In today’s newsletter:

🔎Major Crypto Catalysts in April

📊This Week’s On-chain Alpha

😂Crypto Meme of the Week

🗞️The Latest DeFi news

Today’s email is brought to you by GNUS.AI - a decentralized computing platform with a built-in blockchain payment system

Earn crypto by participating in AI processing with GNUS.ai!

🔎Major Crypto Catalysts in April

April is going to be a big month for crypto.

The highly anticipated Bitcoin Halving will finally occur.

Not only that, but there are also several well-known projects which will either launch their tokens or undergo a major upgrade.

Here are 4 upcoming key crypto events to pay attention to the next month:

1. The Bitcoin Halving

The next Bitcoin Halving is expected to happen in ~22 days.

Once it goes live, it will reduce the no. of new BTC entering circulation by 50%.

However, it’s worth noting that the current BTC inflation rate is already very low. (less than 2% annually)

Due to this, from a fundamental point of view, I’d say that the Halving is not really a big deal. But from a psychological standpoint, this isn’t the case.

A lot of people know that historically, BTC has performed very well in the months after every single Halving event. And because of this, they’ll likely buy our bags again soon, expecting history to repeat.

On top of that, Hong Kong’s Securities and Future Commission is expected to approve the launch of the first spot Bitcoin ETFs in Hong Kong in Q2.

The stars are aligning for Bitcoin.

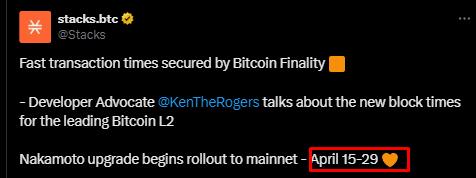

2. Stacks Nakamoto Upgrade

Stacks is a Bitcoin L2 enabling smart contracts & dApps.

Stacks’s Nakamoto Upgrade, which has been under development for a very long time, seems like it will finally begin rollout to mainnet next month.

Nakamoto Upgrade will:

allow sBTC (a BTC pegged asset) to be used in DeFi on Stacks

lower the network block times from 10 minutes to a few seconds

increase the Stack L2 scalability

The upgrade might spark a new Bitcoin L2 season.

$STX, the token of Stacks, can also be considered a beta play for BTC.

Stacks is by far the most popular project built on top of Bitcoin.

3. Solana Airdrop Season

Last year, the huge airdrop announced by Jito led to the revival of the Solana ecosystem. In April, several other popular Solana dApps will launch a token:

All these protocols will do an airdrop.

This list includes only the airdrops that are officially confirmed, so there might actually be a few additional ones that haven’t been announced yet.

Big airdrops can have a massive positive impact on an ecosystem, as they inject more liquidity into it. Here’s for instance what happened with $SOL after $JTO launch was announced in Nov. 2023:

Expecting $SOL to do another 2-3x in the short term due to the upcoming airdrops is unrealistic imo since SOL market cap is now over $80b.

Still, Solana will likely benefit a lot from these ecosystem airdrops, as it has also done in the past.

4. Eigenlayer mainnet launch + potential token launch

There’s a small chance that the Eigenlayer token will go live in late April / early May.

There are multiple reasons for this:

Eigenlayer mainnet is confirmed to go live over the next weeks (and this might be the perfect time for Eigenlayer to also launch a token)

many early investors say that the token will be released in late April / early May

Besides this, April will likely also be the month when the first Eigenlayer Actively Validated Services (AVS) go live. Altlayer, a decentralized protocol for rollups, is an example of a popular AVS.

Protocols that choose to 'rent’ security from Ethereum through Eigenlayer are called AVS (those can be oracles, sidechains, L2s, etc.)

Many of these AVS projects might do an airdrop for Eigenlayer users as Altlayer has also done a few months ago when it launched its token.

