The 2024 NVIDIA GTC Conference will be held in San Jose, California, USA from March 17th to 21st. NVIDIA CEO Jensen Huang will deliver a speech on the theme of "Don't Miss the Transformational Moment of Artificial Intelligence" and will expand to hold more than 900 inspiring meetings. , 300+ exhibitions, 20+ technical seminars covering generative AI and more, and plenty of networking events. This conference will once again focus the attention of the global market on popular fields such as AI, the Metaverse, and semiconductors. Various related AI track encryption targets have also risen in advance. Since the AI track in the encryption world has taken shape in 2023, various AI targets in 2024 will become one of the main lines of speculation and investment throughout the year. This article will take a quick look at some AI encryption projects worthy of attention.

1. Proof of personality

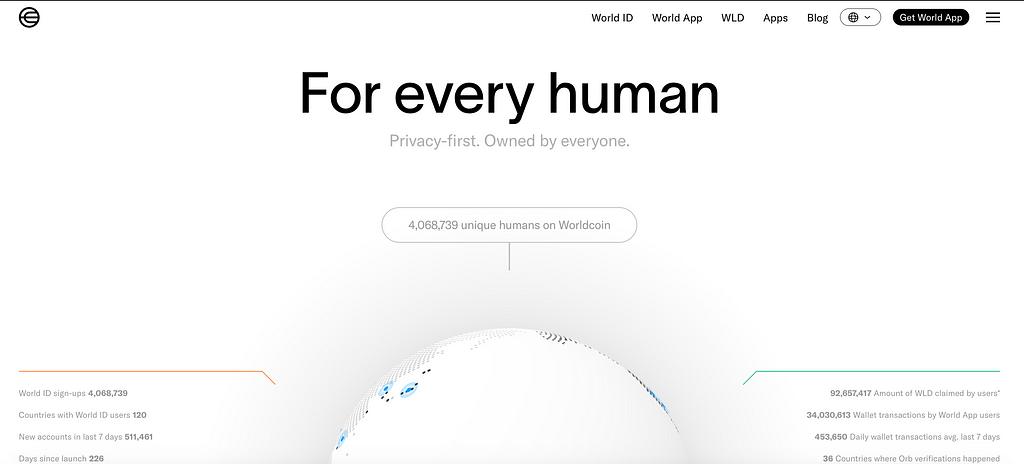

Worldcoin(WLD):

Introduction: Out of considerations for proving personality and protecting economic rights and interests in the AI era, OpenAI founder Sam Altman established Worldcoin in 2020. Worldcoin's vision is to build the world's largest and fair digital identity and digital currency system. It achieves identity authentication by scanning the iris of everyone's eyeballs on the planet, creating a human pass in the Web3.0 era.

Team and investment:

Sam Altman, the founder of Open AI, is the co-founder of Worldcoin. Alex Blania is the CEO and co-founder of Worldcoin and worked as a researcher at the Institute of Quantum Information and Matter at Caltech.

Investment institutions include top VCs such as a16z Crypto, Coinbase Ventures, Multicoin Capital, and Blockchain Capital.

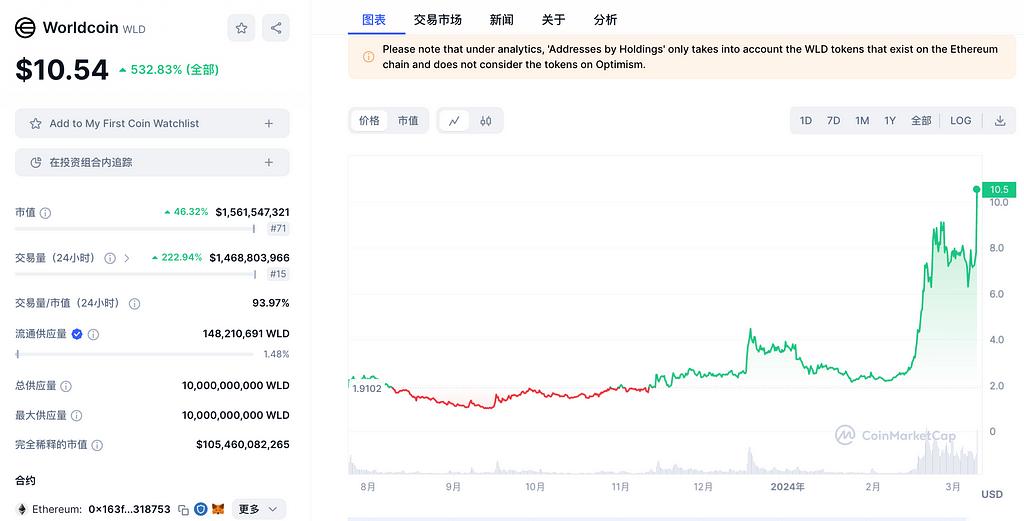

Token situation:

The current market value of WLD is US$1.56 billion, FDV is US$105.4 billion, the total supply is 10 billion tokens, and the current circulation is 1.47%. The main online exchanges are Binance, OKX, and Bybit.

The token release rate is 319,000 tokens/day, which will increase to 6,610,000 tokens/day starting from July 14, 2024. The current chip structure can be divided into three parts: one part is released to regular users, and the rewards of this part of the community are difficult to form a simultaneous massive selling pressure; the other part is given to market makers. The newly effective market maker terms in December 23 loaned 10 million generations. Coins are given to market makers for a period of 6 months, and the new market makers and terms have had a positive impact on the token price starting in December. The last part is the big players. When the token price is around $2, the big players have accumulated more chips.

Although WLD's FDV has always been feared by the market, the current circulation is a more important basis for judgment. In the case of AI fever, when the speed of consensus formation is greater than the speed of release (selling), it will really drive up the token price.

Segment Summary: Compared with other targets, Worldcoin (WLD) is the exclusive AI identity authentication track. With the rapid development of AGI, how to face the problems of identifying human access, preventing adversarial machine learning, and combining ZKML are currently available to humans. There are not many solutions, and Worldcoin (WLD) has a grand narrative and imagination ceiling. In addition, Sam Altman is a leader in the AI industry and the "new king of Silicon Valley." Every benefit he founded OpenAI has brought benefits to AI projects in the crypto world. However, investors in the traditional financial market cannot participate in OpenAI and its Leading upstream and downstream investments, the encryption projects founded and invested by Sam may become the most direct way to participate. Another project he invested in, Arkham (ARKM), will be introduced in the AI application software section of Chapter 5.

