Written by: MIIX Captial

Thailand is a multi-ethnic country. As an export-oriented economy, the gap between the rich and the poor is extremely obvious. Sustained low inflation is leading to a decline in the value of Thailand's currency and continued economic contraction. At the same time, the adoption rate of cryptocurrency in Thailand has been very high since 2017. The government is also continuing to promote the implementation of relevant regulatory policies, hoping to alleviate some problems of economic development through the strengthening of open policies in the encryption market. This has provided a good foundation for the encryption industry. Taking root and developing locally provides a good market and policy environment.

1. Macroeconomic indicators and current situation

Thailand is a middle power in global affairs and a founding member of ASEAN. It ranks high on the Human Development Index and is the second largest economy in Southeast Asia and the 23rd largest economy in the world based on purchasing power parity.

In 2014, Credit Suisse reported that Thailand was the third most unequal country in the world, after Russia and India. The top 10% of the rich hold 79% of the country's assets, and the total net worth of the richest 50 families accounts for 30% of GDP. In 2016, Thailand ranked 87th in the Human Development Index, and ranked 87th in the inequality-adjusted human development index. Ranked 70th in the Development Index.

1.1 Geographical location and population size

The Kingdom of Thailand, referred to as Thailand, with its capital Bangkok, is located in the south-central part of the Indochina Peninsula, bordering the Pacific Ocean to the southeast and the Gulf of Thailand to the southeast and the Indian Ocean and the Andaman Sea to the southwest. It borders Myanmar to the west and northwest, Laos to the northeast, Cambodia to the east, and Malaysia to the south. It has a tropical monsoon climate and the terrain is high in the north and low in the south. With a total area of 513,000 square kilometers and a coastline of 2,705 kilometers, the country is divided into five regions and a total of 77 prefectures.

According to the latest United Nations data compiled by Worldometer: As of January 2, 2024, Thailand's population was 71,844,093. The urban population accounts for 52.0% of the total population (37,322,064 people in 2023). Thailand's population is equivalent to 0.89% of the world's total population. There are more than 30 ethnic groups in total. The Thai ethnic group is the main ethnic group, accounting for 40% of the total population. The rest are Lao, Chinese, Malay, Khmer, as well as Miao, Yao, Gui, Wen, Karen, Shan, and Sai. Mountain peoples such as Mang and Shagai. More than 90% of the people believe in Buddhism, the Malays believe in Islam, and a few people believe in Christianity, Catholicism, Hinduism and Sikhism.

1.2 Economic structure and scale

Thailand is an emerging economy, considered a newly industrialized country, and the second largest economy in Southeast Asia, after Indonesia. Its three main economic sectors are agriculture, manufacturing and services. Thailand implements liberal economic policies and is an export-oriented economy. It mainly relies on external markets such as China, the United States, and Japan. Agricultural products are one of Thailand's main sources of foreign exchange earnings.

In the 1980s, the electronics industry and other manufacturing industries developed rapidly, and the economy continued to grow at a high speed. In 1996, it was classified as a middle-income country. Thailand exports goods and services worth more than US$105 billion annually. Major exports include automobiles, computers, electrical appliances, rice, textiles and footwear, fishery products, rubber and jewelry.

1.3 GDP ranks 9th in Asia

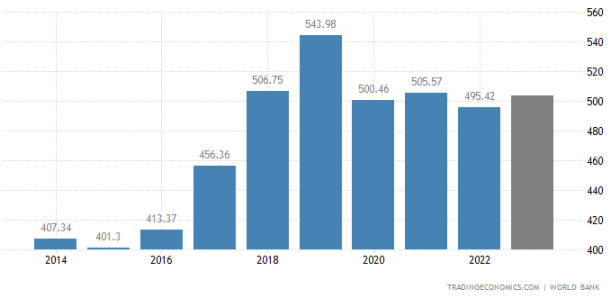

According to official data from the World Bank, Thailand's GDP in 2022 was US$495.42 billion, accounting for 0.21% of the world economy, with a growth rate of 2.6%, making it the ninth largest economy in Asia.

