The content of this article is the author’s observation of new trends in the Rollup market, future development, and possible opportunities. Try discussing the following topics:

What is Rollup Summer?

New Rollup Cases: ZKFair and Manta

The development of Rollup Summer

Secondary Market Opportunities: Related Subjects of the Rollup Summer Narrative

The content of the following article is the author's staged views as of the time of publication. It is more deduced and explained from a business perspective and has less focus on the technical details of Rollup. This article may contain errors and biases in facts and opinions. It is for discussion purposes only. We also look forward to corrections from other investment research colleagues.

Contents

1. What is Rollup Summer?

Similar to the Defi Summer that started in 2020 and the 23-year inscription Summer, Rollup Summer is the author’s definition of the state of the explosion of new Rollup projects that may appear in the future in multiple dimensions such as quantity and business volume (TVL, active users, ecological projects). Although there are initial clues at present, it is just a deduction and hypothesis.

Rollup Summer is specifically reflected in:

A large number of new Rollup or application chain projects have been launched and the mainnet has been launched.

Users, funds, and developers are flowing into the Rollup ecosystem at a much faster rate than in the past year

Business data and asset prices reinforce each other, contributing to the rapid expansion of the total market value of the Rollup track and related projects.

Rollup Summer may start at the end of 2023 or the beginning of 2024, and may become an important narrative throughout half a year or even the entire year.

The main factors that incubate Rollup Summer are:

1. The flywheel effect of the new Rollup

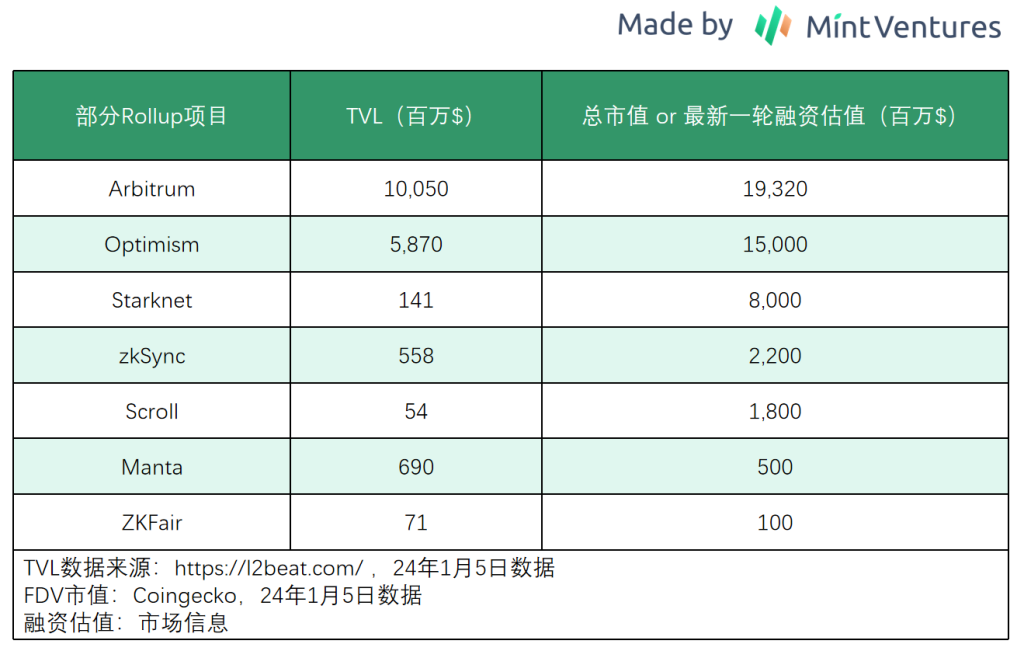

Rollup itself is not a new species. Already launched Rollups including Arbitrum and Optimism already have huge market value and business volume. Other ZK Rollups such as Starknet and zkSync have also been running for a long time.

