LD Capital: With the NVIDIA GTC conference imminent, take a quick look at AI encryption projects worth paying attention to this year.

Scheduled for March 17–21, 2024, in San Jose, California, the event will feature a keynote speech by NVIDIA CEO Jensen Huang titled “Don’t Miss the Moment of AI Transformation.” The conference will host over 900 inspiring sessions, 300 exhibitions, 20 technical workshops covering topics such as generative AI, and numerous networking opportunities. This conference will once again draw global attention to hot topics like AI, the metaverse, and semiconductors, leading to an early surge in various AI-related crypto assets. Since the emergence of AI-related crypto assets in the crypto world in 2023, various AI projects are expected to be one of the main focuses of speculation and investment throughout 2024. This article will provide a quick overview of some AI encryption projects worth paying attention to.

1.Personality Identification

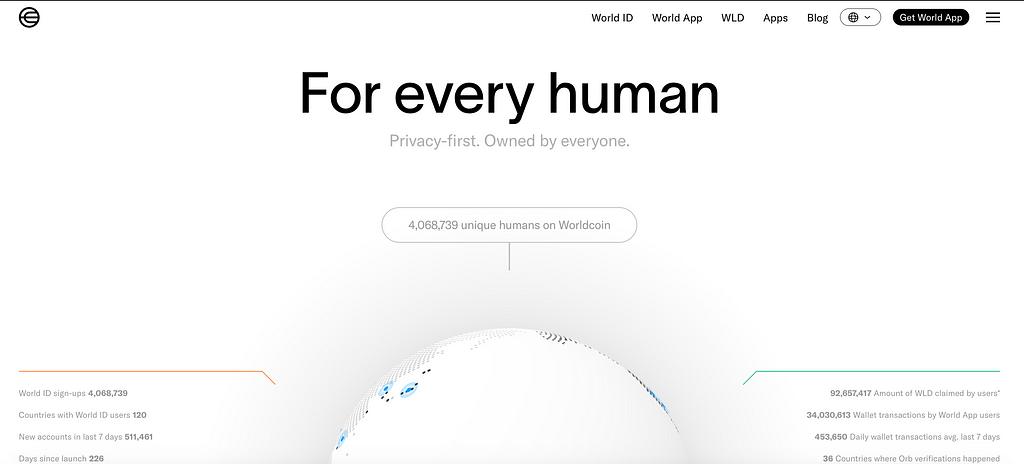

Worldcoin (WLD):

Introduction: Founded by OpenAI’s co-founder Sam Altman in 2020, Worldcoin was established with the aim of providing personality verification and safeguarding economic rights in the AI era. Worldcoin’s vision is to create the world’s largest and most equitable digital identity and currency system. It achieves identity verification by scanning the iris of every person on Earth, creating a human passport for the Web3.0 era.

Team and Investment:

Sam Altman, the co-founder of OpenAI, is a co-founder of Worldcoin. Alex Blania serves as the CEO and co-founder of Worldcoin. He previously worked as a researcher at the Institute for Quantum Information and Matter at the California Institute of Technology.

Top VC investment firms backing Worldcoin include a16z Crypto, Coinbase Ventures, Multicoin Capital, Blockchain Capital, and others.

Token Details:

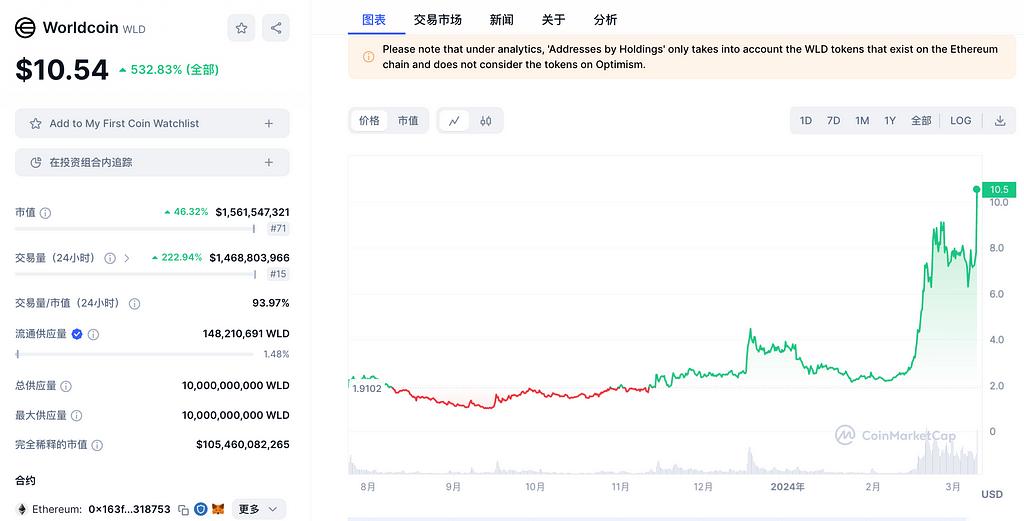

WLD currently has a market capitalization of $1.56 billion and a fully diluted valuation of $105.4 billion. The total token supply is 10 billion tokens, with the current circulating supply being 1.47%. Major exchanges where WLD is primarily listed include Binance, OKX, and Bybit.

Token Release Rate: The token release rate is 3.19 million tokens per day, increasing to 6.61 million tokens per day starting from July 14, 2024. The current token distribution structure can be divided into three parts: a portion released to regular users, which makes it difficult for community rewards to form synchronized massive selling pressure; a portion allocated to liquidity providers, with new liquidity provider terms effective from December 2023 lending 10 million tokens to liquidity providers for a term of 6 months, positively impacting the token price from December onwards; and the last portion held by large holders who accumulated a significant amount of tokens when the token price was around $2.

Although WLD’s FDV has been a concern in the market, the current circulating supply is a more important factor to consider. In the context of the AI boom, when the speed of consensus formation exceeds the speed of token release (selling), it will truly drive the token price upwards.

Sector Summary: Worldcoin (WLD) dominates the AI identity verification sector compared to other projects. With the rapid development of AGI, there are limited options for addressing issues such as identifying human access, preventing adversarial machine learning, and incorporating technologies like ZKML. Worldcoin (WLD) has a grand narrative and vast potential. Additionally, with Sam Altman’s stature as a leader in the AI industry and the founder of OpenAI, each positive development from OpenAI benefits AI projects in the crypto world. However, traditional financial market investors cannot directly participate in OpenAI or its upstream and downstream investments. Sam’s involvement in and investment in crypto projects may be the most direct way for them to participate. Another project he has invested in, Arkham (ARKM), will be discussed in the fifth chapter on AI application software.