Thailand's economy relies heavily on exports, which account for more than two-thirds of gross domestic product (GDP). The Bank of Thailand reported that between 2006 and 2016, only 6% of the country's companies were engaged in the export industry, while the export industry accounted for 60% of the country's total revenue.

1.4 GDP per capita ranks 4th in Southeast Asia

In 2022, Thailand's per capita GDP was US$6,278.35. Thailand's per capita GDP is equivalent to 50% of the world average. From 1960 to 2022, Thailand's per capita GDP averaged US$2,976.71, reaching an all-time high of US$6,453.89 in 2019.

Thailand ranks in the middle of the wealth distribution in Southeast Asia and is the fourth richest country in terms of GDP per capita, after Singapore, Brunei and Malaysia.

1.5 Inflation continues to be below forecast levels

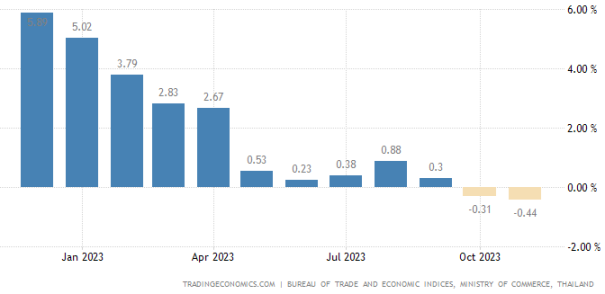

In December 2023, Thai consumer prices fell by 0.83% year-on-year, which was the third episode of deflation after falling by 0.44% in November, compared with expectations for a decline of 0.3%. It also marked the worst deflation in 34 months and the eighth consecutive month that the central bank's target of 1% to 3% has been exceeded. The main contribution was lower energy prices due to government measures, namely lower electricity and gasoline prices.

Core inflation in December was 0.58%, unchanged from November and the lowest since January 2022, while expectations were for a 6% rise. The Commerce Department said the inflation rate in 2023 is 1.23%, and this year's forecast is -0.30% to 1.7%. Monthly CPI fell by 0.46%

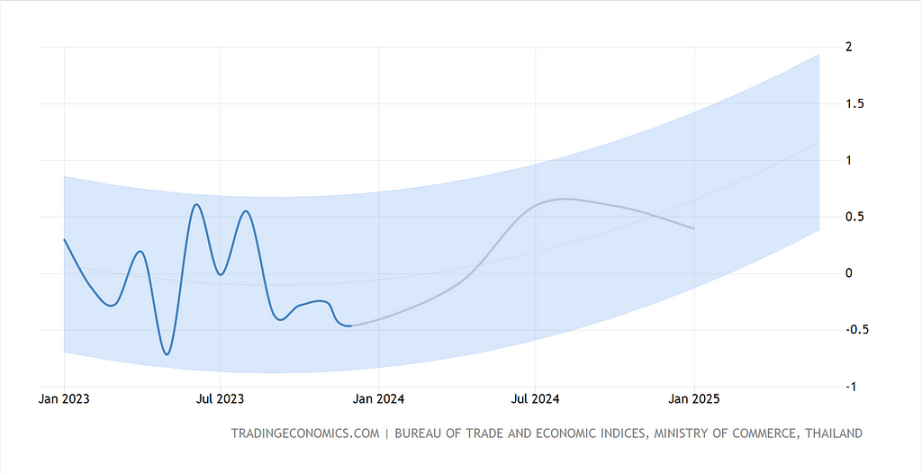

According to Trading Economics global macro model and analyst expectations, Thailand's inflation rate is expected to be -0.10% month-on-month by the end of this quarter. In the long term, Thailand's inflation rate is expected to be around 0.40% in 2024 and 0.30% in 2025. % about. In other words, if the government does not take strong measures to change, Thailand's currency value will decline, the economy will continue to shrink, and the resulting gap between the rich and the poor will continue in 2024.