But the protagonists of this round of Rollup Summer will be the new Rollup projects that have just appeared in this cycle, because:

The concept of modular blockchain is deeply rooted in the hearts of the people, and the infrastructure of each module of Rollup is becoming more and more perfect, such as OP stack, Celestia of the DA layer, decentralized sequencer, and various RaaS service providers, etc., which are developed and maintained with a modular concept The threshold for a Rollup is falling rapidly

New rollup, new tokens, sufficient budget for cold start and incentives, more radical token distribution and incentive methods, more attractive to users and funds

Low starting market value, big room for imagination

Bull market atmosphere, boosted by market optimism

Simply put, the characteristics of this new round of rollup are: new projects, tokens, modularity, generous incentives, making the project’s initial business and currency price flywheel spin faster.

The initial stage of Rollup Summer's flywheel may come from: token airdrop plan → introduction of user assets, increase in core business data i.e. TVL → larger project market value.

The second stage may come from: Token ecological airdrop plan → Directly subsidize dapps in the ecology and indirectly subsidize users → Further introduce user assets and increase core data TVL + number of active users + gas fees → further increase the market value of the project → New Rollup flip Old generation Rollup calls appear → further market sentiment Fomo.

2. Cancun upgrade

In addition to the flywheel effect of emerging Rollup, another background factor is the Ethereum Cancun upgrade expected to come in February this year. The Cancun upgrade itself directly benefits Arbitrum and Optimism, reflected in the rapid reduction of their L1 costs, forming a larger Second level profit margin. But Cancun itself will also attract the attention of the entire market to the Rollup track, bringing attention and funds to new Rollup models.

2. New Rollup cases: ZKFair and Manta

The author takes two recent Rollups that have attracted much attention as examples to analyze the operation mode and characteristics of the new Rollup, the protagonist of Rollup Summer.

1.ZKFair

The main features of ZKFair as a Rollup are:

Built on Polygon cdk, DA layer will use Celestia (currently maintained by self-operated data committee), EVM compatible

