In the field of derivatives decentralized exchanges (DEX), the competitive environment is extremely complex. Market leaders such as GMX, dYdX and SNX firmly occupy the top position, while second-tier platforms such as Gains Network, MUX, Level and ApolloX are also actively competing for market share. At the same time, a steady stream of new protocols is emerging, making this field increasingly dynamic.

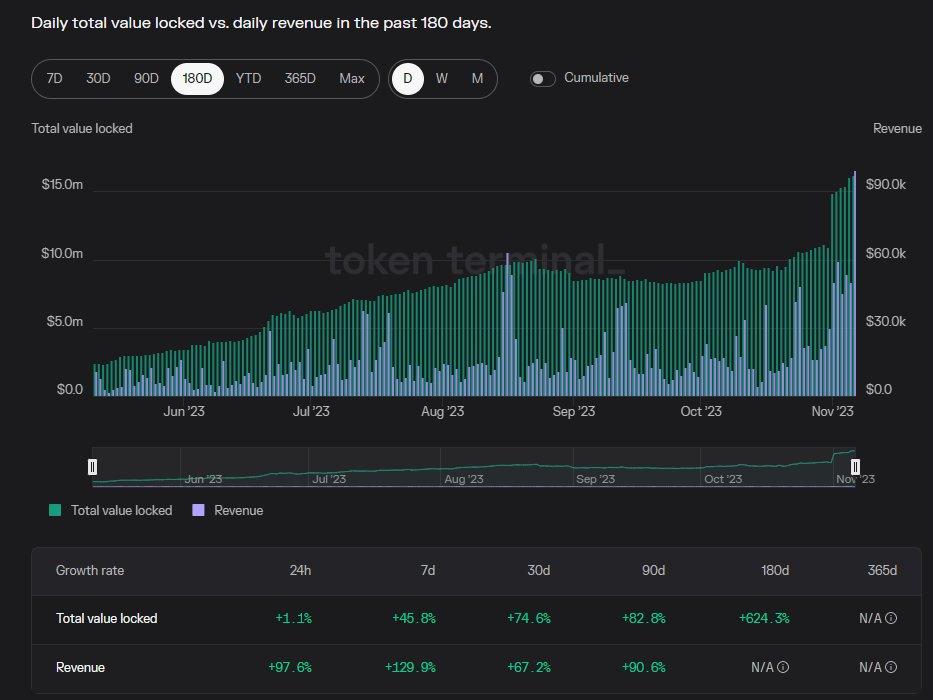

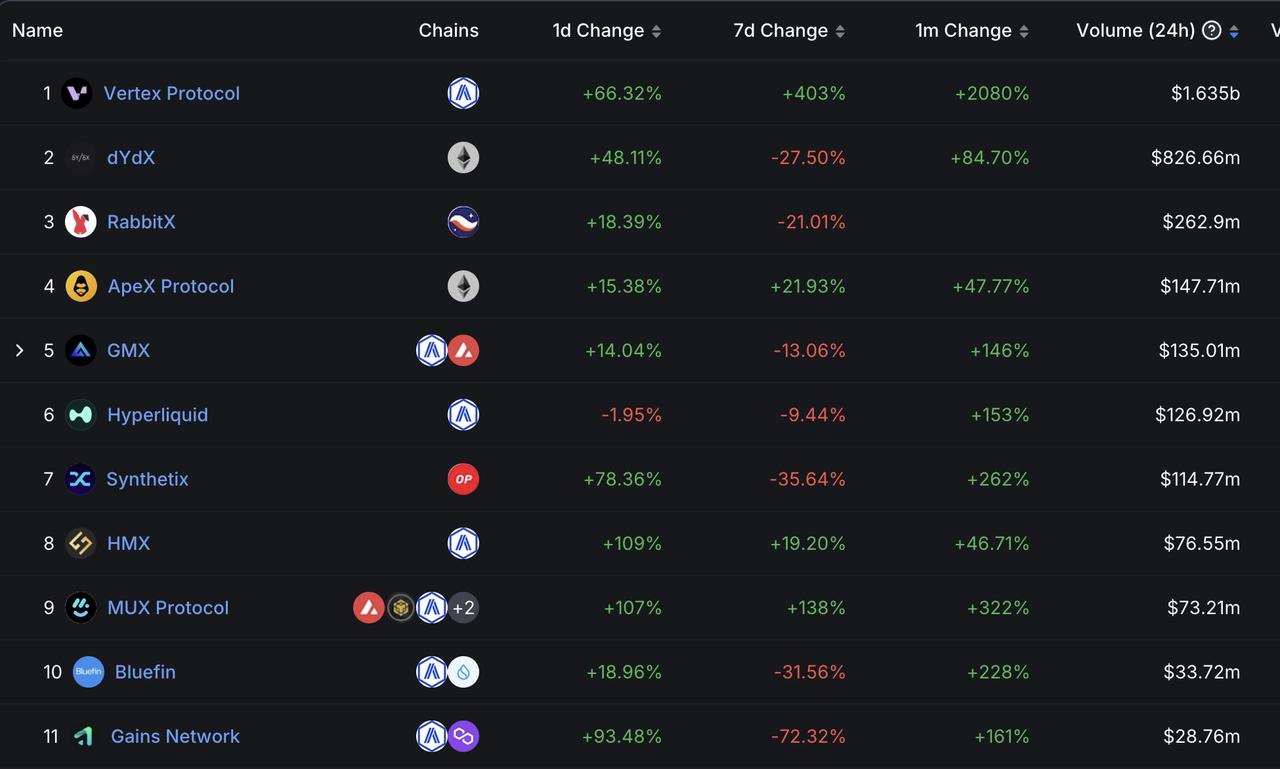

Against this background, Vertex Protocol’s performance is particularly eye-catching, with its transaction volume, total value locked (TVL) and revenue growth rates all reaching record highs. Especially in November last year, Vertex’s performance was eye-catching: on November 6, its single-day trading volume exceeded US$400 million, and in the week from November 2 to November 7, Vertex became the only The platform with the highest trading volume among the on-chain perpetual contract platforms after dYdX. Behind this rapid growth is closely related to Vertex’s own unique features, incentive plans, and the upcoming Liquidity Guided Auction (LBA).

What is even more striking is that on November 28 last year, Vertex achieved a historic breakthrough in the derivatives trading platform, with its single-day trading volume reaching US$1.63 billion.

This achievement not only enabled Vertex to surpass established trading platforms such as dYdX and GMX, but also firmly occupied the first position in the derivatives DEX market. This remarkable result not only proves Vertex’s strength, but also heralds its future leadership in the DeFi derivatives market. The details will be introduced below.

The development history of Vertex Protocol shows an enterprise's adaptation and transformation in the turmoil of the industry. Initially, Vertex operated as a decentralized foreign exchange platform on the Terra chain, but the collapse of Terra in May 2022 forced Vertex to seek a new development path. Making a strategic decision, Vertex migrated to the Arbitrum chain