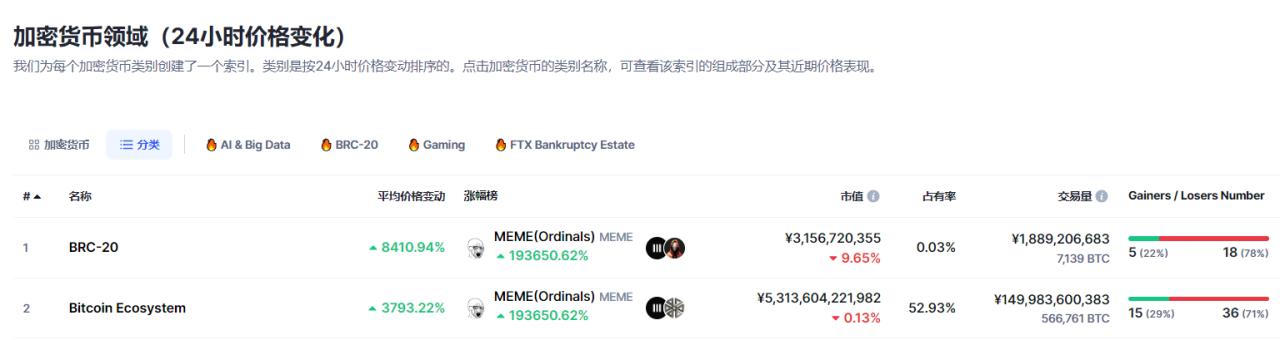

The highlight performance of the BTC ecosystem this year can be said to be one after another. Various new native protocols are emerging one after another. The ecosystem surrounding protocols such as Ordinals , Atomics, Stacks , RGB, etc. is rapidly enriching. There are many potential projects worthy of attention. Worth sharing with everyone. More importantly, the recent strong performance of Bitcoin has occupied the hot spots in the market and attracted more capital inflows. BRC-20 and BTC ecological tokens have experienced sharp rises, and there are many investment opportunities. In this issue, we will conduct an analysis of the pros and cons of investing in the BTC ecological market at this time, and share an inventory of potential Defi projects.

Image source: Coinmarketcap November 21, 2023

Analysis of Bitcoin Ecological Advantages and Disadvantages

advantage analysis:

