Author: ABCED Translation: Shan Opa, Jinse Finance

Preface

Bitcoin has been around for more than 15 years. It was originally positioned as a peer-to-peer payment system independent of any "ecosystem". Discussions about Bitcoin’s scalability have been widespread due to the lack of Turing-complete smart contracts.

We have been witnessing debates and controversies over the years regarding block sizes, hard forks, and the Lightning Network. Never stops trying to expand the Bitcoin ecosystem.

On March 8, 2023, Domodata introduced the BRC20 concept and deployed $ORDI, opening Bitcoin's Pandora's Box. This resulted in a sudden large number of inscribed assets appearing on the Bitcoin network, reminiscent of the Ethereum ICO craze in 2017. Assets like $ORDI and $SATS have experienced exponential growth and have a market capitalization of over $1 billion. The surge in the BRC 20 space drives continued innovation and development throughout the Bitcoin ecosystem.

After intense market attention, what is the outlook for the Bitcoin ecosystem? How did Bitcoin evolve from a peer-to-peer payment system to digital gold?

As we near the end of 2023 and the Bitcoin halving approaches, we present this report to review Bitcoin’s past, assess its current state, and look forward to its promising future.

This report is dedicated to all those who contribute to the Bitcoin ecosystem.

"If you don't believe me, or don't understand, I don't have time to try to convince you, sorry"

——Satoshi Nakamoto

1. The history of Bitcoin: the winding road of ecological evolution

Bitcoin (BTC) Milestones 2018-2023: A Journey Through History

2008.11.01 Satoshi Nakamoto published "Bitcoin: A Peer-to-Peer Electronic Cash System"

On January 3, 2009, Satoshi Nakamoto mined the first block in the history of Bitcoin, the Genesis Block, on an ordinary server in Helsinki, Finland. In the block, he embedded a headline from The Times on January 3, 2009: “The Chancellor is on the brink of a second bailout for banks,” both documenting the time of the block and subtly expressing it raised questions about the global financial crisis and the banking system at that time.

2009.01.12 Satoshi Nakamoto sent 10 Bitcoins to developer Hal Finney, completing the first Bitcoin transaction in history

2010.05.21 Florida programmer Laszlo Hanyecz purchased a pizza for 10,000 Bitcoins, marking the first time Bitcoin was priced at $0.0025 per Bitcoin

2010.07.17 Bitcoin exchange MT.GOX was established in Tokyo

2010.08.15 A Bitcoin vulnerability was discovered and exploited, generating more than 184 billion Bitcoins in a transaction and sent to two addresses. This illegal transaction was quickly discovered and corrected.

2010.12.16 Introduced the concept of mining pool mining and Bitcoin mining pool

2011.04.23 Satoshi Nakamoto sent his last email and then disappeared completely. "I have moved on to other things. Gavin and others will take good care of Bitcoin," the email read.

2012.09.27The Bitcoin Foundation was established

On November 28, 2012, the Bitcoin reward was halved for the first time, from 50 Bitcoins to 25 Bitcoins every 10 minutes. At the same time, the total number of Bitcoins has reached half of the total supply of 21 million.

2012.12.04 Colored Coin White Paper Released

2013.08.15 MasterCoin Initial Coin Offering (ICO)

2013.10.29 Canada launches the world’s first Bitcoin ATM developed by the American company Robocoin

2013.12.05 The People's Bank of China and five ministries and commissions jointly issued a notice on risk prevention and control of Bitcoin, causing the global Bitcoin price to plummet by nearly 30%.

2015.01 Coinbase becomes the first regulated Bitcoin exchange in the United States

2015.09 The U.S. Commodity Futures Trading Commission (CFTC) stipulates that Bitcoin is a commodity governed by the Commodity Exchange Act.

2016.07.10 Bitcoin’s second halving. Reward per block reduced from 25 Bitcoin to 12.5 Bitcoin

2016.08.03 Bitfinex, a well-known overseas Bitcoin exchange, lost more than $60 million worth of Bitcoin due to a hacker attack, causing the price of Bitcoin to plummet by more than 25%. In the end, all users on the platform shared 36% of the total asset loss, and Bitfinex issued the debt token BFX for the "debt-for-equity swap."

On March 11, 2017, the U.S. Securities and Exchange Commission (SEC) announced its rejection of the Bitcoin ETF, causing Bitcoin to fall by 10%. This is the first time a Bitcoin ETF proposal has been rejected by the SEC

2017.05.23 56 Bitcoin startups agreed to the Segwit2M (later changed to Segwit2x) compromise proposed by Barry Silbert and signed the New York Agreement

2017.08.01 Bitcoin Cash was created from a hard fork of the original Bitcoin chain

2017.08.24 Segregated Witness (SegWit) was officially activated.

2017.09.04 The People’s Bank of China declared ICO as an illegal financial activity and suspended all domestic transactions, subsequently closing all Bitcoin exchanges registered in the country.

2017.11.19 Bitcoin price exceeded $10,000 for the first time

2017.12 BTC spawned 8 forked coins in December: SBTC, LBTC, BTP, GOD, BUM, Bitcoin Cash Plus, Bitcoin Silver and Bitcoin X (Bitcoin Unlimited)

2017.12.11 Chicago Board Options Exchange officially launched Bitcoin futures, which surged over 20% on the first trading day

2018.01.01 RSK mainnet launched

2018.03.15 Lightning Network released its first mainnet beta version

2018.09.27 Liquid Network officially launched

2018.11.15 BSV fork

2019.09.23 Bakkt launches physically delivered Bitcoin futures contract

2020.03.12 Due to panic in the financial market, Bitcoin fell by more than 50% in one day

2020.05.12 BTC is halved for the third time, and the current block reward is 6.25 BTC

2020.12.16 Bitcoin breaks through 20,000 US dollars, reaching a record high

2021.01.14 Stacks mainnet 2.0 goes online

2021.02.19 Bitcoin market value exceeds one trillion US dollars for the first time

2021.06.19 The Congress of El Salvador passed a bill making Bitcoin a legal tender in the country, which will take effect 90 days later.