2.Decentralized Computing Power

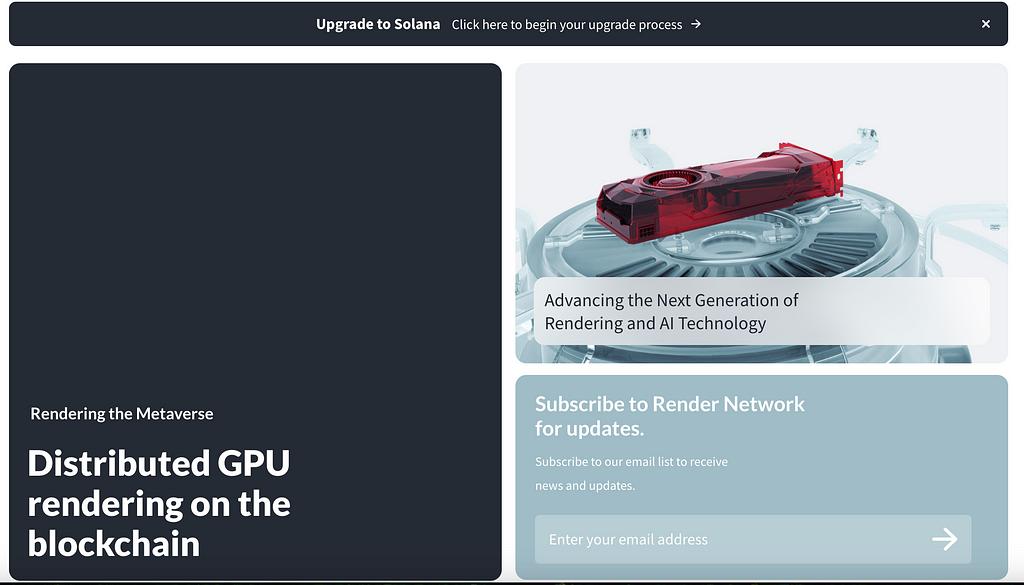

Render Network (RNDR)

Introduction:

Render Network is a decentralized GPU rendering platform that enables artists to expand GPU rendering tasks to high-performance GPU nodes worldwide on demand. Through a blockchain marketplace for idle GPU computing, the network provides artists with the capability to scale next-generation rendering work at a fraction of the cost and with significantly increased speed compared to centralized GPU clouds. Its aim is to provide nearly infinite decentralized GPU computing power for next-generation 3D content creation.

Since the second half of 2023, Render Network has been expanding GPU computing into fields such as AI and ML. To date, Render Network has collaborated with four computing clients to provide distributed GPU resources: IO.Net, Beam, FedMl, and Nosana.

At the upcoming GTC conference in 2024, Render Network’s founder, Jules Urbach, will attend and deliver a speech titled “The Future of Rendering: Real-Time Ray Tracing, Artificial Intelligence, Holographic Displays, and Blockchain.”

Team and Investment:

The founder of Render is Jules Urbach. Jules has set strategic visions for OTOY and served as the company’s Chief Architect for its technical roadmap. With over 25 years of industry experience, he is widely acclaimed as a pioneer in computer graphics, streaming media, and 3D rendering. He created his first game at the age of 18 and went on to create the first 3D video game platform on the internet, licensing the software to Macromedia, Disney, Warner Bros., Nickelodeon, Microsoft, Hasbro, and AT&T.

Render Network’s parent company is OTOY, Inc., founded in 2008. It has since become a leading cloud graphics company, with its groundbreaking technologies redefining content creation and delivery for media and entertainment organizations worldwide. OTOY has won an Academy Award, and its technology is used by leading visual effects studios, artists, animators, designers, architects, and engineers.

Render Network, headquartered in Los Angeles, California, has a global team. It boasts a world-class advisory board, including industry leaders such as Ari Emanuel (co-founder and co-CEO of WME), J.J. Abrams (Chairman and CEO of Bad Robot Productions), Mike Winkelmann (Beeple), and Brendan Eich (co-founder and CEO of WME). With outstanding team strength, successful track records, and industry resources.

Render Network has also received support from top-tier capital, with investors including Multicoin Capital, Alameda Research, Solana Ventures, LD Capital, and others.

Token Details:

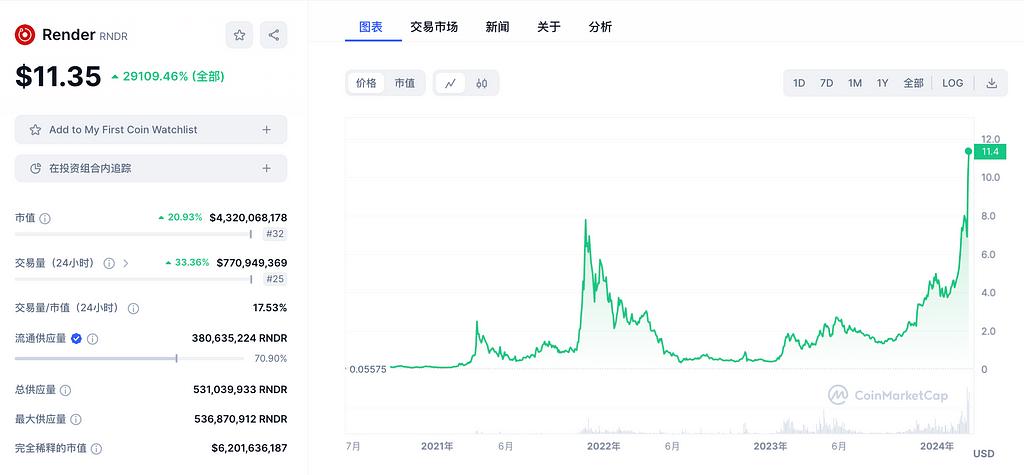

RNDR currently has a market capitalization of $4.32 billion and a fully diluted valuation of $6.2 billion. The maximum supply is 546 million tokens, with the current circulation being 70.48%. Major trading markets include Binance, Coinbase, OKX, and other mainstream exchanges. The Balanced and Minting Emissions (BME) model proposed in Render Network’s RNP001 proposal has been formally adopted and is now being implemented. With Render Network’s leading development, RNDR has the potential to become a deflationary asset. In a scenario with strong network utilization and growth, the token may continue to experience robust price growth.

Akash Network (AKT)

Introduction:

Akash Network is an open network and cloud computing marketplace that establishes a market for renting computational resources, providing resources such as CPU, storage, TLS, IP, and GPU. Akash’s blockchain is built on the Cosmos SDK. Hosting applications on Akash costs about one-third of the cost of Amazon AWS, Google Cloud Platform (GCP), and Microsoft Azure.

In the second half of 2023, Akash Network launched the AI Super Cloud to participate in the AI computing market. The network currently supports NVIDIA GPUs and may choose other GPUs in the future, such as AMD. Akash Network has successfully hosted NVIDIA H100 and A100 GPUs, as well as a range of consumer-grade GPUs. Access to consumer-grade GPUs is one of the distinguishing features of the Akash Super Cloud. Currently, Akash Network can support basic AI model training using its network.

