According to the latest research results from the cryptocurrency research company Coin Metrics, it is almost impossible for a "state-level entity" to attack the Bitcoin or Ethereum network through a 51% attack.

Table of contents

Toggle51% of attacks have no financial motive

A 51% attack occurs when a malicious actor owns more than 51% of the computing power in a proof-of-work system (such as Bitcoin), or more than 51% of the cryptocurrency in a proof-of-stake network (such as Ethereum). In theory, an attacker could use this centralized power to alter the blockchain, such as preventing specific transactions from being confirmed, or reversing transactions to conduct a double spend attack, disrupting the network.

In a February 15 report, Coin Metrics researchers Lucas Nuzzi, Kyle Water and Matias Andrade noted that given the capital costs and operational expenses of today’s networks, it is no longer feasible for nation-state attackers to conduct sustained attacks. Methods.

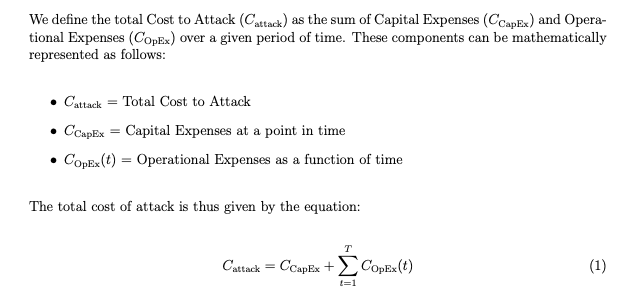

The authors used a metric called "Total Cost of Attack (TCA)" to quantify the cost of attacking a blockchain network.

The final result of the study found that among all the hypothetical attacks proposed against the Bitcoin and Ethereum networks, there was no feasible way to make a profit, which means that the attacker would have no financial motivation to carry out the attack.

"Even in the most profitable double spend scenario proposed, the attacker may only get $1 billion in return after investing $40 billion, which is equivalent to a return of only 2.5%."

By analyzing secondary market data and real-time computing power output data, the study found that a 51% attack on Bitcoin would require an actor to purchase a staggering "7 million ASIC mining machines," which would cost approximately $20 billion, and even if With enough money, there simply aren't enough ASIC mining machines on the market to buy.

But what if actors have the ability to build their own mining rigs? The study points out that assuming a nation-state attacker has sufficient resources to manufacture his own mining rig, and the Bitmain AntMiner S9 is currently the only device available for reverse engineering, the total cost is still estimated to exceed $20 billion.

Ethereum’s 34% attack was also exaggerated

The continued growth of liquid staking protocol Lido is viewed by many as a serious threat to the Ethereum network. However, research suggests that concerns about a 34% stake attack on Ethereum from Lido validators may be unfounded. The report noted that attacking the Ethereum blockchain would not only take an extremely long time, but would also be extremely expensive. Lucas Nuzzi said:

"We estimate that attacking Ethereum will take 6 months because the system limits the one-time deployment of equity tokens (ETH). The total cost is expected to be more than $34 billion. The attacker would have to manage more than 200 nodes, alone The cost on AWS alone is as high as $1 million.”