and transformed into a decentralized exchange (DEX). During this transformation process, Vertex not only migrated its platform, but also massively expanded its business scope, including the introduction of new products such as spot trading, futures trading, and lending markets, to adapt to the increasingly complex and diverse DeFi market needs.

Vertex's transformation and development benefit from the professional skills and market insights of its founding team. Co-founder Darius is responsible for promotion and marketing, while Alwin Peng provides support for Vertex’s technical development with his experience in Jump trading and background as a blockchain engineer. Their collaboration and expertise have been key to Vertex's steady growth in the new environment.

Vertex received strategic investment from Wintermute Ventures in June 2023, which is an important node in its development process. Wintermute Ventures is the investment arm of cryptocurrency market maker Wintermute, which provides market making services to several well-known projects. When Wintermute invested in Vertex, it was pointed out that Vertex has a team of experienced traders and engineers with a proven track record in both traditional finance and decentralized finance markets, and is at the forefront of the industry in smart contracts and market innovation. .

In April 2022, Vertex completed a US$8.5 million seed round of financing, led by Hack VC and Dexterity Capital, with participation from many other institutions. This financing shows the market’s interest in Vertex and its recognition of its future development potential.

Early investors received an 8.5% token allocation, bringing Vertex's seed round valuation to US$100 million. This figure reflects the market's evaluation and expectations of Vertex to a certain extent. Although such valuations and investments have brought certain market attention and expectations, as an emerging company in the rapidly changing DeFi field, Vertex's future performance and market position remain to be tested by time.