2. Decentralized computing power

Render Network(RNDR)

Introduction:

Render Network is a decentralized GPU rendering platform that enables artists to scale GPU rendering jobs to high-performance GPU nodes around the world on demand. Through a blockchain marketplace for idle GPU computing, the network provides artists with the ability to scale next-generation rendering jobs at a fraction of the cost and orders of magnitude faster than centralized GPU clouds. Designed to provide nearly unlimited distributed GPU computing power for next-generation 3D content creation.

Starting from the second half of 2023, Render Network will begin to expand GPU computing power to computing fields such as AI and ML. So far, Render Network has cooperated with four computing clients to provide distributed GPU resources, namely IO.Net, Beam, and FedMl ,Nosana.

At the upcoming GTC conference in 2024, Jules Urbach, the founder of Render Network, will attend and deliver a speech on "The Future of Rendering: Real-time Ray Tracing, Artificial Intelligence, Holographic Display and Blockchain"

Team and investment

The founder of Render is Jules Urbach. Jules sets the strategic vision for OTOY and is the chief architect of the company's technology roadmap. With over 25 years of industry experience, he is widely regarded as a pioneer in computer graphics, streaming and 3D rendering. He made his first game at age 18 and went on to create the first 3D video game platform on the web, licensing the software to Macromedia, Disney, Warner Bros., Nickelodeon, Microsoft, Hasbro and AT&T.

Render Network's parent company is OTOY, Inc. Since its founding in 2008, Render Network has become an authoritative cloud graphics company whose pioneering technology is redefining content creation and delivery for media and entertainment organizations around the world. OTOY is an Academy Award-winning technology used by leading visual effects studios, artists, animators, designers, architects and engineers,

Render Network, headquartered in Los Angeles, California, has team members located around the world. With a world-class advisory board including Ari Emmanuel (Co-Founder and Co-CEO of WME), JJ Abrams (Chairman and CEO of BacRobot Productions), Mike Winkelmann (Beeple) and Brendan Eich (Co-Founder and CEO of WME officials) and other industry leaders. Have excellent team strength, successful resume and industry resources.

Render Network is also supported by top capital, including Multicoin Capital, Alameda Research, Solana Ventures, LD Capital, etc.

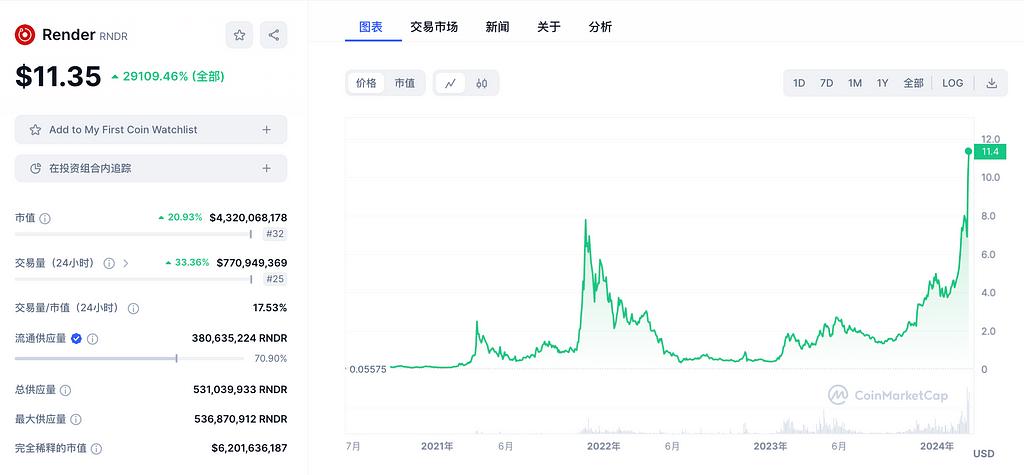

Token situation

The current market value of RNDR is 4.32 billion, FDV is 6.2 billion, the maximum supply is 546 million, and the current circulation is 70.48%. The main trading markets are mainstream exchanges such as Binance, Coinbase, and OKX. The Balancing and Minting Model (BME Model) proposed in Render Network's RNP001 proposal has currently been officially adopted and started to be implemented. With the leading development of Render Network, RNDR has the potential to become a deflationary asset, in the case of strong network utilization and growth. , the token may continue to achieve strong price growth.

Akash Network (AKT)

Introduction:

Akash Network is an open network and cloud computing market that builds a market for leasing computing-related resources, providing CPU, Storage, TLS, IP, GPU and other resources. Akash's blockchain is an application built on the Cosmos SDK. Hosting applications with Akash costs about one-third of the cost of Amazon AWS, Google Cloud Platform (GCP), and Microsoft Azure.

In the second half of 2023, Akash Network launched the artificial intelligence super cloud and has participated in the AI computing market. The network now supports NVIDIA GPUs, and other GPUs such as AMD can be selected in the future; currently it has successfully hosted NVIDIA H100 and A100, as well as a series of consumer-grade GPUs; Access to consumer-grade GPUs is one of the differentiators of the Akash Super Cloud. Currently, Akash Network can support basic AI model training using its network.

Team and investment

The co-founder and CEO of Akash Network is Greg Osuri, whose background is in cloud architecture and entrepreneurship dating back to 2008. Osuri founded Akash as a decentralized alternative to the traditional cloud computing industry. Prior to Akash, Osuri founded four other companies and worked at distinguished companies, including Miracle Software Systems as a technical architect, IBM as a critical infrastructure consultant, and Kaiser Permanente as a cloud infrastructure consultant.

Adam Bozanich, Co-Founder and Chief Technology Officer: Bozanich is a software engineering veteran who has held senior positions since 2006. With experience across software development domains, Bozanich has worked at Symantec in QA automation, Mu Dynamics security engineering, and Topspin Media in server engineering. Prior to Akash, he co-founded two other companies with Osuri: Sproouts Tech and Overclock Labs.

