Recently, a stablecoin has gone crazy.

Investors who got on the bus two months ago have made a fortune.

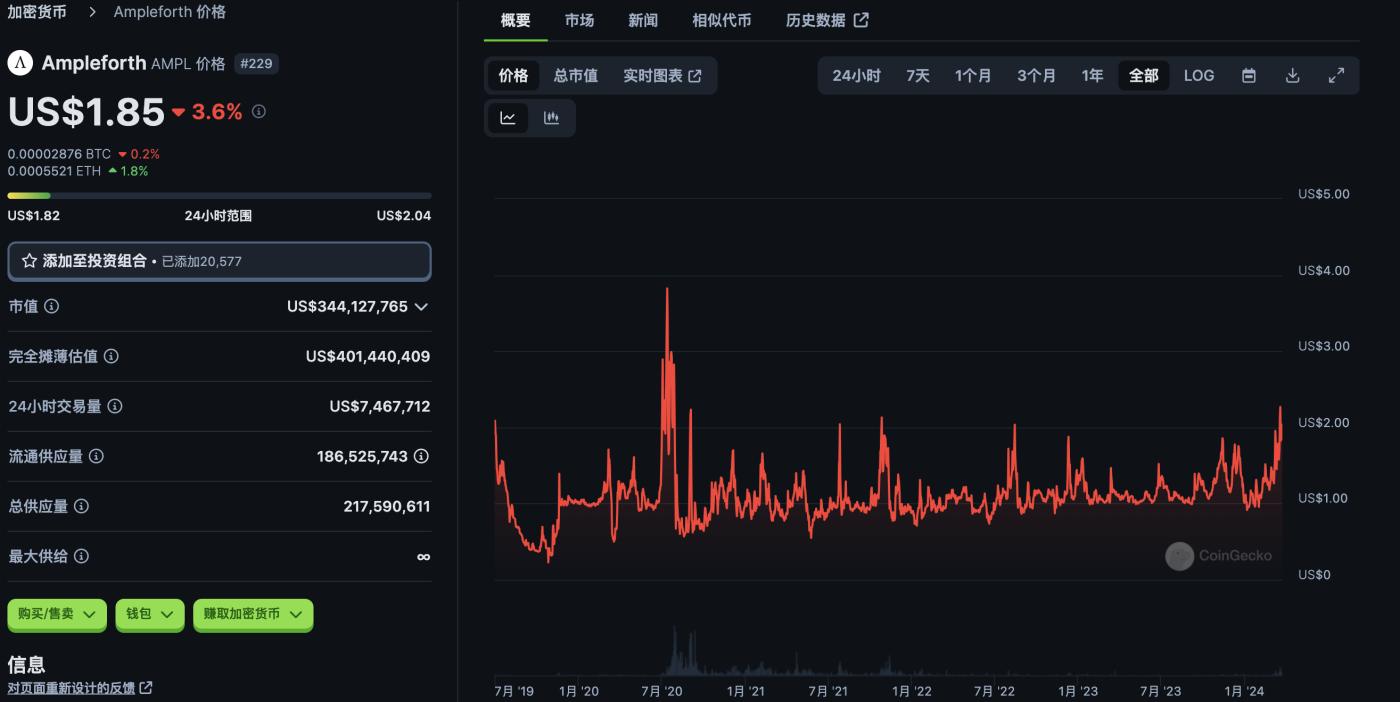

It is AMPL. From US$1, it rose as high as US$2.48. It finally started to fall in the past two days and is currently at US$1.85.

It didn’t rise much, so why did it make so much money?

This coin is very special. When its price is higher than a certain price above US$1, inflation will be triggered, additional tokens will be issued, and the number of tokens on the address will increase. Calculated once a day. Of course, when its price falls below a certain price of $1, deflation is triggered and the number of tokens on the currency holding address will decrease.

Since AMPL has entered a two-month issuance cycle, especially the recent high price, currency holders are "bubbly with joy" in the double spiral of additional issuance and price increases. Finally, this "ancient divine coin" has once again entered the public eye, and there are more and more voices discussing it.

What is the logic of AMPL? Let’s take a quick look.

AMPL's project is called Ampleforth. It was born in 2019. It is the first algorithmic stablecoin to adopt Rebase elastic supply. When you hold it, the amount of AMPL in your wallet will change with positive and negative Rebase every day.

