Written by: Nancy, PANews

More than 15 months after his arrest, FTX founder SBF (Sam Bankman-Fried) was officially sentenced and was ultimately sentenced to a total of 25 years in prison in New York for billions of dollars in fraud. He was ordered to forfeit more than $11 billion in assets. The judge recommended that SBF be placed in a prison close to his family in the San Francisco Bay Area.

He committed perjury three times and was said to have "no remorse"

In today's final trial, several FTX victims appeared in court to accuse FTX, saying that FTX had been claiming on the Internet that it had paid the victims in full, but this was not the case. The FTX bankruptcy estate assumed or mistakenly characterized the victims as unsecured creditors, but the victims should have property rights. At least three people chose to commit suicide because of the FTX fraud. And FTX's bankruptcy law firm S&C was also accused by FTX creditors in the trial of "trampling on their property rights" and selling Solana assets at a 70% discount.

SBF's lawyer said that SBF is a clumsy nerd who is keen on vegetarianism and a billionaire who does not care about material wealth. He thought about his moral obligations to people around the world in middle school and donated his income to charity when he worked on Wall Street. SBF never spends money indiscriminately and persists until the last moment (in the FTX incident). He is not a ruthless financial serial killer and is not predatory. He does not want to personally cause pain to anyone in any way, and he has never thought about becoming the king of crypto, but wants to have the greatest positive impact on the world. He uses the mathematical thinking in his mind to make decisions, rather than harboring malice in his heart.

SBF himself admitted that it was his decision that led to the collapse of FTX and Alameda Research, and apologized for it. He mentioned that although Alameda was in danger of collapse and FTX was not bankrupt, due to excessive leverage, both companies had to liquidate to deal with the run crisis of FTX, which eventually led to the closure of FTX. But he also emphasized that the decision was not made out of selfishness, but a crisis caused by a series of wrong decisions and other factors. He also felt very sorry that although there were enough assets to repay customers, customers have not been repaid so far due to the liquidity crisis.

During the trial, Judge Kaplan rejected SBF's claim that all investors had been reimbursed in full, stating that he found that SBF attempted to tamper with witnesses and provided perjury three times during the trial, including not discovering that Alameda had misappropriated FTX customer funds until the fall of 2022. He lied that he first learned about the $8 billion deficit in October 2022.

After hearing a series of testimonies, Judge Kaplan finally believed that the defendant (SBF) had a superior growth environment, his parents were loving and invested heavily in him, and he made a lot of wealth on Jane Street after graduating from MIT and made extensive donations. Despite suffering from autism, the defendant still showed extraordinary talents and achievements, but he was clumsy in socializing. At the same time, the defendant showed abnormal ambition. He talked about establishing two major companies and his strong interest in politics, intending to use wealth to influence the political situation. He also set up anonymous donation channels to support right-wing groups, while claiming to support proper regulation of the crypto industry. However, all this is just a show. The defendant admitted in an interview that his remarks on regulation were just a public relations tool and he held a contemptuous attitude towards regulators. "SBF obviously has no remorse. I have been doing this job for nearly 30 years and I have never seen such a performance." Kaplan said.

The SBF trial took more than a year and was a stalemate

In December 2022, with SBF's arrest in the Bahamas and witnesses from all parties testifying in court, the truth about the collapse of FTX came to light. The US Department of Justice once described SBF's entire crypto empire as a "house of cards built on lies."

But there was quite a tug-of-war over SBF's conviction and sentencing.

After FTX collapsed, SBF had developed a variety of ways to evade the charges. In a secret memo, SBF planned to support Tucker Carlson, a former Forbes reporter who criticized the Democratic Party, to launch a redemption narrative by changing his political stance. SBF had previously been "loyal" to the Democratic Party, and his mother was the main fundraiser for the Democratic Party. At the same time, he also proposed several plans to evade responsibility in the memo, including blaming the collapse of FTX on his lawyers, his ex-girlfriend, and the bankruptcy team that oversaw his bankrupt company:, and listed plans to appear on the ABC show with writer Michael Lewis and debate with Bloomberg columnist Matt Levine to show that he is still a good person after all.

