A. Market View

1. Macro Liquidity

The Federal Reserve has maintained interest rates at a high level in more than 20 years since July last year. Last week, it unexpectedly maintained its expectation of three interest rate cuts this year. Chairman Powell made dovish remarks at a press conference, which led investors to bet that the Federal Reserve will cut interest rates for the first time this year. Coming in June. U.S. stocks fluctuated at high levels, and the crypto market stagnated.

2. Whole market conditions

Top 100 gainers by market capitalization:

BTC has rebounded weakly this week, and the market is speculating on sub-new stocks with good chip structure, which may be a sign that the market will adjust. Market hot spots revolve around RWA , new public chain Base, TON, and SUI.

1. POLYX: BlackRock Fund announced its entry into the RWA track, triggering hype about the concept. POLYX is a securitization public chain based on the RWA concept, built on Substrate , and participants need to do KYC. However, the business faces great regulatory resistance, and it is difficult to unify the national conditions of various countries into the same public chain regulatory system, which may make it difficult to enjoy the global liquidity advantages similar to Defi.

2. DEGEN: It is the Meme coin on Farcaster. It was initially airdropped to Farcaster’s Degen community and will continue to be airdropped to Base and other participants in the Farcaster ecosystem in the future. Currently it is mainly used for social payments on the Base chain. The Base chain will not issue coins due to US compliance issues, and its ecosystem will receive more capital overflow.

3. SUI: The public chain SUI surged to a new high, and ecological NAVX, CETUS, etc. followed suit. SUI will hold a conference on April 10th and will provide subsidies to encourage the ecosystem in the near future. SUI is the new public chain with the best user experience in this round.

