By Thor and Hyphin

Compiled by: TechFlow

introduce

The strategy of airdropping points through leveraged exposure is likely the best strategy in the current DeFi activity. Participants in the first season of the Ethena activity received returns of 100-500% depending on their leveraged exposure to Ethena "shards". Many people expect Eigenlayer and its LRT ecosystem to match it in terms of returns, and EIGEN points are currently worth 0.2 to 0.4 USD. One way to obtain these points activities is through Airpuff.

Airpuff is a multi-chain money market that provides leveraged exposure to points projects such as Eigenlayer, Renzo, Etherfi, Kelp, Ethena, etc. Users can obtain up to 12.75x points leverage, or trade by lending assets, which can earn over 50% annualized interest. Airpuff is preparing for their $APUFF TGE, and the Foundry LBP will last until April 11th at 12:00 UTC. Today's report will analyze the Airpuff protocol, the $APUFF token, and finally give specific strategies and expected returns.

Use Airpuff to conduct leverage points airdrop activities

At its core, AirPuff is comprised of two key components that work together to facilitate leveraged points activity.

1. Borrowing

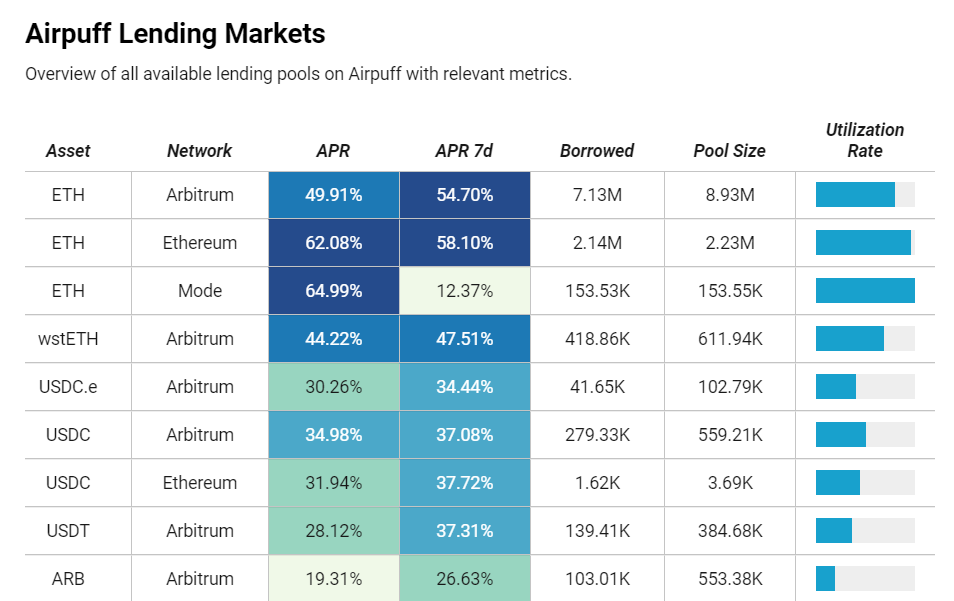

All necessary lending operations are performed through the lending pool, which allows depositors to earn high yields on multiple networks by providing liquidity to the platform.

There are no fees for deposits, but there is a fixed 0.2% fee for withdrawing assets from the lending pool.

The interest received from providing assets is determined by the utilization of the collateral pool, which means it fluctuates constantly based on demand. Accumulated interest is snapshotted every hour and distributed to the value of the tokens being loaned, allowing for effective compounding.

In most cases, ETH is in high demand and offers the most attractive yields. This is primarily because borrowing non-ETH assets automatically converts collateral to ETH when a position is opened, effectively long, which creates additional price risk for the borrower.

Another benefit of participating in the lending market is that users can receive a share of all points earned by using collateral.

WhalesMarket data shows that liquidity providers have earned a total of approximately $77,000 in points across all lending pools.

Borrowers are also eligible to receive AirPuff point rewards based on the specific asset provided (ETH and stETH receive higher rewards), time, and amount provided.

2. Airdrop

You can use the protocol’s native airdrop strategy Buffs to obtain amplified airdrop rewards.

