MicroStrategy continues to affirm its loyalty to the long-term strategy of buying and holding Bitcoin ( BTC ) in 2023 and has become an inspiration for many Bitcoin Holder to confidently pursue this strategy. So far, they have shown they made the right decision.

The following are observations and assessments from BeInCrypto on MicroStrategy's latest Bitcoin acquisition and portfolio.

MicroStrategy continued to buy more than 16,000 BTC at the end of October

Last night, Michael Saylor – Founder of @MicroStrategy – posted a notice on his X account that they had just purchased an additional 16,130 BTC equivalent to 593.3 million USD. This is the purchase of Bitcoin with the largest amount of BTC since March 2021 until now. This proves that the confidence that MicroStrategy has in the scenario of Bitcoin continuing to increase in price is very high.

Michael Saylor said the October BTC purchase price was 36,785 USD/ BTC. And to date, along with this purchase, the company has accumulated 174,530 BTC equivalent to about 5.28 billion USD, with an Medium purchase of the entire portfolio of 30,252 USD/ BTC.

Michael Saylor's X account hardly posts anything other than pictures about Bitcoin and announcements of the company's Bitcoin purchases.

Holding nearly 1% of Bitcoin supply, profit of more than 1.3 billion USD

As of the time of writing, the total value of this BTC has exceeded 6.65 billion USD at market price. Accordingly, MicroStrategy holds nearly 1% of the circulating BTC supply, and is also making a profit of more than 26%, equivalent to more than 1.3 billion USD. And the Medium purchase level of 30,252 USD also coincides with the strong support zone that Bitcoin just established over the past month.

It is very rare that MicroStrategy decides to buy a quantity larger than 10,000 BTC and a total value of more than 500 million USD like this time. Let's XEM history.

MicroStrategy's purchases amounted to nearly 500 million USD worth of BTC.

MicroStrategy's purchases amounted to nearly 500 million USD worth of BTC.- The larger the purchase volume, the more confidence the company has in the future of BTC prices. The largest purchase worth more than 1 billion USD worth of BTC in February 2021 was also their "peak swing". Or the purchase of more than 500 million USD in two consecutive times November + December 2021 is also the second "peak swing".

- Since MicroStrategy accumulated the majority of BTC at lows in 2020, those “swings” did not immediately cause them to lose money. But from here we can see that MicroStrategy's confidence does not always give the desired results.

The remarkable success of MicroStrategy is that they did not stop, but continued to patiently hold and buy more until they saw profits. With the recent purchase, they may want to say that they have no intention of ending it.

Bitcoin price is closely tied to MicroStrategy (MSTR) stock value

MicroStrategy is a business analytics and software services company. But the entire community's interest in this company is about buying and holding Bitcoin. In fact, this activity closely impacts MicroStrategy (MSTR) stock price.

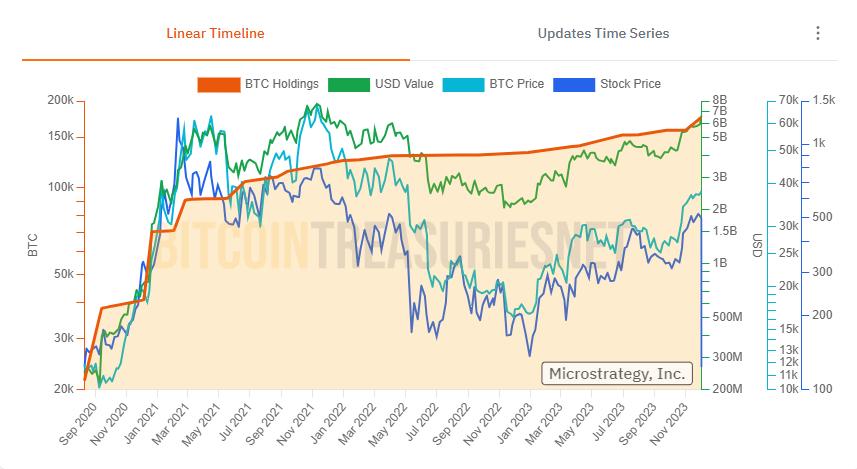

Bitcoin price, MSTR stock. Source: bitcointreasuries

Bitcoin price, MSTR stock. Source: bitcointreasuriesBTC price increased, MSTR also increased in sync. Therefore, buying more Bitcoin does not simply profit from the BTC price, but it helps enhance the value of MSTR's shares. MSTR price recently also set a new high of the year at 530 USD.