3. BTC market

1) Data on the chain

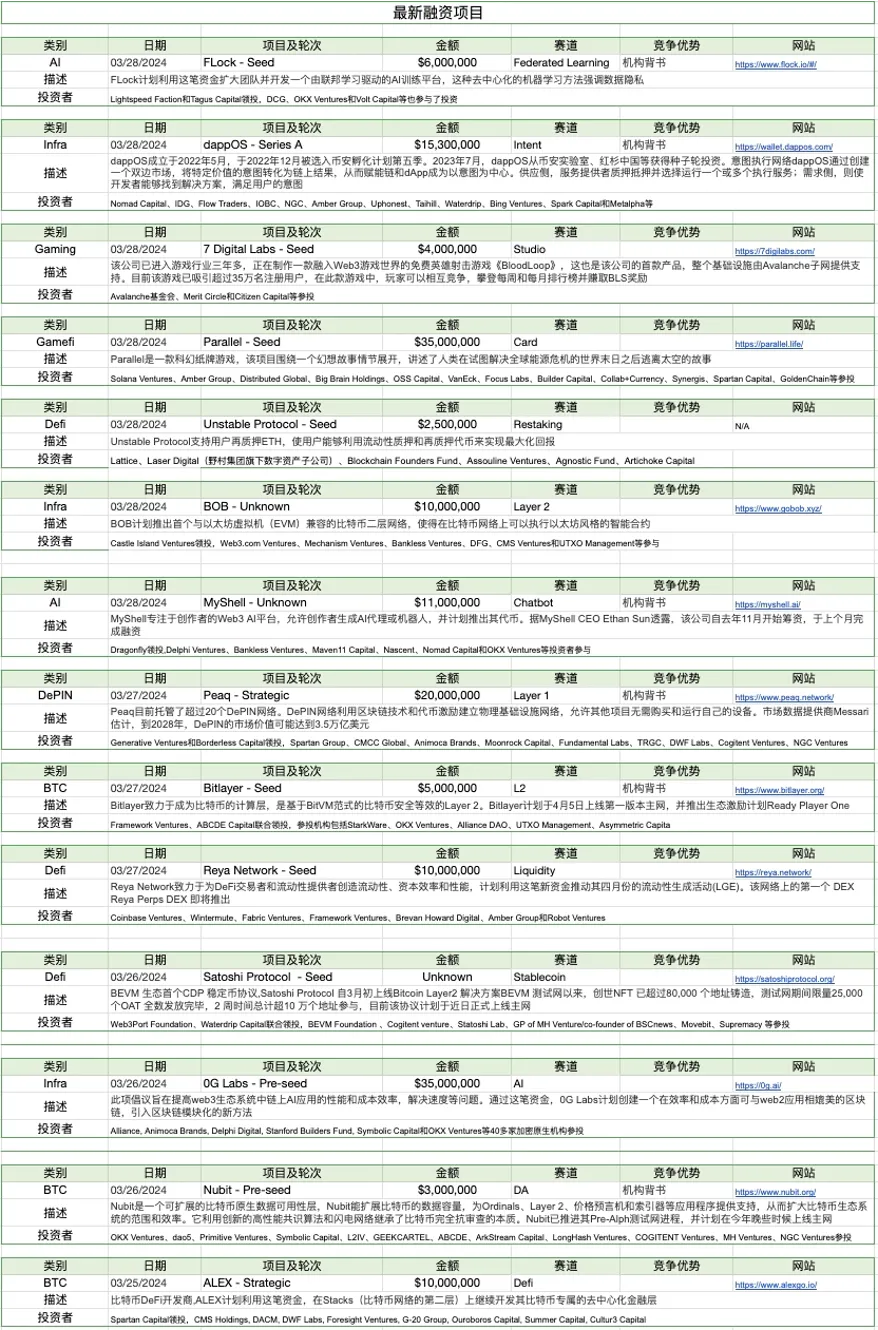

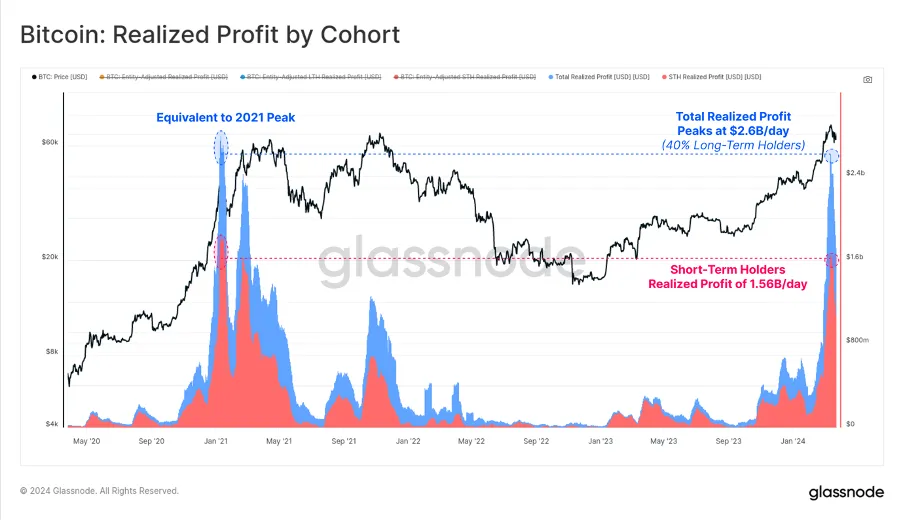

Long-term holders stepped up their efforts to take profits. When the market encountered resistance near the previous high, some investors began to take profits and exit. 40% of the chip selling came from long-term holders, which was similar to the situation in December 2020.

The market value of stablecoins increased by 1.6%. Ethena, a stable project, airdrops tokens. Its stablecoin USDe currently has a scale of US$1.4 billion, ranking fifth.

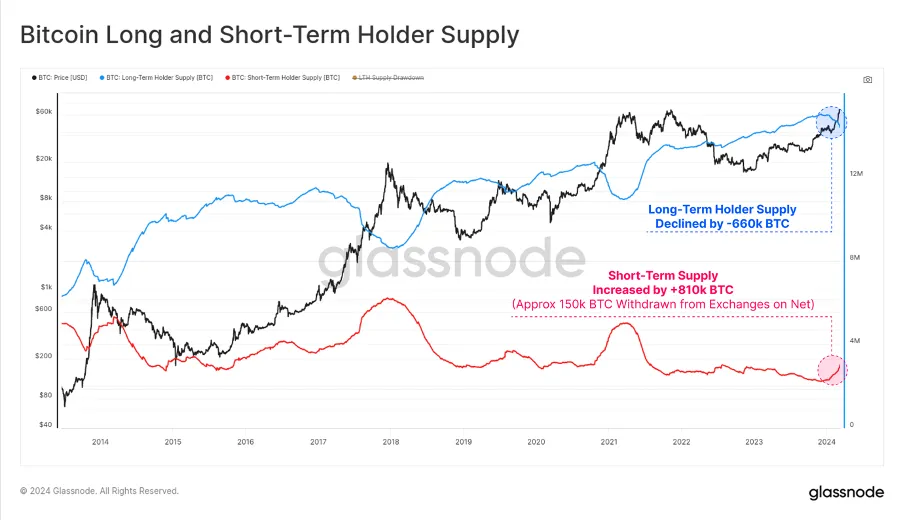

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV fell below the key level 1 and holders were in the red overall. The current indicator is 3.2, entering the intermediate stage.

