In the past seven or eight years, Guanghua has been engaged in the development of the Bitcoin ecosystem. He is a firm believer in Bitcoin technology. Even in the three or four years when Ethereum was most prosperous and had the greatest wealth effect, Guanghua never left Bitcoin. I have left the technical circle. Guanghua is also a very kind person, kind to technology and to people. He said that in the cycle, facing the sadness after his colleagues leave is also part of his understanding of the cycle. Guanghua is also a person with great overall reasoning ability and technical insight. He said that after this bull market, Bitcoin will be as slow and stable as Apple’s stock, and there will no longer be an obvious four-year cycle. He also said that the blockchain will eventually become more and more like the World Wide Web, with Bitcoin on the first layer, Ethereum on the second layer, and high-performance chains on the third layer. Users will be like using the World Wide Web without asking whether it is a metropolitan area network. Or a national area network, or a local area network. Guanghua is also a very straightforward old OG with a boyish side. He always remembers Satoshi Nakamoto's "unfamous" reply, "If you don't believe me or don't get it, I don't have time to try to convince you, sorry."--26x14(Co-founder of 7UpDAO)

26x14: How did you first get involved with Bitcoin? What was the initial story?

Guanghua: When I first graduated in 2014, I went to work on a robotic arm for a relatively large artificial intelligence company in China. At that time, some colleagues would play games together when they were tired of work. While playing games, everyone was playing games. , such as Cosmic Coin, Starry Sky Coin and other Altcoin. At first, I felt that Bitcoin, like these Altcoin, were global scammers. Later, in 2016, I was doing technical research for a national project, which involved yellow signature technology for financial privacy in the bill chain. Yellow signature technology is a predecessor of ZK privacy. At that time, I went looking for relevant code, and at the earliest I met the Bitcoin core team. They made a code warehouse, which is a side chain called elements. From that moment on I started to absolutely love Bitcoin. In fact, the current mainstream narrative of the Bitcoin ecosystem dates back to 2016. The side chain at that time was scalable, and the ring signature technology at that time was the predecessor of range proof in zk-SNARK/zk-STARK. If you go to see it today, you will be surprised by what happened in 2016, as if it happened yesterday. And now it feels like it’s reincarnation again, but the community’s consensus is stronger.

26x14: So your past blockchain entrepreneurial experience has been centered around the Bitcoin ecosystem? Never jumped out?

Guanghua: Yes, what I have been doing before is the BTC cross-chain bridge. Five or six years ago, we built a chain that has served a total of 100,000 Bitcoins over the past few years and was launched earlier than Polkadot. At that time, I thought Gavin Wood (the founder of Polkadot) was cool. He was once the CTO of Ethereum. He wanted to create a concept of interconnection in the crypto market. Then we wanted to help the Polkadot ecosystem build a BTC cross-chain bridge. The idea at the time was, Polkadot's direction is interconnection. If we build a BTC cross-chain in their ecosystem, it will allow BTC and other ecosystems to be interconnected.

26x14: Even during the most prosperous years of the Ethereum ecosystem, you never left the Bitcoin ecosystem to join in. Why?

Guanghua: Hahaha. People's minds are narrow-minded, especially as a technical developer, you will easily become arrogant and stubborn. In 2016, I spent a week changing the Python Ethereum consensus to PoA, and then started a business in the alliance chain. The earliest Bitcoin code I saw was written by Gavin Wood in C++ language for three months in 2014. The technology of Ethereum was actually completed by Gavin Wood himself, so I focused on the expansion of Gavin Wood’s Polkadot ecosystem. I think it would be more interesting to bring BTC to the expansion of Polkadot. In fact, many friends at the time suggested that we should bring BTC to the expansion of the Ethereum ecosystem. However, as a technology developer at the time, I felt that the technology of Ethereum was not that cool, and I still preferred Polkadot. Later, after recognizing some things, I feel like I made some mistakes in my choices at that time.