1. Market hot spots

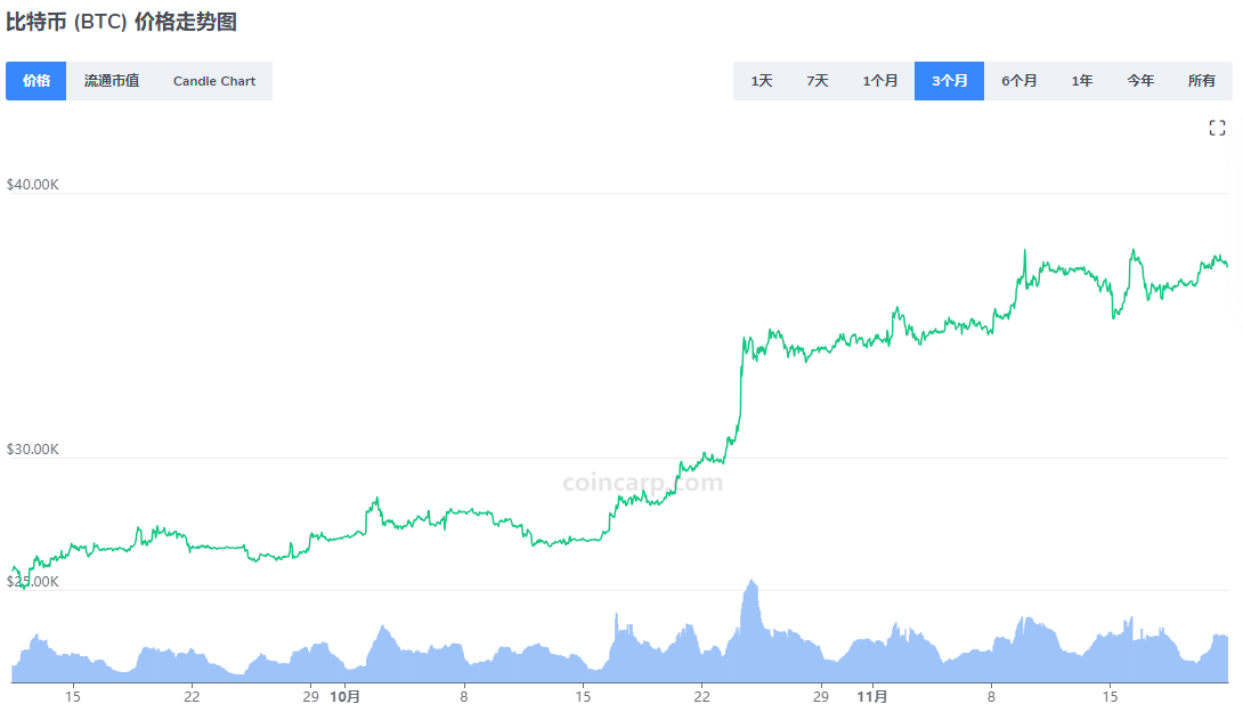

Since the price of Bitcoin has risen strongly from $25,000 to $37,000 in more than a month, it has increased by more than 40%. This rising trend is enough to attract market attention in the short term. Whether it is professional investment institutions or a large number of retail investors or speculative players, a large amount of capital has entered the BTC ecological track.

2. Market hot money & market newcomers

The attention and discussion caused by the continuously rising BTC price has introduced a large amount of capital to projects in the BTC ecosystem. When these capitals enter the BTC ecosystem, they not only help promote the development of existing new projects, but also provide support to projects that are incubating. most needed nutrients. And with this year's new concepts such as Ordinals and BRC 20 after half a year of market testing, the surge in this wave of ecological tokens has also allowed more newcomers who had previously adopted a wait-and-see attitude to enter the market with market confidence. The growth of funds and players makes the entire BTC ecosystem operate in a healthy cycle, and can also make the entire ecosystem more sustainable.

3. Upgrading of existing protocols & emergence of new protocols

The BTC ecosystem has emerged from innovations such as the Ordinals protocol and BRC 20 tokens at the beginning of the year, which have activated the BTC ecosystem. Subsequently, BTC ecological protocols such as ORC 20, Atimicals, Stacks, Lightning Network, RGB, Taproot, BRC 100, BRC 420, Rootstock , BEVM, etc. have assisted the ecological development. It can be seen that the ecosystem is very vital and is in an active development stage. This time multi-dimensional power is injected into the Bitcoin chain, it is foreseeable that more new protocols will emerge, and more protocol plans can be advanced as planned. For example, tokens can be issued smoothly, Defi liquidity will be more abundant and stable, and trading pairs will be more stable. Rich, Gamefi can really run and attract more players, there are more types of NFTs and explosive items, and the infrastructure is constantly improving, etc.

