This week, the price of Ethereum (ETH) rebounded from a low of $3,100, reigniting hopes of new highs for the altcoin.

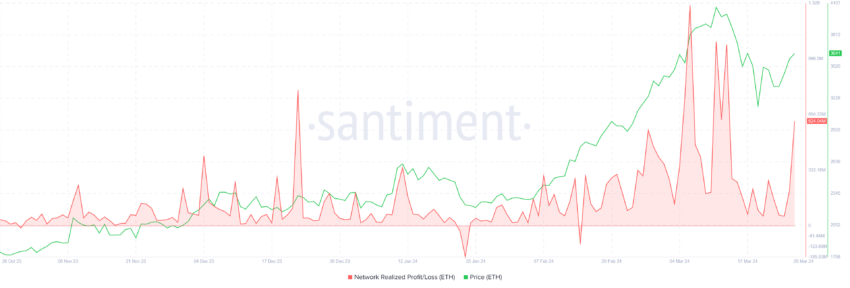

However, the profit-taking tendencies of Ethereum investors may hinder this process.

Investors' restraint due to rising Ethereum price

At the time of writing , the price of Ethereum has risen to $3,642 , which has brought investors back to the network. However, their actions did not meet expectations.

When you transfer Ether from one address to another, you will notice that the current price is higher than the last price. This indicates that the supply held by that address is making a profit, which will encourage other investors to do the same.

This indicates potential profit booking could occur, which would accelerate selling among Ethereum holders.

Read more: How to invest in Ethereum ETF?

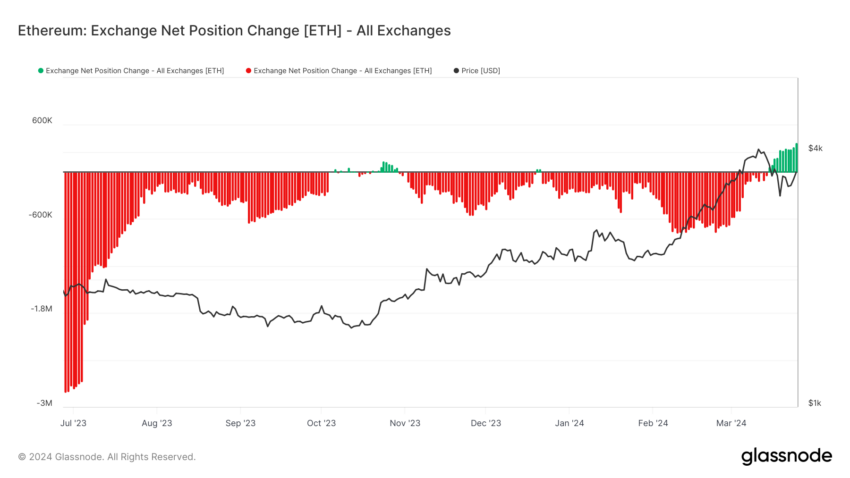

The risk of an Ethereum price decline is already high as investors are offloading their holdings to exchange wallets. Looking at the net position change, we see that 374,130 ETH, worth approximately $1.36 billion, has been sold over the past ten days. In the last 24 hours alone, investors sold 52,030 Ethereum worth $190 million.

Therefore, as profits increase, so does selling, which could soon bring the rally to a halt.

Ethereum Price Prediction: Countdown to $3,000

Ethereum price recovered its 50-day and 100-day exponential moving averages (EMA). However, given the profit-taking sentiment, Ethereum may fall to find support at $3,336, which is in line with the 100-day EMA.

If this support line is lost, the next support level is $3,031, which is the intersection of the 23.6% Fibonacci retracement of $4,626 to $2,539.

On the other hand, Ethereum has already reversed the 50% Fibonacci retracement level . If the price rises further and overturns the 61.8% Fibonacci line as support, the bearish logic may be invalidated.

Read more: Ethereum ETF explained: What it is and how it works

This is because the latter is considered bullish support and tends to reignite rallies. Ethereum, quoted at $3,830, could rise further from here.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.