Current disclosed investors include D1 Ventures and GenBlock Capital.

Token situation

AKT’s current market value is 1.429 billion, FDV is 2.416 billion, the maximum supply is 388 million, and the current circulation is 59.14%. The main trading venues are Kucoin, Kraken, Osmosis, etc. On 2.27 Coinbase has included Akash Network (AKT) in the asset listing route picture.

Clore.AI (CLORE)

Introduction

Clore.AI is a platform based on POW that provides GPU computing power rental services. Any modern computer/server equipped with NVIDIA GPU can be connected to the network. Currently, there are more than 5,500 GPUs connected. Business scope includes: artificial intelligence training, movie rendering, VPN, cryptocurrency mining, etc. When there is a demand for specific computing power services, the tasks assigned by the network are completed; if there is no demand for computing power services, the network finds the cryptocurrency with the highest mining yield at that time and participates in mining. The team is located in Europe and officials say it strictly abides by European laws to ensure the legality and reliability of project operations.

You can check the specific GPU model, configuration, rental price, etc. on the official website. The party that provides computing power can obtain CLORE tokens as a reward; the better the performance of the server, the more rewards it will receive. The party using computing power can pay in CLORE, BTC or USD.

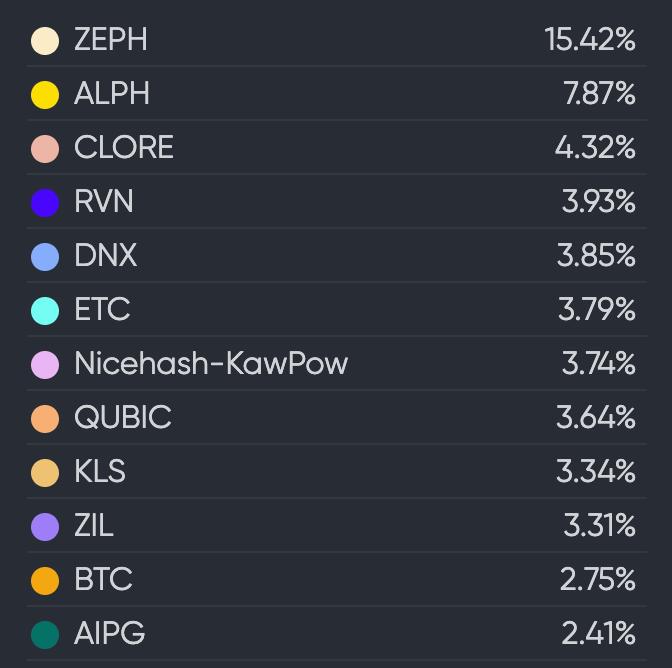

Since the November LD report records its computing power, the data observed on the Hiveon platform has increased significantly, with its proportion increasing from 3% to 4.32%, and its ranking rising from 11th to 3rd.

Token situation

CLORE's current market value is 93.59 million, FDV is 114 million, and the total number of tokens is 1.3 billion. It will start mining in June 2022 and will basically enter full circulation by 2042. The current circulation is about 250 million. The main trading markets are Mexc, Gate, Bitget, etc.

It is a POW token, uses the kawpow algorithm, and is resistant to ASIC mining. There is no pre-mining or ICO for the tokens, and 50% of each block is allocated to miners, 40% to lessors, and 10% to the team.

Section summary: With the breakthrough progress of AI represented by ChatGPT and Sora, the scale and quality of computing power requirements for AI training and reasoning will enter a new era. GPU and computing power will become indispensable in the AI field. Related projects It deserves special attention and is bound to develop rapidly. High-quality projects that have not issued coins include io.net, GPU.net, Aethir, etc.

3. AI infrastructure

Bittensor(TAO)

Introduction: Bittensor is an open source protocol that powers blockchain-based machine learning networks. Machine learning models are trained collaboratively and are rewarded in TAO based on the value of information they provide to the collective. TAO also grants external access, allowing users to extract information from the network while tailoring their activities to their needs.

For Bittensor, the project itself will neither perform calculations nor provide data for on-chain machine learning. Instead, it will mobilize all other off-chain AI models to collaborate together. To put it simply, Bittensor does not produce algorithms, but acts as a porter of algorithms.

Team and investment:

The founder of Bittensor is Jacob Robert Steeves, who was previously a Google software engineer. Co-founder Ala Shaabana was previously an assistant professor at the University of Toronto and a postdoctoral fellow at the University of Waterloo. Graduated from McMaster University. James Woodman is the chief operating officer of Bittensor and previously worked in business development at GSR.

According to official documents, Bittensor will be "fairly launched" in 2021 (without pre-mined tokens), and the token is called TAO. The fair launch of TAO means that there are no common routines such as VC rounds, private equity rounds, ICO/IEO/IDO, foundation reservations, etc. It can be understood as a pure mining currency. On Bittensor’s official website, well-known investors and market makers such as DCG, GSR, Polychain Capital and Firstmask are disclosed. The way for the capital to intervene may be that large institutions come in to act as verification nodes or even miners, and the coins mined by TAO mining or Bittensor official institutions can be returned to their own hands, and then distributed to market makers for market making.