2021.11.16 Taproot upgrade officially launched

2022.12.14 Ordinals protocol released

2023.03.08 Domodata launches brc20 experiment and deploys $ORDI

2023.10.19 Lightning Labs launches the first mainnet alpha version of Taproot assets

1.1 Should Bitcoin be a payment system or digital gold?

There has been a long-running debate over Bitcoin’s functional role—as a payment system or as digital gold.

On June 17, 2010, Satoshi Nakamoto shared his thoughts on the Bitcoin forum:

"This design supports a large number of potential transaction types that I designed many years ago. Escrow transactions, guaranteed contracts, third-party arbitration, multi-party signatures, etc. These are all things we want to explore in the future if Bitcoin becomes popular at scale, but they All must be considered at the beginning of the design to ensure the possibility of future implementation.”

Large-scale applications and trading volumes mean more complex trading instructions and larger trading space.

Between July and September 2010, Satoshi Nakamoto made multiple modifications to the BTC code, including deleting two opcodes and disabling certain features of the Bitcoin programming language Script. Initially, BTC had no block size limit to accommodate the number of transactions within the same time period.

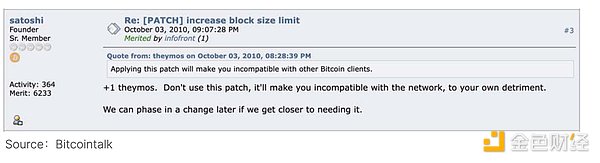

However, at the time, BTC prices were very low and the cost of malicious transactions was extremely low, so a solution was needed. On September 12, 2010, Satoshi Nakamoto presided over a soft fork that added a limit that blocks could not exceed 1MB. On October 4 of the same year, developer Jeff Garzik removed the restrictions set by Satoshi in his new client. This move was opposed by the community and Satoshi himself.

Satoshi noted that this limit is temporary and can be increased in a controlled and gradual manner in the future to meet expansion needs.

In December 2010, Satoshi Nakamoto sent his last public message for unknown reasons and disappeared from the public eye. However, the positioning and scalability issues surrounding BTC remained unresolved at that time, and the 1MB block size limit also paved the way for a series of subsequent debates.

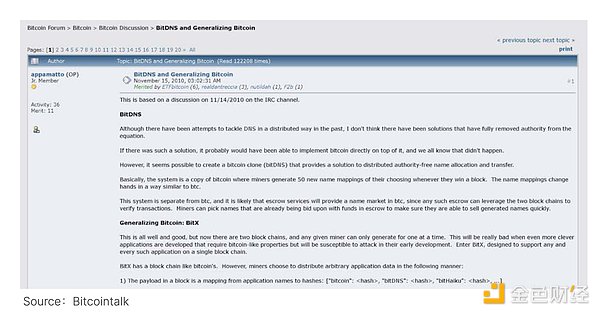

During this period, discussions arose on the Bitcointalk forum about Bitcoin’s ability to move beyond payments. For example, in November 2010, Appamatto proposed developing a decentralized domain name service on the Bitcoin network. However, this proposal was not recognized by early members, including Satoshi Nakamoto himself. Eventually, this proposal called BitDNS evolved into Namecoin, marking the birth of the first alternative currency in history.

1.2 Bitcoin 2.0: Asset Issuance

After Satoshi Nakamoto left, his successor Gavin Andresen led the establishment of Bitcoin Core and the Bitcoin Foundation. During this period, the exploration of BTC’s scalability continues, especially in the area of asset issuance.

•Colored Coins

On March 27, 2012, eToro CEO Yoni Assia first proposed the concept of colored coins in a paper. The concept continued to grow and began to gain traction on forums such as Bitcointalk. Finally, Meni Rosenfeld published a detailed white paper on colored coins on December 4, 2012. The concept of colored coins is to add special markings (i.e. "colors") to specific parts of Bitcoin to represent a wider range of assets and value. Colored coins are presented in a series of physical forms and can be roughly divided into two categories:

Based on OP_RETURN:

For example, Open Assets proposed by Flavien Charlon in 2013 utilizes OP_RETURN (introduced in Bitcoin v0.9.0, which can store small amounts of data on Bitcoin, initially limited to 40 bytes and later increased to 80 bytes). Opcodes are stored in scripts and "colored" and traded via external reads.

This model is similar to how Ordinals relies on external indexes to determine asset legitimacy.

Not based on OP_RETURN:

A typical example is the EPOBC protocol proposed by ChromaWay in 2014. Additional information about EPOBC assets is stored in the nSequence field of Bitcoin transactions. The category and legality of each EPOBC asset needs to be traced back to its creation transaction to determine.

MasterCoin(Omin)

On January 6, 2012, JR Willett published the concept of the MasterCoin project, calling it the "second Bitcoin white paper". The project was officially launched in July 2013 through an initial coin offering (ICO), successfully raising 5,120 Bitcoins (approximately $500,000 at the time). Unlike colored coins, MasterCoin implements a comprehensive node layer that maintains a state model database by scanning Bitcoin blocks.