From the subsequent defense, SBF has indeed been trying to whitewash himself and even claimed that he suffers from depression and ADHD, which will affect his ability to defend himself. After his claim of innocence was rejected, SBF began to prepare a lot of testimony to defend himself. According to his lawyer, the testimony lasted for 4 hours. In the testimony, SBF not only denied the fraud charges by claiming ignorance, but also lied about "amnesia".

However, SBF's defense was not accepted. Not only did the U.S. Department of Justice request a ban on all expert witnesses proposed by SBF from testifying, but the U.S. prosecutors also stated in their closing statement at the SBF trial that "this was fraud, plain and simple theft."

Subsequently, SBF was found guilty of seven counts and could face up to 115 years in prison. The final sentencing is scheduled for March 28 this year. The market has made many predictions about SBF's sentencing. For example, a former U.S. Department of Justice prosecutor predicted that SBF would spend 20 to 25 years in prison, and U.S. federal prosecutors called for SBF to be sentenced to 40 to 50 years in prison for fraud.

In response, SBF said that the US prosecutor's proposal to sentence him to up to 50 years in prison "distorted reality" and portrayed him as a "corrupted super villain." At the end of February this year, SBF changed his lawyer before sentencing negotiations, and the lawyer then asked for a reduction of his sentence to only 63 to 78 months in prison, saying that he faced the risk of "harm and extortion" in prison.

It is worth mentioning that in addition to submitting dozens of victim impact statements from FTX creditors before the trial this week, the U.S. Department of Justice also described their holdings in FTX and the impact of FTX's bankruptcy on their lives. In the latest trial, letters from several victims were made public, which may affect SBF's sentencing to some extent.

SBF's parents were also charged for being blackmailed by fellow inmates and sharing investment advice with prison guards

During the sentencing period, although SBF was released on bail in the amount of $250 million, he was detained in the Brooklyn Metropolitan Detention Center in New York after his bail was revoked in August last year for attempting to interfere with a witness, and his multiple applications for bail were rejected.

