March 2023 marks the start of many important US policies in an effort to save liquidation for banks on the brink of collapse. These plans will expire in March 2024.

From here, many experts began to warn that the banking crisis could return. The following are notes from BeInCrypto.

The FED will end the BTFP emergency lending program

BTFP stands for Bank Term Funding Program, this is a lending program launched by the FED in March 2023 to enhance liquidation for banks. Back in that period, a series of regional banks collapsed such as Signature, Silvergate and Silicon Valley due to lack of liquidation, which greatly affected the Crypto market. At that time , Circle said it had $3.3 billion trapped in Silicon Valley Bank, and Circle 's USDC coin lost its peg.

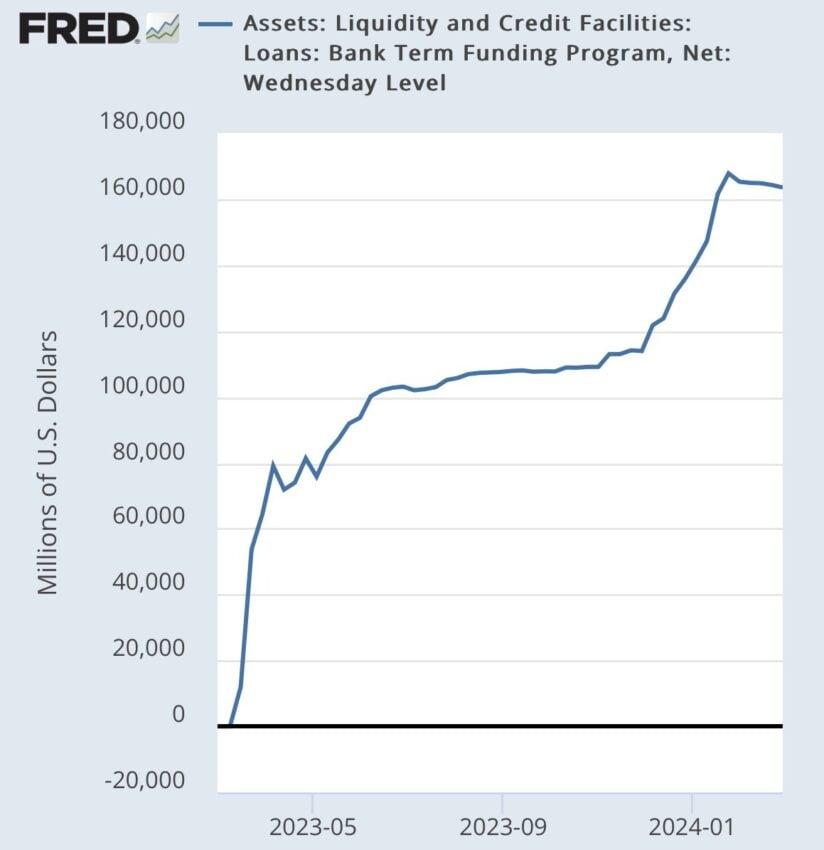

Outstanding debt of the BTFP emergency loan program. Source: FRED

Outstanding debt of the BTFP emergency loan program. Source: FREDAs of March 2024, the total outstanding debt of this program has increased to exceed 160 billion USD. Instead of borrowing through the Discount Window at an interest rate of 5.5%, banks instead take advantage of BTFP to borrow at 4.89%. The deadline for this program is March 11, 2024, which is exactly one year since it was launched. This opens up the risk of liquidation shortage this March.

What are the predictions when the BTFP program ends?

At the beginning of the year, many were skeptical about whether the FED would continue to extend the BTFP program or not? But according to The Wall Street Journal , Michael Barr - a top Fed official - has said that this program may not be extended and will end in mid-March 2024. From here, predictions about the impact when this program ends are made:

Ru Xie – associate professor of finance at the University of Bath – posted on Theconversation that: The end of BTFP may not lead to a bank collapse, as banks have had an extra year to adjust to higher interest rates. , in addition, they still have another option: to borrow from the FED through the Discount Window. Ru Xie believes that the end of BTFP will increase banks' borrowing costs, their profits will decrease, and lead to higher interest rates for borrowers and less credit, affecting the economy.

Right from the last days of January, the investment community began to notice the reaction of New York Community Bancorp (NYCB) stock price. NYCB has decreased from over 10 USD to less than 3 USD to date, recording a decrease of 70%. NYCB is the bank that bought what was left of Signature Bank last March. This is a signal that risks are gradually emerging.

When liquidation risks focus on March in the context that there will also be new economic indicators and new interest rate decisions by the FED, the Crypto market is likely to be affected.

Also Read: 5 events that can greatly affect the Crypto market in March

What do you think about the impact of the BTFP loan program ending? Chia your comments now in our community Telegram chat | Telegram channel | Facebook fanpage .