Token situation

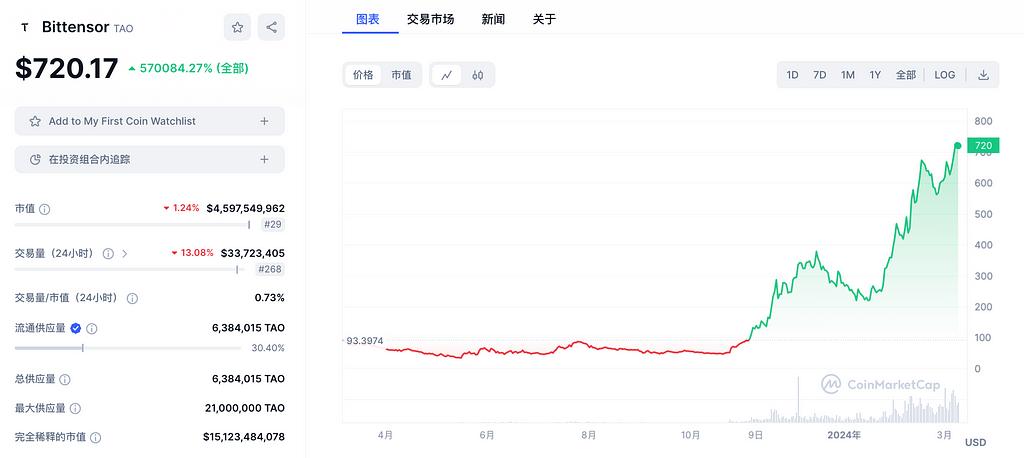

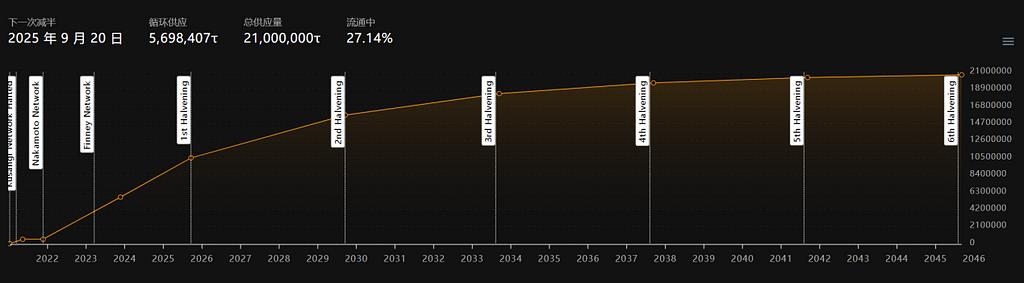

TAO's market value is 4.59 billion, FDV is 15.123 billion, the maximum supply is 21 million, the current circulation rate is 30.36%, and the output is halved every four years. The main trading markets are Gate, Kucoin, and Mexc, and the tokens are currently not listed on Cex.

TAO mines a block approximately every 12 seconds, and each block rewards miners and validators with 1 TAO. On the current inflation schedule, this would result in 7,200 new TAO being issued into circulation every 24 hours, currently divided evenly between miners and validators (including stakers).

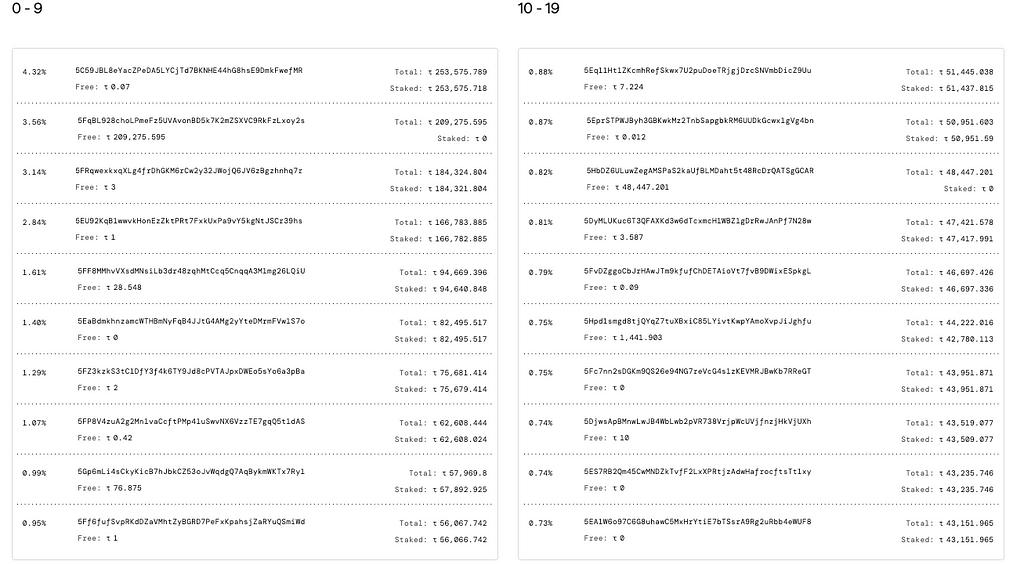

Currently, a large number of tokens are in the entrustment/pledge state, and the largest address holds 250,000 tokens, all of which are in the entrustment state. The top 20 addresses hold more than 1.7 million tokens in total, and the largest free-holding addresses are 209,000 and 48,000, totaling 250,000. There are currently 6.37 million tokens in circulation, with the top 20 accounting for 27% of the circulating supply. There is no lock-up period for the current token pledge, and the pledge can be released at any time. However, due to higher returns, better market expectations, and lower costs for early pledgers, large-scale unstaking may not occur when the market rises. Judging from the on-chain addresses and historical price trends, TAO’s large tokens are concentrated and have increased significantly, making it an obviously strong banker currency.

Livepeer(LPT)

Introduction: It is a decentralized video streaming network built on Ethereum as a scalable platform-as-a-service, providing a real-time media layer in the decentralized development stack for developers who want to add live or on-demand video to their projects. s solution. Livepeer improves the reliability of video streaming from centralized broadcast services while reducing the costs associated with it by up to 50x.

After OpenAI released Sora on February 16, Livepeer announced that as part of its AI video initiative, the community is working to bring these features to the Livepeer network in the coming months.

Team and investment

The co-founder and CEO of Livepeer is Doug Petkanics, who previously co-founded Wildcard Inc and Hyperpublic (acquired by Groupon). He holds a degree in computer science from the University of Pennsylvania. Eric Tang is the co-founder and core developer of Livepeer. Previously, he founded Wildcard and is also the chairman of the Carolyn Faye Kramer Fan Club.

Investors include DCG, Pantera Capital, Coinbase Ventures, CoinFund, Tiger Global, etc.

Token situation

LPT has a market value of 797 million, and the tokens are currently in full circulation. The main trading venues are Binance, OKX, and Coinbase.

In Livepeer, new tokens are minted and distributed to delegators and coordinators every round. The round here refers to the unit of measurement in Ethereum blocks, where one round is equal to 5760 Ethereum blocks. The average block time in Ethereum is 14 seconds, which means a round lasts about 22.4 hours, and the inflation rate is automatically adjusted based on the pledge rate.