1.6 Thai legal tender

Thailand's currency is the Thai Baht, code THB. It is the 10th most frequently used currency in the world and one of the strongest currencies in Southeast Asia. The Thai Baht is becoming increasingly popular among Forex traders. Thailand's economic fundamentals, including healthy tourism and strong exports, underpin the baht's consistent performance.

A developing economy and a growing middle class make Thailand an attractive place to do business. The Bank of Thailand manages the baht and its strong policies help maintain exchange rate stability.

2. Users and market in Thailand

2.1 Ranked 10th in adoption index

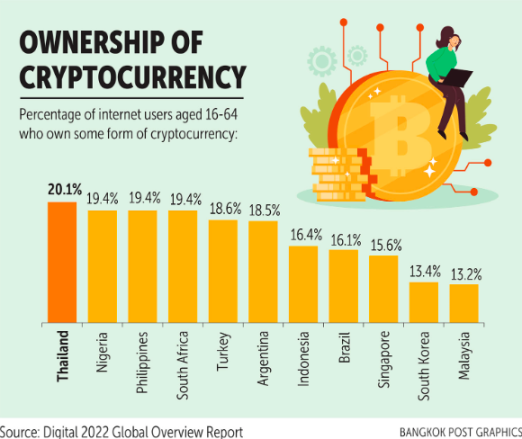

Thailand performs well in terms of civilian adoption, ranking 10th in Chainaanalysis's "Global Cryptocurrency Adoption Index 2023". According to the "Global Digital Overview Report 2022", Thailand is the country with the highest proportion of cryptocurrency owners in the world among Internet users. one,