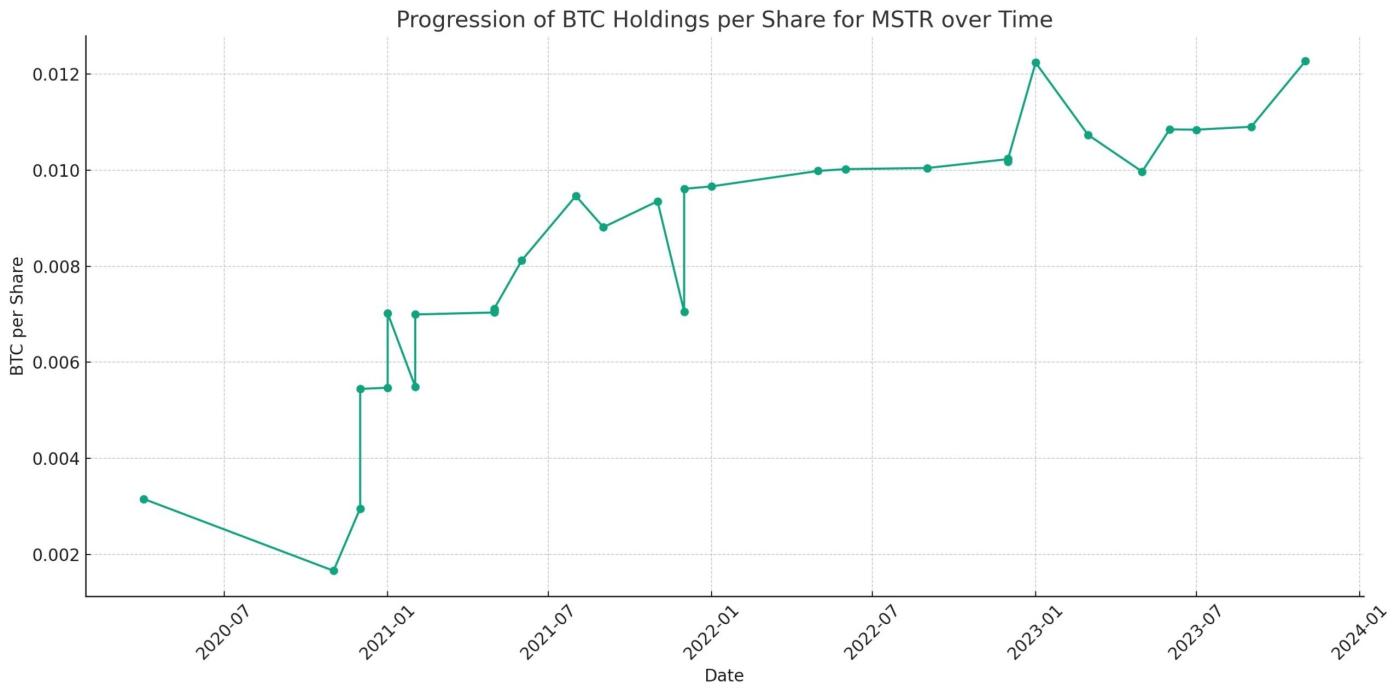

Increase in BTC value per MSTR share. Source: @jimmyvs24

Increase in BTC value per MSTR share. Source: @jimmyvs24According to calculations and graphs by James V. Straten (@jimmyvs24), the BTC value per MSTR share has increased significantly from 2021 until now. From here, although the number of MSTR shares increased through new offerings, the value of BTC per share also increased. Preston Pysh (@PrestonPysh) – Hosts on theinvestorspodcast – commented that this is MicroStrategy's "anti-dilution" effort.

Also Read: TOP 3 cryptocurrency trading platforms for professional investors

What do you think about MicroStrategy's relentless BTC buying? Chia your opinion now in our community group Telegram chat | Telegram channel | Facebook fanpage .