Author: Climber, Jinse Finance

On January 17th, Binance new currency mining launched the 45th project AltLayer (ALT), and announced that it would officially launch multiple ALT spot trading pairs on January 25th. During this period, AltLayer released the Season 1 airdrop details, issuing 3% of the total supply of tokens to active users of multiple related projects.

The previous surge in the modular network Celestia has made AltLayer, which also has this concept, highly anticipated by the market, and AltLayer's restaking (re-pledge) concept has attracted the attention of investors. This issue of Jinse Finance will comprehensively analyze this popular RaaS (Rollup as a service) project and sort out the high-quality ecological projects it cooperates with.

1. What is AltLayer?

AltLayer is a highly scalable application-specific execution layer system. It features application-specific chains, i.e. blockchains customized for a single application. Rather than building on blockchains like Ethereum, application developers are building their own blockchains from scratch through platforms like AltLayer.

AltLayer provides a versatile rollup stack that has been integrated with many mainstream modular technology stacks to meet different rollup needs. Additionally, AltLayer is the only RAAS platform that natively supports WASM.

AltLayer can be seen as a separate Optimism system that derives security from the underlying layer 1 (such as Ethereum) or layer 2 networks (such as Arbitrum and Optimism), and it is designed as a module for the multi-chain and multi-VM world. ized and pluggable framework.

At its core, AltLayer is a system consisting of multiple optimistic rollup-like execution layers (called flash layers), making them tailor-made for a specific application and available for single use, and therefore highly resource optimized.

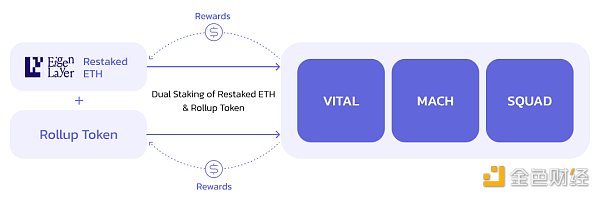

AltLayer also cooperated with EigenLayer to launch a new service project Actively Validated Service (AVS), called Restaked Rollup. It takes any Rollup stack from (such as OP Stack, Arbitrum Orbit, Polygon CDK, ZK Stack, etc.) and provides them with enhanced security, decentralization, interoperability and more efficiency by leveraging EigenLayer’s re-staking mechanism.

Restaked rollups are designed using three modular components: VITAL (AVS for decentralized verification of summary status), MACH (AVS for rapid finalization), and SQUAD (AVS for decentralized sequencing).

In layman's terms, AltLayer provides low-threshold, low-code rollup construction and operation solutions. They help users integrate multiple solutions for various rollup modules on the market, that is, a service aggregator that allows users to build their own designs like Lego. combination.

Because on general chains (such as Ethereum), popular dApps and unpopular dApps will compete for block space, and customizing the application chain specifically for dApps will cause a waste of resources. Therefore, it can be solved by building a temporary execution layer protected by Layer1, but this temporary execution layer must be scalable, and AltLayer is building a transient execution layer system driven by optimistic rollups.

The transition from general chains like Ethereum to specific application chains will become a normal trend for mainstream dApps. Currently, dApps such as DefiKingdoms, Yuga Labs, and dYdX have begun or plan to establish independent customized application chains.

Previous application chains have also destroyed unit composability, causing isolated dApps to be unable to connect with users of other dApps, thus limiting the set of features that dApps can provide. AltLayer allows developers to regain composability after finishing settlement in Layer1.

AltLayer also improves existing rollups from the likes of Arbitrum and Optimism to make sequencers (nodes that execute transactions) more decentralized. Additionally, it is designed for a multi-chain and multi-VM world and will support EVM and WASM.

WASM is a new type of code that can be executed on modern browsers. This new code was created and defined by the World Wide Web Consortium (W3C). Essentially, WASM (often referred to as Ethereum 2.0) has all the features of EVM with extra features.

In summary, one of the key innovations AltLayer brings to the universal chain scaling solution space is a highly elastic execution environment.

Altlayer's idea is to use the Rollup solution as a cloud computing resource. The Rollup solution will only be called when the DApp expects to have considerable access needs and the first-layer network cannot handle it. Once demand tapers off, the DApp can be moved back to the first-tier network.

2. Background information and token economics

Founded in 2021, AltLayer has raised $22.8 million through two rounds of private token sales, in which 18.50% of the total ALT token supply was sold at prices of $0.008/ALT and $0.018/ALT.

On July 1, 2022, AltLayer completed a US$ 7.2 million seed round of financing, led by Polychain Capital, Jump Crypto and Breyer Capital, and co-founded by Polkadot founder Gavin Wood, former Coinbase CTO and former a16z partner Balaji Srinivasan, and Circle Sean Neville and Synthetix and Bodhi Ventures co-founders Kain Warwick and Jordan Momtazi also participated.

