Bitcoin’s ten-year trend, rising 12,300% from 2014 to 2024

Take the ten-year Bitcoin price chart from 2014/3/27 to 2024/3/27 (at the time of writing), data source: CoinGecko .

Ten years ago, the US dollar price of one Bitcoin was $567.64. Today, the US dollar price of one Bitcoin is 70,452.22, an increase of 12,311% .

Reference comparison

Taiwan Semiconductor Manufacturing Co., Ltd.’s ten-year increase in Taiwan stock price during the same period was $116 > $782| +574%

The ten-year increase in the US dollar price of gold during the same period was $1305 > $2179| +67%

What is Bitcoin?

For those of you who don’t know about Bitcoin yet - Introduction to Bitcoin, the King of Cryptocurrencies

Bitcoin is the first cryptocurrency and the first application of blockchain. It can almost be said that this field started with it. From Bitcoin, an entire cryptocurrency industry was born.

Founder of Bitcoin: unknown (Anonymous and unknown, perhaps this will be the biggest mystery of the 21st century)

It is only known that its Internet code name is "Satoshi Nakamoto", and its true identity is unknown. It is also unknown whether there is a person or a group of people behind the code name; Satoshi Nakamoto founded it based on the shortcomings of the existing monetary system after the 2008 financial tsunami. Bitcoin was originally designed as a decentralized payment method outside of banks. Satoshi Nakamoto disappeared around mid-2010. Although the founder has since disappeared, Bitcoin, as a "decentralized" cryptocurrency, continues to operate independently to this day and will continue to operate.

After years of development, blockchain technology continues to make breakthroughs, giving birth to various different cryptocurrencies. There are currently tens of thousands of cryptocurrencies, but Bitcoin is still the big brother of cryptocurrencies and has always been the most famous and largest cryptocurrency by market value. Currency is nicknamed " BTC " in the crypto .

Bitcoin, Bitcoin, referred to as BTC, nicknamed BTC

Bitcoin introductory reading:

Bitcoin’s One Hundred Thousand Whys | Why does Bitcoin always rise first?

Why does Bitcoin have a price?

The original blockchain, simply put, is a decentralized accounting technology that distributes an account to multiple computers and records them together, and compares them synchronously at all times, so there is no fear that someone will record the wrong account or lose the account. The Bitcoin blockchain is an account used to record Bitcoin records, and Bitcoin is the main asset unit that can be transferred on this account. It has no use at first. People who also have Bitcoin wallets can transfer it to each other and play with it. It can be imagined as some kind of virtual currency in online games, and its purpose is to transfer between players.

(Important reminder: This is just an imaginary way to understand, but Bitcoin is not a game token!)

5/22 - Bitcoin Pizza Day

Bitcoin Pizza Day, the first physical transaction of Bitcoin

2010/5/22 On this day, someone made an offer on the Internet, willing to pay 10,000 Bitcoins to buy two pieces of pizza. This is considered to be the first physical transaction of Bitcoin in history. Calculated at current prices, a total of US$700 million was spent = Spending more than NT$20 billion to buy two pieces of pizza may seem ridiculous now, but at the time it was a breakthrough, allowing people to understand that although Bitcoin is just a virtual electronic signal on the Internet, it can be used to purchase items in the real world.

This short story about Bitcoin answers the question at the beginning of this paragraph: Why does Bitcoin have a price?

Because some people are willing to sell, others are willing to buy, and buyers and sellers have a consensus on the transaction price. The value of Bitcoin is based on consensus, and the transaction price depends on the current market supply and demand.

Bitcoin price trend chart over the past ten years

Let’s look at Bitcoin’s ten-year chart again, this time using a logarithmic chart to see it more clearly. Bitcoin fluctuates too much, and the commonly used linear chart will be like the first paragraph of the article. It rises too much in the later period, and the past low price range becomes a line, and no trend can be seen; using a logarithmic chart can present it more clearly. ups and downs.