Use USDC as gas fee

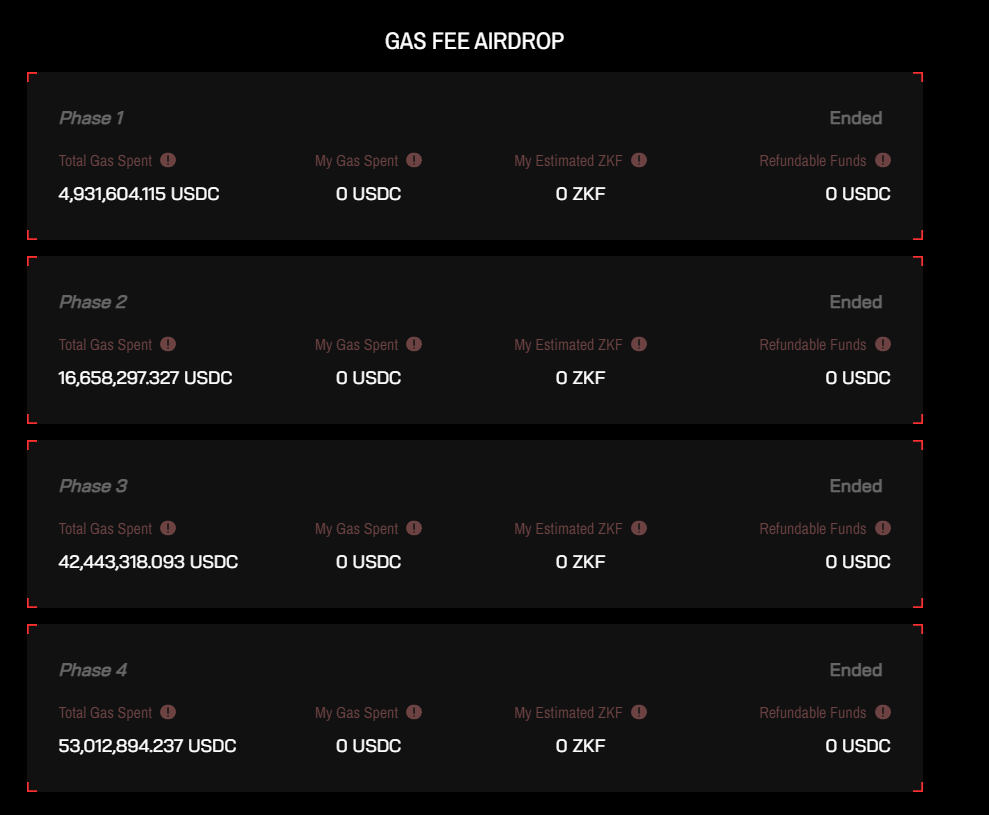

100% of Rollup tokens ZKF are distributed to the community. 75% of the tokens will be distributed in four installments to participants of Gas consumption activities within 48 hours. Essentially, participants participate in the primary market sale of tokens by paying Gas to the official sorter. Correspondingly The primary market financing valuation is only $4 million

Rollup’s operating profits promise to return 100% to the community, 75% of which will be distributed to ZKF LP pledgers and 25% to qualified dapp deployers. The profit here = total expenses – operating costs (Rollup’s browser, oracle and other infrastructure cost)

Since ZKF is distributed based on the ratio of participants' total Gas consumption during the event to the total Gas amount, this means that the sale of ZKF is a game of "fighting for funds", and a large number of users cross-chain USDC to ZKFair mainnet. During the airdrop event of ZKFair, the on-chain funds surged from 0 to a maximum of about 140 million US dollars within 2 or 3 days, which was equivalent to the ZKRollup head project Starknet at that time. Even at the current stage when the airdrop has ended, ZKFair’s TVL of $70 million+ is higher than the ZKRollup project Scroll, which was launched earlier.

The benefits of ZKFair’s above operation are obvious:

Rapid cold start and popularity gathering: TVL on the chain went from 0 to over 100 million within 3 days (currently still 70M+). It is one of the fastest growing rollups, with 334,000 addresses.

Direct token empowerment: Sorter fees are directly allocated to users and developers, providing support for the intrinsic value of Rollup’s tokens

The current FDV of ZKF is about 100 million. For one rollup, compared with the horizontal valuation of other rollups, its market value is still not high.