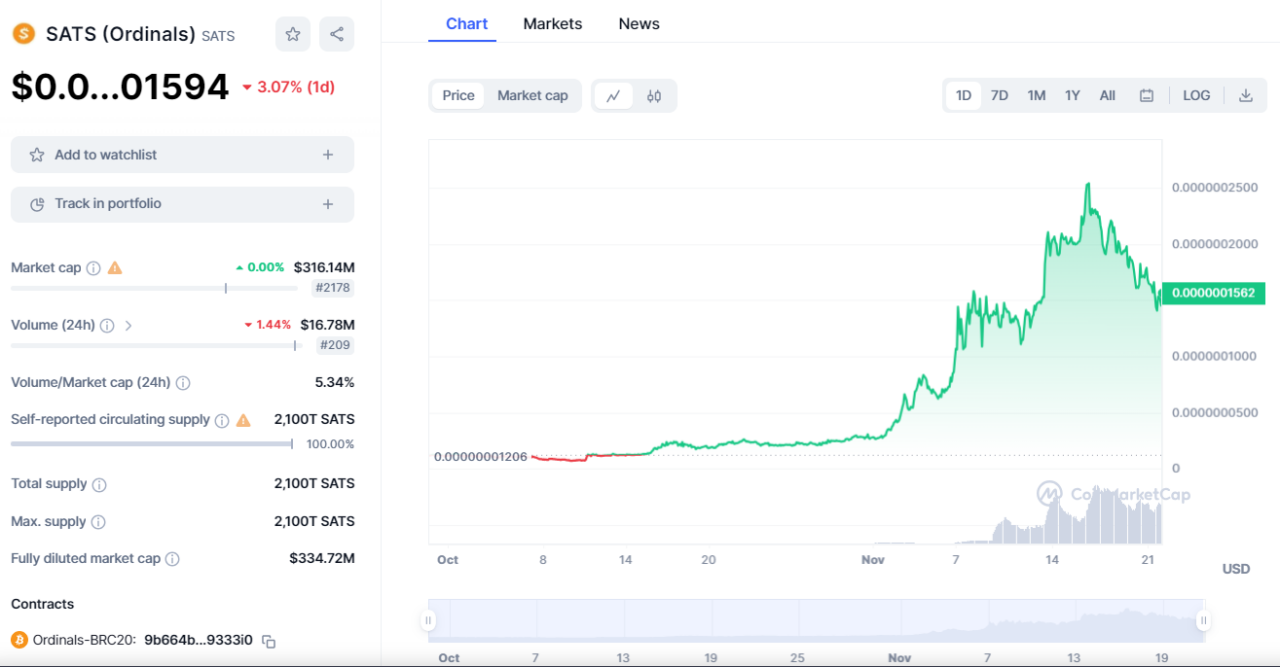

4. Small investment and big return opportunities

First of all, the threshold for participating in investment is low. This advantage is more common in the BTC ecosystem, because many gameplays are brand new, such as the initial inscription carving. Players can easily experience the latest gameplay, and can also participate as an investment behavior. in. For example, for players who participated in mint SATS tokens, the price has increased 10 times so far, and the highest price has increased more than 15 times. Compared with projects participating in established ecosystems, such high-yield opportunities are indeed rare. The BTC ecosystem is in a new stage of development, and new protocols and new ways of playing are emerging one after another, bringing renewed excitement and more opportunities to the crypto.

Risk Analysis:

1. In the early stages of ecological development, the infrastructure is not perfect, and basic operations such as hardware deployment are difficult and costly, and most of the transactions that can be realized still need to be conducted offline OTC;

2. Indirect security issues, due to the use of offline OTC transactions, there are risks and scams;

3. The user experience is poor. Most new protocols require a lot of waiting time for placing orders, and transactions are blocked for a long time;

4. When will the popularity and market hot spots recede? Once the price of BTC drops, the impact on the ecology and bubbles are issues that need to be carefully considered.

Highlight project sharing

1. ALEX

ALEX is an open source Bitcoin DeFi platform based on the Stacks ecosystem. It is currently one of the most important protocols on Stacks. As of the date of writing, the TVL on Stacks has reached 18 M, and ALEX’s TVL occupies 14 M. The products provided by ALEX include Credit launchpad, DEX, order books and futures contracts. It is like Uniswap on the BTC chain, allowing users to swap, pledge, lend and liquidity mining on the Bitcoin chain in a completely decentralized manner. .

As a Defi platform, ALEX also offers liquidation risk-free lending, which provides users with a safe way to lock their assets in contracts to earn interest or perform other financial operations without having to worry about market fluctuations. Liquidation Risk.

In the future, with the development of the Stacks platform and the iteration of Bitcoin technology, more and more projects will be built on Stacks. The Launchpad service provided by ALEX provides a place for these projects to start. This is a very forward-looking feature that will greatly increase the sustainability of the development of the ALEX platform.

ALEX has launched its own project governance token $ALEX, with a current market value of US$36M and a circulation of 600 million. This action also provides users with the opportunity to participate in the platform and enjoy the potential value-added in the future. The project previously raised US$5.8 million in November 2021 and US$2.5 million in March 2023, for a total of US$8.3 million.

2. Arkadiko

Protocol Arkadiko is a decentralized liquidity protocol based on Stacks. The focus of this project is that every ecosystem needs a decentralized stablecoin, and Arkadiko is a stablecoin project of the Bitcoin Stacks ecosystem.

Through Arkadiko, users can use their Stacks’ native token $STX as collateral to mint Arkadikos’ own stablecoin USDA, and the project also supports Swap and lending. USDA can be used to farm within the Arkadiko protocol to repay loans, and the proceeds from the farm are generated by participating in the Stacks consensus mechanism called Proof of Transfer (POX).