26x14: At that time, you believed that the world of blockchain should be the world of smart contracts within the BTC ecosystem, rather than a new world of smart contracts outside of BTC?

Guanghua: Yes, but the earliest origin of this recognition is not me, but actually Vitalik (founder of Ethereum) and BM (founder of EOS). This is a very interesting thing. In 2010, the sentence that BM was criticized by Satoshi Nakamoto became a famous saying in the circle. The sentence is: "If you don't believe me or don't get it, I don't have time to try to Convince you, sorry." But in fact, what BM wanted to express to Satoshi Nakamoto at that time was that he wanted to turn Bitcoin into a scalable thing. Vitalik originally wanted to make Bitcoin a scalable thing. Later, BM made BitShares itself, which was the earliest Dex based on the Bitcoin protocol; at the same time, Vitalik and his team made Colored Coins, which supports users to issue coins on the BTC ecosystem. Anyone can use Bitcoin based on Protocols build assets and trade them. After working on the colored coin project, Vitalik found BM by chance and wanted to write a smart contract platform for Bitcoin together. Therefore, the lively things we see in the Bitcoin ecosystem today were actually already around 2014. It happened. My idea of building smart contracts based on the BTC ecosystem and the Bitcoin protocol was also influenced by these earlier events and was gradually formed in 2016. I also wrote code for EOS in 2017 and 2018, and I was the first to launch a node on EOS. All of this was probably out of respect for BM and his ideas. On the Vitalik line, I followed Gavin Wood more, because Vitalik himself didn’t write much code, so I later focused on the Polkadot ecosystem that Gavin Wood founded after leaving Vitalik.

26x14: Listening to you telling this history, I suddenly had the feeling that Vitalik was originally a “heretic” in the Bitcoin ecosystem, and now it’s time for the Bitcoin ecosystem to seek revenge in Jerusalem.

Guanghua: Hahaha, it’s quite interesting, a bit like that.

26x14: Having experienced so many different cycles, how do you view cycles?

Guanghua: What I like most is the bear market in the cycle. You will find that no matter what cycle you are in, some people will leave. They may leave because they got rich overnight in the bull market, or they may leave because they have not made any money in the long bear market, so leaving is not about money. , but because there is no love. But no matter what, you will be more at ease in a bear market. In fact, I am a relatively emotional person, because I feel that being with my colleagues and meeting each other is a great fate, and I cherish all of this. I feel very sad when some colleagues leave suddenly. This sadness is also part of the understanding of cycles.

Another understanding is that everyone says that Bitcoin has a halving cycle every four years and forms a bull market. But I think the bigger influencing factor is not the halving every four years, but the election every four years in the United States. The U.S. dollar It is the strongest currency in the world. I find that every year when a bull market comes, it is an election year in the United States. Once the US president is elected, the bull market will end. This is basically the case. Before the election, the US presidential candidate implemented EA (effective altruism), which supported any industry and created a prosperous scene; after the president was elected, it became e/acc (effective accelerationism), refined self-interest, and behind the scenes The supporting consortium began to harvest and cash out. This is a rather interesting match.

26x14: Did this bull market come so quickly, did it surprise you? If so, was this unexpectedly strong?

Guanghua: It’s very strong and unexpected. But it didn’t disrupt our rhythm, it was just that our rhythm had to speed up. Because we have been preparing for this for six years. Some time ago, our BEVM project released a white paper. We used this white paper as a commemorative NFT and distributed 10,000 copies. The gameplay required users to copy a piece of code and send transactions to Bitcoin. At the beginning, I typed it myself. I bought 30 copies. Two hours later, 25 of the 30 copies were scrapped. After checking, it turned out that there were tens of thousands of addresses printing this NFT, and among the total 10,000 NFTs, there were 1,300 or 400 copies. It was successful. After the fight, the price was raised forty or fifty times by participating users. I felt like, God, what happened to this market? This incident shocked me too much. I know the market is coming.

26x14: At what point in time did you predict this bull market? What is the basis for judgment?