This unique design allows for more advanced features, including the creation of new assets, decentralized exchanges, automated price feedback, and more. In 2014, Tether also launched the famous stablecoin Tether USD (OMNI) on Bitcoin through the Mastercoin protocol.

• Counterparty

Counterparty was officially launched in 2014. It uses OP_RETURN to store data on the Bitcoin network. Unlike colored coins, Counterparty does not use UTXO to represent assets, but uses OP_RETURN to indicate asset transfers. Assets are transferred when the asset holder signs a transaction containing specific data using the holding address. This approach allows Counterparty to serve as a platform for asset issuance, trading, and compatibility with Ethereum smart contracts. In addition, some believe that Ethereum, Ripple, and BitShares also fall under the broader definition of "Bitcoin 2.0."

1.3 Block size and hard fork debate

As Bitcoin becomes more widely adopted, it faces increasing network congestion and longer transaction confirmation times. In 2015, Gavin Andresen and Mike Hearn proposed implementing BIP-101 in the new version of Bitcoin XT to increase the block size limit from 1 MB to 8 MB, hoping to alleviate network pressure. However, core developers Greg Maxwell, Luke Jr., and Pieter Wuille, among others, expressed opposition to this, fearing that the move would raise the threshold for running a full node and have uncontrollable impacts. The debate gradually expanded both in terms of topics and participants.

To put it simply, regarding the expansion plan, there is currently no absolute pros and cons. Adhering to the small block route cannot solve the core problem: "When block rewards are reduced, how can low transaction volume maintain adequate security?" In addition, even increasing to 8 MB is not the final solution; choosing the large block route is likely to lead to continued Scaling, introducing technical risks associated with unlimited expansion and unpredictability.

Ultimately, this debate is about answering the question, “What is Bitcoin’s vision?”

In 2017, this controversy led to a community split and subsequent hard fork. According to BitMEX Research, in addition to BCH and BSV, more than 50 new forked coins have emerged within a year.

1.4 SegWit & Taproot

After the Bitcoin fork, the BTC chain gradually introduced a series of new technical proposals aimed at improving scalability while keeping the block size unchanged. Among them, Segregated Witness (SegWit) and Taproot are the two most important ones.

Segregated Witness (SegWit):

As an alternative to directly increasing the block size, SegWit was introduced at the same time as the BCH fork.

SegWit divides transactions into two parts: the first part contains the sending and receiving addresses, and the second part holds the transaction signature or witness data. The second part does not count towards the block size but is still valid.

After removing the witness data, each block can accommodate more transactions, thereby increasing the overall throughput.

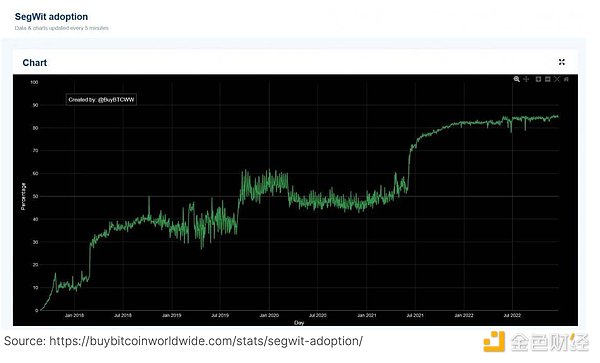

SegWit was introduced through a soft fork, and its adoption rate has grown steadily, exceeding 60% in 2020 and reaching 95% as of December 2023.

In November 2021, Bitcoin officially implemented a major upgrade called Taproot through a soft fork. This upgrade combines the three proposals BIP340, BIP341 and BIP342.

BIP340 introduces Schnorr signature, which can verify multiple transactions at the same time, replacing the original Elliptic Curve Digital Signature Algorithm (ECDSA). This improvement increases network capacity, speeds up batch processing of transactions, and enables the deployment of complex smart contracts.

BIP341 introduces the Merkle Abstract Syntax Tree (MAST), which optimizes the storage of transaction data on the blockchain.

BIP342 (Tapscript) adjusts Bitcoin's scripting language to make it compatible with Schnorr signature and Taproot implementations.

It is worth noting that SegWit did not initially limit the length of verification information, which allowed subsequent projects to bypass the 1 MB block size limit by verifying information, laying the foundation for the rise of Ordinals. This approach has caused controversy in the community, with some opponents believing that it is a "mistake" that SegWit does not set a length limit, and therefore using verification information to transmit data is an inappropriate "attack".

1.5 Early exploration of Bitcoin Layer2

After the Bitcoin block size dispute was resolved, Bitcoin’s Layer 2 solutions began to attract significant attention. Two of the most prominent options are the Lightning Network and sidechains.

Lightning Network was originally proposed by Joseph Poon and Thaddeus Dryja in 2015. The core concept involves locking a portion of Bitcoin in a multi-signature address, thereby establishing an independent governance protocol. Transactions within the Lightning Network occur off-chain and are ultimately confirmed by the Bitcoin network. In March 2018, Lightning Labs officially launched the Lightning Network on the Bitcoin mainnet, with notable applications including Strike, Taro and Lightspark.

Sidechains, on the other hand, are designed to acquire or transfer Bitcoin through transactions unrelated to the Bitcoin network. The exploration of sidechain solutions began earlier, with Blockstream publishing the first technical paper on a sidechain solution for Bitcoin in 2014, although the proposal had not yet been fully implemented at the time. RSK released its white paper in 2015 and successfully launched its fully functional mainnet in January 2018. In September of the same year, Blockstream launched the Liquid Network sidechain. In addition to RSK and Liquid Network, other sidechain solutions include Stacks, RootStocks, Drivechain, etc. In addition, developers have also explored and tried methods such as state channels and roll-ups.