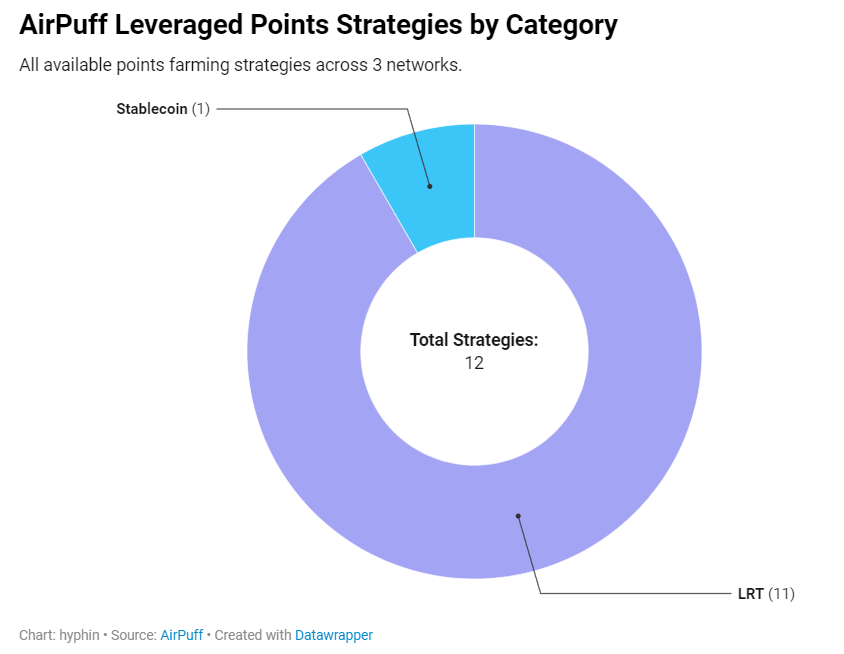

Currently, there are 12 different buffs available on 3 different networks, with most strategies related to LRT providing EigenLayer points while also providing native protocol incentives. However, there are also some options that include additional unique ecosystem rewards (e.g. Mode points for strategies on Mode).

Depending on the strategy, users can leverage a variety of collateral options to maximize potential rewards from activities (including AirPuff) with up to 15x leverage. When lending any asset, be sure to be aware of higher than normal interest rates and take into account the complications of using non-ETH collateral.

10% of all points earned from leveraged positions will be distributed to lenders, and another 5% will be distributed to veAPUFF participants. There is also a fixed 0.2% fee for closing positions.

For speculators with less risk appetite, they can also choose non-leveraged short-drop options while taking advantage of the rewards and incentives provided by the platform.