Guanghua: I used to think that after the halving next year, the bull market will start; the bull market will end the year after that, and it will start to turn bearish. What the entire bull market looks like after one year. But now the momentum and intensity of the entire bull market far exceeds my expectations.

The reason for this kind of misjudgment is that the previous bull market always had some negative events after the event pulled up the market. Then in April and May, the real bull market began. For example, the negative price of the last bull market was 312, and the bull market started in May. Because the water and electricity for mining machines are usually started in May, water and electricity in a certain province will be particularly cheap at that time .

This bull market is coming so fast. I think the expectation of ETF implementation is only a catalyst. The bigger factor is the implementation of the expectation of not raising interest rates. So you will find that all asset classes are rising, but Bitcoin is rising more, because Bitcoin is more sensitive as a risk asset and has more retail holders.

26x14: Do you think this bull market is very different from previous periods? What's the biggest difference?

Guanghua: I think the biggest difference is that the fluctuations in the entire market will not be so large. It is very likely that each round will be less volatile than the previous round. In the previous bull markets, before the market started, there would be a big plunge. This time we are also waiting for this moment of the plunge, and then we want to buy the dips some more bottoms, but we haven't waited yet, and there may not be as big a plunge as before. In addition, the bear-bull cycle of Bitcoin in the future may be different from the past. Judging from the fact that there is not such a large decline before the current bull market, the main line of Bitcoin in the future may be like Nasdaq, showing a long-term slow bull pattern with small fluctuations. , the periodicity will become less and less obvious.

26x14: The above logic is based on the fact that the flow of capital inflow is very large and the value-added expectations of Bitcoin holders are very large. Therefore, the selling volume is very small, so the volatility generated is not large, thus showing the logic of long-term slow bullishness. . But you also said before that the U.S. elections every four years will have an impact on the price of Bitcoin. So comparing this factor with the long-term slow bull conclusion, what is the final result of the superimposed effect?

Guanghua: Election factors will affect all asset classes. The current market value of Bitcoin is about 900 billion US dollars, and it is already ranked in the top ten compared with technology stocks (Apple, Microsoft, Google, Amazon, Nvidia, Bitcoin, Meta , Tesla), Apple’s market value is more than three times that of it. As the market value of Bitcoin increases, the gap in market value between Bitcoin and Apple may also narrow. If we measure and predict the stock price trend of Bitcoin from the trend of Apple's stock price, then it will tend to be stable and show a long-term slow bull, because its banker and the entire capital plate are already large enough, and different funds compete with each other. It will tend to be balanced, and its risk attributes will gradually weaken, and it will not be as sharp as before.

26x14: I understand, this is the last bull market for our entrepreneurs, communities, and retail investors.

Guanghua: Yes, yes. In the past, the consensus on currency prices was in BTC and the community’s consensus was in Ethereum, but now the community’s consensus has returned to BTC from Ethereum. You can see that previous funds were still going towards high-performance public chains, such as Polkadot and EOS in the previous cycle, Solana in the last cycle, and Ethereum L2 in this cycle. The top ten L2s now have a market value of 3 billion. US dollars. At the beginning, everything started with Bitcoin and then spread out in the middle. But now the community no longer develops outwards. They realize that Ethereum is technically saturated at this stage and need to find monetization and implementation in stages. something. At present, $ordi, which has the highest market value in the Bitcoin ecosystem, is only US$1 billion. Bitcoin’s capital volume is three times that of Ethereum, so the market value of the Bitcoin ecosystem should also be three times that of Ethereum. In this case, let’s compare The market value of the Bitcoin ecosystem will have a very high ceiling and expectations. The Ethereum ecosystem has done a lot of things in the past, while the Bitcoin ecosystem is still a barren land, but Bitcoin has three times the amount of funds as Ethereum. So during the two-year bull market cycle, has the Bitcoin ecosystem become a wasteland? Will it soon fill the gaps in the Ethereum ecosystem? And it will be filled in quickly. If the Bitcoin ecosystem fills the gap with the Ethereum ecosystem, then the entire blockchain world will form a closed loop, just like the previous Internet industry, where there will be several leading companies and leading industries. The opportunity left for us, the general public, is for the Bitcoin ecosystem to complement the Ethereum ecosystem during this time period. The opportunity is greater than ever and more urgent than ever. What is lacking now is not technology or model verification, but the awareness that everyone has ignored before. Just like we concentrated on developing Shenzhen in the 1990s, the Bitcoin ecosystem will usher in a Shenzhen speed. Once this opportunity is over, the crypto will be as certain as the Internet before it . Real big money and giants will begin to enter, and there will be very few grassroots opportunities.