Related URL: https://app.vedao.com/projects/4739bc9a8ecb74dc8f25e46080a18c091adc2c0784a4dbaf88d6c8ba1f615559

3. Sovryn

Sovryn is the first non-custodial smart contract application for Bitcoin lending and margin trading on the Rootstock network. Sovryn is not a traditional Ethereum DeFi model, allowing its users to borrow, lend, and leverage Bitcoin’s inherent assets without sacrificing key custody. At the same time, users have a direct say in the development and governance of the Bitocracy system protocol. Sovryn also introduced EVM-compatible Ethereum-style smart contracts for Bitcoin, which is a very important innovation because developers believe that Bitcoin is the center of cryptocurrencies, with more users and more liquidity, and is used by major institutions.

Sovryn provides users with the following specific services:

- Lending pool: users are able to earn interest by lending their tokens to borrowers and margin traders;

-Margin trading: users can create long and short trades with leverage up to 5x;

- Spot exchange: The platform acts as an automated market maker (AMM), allowing instant trading between different tokens at low cost and low slippage;

-Fast BTC relay: Users can instantly leverage Bitcoin from smart contracts and other decentralized products using any BTC wallet.

The project owns token SOV , with a current market value of $11 million and a circulating supply of 37 million. The project had raised US$2.1 million in financing in 2020, three financings of US$2.5 million, US$10 million and US$9 million in 2021, and US$5.4 million in 2022, for a total of US$29 million.

Related websites: https://app.vedao.com/projects/d58aeeb08941cc23cac2a10b7b0ad001af4ca82d12ba6fddc6272aeb97e7a631

4.MoneyOnchain

MoneyOnChain is a decentralized, Bitcoin-backed stablecoin protocol built on RSK. Powered by Bitcoin, the protocol consists of four tokens and offers Bitcoin holders several use cases, including leveraged Bitcoin operations.

-The first token is Dollar on Chain /span> Dollar on Chain (DOC) is a cryptocurrency launched in 2019 and runs on the RSK RBTC platform. View more /span> Dollar on Chain (DOC) is a cryptocurrency launched in 2019 and runs on the RSK RBTC platform. View More (DOC) is a cryptocurrency launched in 2019 and runs on the RSK RBTC platform. DOC is a stablecoin pegged to the US dollar. Users can quickly send and receive any amount of DOC.

-The second token is BitPRO (BPRO), which is specifically designed for Bitcoin holders to earn passive income on their tokens. BPRO holders have several sources of income: they receive a percentage of the fees charged by the platform, interest rates and a small leverage on the price of Bitcoin. BPRO absorbs unwanted Bitcoin volatility from DOC and sells it for BTC 2X.

-The third token is BTC2X , a token for traders who want to 2x the price of Bitcoin. Traders pay interest on these long positions, which goes to BitPro, which also earns a percentage of platform fees and is subsidized in the form of MOC tokens.

-Money On Chain (MoC Token) is the fourth token. It is designed to govern decentralized autonomous organizations (DAOs) and can also be used to pay for using the platform, with rates lower than BTC. MoC holders will also be able to earn rewards for providing services to the platform. MoC token holders will vote on contract modifications and new features. At a basic level, the DAO decides whether to update the code of a smart contract.

Related websites: https://app.vedao.com/projects/8e91a9755178d698483a2770b9727a0038573fa645cbde5dad9bc6747d0338a6

5.BEVM

BEVM is a BTC Layer 2 compatible with EVM. Its core goal is to expand the smart contract scenario of Bitcoin, allowing BTC to break through the constraints of the Bitcoin blockchain that is not Turing complete and does not support smart contracts, so that BTC can be used on Layer 2 of BEVM. Build decentralized applications using BTC as native GAS .

The design concept of BEVM is to directly use Bitcoin's native technology to implement decentralized BTC Layer 2 without changing the original technical framework of Bitcoin. The specific method is Musig 2 aggregation of multi-signature technology + Bitcoin light nodes to achieve BTC decentralization and cross-chain to BTC Layer 2. Since Layer 2 is fully compatible with EVM, BTC can easily implement various decentralized applications.