Last August, Binance Labs announced a strategic investment in AltLayer.

Altlayer's core team is all Chinese, among which founder Yaoqi Jia was the co-founder and chief technology officer of Zilliqa, and one of Forbes Asia's 30 under 30 elites. He received his PhD in Computer Science from the National University of Singapore and has published several top journal papers in the areas of cybersecurity, privacy and distributed systems security.

AltLayer’s co-founder and CEO is Tan Jun Hao, who was once a core developer at Synthetix and was responsible for developing and maintaining the project’s smart contracts and front-end. He was also a senior software engineer at Kyber Network and participated in the development and optimization of decentralized exchanges.

Token Economics:

ALT is AltLayer’s native utility token and is used for the following functions:

Economic Bonds: ALT tokens will be used along with re-staking assets to provide economic collateral. This stake can be reduced if malicious behavior is detected.

Governance: ALT token holders can vote on governance issues.

Protocol incentives: Operators in the AltLayer ecosystem can receive ALT tokens as rewards for their services.

Protocol fees: Network participants need to use ALT tokens to pay for services within the network.

The total amount of ALT is 10 billion, and the initial circulation is 1.1 billion. Investors will allocate 18.5% of the total, Binance Launchpool will allocate 5%, the team will allocate 15%, the strategic advisor will allocate 5%, the protocol development will allocate 20%, and the treasury will allocate 21.5%, and 15% allocated to the ecosystem and community.

3. Main progress of the project

In December last year, AltLayer released the concept of Restaked Rollups, aiming to solve rollups-related problems by utilizing EigenLayer's re-pledge mechanism. And the project party announced that it will become a deployment provider of Polygon CDK to facilitate access to Polygon CDK for users seeking to deploy ZK driver L2 on Ethereum.

In September, AltLayer announced the launch of Turbo, a new rollup framework. The framework is an optimized rollup stack designed to help the ecosystem build scalable, low-latency and seamless immersive interactive experience functions.

In August, AltLayer partnered with Orbiter Finance. In the same month, AltLayer announced that Rollups Suite has expanded support for OP Stack, which is the open source modular code base of Optimism Collective. dApp developers will now be able to experiment and build based on the OP Stack code base, and AltLayer is responsible for managing all node infrastructure of the project. , so that developers can focus on their core business and technical operations.

In July, AltLayer announced the adoption of Celestia's Data Availability (DA) layer to address data availability issues and verify rollup status in a trustless manner. As part of the integration, AltLayer will retrieve the chain data from Rollup, perform compression and upload to the Celesta network, which enables AltLayer to completely reconstruct the rollup state using data from Celestia.

In May, AltLayer launched its first multi-sorter Rollup. In April, AltLayer supported the L3 blockchain Arbitrum Orbit, allowing users to launch any L3 application bound to Arbitrum in minutes through no-code tools.

In February, AltLayer announced that it would open testing access to its "rollup-as-a-service" dashboard to 100 developers, allowing these developers to participate in testing of its no-code rollup solution in preparation for the upcoming full launch. Prepare.

4. Ecological projects

As a modular Ethereum expansion solution and RaaS platform, AltLayer provides a fully open execution environment, supports on-demand expansion and gives developers more flexible application space. It has reached cooperation with many agreements, including many star projects.

At present, AltLayer's product and customer ecosystem is gradually developing and growing, with mature infrastructure providers such as EigenLayer, Espresso, Astria, Radius, Celesita, EigenDA, Avail, OP Stack, ZKStack, Arbitrum Orbit, Polygon CDK, etc. Other service providers include: Blockscout, Dexguru, Parsec Finance, Connext, Celer, HyperLane, Transak, Halliday, and others. In addition, AltLayer also has many other customers and cooperation projects.

1. Infrastructure:

Avail

Avail is a modular blockchain focused on data availability: ordering and recording blockchain transactions to prove that block data is available without downloading the entire block. This allows it to scale in ways that a monolithic blockchain cannot. Off-chain scaling solutions can unlock the full potential of data availability by moving it to Avail. Independent chains can improve the security of validators to ensure data availability by using Avail.

Avail was initially part of the Polygon organization, eventually becoming its own independent entity on March 23, 2023. Avail launched its first testnet in 2022 and is now using its second testnet version, Kate.

EigenLayer

EigenLayer is a middleware protocol based on Ethereum that introduces the concept of re-staking, allowing Ethereum nodes to re-stake their pledged ETH or LSD tokens to other protocols or services that require security and trust, thereby gaining double income and governance rights. At the same time, the utility of the Ethereum consensus layer can also be transferred to various middleware, data availability layers, side chains and other protocols, allowing them to enjoy Ethereum-level security at a lower cost.