26x14: So why is the rise of the Bitcoin ecosystem happening at today’s timing? Not last year, not the year before? What is the trigger that makes it happen?

Guanghua: One of the most awesome things about this is that around October 2021, when Bitcoin was 13 years old, the first major upgrade ushered in, Taproot was launched. This is a cross-generational upgrade of Bitcoin’s underlying technology. It contains 3 BIPs (Bitcoin Improvement Proposals), the first two BIPs are amazing. One is Schinorr signature , which is a signature algorithm that can generate an aggregate signature of thousands of people without taking up too much Gas and storage space. Previously, Vitalik wanted to support Schinorr signatures on Ethereum, but it has not been done yet. The difficulty of implementing this can be seen to be quite high. However, the Substrate framework of Polkadot founded by Gavin Wood later supported Schinorr signatures, but it is a pity that Polkadot did not. A very inclusive mechanism brings the entire ecosystem together. Another BIP is the MAST contract (Merklized Alternative Script Tree) , which allows users to insert various scripts in the tree diagram, use Schinorr signatures to create many interesting contracts, and implement things related to Bitcoin innovative contracts. Although it is still not Turing complete, it can already simulate some things that are Turing complete. In other words, it cannot be as complete as a complete while(if) loop, but it can gradually simulate a state close to a while(if) loop by assembling many if...else. Therefore, the launch of Taproot with these two major BIPs has brought a very scalable underlying technical framework to Bitcoin. If you taste these codes carefully, you will find that from the perspective of technical design philosophy, its appearance is so beautiful and amazing, and there is something very magical about cryptography. Therefore, after the launch of Taproot, the decentralized L2 of the Bitcoin ecosystem can be realized, but it was not possible before that. If you are a Bitcoin holder, you will find that Bitcoin has 5 types of addresses. The address starting with [bc1p] is the address after Bitcoin upgrades Taproot. Many users buy Inscription and engage in Lightning Network assets. Use All addresses start with this.

But why didn’t it explode after Taproot was launched in October 2021, but why did it start to explode after the Spring Festival this year? In fact, we started promoting Taproot's technology two years ago, and even applied for some related patents, which were finally approved and stamped by the China Patent Office. But when I think about it now, although we started to push it two years ago, it was indeed not easy to push it because when the technology was first launched, some infrastructure, such as Bitcoin’s online signature wallet and Bitcoin issuance Some currency-related protocols had not yet come out at that time. Even if these are developed, it will still take some time to give users an experience and recognition process. These all take a certain amount of time to settle. In fact, last year, the NFT concept in the Bitcoin ecosystem began to become popular. In March this year, the BRC-20 inscription became even more popular, and now it has reached an unprecedented high point. But you can also find that the Bitcoin NFT that started last year, the BRC-20 inscription in March this year, and more recently, are basically in line with Taproot’s version upgrade timeline. It’s just that users’ perception level will be slightly behind the technical version iterations.

26x14: In which aspect do you think the greatest value is captured in the Bitcoin ecosystem?