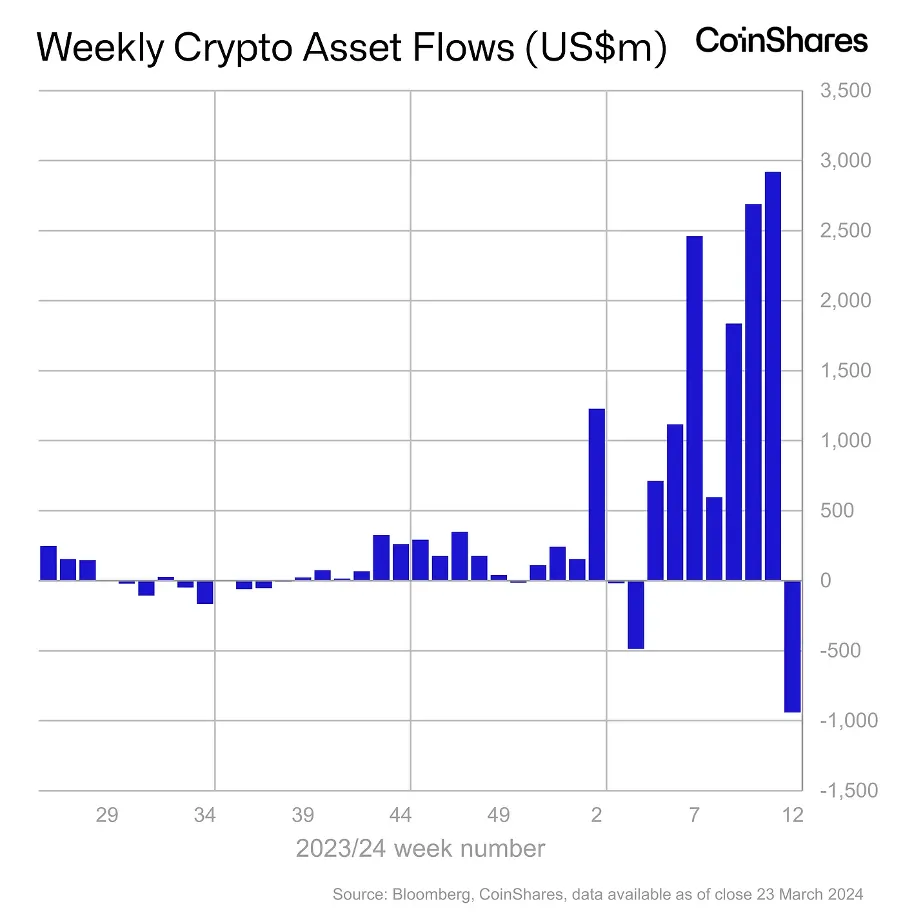

Institutional funds began to experience a substantial net outflow of US$900 million, mainly due to a significant decrease in funds flowing into US spot ETFs .