Team and Investment:

Greg Osuri, co-founder and CEO of Akash Network, has a background in cloud architecture and entrepreneurship dating back to 2008. Osuri founded Akash as a decentralized alternative to traditional cloud computing. Before Akash, Osuri founded four other companies and worked at notable companies, including Miracle Software Systems as a technical architect, IBM as a key infrastructure consultant, and Kaiser Permanente as a cloud infrastructure consultant.

Adam Bozanich, co-founder and CTO, is a seasoned professional in the field of software engineering, holding senior positions since 2006. With experience across software development domains, Bozanich has worked in QA automation at Symantec, security engineering at Mu Dynamics, and server engineering at Topspin Media. Before Akash, he co-founded two other companies with Osuri: Sproouts Tech and Overclock Labs.

Investors disclosed to date include D1 Ventures and GenBlock Capital.

Token Details:

AKT currently has a market capitalization of $1.429 billion and a fully diluted valuation of $2.416 billion. The maximum supply is 388 million tokens, with the current circulation being 59.14%. Major trading venues include Kucoin, Kraken, Osmosis, and Coinbase, which listed Akash Network (AKT) on its asset listing roadmap on February 27, 2024.

Clore.AI (CLORE)

Introduction:

Clore.AI is a platform that offers GPU computing power rental services built on a Proof of Work (POW) basis. Any modern computer/server equipped with NVIDIA GPU can be connected to this network, with over 5500 GPUs currently connected. The business scope includes artificial intelligence training, movie rendering, VPN services, cryptocurrency mining, among others. When there is a specific computing power service demand, tasks are allocated within the network. If there is no computing power service demand, the network identifies the cryptocurrency with the highest mining profitability at the time and participates in mining. The team is based in Europe, and the official statement claims strict adherence to European laws to ensure the legality and reliability of project operations.

On the official website, users can view specific GPU models, configurations, leasing prices, and other details. The party providing computing power can receive CLORE tokens as rewards; the better the performance of the server, the higher the rewards. The party using computing power can pay with CLORE, BTC, or USD.

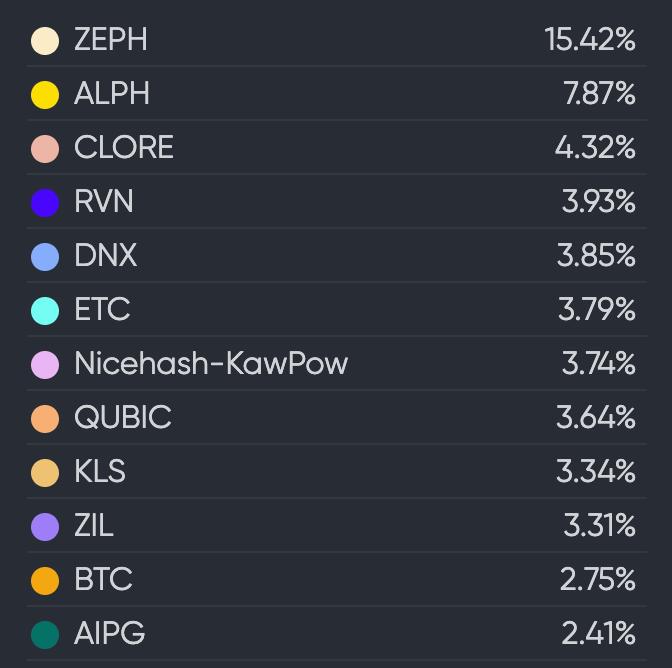

Since the November LD report, there has been a noticeable increase in the computing power observed on the Hiveon platform. The share has increased from 3% to 4.32%, and the ranking has risen from 11th place to 3rd place.

Token Details:

CLORE currently has a market capitalization of $93.59 million and a fully diluted valuation of $114 million. The total token supply is 1.3 billion tokens. Mining started in June 2022, and it is expected to enter full circulation by 2042. The current circulating supply is around 250 million tokens. The main trading markets include Mexc, Gate, Bitget, among others.

CLORE is a POW token that utilizes the kawpow algorithm, which is resistant to ASIC mining. There was no pre-mining or ICO for the token. 50% of each block’s rewards are allocated to miners, 40% to lessors, and 10% to the team.

Sector Summary: With breakthrough advancements in AI represented by projects like ChatGPT and Sora, the demand for computing power in AI training and inference is entering a new era in terms of scale and quality. GPUs and computing power are becoming indispensable resources in the AI field, akin to water. Therefore, projects related to this domain deserve significant attention and are poised for rapid development. Notable upcoming projects that have yet to launch tokens include io.net, GPU.net, and Aethir.

3.AI Infrastructure

Bittensor (TAO)

Introduction:

Bittensor is an open-source protocol that supports blockchain-based machine learning networks. Machine learning models collaborate in training and are rewarded in TAO based on the value of information they provide to the collective. TAO also grants external access, allowing users to extract information from the network while adjusting their activities according to their needs.

For Bittensor, the project itself neither computes nor provides data for machine learning on-chain. Instead, it leverages all other off-chain AI models to collaborate. In simple terms, Bittensor acts as a transporter for algorithms rather than producing them.

Team and Investment:

Bittensor was founded by Jacob Robert Steeves, a former Google software engineer. Co-founder Ala Shaabana was previously an assistant professor at the University of Toronto and a postdoctoral fellow at the University of Waterloo. He holds a degree from McMaster University. James Woodman serves as Bittensor’s Chief Operating Officer and previously worked in business development at GSR.

According to official documentation, Bittensor had a “fair launch” in 2021 (no pre-mined tokens), and the token is called TAO. The fair launch implies no common practices like VC rounds, private rounds, ICO/IEO/IDO, foundation reserves, etc., making it a purely mined coin. On Bittensor’s website, notable backers and market makers include DCG, GSR, Polychain Capital, and Firstmask. Their involvement may entail major institutions acting as validation nodes or miners, engaging in TAO mining, or acquiring coins mined by Bittensor’s official institutions for distribution to market makers.