Guanghua: From a short-term perspective, inscriptions such as $ordi and $sat have shown a hundredfold or a thousandfold profitability, which is difficult to see in other ecosystems. What we are more optimistic about is Ordinals, which consists of three parts. One is NFT, which started to take off last year; the second is BRC-20, which started to become popular this year, which can achieve fair launch of memes; the third part is the Runes protocol, which not only It supports BRC-20 and is also compatible with ERC-20, which can better help some investors broaden their capital exit channels after investment. The direction represented by the Runes protocol will definitely explode in the next few years, because it can launch some things that have been verified on Ethereum, such as Launchpad; in addition, some CEX exchanges can use it to rank first and second As a leader, some Bitcoin "trading pairs" will allow more users to deposit money; there are also some Deifi four-piece sets and game mechanisms that have been verified on Ethereum, which will live well in the Bitcoin ecosystem. Of course, there is still a big gap in smart contracts between Bitcoin and EVM virtual machines, so the Bitcoin ecosystem needs the existence of L2 more than the Ethereum ecosystem. You see, Ethereum L2 still has a lot of correlations and duplications with Ethereum L1, but BTC’s L2 is really solving things that BTC can’t do.

But I predict that next year will not be the time to decide who is the leader of BTC L2, but the next bull market will be . Therefore, I think the biggest value capture in the Bitcoin ecosystem may not be the bull market that has started now, but in the next cycle, there will be an oligopolistic BTC L2 to compete with Ethereum, or even be bigger than Ethereum. But there is also a possibility that VITALIK itself will cross Ethereum to BTC L2. In fact, according to the news I have learned myself, many of the current ETH L2 leaders thought about crossing BTC L2 a year ago, and they may eventually return to the Bitcoin ecosystem. If you look at the OP's white paper, the roadmap a year ago mentioned that it would eventually be the L2 of BTC; and Starknet's CEO has already made it clear that they would use ZK to be the L2 of BTC.

26x14: Looking at it this way, today’s world situation may not necessarily go as planned in the script. There are still many unexpected changes waiting behind it.

Guanghua: Yes, those giants who have raised hundreds of millions of dollars are waiting, just to see when it is worth taking action. The market value of the BTC ecosystem should account for 20% of the total market value of Bitcoin , which is about 4.2 million Bitcoins . Among them, BTC L2 will probably account for about half of the BTC ecosystem, which is 10% of the total market value of Bitcoin; others The leaders in subdivided tracks, such as the four-piece meme and Defi leaders, may each account for about 2% of the total market value of Bitcoin. These add up to a 20% puzzle . Meme assets may be able to determine who is the leader in this bull market, while L2 may not be able to determine the winner for another four years.

26x14: When do you think the Defi Summer belonging to the BTC ecosystem will arrive?

Guanghua: In the second half of next year.

26x14: Before this, was it still mainly memes?

Guanghua: Yes, mainly meme assets, but "semi-centralized" exchanges will also start to emerge, such as OKx's wallet and Unisat's Swap. They are all "semi-centralized" things and will precede Defi. Fire up.

26x14: So what’s next for Ethereum? What will happen next for Ethereum L2 and ZK, technology narratives that have attracted large capital investments in the past? How did you predict it?

Guanghua: As for Ethereum, you should still be quite anxious. What can kill you is often not the one you always imagined. Who would have thought that the script would say that what killed Ethereum was not the high-performance public chain that had overcome obstacles along the way, but the very first and most primitive grudge, Bitcoin. When you come back from failure all the way, you look up and see that person whose market value is three times higher than yours is still standing there, looking at you. It turns out that all your past successes are just your own imagination. From my personal logic, the best outcome for Ethereum is for the ETH mainnet to be compatible with the Bitcoin ecosystem and become BTC L2 .

As for ZK, it is like AI more than ten years ago. Everyone knows that it is the future and a very stable technical narrative, but everyone also knows that it will be difficult to arrive in at least one or two years, and when will it finally arrive? , and it’s hard to know. But if ZK can be implemented, it will be sexier to use ZK technology to empower BTC L2. Because Bitcoin is POW, ZK also requires intensive verification. You only need to raise a BIP for BTC and add an OP code to the consensus code of BTC to support a verification algorithm of ZK. In this case, Bitcoin mining machines can Directly compatible with a computing power of ZK, so that Bitcoin can increase ZK to infinitely expand, and these computing power can also allow POW mining machines to maintain these calculations. So is ZK more suitable for POW?