Vertex Protocol has demonstrated significant innovation capabilities in the DeFi field, and its features and service models are particularly prominent in data-driven decision-making. Related specific advantages include:

1. Deeply explore the decentralized derivatives track: Vertex mainly conducts business around the contract market, especially perpetual contract trading, which is quite distinctive among many DeFi platforms; the spot and lending markets provide more support for contract trading, which is reflected in In the trading data, most transactions are concentrated on perpetual contracts.

2. Hybrid order book-AMM model: Vertex combines off-chain order books with on-chain AMM, aiming to increase transaction speed and reduce the possibility of MEV attacks; through data analysis, Vertex optimizes transaction paths to ensure liquidity even in order books When insufficient, the transaction remains valid.

3. Universal Cross Margin: Vertex’s Universal Cross Margin model expands the application scope of margin; compared with the traditional isolated margin and cross margin models, this model allows all users’ funds (including LP funds) to be used as margin, which greatly improves the margin. improve the efficiency of the use of funds.

4. The transaction fee structure is more attractive: Vertex’s transaction fee structure is more beneficial to users, with maker fees of zero and taker fees between 0.01% and 0.04%; according to transaction data, this fee structure attracts a large number of users. Especially high-frequency traders.

5. Compared with competing products, the funding rate is more favorable: In terms of fees and funding efficiency, Vertex has obvious advantages compared with other mainstream derivatives DEX. Compared to GMX (0.1% opening and closing fees), dYdX (0.02% to 0.05% trading fees, decreasing with trading volume), and Kwenta (0.02% to 0.06% trading fees), Vertex Its low fee structure makes it competitive in the market.

In summary, Vertex Protocol has established its unique positioning in the DeFi market through its data-driven trading products, innovative liquidity supply model, capital efficiency improvement strategy, and competitive fee structure. These characteristics reflect Vertex's sensitivity to market trends and deep understanding of user needs.

Although Vertex faces fierce market competition and a changing technological environment, its data and market performance to date show its potential and room for development in the DeFi field. How Vertex leverages these strengths to solidify and expand its market position over time will be key to determining its long-term success.

Vertex Protocol officially issued its official token VRTX on November 20, 2023. This move injected new impetus into its development in the DeFi derivatives market.

The total supply of VRTX is set at 1 billion, and its distribution strategy reflects the consideration of different stakeholders:

1. Continuous incentives: 34% of the tokens are used for continuous incentives to encourage user participation and contribution.

2. Founding team: 20% is allocated to the founding team to support their long-term investment and development.

3. Initial Token Phase: 10% is used for the first phase of the “Trade & Earn” plan.

4. Treasury: 11.7% belongs to the project’s treasury.

5. Ecosystem: 9% is used for ecosystem construction and expansion.

6. Early investors: 8.8% is allocated to early investors and is expected to be allocated within 2 to 3 years after the project is launched.

7. Future contributors: 5% is reserved for individuals or teams who will contribute to the project in the future.

8. Liquidity Guided Auction (LBA): 1% is used for liquidity guidance.

9. Consultants: 0.5% is used for the consultant team.

The VRTX token distribution strategy shows Vertex’s long-term planning and market expansion goals. According to official documents, 90.85% of VRTX will be distributed over 5 years, and this slow token release plan is designed to ensure the stability and sustainable development of the project. Currently, token distribution only accounts for 16% of the total supply, of which only 10% is in real circulation.