Token Details:

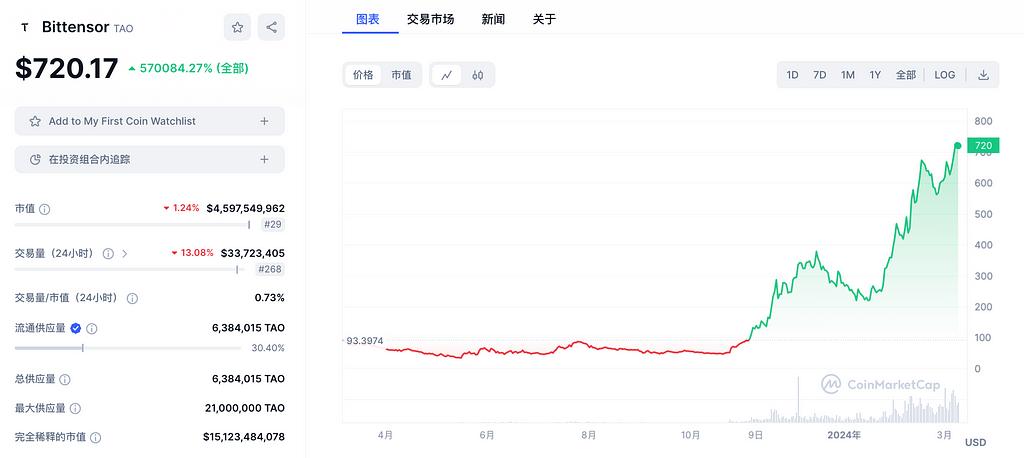

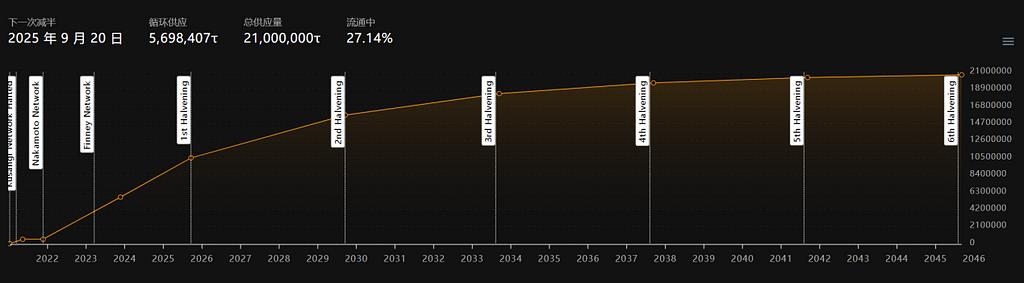

TAO has a market capitalization of $45.9 billion and a fully diluted valuation of $151.23 billion. The maximum supply is 21 million, with a current circulation rate of 30.36%. Output halves every four years. Major trading markets include Gate, Kucoin, and Mexc, with the token yet to be listed on top-tier CEXs.

TAO generates approximately one block every 12 seconds, with each block rewarding miners and validators with 1 TAO. According to the current inflation schedule, this results in the issuance of 7,200 new TAO into circulation every 24 hours, distributed on average among miners and validators (including stakers).

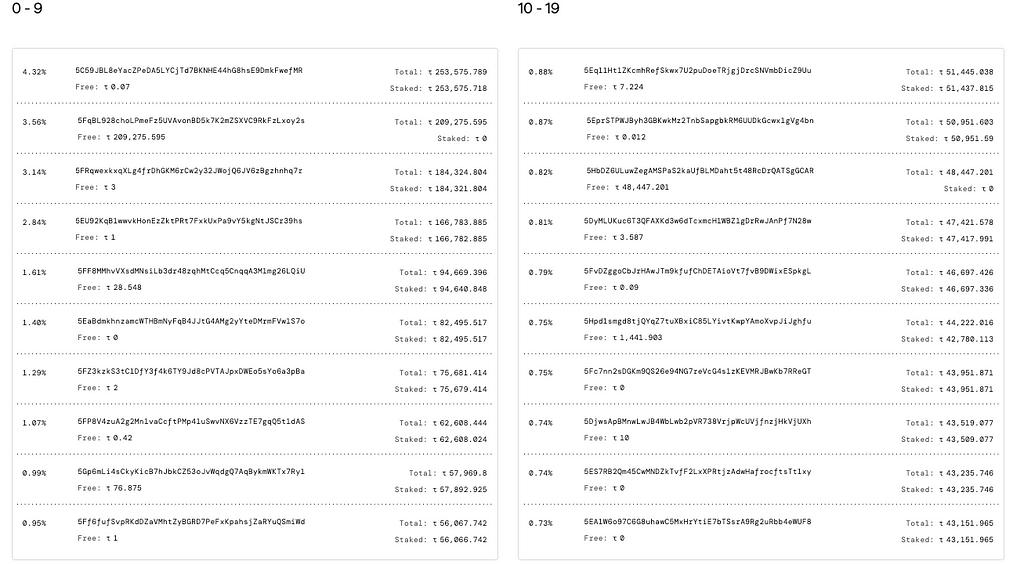

Currently, a large portion of the tokens are staked/delegated. The largest address holds 250,000 tokens, all of which are in a delegated state. The top 20 addresses collectively hold over 1.7 million tokens, with the largest freely held addresses owning 209,000 and 48,000 tokens, totaling 257,000 tokens. There are currently 6.37 million tokens in circulation, with the top 20 addresses holding 27% of the circulating supply.

There is no lock-up period for token staking, and staking can be unstaked at any time. However, due to the high returns and positive market expectations, coupled with the lower costs for early stakers, significant unstaking may not occur during market upswings. Considering the on-chain addresses and historical price trends, TAO tokens are concentrated among large holders, leading to significant price increases, indicating strong manipulation by large players.

Livepeer (LPT)

Introduction: Livepeer is a decentralized video streaming network built on Ethereum. It serves as a scalable platform-as-a-service, offering a solution for developers looking to integrate real-time or on-demand video into their projects through a decentralized development stack. Livepeer aims to enhance the reliability of centralized broadcasting services for video streaming while reducing associated costs by up to 50%.

Following the release of Sora by OpenAI on February 16th, Livepeer announced that as part of the AI Video Initiative, the community is working to introduce these features to the Livepeer network in the coming months.

Team and Investment: Doug Petkanics, co-founder and CEO of Livepeer, previously co-founded Wildcard Inc and Hyperpublic (acquired by Groupon). He holds a degree in Computer Science from the University of Pennsylvania. Eric Tang is a co-founder and core developer at Livepeer, having previously founded Wildcard and served as the president of the Carolyn Faye Kramer Fan Club.

Investors include DCG, Pantera Capital, Coinbase Ventures, CoinFund, Tiger Global, among others.

Token Situation

LPT has a market capitalization of $797 million, and the tokens are currently fully circulated. The primary trading venues include Binance, OKX, and Coinbase.

In Livepeer, new tokens are minted in each round and distributed to delegators and orchestrators. Here, rounds are measured in units of Ethereum blocks, with one round equivalent to 5760 Ethereum blocks. The average block time in Ethereum is around 14 seconds, meaning a round lasts approximately 22.4 hours. The inflation rate adjusts automatically based on the staking ratio.

Numbers Protocol (NUM)

Introduction: Numbers Protocol is building a decentralized image network to create community, value, and trust for digital media. Its digital protocol redefines digital visual media as assets for registering and retrieving images and videos on digital networks. The Numbers blockchain aims to support the entire lifecycle of modern digital assets, including NFT minting, royalty distribution, and more, through additional smart contract support.