26x14: Why is your deduction that the ETH mainnet is used for BTC L2, rather than ETH L2 being compatible with BTC L2?

Guanghua: If ETH L2 is compatible with BTC L2, the market value of ETH L2 may exceed the Ethereum mainnet in the future.

26x14: What do you think is Vitalik’s real conspiracy to bring the blockchain from POW to POS?

Guanghua: I was not that optimistic about Ethereum before, so I missed Defi Summer in 2020. Now looking back and thinking about it, Vitalik is too smart. Not only is he very tolerant, he also hits every beat very accurately. He proposed in 2016 that Ethereum would expand Sharding capacity and transfer POS to the network. When it came to making mining machines, he said that you should stop making mining machines. We (Ethereum) would immediately switch from POW to POS. He also chose the time to switch to POS very well. Why was it proposed in 2016 but only finally pushed forward this time last year? He came up with an algorithm to destroy ETH. Of all the POS networks now, only Ethereum is the safest. Vitalik once said that only Ethereum can build a POS network. The reason is that your POS network will be safe only if the inflation problem of the POS network is solved. Otherwise, the tokens of the POS network will fall and tend to return to zero in the long run. The reason why Ethereum's POS is safe is that they provide an EIP with an ETH destruction mechanism, which can provide a deflation guarantee when ETH is issued. Judging from the design of this idea, the layout before and after, and the timing of the final launch of POS, Vitalik is very sophisticated and not as young as his real age. From proposing POS in 2016 to launching it in 2022 last year, he was able to endure the 6 years of dormancy. , and continuing to push without being scolded by the community is not something ordinary people can do.

The reason why Vitalik wants to promote POS may be that he feels that miners do not have much value. Ethereum is different from Bitcoin. Bitcoin has the attributes of currency and gold. It depends on how much labor, electricity and computing power is spent, and then everyone works together to maintain the system and operational security of the entire network. The source of value of ETH is different. The value system of ETH is mainly based on the creativity of technology and finance. Its mission is to issue assets more efficiently. It wants to use the money that should have been paid to these labor providers of POW. To reward those who bring innovation to ETH, we want to run such a value network by building a financial technology business closed loop.

26x14: In the narrative of the Bitcoin ecosystem, is there room for POS to survive? Will it all be POW in the future? Or is it an ecosystem that combines POW and POS?

Guanghua: The two should be combined, and we should approach it with an inclusive attitude. The first level is still POW, and more of it is currency and gold attributes, so POW is OK. But if you want to build a second-layer ecosystem, you need to take into account the technological attributes and the POS that Ethereum has verified. Let the BTC ecosystem combine the two different groups of POW and POS services. Judging from past history, the chains that finally survived the first few cycles all had to have an inclusive mentality. Only with an inclusive mentality can decentralization be achieved.

26x14: At present, the blockchain economy is still an attention economy. Now that the Bitcoin ecosystem has taken away a lot of attention, and Ethereum still has its basic base, what will other public chains do, such as Move ecosystem, Ton, etc., because the energy of developers is limited, will these Players be the biggest victims of the rise of the Bitcoin ecosystem?