Numbers Protocol (NUM)

Introduction: Numbers Protocol is building a decentralized image network that creates community, value and trust for digital media. Its digital protocols redefine digital visual media as assets for the registration and retrieval of images and videos across digital networks. Numbers Blockchain is committed to supporting the entire life cycle of modern digital assets with additional smart contract support, including NFT minting, royalty distribution, and more.

On the 2.6th, Numbers Protocol announced that it had been selected into the Google News Digital Transformation Program.

Team and investment

The founder and CEO of Numbers is Tammy Y. She has a PhD in particle physics and her education includes National Taiwan University and the University of Manchester in the UK.

Investment institutions include Protocol Labs, Binance, Race Capital, YouTube, and twitch

Token situation

The current market value of NUM is 120 million, the FDV is 205 million, the maximum supply of tokens is 1 billion, and the current circulation is 58.77%. The main trading venues are Kucoin, Gate, and Pancake. The token was issued in November 21, and the price has been falling. Recently, due to the positive release of Web2's cooperation resources and the gradual increase in the popularity of the data sector, it is a medium market capitalization target that has climbed from a low level.

Sector summary: AI infrastructure is the core component of the AI track in the encryption market, and can also be subdivided into more specific sectors. For example, data protocols worthy of attention include The Graph (GRT), Ocean Protocol (OCEAN), etc.; Decentralized storage Filecoin (FIL), Arweave (AR), etc.; computing network Phoenix (PHB), etc.; distributed AI computing network Gensyn, etc. With the rapid development of Web2 artificial intelligence, Web3 infrastructure projects with better resources tend to cooperate with Web2 companies to accelerate their own development and popularity.

4. AI agent

Fetch.ai (FET)

Introduction: Fetch.ai creates artificial intelligence platforms and services that allow anyone to build and deploy artificial intelligence services at scale, anytime, anywhere. Its main products include the front-end Delta V for chat and interaction, the back-end AI agent architecture and components AI Engine; AI Agents; Agentverse; Fetch Network.

On March 5, Fetch.ai announced the launch of the US$100 million infrastructure investment project "Fetch Compute", which will deploy Nvidia H200, H100 and A100 GPUs to create a platform for developers and users to utilize computing power. , deepening the foundation of the artificial intelligence economy. In addition, Fetch.ai will introduce innovative reward mechanisms to its community through this project. Starting March 7, 2024, users who stake Fetch.ai’s native token FET will be rewarded with Fetch Compute Credits, which they can then use to pay for GPU usage on the Fetch Compute network.

Team and investment

Humayun Sheikh is the CEO and founder of Fetchai and Mettalex, and an investor in DeepMind, a British-American artificial intelligence laboratory, focusing on artificial intelligence, machine learning, blockchain and token-based economies.

Edward Fitzgerald is the Chief Technology Officer of Fetchai. Previously, Edward worked at Nokia Bell Labs as an adaptive consensus protocol researcher.

Maria Minaricova is the Director of Business Development at Fetch.ai, a Cambridge-based innovation lab that develops state-of-the-art technologies using AI Agents technology, the Web, and AI/ML tools. She is building strategic alliances and partnerships with industry and academia.

Fetchai’s investment institutions include DWF Labs, Outlier Ventures, etc.

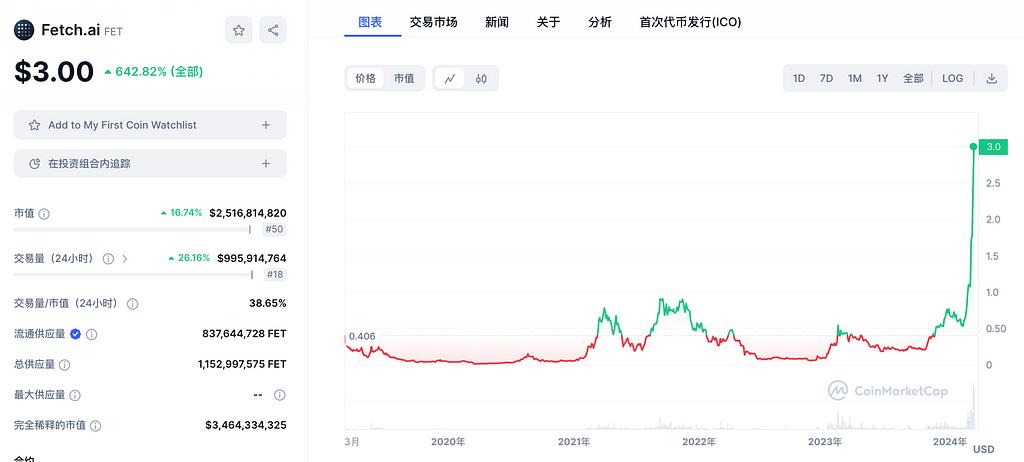

Token situation

The market value of FET is 2.516 billion, FDV is 3.464 billion, and the current token circulation is 836 million. The main trading markets are Binance, Coinbase, and Bybit. As it invested in computing power facilities and expanded FET's pledge and use cases on March 5, the token price has been rising. If it achieves substantial advancement in the field of computing power, the price will be more imaginative.

SingularityNET(AGIX)

Introduction: SingularityNET is an open and decentralized artificial intelligence service network whose mission is to create a decentralized, democratic, inclusive and beneficial general artificial intelligence. Developers publish their services to the SingularityNET network, where they are available to anyone with an Internet connection. Developers can charge for the use of their services using native AGIX tokens.

SingularityNET's services can provide inference or model training across multiple domains, such as image, video, speech, text, time series, bioartificial intelligence and network analysis. These services can be as simple as encapsulating a well-known algorithm, a complete end-to-end solution to an industry problem, or a standalone AI application. Developers can also deploy autonomous artificial intelligence agents to interoperate with other services on the network. Examples include facilitating trustless and automated transactions through multi-party escrow, launching new AI services and organizations on the blockchain, tracking successful API calls, and defining pricing strategies.

Team and investment

The founder and CEO of SingularityNET is Ben Goertzel, who is also the chief artificial intelligence scientist of Hypercycle and chairman of the OpenCog Foundation. He graduated from New York University and received a degree in mathematics from Temple University.

Janet Adams is Chief Operating Officer of SingularityNET. He has worked at Royal Bank of Scotland and HSBC as an operations executive. He graduated from the University of Essex and received a science degree from Imperial College.