2.Manta

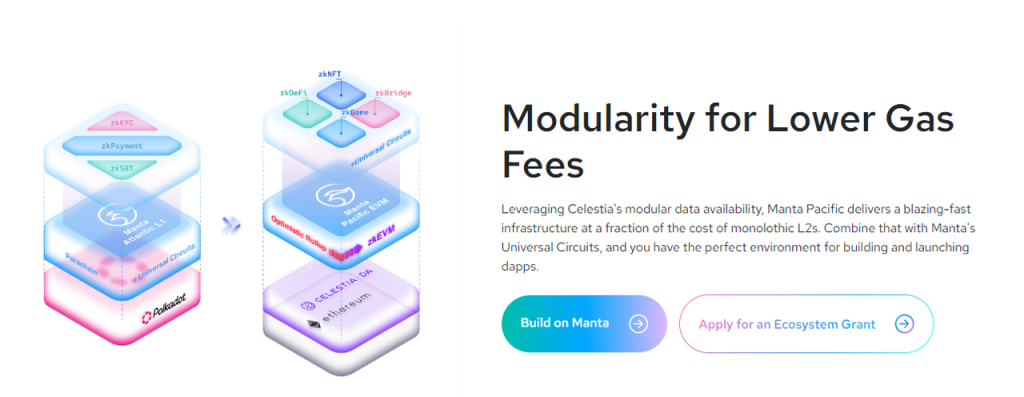

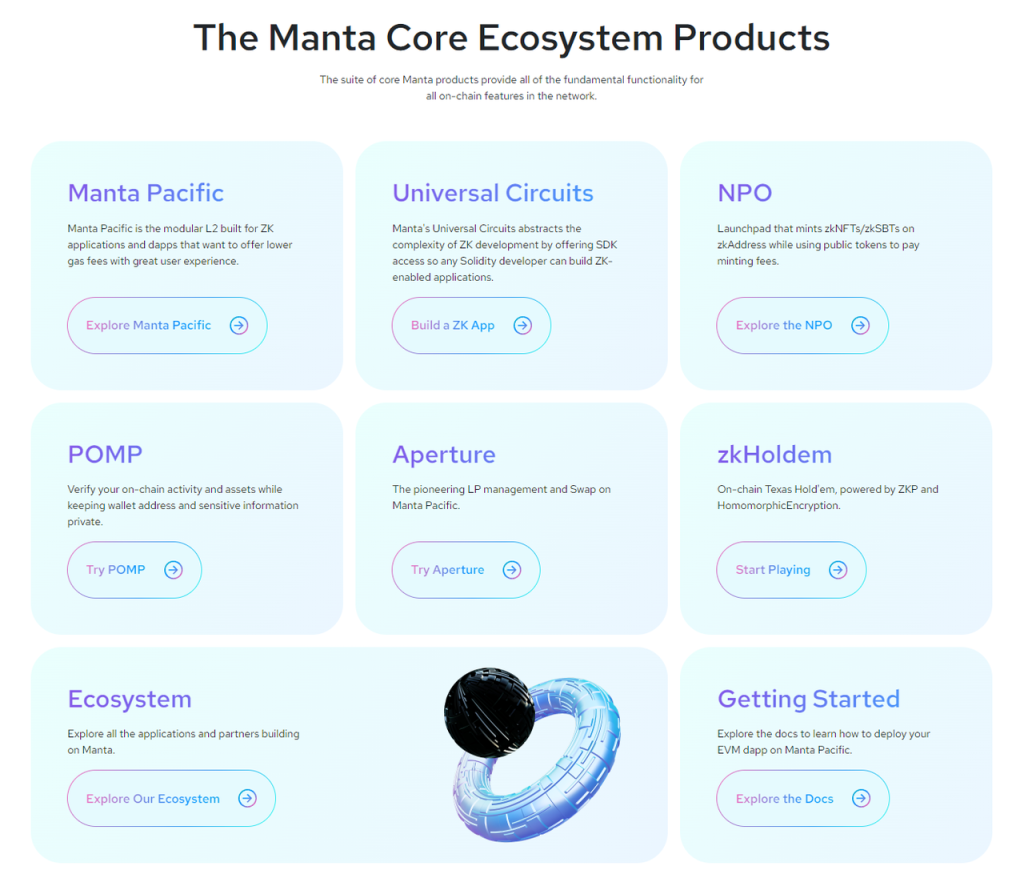

Features of Manta Rollup are:

Built on Celestia DA+Polygon zkevm, EVM compatible

In addition to Rollup, the overall product line is rich, especially a large number of ZK-based suite services