2) Futures market

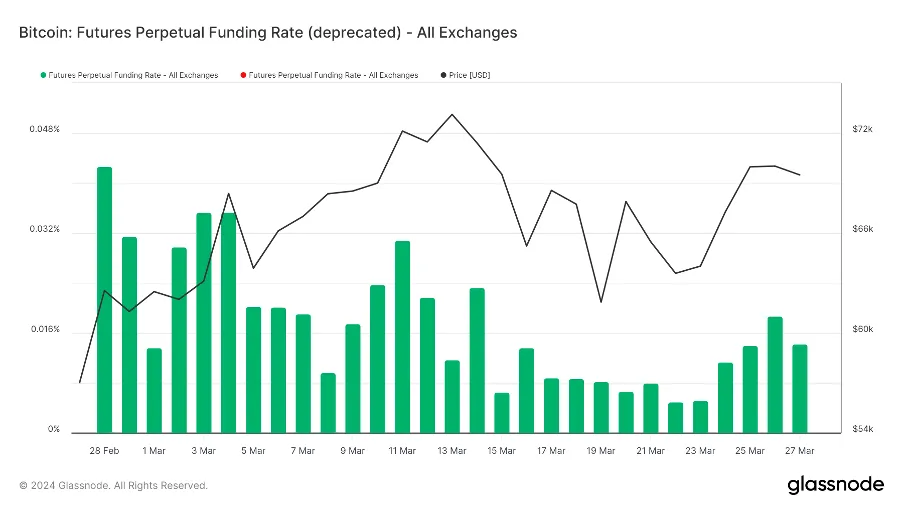

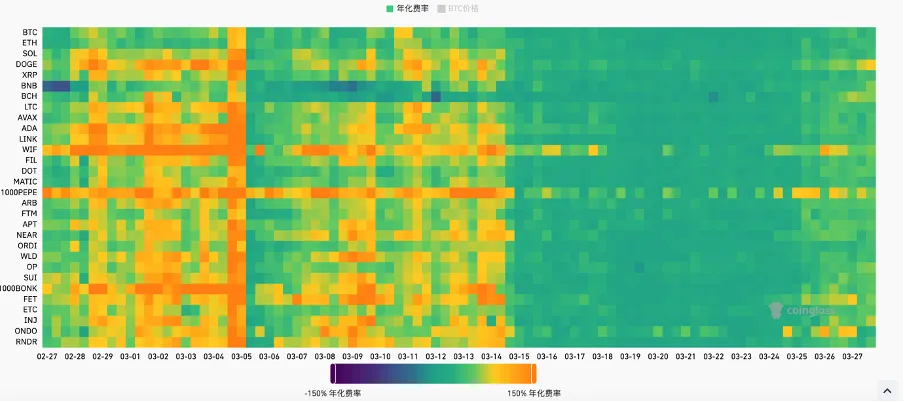

Futures funding rates: Rates increased slightly this week. The fee rate is 0.05-0.1%, and the long leverage is high, which is the short-term top of the market; the fee rate is -0.1-0%, the short leverage is high, and it is the short-term bottom of the market.

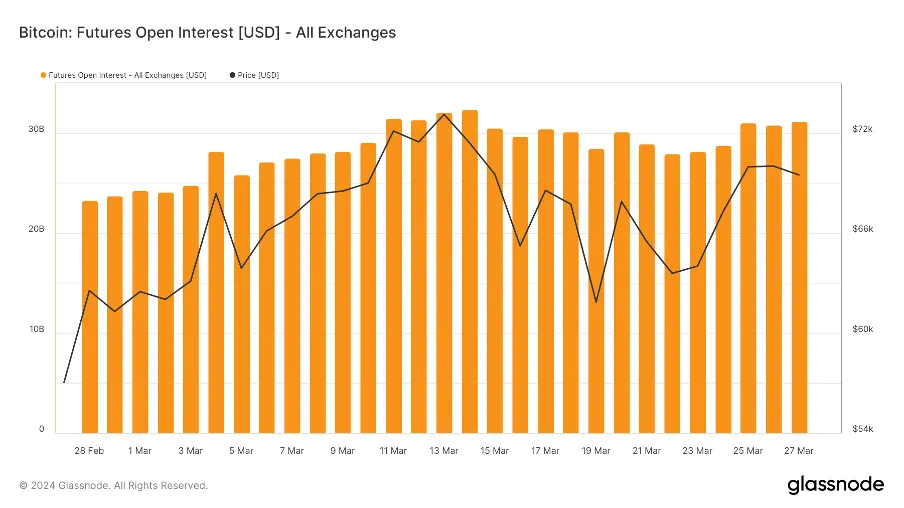

Futures positions: BTC positions rebounded slightly this week.

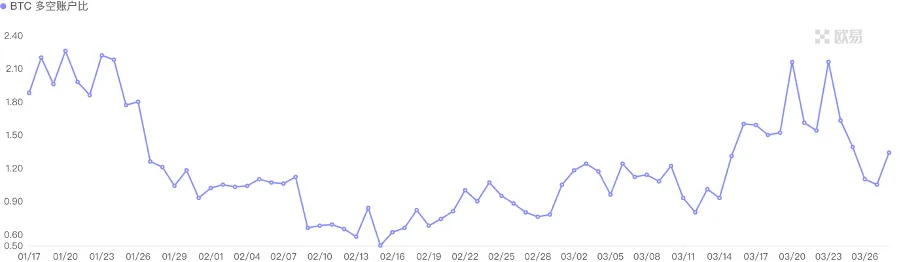

Futures long-short ratio: 1.3, market sentiment is normal. Retail investor sentiment is mostly a reverse indicator , with a reading below 0.7 indicating panic and a reading above 2.0 indicating greed. The long-short ratio data fluctuates greatly, and the reference significance is weakened.

