The LRT (Liquidity Restaking Token) track is one of the few popular sectors in the crypto market before the Spring Festival.

The LRT protocol is a staking income amplification protocol based on the Restaking protocol EigenLayer. The gameplay is consistent with the dual mining in DeFi Summer that year.

The LRT protocol supports users to pledge LST (stETH, wstETH) assets or ETH itself to the protocol, while mining EigenLayer's points and the LRT protocol's own points.

Originally, in everyone's mind, the LRT track was just a DeFi Degen game that repeated stacking of Lego without actual value support.

However, with the overall upgrade of the industry's understanding of the DA layer, the value of EigenDA, the first AVS instance of the Restaking protocol EigenLayer, has been recognized by the market, and everyone realizes that LRT can help enhance the economic security of AVS.

This allows the LRT track to finally find value support and application scenarios.

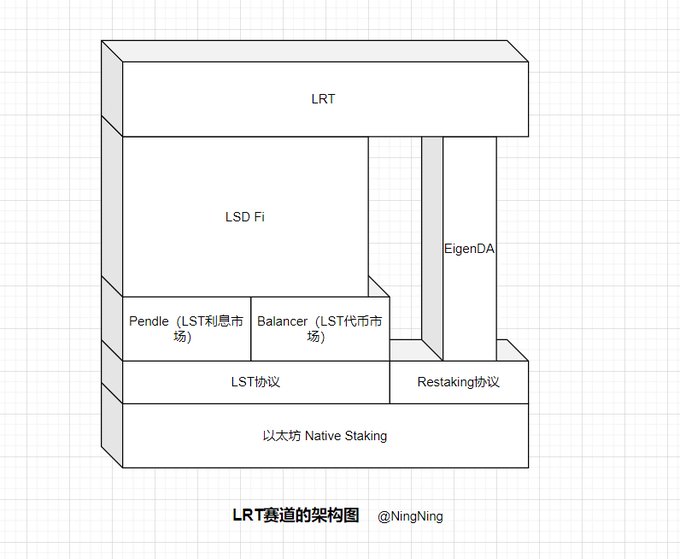

The latest architecture of the LRT track is as follows:

- Ethereum Native Staking

- LST protocol and Restaking protocol (EigenLayer supports LST protocol and native staking)

- Balancer (LST Protocol Token Pricing Market) and Pendle (LST Protocol Token Benefit Pricing Market)

- LSDfi (mainly CDP stablecoin protocols such as Lybra, Prisma, Raft, etc. that use LST protocol Token as collateral)

- EigenDA (the first AVS instance of EigenLayer, the DA layer within the Ethereum ecosystem, a competitor of the Celesita DA layer)

- LRT (KelpDAO, http:// Ether.fi , Renzo, etc., support dual mining of EigenLayer’s points and LRT protocol’s own points)

Overall, the LRT track is a rapidly growing niche market, from a TVL of ~8,000 ETH in November 2023 to a TVL of 217,000 ETH today.

However, one thing to note is that the tens of billions of dollars of LST protocol tokens are actually deposited in DeFi lending protocols such as AAVE, MakerDAO, and Summer, and the inflows into LSDfi and LRT are only tributaries.