Linear graph: The distance between each grid on the vertical axis is the same, for example, 1 > 2 > 3 > 4

Logarithmic graph: The quotients between each cell of the vertical axis scale are the same, for example, 1 > 10 > 100 > 1000

Two halvings have occurred in the past ten years. 2016 was the second halving of Bitcoin, which increased 30 times after the halving. The third halving in 2020 increased 8 times. The fourth halving is expected to occur in 2024. / late April.

What is Bitcoin Halving?

Mining rewards are cut in half, and Bitcoin production is cut in half.

Halving does not cut Bitcoin in half, but cuts the number of block rewards for issuing Bitcoins in half.

Bitcoin is a decentralized cryptocurrency that is mined by miners to maintain the operation of the Bitcoin blockchain. Miners who participate in the Bitcoin network will receive rewards in return, mainly block rewards. This is also the way Bitcoin is issued. , with each block generated (Bitcoin generates a new block every ten minutes on average), a certain number of Bitcoins are created and issued to the network.

The total issuance of Bitcoin is capped at 21 million. Through the halving of block rewards every four years, the issuance will gradually decrease until all 21 million are issued.

Reference reading:

Why is Bitcoin soaring? What factors affect the price of Bitcoin?

A 12,300% increase in ten years is an exaggeration, at least in the world outside of cryptocurrencies. Why can Bitcoin soar? What are the key factors?

Factors affecting Bitcoin price: consensus

Bitcoin is a decentralized cryptocurrency with no physical support behind it. Its main value is based on consensus. The so-called consensus is how many people think Bitcoin is valuable? How valuable is this?

The more people who think Bitcoin is valuable, the stronger the consensus.

The higher the value of Bitcoin is believed to be, the stronger the consensus

At the beginning, Bitcoin only had a consensus among a small group of people. Gradually, more and more people know and agree with Bitcoin. The consensus is getting stronger and stronger. With the birth of the cryptocurrency industry, more people know Bitcoin. , agree with Bitcoin, and the consensus is stronger.

Nowadays, some countries have listed Bitcoin as legal tender, and even used national assets for investment; many countries have adopted Bitcoin spot ETFs, and general investment channels can also invest in Bitcoin. It has also entered the public eye, and more people will understand Bitcoin.

Compared with the early years, Bitcoin’s current value consensus is no longer the same.

Factors affecting Bitcoin price: general economy and market supply and demand

Value is based on consensus, but prices fluctuate with market conditions, mainly based on current market supply and demand:

Supply exceeds demand > falls

Demand is greater than supply > rise

Consensus and supply and demand are the two most important factors. Other factors that can affect these two factors can affect the price of Bitcoin. Here are a few examples:

2016 Halving Bull Market Factors:

Bitcoin’s Second Halving > Supply Reduced

ICO boom > Funds are pouring into the cryptocurrency field, increasing demand and consensus

Bitcoin Futures ETF passes > More funds enter, demand increases, and consensus increases

2020 halving bull market factors:

Bitcoin’s third halving > supply reduced

Development of cryptocurrencies such as DeFi Summer, public chains, and NFTs > More practical developments will introduce more funds and users, increasing demand and consensus

Countries are releasing QE > Investment funds are flooding, looking for investment targets, and demand is increasing

Will Bitcoin rise again? Can we expect a bull market in 2024?

From the previous paragraph, we can know that the two most important factors affecting the price of Bitcoin are consensus and supply and demand. To answer the question, will Bitcoin rise again? Can the analytical consensus get any stronger? How will supply and demand change in the future?