Expected Return

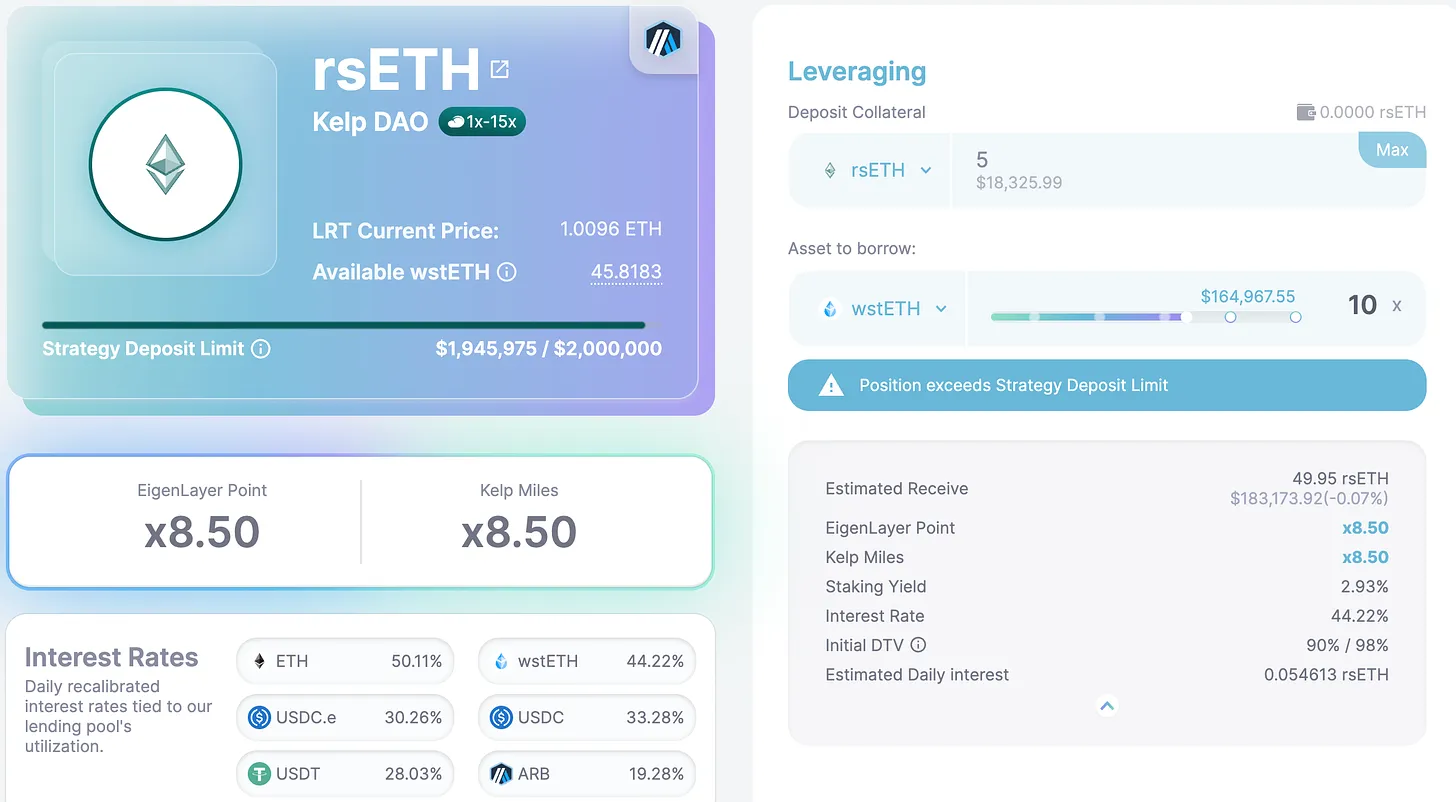

To illustrate the potential returns of the strategy, let’s take a look at the rsETH liquid re-staking token from Kelp . The image below shows the vault on Airpuff. While it is almost full right now, capacity will likely increase in the future.