Espresso Systems

Espresso Systems is an EVM-compatible blockchain that provides scaling and privacy systems for Web 3 applications. By combining the PoS consensus protocol with the zk Rollup mechanism, Espresso Systems packages multiple transactions in a more resource-efficient manner.

In March 2022, Espresso Systems completed a $32 million seed round of financing.

Radius

Radius is a shared sorting layer designed to eliminate harmful MEV and censorship while creating economic value for aggregation. It uses an encrypted memory pool with PVDE (Practical Verifiable Delayed Encryption), an advanced cryptography and ZK-based scheme. PVDE ensures that the transaction ordering process is trustless, preventing centralized orderers from engaging in front-running, sandwiching, and censoring transactions.

In June 2023, Radius completed a Pre-seed round of financing of US$1.7 million.

Blockscout

Blockscout is a block explorer for the Ethereum network, a tool for inspecting and analyzing EVM-based blockchains.

Dexguru

Dexguru is a cryptocurrency decentralized exchange (DEX) analysis platform that helps users better understand the cryptocurrency trading market on various decentralized exchanges.

In April 2021, DexGuru completed a US$1 million seed round of financing, and in February 2022, it completed a US$5 million financing.

Hyperlane

Hyperlane is an interoperability platform that allows developers to build cross-chain applications. It completed US$18.5 million in financing in September 2022 and aims to provide developers with messaging APIs and SDKs to easily build applications that can be accessed from any blockchain.

Connext

Connext is a trust-minimized cross-chain communication protocol that makes blockchains composable. Developers can use Connext to build cross-chain applications. Connext is the leading protocol for fast, fully unmanaged transfers and contract calls between EVM-compatible chains. Anyone can use Connext to send value transactions or call data across chains and aggregates. In September 2021, Connext will be launched on the mainnet.

In June 2023, Connext completed a strategic financing of US$7.5 million with a valuation of US$250 million; in July 2021, it completed a US$12 million Series A financing; in March 2021, it completed a US$2.2 million seed round of financing.

Celer

Celer is a blockchain interoperability protocol that enables a one-click user experience for accessing tokens, DeFi, GameFi, NFTs, governance, and more across multiple chains. Developers can use the Celer inter-chain messaging SDK to build inter-chain native dApps for efficient liquidity utilization, coherent application logic and shared state.

Omni

Omni is Ethereum’s interoperability layer and serves as the core infrastructure supporting all modular applications on Ethereum. When building applications, developers will no longer be forced to build within the confines of a single rollup or execution environment - they will be able to seamlessly build applications that live everywhere in the Ethereum ecosystem, while accessing all users and all capital. Omni's predecessor is Rift Finance, a DeFi protocol that provides financial services for Web3 projects.

In February 2022, Omni Network completed US$18 million in financing. In June 2023, Omni Network will be launched on the test network.

Superbridge

Superbridge is the Ethereum rollups solution. With Superbridge, users can bridge Ether and other tokens into and out of any OP Stack or Arbitrum Nitro supported rollups. Superbridge aims to support the deposit and withdrawal functionality of every rollups ecosystem.

Orbiter Finance

Orbiter Finance is a decentralized cross-rollup bridge for transferring native assets of Ethereum. In Orbiter Finance, there are two roles: Sender and Maker. When Sender initiates a transfer, Maker provides liquidity for it. Smart contracts ensure the security of this process.

In November 2022, Orbiter Finance completed a seed round of financing of US$3.2 million, with a valuation of US$40 million.

2. Payment:

Singularity

Singularity is an instant checkout solution for web3 games. With Singularity, developers can onboard any user to their game, instantly and easily create a blockchain wallet for them, record all transactions on-chain, and provide users with a smooth shopping cart and checkout experience that they can use on any chain. Pay using any fiat currency or cryptocurrency.

transak

Transak supports the conversion of fiat currencies into cryptocurrencies for a global user base. It does this by providing API-driven deposit and withdrawal payment methods for more than 130 crypto assets, and solves the complexities of user KYC, risk monitoring and compliance, payment methods and customer support. Transak's widgets can be integrated into applications with just a few lines of code.

Ramp

Ramp is a non-custodial, full-stack payments infrastructure that allows users to purchase cryptocurrencies without leaving the dApp or wallet.

In August 2023, Ramp completed US$300 million in financing; in November 2022, Ramp completed US$70 million in Series B financing; in December 2021, Ramp completed US$52.7 million in Series A financing; in June 2021, Ramp completed US$10 million Seed round financing.