On February 6th, Numbers Protocol announced its selection for the Google News Initiative Digital Transformation Program.

Team and Investment: Tammy Y. is the founder and CEO of Numbers. She holds a PhD in Particle Physics and has educational backgrounds from National Taiwan University and the University of Manchester in the UK.

Investors include Protocol Labs, Binance, Race Capital, YouTube, and Twitch.

Token Situation:

NUM currently has a market capitalization of $120 million and a fully diluted valuation of $205 million, with a maximum token supply of 1 billion. Currently, 58.77% of the tokens are in circulation. The main trading venues for NUM are Kucoin, Gate, and Pancake. The token was issued in November 2021 and has seen a declining price trend since then. However, recent positive developments, such as collaborations with Web2 resources and increasing interest in the data sector, have led to gradual improvements in its value. It can be categorized as a mid-cap asset experiencing a low-level ascent.

Sector Summary: AI infrastructure represents a core component of the AI sector within the cryptocurrency market. It can be further divided into more specific sectors, such as data protocols, where projects like The Graph (GRT) and Ocean Protocol (OCEAN) are worth paying attention to; decentralized storage, including Filecoin (FIL) and Arweave (AR); computing networks like Phoenix (PHB); and distributed AI computing networks like Gensyn. With the rapid development of Web2 artificial intelligence, well-resourced Web3 infrastructure projects are increasingly collaborating with Web2 companies to accelerate their own development and exposure to heat.

4. AI Agent

Fetch.ai (FET)

Introduction: Fetch.ai is creating an artificial intelligence platform and service that enables anyone to build and deploy AI services at scale anytime, anywhere. Its main products include the frontend Delta V for chat and interaction, the backend AI agent architecture and components AI Engine, AI Agents, Agentverse, and Fetch Network.

On March 5th, Fetch.ai announced the launch of the Fetch Compute initiative, a $100 million infrastructure investment project. This project will deploy Nvidia H200, H100, and A100 GPUs to create a platform for developers and users to leverage computing power, deepening the foundation of the AI economy. Additionally, Fetch.ai will introduce innovative reward mechanisms for its community through this initiative. Starting from March 7, 2024, users staking Fetch.ai’s native token FET will receive Fetch Compute Credits as rewards, which they can then use to pay for GPU usage fees on the Fetch Compute network.

Team and Investment

Humayun Sheikh is the CEO and founder of Fetch.ai and Mettalex. He is also an investor in DeepMind, focusing on artificial intelligence, machine learning, blockchain, and token-based economies.

Edward Fitzgerald is the Chief Technology Officer at Fetch.ai. Previously, Edward worked at Nokia Bell Labs as a researcher specializing in adaptive consensus protocols.

Maria Minaricova is the Director of Business Development at Fetch.ai’s innovation lab in Cambridge. The lab utilizes AI Agents technology, web3, and AI/ML tools to develop cutting-edge technology. She is involved in establishing strategic alliances and partnerships with industry and academia.

Fetch.ai’s investment institutions include DWF Labs, Outlier Ventures, and others.

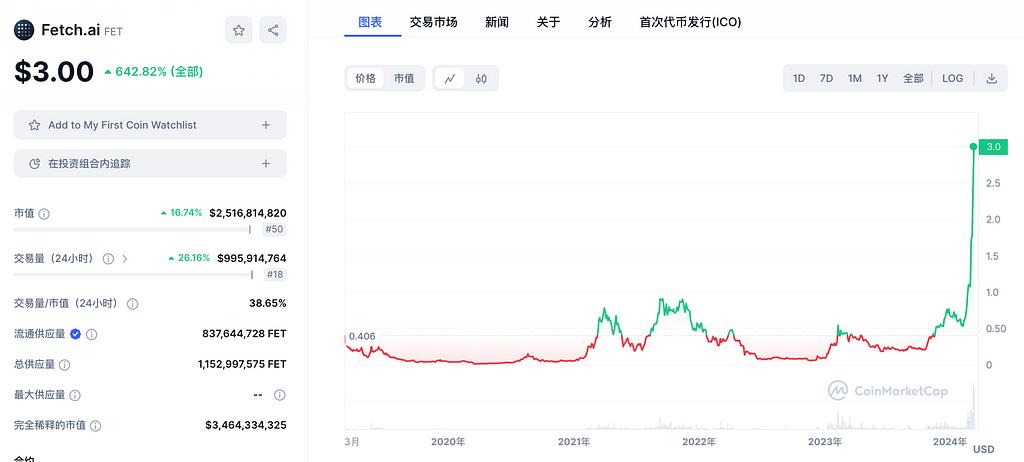

Token Information

FET has a market capitalization of $2.516 billion, with a fully diluted valuation of $3.464 billion. The current circulating supply of tokens is 836 million. The main trading markets are Binance, Coinbase, and Bybit. Following the investment in computational power infrastructure on March 5th and the expansion of FET’s staking and use cases, the token price has been steadily increasing. If Fetch.ai makes substantial progress in the field of computational power, there is even more potential for price appreciation.

SingularityNET(AGIX)

Introduction: SingularityNET is an open and decentralized AI service network with a mission to create a decentralized, democratic, inclusive, and beneficial general artificial intelligence. Developers can publish their services to the SingularityNET network, and anyone with internet access can use these services. Developers can charge for the use of their services using the native AGIX token.

SingularityNET’s services can provide reasoning or model training across multiple domains, such as image, video, speech, text, time series, biologically inspired AI, and network analytics. These services can be as simple as encapsulating a well-known algorithm, complete end-to-end solutions for industry problems, or standalone AI applications. Developers can also deploy autonomous AI agents that interoperate with other services on the network. For example, facilitating trust and automated transactions through multi-party hosting, publishing new AI services and organizations on the blockchain, tracking successful API calls, and defining pricing strategies.

Team and Investment:

Ben Goertzel is the CEO and founder of SingularityNET. He is also the Chief AI Scientist at Hypercycle, Chairman of the OpenCog Foundation, and holds a mathematics degree from New York University and a PhD from Temple University.

Janet Adams is the Chief Operating Officer at SingularityNET. She previously held positions as an operations executive at the Royal Bank of Scotland and HSBC. She holds a Bachelor of Science degree from the University of Essex and studied at Imperial College.

Investors in SingularityNET include Fundamental Labs. In May 2022, SingularityNET and Singularity DAO received a $25 million investment commitment from the investment group LDA Capital.