Disclosed investors include Fundamental Labs, and in May 2022, SingularityNET and Singularity DAO received a $25 million investment commitment from the investment group LDA Capital.

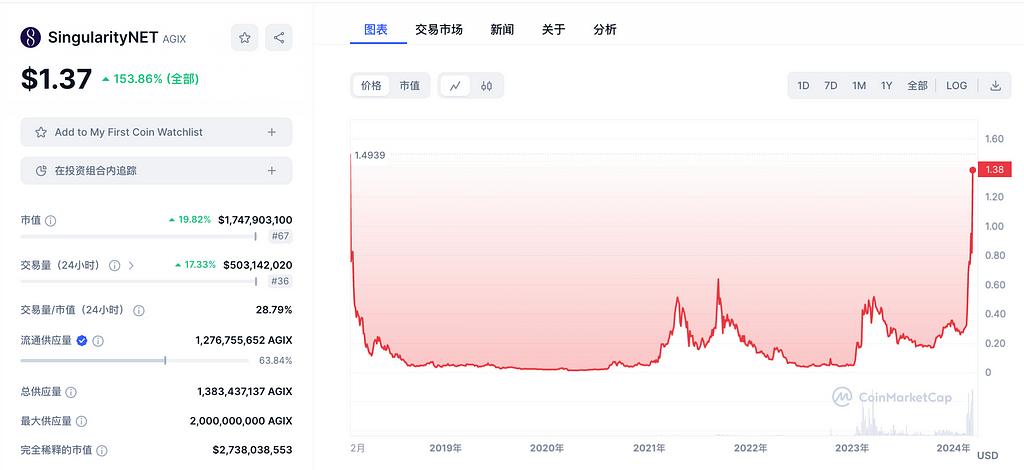

Token situation

The current market value of AGIX is 1.747 billion, FDV is 2.738 billion, the maximum supply is 2 billion, and the current circulation is 63.84%. The main trading markets are Binance, OKX, and Bybit. More than 27.55% of the tokens are accumulated in Binance, and the exchanges have accumulated about 40% in total. The project party holds 6.5% of the tokens. The top 20 largest currency holders on the chain have a certain scale of seizing the wallets on the chain. Big sell off.

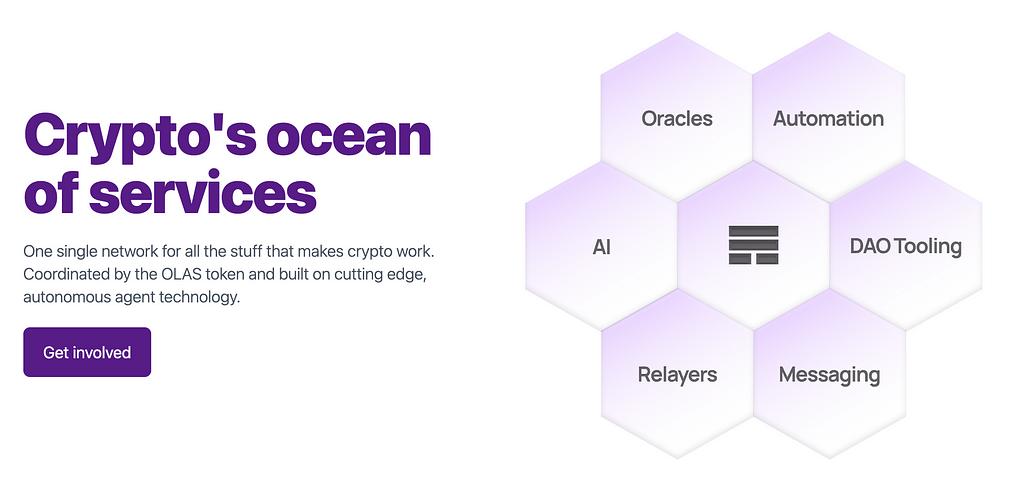

Autonolas (OLAS)

Introduction:

The Autonolas Protocol is a smart contract-based DAO tool that implements a mechanism for coordinating, protecting, and managing software code on a public blockchain, and provides incentives to developers based on their relative contribution to the growth of the Autonolas ecosystem.

Autonolas has four core components 1. Multi-agent system architecture 2. Agent service consensus (state minimization consensus tool)

3. Architecture of encrypted native off-chain services (artificial intelligence agents need to execute off-chain logic to maintain high performance. This means that on-chain artificial intelligence agents will host their logic/computation off-chain to optimize efficiency, but agent decision-making will be on-chain Execution on the chain) 4. On-chain protocol. Simply put, Bittensor (TAO) wants to unify different algorithms under a consensus network; Autonolas (OLAS)

Want to unify the application modules of different AI agents under a consensus network.

Team and investment

David Minarsch is the CEO and co-founder of Valory, the parent company of Autonolas. He has a PhD in Economics from Cambridge. He specializes in multi-agent services and was the head of multi-agent services at Fetch.ai.

David Galindo is the CTO and co-founder of Valory, the parent company of Autonolas. He was the head of cryptography at Fetch.ai and a member of the EU Blockchain Observation and Forum Expert Group. He has more than 15 years of work experience.

Investors include Signature Ventures, Semantic Ventures, True Ventures, Proof Group, etc.

Token situation

According to data previously disclosed by the project team, OLAS’ current market value is 253 million, FDV is 2.857 billion, and the current circulating supply is 47.61 million tokens. The main trading market is Uniswap, and Bitget has recently been launched. With its popularity and development, there are also Expectations for further listing of Dex. Previously, the token price was sluggish due to the problem of project parties selling tokens and centralized token operations. Recently, there have been new token pledge proposals. We remain optimistic about its fundamentals, but the actual operation and token chip structure still need to be continued. Follow up.

Segment summary: The AI agent or AGI sector in the encryption project has not yet had a substantial implementation project. Web2 Company also has a real implementation of AGI, but the progress and achievability are much higher than that of the encryption project. In addition to tracking the progress of the project itself, the purpose of studying this sector should also pay close attention to the progress of AGI and AI agnet in the Web2 technology circle, which will drive the development of encrypted AI projects and token prices.