3. DeFi

Injective

Injective is an interoperable layer-1 blockchain powering the next generation of DeFi applications. Injective uniquely provides plug-and-play financial infrastructure primitives such as high-performance on-chain decentralized trading infrastructure, decentralized bridges, oracles, and a composable smart contract layer with CosmWasm.

Catalyst

Catalyst is an open source protocol that provides liquidity between modular blockchains. With Catalyst, any new modular chain can automatically connect liquidity and trade with any chain – including liquidity hubs like Ethereum and Cosmos.

In April 2023, Catalyst completed a seed round of financing of US$4.2 million.

Deri Protocol

Deri Protocol is the DeFi way of trading derivatives: hedging, speculation, arbitrage, everything on the chain. Using the Deri protocol, transactions are executed under the AMM paradigm, and positions are tokenized into NFTs, which can be highly combined with other DeFi projects. Deri Protocol provides an on-chain mechanism to trade exposure accurately and efficiently, creating one of the most important blocks in DeFi infrastructure.

ALLO

Allo is a Layer 1 platform focused on real asset lending and trading. It provides services to tokenize high-value assets such as real estate or art, supports fragmented ownership, and enables a wider investor group to participate in investment.

4. NFT and social networking

Avive

Avive is building social infrastructure to provide an interoperable layer for on-chain and off-chain sovereign footprints, including off-chain geographic data and on-chain relationships. This infrastructure is designed to enable individuals to connect, interact and share information in a decentralized, fair and free social world. It features various social elements such as LBS (Location Based Services), SBT (Soul Bound Identity) and DeSoc.

AsMatch

AsMatch is a Web3 social matching mobile application based on astrology. It combines Artificial Intelligence Generated Content (AIGC), Zero Knowledge Proofs (ZKP) and zkSBT powered by Manta Network, with a matching earning model with token incentives on the BNB chain. The app’s astrology-centric matching engine connects users for dating, social networking, and professional connections.

Lemonade

Lemonade is a no-code d-commerce platform that allows brands and creators to use web3 frictionlessly, including creating immersive events, NFT ticketing and utilities, and community rewards.

5. GameFi:

Double Jump

Official website: https://www.doublejump.tokyo/

Double Jump is a Japanese blockchain game developer that focuses on the development of blockchain games. Its main products include the blockchain game My Crypto Heroes, a role-playing game in which users can use items and characters as unavailable objects. Alternative tokens are traded to earn cryptocurrency.

Raised 3 billion yen in Series C in April 2022, led by: Jump Crypto, Jafco Ventures, Amber Group

Following investment institutions: Wemade, Fenbushi Capital, Dentsu Ventures.

Cometh

Official website: https://www.cometh.io/

Cometh is a blockchain game development studio that provides users with income-generating NFTs and integrates DeFi and NFT functions into games. It also owns the blockchain game Cometh Battle.

In May 2022, Cometh received $10 million in seed round financing.

Cellula

Official website: www.cellula.life

Cellula is a completely on-chain autonomous life simulation strategy game. Players cultivate and evolve unique life forms, employing various strategies to survive and compete.

Polychain Monsters (PMON )

Official website: https://polychainmonsters.com/

Polychain Monsters is essentially a trading game created using blockchain technology and borrows from the Pokémon card trading mechanics that were popular in the 90s.

Polychain Monsters was founded in early March 2021 and received US$740,000 in financing led by Moonrock Capital and Morningstar Ventures. An IDO (initial dex offering) event held at Polkastarted the same month helped the founders raise approximately $100,000.

BladeDAO

Official website: www.bladedao.games

BladeDAO is a decentralized on-chain gaming ecosystem based on zkSync Era, created by a group of crypto-native degen players. Its first self-developed medieval-themed placement dungeon game Legends of Valoria (LOV) features PvE and PvP gameplay and will be released at the end of June and early July this year.

Galaxia Studios

Official website: https://www.galaxiastudios.com/

Galaxia Studios is a Web3 product studio focusing on blockchain game development, focusing on the fields of fully on-chain games, dynamic NFTs (dNFTs), and EVM infrastructure.

Summarize

There is a general need for expansion in general public chains such as Ethereum, and with the growth of the encryption economy, dApps are also increasing, which requires highly scalable Rollup solutions. AltLayer, the RaaS infrastructure that took the lead, has a relatively first-mover advantage and will be more likely to occupy market share in the future.

However, the RaaS track, especially blockchain technology, is iterating rapidly. If AltLayer cannot maintain its technical leadership, it will soon be surpassed. In addition, AltLayer's RaaS protocol involves a variety of technical aspects and business scenarios, and may encounter some technical difficulties and security risks. Therefore, AltLayer still needs to undergo the test of the market and time.