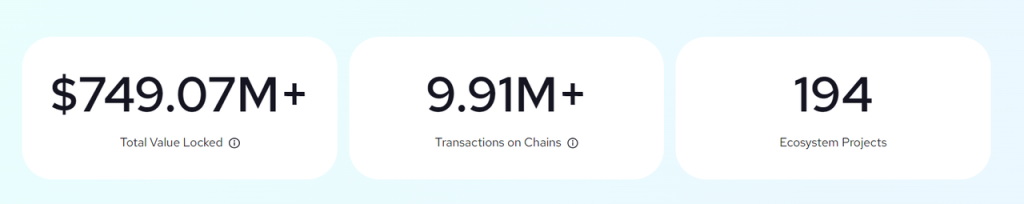

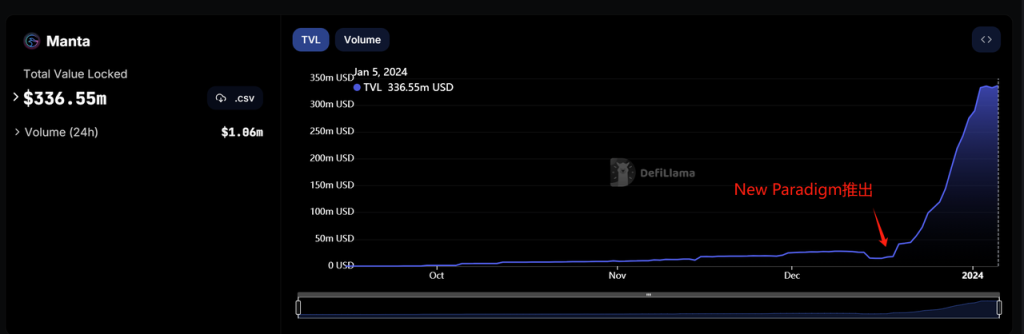

Manta's Rollup was officially launched in September 23, but the business data took off after the launch of the new paradigm event in mid-December. The current total amount of funds on the chain (official data) is close to 750 million.

The picture below shows the trend of Manta’s on-chain Defi TVL. We can see the obvious growth inflection point after the launch of the new paradigm.

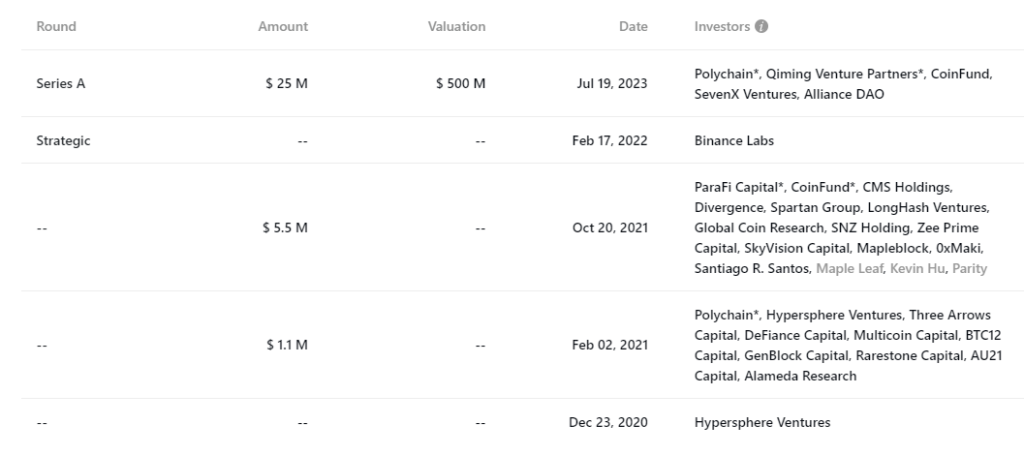

Manta’s investment lineup is also very luxurious, with a valuation of $500 million in its last round of financing:

The activity logic of New Paradigm is very simple and is an upgrade of blur’s blast mode:

Distribute your own rollup token rewards according to the amount of cross-chain funds, quickly increasing the amount of funds on the chain

Cross-chain assets will at least receive the basic interest rate in the crypto world (eth pos + stable currency treasury bond income), reducing the user’s opportunity cost of funds.