2. BTC Ecosystem: Inscription Opens Pandora’s Box

Before Ordinals came on the scene, Bitcoin was rarely called an "ecosystem" because of its inability to support Turing-complete smart contracts. At that time, perhaps the only ones that could barely relate to "ecology" were Lightning Network and Stacks. Most of the headlines in the blockchain world focus on solutions provided by Ethereum, L2 and various emerging L1 smart contract platforms.

The emergence of Ordinals was like a blockbuster, subverting the entire industry. Through the concept of "inscription", it attracted countless attention overnight. Ironically, this craze has even spread to other L1 and L2 chains such as Arbitrum and Solana. As of the end of December, most smart contract platforms have begun to try the "inscription" function.

2.0 $ORDI Schedule

March 8: @domodata proposes BRC20 experiment and deploys $ORDI.

March 9: $ORDI is fully minted, priced at 5U each.

March 10 to March 23: OTC price was around 0.03U.

March 23: UniSat launched the BRC20 market, and the price quickly increased to 0.3U, but the market was subsequently closed due to double-spending issues.

April 27: UniSat relaunches the BRC20 trading market, opening it to a select few users, and the price of $ORDI surges to 1U and continues to rise.

May 5: Opensea announced support for Ordinals and BRC20. The market fell into FOMO, the price reached 6U, and various new BRC20s were hyped by various communities, such as NALS, XING, OSHI, SHIB, etc.

May 8: $ORDI was listed on Gate.io. On the same day, BTC’s on-chain transaction fees accounted for 43.7% of miners’ total revenue. After the listing on Gate.io, the price surged from 9U to 20U.

May 9: $ORDI reached its peak of 28U, and Gate.io began to list various BRC20s, such as BANK, PIZA, lRC20, DRC20, etc., attracting people's attention.

May 9th to May 12th: The price of $ORDI fell to 7.5U as major holders sold $ORDI and the overall market was depressed. The market begins to cool down.

May 12: OKX announced a formal partnership with UniSat to jointly establish the BRC20 industry standard, after which the price of $ORDI recovered and climbed back to 12U on the same day.

May 20: $ORDI is listed on @OKX and @HuobiGlobal exchanges, and the price rises from 12U to 15U before falling for four consecutive months.

September 11th: Price fell below 3U, a dark day for $ORDI holders.

October 18: UniSat releases Brc20-swap and $ORDI begins to recover. Since then, $ORDI has taken off.

November 3rd: The BRC20 ecosystem is gaining momentum and the price is gradually rising to 6.2U. On the same day $SATS, another BRC20 token, has a market cap exceeding $ORDI.

November 7: Binance announced the listing of $ORDI, and the price soared from 7.4U to 13.5U, starting to return.

November 10th to December 1st: Price hovered around 20U.

December 2: $ORDI rises from 21.7U to 32U, surpassing May’s all-time high price (ATH).

December 5: $ORDI rises to 69U, market cap exceeds $1 billion.

2.1 Ordinals & BRC20

To summarize, Ordinals is essentially a protocol that uses Bitcoin as a hard drive.

Since the Taproot upgrade two years ago removed the data size limit for a single transaction in the Segregated Witness field, the maximum data size was relaxed to 4MB. This move unexpectedly gives Bitcoin "tamper-proof, permanent storage" properties similar to Arweave.

Ordinals founder Casey Rodarmor accidentally opened Pandora's box. When he founded Ordinals, he may not have predicted that the inscription ecology on Bitcoin would develop to the complexity it has today.

Ordinals can be compared to NFTs, but unlike Ethereum and other public chains, which usually store NFT metadata in IPFS or centralized servers, the metadata of Ordinals is embedded in the witness data of the transaction, as if "engraved" in specific bits Coin (Satoshi). This is also the origin of the word "inscription".

Initially, Ordinal was characterized by its focus on the "hard drive" nature of Bitcoin's immutable and permanent storage. It allows metadata to support various content types such as text, images, videos, etc. Despite the 4MB size limit (which will become irrelevant in recursive inscriptions), BTC seems to be the best choice for an NFT platform. During this time, several ETH NFT clones, including BTC Punks and Apes, switched to BTC and gained popularity. Surprisingly, Bitcoin Frogs emerged as the ultimate winner.

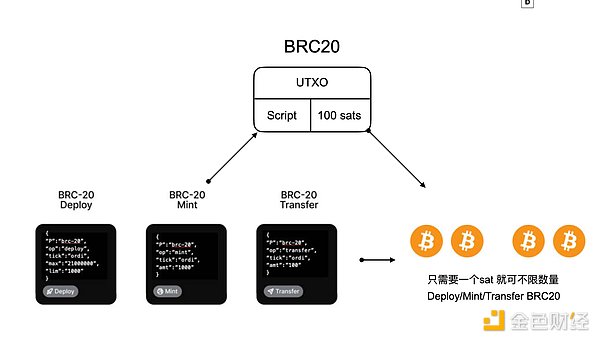

However, as the market develops, it gradually becomes clear that NFT alone will not be able to meet market demand. The non-fungible and illiquid nature of Ordinal hinders the development of fungible tokens. This is where a smart innovator DOMO enters the scene. He leveraged the Ordinal protocol, which focuses primarily on NFTs, and successfully simulated a fungible token mechanism similar to ERC20. This new token standard is named BRC-20.