Since BEVM is Layer 2 compatible with EVM, all decentralized applications such as DeFi, GameFi, SocialFi, and NFTFi that can be deployed on ETH EVM can be deployed on BEVM. The only difference is that ETH Layer 2 uses ETH as GAS, and BTC Layer 2 uses BTC as Gas. Every transaction on BTC Layer 2 will be packaged into BTC Layer 1 with a sequencer at a ratio of 10:1, allowing BTC Layer 2 to share the security of BTC Layer 1. In the long term, BVEM, a BTC Layer 2 solution that aims to enhance scalability, reduce fees, and cultivate a more secure and decentralized financial ecosystem, is of great significance to the long-term development of Bitcoin.

6.HOTFI

HOTFI is a liquidity solution built on the BRC20 standard token based on the Ordinal Protocol and the EVM protocol. It will introduce the Launchpad function to promote the launch of high-quality projects and is committed to providing continuous development momentum for the DeFi ecosystem within the Ordinal.

HOTFI provides the following features for ordinal users:

-Decentralized peer-to-peer matching transaction function of BRC20 standard token;

-Real-time Swap function;

- Allow users to provide liquidity and earn passive income through AMM;

-Stake section, where users can deposit their BRC20 tokens and receive farming rewards;

-Community support and open DAO governance, building the DEFI ecosystem together with users.

The DeFi functional services provided by HOTFI almost cover the common needs of users. On this basis, through more community participation and DAO governance mechanisms, as well as the attention and introduction of future high-quality projects, the Ordi ecosystem will be progressively improved. Gather strength. As the BTC ecosystem and BRC20 tokens continue to develop and grow in the future, HOTFI is also expected to become a pivotal part of the ecosystem.

Related websites: https://app.vedao.com/projects/a 918 b 86 f 7 3d85939b7dcbe82d57baeb26685e273ce559a95cded8e2295e07060