Set airdrop expectations for dapp interactions, encourage users to interact with existing dapps after cross-chain, and boost developer confidence

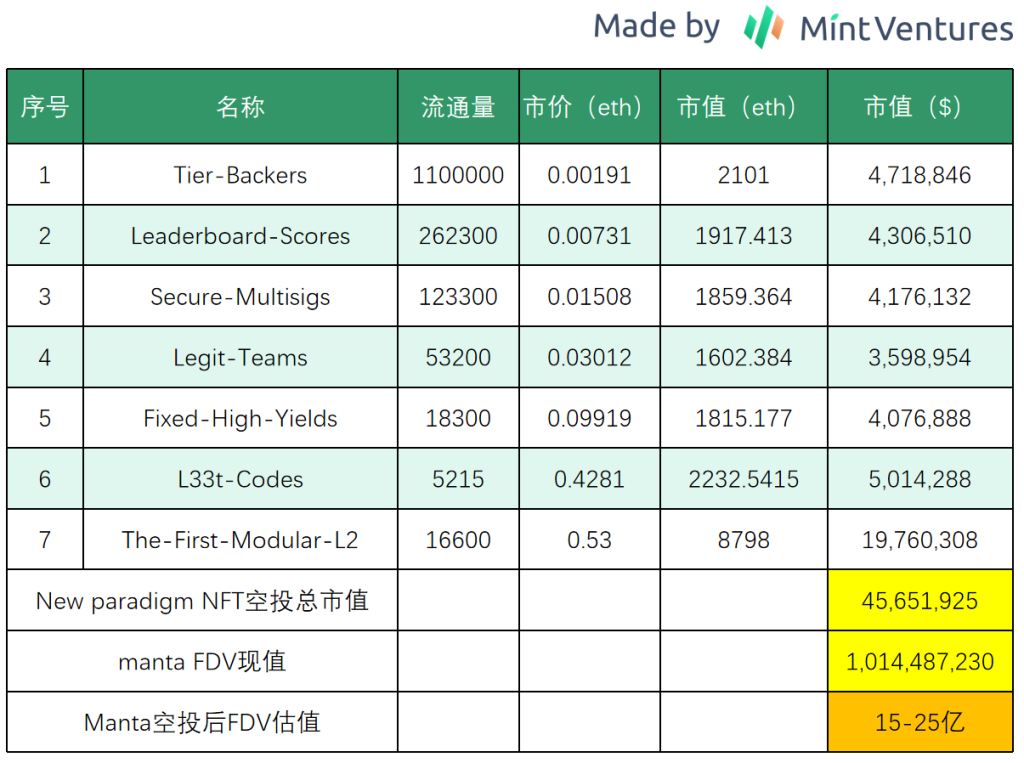

New paradigm will distribute a total of 45 million Manta tokens to NFT holders, accounting for 4.5% of the total. The author roughly calculated based on today’s (24.1.5) NFT secondary market data that the FDV valuation of the project after the Manta token is launched is at $1.5-2.5 billion range.

In addition to ZKFair and Manta, other similar new Rollups are also appearing in large numbers, such as Blast, which was launched earlier, and Layer X, which recently mixed ZKFair and Manta modes, etc.

In addition, considering that ZKRollup projects such as Scroll and zkSync have not yet issued tokens, these projects that were launched earlier on the mainnet also have the opportunity to refer to the ZKFair and Manta models and directly attract users and users for their own ecology through a clearer token reward mechanism. funds.

3. Rollup Summer follow-up deduction

Next, we can deduce the possible development path of Rollup Summer:

The new type of Rollup is launched, and the volume is quickly increased through token airdrops and interactive activities. The rapidly soaring data and better mechanisms give the market good expectations for its growth (implementation is underway)

The Rollup project's currency issuance is online or listed on the exchange, and the wealth effect is evident (ZKFair 25-30 times increase), stimulating the attention of more players and funds.