Since Ordinal has no file format restrictions, JSON files are also a viable option. With three simple "operation codes" - Deploy, Mint, Transfer, BRC-20 can achieve minting and transfer functions similar to ERC-20, thanks to the help of Indexer.

Currently, Indexers provides a basic setup for searching all BRC20 on the Bitcoin chain relative to centralization. It indexes the number of BRC20 tokens each person may own based on deploy, mint and transfer operations.

There are three notable terms in the BRC20 ecosystem:

- ORDI : the first BRC20 token, setting the benchmark for the entire token space. Although it may be considered a meme due to its applied properties, being the first is of great significance. Without ORDI, there would not have been the hundreds of BRC20 tokens that followed, nor the various XRC20 tokens that appeared in the BTC ecosystem, nor the token systems that expanded to other major public chains.

- SATS : It has a more decentralized structure compared to ORDI due to a six-month minting period and numerous zeros after the decimal point. Granted by Unisat its first "useful" inscription as a BRC-20 Swap charge, Sats once surpassed the market capitalization of leading ORDI and showed a tendency to compete with ORDI for first place. Regardless of the outcome, ORDI and SATS have become top inscriptions recognized by the market.

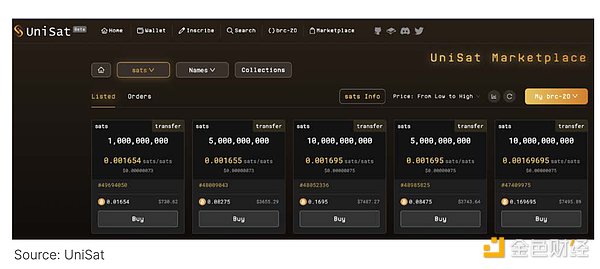

- UniSat : Currently the most important infrastructure in the BRC20 ecosystem. From the earliest proxy services to wallets, Indexers to marketplaces, UniSat modules have become the foundation of today’s Inscription ecosystem.

Interestingly, Casey, the founder of Ordinals, is not optimistic about the BRC-20 inscription. He is worried that it will flood the Bitcoin block space with "junk UTXO", thereby affecting normal BTC transfers. However, the popularity of the BRC-20 has become overwhelming and no one’s opposition can stop its development. As Inscription continues to evolve, more sophisticated XRC-20 assets are becoming available on the market.

2.2 Atomics: Rising Stars

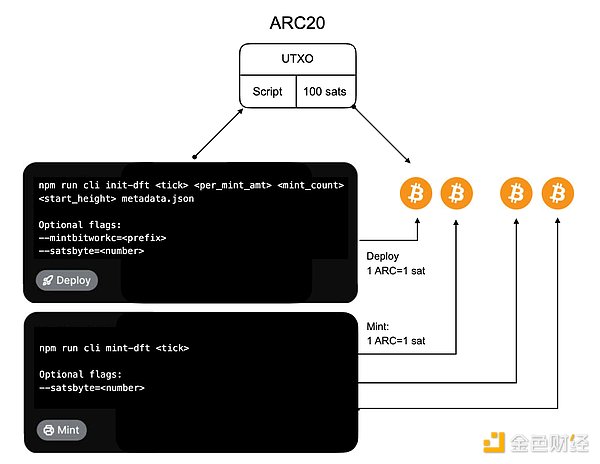

If the role of Ordinals in the Bitcoin ecosystem is similar to Bitcoin itself, then the Atomics protocol is undoubtedly closer to Ethereum. Similar to BRC-20, ARC-20 also supports the creation of various types of tokens on the Bitcoin blockchain, but the two are fundamentally different in underlying design.

The subtleties of ARC-20:

ARC-20 brings the concept of colored coins to Bitcoin and utilizes each Satoshi in a UTXO to represent a unit of ownership of a deployed token. These UTXOs themselves can be combined in Bitcoin transactions, enhancing the programmability of the ARC-20 token. In theory, direct exchange between Bitcoin and ARC-20 can be achieved by simply exchanging the input and output of UTXO.

Unlike BRC-20, which relies heavily on the indexer from minting to transfer, ARC-20 transactions are completely driven by Bitcoin L1 (layer 1) UTXO and are completely independent of the indexer. Therefore, Atomics avoids the problem of generating "garbage UTXOs".

Of course, everything comes with a price. ARC-20 increases the cost of asset issuance, and after holding UTXO is "spent", the asset may also be lost. Another problem is its lagging infrastructure, which is far less mature than BRC-20 (but thankfully, UniSat has begun to support Atomical). Therefore, Atomics still has a long way to go in catching up with Ordinals.

Interesting facts about Atomics:

Initially viewed as plagiarism: Many people initially viewed Atomics as a simple copy of Ordinals. However, after joining the community, they quickly realized that it was not a simple and easy-to-understand BRC-20, but something unique.

Complex yet sophisticated: Atomics has a long development process, committed founders, and carefully planned scenarios and features. It's actually a very comprehensive agreement. Some key opinion leaders (KOLs) have even compared its anonymous founder to a young Steve Jobs, praising his rational demeanor in multiple interviews. This Jobsian touch adds a unique charm to the protocol.

Ambitious AVM: The ZeroSync team announced BitVM, a concept that can compute anything on Bitcoin. This is technically possible, but would likely take years to achieve and is currently not commercially practical. The founders of Atomics have expressed great interest in this and see the potential of its protocol, and have high hopes for AVM.