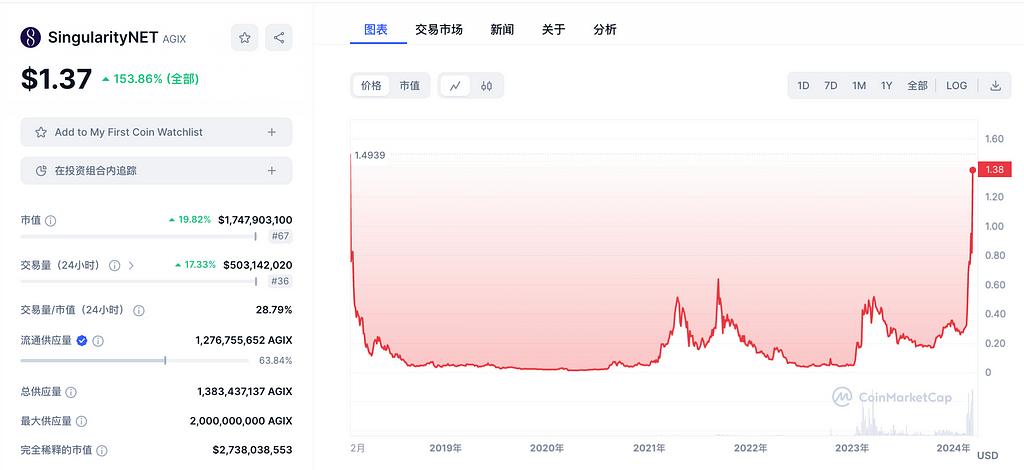

Token Information:

AGIX currently has a market capitalization of $1.747 billion, with a fully diluted valuation of $2.738 billion. The maximum supply is 20 billion tokens, with a current circulation of 63.84%. The main trading markets are Binance, OKX, and Bybit. Over 27.55% of the tokens are accumulated on Binance, and exchanges hold approximately 40% of the total. The project team holds 6.5% of the tokens. The top 20 holders on the chain have engaged in significant accumulation behaviors into on-chain wallets, with no large-scale sell-offs observed.

Autonolas(OLAS)

Introduction:

The Autonolas protocol is a DAO tool based on smart contracts, which implements mechanisms for coordinating, protecting, and managing software code on public blockchains, providing incentives based on developers’ relative contributions to the growth of the Autonolas ecosystem.

Autonolas has four core components:

- 1.Multi-agent system architecture

- 2.Agent service consensus (state-minimized consensus tool)

- 3.Architecture for encrypted native off-chain services (AI agents need to execute off-chain logic to maintain high performance. This means that on-chain AI agents will host their logic/computations off-chain to optimize efficiency, but agent decisions will be executed on-chain.)

- 4.On-chain protocols.

In simple terms, while Bittensor (TAO) aims to unify different algorithms under a consensus network, Autonolas (OLAS) aims to unify the application modules of different AI agents under a consensus network.

Team and Investment:

David Minarsch serves as the CEO and co-founder of Valory, the parent company of Autonolas. He holds a Ph.D. in Economics from the University of Cambridge, specializing in multi-agent services. Previously, he held the position of Head of Multi-Agent Services at Fetch.ai.

David Galindo is the CTO and co-founder of Valory, the parent company of Autonolas. He previously served as the Head of Cryptography at Fetch.ai and is a member of the European Union Blockchain Observatory and Forum expert group. He has over 15 years of work experience.

Investors include Signature Ventures, Semantic Ventures, True Ventures, Proof Group, among others.

Token Situation:

According to data disclosed by the project team, OLAS currently has a market value of 253 million, with a fully diluted valuation of 2.857 billion. The current circulating supply is 47.61 million tokens, with the main trading market on Uniswap. It recently launched on Bitget, with further expectations of listing on decentralized exchanges (DEX) as the popularity and development grow. Previously, the token price remained subdued due to issues related to token sales by the project team and centralization of token operations. However, with new token staking proposals and positive fundamentals, the outlook remains optimistic, although continuous monitoring of actual operations and token chip structure is necessary.

Summary of the Sector:

The AI agent or AGI sector within the cryptocurrency space has yet to see substantial real-world implementations. In contrast, Web2 companies have made more progress and advancements in achieving true AGI, with higher levels of feasibility and progress compared to crypto projects. Researching targets within this sector should not only involve tracking the progress of individual projects but also paying close attention to developments in the Web2 tech industry regarding AGI and AI agents. Such advancements are likely to drive the development of AI projects within the crypto space and influence token prices.

5.AI Application Software

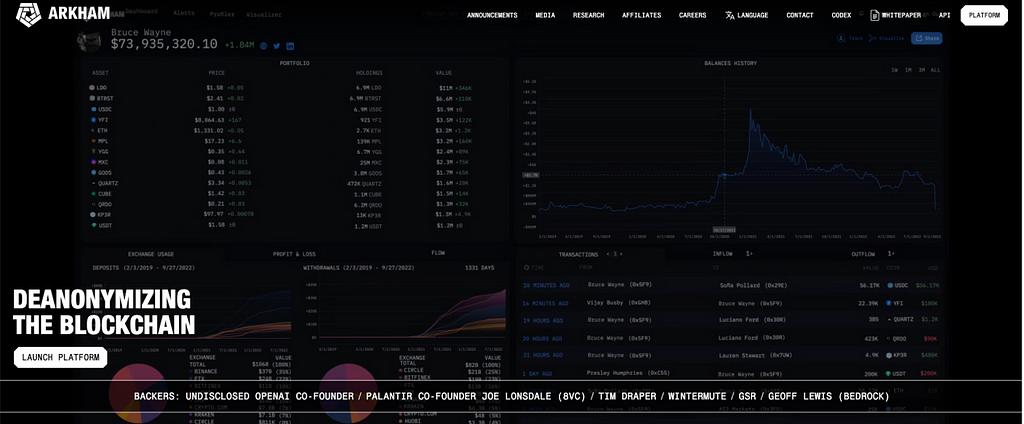

Arkham (ARKM) is a platform for cryptographic intelligence that systematically analyzes blockchain transactions and de-anonymizes them to reveal the individuals and companies behind blockchain activities, along with data and analysis of their behavior, making blockchain data analyzable.

Key Modules of Arkham:

- 1.Foundational Technology: Arkham Ultra is a proprietary artificial intelligence system for synthesizing blockchain data. It collects data from various sources, both on-chain and off-chain, and synthesizes them into a single, scalable, and modifiable source of truth. Currently, the Arkham platform includes over 350 million tags and 200,000 entity pages.

- 2.Frontend Display: Profiler provides features such as transaction history, portfolio holdings, balance history, gains and losses, counterparties, and exchange information.

- 3.Information Exchange: Arkham aims to build a decentralized intelligence economy where anyone can trade information using the native currency ARKM. Buyers request intelligence through bounties, while sellers offer intelligence through auctions. Both bounties and auctions are conducted through audited smart contracts, without any centralized entity holding funds.