Token incentives have shifted from pure TVL in the initial stage to increasing ecological activity, gas fee consumption and project introduction, and the market has shifted from observing TVL to observing the sustainability of ecological development (challenges begin to increase here)

A large number of new Rollups are launched wholesale, and funds and attention are diluted (which also means that the wealth effect of new Rollup tokens is reduced), the quality of projects plummets, and even fraudulent projects appear (which attract funds and then get stolen or run away). Market confidence damaged

Summer has subsided and Rollup competition has returned to a steady state, but the distribution method of Rollup tokens in the future may inherit the method of this round (to solve the problem of business cold start)

We can see from this that the biggest challenge for the new Rollups and Rollup Summer after their initial success is how to stimulate the sustainable development of the ecosystem after completing the initial distribution of tokens, and how to make their own Rollup ecosystem emerge with talents that can be retained. Users and funds, applications and services with wealth effects, whether it is Meme, Defi or more airdrops and exquisite Ponzi.

4. Secondary opportunities: Rollup Summer narrative-related targets

Which secondary targets will benefit from the development of Rollup Summer? Starting from Rollup Summer, the following sub-narratives may be further derived:

Sub-narrative guess 1: “Celestia is the Ethereum of the Rollup era”

ZKFair and Manta and more new Rollups will adopt Celestia's DA products, and Celestia is moving from stories to examples. Once an example project using Celestia gets good market feedback, more new Rollups will inevitably follow suit. "Using Celestia as the DA layer" may become the standard configuration of the new Rollup. Celestia becomes the new consensus layer of Rollup, and then becomes the core infrastructure of the Rollup era.

From this, a sub-narrative of "Celestia is the Ethereum of the Rollup era" may emerge. Whether this story can come true in the future is not important in the short term, because judging from Celestia's current circulating market value of only $2.3 billion, it is far away from Ethereum. The circulating market value of $270 billion has enough room for two orders of magnitude.

Sub-narrative speculation 2: Interest-earning assets become standard

Interest-bearing assets, especially interest-bearing stablecoins such as sDAI, have been slow to replace mainstream stablecoins in the past. However, in the airdrop activities of Blast and Manta, ETH interest-bearing assets and interest-bearing stablecoins have almost become the native assets of this new type of Rollup. , if more Rollups follow up on this kind of practice, it will directly promote the expansion of user groups and the development of habits. This directly benefits interest-earning asset issuers that have the ability to obtain strong Rollup cooperation. For example, Blast chose Lido and MakerDao, and Manta chose Stakestone and Mountain Protocol.

Sub-narrative speculation 3: Rollup devours L1 market share

In terms of experience, there is no real difference between Rollup and L1. The L1 public chain wave in the previous cycle may reappear in the form of a sovereign Rollup wave in this cycle. While Rollup competes with each other, it will also directly compete with L1. A battle for users and funds occurs. At the same time, some fast-growing native dapps on Rollup also have opportunities worthy of attention. For example, the lending project LayerBank on Manta has a total deposit size of more than $300 million, which is close to the data of Radiant, the leading lending project on Arbitrum.

However, while being optimistic about the rapid development of many Rollups, we also need to consider the risk of narrative failure.

The Risks of the Rollup Summer Narrative

The core challenge of the new Rollup is the smooth transition from the start-up phase to the growth phase. It is relatively simple to use token airdrops to stimulate capital inflows, but if you want to retain users and funds for a long time, the incentive challenge will be more complex. In fact, various L1s in the previous cycle also made similar attempts, such as launching hundreds of millions of public chain incentive funds to encourage the leading Defi on Ethereum to migrate, and Defi will transfer the incentives they received. Giving their own users to improve their business data, such measures achieved good results in the early stages. However, as various public chains launched similar policies, the incentive effect gradually declined in the competition.

Even the current established Rollups such as Arbitrum and Optimism have been distributing their own token subsidies to ecological projects and then delivering them to users through ecological projects, hoping to retain users' activity and funds. The total incentive amount of Arbitrum’s latest round has exceeded 70 million ARB (currently worth more than 140 million US dollars).

Therefore, how Rollup Summer will develop as a narrative in its embryonic state, we still need to observe the next move of the new Rollup.