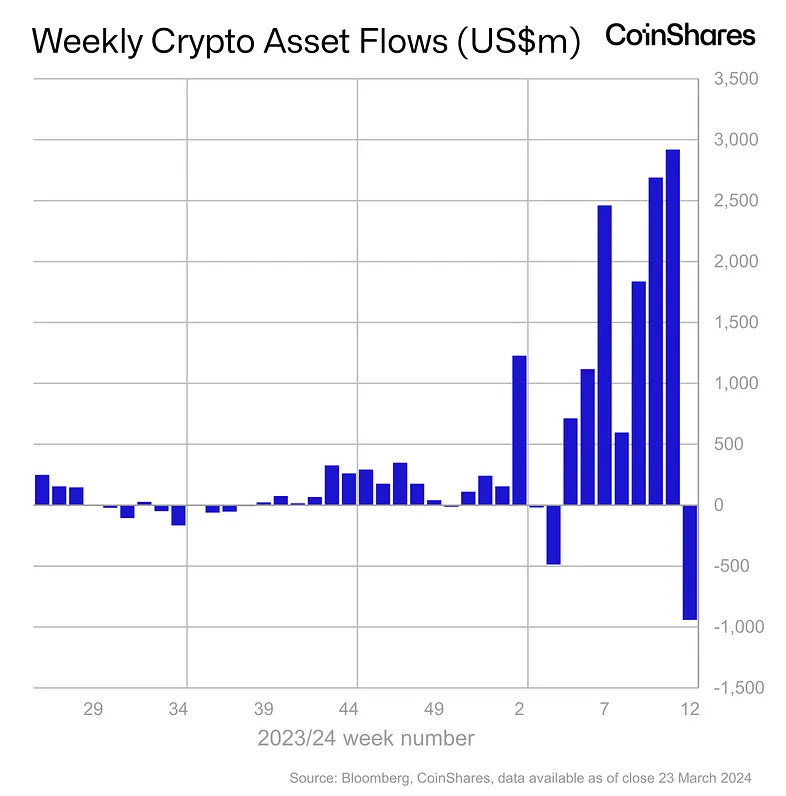

According to the weekly capital flow report compiled by CoinShares, since the passage of the U.S. spot ETF, large amounts of capital have flowed in almost every week, and Wall Street funds have continued to purchase Bitcoin.