2.2 The proportion of encryption users continues to grow

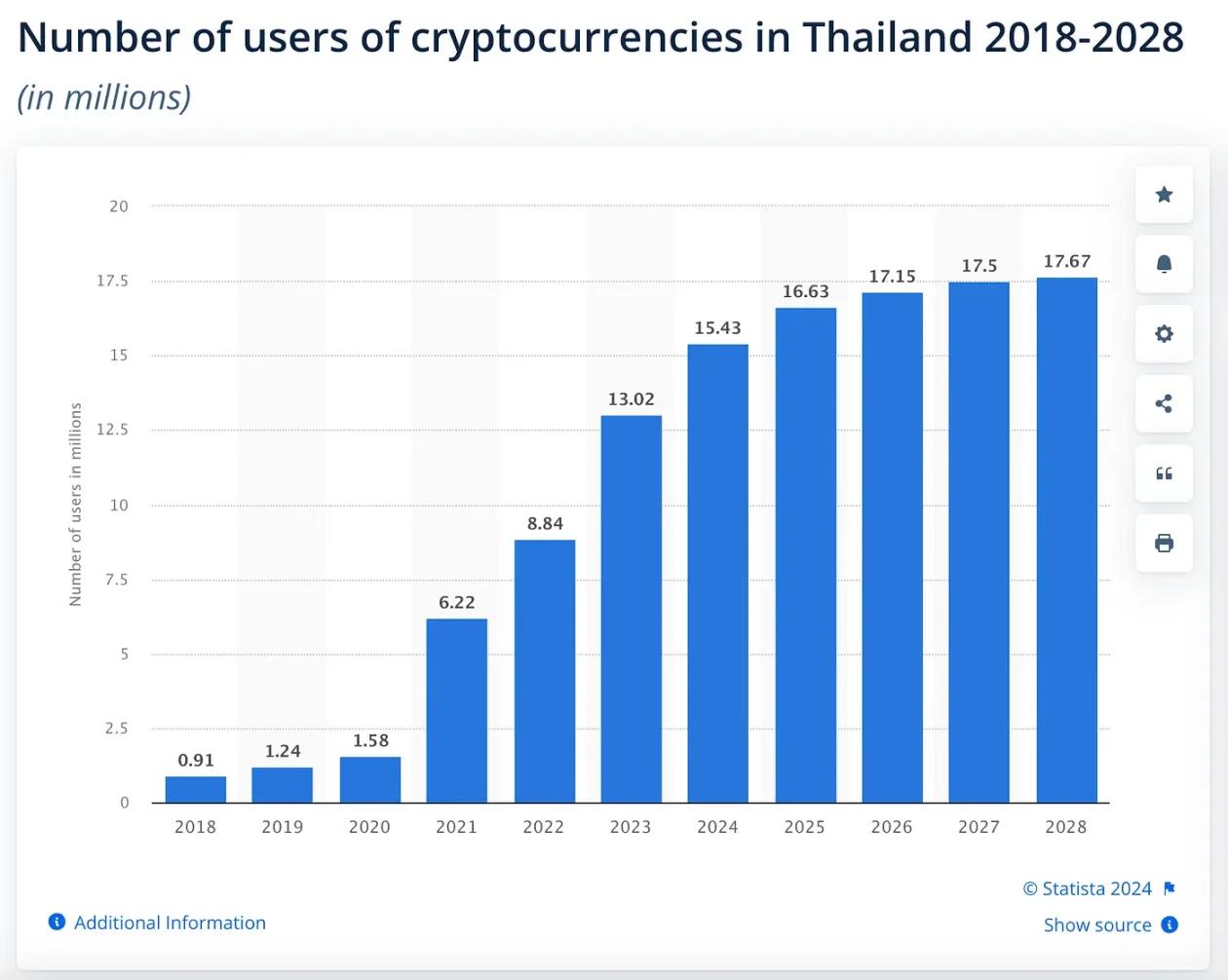

Statista.com January 11, 2024 data: There are 13.02 million cryptocurrency users in Thailand as of 2023 , or about 18.1% of the population, and after the tenth consecutive year of growth, the indicator is expected to It will reach 17.67 million users and reach a new peak in 2028. It is worth noting that the number of users in the “cryptocurrency” sector of the fintech market has continued to grow over the past few years.

2.3 Young men are the core user group

There is less user data in the Thai crypto market. According to a 2022 Datareportal report in partnership with Hootsuite and WeAreSocial: Thailand leads the world in the proportion of Internet users who own cryptocurrencies, engage in online shopping, and buy groceries online. Internet users in Thailand aged 16 to 64 A significant portion of the population owns cryptocurrencies (20.1%), the highest percentage in the world.

Cryptocurrency investors are mainly male, accounting for 52.9% of the total number of investors. Cryptocurrency has become an urgently needed form of investment for Thais;

About 75% of cryptocurrency investors are between the ages of 18 and 24, and only 1.1% are 55 and older;

3. CEX preferences of Thai users

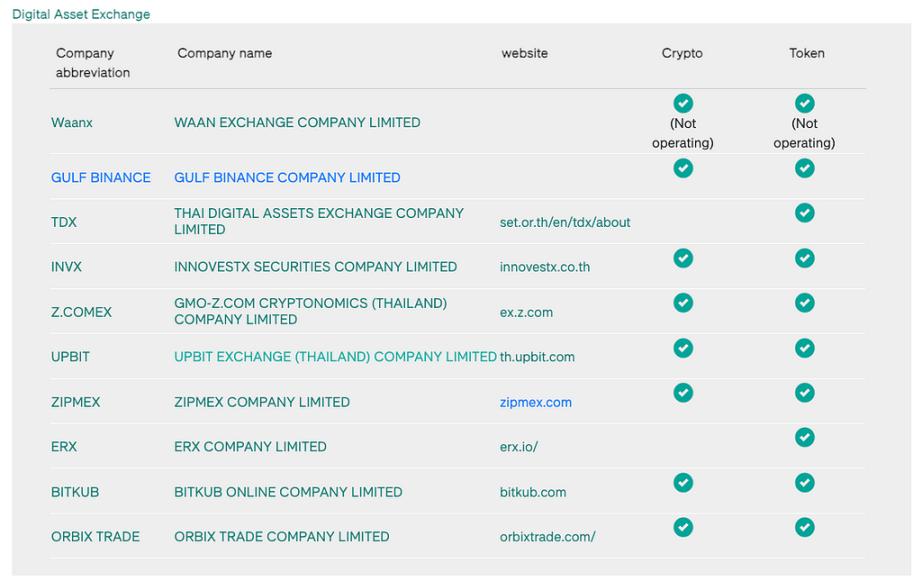

According to the Securities and Exchange Commission of Thailand, there is a list of registered and licensed CEXs . The following exchanges are allowed to operate in Thailand:

3.1 Bitkub is a CEX recognized by the SEC

Located in the heart of Bangkok, Bitkub is officially recognized by the Securities and Exchange Commission of Thailand (SEC) and has excellent credibility. As Thailand's largest cryptocurrency exchange, Bitkub provides Thai baht exchange services, accounting for 75.4% of the country's exchange market share, according to Coingecko.com.

3.2 Zipmex Thailand’s second largest CEX

Founded in 2018 and headquartered in Singapore, Zipmex is a cryptocurrency exchange serving retail and institutional investors. It leverages blockchain technology to provide secure investment, saving and spending opportunities in Southeast Asia. According to Coingecko.com, as of 2022, Zipmex's market share in Thailand is 14.78% based on trading volume.

3.3 ORBIX is the most convenient CEX to use

ORBIX is the most reliable digital asset trading and exchange center and the first regulated digital asset exchange in Thailand, providing Thai baht cryptocurrency trading services so that users can trade digital assets more safely.

3.4 CEX in which Bitazza broker participates

According to Coingecko.com, Bitazza is the third largest cryptocurrency exchange based on trading volume, with a market share of 8.52%. Bitazza is an ASEAN local digital asset platform, consisting of related exchanges and brokers established across Asia and holding local operating licenses. Clients have direct access to the corresponding personal broker for their trading account (not just emails and bots).

Bitazza provides easy access to local digital asset financial and custody services, as well as easy and fast deposits, withdrawals, and local fiat-to-crypto-to-fiat conversions.

3.5 Binance operates as GulfBinance localization

Binance is the world's largest cryptocurrency exchange by trading volume, with 172 million users . GulfBinance is a joint venture between Binance and Gulf. It has obtained a digital asset operator license issued by the Ministry of Finance of Thailand, and its digital asset platform is licensed by the country's Securities Exchange. Commission regulation and will begin operations in Thailand in the fourth quarter of 2023. GulfBinance will move forward with plans to open a digital asset exchange and digital asset broker that complies with local regulatory guidelines.

3.6 Upbit obtains Korean CEX operating license

Upbit is another centralized cryptocurrency exchange allowed to operate in Thailand. Upbit is a South Korean cryptocurrency exchange founded in 2017 and operated by Dunamu, one of the most valuable startups in South Korea. Upbit has also obtained licenses in South Korea (48% market share), Singapore and Indonesia, and aims to become one of the top centralized exchanges in Southeast Asia.

4. Thailand’s Web3 project

4.1 Token Unlocks token data analysis platform

Token Unlocks has developed a token analysis platform that integrates on-chain and off-chain data to provide the best user experience. Their services include structured and tagged on-chain and off-chain token data, as well as customized on-chain monitoring for tracking token projects. This enables traders to make informed investment decisions by obtaining accurate token information and keeping abreast of project dynamics.

4.2 GuildFi is a gaming guild that empowers players

GuildFi is a gaming platform that empowers all gamer communities and creates interoperability across the metaverse, with investors including Coinbase Venture, Animoca Brands, and Pantera, among others. They are building an infrastructure designed to connect players, guilds, and investors to accelerate game financing in the blockchain economy, from Play-To-Earn games to Metaverse and more.