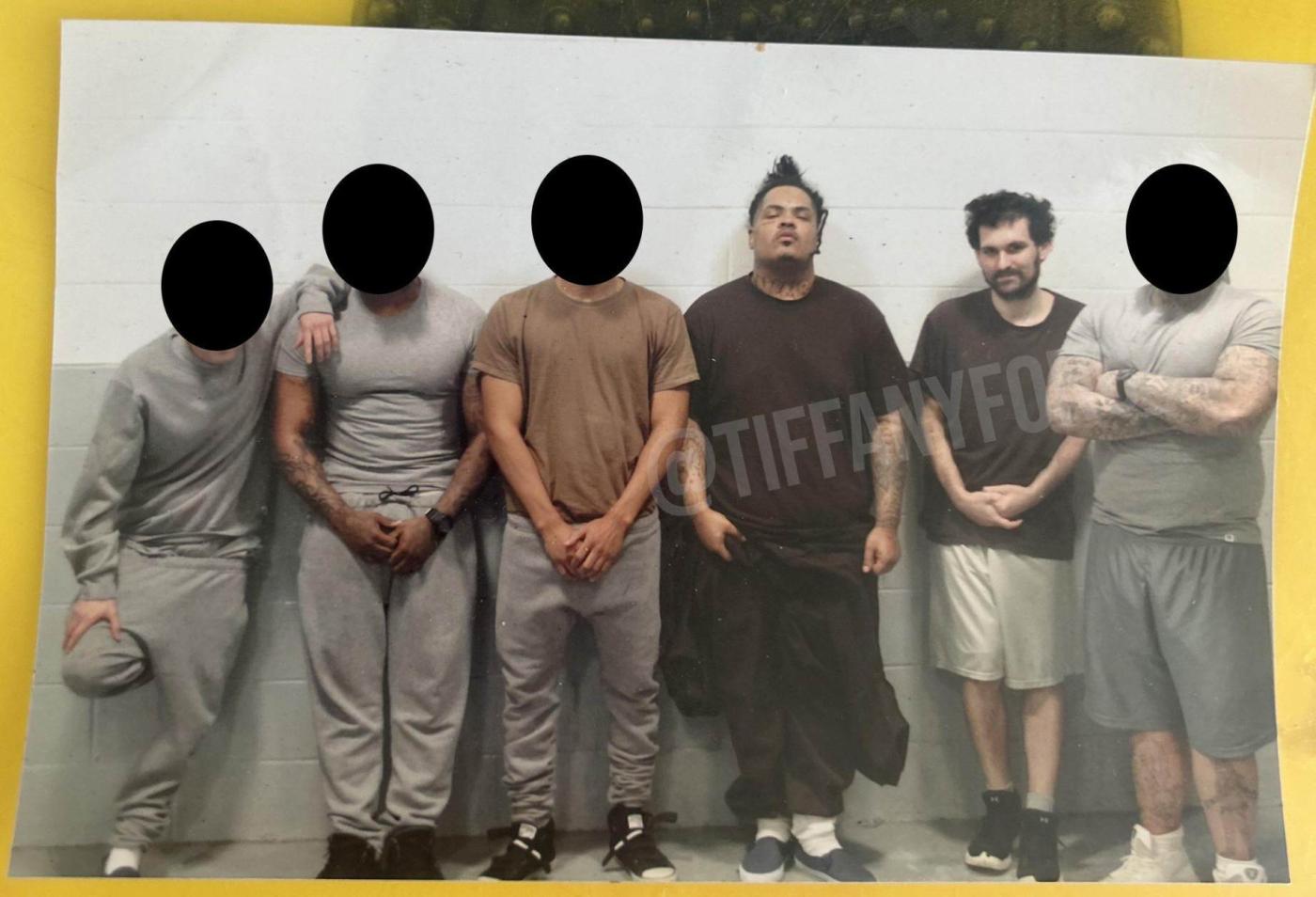

SBF himself seems to be having a hard time in prison. Crypto KOL Tiffany Fong once posted on social media the first photo of SBF during pre-trial detention, showing him looking thin and frail, unlike before. According to a previous article published by Coindesk, SBF's detention environment is overcrowded, and he survives on only bread and water, sometimes peanut butter, and the dormitories and prison rooms are in a semi-dark state.

In addition to the poor prison environment, SBF was also exposed as a target of blackmail due to his timid nature and "the physique of an 80-year-old man." SBF's cellmates pointed out that SBF was the least threatening person... Compared with ordinary prisoners, he was more frequently targeted by bullying, harassment, and attacks. The extensive media coverage of SBF's case and his former net worth led to multiple blackmail attempts. Clinical psychiatrist Hassan Minhas said that he believed SBF met the diagnostic criteria for autism spectrum disorder, which means that he may "face a series of additional challenges" in prison and therefore "need to receive ongoing treatment and supervision." In addition, in addition to handling related cases in prison, SBF also shared advice on the crypto market with prison guards and recommended investing in Solana.

Interestingly, in February this year, Carmine Simpson, a former New York Police Department officer who was imprisoned with SBF, wrote to a US judge asking for leniency. He said, "Although 12 out of every 14 meals Sam eats a week are uncooked rice, a spoonful of disgusting-looking beans and week-old lettuce, he has always kept his promise not to abuse animals. When SBF first told him that the main reason he worked so hard to become a successful and wealthy man was to donate all his money to noble causes and people in need, frankly, I thought he was lying to me. But I soon concluded that Sam is the most selfless person I have ever had the privilege of meeting. If SBF gets out of prison, the world will be a much better place."

In addition to SBF, his father Joseph Bankman and mother Barbara Fried were also sued by FTX creditors, accusing their parents of embezzling millions of dollars by participating in the exchange business. According to previous court documents, SBF gave his parents $10 million in funds and a Bahamas property worth $16.4 million, which was provided by FTX Trading. In response, SBF's parents are seeking to withdraw the lawsuit filed by FTX against them, denying the allegations that they knew there were problems with the crypto trading platform and deliberately benefited from the company's misconduct.

Although SBF's trial of the century has finally come to an end, the billions of user funds lost and the huge blow to the reputation of the crypto industry cannot be glossed over. It is a profound lesson and a huge warning for investors and practitioners.