Author: Maxwell, Jessy, Climber, Jinse Finance

Who is "other people's alumnus" Zhang Yufeng?

On September 27, 2023, at the 40th anniversary of Shenzhen University, Zhang Yufeng, a 2018 alumnus of Shenzhen University, donated 50 million yuan to his alma mater in his own name.

As a bachelor's degree graduate who has just graduated one year ago, Zhang Yufeng's "great feat" attracted attention.

Social media began to discuss who Zhang Yufeng is? What does he do? Where does his wealth come from? How did he invest?

Who is Zhang Yufeng?

According to media reports, Zhang Yufeng is a student in the second class of 2018 majoring in international economics and trade at the School of Economics at Shenzhen University.

On June 8, 2022, Zhang Yufeng, who was still a senior, gave a lecture in the School of Economics titled "Interviews with Teachers and Students—The Innovation and Entrepreneurship Path of Zhang Yufeng, a senior majoring in international trade, to achieve financial freedom." The lecture included Alternative asset trading, how to balance course studies and extracurricular internship schedules, obtaining internship offers from famous companies, etc.

According to the notice of the lecture at that time, Zhang Yufeng was a partner of Singapore hedge fund ABD Venture at the time. He was mainly engaged in alternative asset investment and trading, with outstanding performance and huge profits. Alternative assets refer to assets that are different from traditional asset classes, such as private equity, hedge funds, collectibles, virtual currencies, etc.

There are rumors on the Internet that he is the son of Tencent co-founder Zhang Zhidong. But according to Zhang Yufeng’s own disclosure on social platforms, his father is a traditional printing industry manufacturer . According to what he shared on social platforms in the middle of this year, because it was difficult to do business in the traditional printing industry, under his persuasion and lending his father a sum of money, his father bought a UV printing machine, transformed into a high-end printing industry, and cooperated with Vietnam and Cambodia. Stagger the market. Finally, we received a printing order from a major player card manufacturer, and the traditional printing factory successfully transformed.

Three major sources of wealth: Solana, LUNA, FTT

Zhang Yufeng is extremely active on social media such as Jiji and X (formerly Twitter).

Jinse Finance reporters combed through the social media content released by him and found that Zhang Yufeng’s main wealth comes from cryptocurrency, and his three major sources of wealth are Solana, LUNA, and FTT.

When Zhang Yufeng was a senior in college, he entered a leading domestic CVC (Corporate Venture Capital) company as a primary market investment intern and became a full-time employee. He initially came into contact with Crypto and grew rapidly. After working at CVC, I did crypto trading privately. I found that the income and trust in my crypto industry exceeded that of traditional VC primary investment, and then I resigned and became a full-time crypto trader.

Buy Solana for $3 and hold it until the highest price is more than $200: Solana is Zhang Yufeng’s personal success from a 6-digit income. Based on the congestion and spillover effect of Ethereum, I selected Solana after screening many public chains. The price of buying Solana in early 2011 was around US$3, and I insisted on holding SOL until the highest price of SOL was more than US$200.

As a result, Zhang Yufeng jumped into the top 100 FTX traders list, and through this opportunity, he met FTX CEO SBF and entered the FTX trading department.

Short LUNA, the profit is hundreds of times: After entering FTX in March 2022, Zhang Yufeng has been following Luna for a long time and just started to be long LUNA. The contract long during LUNA's rise from $50 to $90. But when LUNA anchored Bitcoin, it smelled of blood. In May, Zhang Yufeng personally and the FTX trading department he was responsible for short LUNA at the same time, from US$86 to many decimal points after 0, with profits reaching hundreds of times. The LUNA battle helped Zhang Yufeng gain a foothold in FTX.

FTX thunder and FTT: According to Zhang Yufeng’s recollection, after Coindesk broke the news that Alameda Research was insolvent, Zhang Yufeng initially did not believe that FTX would have problems and thought it was just ordinary FUD. But after carefully studying the mutual transfers between Alameda Research and FTX, I found that FTT is very much like market making by one of my own people. After CZ announced short selling of FTT on November 6, there was a run on FTX. FTX staff could not contact SBF, and all FTX transactions were suspended. Although Zhang Yufeng did not disclose whether he was short FTT during the interview, according to the style of short LUNA for the company departments and individuals he was responsible for when he was at FTX, there is a high chance that Zhang Yufeng short FTT.

Zhang Yufeng’s other investments

According to Zhang Yufeng's personal disclosure on social platforms, he successfully buy the dips Bitcoin at a low price of about 15,800 knives in November 2022. At the beginning of 2022, long Aptos also made ten times the profit.

According to information on his social platform, Zhang Yufeng is not only involved in transactions in the crypto, but he is also involved in the investment and trading of some traditional collectibles. For example, he once spent tens of thousands of yuan to purchase one of the series of books printed by Mr. Lu Xun at his own expense and published in the name of "Sanxian Bookstore" in 1936. The current price listed on Confucius Online is 390,000 yuan.

He has also dabbled in stocks. According to his personal disclosure on his social platform , he completed opening a position when the stock price of station B was 15.8 US dollars in 2020, and began to sell in batches when the stock price peaked at 150 US dollars, until it fell to 90 to complete the liquidation in batches.

In daily life, Zhang Yufeng likes to watch racing games, basketball games, and pet dogs. He will also invest in NFT, such as holding BAYC, Aruki, etc.

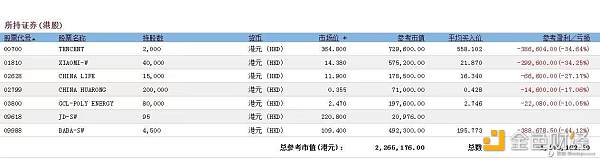

However, Zhang Yufeng also had failed investments. According to his disclosure on his personal social platform in March 2022, he made a floating loss of more than 1 million Hong Kong dollars when investing in Hong Kong stocks .

According to Zhang Yufeng in June 2022, his biggest loss in the crypto came from managed private placements.