Back then, when algorithmic stablecoins were on the rise, AMPL was simply the most popular. But because of the unique properties of this token, many people have suffered greatly in the "downward spiral".

In the past few years, AMPL has also evolved based on the basic gameplay of Rebase. For example, it has developed 3 core assets:

1. AMPL - main asset, elastic supply based on Rebase algorithm;

2. stAMPL - Staking & Leveraged AMPL;

3.SPOT - low volatility derivatives based on AMPL, acting as a decentralized flatcoin stablecoin.

It takes time to understand, and overall it makes AMPL more complex.

For detailed research, please read this article by CM: https:// Followin.io/zh-Hans/feed/8390315

At that time, AMPL's route was to be a stablecoin anchored to 1 US dollar. Now, its positioning is probably an anti-inflation stablecoin. Because it is difficult to anchor to 1 dollar.

Why I am writing this article today is, firstly, because the price of AMPL has risen, and secondly, there have been more people discussing it recently. But it has to be said that as an ancient project, AMPL is not popular, or even very cold.

Searching the Odaily website, the latest discussion article is from June 22, and the latest news is from September 22.

Search the block BlockBeats website, again, the latest content stays at the end of 22 years.

This means that the Chinese media has "ignored" it.

Of course, in Followin, you can find more latest opinion content from non-media.

In the author’s opinion, algorithmic stablecoins experienced a disaster in the last round of bear market. For stablecoins without any reserves or mortgages, the supply and circulation are completely regulated by algorithms. This crazy and highly narrative concept has been used in the past time. has been almost eliminated, and existing stablecoin projects have joined the staking camp, such as Makerdao’s DAI.

In the past, many encryption practitioners have fallen into this wonderful narrative.

But AMPL’s unique gameplay allows it to still have a place in this narrative. As one practitioner said, AMPL should be the top MEME in the stable industry.

How to play AMPL?

The suggestions from Twitter KOL CM are:

1. When buying AMPL, look at the market value rather than the price, because the number of your tokens will be rebased along with the total market value, so what you buy is the "shares" of the entire AMPL. To put it simply, even if the current price is $1.8, the market value is only 10 million, then it is definitely more cost-effective than buying it for $1 when the market value is 100 million.

2. The reason why AMPL can ignore the bull and bear market is because although it is also anchored to the price of the US dollar, when the demand for stablecoins shrinks sharply in the bear market, its quantity will also deflate. The market value in the bull market is hundreds of millions, and the market value in the bear market is tens of millions. In fact, this is the most authentic feedback on the demand for stablecoins. Rebase does not lie. So it's very Crypto native.

3. AMPL is rumored to be inextricably linked to Coinbase, and the little known fact wAMPL has been listed on Coinbase.

4. AMPL is most likely to cause trouble in the Base chain. Currently, wAMPL already has liquidity on the Base chain.

5. If you are an ordinary player, it is as simple as buying AMPL and then holding it. It is not necessary to really understand stAMPL and SPOT at the moment, but try to understand it after v2 is launched.

6. It is still important to establish the concept of market capitalization share. If you buy 100,000 when the market capitalization is 10 million, then if the market capitalization rises to 100 million, you will be rebased to 1 million, and it has nothing to do with the short-term price. Of course, the reverse is also true, and negative rebase is equally terrible.

7. If you still don’t understand rebase and don’t know if you are making money, then you can directly look at the price of wAMPL. wAMPL is an ERC20 token that encapsulates rebase. By analogy, AMPL is stETH and wAMPL is wstETH.

8. AMPL is the simplest and most stable calculation. There are no complicated Ponzi twists and turns. It is simple, buy at the appropriate market value, then hold, and sell at the appropriate market value. You can evaluate it yourself where it is suitable.

9. Many old leeks know that the problem of AMPL being unable to open application scenarios comes precisely from the rebase feature, so exchanges and lending markets can only support wAMPL. For this problem, the project team places its hope on the performance of v2 and SPOT.

10. It is still unclear how much market value AMPL can achieve in this round. Everyone has a scale in mind, but its ceiling in this round depends on v2 and SPOT.

CM is a Twitter influencer among KOLs who often introduces AMPL, and his views will have a certain tendency. It must be said that AMPL carries great risks, so investment needs to be cautious.