GuildFi has its own Treasury Zone (accumulated wealth section), which is divided into different areas such as growth funds, development funds, and venture funds. It also has a Tool Zone tool area for users to collect relevant game data and other results. Although there is still a certain gap compared with the total number of YGG guilds, it is not inferior to the former in terms of complete functions and popularity, and its potential cannot be underestimated.

4.3 Together.ai decentralized cloud service platform

Together.ai operates a technology services platform focused on providing decentralized cloud services for artificial intelligence. Their platform specializes in building large, user-friendly and open-source models. This helps researchers, developers and companies leverage and enhance artificial intelligence through an intuitive platform that spans data, models and computation.

4.4 Token X financing and asset tokenization service provider

Token X Co., Ltd. is a subsidiary of SCBX and provides ICO portal services and digital asset tokenization services. The company aims to be a successful partner in tokenization and its services span tokenization consulting, blockchain technology development and blockchain networks. Their customer base is primarily companies looking for more flexible financing solutions. ICOs provide token issuers with more options regarding backing assets. These supporting assets can be traditional real estate or rights and services.

4.5 3Landers Adventure Collaboration Collectible NFT

3Landers is a collectible NFT project centered around community, adventure, and collaboration. Each 3Lander resides on the Ethereum blockchain as a unique, non-fungible token (NFT), consisting of a unique combination of characteristics and underlying " DNA ".

Holding a 3Landers NFT makes you a member of 3Lander — a world and community dedicated to building meaningful, long-term connections through collaboration, risk-taking, building, creating, and dreaming.

4.6 Bitkub Chain Ethereum fork public chain

Developed by Bitkub Blockchain Technology Co., Ltd., Bitkub Chain is a blockchain platform forked from Ethereum and has technical standards equivalent to Ethereum. Its native token, Bitkub Coin (KUB), has been listed on multiple exchanges.

The platform supports tokens based on the KAP-20 standard, such as KKUB, KUSDT, KBTC, LUMI, DK, etc. Bitkub Chain makes the development of decentralized applications (DApps) easy by leveraging Ethereum-compatible data sets. The platform features fast block verification and placement, taking just seconds, and maintains low transaction fees through the Proof of Staked Authority (PoSA) consensus algorithm.

5. Crypto Venture Capital in Thailand

Thailand's venture capital is mainly from traditional large enterprises, including Thailand's two major banks, Siam Commercial Bank (SCB) and Kasikornbank (KBANK). SCB 10x is a venture capital subsidiary of SCB, and KX is KBTG, a subsidiary of Kasikornbank (KBANK). Venture capital initiated.

5.1 SCB 10X

In Thailand, traditional banks can participate in the cryptocurrency space by setting up subsidiaries, and SCBX (Thailand Commercial Bank) operates within this framework through SCB10X, which is one of the most successful crypto venture capital companies in Thailand.

SCB 10X was established in 2020 and is headquartered in Bangkok, Thailand. It tends to invest in projects in the directions of big data analysis, machine learning, blockchain, financial technology and decentralized finance, digital work and lifestyle, etc. These projects cover countries such as the United States, China, Israel and Southeast Asia. SCBX also launched TokenX as a web3 project incubator, and their portfolio includes Together.ai, Visai.ai, Ai21.com, etc.

5.2 KBTG

Kasikorn Business Technology Group (KBTG) has launched a $100 million fund KXV to invest exclusively in startups related to web3 and artificial intelligence. It is jointly supervised by Krating Poonpol, chairman of KBTG Group, and Jom Vimolnoht, managing director of KXVC.

The fund's primary focus is to identify and support AI, web3 and deep tech fintech startups globally, with a possible focus on the Asia-Pacific region. In the field of web3, KXVC will actively consider various technology startups, including innovative technologies such as zero-knowledge proofs and liquid collateral derivatives.

KBTG is KBTG is the technology arm of Kasikornbank (KBank), which ranks second in Thailand in terms of asset size.