3) Spot market price

As BTC encounters resistance at new highs of 73,000, long-term holders increase their profit-taking efforts, and funds may flow from BTC to Altcoin. Historically, after BTC reaches a new high, Altcoin will follow it to a new high in the next 2 months. It is recommended to pay attention to new public chain opportunities Base, TON, and SUI.

B. Market data

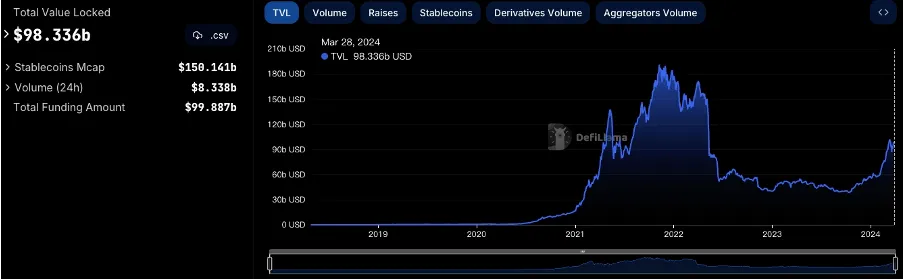

1. The total lock-up amount of the public chain

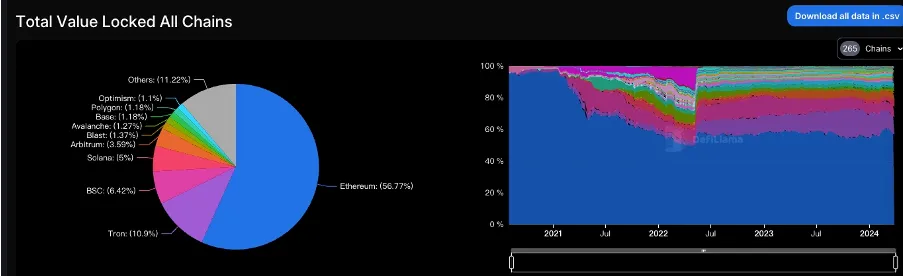

2. TVL proportion of each public chain

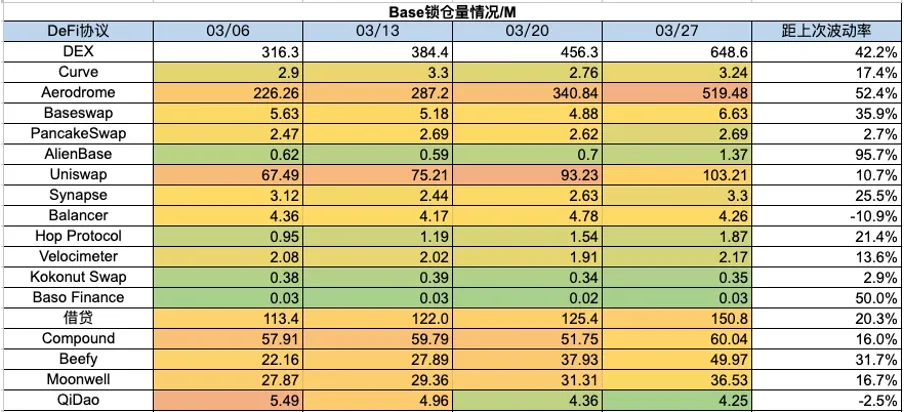

The total TVL this week was 98.3 billion US dollars, an overall increase of 3.8 billion US dollars, an increase of about 4%. BTC rebounded to 71,000 after a correction this week and is still looking for and forming a higher support level. This week, TVL of all mainstream public chains rose except for the ETH chain. At present, the performance of the ETH chain in this cycle is relatively weak, with a decline of nearly 2% in the past week. TRON chain, BSC chain and ARB chain all increased by about 3%, and SOLANA chain, OP chain and BTC chain increased by about 6%. The POLYGON chain rose by nearly 8%, and the SUI chain rose by 13%. The most noteworthy are the BLAST chain and BASE chain, which surged by 25% and 41% respectively. The BASE chain has risen by 161% in the past month, which has also made the total TVL of the BASE chain exceed 1 billion, successfully surpassing the OP chain and POLYGON and ranking eighth. On the other side, BLAST chain TVL has reached 1.27 billion and ranks sixth.

