, but its future remains uncertain. In a recent Twitter Spaces conversation with Ordinals Show co-host Trevor Owens, Rodarmor revealed that he only came up with the idea for Runes last week. He also expressed uncertainty about whether further development of the concept would continue.

Runes' proposal has already gained attention and support. After the conversation, Owens proposed a major incentive: a $100,000 investment from the BTC Frontier Fund. Any developer with the ability to create a functional Runes application will have access to this funding, furthering Rodarmor’s innovative proposals.

summary

While Runes is still in its infancy, the buzz it has created within the cryptocurrency community is undeniable. Against a backdrop of skepticism about Bitcoin’s fungible tokens, Rodarmor’s proposal is evidence of the ongoing search for innovative solutions. Innovators like Rodarmor play a key role in shaping its trajectory, ensuring it remains efficient, transparent and valuable to its users. Only time will tell if Runes will become the next big thing in the Bitcoin world. While many people associate fungible tokens with scams and memes, the same protocol, done right, can bring huge benefits to the Bitcoin network.