- 4.Token: Buyers seeking specific intelligence stake ARKM to receive rewards. Sellers can also obtain intelligence by participating in auctions. Participants receiving rewards and winning auctions will have exclusive access to purchased intelligence for 90 days. Afterward, it may propagate to the broader Arkham platform for general use. To support the network, Arkham charges a 2.5% manufacturer fee on submitted bounties and auction bids and a 5% receiver fee on bounty payouts and successful auction bids.

Team and Investment:

Miguel Morel currently serves as the CEO of Arkham and is also a co-founder of the Reserve Protocol. He is a seasoned technology entrepreneur with years of experience in strategy, management, recruitment, and fundraising. Alexander Lerangis is the Director of Business Development. Previously, he served as a manager in Deloitte’s banking and securities industry risk and financial advisory practice.

Investors include Binance Labs, Sam Altman, Tim Draper, and other prominent figures from the cryptocurrency and technology sectors.

Token Details:

ARKM has a market capitalization of $411 million and a fully diluted valuation of $2.74 billion. The total token supply is 1 billion, with 15% currently in circulation. The token is primarily listed on exchanges such as Binance, Bybit, and Gate.

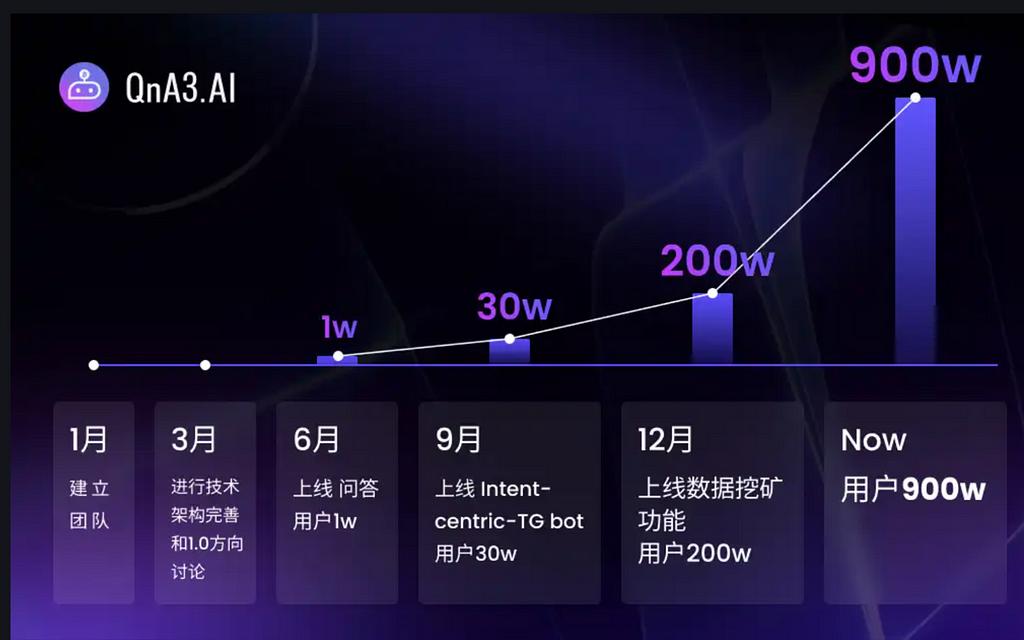

Introduction: QnA3.AI is an AI-driven Web3 knowledge platform and investment research trading tool, focusing on providing GPT models in the Web3 domain. The QnA3 team believes that user intent can be summarized in three steps: “information gathering,” “information analysis,” and “executing actual trading actions,” introducing AI question-answering bots, technical analysis bots, and asset trading capabilities into the Web3 world.

In January 2023, QnA3.AI launched its computing power mining feature, expecting to increase user numbers to a new height. QnA3.AI’s computing power mining utilizes idle computing power while browsing the web, participating in data processing tasks simply by using a Chrome plugin. Upon installation, it automatically completes data collection, cleaning, and model pre-training tasks in the background, earning QnA3 Credits as rewards.

Team and Investment:

The founder and CEO of QnA3.AI is Kane. While detailed information about the team is not publicly disclosed, judging from the resources acquired since the project’s development, the team and investment backgrounds seem promising. QnA3.AI was incubated as part of the sixth season by Binance Labs. On February 25, 2024, it announced an investment from the Solana Foundation, establishing a strategic alliance with the Solana Foundation to focus on AI and DePIN development. QnA3.AI also stated that it is actively developing an application customized for Solana Saga. On March 8, it officially announced new investment from Binance Labs. Its products are integrated into both the Binance and OKX wallets.

Token Information:

According to the whitepaper, the total supply of GPT is 1 billion tokens, with 10% allocated during the TGE phase: Jumpstart (3%) + airdrop (0.5%) + Market Maker (3%) + Development (3.5%) = 10%. Currently, 5 million tokens have been distributed through airdrops to individual holders, 30 million tokens allocated for Jumpstart, 30 million for Market Makers, and 35 million for Development, most of which are not yet in circulation. Approximately 65 to 80 million tokens are in circulation, with the current market value estimated to be between $45.5 to $56 million.

Alethea AI (ALI)

Introduction:

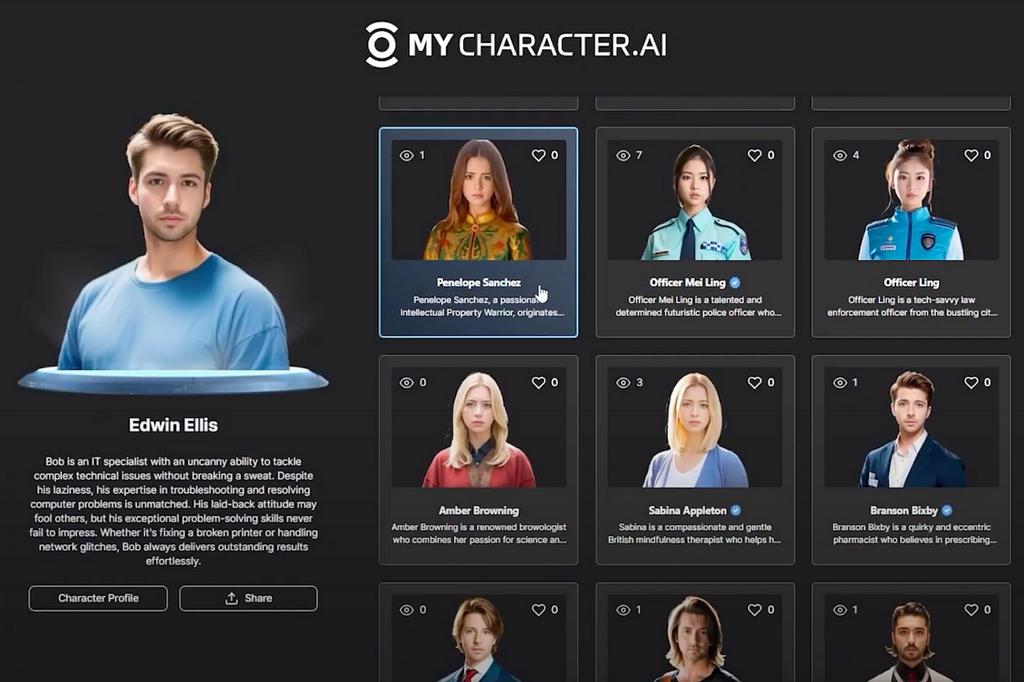

Alethea AI is an intelligent and interactive NFT metaverse. As the pioneer of decentralized iNFT protocols, Alethea AI is at the forefront of embedding AI animation, interaction, and AI generation capabilities into NFTs. Community members can create, train, and earn iNFTs in a metaverse called Noah’s Ark. Intelligent NFTs (iNFTs) are a new NFT standard that can create NFTs with embedded AI animation, voice synthesis, and AI generation features.

Alethea AI generates AI characters through its CharacterGPT feature, making it the world’s first multimodal AI system capable of generating interactive AI characters based on natural language descriptions. It allows users to quickly generate interactive artificial intelligence characters with higher fidelity in appearance, voice, personality, and identity. These generated AI characters can be tokenized, customized, and trained on the blockchain to fulfill various roles and tasks.

With the advancement of artificial intelligence, the way content creation is approached is undergoing fundamental changes. Large language models such as GPT-3 and ChatGPT, along with models like Stable Diffusion, DALL-E 2, and MidJourney, which transition from text to image, are now complemented by Alethea AI, which bridges the gap from text to AI-generated characters.

Alethea AI’s CEO and founder is Arif Khan. He previously worked at Grab and LinkedIn, and served as Chief Marketing Officer at SingularityNET from 2017 to 2019. He graduated from the Singapore Management University.

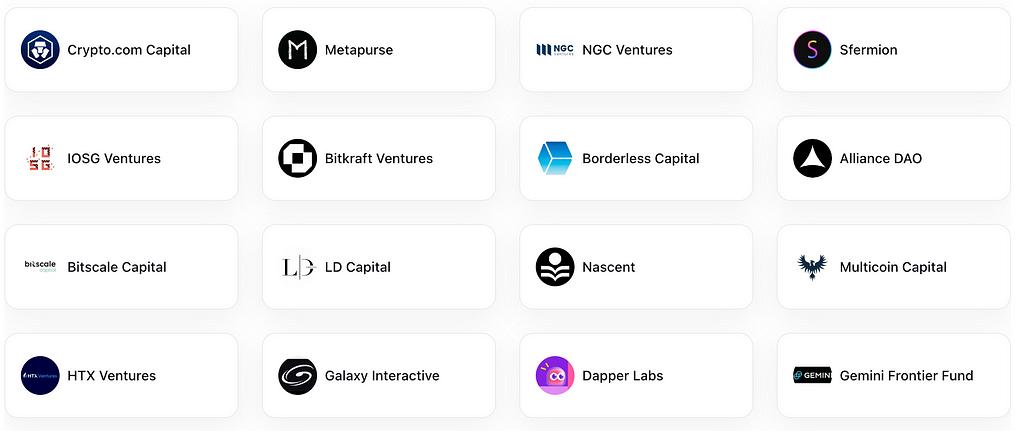

Alethea AI has received support from top-tier investors including Multicoin Capital, Binance, Crypto.com Capital, LD Capital, among others.

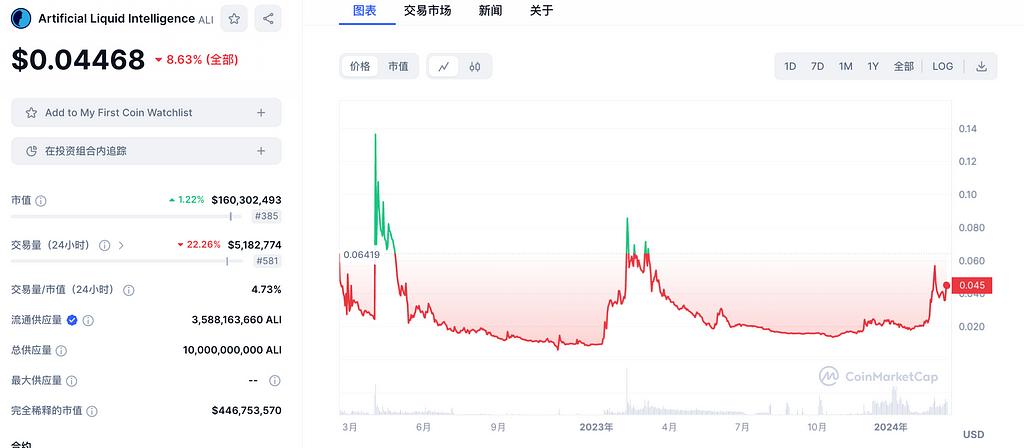

Token Situation:

ALI currently has a market value of $160 million and a fully diluted valuation of $446 million. The maximum token supply is 10 billion, with 35.88% currently in circulation. Its primary trading venues are HTX, Gate, and Crypto.com, with the potential for further expansion into mainstream decentralized exchanges (Dex).

Sector Summary: The AI application sector boasts a relatively high number of projects and offers the most tangible experiences. When selecting projects, it’s crucial to prioritize factors such as the project’s underlying data and popularity, product usability, and the resources backing it. Amid the fervor surrounding AI, notable projects include Sleepless AI (AI), Delysium (AGI), and NFPrompt (NFP). Additionally, ecosystem-oriented application projects like PAAL AI (PAAL) and ChainGPT (CGPT) are gaining traction.

LD Capital

As a global blockchain investment firm, we have built a portfolio of over 250 investments since 2016, spanning across various sectors, including infrastructure, DeFi, GameFi, AI, and the Ethereum ecosystem. We focus on investing in projects with disruptive innovations, actively taking on the role of primary investors, and providing comprehensive post-investment services to these projects. We employ a combination of direct investment from our own funds and a distributed fund model to cover all-stages of investment.

Trend Research

Trend Research division specializes in crypto hedge funds focusing on secondary areas within the crypto market. Our team members come from top platforms and institutions like Binance and CITIC. We excel in macroeconomics, industry trends, and project data analysis, with trend, hedge, and liquidity funds.

Cycle Trading

We specialize in Web3 project investment and service, with a strong emphasis on Infra, applications, and AI. We have a team of nearly 20 senior engineers and dozens of crypto experts as advisors, assisting projects in strategic design, capital platform relations, and liquidity enhancement.

website: ldcap.com

twitter: twitter.com/ld_capital

mail: BP@ldcap.com

medium:ld-capital.medium.com