6. Thailand’s Cryptocurrency Regulatory Framework

Before 2018, Thailand had always adhered to the regulatory concept of "strictly prohibiting cryptocurrency transactions." After noticing the wave of ICOs in various domestic crypto projects in 2017, the Securities and Exchange Commission of Thailand decided to launch guidelines for cryptocurrencies and initial coin offerings (ICOs) after months of public consultation and was ready to accept cryptocurrency transactions.

6.1 The process of improving regulatory regulations in the encryption industry

In May 2018, the "Digital Asset Business Emergency Decree" officially came into effect, stipulating that the Securities and Exchange Commission of Thailand (SEC) is the official regulator of all digital assets in Thailand, requiring all relevant parties involved in digital asset transactions to register with the SEC, and Obtain business license.

In June 2018, Thailand announced digital asset regulatory guidelines, allowing investors to legally trade seven mainstream cryptocurrencies, and allowing ICO issuers to apply for issuance and application to provide digital tokens.

In July 2018, the Thai SEC issued standards to support digital asset business operations. According to the decree, crypto companies operating cryptocurrency trading businesses in Thailand must obtain a digital asset business license issued by the Ministry of Finance.

In August 2020, the SEC required crypto trading accounts to strictly follow KYC standards. This regulation requires crypto companies to set KYC levels to facilitate the use of different types of customers.

In February 2021, the SEC required crypto companies to comply with investor knowledge testing standards, conduct knowledge tests for crypto users before providing crypto services, and refuse to provide services to users who do not meet the tests.

In May 2021, the SEC stipulated that DeFi businesses involving the issuance of digital tokens need to comply with regulations. If DeFi projects operating in Thailand involve the issuance of digital tokens to serve users, they need to obtain a business license and comply with the Digital Assets Act.

In August 2021, the SEC stipulated that encryption companies must protect platform user assets, requiring platform customer funds to require multi-person signature authorization before withdrawal or transfer. User encrypted assets stored on the platform must not be misappropriated for other purposes, and user funds are prohibited from being deposited in commercial banks for any purpose. Interest.

In February 2022, the SEC revised the principles of advertising regulations to restrict the inductive publicity of crypto advertising, stipulating that crypto advertising must not be exaggerated, must be clear and appropriate, and be published in the official channels of crypto companies, and advertisements must not be published in other public areas.

In March 2022, the SEC issued the "Service Standard Specification for Digital Asset Business Operators", which requires encryption companies not to use cryptocurrency to pay for goods or purchase services, and not to use cryptocurrency as a means of payment, so as not to affect Thailand's financial security.

In December 2022, the SEC released the draft "ICO Portal and Digital Token Issuance Supervision Standards", which improved the principles of ICO portal regulatory rules and related digital token issuance rules.

In March 2023, the SEC released the "Overall Digital Asset Supervision Policy", which covers the regulatory policy for the entire industry chain in the encryption field, including the issuance of primary market tokens, the operation supervision of secondary market exchanges, etc.

In November 2023, the SEC updated the debt ICO and infrastructure supporting ICO standards, adding debt ICO and infrastructure ICO products, requiring the credibility of the above two types of encryption projects to be evaluated and disclosed through the ICO portal. At the same time, due diligence and property evaluation must be conducted on the ICO project.

From 2018 to 2023, Thailand's cryptocurrency regulatory policy has undergone many improvements and updates, and the entire regulatory scope has been meticulously penetrating into every aspect of the encryption industry. Whether it is corporate registration, digital asset issuance, digital currency trading, user asset protection, supervision of crypto derivatives, upstream and downstream crypto industry specifications for KYC due diligence, or thoughtful details such as ICO issuance portals, investor guidance, and crypto company registration guides. All of this shows that Thailand does not simply regulate the encryption industry, but quickly guides the development of the domestic encryption market through deep participation and deep embrace.

6.2 Businesses are strictly prohibited from accepting cryptocurrencies

Starting in April 2022, the Thailand Securities and Exchange Commission began to ban companies from accepting cryptocurrencies in order to maintain economic stability. Despite removing the 7% tax on digital asset investments, the country explicitly banned crypto companies from providing staking and lending services in September 2022.