2.3. Rune & BRC100

Rune

Casey, the founder of Bitcoin Inscription, has always been dissatisfied with BRC-20, but was unable to change it. Inspired by the Atomincal protocol (guess, because Atomincal was released earlier), Casey proposed a protocol called Rune for issuing inscriptions similar to fungible tokens.

In essence, Rune and Atomincal are very similar. Both write token ID, output and quantity information into UTXO scripts, with BTC Layer 1 handling the transfer and not relying heavily on indexers. The main difference is that Rune includes a specific number of tokens in the script data, rather than following a 1 sat = 1 token model. This provides greater accuracy than ARC20, but also increases complexity, limiting the composability of BTC UTXOs that can be easily exploited like ARC20.

Interestingly, Casey's Rune Protocol started out as an "idea" with no concrete product. However, the founders of TRAC were the first to develop the first usable protocol based on this idea and released the pipe inscription.

Later, a project called Rune Alpha emerged, introducing Cook inscriptions. At first, everyone thought it was Casey's project, but surprisingly, he denied involvement. Despite the denials, market enthusiasm has ignited, leading to continued hype surrounding Cook's inscription.

• BRC100

BRC100 claims to be an application protocol. It follows the inscription theory of BRC 20 but adds more concepts such as protocol inheritance, application nesting, state machines, models, and decentralized governance.

These improvements may enable the Bitcoin blockchain to support the development of native decentralized applications (dApps) such as AMM DEX, lending platforms, SocialFi, and GameFi in the future. This protocol is still under development, please refer to [ https://docs.brc100.org/ ] to view its current status.

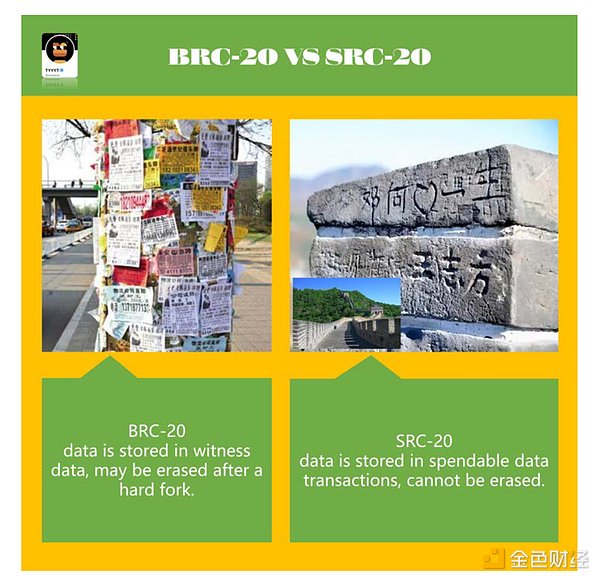

2.4. SRC20 & BRC420

• SRC20

SRC20 is not a derivative of Ordinal, but a direct competitor. There is a comparison chart online that clearly shows the difference between BTC Stamps and Ordinal.

In direct comparison, Ordinal stores data in SegWit fields, while BTC Stamps stores data in BTC transaction outputs. Therefore, in BTC Stamps, SRC20 is equivalent to the fungible token version of BRC20.

The advantage of SRC20 over BRC20 is that data stored in SegWit fields may be "pruned" by full nodes, but transaction outputs will not. This makes SRC20 or BTC Stamps a truly “permanent” protocol.

However, the disadvantages are also obvious: SRC20 is very expensive. Although the casting cost of BRC20 is between 3-5 US dollars, the SRC20 is much higher, about 30-50 US dollars, a difference of 5-10 times.

Overall, SRC20 seems to be more popular among Western developers as it is designed to compete against the Eastern BRC20 ecosystem.

BRC420

BRC420 is the "BTC Metaverse Protocol" launched by the Recursiverse team ( https://twitter.com/rcsvio ). Unlike previous asset issuance protocols, BRC420 focuses more on the application layer and is known for its complexity.

The BRC420 introduces three interesting innovations:

A. New asset types:

BRC420 introduces more complex asset formats using recursion by combining multiple inscriptions to create elaborate inscriptions. This allows for the creation of various Metaverse inscriptions such as game characters, game DLC, HTML scripts, music, videos, and more. The ultimate goal is to achieve "on-chain inscription modularity."

B. On-chain royalties:

By enabling recursive module asset calls to each other, on-chain assets can cover everything from characters and pets to entire game scripts, virtual machines and even large AI models. Implementing a fair and automated royalty system can incentivize a thriving developer ecosystem and promote the production of more valuable modules on the chain.

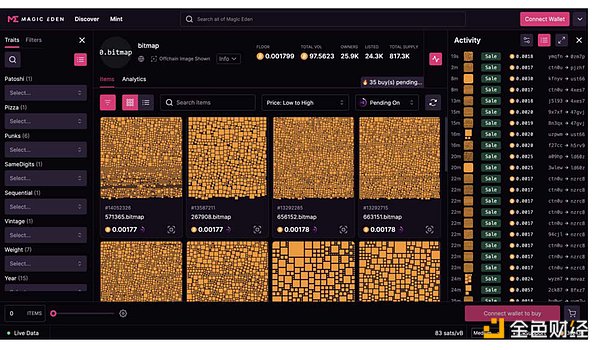

C. Bitmap:

The concept of Bitmap is fascinating and advanced. It can be considered a BTC-based Sandbox Land, but with more powerful native features. Each .bitmap inscription corresponds to a Bitcoin block, and the number will increase simultaneously with the block. Currently, there are more than 810,000 Bitmaps.

BRC420 has a token supply that increases by 50,000 annually. With more than 20,000 unique holder addresses, it ranks second after ORDI and SATS.