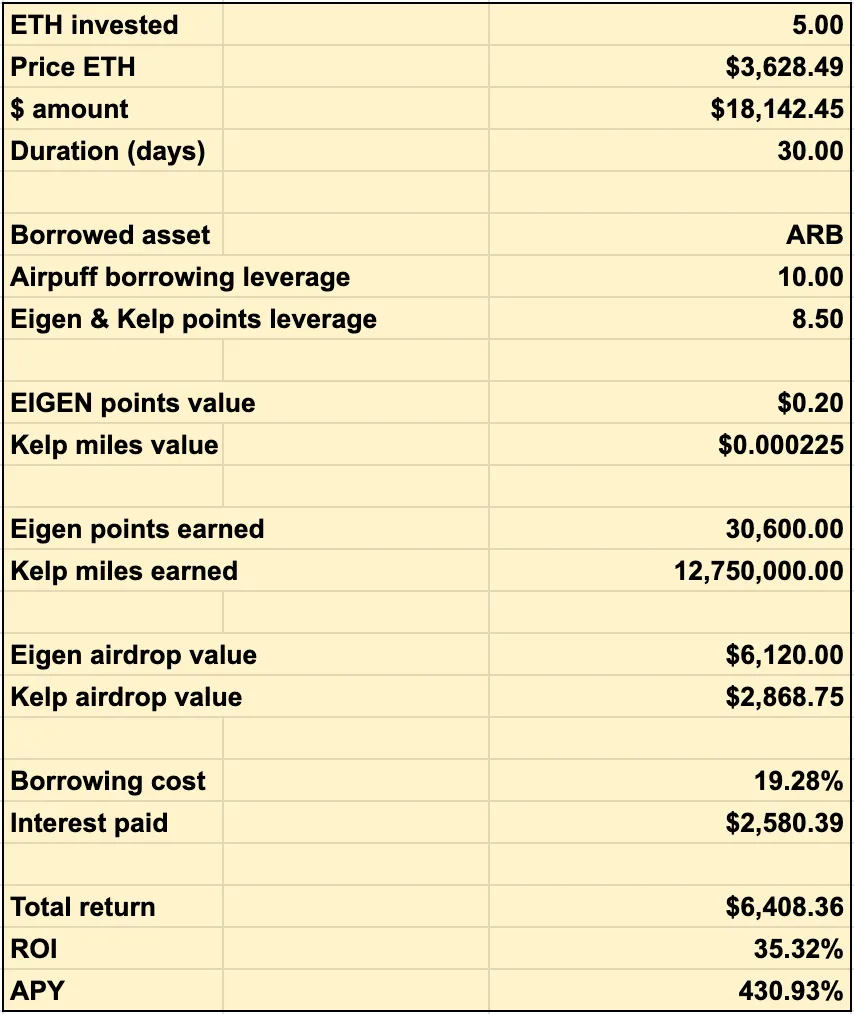

In this example, wstETH is borrowed against 5 ETH as collateral with 10x leverage. Each cycle then converts wstETH to rsETH. Since Airpuff extracts points to distribute to veAPUFF holders and lenders, the effective point leverage is 8.5x. The interest rates for various assets can be seen in the lower left corner.

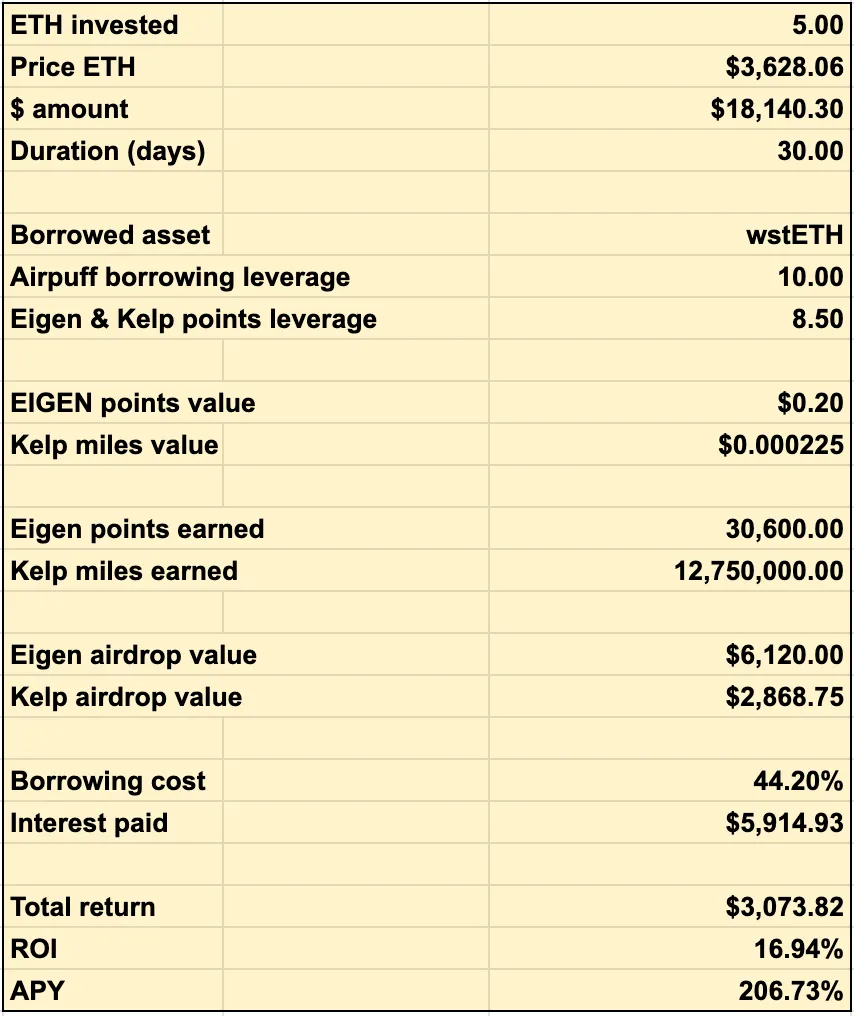

Here are the returns for this strategy. The values of Eigen Points and Kelp Miles are based on the TVL and airdrop percentages predicted in another post and should be taken with a grain of salt (although these prices are more conservative). As you can see, by depositing 5 ETH, with 10x leverage and a duration of 30 days, and lending wstETH, the return on this strategy is 16.94% ROI, which is equivalent to an annualized rate of return of about 206%. Keep in mind that there are a lot of assumptions here, so actual returns may differ from the estimates.