This is in stark contrast to Thailand’s pro-blockchain policies and poses a challenge to Thailand’s goal of becoming a major hub for blockchain innovation. In response, the Securities and Exchange Commission of Thailand and the Bank of Thailand raised concerns about the risks posed by the widespread use of digital assets for the exchange of goods and services in a joint statement.

Separately, banks in Thailand are also prohibited from directly participating in cryptocurrency transactions and have a unique verification process for first-time crypto investors that requires on-site verification using a “dip-chip” machine to scan national ID documents. For transactions exceeding 100,000 baht, exchanges must keep data for at least ten years to prevent money laundering.

6.3 Regarding taxation of crypto businesses

For individuals, when trading any cryptocurrency in Thailand, or gaining profits through mining, staking, etc., they are required to pay withholding tax and personal income tax.

Withholding tax refers to profits made through crypto activities (such as investment, mining, etc.), and the profit part needs to pay a 15% withholding tax;

Personal income tax is progressive, with general tax rates ranging from 5% to 37%. All Thai residents or residents who have lived in Thailand for more than 180 days are required to pay personal income tax on income derived from cryptocurrency;

Individuals whose turnover exceeds 1.2 million baht are required to pay 7% value-added tax. In some cases, VAT refund can be applied for;

Basically, investors in Thailand only need to pay withholding tax, value-added tax and personal income tax in accordance with regulations, but it does not exclude new taxes arising from residence status or other special requirements. Investors also need to pay annual During the tax process, confirm again to avoid omissions.

If you open a crypto company in Thailand, you need to pay corporate income tax, value-added tax, withholding tax, and special business tax depending on the situation.

Thailand's corporate income tax payment is also tiered. If the net profit is less than 1 million baht, 20% will be paid; if the net profit is between 1 million and 3 million baht, 25% will be paid; but generally speaking, companies entering Thailand will enjoy a variety of tax exemption policies according to different circumstances;

Companies in Thailand with a turnover of more than 1.2 million baht are required to pay 7% value-added tax, but in some cases they can also apply for tax refund, depending on the actual situation;

For companies that legally operate crypto businesses in Thailand, withholding tax is exempt, but if they are foreign companies or their legal persons, they need to pay the normal 15% withholding tax;

There are currently no specific regulations on special business tax, but it will be a variant of value-added tax, and crypto companies will only need to pay special business tax;

7. Summary

Thailand is located in Southeast Asia. Its economy relies heavily on exports. Its GDP ranks 9th among Asian economies. Driven by the three major sectors of agriculture, manufacturing and services, Thailand has transformed from an underdeveloped country to a "middle-income" country. country, and Thailand’s fiat currency is one of the strongest in Southeast Asia.

Thailand’s cryptocurrency adoption rate is among the highest globally, on par with other countries. Currently, 13.02 million people (9.3% of the total population) own cryptocurrencies. Thailand’s crypto ecosystem is quite developed and traditional banks are entering this emerging industry by setting up venture capital funds and investing in crypto-native and artificial intelligence startups, which will further drive Thailand’s growth in cryptocurrency adoption and crypto market development.

The Thai government has a fairly positive attitude towards cryptocurrencies and recognizes cryptocurrencies as “digital assets” regulated by the Securities and Exchange Commission of Thailand, requiring operators to obtain a license. Thai citizens can buy and sell cryptocurrencies, but businesses are prohibited from accepting cryptocurrencies as payment.

Especially in terms of supervision, Thailand has been at the forefront of the world. For crypto investors, whether they are participating in cryptocurrency transactions in Thailand or participating in derivatives businesses such as DeFi, users do not need to be responsible for the assets of centralized platforms under supervision. There are no security concerns, and it can also prevent consumers from encountering encryption scams as much as possible. As the industry continues to develop, Thailand’s encryption ecology will inevitably produce a similar siphon effect, attracting more and more projects and funds, and giving birth to Develop more innovative technologies and products that can promote the development of the industry.