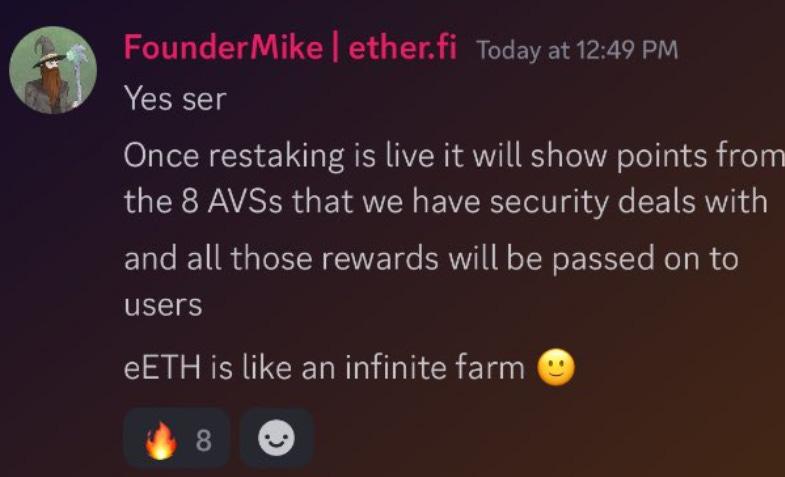

According to the Etherfi team, 8 AVSs will start distributing points or token rewards to EtherFi’s eETH liquid restaking token holders soon.

By restaking ETH, you’ll be able to farm the airdrops of Eigenlayer, liquid restaking protocols, and Actively Validated Services at the same time🧑🌾

Together with GNUS.ai

EARN CRYPTO BY PARTICIPATING IN AI PROCESSING

The rise of AI came with a huge demand for powerful computing resources.

While there are many centralized cloud computing services for this, many of those come with high costs and a lack of transparency.

GNUS.ai’s goal is to address these problems.

Here’s how it works:

A customer requests data processing for AI/Machine Learning and pays into an account with crypto

The data to be processed is uploaded to an area in a distributed file system

Using a distributed networking system, the transaction is communicated to participants with games and apps installed that can process the AI data

After the data is processed and validated, the transaction is completed, and the nodes get Genius tokens. For each AI request, a portion of GNUS tokens is burned

Any app including video games can easily integrate GNUS.ai by using a special SDK that can be included in their applications.

In this way, their app publishers can earn a whopping 20% of the platform revenue.

Just a few days ago, GNUS.ai team attended the Orbis86 game developers conference.

Explore GNUS.ai and start earning crypto by participating in AI processing!

On-chain Alpha🔎

$86B in institutional funds entered BTC in the past 6 months

As you can see in the image above, the institutional inflows into BTC have skyrocketed following the launch of the spot BTC ETFs.

This makes me think about what will happen with ETH institutional adoption after a spot Ethereum ETF is (hopefully) also approved later this year.

It’s becoming increasingly clear that institutions are starting to realize that crypto is here to say.

Crypto Meme of the Week😂

The latest developments in DeFi

CTFC reaffirmed that ETH is a commodity, increasing the chances of a spot Ethereum ETF being approved

Ethena announced that the $ENA token launch will happen on April 2. 5% of $ENA supply will be airdropped to early adopters

Optimism has allocated $3B for grants within the Optimism Collective & Superchain

NEAR Protocol introduced Chain Signatures, which enable NEAR accounts to sign transactions for any blockchain. The goal is to improve the cross-chain UX

Circle released its Cross-Chain Transfer Protocol on Solana. USDC holders can now move USDC across 8 chains with 1:1 capital efficiency

Zero1 introduced Keymaker, a marketplace for all things related to Decentralized AI. Keymaker aims to be the largest deAI ecosystem

Ankr introduced Neura, a blockchain built for AI. Neura will secure its network by leveraging Bitcoin’s security via Babylon

Polygon introduced the dApp Launchpad, a developer's gateway to the Polygon ecosystem. dApp Launchpad’s goal is to improve the Polygon developer experience

Angle Protocol introduced USDA, a yield bearing and RWA-backed USD stablecoin. USDA will have several anti-depeg mechanisms and the same liquidity as USDC

PancakeSwap announced the launch of MancakeSwap, PancakeSwap’s first affiliate DEX on Mantle Network. Mancake will pay 60% of its revenue to Pancakeswap

Liquity presented the key feature of Liquity V2, user-set interest rates, aiming to create an efficient market between borrowers & stablecoin holders

EtherFi released Points Season 2. Season 2 allocation is 5% of the total ETHFI supply and will conclude on June 30

Munchables, a popular protocol on Blast L2, has suffered a $63M hack. Happily, the funds have been returned by the hacker

That’s all for this week!

Until next time,

The DeFi Investor

For more DeFi content, follow me on Twitter.