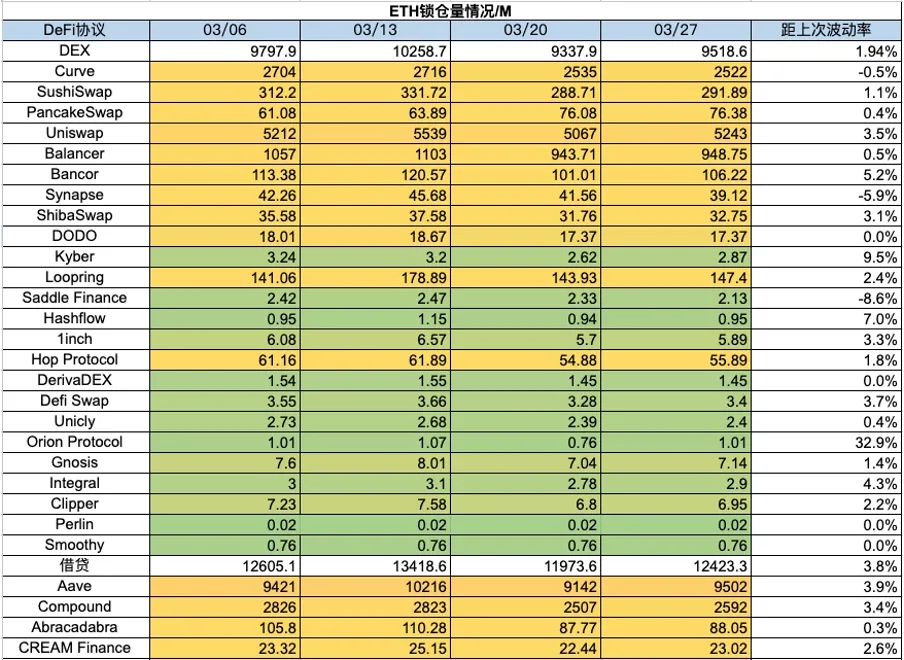

3. Lock-up volume of each chain protocol

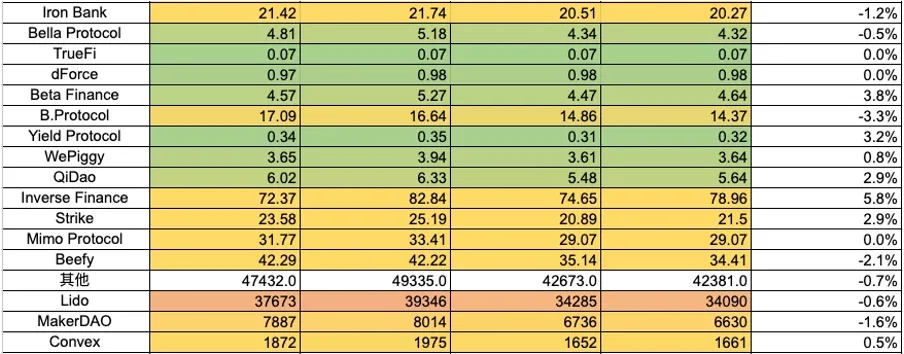

1) ETH lock-up amount

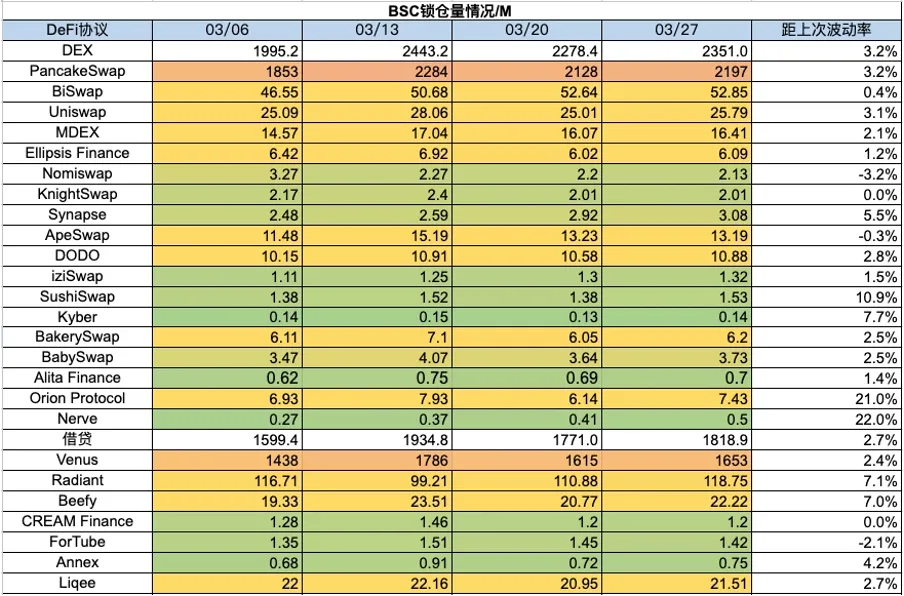

2) BSC lock-up amount

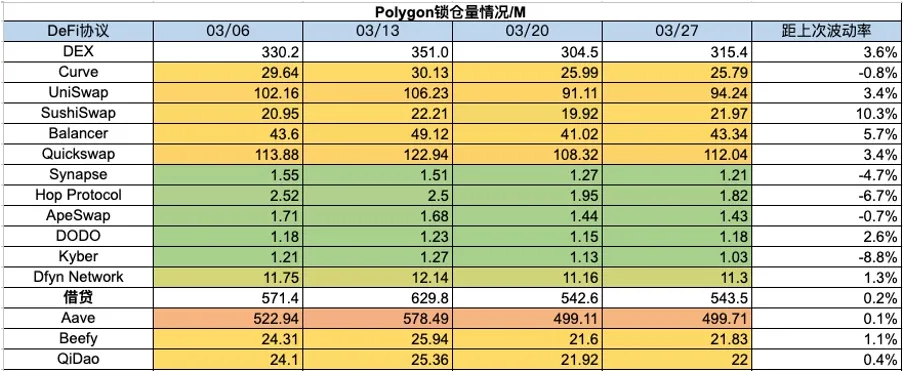

3) Polygon lock-up amount

4) Arbitrum lock-up amount

5) Optimism lock-up amount

6) Base lock-up amount

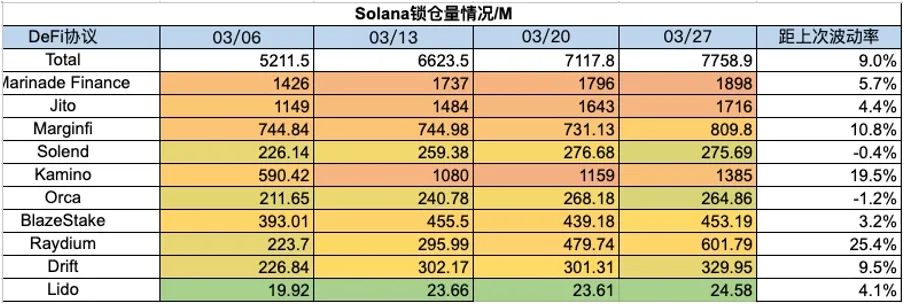

7) Solana lock-up amount