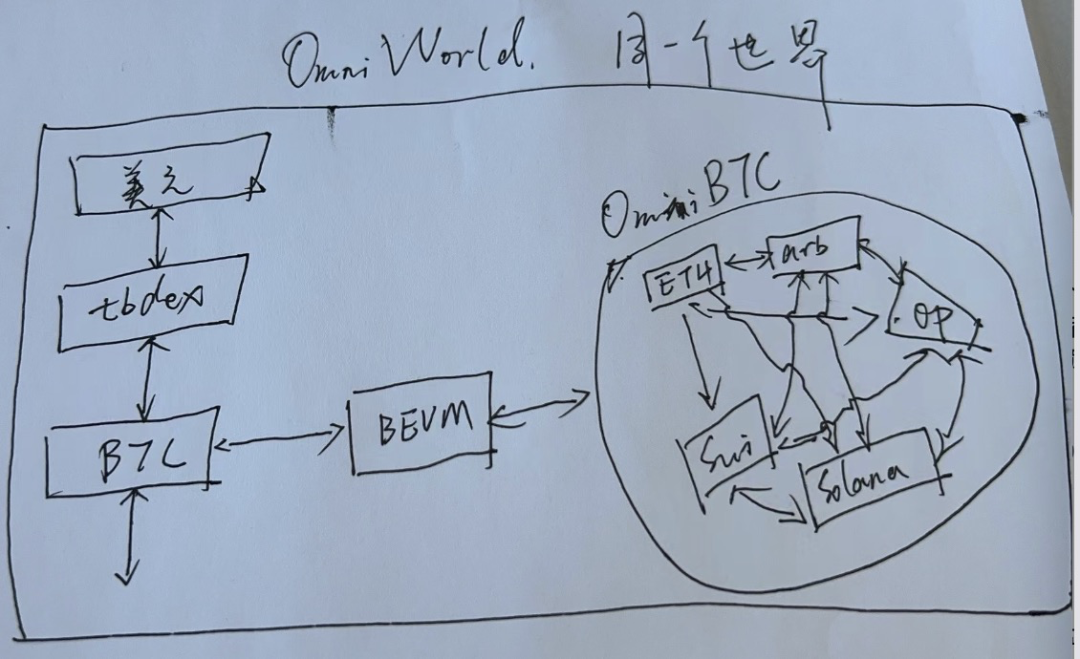

Guanghua: First of all, I think we need to have an inclusive mentality. The accumulation of technology will only get better and better, but it does not necessarily happen at the level of token economy. My personal assumption is this: Bitcoin, because of its very beautiful currency and gold-like code design, will be on the first layer; Ethereum is a good financial technology and ecological design, and it will be on the second layer; The third layer can be some high-concurrency chains that are slightly remote from finance, but closer to more down-to-earth applications such as social networking and games. The entire system should be an integrated framework, just like the World Wide Web. At the beginning, everyone only had local area networks available; later, local area networks began to interconnect and become metropolitan area networks; metropolitan area networks then interconnected with the Internet to become national networks; eventually, worldwide interconnection became the World Wide Web. In the future, the blockchain will be like the World Wide Web, starting from the local area network and eventually interconnecting. Users will not care what layer of network it uses, whether it is called a metropolitan area network technology or a local area network technology. Users only need to consider The pleasure of the service experience itself. The blockchain is ultimately a complete chain, a full chain. Bitcoin is used as a layer because it has the most beautiful code characteristics and is suitable as a layer.

26x14: I am very buying this inference. Of course, under this inference, we will not have too many bull and bear cycles. Maybe in two more cycles, blockchain will be part of the financial technology Internet, and it will also belong to Part of Tech Internet Valuation and Price Attributes.

26x14: The last question, also for the sake of program effect, who do you think Satoshi Nakamoto is? Is he still alive? Or has he always been just a symbol and soul sustenance?

Guanghua: I think Satoshi Nakamoto is an idea, a more equitable distribution and more decentralized idea. The reason why Vitalik has achieved such great success is because he is closest to the thinking of Satoshi Nakamoto. Compared with other founders, he is the most tolerant, so Ethereum is currently ranked second. Then, judging from personal random thoughts, Satoshi Nakamoto may be a time traveler from the future. He traveled back from the future in order to save mankind when an irreparable financial crisis occurred in the U.S. dollar financial system in the future. Therefore, it can also explain why He had so many Bitcoins that he didn’t use them for personal use. I want to believe this story because it makes me very comfortable.