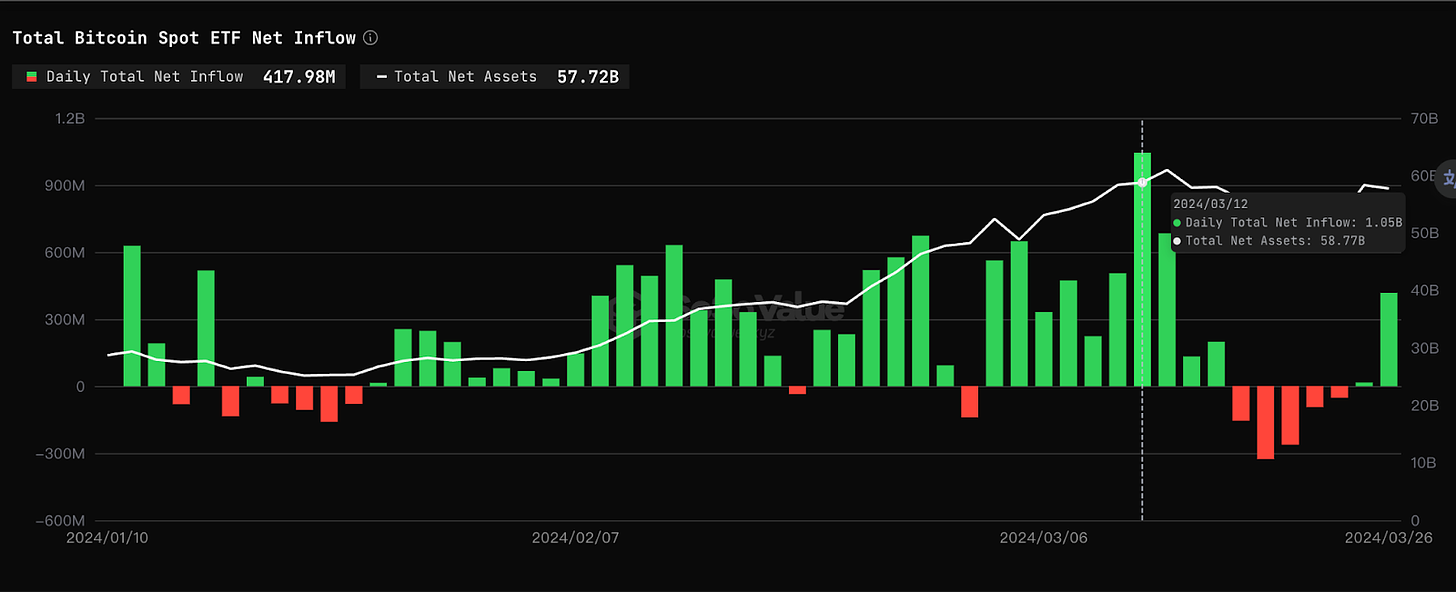

Since the adoption of the BTC ETF on 2024/01/10, the current net inflow of the BTC ETF is US$57.7 billion, with the highest single-day net inflow being US$1.05 billion on March 12.

(Reference: https://sosovalue.xyz/assets/etf )

Reference reading:

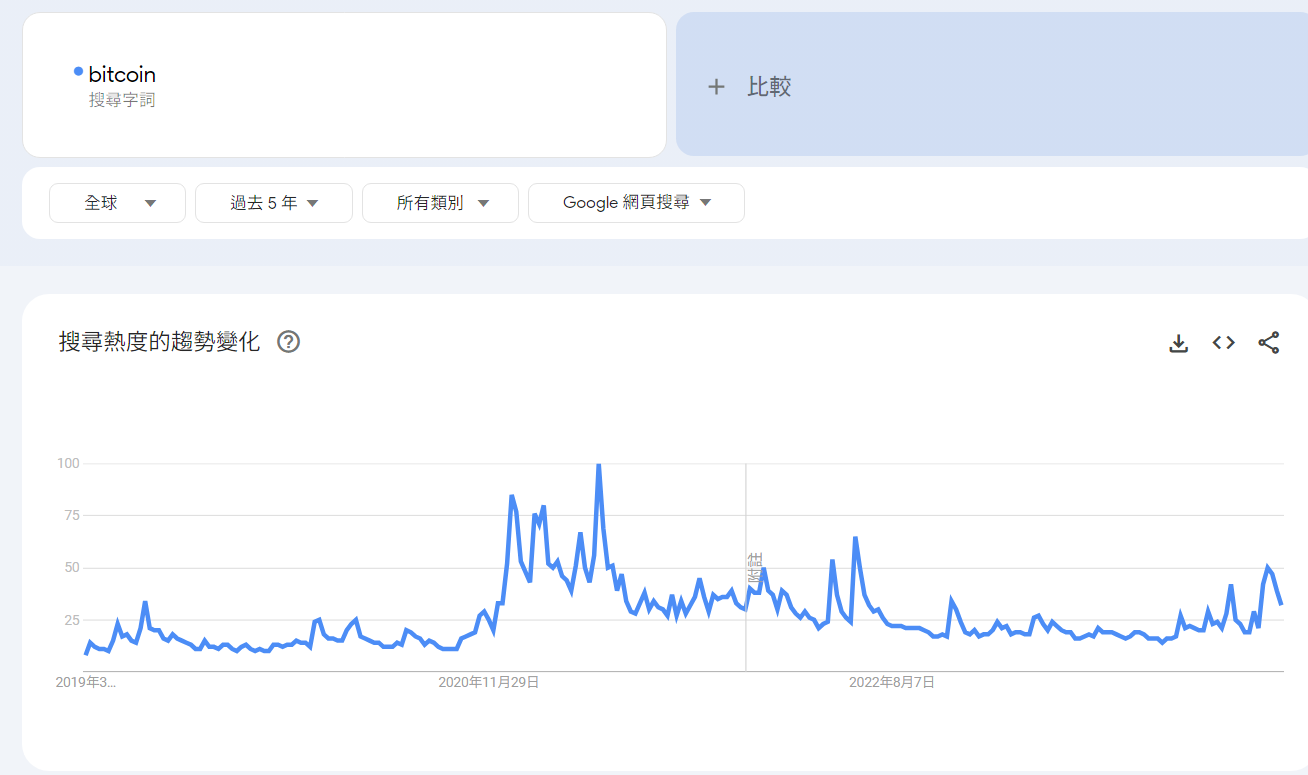

According to Google trend data, although Bitcoin has risen for more than a year from the lows of the last bear market, its global search popularity is currently less than half of the previous bull market.