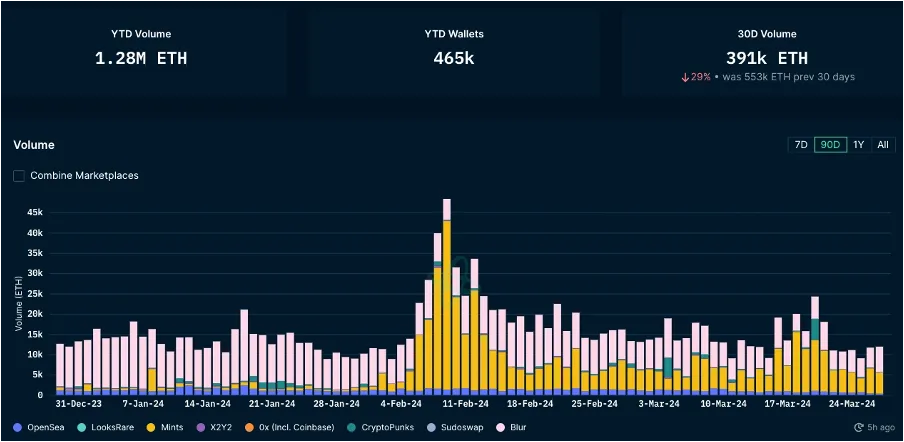

4. Changes in NFT market data

1) NFT-500 Index

2) NFT market situation

3) NFT trading market share

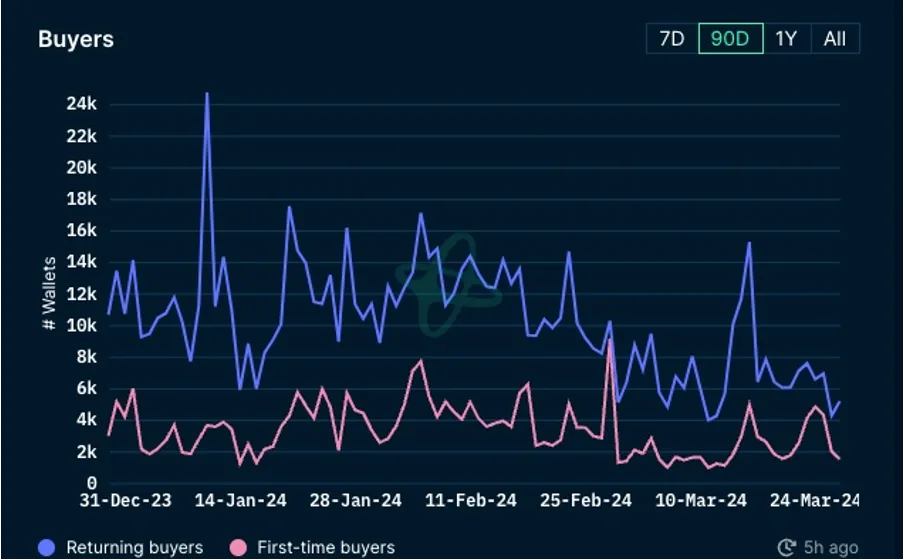

4) NFT buyer analysis

The floor prices of blue-chip projects in the NFT market rose and fell this week, and the market continued to fall after a slight rise. BAYC fell 6%, CryptoPunks fell 7%, Milady fell 3%, and The Captainz fell 