With utilization rates of over 80% in various markets, borrowing rates are currently very high, which has had a negative impact on returns (nearly $6,000 in interest paid). More information on these is below:

0-80% Utilization: The interest rate will increase linearly from 5% to 15%.

80-100% Utilization: Rates will increase linearly from 15% to 45%.

Since the borrowing rate is much lower, why not borrow in USDC or ARB? Because you are taking on more liquidation risk. If the value of rsETH against USDC or ARB drops, you may be liquidated and lose your entire deposit. As leverage increases, the risk of being liquidated also increases. The risk is much lower when borrowing wstETH because they both track ETH, but you may also be liquidated if rsETH decouples. The returns of borrowing ARB compared to borrowing wstETH are as follows:

As you can see, the returns are higher. However, it is important to note that the risk of liquidation is also higher.

TGE & $APUFF

Early depositors of Airpuff will not only receive base points through Eigenlayer and LRT, but also receive "Airpuff Points", which will be converted into a $APUFF airdrop in May. A total of 7% of the $APUFF supply will be airdropped to protocol users over two seasons. 4% of this will be airdropped in the first season, and another 3% in the following season. For more information on how to qualify, see this page.

Additionally, the $APUFF Liquidity Bootstrapping Pool (LBP) is currently live on Fjord Foundry from 12:00 AM UTC on April 8th to 12:00 AM UTC on April 11th. As of the time of writing, Airpuff has raised $2.5 million in $APUFF in the LBP, which will bring the token's market cap to $8.7 million and FDV to $58 million. Click here to go to the LBP's website:

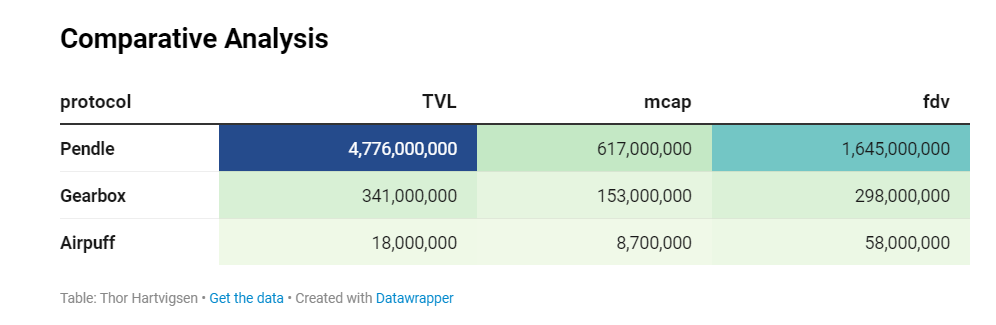

Once LBP is over, $APUFF tokens will be listed. The initial circulating supply is 16% (15% from LBP and 1% from private sale). Here are some comparative metrics between Airpuff, Pendle, and Gearbox.

APUFF Token Economics

Airpuff uses a dual token model with $APUFF. Users can choose to lock $APUFF to obtain veAPUFF (similar to vePENDLE), which will entitle them to vote on token incentive allocations in various markets and receive revenue through bribes. These bribes come from the revenue that protocols pay to Airpuff to develop library strategies and direct issuance as a means of promoting the growth of their protocols and increasing adoption.

To further strengthen the token holder community, and in order to be eligible for $APUFF issuance, users must lock at least 5% of the value of their holdings in veAPUFF. Finally, Airpuff takes a 5% fee from the points earned by all lenders and borrowers (Eigen points, LRT points, etc.) and distributes it to veAPUFF holders to further increase the utility of the token.

in conclusion

2024 is the year of points trading, and Airpuff enables this in a unique way with its money market and built-in leverage. In the coming months, Airpuff will integrate new vaults, launch more projects on the chain, and release $APUFF tokens to give users more exposure to various points projects.