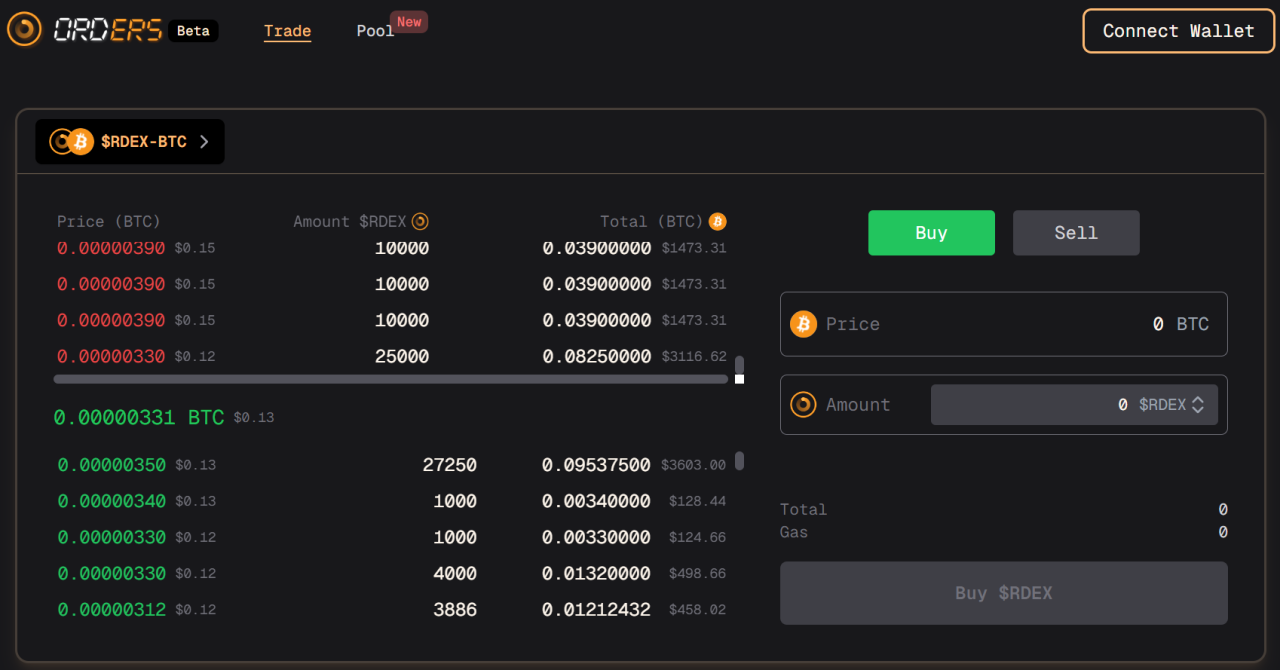

7.Orders

Exchange Orders is the first DEX to run entirely on the Bitcoin network, with its order book running entirely on the Bitcoin network. Orders is designed to witness a trustless order book DEX, liquidity pool, exchange DEX and LaunchPad that leverages the full potential of Bitcoin Layer 1, powered by a combination of Ordinal Protocol, PSBT technology, Bitcoin Script and the revolutionary Nostr protocol support.

Summary of Orders highlights:

-Orders cleverly learned the NFT gameplay of blur and presented the BRC 20 token, which is currently complex and difficult to trade, into an on-chain DEX system;

- Combines liquidity mining, order book and buying and selling mechanism (Ask&Bid) - Simple and friendly user interface, very similar to blur gameplay, easy to use;

-The project token RDEX token has practical application value and has excellent liquidity as a trading pair;

-A team with many years of professional background, whose technical capabilities can be verified from the white paper.

Currently, Orders has released a Beta version and is ready for online use. It has actual implementation scenarios and usage requirements. The white paper reflects the team's professional capabilities and makes people feel optimistic about the development of the project. However, this project has also emerged suddenly. As the first DEX on the Bitcoin network, there are many mechanisms that need to be optimized in the future, and based on the token distribution mechanism, there are potential risks such as future market crashes. It is recommended that you be interested. Get involved before considering investing in RDEX tokens.

8.MultiBit

MultiBit is the first-ever two-way bridge designed for cross-network transfers between BRC20 and ERC20 tokens. Its most significant advantage is the liquidity of BRC20 tokens, which breaks the previous barriers between different blockchain networks. This innovative design also improves the accessibility of the token, allowing users to transfer between different networks more conveniently and flexibly.

MultiBit simplifies the token transfer process between Bitcoin BRC20 and the EVM network. First, users transfer BRC20 tokens to a dedicated BRC20 address. Once confirmed, these tokens are ready to be minted on the EVM network. But what makes MultiBit unique is its double-sided bridging feature, which enables seamless transfers back to Bitcoin from the EVM network.

There is no doubt that MultiBit has broken the barriers between BRC20 and the outside world and will greatly promote the development of the BTC ecosystem. This is foreseeable and worthy of recognition. In addition, MultiBit also emphasizes on promoting the liquidity and accessibility of BRC and ERC tokens in a safe and user-friendly manner, providing users with an environment of trust and peace of mind with security guarantees. The realization and guarantee of this will give MultiBit more development, because security and convenience are necessary properties for a cross-chain project to go further and remain evergreen.

Related websites: https://app.vedao.com/projects/61a2110e7fda9645ccd1ee03e7db376c044c009dcc115b0aa9900e1eaa451150

9.Bitlight Labs ( Cosminmart )

Bitlight Labs develops infrastructure based on the RGB protocol and deploys multiple applications on the Lightning Network. Among them are Bitswap and Bitlight wallets. The establishment of this ecosystem provides users with more ways to trade and interact, enabling faster and maximum transactions.

Its characteristics are as follows:

-Smart contract system capable of managing rich states;

-Using Peter Todd's client validation example: data is held by "state owners" (e.g. asset owners) rather than by public knowledge;

- Operations on the Bitcoin transaction chart can come from the Lightning channel of the Bitcoin blockchain;

-Scripts can be written using Blockstream's Simplicity scripting language, which is formally verified by Turing arguments.

Lightning Labs ’ open source, secure and scalable Lightning system enables users to send and receive money more efficiently than ever before. Lightning Labs also offers a range of verifiable, non-custodial financial services based on the Lightning Network.

Related websites: https://app.vedao.com/projects/305adabf878756efea2ebb55de51eb5f6d564e1657b01820ed8635f36b19a3dd

Follow us

veDAO is an AI-driven web3 trend tracking & intelligent trading one-stop platform.

Website: http://www.vedao.com/

Investment is risky, the project is for reference only, please bear the risk at your own risk