5. AI application software

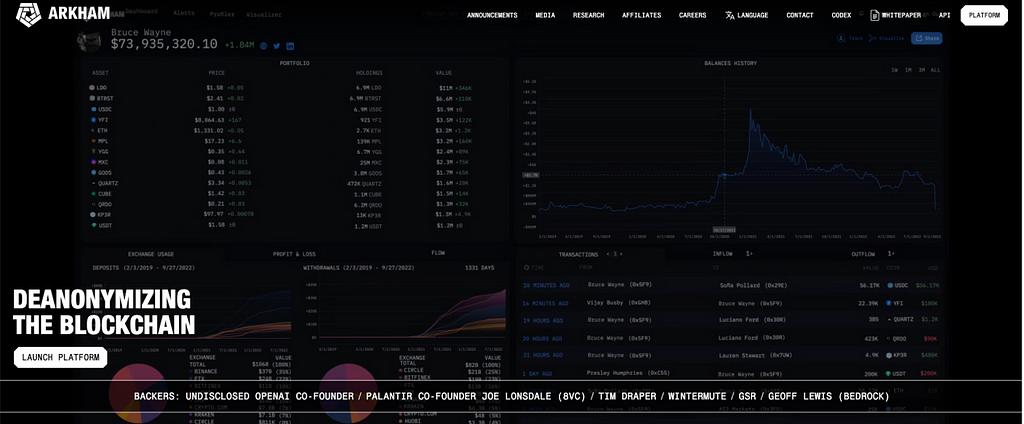

Arkham (ARKM)

Introduction: Blockchain transactions are public by nature, allowing any third party to view and investigate them. However, these raw transaction data are unprocessed and anonymous by default. It needs to be analyzed and de-anonymized before it can be used. Arkham is a crypto intelligence platform that systematically analyzes and de-anonymizes blockchain transactions, showing users the people and companies behind blockchain activity, as well as data and analytics about their actions , making blockchain data analyzable.

Arkham has four important modules 1. Underlying technology: Arkham Ultra is a proprietary artificial intelligence system for blockchain data synthesis. It collects on-chain and off-chain data from various sources and synthesizes them into a single 1. Scalable and modifiable source of truth. Currently, the Arkham platform includes more than 350 million tags and 200,000 entity pages; 2. Display front-end: profiler-transaction history, portfolio holdings, balance history, gains and losses, Counterparties, exchange conditions, etc. 3. Information Exchange: Build a decentralized intelligence economy where anyone can use the local currency ARKM to trade information, such as entity tags, hacker tracking and selected data sources. Buyers offer rewards for information. Seller provides information through auction. Bounties and auctions are conducted via audited smart contracts, with no central entity holding funds in custody. 4. Tokens: Buyers seeking specific information obtain rewards by staking ARKM. Sellers can also use auctions to gain intelligence. Bounty participants and auction winners will receive exclusive access to purchased intelligence for 90 days. After that, it may be spread to the wider Arkham platform for everyone to use. To support the network, Arkham charges a 2.5% maker fee on submitted bounties and auction bids, and a 5% recipient fee on bounty payouts and successful auction bids.

Team and investment:

Miguel Morel is currently the CEO of Arkham and the co-founder of Reserve Protocol. He is a technology entrepreneur with many years of experience in strategy, management, recruitment, and fundraising; Alexander Lerangis is the head of business development. Prior to that, he was a manager in Deloitte's banking and securities industry risk and financial advisory practice.

Investors include Binance Labs, Sam Altman, Tim Draper and other crypto and technology circle resources.

Token situation:

ARKM's market value is US$411 million, FDV is US$2.74 billion, and its total supply is 1 billion tokens, with 15% currently in circulation. The main online exchanges are Binance, Bybit, and Gate.

QnA3.AI(GPT)

Introduction: QnA3.AI is an AI-driven Web3 knowledge platform and investment research and trading tool, focusing on providing GPT in the web3 field. The QnA3 team believes that user intentions can be summarized in three steps: "information collection", "information analysis" and "execution of actual trading behavior", and introduces the encryption industry's AI question and answer robots, technical analysis robots and asset trading capabilities into the Web3 world.

In January 2023, QnA3.AI launched the computing power mining function, which is expected to increase the user level to a new level in conjunction with the airdrop. The computing power mining of QnA3.AI can use the idle computing power when browsing the web to participate in data processing tasks, which is simply achieved through the Chrome plug-in. After installation, data collection, cleaning and model pre-training tasks are automatically completed in the background, and QnA3 Credit is obtained as a reward.

Team and investment

The founder and CEO of QnA3.AI is Kane. The team information has not been publicly disclosed in detail, but judging from the resources obtained since the development of the project, the team and investment background are relatively good. QnA3.AI is a project incubated by Binance Labs in the sixth season. On February 25, 2024, it was announced that it had received investment from the Solana Foundation and will jointly establish a strategic alliance with the Solana Foundation to focus on artificial intelligence and DePIN development. QnA3.AI also said that it is working hard to develop an application customized for Solana Saga. On March 8, it was officially announced that it had received a new round of investment from Binance Labs. Both Binance and OKX wallets integrate their products.

Token situation

According to the white paper, the total supply of GPT is 1 billion, and the TGE stage is 10%: Jumpstart 3%+airdrop 0.5%+Market Maker 3%+Development 3.5%=10%; the current retail airdrop is 5 million; Jumpstart 30 million; MM30 million , most of Development 3500w have not been put into the market for the time being, with about 6500-8000w tokens in circulation, and the current market value is about 45.5-56 million.