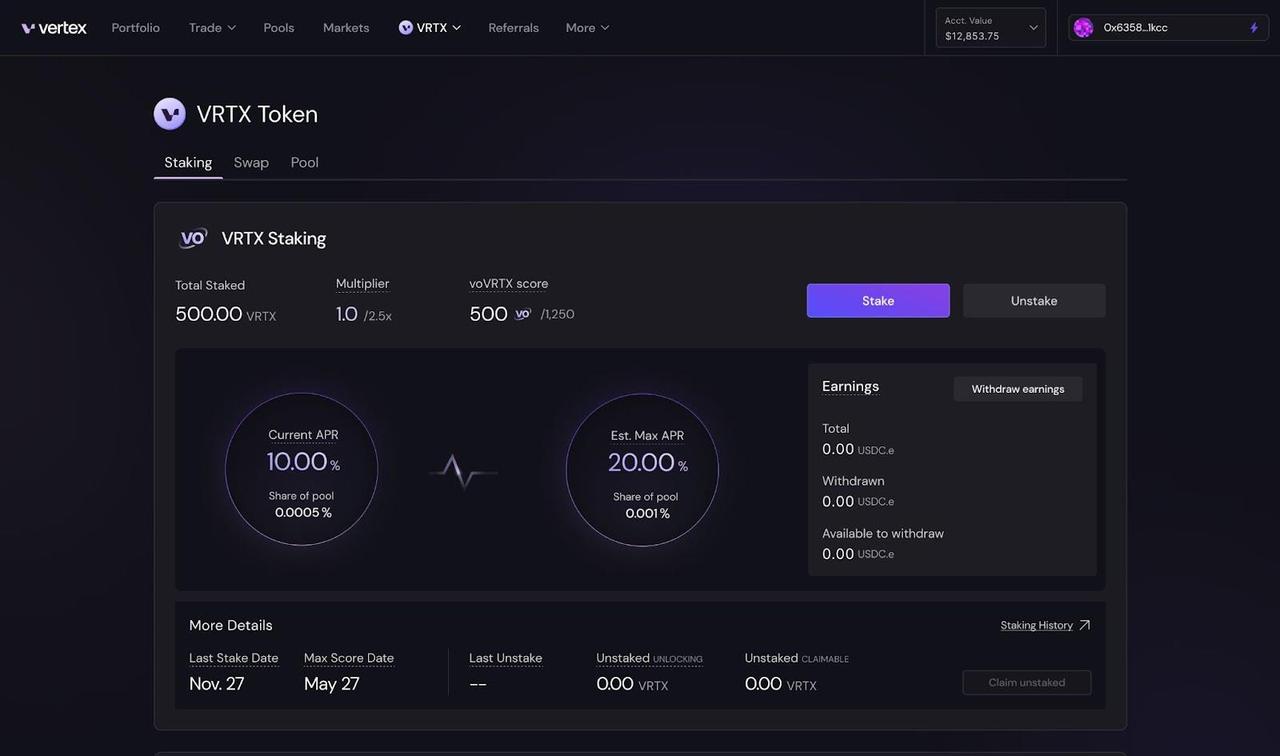

The main purpose of the VRTX token is to promote the activity and collaborative development of the Vertex community. Its main functions include staking and incentives. Among them, users can contribute to the security of the Vertex ecosystem by staking VRTX. Vertex has introduced the "VE" model, which generates voVRTX points based on the length of mortgage time to encourage users to hold and participate for a long time; it also provides rewards for contributors of varying degrees to the protocol to encourage continued participation and support.

Despite the fierce competition in the DeFi derivatives market, "transaction mining" still shows practicality as a cold start method. But for Vertex, how to maintain popularity and cultivate a loyal user base after the rewards end is still unknown. At the same time, currently more than 97% of derivatives trading volume is still conducted on centralized exchanges (CEX), and derivatives DEX only account for 2.72% of the total trading volume. Once derivatives DEX achieves a breakthrough, it may bring about major changes in the market. This has led many investors to be optimistic about the derivatives DEX space and believe that they may play a central role in the next bull market.

From a market perspective, Vertex Protocol’s VRTX token issuance and its potential market influence demonstrate the ambition of an enterprise seeking innovation and breakthroughs in the DeFi field. Although derivatives DEX currently account for a small proportion of the entire cryptocurrency market, with the development of technology and the improvement of user awareness, the DeFi derivatives market has the potential to achieve significant growth. Vertex is trying to occupy a position in this rapidly developing market through its token economic model and ecosystem construction.

Ultimately, whether Vertex can successfully maintain its market popularity and maintain its long-term influence in the DeFi derivatives market will depend on whether it can continue to attract and meet the needs of users, and how it adapts to future market changes and challenges. As the DeFi field continues to evolve, the future performance of Vertex and its VRTX token still deserves the attention and expectations of the market and investors.