Why are these three factors important factors in evaluating whether Bitcoin will rise?

The fourth halving > reduces the Bitcoin supply again, expected to occur in mid-to-late April 2024

Spot ETF brings Bitcoin into the eyes of the investing public, attracts more capital inflows, more people will know Bitcoin, and the demand and consensus will increase. It has been passed

RWA Real-world Asset Tokenization > Bringing more real-world assets to the blockchain can also attract more funds & people. The demand and consensus are increasing, and the industry is developing.

Is now the right time to invest in Bitcoin?

Perhaps a better question is: "What is the best way to invest in Bitcoin?"

It has been more than fifteen years since the birth of Bitcoin, and the cryptocurrency industry is also developing rapidly. Of course, the opportunities in a growing field outweigh the risks, but the risks still cannot be ignored.

If you don’t pursue growth, but pursue stability and stability, then it may not be the right time to buy Bitcoin. After all, Bitcoin is still a bit too new and too uncertain and unstable.

If you are pursuing growth, you certainly shouldn’t miss the rapidly growing Bitcoin. However, compared to general investment commodities, Bitcoin is extremely volatile and risky. The more important question is “What method is more suitable to buy?”

Borrow money to buy Bitcoin

Buy Bitcoin X with money that is not spare money

All in at every turn X

Act within your ability, participate with spare money, asset allocation, regular quota O

Reference reading:

How to buy Bitcoin?

Currently, there are three common ways to purchase Bitcoin using Taiwan dollars:

Buy coins on exchange

You need to register an exchange account. The registered account needs to pass real-name verification (KYC) and provide identity documents. The payment method is by swiping a card. Some cards cannot be swiped. Counting overseas card swiping, the overall handling fee is higher but it is the most convenient. It can also be directly used with the exchange's fixed investment robot function for regular fixed-amount purchases. Some Taiwan exchanges can use bank transfer to deposit funds, and can use the Taiwan dollar balance to make regular fixed-term purchases.Purchase coins on behalf of others

The most common one in Taiwan is Maicoin. You need to register an account first. The payment method is remittance/payment at convenience stores such as 7-11. The agency will earn the price difference as a service fee. The buying and selling price difference is large, so it is not suitable for frequent entry and exit.C2C / P2P buy coins with other individuals or currency dealers

You need to have an exchange account/cryptocurrency wallet to receive the purchased coins. The overall exchange rate may be the best, but the risk is the highest and fraud is common. It is not recommended for novices.

Important: Never use exchanges recommended by unknown strangers, it is very likely to be a scam!

Reference reading:

7-11 / Buying Bitcoin for the whole family? Tutorial on buying coins in convenience stores in Taiwan

Are there other coins besides Bitcoin?

Since the birth of Bitcoin, newer cryptocurrencies have continued to appear. Especially after the birth of Ethereum, which combines blockchain and smart contracts, various cryptocurrencies have flourished. There are currently tens of thousands of cryptocurrencies.

If you want to find cryptocurrency information, it is recommended to use the mainstream cryptocurrency information websites:

Bitcoin has soared 12,300% in ten years. Cryptocurrencies that have increased more than this amount in ten years are not uncommon, but they are not uncommon. However, there are too many coins to study and select one by one. In practice, it is recommended to screen from two directions:

Ranking

track

Cryptocurrency information websites all provide market value ranking lists. You can directly find the more mainstream and well-known cryptocurrencies by filtering through the rankings. The disadvantage is that it is more difficult to find early projects.

Another way is to filter from the track. The concept of track is like stocks in the stock market. They are also cryptocurrencies, but they may focus on completely different business fields or technologies, such as for RWA (real asset tokenization) or for DeFi (decentralized finance), this is the division of tracks; first find out the tracks that you are interested in and think have potential, and then select cryptocurrency projects in the tracks.