.png)

In the last week of October, Bitcoin broke out to a new 17-month high, surpassing $35,000 amid renewed optimism over the approval of the Bitcoin ETF Spot.

Notably, the bullish move not only recorded a yearly high for BTC , but also marked a major milestone in successfully closing the price gap on the CME Bitcoin chart. This is an index that is often closely watched by traders and analysts. Because they give valuable signals about potential price movements.

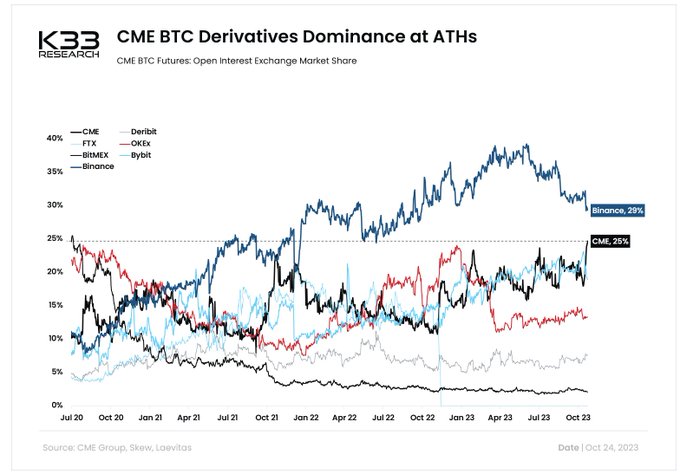

Specifically, according to Vetle Lunde, senior analyst at K33Research, Open Interest (OI) for BTC Futures Contract on CME exceeded the 100,000 BTC mark (3.4 billion USD) for the first time. In addition, CME's market share also reached an All-Time-High of 25%, approaching Binance's permanent and future market share.

CME BTC futures OI has breached 100k BTC for the first time ever.

— Vetle Lunde (@VetleLunde) October 24, 2023

While offshore perp OI shrank by 26,735 BTC yesterday, CME's OI grew by 4,380 BTC . pic.twitter.com/kjKBRYCoSX

A record rise in BTC Futures Contract statistics on CME signals a new era in which major players (especially traditional institutions) are increasingly embracing Bitcoin trading, even , they also race to buy Bitcoin.

CME's market share has increased to a new All-Time-High of 25%, quickly approaching Binance (Perps + Futures)

Besides, on October 24, CME also reported that daily volume of cryptocurrency Derivative skyrocketed in the third quarter of 2023, reaching 1.8 billion USD in the past 24 hours, with 10,942 The contract is worth 5 BTC per contract.

.png)

CME Bitcoin volume . Source: CryptoCompare

Furthermore, thanks to strong buying pressure in Asia, Hong Kong's CSOP Bitcoin ETF achieved volume of $22.37 million with Capital of $17.64 million - a record for both volume and Capital . enter. Previous daily revenue was between $125,000 and $250,000.

It is known that Chicago Mercantile Exchange (CME) is the world's leading Derivative market, with a history of 125 years. CME's managed and cash-settled Futures Contract have long been popular with institutions that want exposure to cryptocurrency but don't want to actually own it.

On the Open Interest side (Open contract volume, this is the total buy/sell position hanging in the market, helping investors determine psychology and Capital circulation in the market.

Therefore, the sudden increase in Open Interest shows that the money flow into the market is increasing. However, this is not an official indicator to predict price increases, but an increase in Open Interest is still considered a good signal for investors.

VIC Crypto compiled

Related news:

The head of CME's disastrous "slip of the tongue" statement on Fox News

The head of CME's disastrous "slip of the tongue" statement on Fox News

Bitcoin remains resilient in the face of global instability

Bitcoin remains resilient in the face of global instability

Searches for the keyword “Bitcoin ETF Spot” peaked on Google

Searches for the keyword “Bitcoin ETF Spot” peaked on Google