Although BRC420 does not own Bitmap, it is its biggest promoter, dominating over 95% of browser traffic. There are more than a hundred teams issuing assets on BRC420, making it an application protocol closely linked to Bitmap.

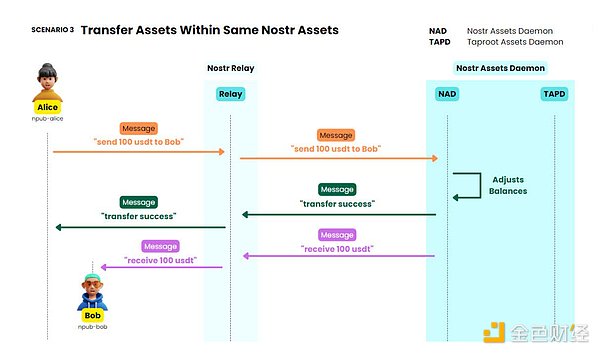

2.4. Taproot Asset & RG

These two technical solutions are considered important candidates for Bitcoin’s long-term expansion, namely Client Side Validation. Of note is the Nostr Asset Protocol (one of Taproot Assets). Despite common misunderstanding, Nostr assets and Nostr (a decentralized social network messaging protocol) are not the same thing. Nostr Assets does not use the Nostr protocol to issue assets, but serves as an application on Nostr, using Nostr messages to manage managed wallets.

This allows users to send and receive Taproot assets at the protocol layer via Nostr's public and private keys. The project team faced controversy for some time over the naming issue. In the first half of next year, Taproot assets will undergo integration testing with the Lightning Network. If successful, we can expect more releases of Taproot assets and new applications on Lightning Network sidechains in the next 6-12 months.

Although RGB misses out on the current hot Bitcoin ecosystem, it is still one of the best solutions for Bitcoin’s long-term expansion. Its support for smart contracts gives it an advantage over Taproot in terms of scalability and flexibility, especially if Tether intends to issue USDT on RGB. The number of teams developing on RGB is also much higher than Taproot assets.

However, conversations with several RGB and Taproot developers revealed that RGB currently faces significant technical challenges in integrating with the Lightning Network. Therefore, Liquid sidechain may become a short-term "temporary option" for RGB. Founder Maxim even considered launching a new Layer 1 to host RGB. From a legal perspective, the Lightning Network is undoubtedly the best choice. However, only time will tell whether the technical compatibility issues can be overcome.

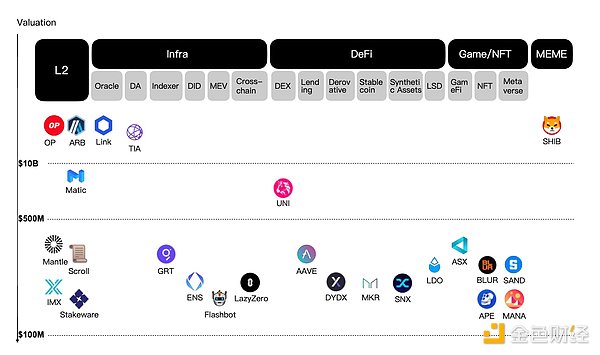

3. The future of Bitcoin: entering the golden age

As we look toward the future of the Bitcoin ecosystem, we can expect exciting innovations and shifts in many key areas. It is expected to emulate what the Ethereum ecosystem has achieved over the past few years.

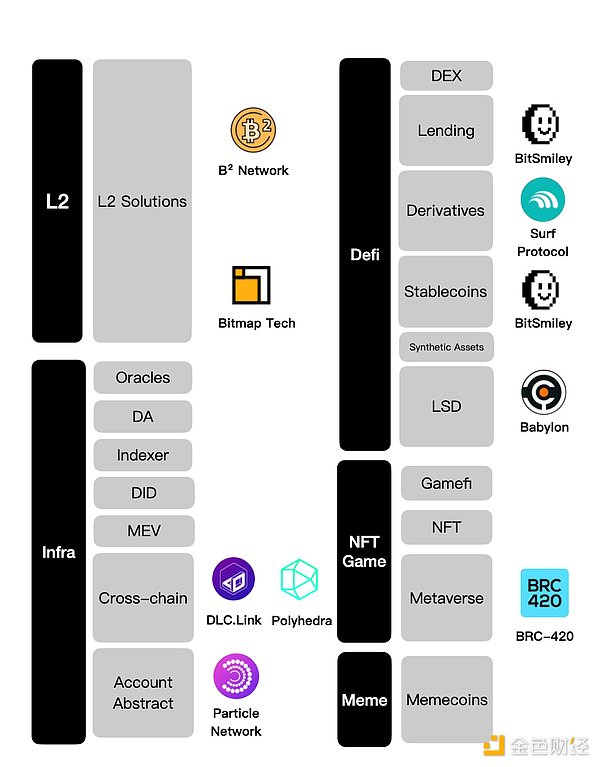

1. Second layer solution

Congestion and high transaction fees on the Bitcoin network have always been stumbling blocks to its large-scale adoption. Layer 2 technology emerged to solve these problems and unlock Bitcoin’s potential.

Among them, BSquared stands out. It is a Layer 2 platform compatible with the Ethereum Virtual Machine (EVM), provides an off-chain trading platform and supports Turing-complete smart contracts. This greatly improves transaction efficiency and reduces costs. BSquared ensures stronger transaction privacy and security by integrating zero-knowledge proof (ZKP) technology with Bitcoin’s Taproot. Even, the project can achieve transaction fees that are 50 times lower than the Bitcoin mainnet and transaction speeds that are 300 times faster. The BSquared team actively encourages developers to build various DeFi and NFT platforms on the chain, with the ultimate goal of developing Bitcoin into a vibrant platform.

