On Friday, after the U.S. Department of Labor released employment data that was much higher than expected, the crypto market turned down, with Bitcoin fluctuating 4% in the short term, falling to around $66,000, and rebounding to over $67,000 at press time. Ethereum fell to as low as $3,214 during the day, and recovered slightly to over $3,340 during the closing period.

Only 20 of the top 200 tokens by market cap rose. Yield Guild Games (YGG) led the gains, up 20.71%, NEAR Protocol (NEAR) up 8.6%, and Toncoin (TON) up 7%. Meme coin cat in dogs world (MEW) fell the most, down 27.7%, followed by Aragon (ANT) down 20.3%, and Biconomy (BICO) down 19.4%.

In the traditional market, major US stock indexes opened higher and closed higher, with the Dow Jones Industrial Average initially closing up 307 points, the S&P 500 up 1.1%, and the Nasdaq up 1.2%. The 10-year US Treasury yield rose 6.5 basis points to 4.38%, and the US dollar index rose 0.5%.

Uncertainty over rate cuts leads to volatility

Investors are nervous about rising commodity prices and the path of the Federal Reserve's interest rate cuts. On the one hand, they hope that the economy is strong to support further growth in corporate profits, and on the other hand, they hope that the weakness in the job market will give the Fed a green light to start cutting interest rates.

The Labor Department data showed that the U.S. economy added 303,000 jobs in March, far exceeding the expected 212,000. The unemployment rate fell to 3.8% in March, slightly lower than the 3.9% forecast by economists. The employment data for February also unexpectedly rose – 275,000 jobs were added, while economists had expected only 198,000.

Some Fed officials have said strong economic data could cause central bankers to halt plans to cut interest rates. Minneapolis Federal Reserve Bank President Neel Kashkari shocked markets on Thursday by saying the central bank might choose not to cut rates at all if inflation remains high and the economy continues to show signs of growth.

The jobs report is just one of many data points the Fed is watching, and Noelle Acheson, author of Crypto is Macro Now, said in her market update: "We have to remember that these indicators only give us a small picture of a blurred picture."

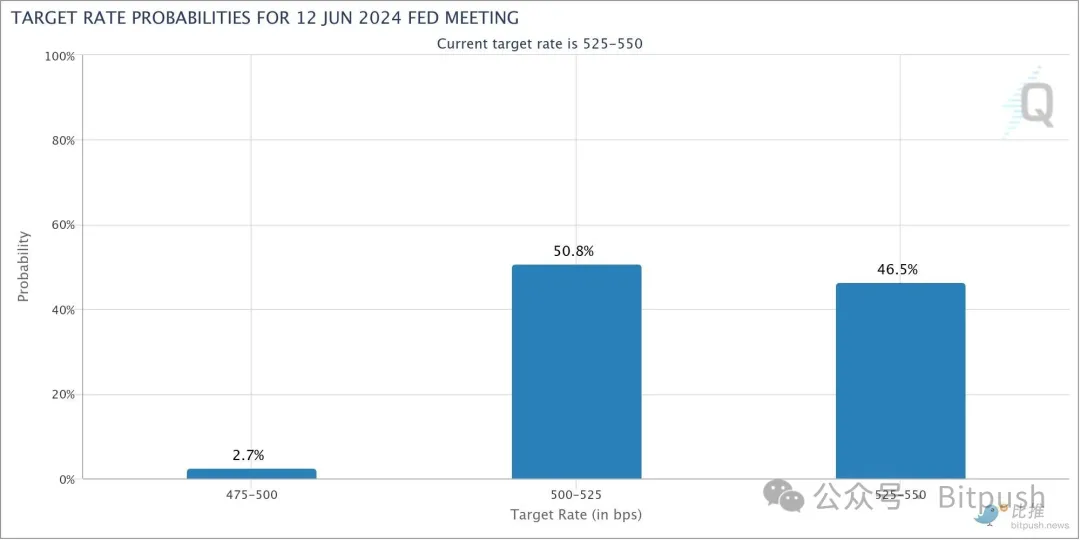

The latest data from the CME FedWatch tool shows that the probability of a rate cut in 2024 has been pushed further to the end of the year. As of this writing, the probability of a rate cut in June is just over 50%, down 10% from earlier this week.

Bitcoin and Ethereum have had a slow start to the second quarter, falling around 6% and 10% respectively since the beginning of the month.

“Bitcoin is currently forming a symmetrical triangle pattern, hovering in the middle with no clear direction,” said analysts at Secure Digital Markets. “After rebounding from the lower edge of the trending triangle near $64,500, the momentum is expected to propel us towards the recent peak of $72,000.”

The analysts added: “With the ETF market seeing strong inflows and the market anticipating a looming supply shock, a breakout from this pattern to new all-time highs seems likely in the short term. In terms of ETF moves, the picture remains bullish with net inflows reaching $106.8 million, while Grayscale saw relatively modest outflows of $79.3 million.”

Sergei Gorev, risk manager at fintech platform YouHodler, said Bitcoin is still in a price consolidation phase ahead of the upcoming Bitcoin halving, when the mining reward for each block will be reduced. He said: "It is clear in the market that investors who bought Bitcoin at a lower price are now taking profits. However, there are still many cryptocurrency enthusiasts waiting for the price to fall in order to make further purchases."

Gorev believes that the absence of major negative factors in the cryptocurrency market at the moment could lead to the end of Bitcoin’s seven-month upward trend in price in April.

Others are more optimistic.

Will McDonough, founder of commercial bank Corestone Capital, pointed out that spot Bitcoin ETFs have lowered the barrier to entry for many people into the asset class. He expects this trend to expand as major brokerage firms begin to allow allocation of such products, and new groups of high-net-worth investors entering this space will coincide with the Bitcoin halving in a few weeks.

McDonough said in a Bloomberg interview: "I expect the price of Bitcoin to easily reach six figures (at least $100,000) by the end of this year, and if there is no large amount of information released during the US election about prohibiting the adoption of blockchain, I don't think there will be anything that can stop this momentum this year."