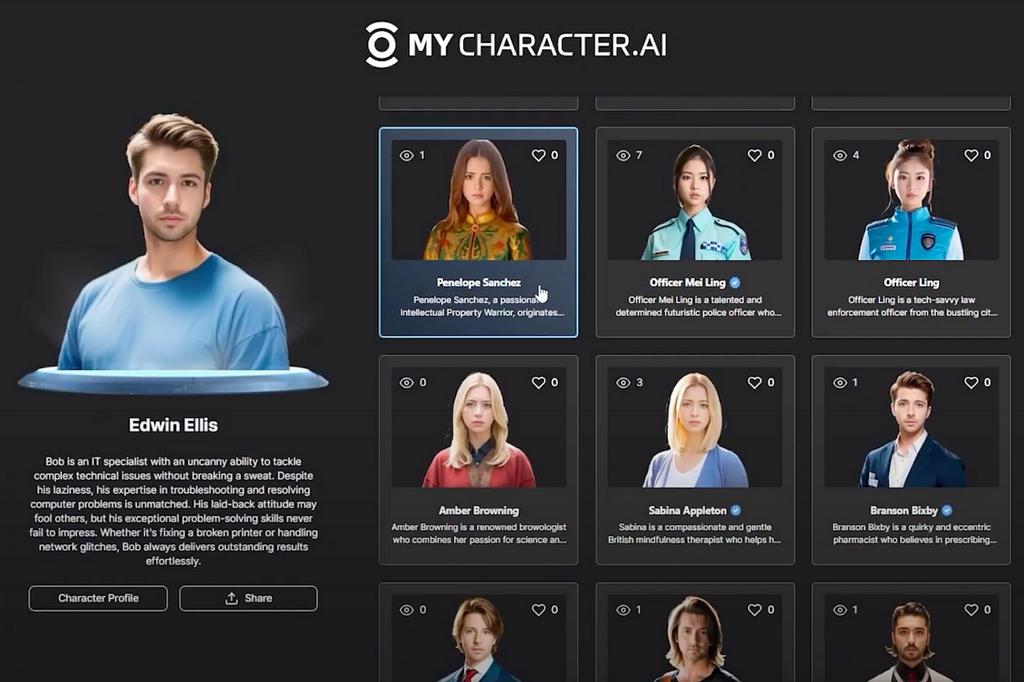

Alethea AI (ALI)

Introduction

Alethea AI is an intelligent metaverse of intelligent and interactive NFTs. As the originator of the decentralized iNFT protocol, Alethea AI is at the forefront of embedding AI animation, interaction, and generative AI capabilities into NFTs. Community members can create, train and earn iNFTs in an intelligent metaverse called Noah’s Ark. Intelligent NFT (iNFT) is a new NFT standard that enables the creation of NFTs with embedded AI animation, speech synthesis, and generative AI functions.

Alethea AI generates AI characters through the CharacterGPT function. It is the world's first multi-modal AI system that can generate interactive AI characters based on natural language descriptions. It allows users to quickly generate appearances, voices, personalities and characters with higher fidelity. Interactive AI characters for identity. These generated AI characters can be tokenized, customized, and trained on the blockchain to perform various roles and tasks.

With the development of artificial intelligence, the way content is created is undergoing fundamental changes. Large language models such as GPT-3 and ChatGPT, Stable Diffusion, DALL-E 2 and MidJourney have moved from text to image models, and now Alethea AI has built a text-to-character image artificial intelligence system.

Team and investment

The CEO and founder of Alethea AI is Arif Khan. He has worked at Grab and LinkedIn, and served as Chief Marketing Officer at SingularityNET from 2017–2019. Graduated from Singapore Management University.

Alethea AI has received support from top capitals such as Multicoin Capital, Binance, Crypto.com Capital, and LD Capital.

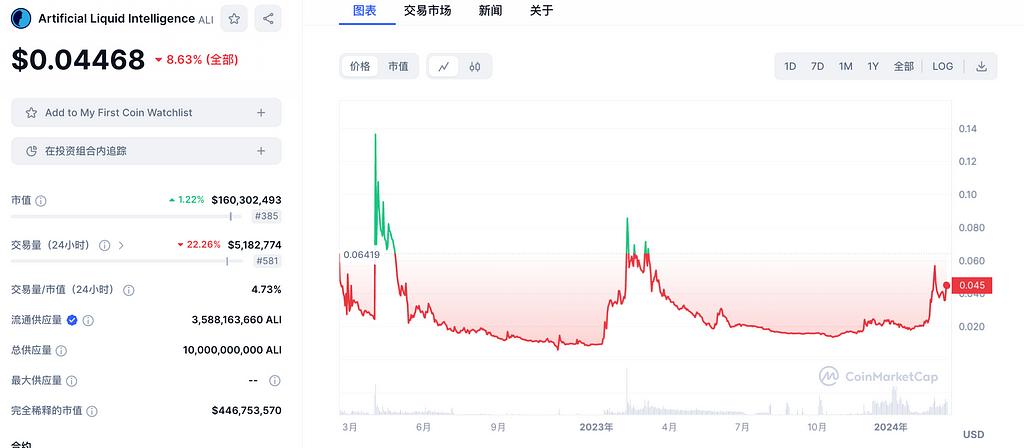

Token situation

ALI's current market capitalization is 160 million, FDV is 446 million, the maximum token supply is 10 billion, and the current circulation is 35.88%. The main trading venues are HTX, Gate, and Crypto.com, and it has the potential to further expand mainstream Dex.

Segment summary: AI application projects have the largest number of projects and are the most intuitive. You should pay attention to the data and popularity behind the projects, product experience and the resources behind them to select projects. With the high level of AI hype, there are Sleepless AI (AI), Delysium (AGI), NFPrompt (NFP), etc., and ecological application projects include PAAL AI (PAAL), ChainGPT

(CGPT) etc.

LD Capital

As a global blockchain investment firm, we have built a portfolio of over 250 investments since 2016, spanning across various sectors, including infrastructure, DeFi, GameFi, AI, and the Ethereum ecosystem. We focus on investing in projects with disruptive innovations, actively taking on the role of primary investors, and providing comprehensive post-investment services to these projects. We employ a combination of direct investment from our own funds and a distributed fund model to cover all-stages of investment.

Trend Research

Trend Research division specializes in crypto hedge funds focusing on secondary areas within the crypto market. Our team members come from top platforms and institutions like Binance and CITIC. We excel in macroeconomics, industry trends, and project data analysis, with trend, hedge, and liquidity funds.

Cycle Trading

We specialize in Web3 project investment and service, with a strong emphasis on Infra, applications, and AI. We have a team of nearly 20 senior engineers and dozens of crypto experts as advisors, assisting projects in strategic design, capital platform relations, and liquidity enhancement.

website: ldcap.com

twitter: twitter.com/ld_capital

mail: BP@ldcap.com

medium:ld-capital.medium.com