In addition to BSquared, Bitmap and Babylon are also developing Layer 2 services respectively. Bitmap leverages its strong community and influence in Layer 1 asset protocols to gain a strong position in the Layer 2 ecosystem. Similarly, Babylon can also use the huge traffic generated by Bitcoin mortgage to promote the construction of Layer 2.

2. Asset issuance and trading

In the future Bitcoin ecosystem, we can expect more asset issuance and trading platforms to emerge. These platforms will enable users to create and trade a variety of digital assets. In this regard, Bitmap introduced the BRC420 protocol, which takes a different approach compared to protocols such as Ordinals. The BRC-420 protocol creatively merges multiple inscriptions into one complex inscription, deviating from the traditional "single inscription" approach. This means users can create on-chain assets ranging from character images or pets to complete game scripts, virtual machines, and even large AI models. Developers can purchase these assets or pay to use them.

3. Stablecoins

Stablecoins mitigate Bitcoin’s volatility by providing a stable digital asset, thereby enhancing Bitcoin’s utility as a reliable store of value. BitSmileyDAO provides peer-to-peer lending based on BRC20, as well as insurance and CDS derivatives built on this lending. In addition, they have established partnerships with several BTC second-layer platforms to provide stablecoins and DeFi ecosystem products. BitUSD’s overcollateralization mechanism is similar to MakerDAO. At the currency issuance level, users can mint bitUSD by staking BTC using Wrapped BTC on partnered Layer2 or bridging BTC through BitSmiley’s official bridge. BitSmiley fills a critical gap in the current BTC ecosystem with its "inscription-formed stablecoin" approach and opens new doors in BTC DeFi with its lending, insurance, and CDS derivatives solutions. It has quickly become an indispensable and key component project in the BTC ecosystem.

4. Lending and Borrowing

As Bitcoin becomes more popular, lending platforms will expand to provide Bitcoin holders with services to borrow money and earn interest. This will further financialize Bitcoin and attract traditional financial institutions. Babylon allows Bitcoin holders to stake their idle Bitcoins. This not only enhances the security of the Proof-of-Stake (PoS) chain, but also enables users to profit in the process. Babylon proposes a Bitcoin proof-of-stake protocol that eliminates the need to bridge to the PoS chain, ensuring complete and reducible security guarantees of the chain. Additionally, the protocol supports fast unlocking, maximizing liquidity for Bitcoin holders. Its modular plug-in design makes it compatible with various PoS consensus algorithms, laying a solid foundation for building resettable protocols.

5. Bridging

In the future, cross-chain technology in the Bitcoin ecosystem will mature, enabling interoperability between different blockchains. This will enhance the synergy of the blockchain ecosystem and promote cooperation and interaction between projects. In order to explore DeFi applications in the Bitcoin network, BTC assets can effectively introduce public chains with smart contract functions, such as Ethereum. Polyhedra Network introduces a zkBridge-based Bitcoin cross-chain messaging protocol, improving the interoperability of the Bitcoin network. This innovation enables secure interaction between the Bitcoin network and other blockchain networks and represents a major advancement in blockchain technology, opening up new possibilities for interactions between Bitcoin and various blockchains. sex.

6. Applications

Bitcoin will have great application potential in the future, covering various fields. These decentralized applications will provide users with more reliable solutions due to Bitcoin’s security and immutability. Among these applications, Bitmask is the most popular and representative wallet for trading on RGB. It has a built-in marketplace (coming soon) that supports trading of RGB assets. Additionally, the team plans to roll out the Launchpad component in the next phase. Since RGB is a "native extension" solution, it is technically and logistically the most compatible with BTC. It is worth noting that RGB V0.1 has been officially released for half a year, and V0.11 Alpha is about to be released. Therefore, the RGB ecosystem is expected to gain momentum over the next six months, perfectly coinciding with Bitcoin’s halving event.

7.MEV

MEV, a feature of the proof-of-mining (PoW) mechanism, theoretically also applies to Bitcoin. During the BRC-20 craze, a veteran Bitcoin player used inscription technology to create an MEV machine called "Sophon" to protect Bitcoin from "dust attacks."

“Sophon” uses a front-running strategy to quickly deploy tokens with the same name, setting the supply to 1 and ensuring priority deployment by paying high gas fees. This effectively prevents others from deploying the coin of the same name. The emergence of Sophon caused rapid fluctuations in the number of BRC-20 tokens, becoming an experiment in the potential of Bitcoin's MEV.

Bitcoin transactions are currently mainly based on simple Bitcoin transfers, resulting in relatively limited opportunities for MEV (miners to extract value). However, the potential of MEV is likely to increase with the introduction of more sophisticated solutions such as Taproot or Layer 2. Especially after all Bitcoin mining is completed, MEV may become a new source of revenue for miners.

Currently, miners have no financial incentive to actively seek out MEV, but we could see ecological projects like Flashbots appear on Bitcoin Layer 2 in the near future.

These innovations and transformations will shape the future of the Bitcoin ecosystem, making it more accessible, scalable, and adaptable. This is not only a preliminary imagination, but also a promising prospect. Future actual development will benefit from continued scientific and technological progress, collaborative cooperation within the community, and continued market demand for innovation

Portfolio Overview

ABCDE Capital (BTC Ecology) Investment Portfolio