5%. Pandora had the best performance among blue-chip projects this week, rising 22%. In addition, Azuki also rose 14% and Pudgy Penguins rose 3%. The overall NFT transaction volume has rebounded slightly, but the number of first-time NFT users and repeat buyers continues to decline. The NFT market currently shows no signs of recovery.

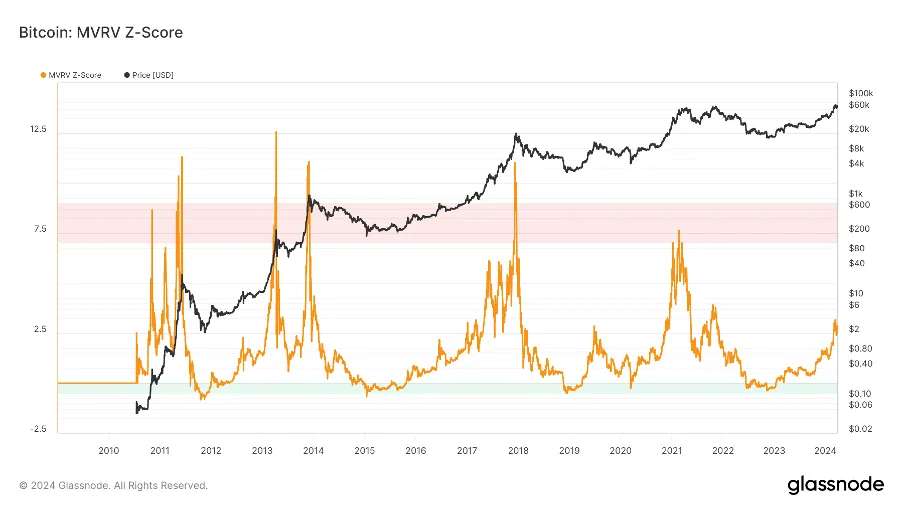

5. Latest financing situation of the project